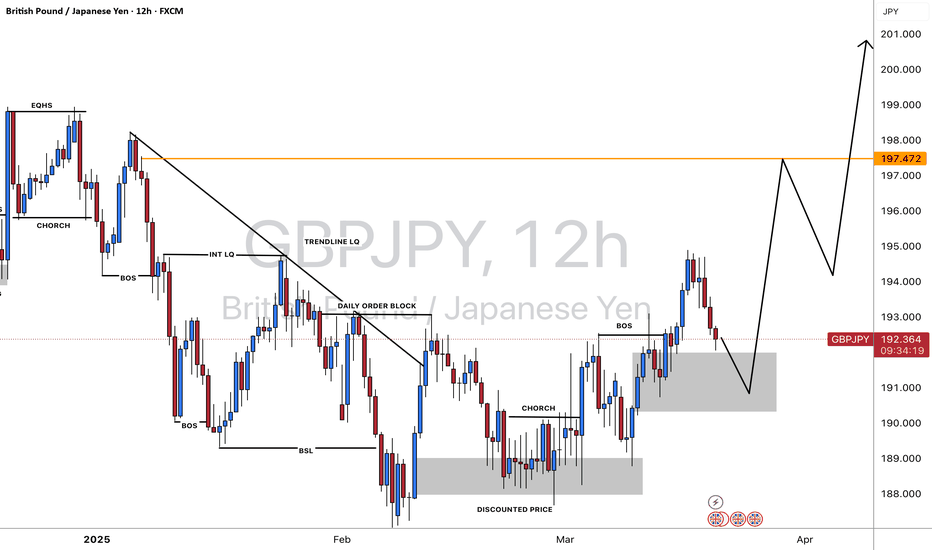

Gbpjpy_outlook

gbpjpy sell signal. Don't forget about stop-loss.

Write in the comments all your questions and instruments analysis of which you want to see.

Friends, push the like button, write a comment, and share with your mates - that would be the best THANK YOU.

P.S. I personally will open entry if the price will show it according to my strategy.

Always make your analysis before a trade

GBPJPY Bulls Are Back In TownAs explained in the video, we have several bullish confirmations...

Key Sup 190.3

Key Res 193

- Bullish CHoCH

- Formed a new HH and HL

- H4 TL break and retest

- Retest of bullish OB

- Multiple bullish FVGs

- Bullish MACD

I have a small position open...

🟢BUY GJ 192.315

SL 191.6

TP1 192.515

TP2 192.815

TP3 193.315

TP4 194.315

Will scale in another position if we get a break and close above 193.

GBP/JPY e Analysis & Probability Estimation March 4 2025Key Observations Across Timeframes:

1. Market Structure & Trend Analysis:

Short-term (M15, M30):

Price is consolidating near 189.200, testing the previous daily low (PDL) for liquidity.

A Break of Structure (BOS) occurred, signaling short-term bearish control.

The price is hovering at a key demand zone (PWL - 188.500/187.800).

If price breaks below 188.800, further downside is likely.

Mid-term (H1, H4):

The price rejected equilibrium (~189.800 - 190.000), showing weakness.

A Change of Character (ChOCH) to the downside suggests a bearish trend continuation.

Liquidity below PWL (187.800) could be a target before a potential bounce.

Long-term (D1):

The price is in a larger downtrend, failing to break above premium zones (~190.500 - 192.000).

Liquidity below PWL (~188.000 - 187.500) is uncollected, making it a likely target.

The next major support lies in the discount zone (~185.500 - 186.500).

2. Key Liquidity Zones & Supply/Demand Areas:

Premium Zone (~190.500 - 192.000): Major resistance; rejection happened here.

Equilibrium (~189.800 - 190.000): Price failed to hold above, signaling weakness.

Discount Zone (~187.500 - 186.500): Next strong demand area if price continues lower.

Previous Daily Low (PDL - 188.800): Price is testing this level for liquidity; a break here could lead to further downside.

Previous Weekly Low (PWL - 187.500): Untapped liquidity below, making it a strong target for price movement.

Probability-Based Scenarios:

1. Bearish Continuation to 187.800 - 186.500 (Break Below PDL & PWL)

Probability: 65%

Reasons:

Failure to hold above equilibrium (189.800).

Bearish BOS & ChOCH confirmations on H1/H4 suggest a move down.

Liquidity below 188.000 (PWL) remains uncollected.

Strong daily downtrend supports further downside.

Bearish Confirmation:

If price breaks and holds below 188.800, expect a move toward 187.500 - 186.500.

2. Bullish Reversal from Discount Zone (Bounce from 188.500 - 187.500)

Probability: 35%

Reasons:

Potential liquidity grab at PWL (188.000 - 187.500) before reversing.

Demand zone at 187.500 - 186.500 could cause a bullish reaction.

If price holds above 188.800, we may see a bounce to 189.800 - 190.000.

Bullish Confirmation:

If price fails to break below 188.500, a push back toward equilibrium (189.800) is possible.

Final Thoughts & Trade Plan:

Bearish bias (65% probability) for continuation toward 187.800 - 186.500.

Key Confirmation Levels:

Below 188.800: Bearish toward 187.500 - 186.500.

Above 189.200: Potential bullish recovery toward 189.800 - 190.000.

Trade Setup Overview:

Bias: Bearish (65% probability)

Entry Type: Breakout & Retest

📉 Sell (Short) Trade Setup:

🔴 Entry: Below 188.800 (Confirmed BOS)

🎯 Take Profit (TP) Targets:

TP1: 188.200 (PWL - Previous Weekly Low)

TP2: 187.800 (Liquidity sweep level)

TP3: 186.500 (Major discount zone)

🛑 Stop Loss (SL): 189.400 (Above minor liquidity)

📊 Risk-to-Reward (R:R):

TP1: ~1:2

TP2: ~1:3

TP3: ~1:5

🔹 Confirmation Needed:

Strong candle close below 188.800 (Break & retest scenario)

No immediate bullish rejection at 188.500

📈 Buy (Long) Trade Setup (Lower Probability - 35%)

🟢 Entry: Above 189.200 (Bullish rejection & BOS)

🎯 Take Profit (TP) Targets:

TP1: 189.800 (Equilibrium zone)

TP2: 190.500 (Supply zone)

TP3: 191.500 (Major resistance)

🛑 Stop Loss (SL): 188.700 (Below structure low)

📊 Risk-to-Reward (R:R):

TP1: ~1:2

TP2: ~1:3

TP3: ~1:5

🔹 Confirmation Needed:

Price needs to hold above 189.200 with strong bullish momentum.

No immediate rejection from equilibrium (189.800).

🛠️ Execution Tips:

🔄 Wait for a clear breakout & retest before entering.

⚖️ Adjust lot size based on risk tolerance (~1-2% per trade).

🕰️ Monitor price action on the lower timeframes (M15/M30) for entry precision.

GBP/JPY "The Beast" Forex Market Heist Plan🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑💰🐱👤🐱🏍

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the GBP/JPY "The Beast" Forex market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry and short entry. 🏆💸Book Profits, Be wealthy and safe trade.💪🏆🎉

Entry 📈 :

"The loot's within reach! Wait for the breakout, then grab your share - whether you're a Bullish thief or a Bearish bandit!"

Buy entry above 192.500

Sell Entry below 187.000

However, I recommended to place buy stop for bullish side and sell stop for bearish side.

Stop Loss 🛑:

-Thief SL placed at 189.000 (swing Trade Basis) for Bullish Trade

-Thief SL placed at 189.000 (swing Trade Basis) for Bearish Trade

Using the 4H period, the recent / swing low or high level.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯:

-Bullish Robbers Primary TP 197.000 / Secondary TP 201.000 (or) Escape Before the Target

-Bearish Robbers TP 184.000 (or) Escape Before the Target

📰🗞️Fundamental, Macro Economics, COT data, Sentimental Outlook:

GBP/JPY "The Beast" Forex market is currently experiencing a Neutral trend (there is a higher chance for Bearishness)., driven by several key factors.

🟠Fundamental Analysis

Interest Rates: BoE likely cutting to 4-4.5%; BoJ at 0.25-0.5%, supporting GBP/JPY upside mildly.

Inflation: UK at 2.5-3%, Japan at 2-2.5%, capping GBP strength, mildly boosting JPY.

Growth: UK GDP 1-1.5%, Japan ~1%, both modest, JPY favored in risk-off.

Trade/Geopolitics: U.S. tariffs may boost JPY, UK less exposed.

Energy: Stable oil prices (~$70) neutral for JPY.

🟤Macroeconomic Factors

USD Strength: Pressures GBP/JPY, JPY gains in risk-off.

Global Growth: 3% in 2025, U.S./China slowdown favors JPY.

UK Risks: BoE easing weakens GBP.

Japan Risks: Policy tolerance limits JPY gains.

🔴COT Data

Speculators: Net short JPY (~150,000 contracts), fading bearishness.

Hedgers: Net long JPY (~100,000), expect strength.

Trend: JPY bottoming, potential GBP/JPY decline.

🟣Market Sentiment

Retail: 70% short GBP/JPY, contrarian upside risk.

Social Media: Bearish GBP/JPY, JPY optimism.

Broker Data: 65% long, overcrowded, reversal possible.

🟡Positioning Analysis

Speculators: Moderating JPY shorts, bearish GBP/JPY.

Retail: Short cluster at 190.00, squeeze risk.

Institutions: Eye 184.000 target.

🔵Next Trend Move

Technical: Below 50/200 SMA (194.23/193.20), bearish.

Short-Term: Down to 185.00-183.00.

Medium-Term: Range 175.94-190.00.

Triggers: UK data up to 192.00, JPY strength to 180.00.

🟢Overall Summary Outlook

GBP/JPY at 189.000 reflects a tug-of-war between a weakening GBP (due to BoE easing and UK growth risks) and a cautiously strengthening JPY (safe-haven flows, modest BoJ tightening). Fundamentals favor a mild JPY edge, supported by macro trends like U.S. tariff impacts and global slowdown risks. COT data hints at a JPY bottoming, while sentiment and positioning suggest overcrowding in shorts, risking a brief squeeze.

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan will enable us to effortlessly make and steal money 💰💵 Tell your friends, Colleagues and family to follow, like, and share. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

GBPJPY jumps above 190.50The GBP/JPY pair climbs to around 190.70 during the early European trading hours on Friday. The British Pound (GBP) gains strength against the Japanese Yen (JPY) following the release of the UK's January Retail Sales data.

The Office for National Statistics reported on Friday that UK Retail Sales rose by 1.7% month-on-month in January, compared to a decline of 0.3% in December. This figure exceeded the market's expectation of a 0.3% increase. On a yearly basis, Retail Sales grew by 1.0% in January, compared to a previously revised increase of 2.8% (originally 3.6%), surpassing the forecast of 0.6%. The GBP remains strong in immediate response to the positive UK Retail Sales figures.

gbpjpy buy signal. Don't forget about stop-loss.

Write in the comments all your questions and instruments analysis of which you want to see.

Friends, push the like button, write a comment, and share with your mates - that would be the best THANK YOU.

P.S. I personally will open entry if the price will show it according to my strategy.

Always make your analysis before a trade

#GBPJPY 1DAYGBPJPY (4H Timeframe) Analysis

Market Structure:

The price is currently forming a symmetrical triangle pattern, indicating consolidation and decreasing volatility. This pattern suggests that the market is in indecision, and a breakout in either direction could lead to a strong move.

Forecast:

A breakout on either side will determine the next direction. Traders should wait for confirmation before entering a position.

Key Levels to Watch:

- Entry Zone: A buy position can be considered if the price breaks above the upper trendline, while a sell position can be considered if the price breaks below the lower trendline.

- Risk Management:

- Stop Loss: Placed beyond the breakout level to manage risk.

- Take Profit: Target key support or resistance levels based on the breakout direction.

Market Sentiment:

The symmetrical triangle pattern suggests that momentum is building up, and a strong move is expected after a breakout. Waiting for a clear confirmation will help avoid false signals.

gbpjpy buy signal. Don't forget about stop-loss.

Write in the comments all your questions and instruments analysis of which you want to see.

Friends, push the like button, write a comment, and share with your mates - that would be the best THANK YOU.

P.S. I personally will open entry if the price will show it according to my strategy.

Always make your analysis before a trade

GBPJPY AnalysisGBPJPY Analysis and Trade Setup

GBP/JPY is currently testing a historically significant resistance level that has repeatedly acted as a barrier to price advancement. Given the strength of this resistance zone, it is reasonable to anticipate a potential rejection or pullback. Historically, such levels often prompt a reversal, particularly after a retest of the structure, which could further confirm the resistance's validity.

The likelihood of a rejection at this level is supported by the principles of technical analysis, as repeated tests of a resistance level tend to reinforce its significance.

In summary, while the current setup suggests a potential pullback from the resistance level, traders should remain cautious and monitor key technical and fundamental factors,

GBPJPY: Let's Sell After The CorrectionThe pair is still creating LLs and LHs which is indicative of a bearish trend. I'm looking for a pull back up to retest the POI. Also be aware of the premium fibs, watch for bearish price action at those levels.

Key Sup: 188

Key Res: 189.5 if broken, could get a retest of 190.5

If 189.5 gets flipped to support, this could indicate a reversal.

GBP/JPY Tests Resistance Zone: Breakout or Rejection?GBP/JPY Analysis:

Trendline Support: The price is forming higher lows (HL), with the trendline providing strong support, maintaining a bullish structure.

Resistance Zone : A key resistance zone between 197 and 199.5 has caused multiple rejections (1, 2, 3), indicating a strong supply area.

Next Move: If the price retests the resistance zone and faces rejection, it may form HL5 near the trendline before another potential breakout.

gbpjpy buy signal. Don't forget about stop-loss.

Write in the comments all your questions and instruments analysis of which you want to see.

Friends, push the like button, write a comment, and share with your mates - that would be the best THANK YOU.

P.S. I personally will open entry if the price will show it according to my strategy.

Always make your analysis before a trade

gbpjpy buy signal. Don't forget about stop-loss.

Write in the comments all your questions and instruments analysis of which you want to see.

Friends, push the like button, write a comment, and share with your mates - that would be the best THANK YOU.

P.S. I personally will open entry if the price will show it according to my strategy.

Always make your analysis before a trade

gbpjpy buy signal. Don't forget about stop-loss.

Write in the comments all your questions and instruments analysis of which you want to see.

Friends, push the like button, write a comment, and share with your mates - that would be the best THANK YOU.

P.S. I personally will open entry if the price will show it according to my strategy.

Always make your analysis before a trade

gbpjpy sell signal. Don't forget about stop-loss.

Write in the comments all your questions and instruments analysis of which you want to see.

Friends, push the like button, write a comment, and share with your mates - that would be the best THANK YOU.

P.S. I personally will open entry if the price will show it according to my strategy.

Always make your analysis before a trade

Will GBP/JPY Break the 200.000 Level? A Bullish OutlookThe pair GBP/JPY trading near the key horizontal resistance zone around 200.000. A breakout and sustained move above this level could signal a continuation of the bullish trend, targeting higher levels.

The ascending trendline below serves as strong dynamic support, indicating buyers' interest. Invalidations occur if the price closes below the trendline.

DYOR, NFA

GBPJPY next possible move🔴🔴 DIFFERENCES BETWEEN AMATEUR TRADERS AND SUCCESSFUL TRADERS

💡 Amateur Traders:

❌ Rely on "27" technical indicators without a clear strategy.

❌ Are influenced by the opinions of others.

❌ Make decisions based on emotions rather than logic.

❌ Take reckless risks, often due to a lack of preparation.

🔥 Successful Traders:

✅ Analyze price movements with precision and discernment.

✅ Prepare clear action plans and adapt quickly to new market data.

✅ Use structured trading systems to minimize uncertainty.

✅ Take calculated risks based on rational analysis and probabilities.

⚠️ Lesson: Don’t let emotions or external noise dictate your decisions. Be methodical, structured, and disciplined. That’s where the key to trading success lies.

🎯 Which category do you choose to join today?