GBPJPY

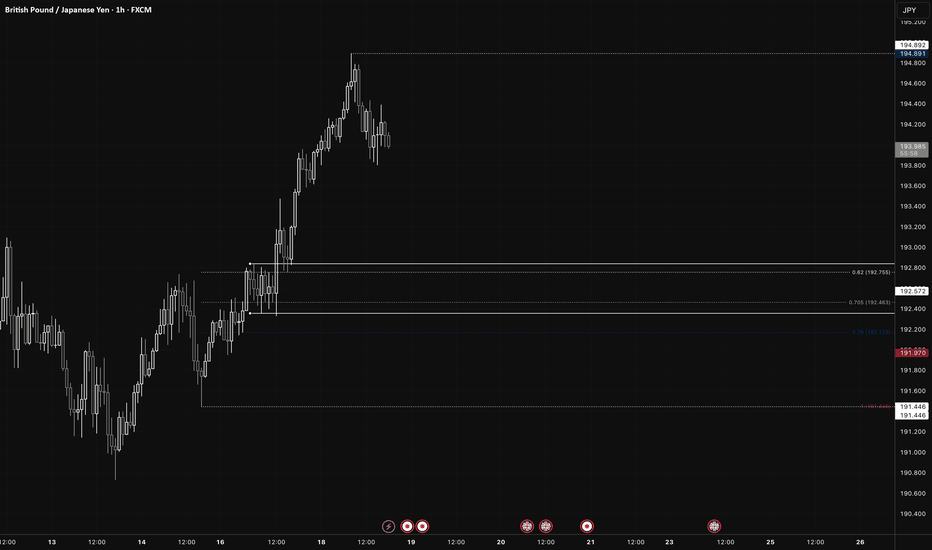

GBP/JPY (Long)Daily:

Price > 200EMA

Swing Period 10

Swing Low: 187.666

Swing Low: 194.892

Volume Imbalance: 2 Candles

Daily Order Block: 197.399 / 195.104

H4:

Price < 200EMA

Swing Period: 7

Swing High: 194.892

Swing Low: 190.728

Volume Imbalance: 2 Candles

H4 Order Block: 192.357 / 192.841

H1:

Swing Period: 5

Swing High: 194.892

Swing Low: 191.446

Volume Imbalance: 11 Candles

H1 Order Block: 192.357 / 192.841

Model 1:

Entry Price: 192.572

Stop Loss: 191.970

TP1: 191.970 @ 1:1 / 50%

TP2: 193.775 @ 1:2 / 25%

SL: Breakeven

TP3: 194.891 @ 1:3 / 25%

Model 2:

Entry Price: 192.750 - 192.159

Entry Trigger: 9EMA X 21EMA

SL: Above recent swing low

TP1: 1:2

SL: Trailing 9EMA

Why GBPJPY is Bullish?? Detailed technical and fundamentalsThe GBP/JPY pair has recently confirmed a bullish reversal by breaking out of a falling wedge pattern, aligning with our earlier analysis. Currently trading at 194.000, the pair is on track toward our target of 199.000.

Technically, the breakout from the falling wedge—a pattern typically indicative of bullish reversals—suggests increased buying momentum. This is further supported by the pair's ability to maintain levels above key resistance points, now acting as support. The next significant resistance is anticipated around the 195.000 level, a psychological barrier that, if surpassed, could pave the way toward our 199.000 target.

Fundamentally, the British pound has been bolstered by positive economic indicators, including robust GDP growth and a resilient labor market, enhancing investor confidence. Conversely, the Japanese yen has experienced depreciation due to the Bank of Japan's commitment to ultra-loose monetary policies, aiming to stimulate inflation and economic growth. This monetary policy divergence has contributed to the upward trajectory of GBP/JPY.

In conclusion, the confluence of technical and fundamental factors supports a bullish outlook for GBP/JPY. Traders should monitor upcoming economic releases and central bank communications, as these could impact market sentiment and price action. Maintaining a disciplined approach with appropriate risk management strategies is essential as the pair approaches the 199.000 target.

GBPJPY The Target Is DOWN! SELL!

My dear subscribers,

This is my opinion on the GBPJPY next move:

The instrument tests an important psychological level 193.00

Bias - Bearish

Technical Indicators: Supper Trend gives a precise Bearish signal, while Pivot Point HL predicts price changes and potential reversals in the market.

Target - 191.639

My Stop Loss - 193.69

About Used Indicators:

On the subsequent day, trading above the pivot point is thought to indicate ongoing bullish sentiment, while trading below the pivot point indicates bearish sentiment.

———————————

WISH YOU ALL LUCK

GBPJPY is in the Down TrendHello Traders

In This Chart GBPJPY HOURLY Forex Forecast By FOREX PLANET

today GBPJPY analysis 👆

🟢This Chart includes_ (GBPJPY market update)

🟢What is The Next Opportunity on GBPJPY Market

🟢how to Enter to the Valid Entry With Assurance Profit

This CHART is For Trader's that Want to Improve Their Technical Analysis Skills and Their Trading By Understanding How To Analyze The Market Using Multiple Timeframes and Understanding The Bigger Picture on the Charts

gbpjpy sell signal. Don't forget about stop-loss.

Write in the comments all your questions and instruments analysis of which you want to see.

Friends, push the like button, write a comment, and share with your mates - that would be the best THANK YOU.

P.S. I personally will open entry if the price will show it according to my strategy.

Always make your analysis before a trade

GBPJPY Trade Analysis**GBP/JPY 15-minute chart**

**Trade Analysis & Idea:**

📉 **Previous Downtrend**: The pair experienced a strong drop before finding support around **191.400**.

📈 **Current Recovery**: Price is now rebounding and trading above short-term moving averages (blue & red EMA).

🔄 **Resistance Zone**: The **192.000 - 192.200** area may act as resistance for further upside.

### **Potential Trade Setups:**

1️⃣ **Bullish Continuation**:

- If price **breaks & closes above 192.000**, we could see further upside towards **192.400 - 192.600**.

- A strong candle close above resistance would confirm bullish momentum.

2️⃣ **Rejection & Pullback**:

- If price struggles to hold above 192.000, a pullback toward **191.700 - 191.500** is possible.

- Look for **bearish candlestick patterns** (e.g., rejection wicks, engulfing candles) to confirm a short opportunity.

### **Risk Management:**

✅ Secure partial profits at key levels.

✅ Use **tight stop-loss** below **191.700** for longs or above **192.200** for shorts.

GBPJPY - Higher Probability Favors Upside ContinuationThe GBP/JPY pair is displaying strong bullish momentum as it trades near 192.25, having recently tested but failed to break through the key resistance level at 193.05. After forming a higher low structure within an ascending trendline since late February, the pair shows notable strength with buyers stepping in at each pullback. Technical analysis suggests that the higher probability move is a continuation to the upside, with price likely to break above the horizontal resistance at 193.05 after a possible minor retracement. If this bullish scenario plays out, we could see the pair extend toward the 194.50 level before potentially reaching higher targets as indicated by the upward-pointing arrow on the chart. The ascending trendline and the support zone marked by the blue box near 191.00 should provide solid foundations for this anticipated upward move, keeping the overall bullish bias intact as long as price remains above these key structural levels.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

GBPJPY is in the Down TrendHello Traders

In This Chart GBPJPY HOURLY Forex Forecast By FOREX PLANET

today GBPJPY analysis 👆

🟢This Chart includes_ (GBPJPY market update)

🟢What is The Next Opportunity on GBPJPY Market

🟢how to Enter to the Valid Entry With Assurance Profit

This CHART is For Trader's that Want to Improve Their Technical Analysis Skills and Their Trading By Understanding How To Analyze The Market Using Multiple Timeframes and Understanding The Bigger Picture on the Charts

Why EURUSD is still Bullish? Detailed Fundaments and technicals EURUSD is showing strong bullish momentum, currently trading around 1.087 and bouncing as predicted. The pair has respected key support levels, confirming the continuation of the **uptrend**. With increasing buying pressure, we anticipate further upside movement toward the main target of 1.1200. The **bullish structure remains intact**, and if this momentum sustains, eurusd could soon hit the projected target.

From a technical perspective, the pair has formed a solid base near recent support, aligning with key **fibonacci retracement levels** and previous demand zones. A break above **1.0900 psychological resistance** will add further confirmation to the bullish bias, leading to a potential rally toward **1.1000 and beyond**. Traders should look for volume confirmation and price action signals for additional entry opportunities.

On the fundamental side, the **us dollar is facing slight weakness**, primarily due to shifting Federal Reserve expectations and lower bond yields. Meanwhile, **eurozone economic data** has shown resilience, supporting the euro’s strength. If risk sentiment remains positive and economic conditions continue improving, eurusd could maintain its bullish trajectory and test higher resistance levels.

Overall, eurusd is still in a bullish phase, and with strong buying momentum, the price is on track to reach the **1.1200 target**. Traders should monitor key levels and market sentiment for potential breakout confirmations.

GBPJPY Will Fall! Short!

Take a look at our analysis for GBPJPY.

Time Frame: 9h

Current Trend: Bearish

Sentiment: Overbought (based on 7-period RSI)

Forecast: Bearish

The market is on a crucial zone of supply 192.236.

The above-mentioned technicals clearly indicate the dominance of sellers on the market. I recommend shorting the instrument, aiming at 190.200 level.

P.S

We determine oversold/overbought condition with RSI indicator.

When it drops below 30 - the market is considered to be oversold.

When it bounces above 70 - the market is considered to be overbought.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Like and subscribe and comment my ideas if you enjoy them!

GBPJPY: Bearish Continuation & Short Signal

GBPJPY

- Classic bearish formation

- Our team expects pullback

SUGGESTED TRADE:

Swing Trade

Short GBPJPY

Entry - 192.49

Sl - 193.31

Tp - 191.06

Our Risk - 1%

Start protection of your profits from lower levels

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

DeGRAM | GBPJPY held the trend lineGBPJPY is in a descending channel between the trend lines.

The price is moving from the lower boundary of the channel, support level and lower trend line.

We expect the chart to rise after consolidating above the resistance level, which coincides with the 50% retracement level.

-------------------

Share your opinion in the comments and support the idea with like. Thanks for your support!

USDJPY and GBPJPY Analysis todayHello traders, this is a complete multiple timeframe analysis of this pair. We see could find significant trading opportunities as per analysis upon price action confirmation we may take this trade. Smash the like button if you find value in this analysis and drop a comment if you have any questions or let me know which pair to cover in my next analysis.

GJ, Major PRICE RISE is expected from here - 189 zone.TRADE SEED SIGNAL:

LONG GBPJPY.

After that drop from from a strong resistance line, GJ is back at its favorite ascending support zone hinting of another shift to the other side - UPSIDE.

A strong buy from this price zone is deal.

Spotted at 189.40

Interim target at 192.0

Mid target at 195.0

Trade Safely.

TAYOR.

Bearish drop?GBP/JPY is rising towards the resistance level which is a pullback resistance that lines up with the 38.2% Fibonacci retracement and could drop from this level to our take profit.

Entry: 191.34

Why we like it:

There is a pullback resistance level that aligns with the 38.2% Fibonacci retracement.

Stop loss: 192.02

Why we like it:

There is an overlap resistance level.

Take profit: 190.21

Why we like it:

There is an overlap support level that line sup with the 100% Fibonacci projection.

Enjoying your TradingView experience? Review us!

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.

GBPJPY - MASSIVE Swing Potential Buy - Happening Now (March)This is a longer term swing idea.

Top down analysis from HTF indicates that:

- Push lower on JPYX Yen index

- Retrace higher on XXXJPY pairs

- Divergence in the Yen pairs, confirming a low

- Price Action has created a lot of liquidity on the downside, which has been taken, signifying upside.

Comment below if you have questions. Happy to help.

Peaceful Trading to you all.

GBPJPY Will Collapse! SELL!

My dear subscribers,

My technical analysis for GBPJPY is below:

The price is coiling around a solid key level - 191.33

Bias - Bearish

Technical Indicators: Pivot Points Low anticipates a potential price reversal.

Super trend shows a clear sell, giving a perfect indicators' convergence.

Goal - 190.40

My Stop Loss - 191.87

About Used Indicators:

By the very nature of the supertrend indicator, it offers firm support and resistance levels for traders to enter and exit trades. Additionally, it also provides signals for setting stop losses

———————————

WISH YOU ALL LUCK

GBPJPY INTRADAY bullish breakout continuationThe GBP/JPY currency pair is currently exhibiting a bullish sentiment, supported by the prevailing uptrend. Recent intraday price action shows a sideways consolidation, suggesting the formation of a new support zone at the previous resistance level. This consolidation phase reflects a temporary pause within the broader bullish trend.

The key trading level to watch is 190.70, which represents the previous consolidation price range. A corrective pullback towards this level, followed by a bullish bounce, could confirm continued upward momentum, targeting the 193.10 resistance level. Sustained buying pressure could further extend gains to 193.90 and ultimately 195.00 over the longer timeframe.

However, if the pair experiences a confirmed loss of the 190.70 support level and a daily close below this point, it would invalidate the bullish outlook. In that scenario, the pair may face increased selling pressure, leading to a retracement towards 189.14. Further downside movement could expose the next support levels at 187.20 and 186.40.

Conclusion:

The bullish sentiment for GBP/JPY remains intact as long as the 190.70 support holds. Traders should monitor this key level closely, as a bounce back would reaffirm the uptrend, while a break below could trigger a deeper retracement.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.