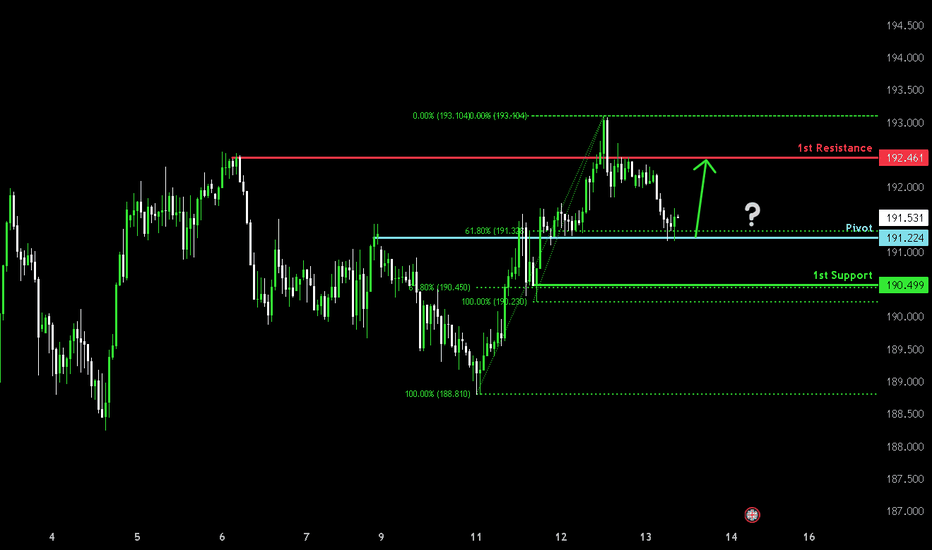

Bullish bounce?GBP/JPY is reacting off the pivot which acts as an overlap support and could rise to the 1st resistance.

Pivot: 191.22

1st Support: 190.49

1st Resistance: 192.46

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

GBPJPY

GBP/JPY SELLERS WILL DOMINATE THE MARKET|SHORT

Hello, Friends!

We are going short on the GBP/JPY with the target of 186.545 level, because the pair is overbought and will soon hit the resistance line above. We deduced the overbought condition from the price being near to the upper BB band. However, we should use low risk here because the 1W TF is green and gives us a counter-signal.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

GBPJPY Price ActionHello Traders,

As you can see, I have marked the liquidity levels on the left-hand side where a liquidity sweep has already occurred. Additionally, I have identified a new liquidity area where the price is expected to sweep next. I have also marked the take profit area.

Furthermore, you can see other liquidity levels, which I have highlighted with circles. This pattern is also known as the QM Pattern or Head & Shoulders (HS) Pattern .

Don't forget to manage your risk and protect your balance. Market structure repeats itself over and over again.

Wishing you all the best and happy trading!

Thank you.

GBPJPY is in the Down TrendHello Traders

In This Chart GBPJPY HOURLY Forex Forecast By FOREX PLANET

today GBPJPY analysis 👆

🟢This Chart includes_ (GBPJPY market update)

🟢What is The Next Opportunity on GBPJPY Market

🟢how to Enter to the Valid Entry With Assurance Profit

This CHART is For Trader's that Want to Improve Their Technical Analysis Skills and Their Trading By Understanding How To Analyze The Market Using Multiple Timeframes and Understanding The Bigger Picture on the Charts

GBP/JPY Key Resistance Breakout or Reversal?This chart is an analysis of the GBP/JPY currency pair on the 45-minute timeframe. Here's a breakdown of the key elements:

Resistance Zone (Red Box):

The price is currently testing a resistance zone around 192.500.

A breakout above this level could lead to new highs.

Breakout or Rejection?

The text in the chart states: "if it breaks here then it will make new high," indicating a bullish bias if resistance is broken.

There is a black circle marking the breakout area. If price breaks above and holds, it may continue upward (red arrow up).

If rejection occurs, the price could fall back down (orange circle and red arrow down).

Trendline Support (Blue Line):

hello traders

what are your thoughtson GBP/JPY.

My Analysis.

Price has been respecting an ascending trendline, indicating a short-term bullish trend.

A break below this trendline could signal a trend reversal and move price lower.

Demand Zone (Gray Box at the Bottom):

If price fails to hold above resistance and breaks downward, the next potential support is the demand zone near 189.000.

Possible Trading Scenarios:

✅ Bullish Case: If price breaks and holds above the resistance zone, it may continue to new highs (above 193.000).

❌ Bearish Case: If price rejects resistance and breaks the trendline, it may drop towards 189.000 support.

GBPJPY: Bearish Continuation & Short Trade

GBPJPY

- Classic bearish formation

- Our team expects pullback

SUGGESTED TRADE:

Swing Trade

Short GBPJPY

Entry - 193.00

Sl - 193.98

Tp - 191.10

Our Risk - 1%

Start protection of your profits from lower levels

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

WHY GBPJPY BULLISH, DETAILED ANALYSIS GBPJPY is currently trading at 192.200 after successfully breaking out of a falling wedge pattern, a strong bullish reversal signal. This technical breakout suggests the pair is set for a significant upside move, with a potential target of 195.000 and beyond. The falling wedge is known for its bullish implications, indicating that sellers are losing control while buyers are stepping in with increased demand. If momentum continues, we could see a gain of over 500 pips in the coming sessions.

From a technical perspective, GBPJPY has cleared key resistance levels and is now forming a strong bullish structure. A retest of the breakout zone around 191.500-192.000 has already provided support, reinforcing the likelihood of further upward movement. The next major resistance lies at 194.000, followed by 195.000, which aligns with key Fibonacci retracement levels and previous price action zones. If buyers maintain control, a push towards 196.000 and beyond is also possible.

Fundamentally, GBPJPY remains bullish due to the policy divergence between the Bank of England (BoE) and the Bank of Japan (BoJ). The BoE's firm stance on interest rates, coupled with the BoJ’s continued ultra-loose monetary policy, favors a stronger GBP against the JPY. Additionally, risk sentiment plays a crucial role in GBPJPY's movements, and with equity markets showing strength, the yen's safe-haven appeal weakens, further boosting the bullish case for this pair.

With both technical and fundamental factors aligning, GBPJPY presents a strong buying opportunity. Traders should watch for a sustained move above 193.000 for confirmation of further gains, with the potential to reach 195.000 and beyond. A breakout continuation could trigger even stronger bullish momentum, making this a high-probability setup for traders looking to capitalize on the trend.

GBPJPY Buy Analysis: GTEGBPJPY has successfully broken out of the descending trendline, confirming a bullish breakout. This signals a potential continuation to the upside, with price now targeting the next resistance zone around 192.50 - 193.00.

As long as price holds above the breakout level near 191.30, the bullish momentum remains intact. The breakout suggests further upside movement, with buyers stepping in to push price toward the previous highs. Watch for confirmation on lower timeframes to strengthen the move.

GBPJPY High chance of rejection to new market low.GBPJPY is basically consolidating around its MA50 (4h), staying under the January 24th lower highs trend line.

The pattern is very similar to February 4th, which shortly after collapsed to the 1.618 Fibonacci extension.

Trading Plan:

1. Sell on the current market price.

Targets:

1. 186.500 (the 1.618 Fibonacci extension).

Tips:

1. The RSI (4h) is also priting the exact same pattern as late January.

Please like, follow and comment!!

GBPJPY Key Support Retest – Potential Bounce or Break?I've been watching #GBPJPY on the 30-minute chart, and there's a strong support level around 189.91. The price has tested this level multiple times and bounced back each time, showing clear buying interest. Right now, it's retesting the same zone, and if it rejects again, we could see another push to the upside. I'm keeping an eye on this level for a potential long setup, but if it breaks below, further downside could be in play. Waiting for confirmation before making a move!

GBPJPY Sellers In Panic! BUY!

My dear followers,

This is my opinion on the GBPJPY next move:

The asset is approaching an important pivot point 189.48

Bias - Bullish

Technical Indicators: Supper Trend generates a clear signal while Pivot Point HL is currently determining the overall Bullish trend of the market.

Goal - 190.65

About Used Indicators:

For more efficient signals, super-trend is used in combination with other indicators like Pivot Points.

———————————

WISH YOU ALL LUCK

GBPJPY Price ActionHello Traders, Today's setup is based on the 4H timeframe. I identified a clear Quasimodo (QM) or Head-and-Shoulders (HS) pattern visible on both the H4 and 1H charts. After patiently observing market movements, I noticed that the price left behind liquidity and established a demand zone.

I'm now waiting for the market to sweep the liquidity and retest the demand zone before anticipating an upward move. Always ensure you practice strict risk management.

Wishing you the best of luck and happy trading!

USDJPY and GBPJPY AnalysisHello traders, this is a complete multiple timeframe analysis of this pair. We see could find significant trading opportunities as per analysis upon price action confirmation we may take this trade. Smash the like button if you find value in this analysis and drop a comment if you have any questions or let me know which pair to cover in my next analysis.

CADJPY - Take Advantage of This Clean Correction!CADJPY Daily Timeframe

CADJPY has shown a clear impulse in July 2024. We are now in a massive correction, consisting of 3 major waves, ABC. It appears we have almost completed Wave B and now we are anticipating wave C.

We expect wave C to push up to the corrective highs where we have the 61.8 fib.

Here are some key things to watch:

- Wave Structure: Ensure that Wave B has completed its corrective pattern

- Wave C Confirmation: Look for a strong bullish impulse off the lows of Wave B.

- Volume & Momentum: A rise in volume and bullish divergence in RSI/MACD could confirm Wave C is underway.

Confirmation for Wave C:

Break of Structure (BOS) / Trendline Break

When identifying confirmation for Wave C, a Break of Structure (BOS) or a Trendline Break is one of the strongest signals that the corrective phase is ending.

Break of Structure (BOS) – Key Levels to Watch

Wave B typically forms lower highs and lower lows. A break above the last lower high signals a bullish shift.

Look for a decisive close above the previous swing high on the 4H or daily timeframe. A weak break (with wicks) may indicate hesitation.

A higher low after the break adds extra confirmation.

Trendline Break – Reversal Signal

If Wave B formed a descending trendline, watch for a clean breakout with strong bullish candles (not just wicks).

Retest of the trendline as support after the breakout strengthens the case for Wave C starting.

Trade Idea:

- Watch for Wave C to start using the techniques listed above

- Once entered, keep stops below wave B

- Targets: 107 (500pips), 112 (1000pips)

Goodluck and as always trade safe!

See below for our previous swing setups:

Swing Setup 1

Swing Setup 2

Swing Setup 3

NZDJPY - 2025 Plan. Make It Your Best Year Yet!Here we have the 2 Day chart for NZDJPY.

We've seen a massive impulse mid 2024. We are now in an ABC correction.

We are currently in wave B of the correction, subwave B. Expecting subwave C to complete wave B.

We're looking for a rejection of the fib zone and a drop of over 700pips.

Trade idea:

- Watch for rejection of fib zone

- Once rejection appears, enter with stops above the highs

- Targets: 86 (350pips), 83 (700pips)

Once we've completed this move down, we'll be looking for longs. We'll update this setup if there's enough engagement.

Goodluck and as always, trade safe!

AUDJPY - Growing SHORTS! Big Move Ahead!In one of our last AUDJPY analysis, we indicated that price looked foppish. Since then, we've had almost a 2000pip drop!

That big drop can be marked as wave 1 in our new bearish impulsive trend.

We are now in Wave 2, which is an ABC correction. We have completed Wave A (3 waves). We are now in Wave B (3 waves). We're currently in subwave b of wave B. Expecting subwave c to appear very soon.

Trade Idea:

- Watch for bearish price action on lower timeframe

- You can use trendline break, fibs or BOS to find the reversal point

- When entered, put stops above subwave B.

- Target: 91 (750pips)

4Week Chart

Goodluck and as always, trade safe!

See our previous setups below:

AUDUSD Bearish Flag Formation: Potential for a Strong Downtrend

AUDUSD is currently trading around 0.63, forming a bearish flag pattern, which is a strong continuation signal for a potential drop in price. The market structure suggests that after a brief consolidation phase, the pair may break downward, targeting the 0.61 level. A confirmed breakout below the flag formation could accelerate selling pressure, leading to a sharp decline. Traders should monitor key support levels and bearish confirmations before entering short positions.

Fundamentally, the U.S. dollar remains strong amid expectations of continued Federal Reserve hawkishness. Recent economic data and risk-off sentiment in global markets have provided further support for USD strength, weighing heavily on AUDUSD. If market sentiment remains risk-averse, the pair could see additional downside pressure, making 0.61 a highly probable target.

From a technical perspective, maintaining a cautious approach is crucial. If AUDUSD breaks below the lower boundary of the flag pattern with strong volume, it could confirm further downside momentum. Traders should look for key resistance at 0.6350, as any rejection from this level could strengthen the bearish outlook. Keeping an eye on upcoming fundamental catalysts such as U.S. economic data and Australian trade reports will be crucial in determining the next move.

GBP/JPY Bullish Channel (07.3.25)The GBP/JPY pair on the M30 timeframe presents a Potential Buying Opportunity due to a recent Formation of a Channel Pattern. This suggests a shift in momentum towards the upside and a higher likelihood of further advances in the coming hours.

Possible Long Trade:

Entry: Consider Entering A Long Position around Trendline Of The Pattern.

Target Levels:

1st Resistance – 192.46

2nd Resistance – 193.40

🎁 Please hit the like button and

🎁 Leave a comment to support for My Post !

Your likes and comments are incredibly motivating and will encourage me to share more analysis with you.

Best Regards, KABHI_TA_TRADING

Thank you.

"GBP/JPY Short Trade Analysis – Successful Take Profit ExecutionThis is a GBP/JPY (British Pound/Japanese Yen) 1-hour chart from TradingView, showing a short trade setup with take profit (TP) levels and stop loss.

Key Observations:

Entry Point (Red Arrow)

The trader appears to have entered a sell (short) position at a resistance level, marked by the red arrow.

Price was likely rejected at this level, signaling a potential downward move.

Stop Loss (Red Box - Upper Zone)

The stop loss is placed above the entry point, at 192.386.

If the price moves above this level, the trade will be closed at a loss.

Take Profit Levels (Blue Lines)

TP1 (~190.750): First target for partial profit-taking.

TP2 (~190.000): Second target for further downside move.

Final TP (~189.275): If the price reaches this level, the trade will be fully closed in profit.

Trade Outcome

The chart annotation suggests that all TP levels were hit, meaning the price successfully moved downward after entry.

The trader made a successful short trade and secured profits.

Market Structure & Strategy:

The price initially moved up, but failed to break resistance, leading to a bearish rejection.

The trader likely identified this as a liquidity grab or false breakout, then entered a short position.

The price dropped and hit all take profit levels, confirming the trade's success.

Conclusion:

This was a well-planned short trade with proper risk management.

The risk-to-reward ratio looks good, with potential reward outweighing risk.

The trade was executed based on technical levels (support/resistance) and price action.

GBPJPY A Fall Expected! SELL!

My dear friends,

Please, find my technical outlook for GBPJPY below:

The instrument tests an important psychological level 191.67

Bias - Bearish

Technical Indicators: Supper Trend gives a precise Bearish signal, while Pivot Point HL predicts price changes and potential reversals in the market.

Target - 190.34

About Used Indicators:

Super-trend indicator is more useful in trending markets where there are clear uptrends and downtrends in price.

———————————

WISH YOU ALL LUCK

GBP/JPY Bullish above 189.14 levelKey Trading Level: 189.14

Bullish Scenario:

The overall sentiment remains bullish, supported by a breakout above the longer-term prevailing downtrend. The recent price action suggests an oversold consolidation, potentially retesting the breakout zone at 189.14. A bullish reversal from this level could reinforce the uptrend, targeting 190.60 as the next resistance, followed by 191.75 and 192.52 if upward momentum continues.

Bearish Scenario:

A confirmed loss of the 189.14 level and a daily close below it would invalidate the bullish outlook, signaling a potential reversal. In this case, downside targets include 187.93 as the first support level, with further declines extending toward 187.24 and 186.50 if selling pressure intensifies.

Conclusion:

The 189.14 level is a key pivot point for the next move in GBP/JPY. A successful retest and rebound could sustain the bullish trend, while a breakdown below this level would shift momentum in favor of the bears. Traders should closely watch price action around 189.14 for confirmation of the prevailing trend.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

GBPJPY: Expecting Bullish Continuation! Here is Why:

Remember that we can not, and should not impose our will on the market but rather listen to its whims and make profit by following it. And thus shall be done today on the GBPJPY pair which is likely to be pushed up by the bulls so we will buy!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

GBPJPY - More downside?GBP/JPY appears to be in a potentially bearish setup after recently testing resistance. The chart shows that price has formed a significant consolidation zone with clear upper and lower boundaries marked by the red horizontal lines. After making a recent high, the price seems to be struggling to break above the upper resistance zone highlighted by the pink box. The long downward-pointing red arrow marked on the chart is our highest probability move that we anticipate right now.

Given the recent price action and failure to establish new highs above resistance, the higher probability move is likely downward. This bearish outlook is supported by the apparent double top formation near the resistance zone and the pronounced selling pressure that has emerged after testing these levels. Traders should watch for a potential breakdown below recent support levels, which could accelerate the downside move toward the lower boundary of the range as indicated by the arrow's trajectory.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.