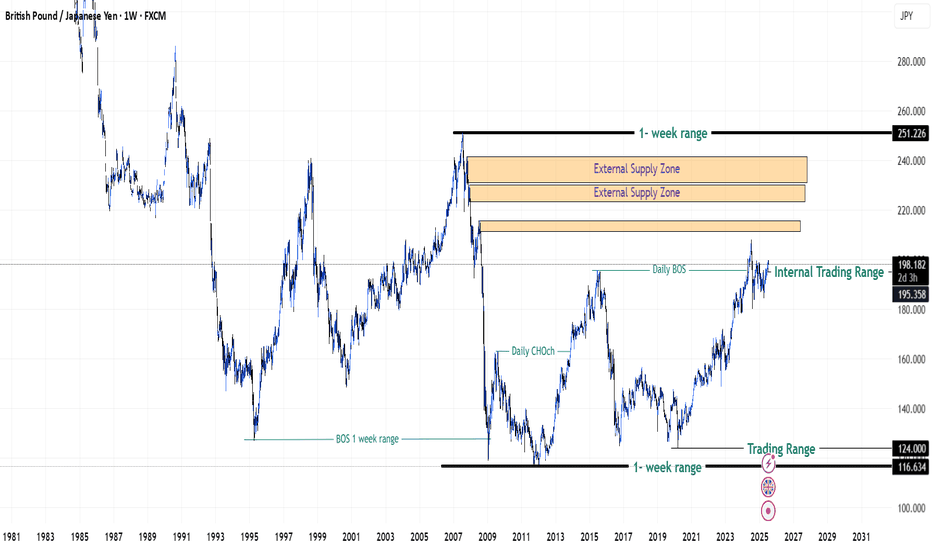

GBPJPY in Premium Zones of 2008 Financial Crisis - {17/07/2025}Educational Analysis says that GBPJPY (FX pair) may give trend Trading opportunities from this range, according to my technical analysis.

Broker - FXCM

So, my analysis is based on a top-down approach from weekly to trend range to internal trend range.

So my analysis comprises of two structures: 1) Break of structure on weekly range and 2) Trading Range to fill the remaining fair value gap

Will Jpy start to lose value like it is doing since 2019 or it will do free fall same like 2008 crisis.

Let's see what this FX pair brings to the table for us in the future.

Please check the comment section to see how this turned out.

DISCLAIMER:-

This is not an entry signal. THIS IS FOR EDUCATIONAL PURPOSES ONLY.

I HAVE NO CONCERNS WITH YOUR PROFIT OR LOSS,

Happy Trading.

Gbpjpy_outlook

STEAL THIS TRADE! GBP/JPY Long Setup(Thief Trader’s Secret Plan)💰 Thief Trader’s GBP/JPY Heist Alert – Stealthy Long Setup Loading!

🌍 Greetings, Profit Raiders!

Hola, Konnichiwa, Ni Hao, Privyet, Hallo, Bonjour!

📢 Attention Market Bandits & Chart Pirates—the GBP/JPY Beast is ripe for plunder! Time to execute the next Thief Trader Masterplan.

🎯 Entry Zone – Loot the Dip!

Current price = Open vault. Fire longs now or snipe pullbacks (15M/30M charts recent swing low level).

Pro Thief Move: Stack buy limits near swing lows/highs. Chart alerts = your secret weapon. 🔫

🛑 Stop Loss – Guard the Treasure!

Swing Thieves: Hide SL below 2H swing low of candle wick @ (~197.000).

Day Raiders: Adjust SL to your risk size & order count. No free rides!

🎯 Profit Target – Escape with the Cash!

Take the 202.000 bag or exit early if momentum fades.

🔪 Scalpers vs. Swingers – Choose Your Weapon!

Scalpers (Quick Strikes): Longs only. No distractions.

Swing Traders (Patient Hunters): Trail stops & lock in gains.

🌪️ Market Pulse – Bullish Winds Blowing!

Price battling MA Resistance? No panic. Bulls still rule thanks to:

Fundamentals + Macro Trends

COT Data + Sentiment Shift

Quant Scores & Intermarket Alignments

(Check Linnkss for the full heist blueprint.)

⚠️ News Trap Warning!

Upcoming high-impact events? Freeze trades or tighten stops. Trailing SL = your escape route.

🚨 Join the Thief Trading Crew!

Like 👍 or Boost 🚀 this idea to fuel our next raid.

Thief Trader Tactics = Daily Market Domination. Your support keeps the heists alive! 💰❤️

🤑 Stay Locked In – The Next Big Score is Coming…

Timing is everything. Watch the charts. Strike hard. Exit smarter.

"GBP/JPY: High-Risk Pips Grab – Escape Before Cops! 🏴☠️ GBP/JPY "Dragon Heist" – Bulletproof Bullish Raid (High-Risk, High-Reward) 🚨

🔥 Attention Market Pirates & Profit Raiders! 🔥

(Day/Swing Trade Plan – Long Entry Focused)

🔑 Entry Zone (Vault Cracked!):

"The Dragon’s loot is unguarded! Bullish pullback = prime stealing opportunity."

Buy Limit Orders: Layer entries near 15M/30M swing lows (wick/body). DCA-friendly!

Thief Pro Tip: Scalpers ride long-only waves. Swing traders? Stack slowly, escape rich.

🎯 Target (Escape Routes):

200.600 (or bail early if cops (resistance) swarm!)

🚨 Red Zone = High-Risk Take-Profit (Overbought? Reversal? Police (bears) lurk here!)

⛔ Stop Loss (Emergency Exit):

4H Swing Low/High (Wick-based) – Adjust for risk/lot size!

No martyr trades! SL = your heist survival kit.

📢 Breaking News (Fundamental Edge):

Dragon’s bullish fuel? Macro data, COT reports, sentiment—CHEK THE LIiNKk 👉🔗 (Don’t skip homework!)

💣 Trading Alerts:

News = Landmines! Avoid new trades during releases.

Trailing SL = Your Getaway Car (Lock profits, dodge volatility.)

💥 Boost This Heist!

Smash 👍, hit 🔔, and fund our next raid! Every boost = more stolen pips for the crew.

Stay tuned—another heist drops soon! 🤑 #ForexBandits

GBPJPY: Bullish Structure Still IntactGJ created a new HH then turned sideways. More consolidation or a deeper pull back could be seen before the next rally.

Last BOS: Break above 199.70 → confirmed bullish strength

H4 Demand Zone (Pullback): 198.30–198.60

Liquidity Above: Clean pools at 200.30 – 200.70

H1 Key Zone: 198.60–198.90 (H1 OB + unfilled FVG) → currently being tested.

Momentum Trigger: BOS above 199.30 to confirm buyers stepping back in.

M15 Micro-Structure: Slightly bearish (short-term), sweeping liquidity under 198.80.

What to Watch: M15 bullish BOS above 199.10–199.30 for intraday buy confirmation.

🟢Entry Zone 198.30 – 198.60

SL 197.90

TP1 199.70

TP2 200.30

TP3 201.00

❌ Bullish Invalidation

H1 close below 197.90 → bullish bias neutralized, expect deeper retrace into 197.20 – 197.50.

GBPJPY Extremely BullishAs described earlier GJ is extremely bullish and wants to target previous swing. current trading at 199.400 and travelling to the 199.857 which is previous swing high. In my yesterday's analysis I have given clue of GJ's being retracing and accumulating and going up again same is showing. We can see a pullback after taking swing high.

GBPJPY: Bullish Impulse May Take Price To 205! 700+ Pips MoveGBPJPY is in steady bullish move in other words it is in impulse move; price has not yet exhausted and there is still extended bullish move to completed before bears takes control over. Please use accurate risk management while trading and do your own analysis.

LIKE

COMMENT

SHARE

Good luck.

Team Setupsfx_

GBPJPY Eyes 200 BoJ Dovishness & Bullish UK SentimentGBPJPY pair has staged a decisive breakout from a multi-day consolidation zone, with technical momentum and macro fundamentals aligning in favor of further upside. Price action has respected a bullish continuation structure — a falling wedge followed by horizontal accumulation — and is now pressing toward the psychological 200.00 level. With the Bank of England holding firm on policy and the Bank of Japan maintaining its ultra-loose stance, GBPJPY presents one of the strongest carry trade setups in the market. Here's a breakdown of what’s driving this move and what to watch next:

📈 Current Bias: Bullish

The pair has confirmed a bullish breakout above the 198.80–198.95 resistance zone, targeting higher fib extensions at 199.40 and 200.00. Momentum is clearly on the bulls’ side as GBPJPY follows through on a textbook pattern breakout.

🔍 Key Fundamentals:

Bank of Japan’s Dovish Stance: The BoJ continues to resist any significant tightening, reaffirming yield curve control and negative real yields. This keeps the yen fundamentally weak, especially against higher-yielding currencies.

Bank of England’s Hawkish Hold: Despite global easing signals, the BoE remains cautious and data-dependent, with inflation still sticky in the UK. This underpins GBP strength relative to the yen.

Global Risk Appetite: Strong equity markets, especially the US500 rally, reduce demand for the safe-haven JPY and increase appetite for high-yielding cross pairs like GBPJPY.

⚠️ Risks to the Trend:

Safe-Haven Shocks: Any sudden geopolitical tension (e.g., Middle East, US-China trade rhetoric) may trigger JPY demand and reverse the bullish flow.

Unexpected BoE Dovish Pivot: A surprise in UK inflation or dovish commentary from the BoE could weaken GBP momentum.

JPY Intervention Risks: With the yen near historically weak levels, any threat or action from Japan’s Ministry of Finance or verbal intervention by BoJ officials could spark sudden volatility.

📅 Key News/Events Ahead:

Japan’s Tankan Survey (June 30): May influence BoJ tone.

UK Final Manufacturing PMI (July 3): A key gauge for growth momentum.

BoE Governor Bailey Speech (July 5): Any hints on policy trajectory will be market-moving.

US NFP & Global Risk Sentiment: Impacts broader carry trade appetite.

⚖️ Leader or Lagger?

GBPJPY is a leader — it often acts as the flagship pair for carry trade demand. Moves in GBPJPY frequently guide sentiment across other JPY pairs like CADJPY, AUDJPY, and NZDJPY, especially when driven by macro divergences. Its high beta to risk sentiment also makes it a prime barometer for global financial mood.

🎯 Conclusion:

GBPJPY has momentum, macro divergence, and a clean technical setup on its side. The breakout above consolidation favors a continued rally toward 199.40 and possibly 200.00. While geopolitical or policy shocks remain risks, the current backdrop supports staying bullish while above the 197.65 invalidation level.

#GBPJPY: UPDATED VIEW 24/10/2024 **GBPJPY UPDATED VIEW BASED ON PREVIOUS ANALYSIS**

Dear Traders,

I hope you are doing well. Based on our previous analysis of GBPJPY, we identified two potential selling opportunities within the market.

However, the bullish sentiment in the DXY currency pair has had a significant impact on JPY, causing it to fall short of its full value within the daily timeframe. As of today, we have observed a potential exhaustion of DXY’s bullish momentum, with four-hour candles indicating a strong bearish pressure. This development presents an opportunity for JPY to rebound, potentially allowing us to secure substantial profits within the market.

Now, let’s focus on the GBPJPY currency pair. The price has extended its bullish trend, although there is a possibility of a reversal from its current position. We recommend implementing appropriate stop-loss orders for any sell entries taken from the current market price. If the initial entry fails, we are confident that the price is likely to reverse from our second entry.

Before making any decisions based on this analysis, it is essential to conduct your own research. This analysis is solely for educational purposes and should not be considered financial advice.

We appreciate your feedback and support. If you find our work valuable, please consider liking and commenting on our ideas. Additionally, following us will provide us with encouragement and motivation.

Best regards,

Team SetupsFX_

#GBPJPY: 1170+ Massive Sell Opportunity! Get Ready For Big MoveDear Traders,

We have an excellent selling opportunity on GBPJPY, with over 1100+ selling move is likely to occur within next couple of weeks. Please use accurate risk management. For more chart related information read the chart carefully.

GBPJPY: Price is trading at crucial level, Possible Swing MoveDear Traders,

GBPJPY, price is currently trading at very crucial area from where we can expect price to reverse, currently the price momentum shows a strong bearish presence. This can be a swing sell after looking at the data, price can touch the previous yearly low.

#GBPJPY: Buyers and Sellers Both Has Equal Chances! Hey there! So, GBPJPY is at a pivotal moment, and we might see a mix of buying and selling activity in the market. Since the bulls aren’t exactly sure what to do next, here’s what we think:

- The GBPJPY pair is having a tough time breaking through the 194 region. The Japanese yen (JPY) is holding steady, making it hard to predict what will happen next. This has made trading JPY pairs a real challenge.

- Looking back at how prices have behaved in similar situations can give us some clues about what might happen in the future. But it’s important to do thorough research before we start trading. Just because something happened in the past doesn’t mean it will happen again.

- The Japanese yen (JPY) also tends to go down when the US dollar (USD) goes up. Since we’re bullish on the DXY index in the coming days, we think the JPY will probably take a hit, and it could go down a lot. It’s also worth keeping an eye on the GBP, which has been one of the most popular currencies since the market opened earlier today.

- In the meantime, we suggest setting two take-profit targets: one at 197 and another at 199. These levels are likely to see a lot of selling activity.

Now, let’s talk about what sellers should do:

- The price is currently in favour of sellers since it dropped from 195.50 to 193.50. And since the last two daily candles closed with strong bearish volume, it looks like the price is going to keep going down.

- If the price breaks below 190.50, that would be a great opportunity for sellers to make some money.

Good luck and trade safely!

Thank you for your unwavering support! 😊

If you’d like to contribute, here are a few ways you can help us:

- Like our ideas

- Comment on our ideas

- Share our ideas

Team Setupsfx_

❤️🚀

#GBPJPY: 600+ Pips Swing Move, JPY To Drop! GBPJPY has successfully rejected the area previously identified in our analysis of GJ. We had anticipated a price rejection and reversal with a strong bullish impulse, which has materialised. Following the positive candle close on Friday, we anticipate a continuation of the bullish trend and potential reaching of the 200 mark.

When trading, it is crucial to prioritise risk management. Conduct your own analysis and utilise this information solely for educational purposes.

Three potential targets have been identified: 198, 200, and 202. A stop loss can be positioned below our buying zone, as indicated by the black-marked zone.

Your support, expressed through likes, comments, and shares, is greatly appreciated and encourages us to continue providing valuable content.

❤️🚀

Team Setupsfx_

GBPJPY: Bullish As Long As 195 Hold As SupportI'm looking to buy GJ after a small retracement or breakout entry...

POI 195.2-195.4 which has a 50 and 62 fib confluence.

If no retracement, I will be looking for a breakout entry above 196.2

Let's wait and let the market come to us. Set those price alerts!

GBPJPY: 1050+ Pips Move! Will JPY continue dropping? In our previous analysis, we anticipated a similar move for GBPJPY, but the price dropped a bit further than expected. It’s now in a position to buy long, but please use accurate risk management as JPY pairs are likely to remain more volatile than ever. There are three targets you can keep an eye on: 197, then 200. Remember, trading involves risk, so make your own decisions.

Good luck and trade safely!

Thank you for your unwavering support! 😊

If you’d like to contribute, here are a few ways you can help us:

- Like our ideas

- Comment on our ideas

- Share our ideas

Team Setupsfx_

❤️🚀

#GBPJPY: +916 Pips Swing Buy Opportunity! Comment Down Your ViewThe FX:GBPJPY price has moved nicely from 187 to 191, almost +400 pips. I expect a small correction, but then the bullish move should continue towards the 200 region. You can set a target based on your analysis or set it at 200, whichever works for you. Good luck and trade safely.

Good luck and trade safely!

Thank you for your unwavering support! 😊

If you’d like to contribute, here are a few ways you can help us:

- Like our ideas

- Comment on our ideas

- Share our ideas

Team Setupsfx_

❤️🚀

GBPJPY - Short Term Sell Trade Update!!!Hi Traders, on May 14th I shared this idea "GBPJPY - Looking To Sell Pullbacks In The Short Term"

I expected to see pullbacks and further continuation lower until the strong resistance zone holds. You can read the full post using the link above.

Pullback and push lower happened as per the plan!!!

If you enjoy this idea, don’t forget to LIKE 👍, FOLLOW ✅, SHARE 🙌, and COMMENT ✍! Drop your thoughts and charts below to keep the discussion going. Your support helps keep this content free and reach more people! 🚀

-------------------------------------------------------------------------------------------------------------------

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

GBP)JPY) Technical analysis setup Read The ChaptianSMC trading point update

Technical analysis of GBP/JPY (British Pound / Japanese Yen) on the 3-hour timeframe using Smart Money Concepts (SMC) and structure-based patterns.

---

Market Overview

Current Price: 193.808

EMA 200: 193.100 (acting as dynamic support)

RSI (14): 42.24 → Neutral/Bearish territory

---

Two Possible Scenarios (Bullish & Bearish)

Bullish Scenario

Zone of Interest: 193.1–193.5 (support area)

Price is hovering just above the support level and 200 EMA.

Double green arrows mark previous rejections = demand zone.

If price respects support and forms a higher low:

Possible rally to:

First Target: 196.415

Second Target: 198.838

Bearish Scenario

If price breaks below the yellow support zone and 200 EMA:

Clean path down to:

Target Point: 190.098 (marked strong support zone)

---

Zones of Importance

Support Level: 193.0–193.5 (minor support, under retest)

Strong Support Level: ~190.1 (high probability bounce zone)

Target Resistances:

196.415 (intermediate high)

198.838 (major resistance / swing high)

---

Trade Plan Summary

Direction Entry Zone SL Target R/R Potential

Long 193.1–193.5 Below 193.0 196.4 / 198.8 1:2 to 1:3+

Short Below 193.0 Above 194.0 190.1 1:2+

Mr SMC Trading point

---

Additional Notes

Watch price action closely at the support zone before entry.

RSI shows some bearish momentum but not oversold yet.

The outcome may be influenced by JPY strength and macro events (check economic calendar).

pales support boost 🚀 analysis follow)

gbpjpy sell signal. Don't forget about stop-loss.

Write in the comments all your questions and instruments analysis of which you want to see.

Friends, push the like button, write a comment, and share with your mates - that would be the best THANK YOU.

P.S. I personally will open entry if the price will show it according to my strategy.

Always make your analysis before a trade

gbpjpy sell signal. Don't forget about stop-loss.

Write in the comments all your questions and instruments analysis of which you want to see.

Friends, push the like button, write a comment, and share with your mates - that would be the best THANK YOU.

P.S. I personally will open entry if the price will show it according to my strategy.

Always make your analysis before a trade

GBPJPY: Will Price Touch a Major Psychological Point Of 200? The GBPJPY currency pair is currently struggling to break through the 194 region as the Japanese yen (JPY) consolidates, making the future price trajectory uncertain. This situation has significantly complicated trading JPY pairs.

Analysing historical price behaviour in similar circumstances can provide insights into potential future movements, but it’s crucial to conduct thorough research before engaging in trading. Past performance doesn’t guarantee adherence to chart trends.

The Japanese yen (JPY) also exhibits a negative correlation with the US dollar (USD). Given our bullish stance on the DXY index in the coming days, we anticipate substantial pressure on the JPY, potentially leading to a significant decline. It’s also worth considering the GBP, which has surged to prominence as one of the most sought-after currencies since the market opened earlier today.

In the meantime, we recommend setting two take-profit targets: one at 197 and another at 199. These levels are likely to witness substantial bearish volume entering the market.

We wish you successful trading and emphasise the importance of adhering to safety protocols.

We appreciate your unwavering support and encourage you to contribute by liking, commenting, or sharing our ideas.

Team Setupsfx_

❤️🚀

GBP/JPY) bullish trend analysis Read The ChaptianSMC trading point update

Technical analysis setup for the GBP/JPY pair on a 4-hour timeframe. Here's the breakdown of the trading idea:

---

Key Concepts Highlighted:

1. Support Trend Level (Yellow Zone):

The yellow zone marks a strong confluence area:

Horizontal support from previous price reactions.

Trendline support that has held multiple times.

Close to the 200 EMA (at 191.833), which acts as dynamic support.

2. Bullish Reversal Pattern:

The chart shows a rounded bottom/cup-like structure forming at support—often a sign of accumulation before a reversal.

Price is expected to bounce from this support zone and move higher within the ascending channel.

3. Target Point Projection:

The projected move is around 515.8 pips, targeting the 197.949 level.

This target aligns with the upper boundary of the ascending trend channel.

4. RSI (Relative Strength Index):

RSI is around 43–44, near oversold territory, suggesting potential bullish momentum if a bounce occurs.

Mr SMC Trading point

Conclusion:

This setup suggests a potential long (buy) opportunity:

Entry near the 193.0–193.5 zone (support/trendline confluence).

Stop loss likely below the 200 EMA (~191.5 area).

Target arounSMC trading point update

Technical analysis setup for the GBP/JPY pair on a 4-hour timeframe. Here's the breakdown of the trading idea:

---

Key Concepts Highlighted:

1. Support Trend Level (Yellow Zone):

The yellow zone marks a strong confluence area:

Horizontal support from previous price reactions.

Trendline support that has held multiple times.

Close to the 200 EMA (at 191.833), which acts as dynamic support.

2. Bullish Reversal Pattern:

The chart shows a rounded bottom/cup-like structure forming at support—often a sign of accumulation before a reversal.

Price is expected to bounce from this support zone and move higher within the ascending channel.

3. Target Point Projection:

The projected move is around 515.8 pips, targeting the 197.949 level.

This target aligns with the upper boundary of the ascending trend channel.

4. RSI (Relative Strength Index):

RSI is around 43–44, near oversold territory, suggesting potential bullish momentum if a bounce occurs.

Mr SMC Trading point

Conclusion:

This setup suggests a potential long (buy) opportunity:

Entry near the 193.0–193.5 zone (support/trendline confluence).

Stop loss likely below the 200 EMA (~191.5 area).

Target around 197.95, offering a good risk/reward ratio.

The idea is based on trend continuation, a bounce from confluence support, and RSI support for bullish reversal.

Pales support boost 🚀 analysis follow )