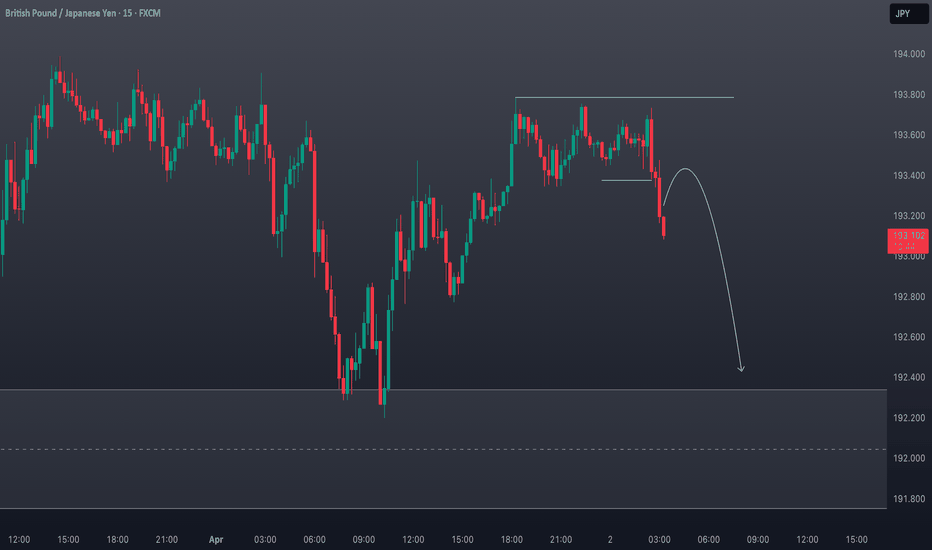

GBPJPY SHORT FORECAST Q2 W20 D16 Y25GBPJPY SHORT FORECAST Q2 W20 D16 Y25

Professional Risk Managers👋

Welcome back to another FRGNT chart update📈

Diving into some Forex setups using predominantly higher time frame order blocks alongside confirmation breaks of structure.

Let’s see what price action is telling us today!

💡Here are some trade confluences📝

✅Weekly order block rejection

✅Daily order block rejection

✅Intraday 15' order blocks

✅Higher time frame bearish structure

🔑 Remember, to participate in trading comes always with a degree of risk, therefore as professional risk managers it remains vital that we stick to our risk management plan as well as our trading strategies.

📈The rest, we leave to the balance of probabilities.

💡Fail to plan. Plan to fail.

🏆It has always been that simple.

❤️Good luck with your trading journey, I shall see you at the very top.

🎯Trade consistent, FRGNT X

Gbpjpy_outlook

GBPJPY SHORT FORECAST Q2 W20 D15 Y25GBPJPY SHORT FORECAST Q2 W20 D15 Y25

Professional Risk Managers👋

Welcome back to another FRGNT chart update📈

Diving into some Forex setups using predominantly higher time frame order blocks alongside confirmation breaks of structure.

Let’s see what price action is telling us today!

💡Here are some trade confluences📝

✅Weekly order block rejection

✅Daily order block rejection

✅Intraday 15' order blocks

✅Gap fill

🔑 Remember, to participate in trading comes always with a degree of risk, therefore as professional risk managers it remains vital that we stick to our risk management plan as well as our trading strategies.

📈The rest, we leave to the balance of probabilities.

💡Fail to plan. Plan to fail.

🏆It has always been that simple.

❤️Good luck with your trading journey, I shall see you at the very top.

🎯Trade consistent, FRGNT X

GBPJPY SHORT FORECAST Q2 W20 D14 Y25GBPJPY SHORT FORECAST Q2 W20 D14 Y25

Professional Risk Managers👋

Welcome back to another FRGNT chart update📈

Diving into some Forex setups using predominantly higher time frame order blocks alongside confirmation breaks of structure.

Let’s see what price action is telling us today!

💡Here are some trade confluences📝

✅Weekly order block rejection

✅Daily order block rejection

✅Intraday 15' order blocks

✅Gap fill

🔑 Remember, to participate in trading comes always with a degree of risk, therefore as professional risk managers it remains vital that we stick to our risk management plan as well as our trading strategies.

📈The rest, we leave to the balance of probabilities.

💡Fail to plan. Plan to fail.

🏆It has always been that simple.

❤️Good luck with your trading journey, I shall see you at the very top.

🎯Trade consistent, FRGNT X

GBPJPY SHORT FORECAST Q2 W20 D13 Y25GBPJPY SHORT FORECAST Q2 W20 D13 Y25

Professional Risk Managers👋

Welcome back to another FRGNT chart update📈

Diving into some Forex setups using predominantly higher time frame order blocks alongside confirmation breaks of structure.

Let’s see what price action is telling us today!

💡Here are some trade confluences📝

✅Weekly order block rejection

✅Daily order block rejection

✅Intraday 15' order blocks

✅Gap fill

🔑 Remember, to participate in trading comes always with a degree of risk, therefore as professional risk managers it remains vital that we stick to our risk management plan as well as our trading strategies.

📈The rest, we leave to the balance of probabilities.

💡Fail to plan. Plan to fail.

🏆It has always been that simple.

❤️Good luck with your trading journey, I shall see you at the very top.

🎯Trade consistent, FRGNT X

GBPJPY Bullish Breakout – Watch for Momentum Towards 194.60GBPJPY has broken out of a descending wedge and is now retesting the breakout zone near 189.50–189.80. This area aligns with previous structure support and the wedge's upper boundary. Price action indicates bullish momentum is resuming.

🔑 Key Levels:

Current Price: 189.66

Breakout Level: ~189.50

Resistance Targets:

TP1: 190.55 (recent resistance high)

TP2: 192.57

TP3: 194.61 (key supply/weekly resistance zone)

✅ Bullish Confluence:

Breakout from falling wedge pattern

Strong retest of breakout zone with consolidation

Higher low formation and bullish engulfing attempt

No major resistance until 190.50, providing clean upside

🧠 Fundamental Context:

CBI Report (UK): Sentiment and investment outlook among UK manufacturers is deteriorating, but the pound has shown resilience likely driven by broader risk-on market sentiment.

BOJ Outlook (Japan): IMF suggests BOJ is likely to delay further rate hikes due to global uncertainty from US tariffs, maintaining a dovish bias. This weakens the yen’s fundamental strength.

Market Mood: With Japan facing delayed policy tightening and UK's inflation still above target, GBPJPY favors the bullish case in the short term.

💡 Trade Idea:

Bias: Bullish above 189.30

Entry: On retest confirmation around 189.50

Target 1: 190.55

Target 2: 192.57

Target 3: 194.61

Stop Loss: Below 188.80

📌 Note: Keep an eye on US data and BOJ tone shifts. Any risk-off shift in global markets could affect yen strength unexpectedly.

GBPJPY SHORT FORECAST Q2 W19 D9 Y25GBPJPY SHORT FORECAST Q2 W19 D9 Y25

Professional Risk Managers👋

Welcome back to another FRGNT chart update📈

Diving into some Forex setups using predominantly higher time frame order blocks alongside confirmation breaks of structure.

Let’s see what price action is telling us today!

💡Here are some trade confluences📝

✅Weekly order block rejection

✅Daily order block rejection

✅Intraday 15' order blocks

✅Tokyo ranges to be filled

🔑 Remember, to participate in trading comes always with a degree of risk, therefore as professional risk managers it remains vital that we stick to our risk management plan as well as our trading strategies.

📈The rest, we leave to the balance of probabilities.

💡Fail to plan. Plan to fail.

🏆It has always been that simple.

❤️Good luck with your trading journey, I shall see you at the very top.

🎯Trade consistent, FRGNT X

GBPJPY SHORT FORECAST Q2 W19 D8 Y25GBPJPY SHORT FORECAST Q2 W19 D8 Y25

Professional Risk Managers👋

Welcome back to another FRGNT chart update📈

Diving into some Forex setups using predominantly higher time frame order blocks alongside confirmation breaks of structure.

Let’s see what price action is telling us today!

💡Here are some trade confluences📝

✅Weekly order block rejection

✅Daily order block rejection

✅Intraday 15' order blocks

✅Tokyo ranges to be filled

🔑 Remember, to participate in trading comes always with a degree of risk, therefore as professional risk managers it remains vital that we stick to our risk management plan as well as our trading strategies.

📈The rest, we leave to the balance of probabilities.

💡Fail to plan. Plan to fail.

🏆It has always been that simple.

❤️Good luck with your trading journey, I shall see you at the very top.

🎯Trade consistent, FRGNT X

GBPJPY SHORT FORECAST Q2 W19 D7 Y25GBPJPY SHORT FORECAST Q2 W19 D7 Y25

Professional Risk Managers👋

Welcome back to another FRGNT chart update📈

Diving into some Forex setups using predominantly higher time frame order blocks alongside confirmation breaks of structure.

Let’s see what price action is telling us today!

💡Here are some trade confluences📝

✅Weekly order block rejection

✅Daily order block rejection

✅Intraday 15' order blocks

✅Tokyo ranges to be filled

🔑 Remember, to participate in trading comes always with a degree of risk, therefore as professional risk managers it remains vital that we stick to our risk management plan as well as our trading strategies.

📈The rest, we leave to the balance of probabilities.

💡Fail to plan. Plan to fail.

🏆It has always been that simple.

❤️Good luck with your trading journey, I shall see you at the very top.

🎯Trade consistent, FRGNT X

GBPJPY: Structure Is Still BullishAs explained in the video, my bias is still bullish. HHs and LHs are still being formed. So I am looking to buy GJ as long at 189.97 holds as support. Nice breakout and retest of the falling wedge, which has a bullish FVG and bearish breaker block confluence. I am waiting to see how London looks. Remember we have FOMC tomorrow.

GBP/JPY "The Dragon" Forex Bank Heist Plan (Scalping/Day Trade)🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑 💰💸✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the GBP/JPY "The Dragon" Forex Market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is to escape near the high-risk MA Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 🏆💸"Take profit and treat yourself, traders. You deserve it!💪🏆🎉

Entry 📈 : "The vault is wide open! Swipe the Bullish loot at any price - the heist is on!

however I advise to Place buy limit orders within a 15 or 30 minute timeframe nearest or swing low or high level for pullback entries.

Stop Loss 🛑:

📍 Thief SL placed at the recent/swing low level Using the 1H timeframe (188.000) Day/Scalping trade basis.

📍 SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

🏴☠️Target 🎯: 191.000

💰💵💸GBP/JPY "The Beast" Forex Market Heist Plan (Scalping/Day) is currently experiencing a bullishness,., driven by several key factors. 👇👇👇

📰🗞️Get & Read the Fundamental, Macro, COT Report, Quantitative Analysis, Sentimental Outlook, Intermarket Analysis, Future trend targets and Overall outlook score..., go ahead to check 👉👉👉🔗

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

GBPJPY LONG FORECAST Q2 W19 D6 Y25GBPJPY LONG FORECAST Q2 W19 D6 Y25

Professional Risk Managers👋

Welcome back to another FRGNT chart update📈

Diving into some Forex setups using predominantly higher time frame order blocks alongside confirmation breaks of structure.

Let’s see what price action is telling us today!

💡Here are some trade confluences📝

✅Weekly 50 EMA

✅Daily 50 EMA

✅Intraday 15' order block

✅Tokyo ranges to be filled

✅Intraday bullish breaks of structure to be confirmed

🔑 Remember, to participate in trading comes always with a degree of risk, therefore as professional risk managers it remains vital that we stick to our risk management plan as well as our trading strategies.

📈The rest, we leave to the balance of probabilities.

💡Fail to plan. Plan to fail.

🏆It has always been that simple.

❤️Good luck with your trading journey, I shall see you at the very top.

🎯Trade consistent, FRGNT X

#GBPJPY:Three Positions Currently Opened, What about the next? Our three positions are currently open based on our last three ideas on GJ. We’re witnessing a strong bullish movement at the moment. Our next big target is 197, and then we aim for 200. Remember, trading involves risk, so take your own decisions.

Good luck and trade safely!

Thank you for your unwavering support! 😊

If you’d like to contribute, here are a few ways you can help us:

- Like our ideas

- Comment on our ideas

- Share our ideas

Team Setupsfx_

❤️🚀

GBPJPY: Are Bulls Ready To Rally?I've already entered a buy. A more conservative entry would be to wait for the descending TL break and retest. Another potential buy entry would be a buy stop around 191.743.

Confirmations:

- Bullish CHoCH

- Creating new HHs and HLs

- Multiple Bullsih FVGs

- Trading above major QP 190

Group Signal:

Entry 191.066

SL 190.5

TP1 191.266

TP2 191.566

TP3 192.066

TP4 193.066

GBPJPY LONG FORECAST Q2 W18 D28 Y25GBPJPY LONG FORECAST Q2 W18 D28 Y25

Professional Risk Managers👋

Welcome back to another FRGNT chart update📈

Diving into some Forex setups using predominantly higher time frame order blocks alongside confirmation breaks of structure.

Let’s see what price action is telling us today!

💡Here are some trade confluences📝

✅Weekly 50 EMA

✅Daily 50 EMA

✅Intraday 15' order blocks

✅Tokyo ranges to be filled

✅Intraday 15' order block trading levels

🔑 Remember, to participate in trading comes always with a degree of risk, therefore as professional risk managers it remains vital that we stick to our risk management plan as well as our trading strategies.

📈The rest, we leave to the balance of probabilities.

💡Fail to plan. Plan to fail.

🏆It has always been that simple.

❤️Good luck with your trading journey, I shall see you at the very top.

🎯Trade consistent, FRGNT X

GBPJPY Reclaims 190 – Ready for 195?After breaking below the 188.00 support zone and testing 184.50 support, GBPJPY quickly reversed, signaling strong buying interest and a classic false breakdown.

Last week, the pair also reclaimed the key 190.00 level – an important technical and psychological area – showing clear strength and readiness for a potential continuation higher.

The key question now: Is GBPJPY ready to launch towards new highs?

Here’s why I stay bullish:

- Strong rejection at 184.50 confirms buyer dominance.

- Recovery above 190.00 is a major bullish signal.

- Market structure now favors buying dips

T rading Plan:

I’m looking to buy dips, staying bullish as long as 187.00 remains intact.

🎯 Targeting a move towards 195.00.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analyses and educational articles.

#GBPJPY: Will JPY Drop or Continue The Bullish Trend? As JPY strengthens, all ‘XXXJPY’ pairs sold heavily. This trade war scenario is uncertain, so it brings significant risk. If strong news supports the US DOLLAR, we’ll likely see a sharp price drop. Use accurate risk management and analyse before blindly following any advice.

Good luck and trade safely. We wish you the best.

Thanks for your support and love.

Team Setupsfx_

#GBPJPY: +250 Pips From Last Idea Expecting A Strong Bulls! The GBPJPY currency pair experienced a decline to the 190 area, which represents a discounted price range. Subsequently, the price reversed positively by approximately 250 pips. Our market analysis remains unchanged, and we anticipate that the price will continue to exert dominance.

It is possible that the price may experience a correction or a downward movement, as we anticipate the release of strong economic data this week. This data is likely to influence the future trajectory of the currency pair.

We encourage you to like and comment for further insights. Your support has been invaluable throughout our journey, and we sincerely hope that you achieve success in your own market endeavours.

Team Setupsfx_

❤️🚀

GBPJPY Under Pressure: Potential Sell Opportunity.The GBPJPY pair has recently broken structure to the downside on the 4-hour timeframe, signaling bearish momentum. The pair is currently under significant selling pressure, with price action suggesting a potential continuation of the downtrend. Here's a deeper analysis of the situation:

Market Structure: The recent break of structure to the downside indicates that sellers are in control. The pair has failed to reclaim previous highs, reinforcing the bearish sentiment.

Key Levels:

Range High: The stop-loss level should be placed above the recent range high to manage risk effectively. This level acts as a key invalidation point for the bearish setup. 🚫

Range Low: The target is the previous range low, which aligns with a strong support zone. This level could act as a magnet for price, given the current bearish momentum. 🎯

Bearish Pressure: The pair is trading below key moving averages (e.g., 50 EMA and 200 EMA on the 4-hour chart), further confirming the bearish bias. Additionally, momentum indicators like RSI and MACD may show bearish divergence or oversold conditions, which could provide further confluence for the trade idea. 📊

Risk Management: As always, proper risk management is crucial. Ensure that the position size aligns with your trading plan, and avoid over-leveraging. 🔒

Fundamental Context: Keep an eye on any GBP or JPY-related news that could impact the pair, such as central bank decisions, economic data releases, or geopolitical developments. These factors could either accelerate or invalidate the current technical setup. 📰

Disclaimer ⚠️

This analysis is for educational and informational purposes only and does not constitute financial advice. Trading involves significant risk, and you should only trade with capital you can afford to lose. Always conduct your own research and consult with a financial professional before making any trading decisions. 📢

#GBPJPY: 681+ Pips Buying Chance from a Key Level. Dear Traders,

Since the Japanese Yen (JPY) experienced a significant decline in the market, prices have risen. This analysis examines two key areas: the complex bullish price behaviour and the rejection of prices at levels we are currently monitoring for potential entry. While this chart analysis serves as a secondary reference, it should complement your own trading strategies.

Best regards,

Team Setupsfx_

My Directional Bias on GBPJPY for the long run {29/03/2025}Educational Analysis says that GBPJPY may give countertrend opportunities from this range, according to my technical analysis.

Broker - FXCM

So, my analysis is based on a top-down approach from weekly to trend range to internal trend range.

So my analysis comprises of two structures: 1) Break of structure on weekly range and 2) External pushback to fill the remaining fair value gap

1) Break of structure on weekly range is down trend for the long run period of 10 years, may be it switch to new character or change its direction to bullish.

2) External pushback structure is the trading range where it trades on the smaller time frame,

On this structure range market on inside trading or smaller time frame is bullish towards fib of 1.618 and make turn to fill the fair value gaps of it.

Let's see what this pair brings to the table for us in the future.

Please check the comment section to see how this turned out.

DISCLAIMER:-

This is not an entry signal. THIS IS ONLY EDUCATIONAL PURPOSE ANALYSIS.

I have no concerns with your profit and loss from this analysis.

I HAVE NO CONCERNS WITH YOUR PROFIT OR LOSS,

Happy Trading, Fx Dollars.

GBPJPY - Short Term Sell Idea Update!!!Hi Traders, on March 26th I shared this idea "GBPJPY - Expecting Bearish Continuation In The Short Term"

We expected to see retraces and further continuation lower. You can read the full post using the link above.

Retrace and push lower happened until it was blocked by a bullish divergence.

If you enjoy this idea, don’t forget to LIKE 👍, FOLLOW ✅, SHARE 🙌, and COMMENT ✍! Drop your thoughts and charts below to keep the discussion going. Your support helps keep this content free and reach more people! 🚀

-------------------------------------------------------------------------------------------------------------------

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

GBP/JPY: Fibonacci Levels Signal Possible Bullish ContinuationTechnical Analysis: GBP/JPY Bullish Continuation 📈

The GBP/JPY chart provided highlights a bullish trend continuation setup, supported by Fibonacci retracement levels. Here's a detailed breakdown:

📊 Fibonacci Levels in Play

The swing low to swing high has been plotted, revealing key retracement levels.

The price is currently near the 50% retracement level (194.326), a critical support zone in bullish trends.

The 61.8% retracement level (194.165), often called the "golden ratio," serves as a stronger support below this.

📈 Bullish Bias

The overall trend remains bullish, with higher highs and higher lows visible on the chart.

The corrective pullback to Fibonacci levels suggests a potential continuation of the upward momentum.

🎯 Target Projection

The arrow on the chart points to a projected move toward the 195.683 level, aligning with the -50% Fibonacci extension.

This target aligns with the bullish trend and indicates a potential breakout above the recent high.

🔍 Confluence and Confirmation

The price action shows signs of rejection at the 50% retracement level, indicating buyer interest.

A bullish candlestick pattern or increased volume near this zone would further confirm the upward move.

⚠️ Risk Management

The 61.8% level (194.165) is a key invalidation point. A break below this level could signal a deeper retracement toward the 78.6% level (193.937) or even the swing low.

This analysis is for informational purposes only and does not constitute financial advice. Trading involves significant risk, and you should only trade with capital you can afford to lose. Always conduct your own research and consult with a financial advisor before making trading decisions.