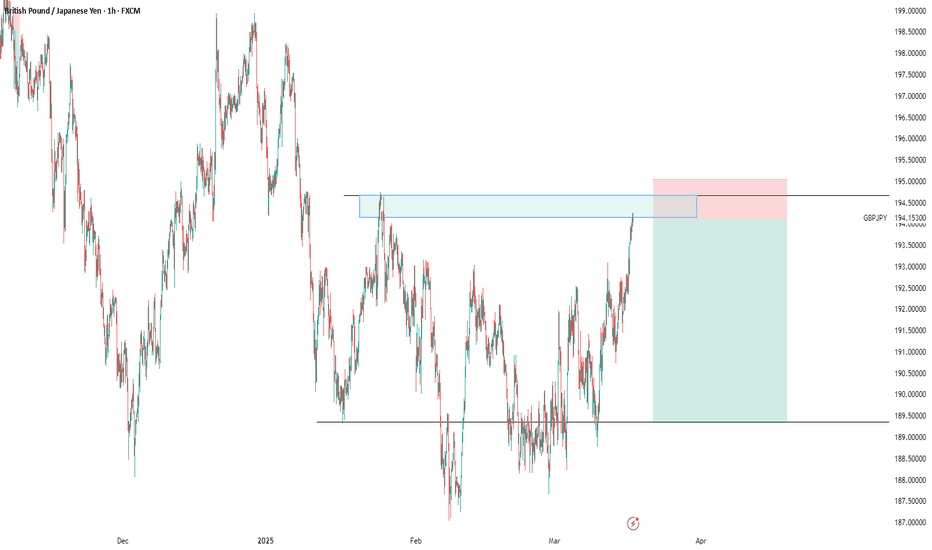

#GBPJPY: 681+ Pips Buying Chance from a Key Level. Dear Traders,

Since the Japanese Yen (JPY) experienced a significant decline in the market, prices have risen. This analysis examines two key areas: the complex bullish price behaviour and the rejection of prices at levels we are currently monitoring for potential entry. While this chart analysis serves as a secondary reference, it should complement your own trading strategies.

Best regards,

Team Setupsfx_

Gbpjpydaily

My Directional Bias on GBPJPY for the long run {29/03/2025}Educational Analysis says that GBPJPY may give countertrend opportunities from this range, according to my technical analysis.

Broker - FXCM

So, my analysis is based on a top-down approach from weekly to trend range to internal trend range.

So my analysis comprises of two structures: 1) Break of structure on weekly range and 2) External pushback to fill the remaining fair value gap

1) Break of structure on weekly range is down trend for the long run period of 10 years, may be it switch to new character or change its direction to bullish.

2) External pushback structure is the trading range where it trades on the smaller time frame,

On this structure range market on inside trading or smaller time frame is bullish towards fib of 1.618 and make turn to fill the fair value gaps of it.

Let's see what this pair brings to the table for us in the future.

Please check the comment section to see how this turned out.

DISCLAIMER:-

This is not an entry signal. THIS IS ONLY EDUCATIONAL PURPOSE ANALYSIS.

I have no concerns with your profit and loss from this analysis.

I HAVE NO CONCERNS WITH YOUR PROFIT OR LOSS,

Happy Trading, Fx Dollars.

gbpjpy sell signal. Don't forget about stop-loss.

Write in the comments all your questions and instruments analysis of which you want to see.

Friends, push the like button, write a comment, and share with your mates - that would be the best THANK YOU.

P.S. I personally will open entry if the price will show it according to my strategy.

Always make your analysis before a trade

gbpjpy sell signal. Don't forget about stop-loss.

Write in the comments all your questions and instruments analysis of which you want to see.

Friends, push the like button, write a comment, and share with your mates - that would be the best THANK YOU.

P.S. I personally will open entry if the price will show it according to my strategy.

Always make your analysis before a trade

GBP/JPY e Analysis & Probability Estimation March 4 2025Key Observations Across Timeframes:

1. Market Structure & Trend Analysis:

Short-term (M15, M30):

Price is consolidating near 189.200, testing the previous daily low (PDL) for liquidity.

A Break of Structure (BOS) occurred, signaling short-term bearish control.

The price is hovering at a key demand zone (PWL - 188.500/187.800).

If price breaks below 188.800, further downside is likely.

Mid-term (H1, H4):

The price rejected equilibrium (~189.800 - 190.000), showing weakness.

A Change of Character (ChOCH) to the downside suggests a bearish trend continuation.

Liquidity below PWL (187.800) could be a target before a potential bounce.

Long-term (D1):

The price is in a larger downtrend, failing to break above premium zones (~190.500 - 192.000).

Liquidity below PWL (~188.000 - 187.500) is uncollected, making it a likely target.

The next major support lies in the discount zone (~185.500 - 186.500).

2. Key Liquidity Zones & Supply/Demand Areas:

Premium Zone (~190.500 - 192.000): Major resistance; rejection happened here.

Equilibrium (~189.800 - 190.000): Price failed to hold above, signaling weakness.

Discount Zone (~187.500 - 186.500): Next strong demand area if price continues lower.

Previous Daily Low (PDL - 188.800): Price is testing this level for liquidity; a break here could lead to further downside.

Previous Weekly Low (PWL - 187.500): Untapped liquidity below, making it a strong target for price movement.

Probability-Based Scenarios:

1. Bearish Continuation to 187.800 - 186.500 (Break Below PDL & PWL)

Probability: 65%

Reasons:

Failure to hold above equilibrium (189.800).

Bearish BOS & ChOCH confirmations on H1/H4 suggest a move down.

Liquidity below 188.000 (PWL) remains uncollected.

Strong daily downtrend supports further downside.

Bearish Confirmation:

If price breaks and holds below 188.800, expect a move toward 187.500 - 186.500.

2. Bullish Reversal from Discount Zone (Bounce from 188.500 - 187.500)

Probability: 35%

Reasons:

Potential liquidity grab at PWL (188.000 - 187.500) before reversing.

Demand zone at 187.500 - 186.500 could cause a bullish reaction.

If price holds above 188.800, we may see a bounce to 189.800 - 190.000.

Bullish Confirmation:

If price fails to break below 188.500, a push back toward equilibrium (189.800) is possible.

Final Thoughts & Trade Plan:

Bearish bias (65% probability) for continuation toward 187.800 - 186.500.

Key Confirmation Levels:

Below 188.800: Bearish toward 187.500 - 186.500.

Above 189.200: Potential bullish recovery toward 189.800 - 190.000.

Trade Setup Overview:

Bias: Bearish (65% probability)

Entry Type: Breakout & Retest

📉 Sell (Short) Trade Setup:

🔴 Entry: Below 188.800 (Confirmed BOS)

🎯 Take Profit (TP) Targets:

TP1: 188.200 (PWL - Previous Weekly Low)

TP2: 187.800 (Liquidity sweep level)

TP3: 186.500 (Major discount zone)

🛑 Stop Loss (SL): 189.400 (Above minor liquidity)

📊 Risk-to-Reward (R:R):

TP1: ~1:2

TP2: ~1:3

TP3: ~1:5

🔹 Confirmation Needed:

Strong candle close below 188.800 (Break & retest scenario)

No immediate bullish rejection at 188.500

📈 Buy (Long) Trade Setup (Lower Probability - 35%)

🟢 Entry: Above 189.200 (Bullish rejection & BOS)

🎯 Take Profit (TP) Targets:

TP1: 189.800 (Equilibrium zone)

TP2: 190.500 (Supply zone)

TP3: 191.500 (Major resistance)

🛑 Stop Loss (SL): 188.700 (Below structure low)

📊 Risk-to-Reward (R:R):

TP1: ~1:2

TP2: ~1:3

TP3: ~1:5

🔹 Confirmation Needed:

Price needs to hold above 189.200 with strong bullish momentum.

No immediate rejection from equilibrium (189.800).

🛠️ Execution Tips:

🔄 Wait for a clear breakout & retest before entering.

⚖️ Adjust lot size based on risk tolerance (~1-2% per trade).

🕰️ Monitor price action on the lower timeframes (M15/M30) for entry precision.

GBPJPY jumps above 190.50The GBP/JPY pair climbs to around 190.70 during the early European trading hours on Friday. The British Pound (GBP) gains strength against the Japanese Yen (JPY) following the release of the UK's January Retail Sales data.

The Office for National Statistics reported on Friday that UK Retail Sales rose by 1.7% month-on-month in January, compared to a decline of 0.3% in December. This figure exceeded the market's expectation of a 0.3% increase. On a yearly basis, Retail Sales grew by 1.0% in January, compared to a previously revised increase of 2.8% (originally 3.6%), surpassing the forecast of 0.6%. The GBP remains strong in immediate response to the positive UK Retail Sales figures.

gbpjpy buy signal. Don't forget about stop-loss.

Write in the comments all your questions and instruments analysis of which you want to see.

Friends, push the like button, write a comment, and share with your mates - that would be the best THANK YOU.

P.S. I personally will open entry if the price will show it according to my strategy.

Always make your analysis before a trade

#GBPJPY 1DAYGBPJPY (4H Timeframe) Analysis

Market Structure:

The price is currently forming a symmetrical triangle pattern, indicating consolidation and decreasing volatility. This pattern suggests that the market is in indecision, and a breakout in either direction could lead to a strong move.

Forecast:

A breakout on either side will determine the next direction. Traders should wait for confirmation before entering a position.

Key Levels to Watch:

- Entry Zone: A buy position can be considered if the price breaks above the upper trendline, while a sell position can be considered if the price breaks below the lower trendline.

- Risk Management:

- Stop Loss: Placed beyond the breakout level to manage risk.

- Take Profit: Target key support or resistance levels based on the breakout direction.

Market Sentiment:

The symmetrical triangle pattern suggests that momentum is building up, and a strong move is expected after a breakout. Waiting for a clear confirmation will help avoid false signals.

GBP/JPY "The Guppy" Forex Market Bullish Heist Plan🌟Hi! Hola! Ola! Bonjour! Hallo!🌟

Dear Money Makers & Thieves, 🤑 💰🐱👤

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the GBP/JPY "The Guppy" Forex market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is the high-risk Red Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 🏆💸Be wealthy and safe trade.💪🏆🎉

Entry 📈 : "The heist is on! Wait for the breakout (193.400) then make your move - Bullish profits await!"

however I advise placing Buy limit orders within a 15 or 30 minute timeframe. Entry from the most recent or closest low or high level should be in retest.

Stop Loss 🛑: Thief SL placed at 191.600 (swing Trade) Using the 2H period, the recent / nearest low level.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯: 199.000 (or) Escape Before the Target

Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

📰🗞️Fundamental, Macro, COT, Sentimental Outlook:

GBP/JPY "The Guppy" Forex Market market is currently experiencing a bullish trend,., driven by several key factors.

🎆 Fundamental Analysis

1. Economic Growth: The UK's economic growth is expected to slow down due to Brexit uncertainty, while Japan's economy is expected to grow at a moderate pace.

2. Inflation: The UK's inflation rate is expected to remain above the Bank of England's target, while Japan's inflation rate is expected to remain low.

3. Interest Rates: The Bank of England is expected to keep interest rates steady, while the Bank of Japan is expected to maintain its accommodative monetary policy.

🎆 Macroeconomic Analysis

1. Trade Balance: The UK's trade balance is expected to remain in deficit, while Japan's trade balance is expected to remain in surplus.

2. GDP Growth: The UK's GDP growth rate is expected to slow down to 1.2% in 2023, while Japan's GDP growth rate is expected to remain at 1.1%.

3. Fiscal Policy: The UK's fiscal policy is expected to remain expansionary, while Japan's fiscal policy is expected to remain neutral.

🎆 COT Analysis

1. Non-Commercial Traders: Net long 20,019 contracts (increase of 5,011 contracts from last week)

2. Commercial Traders: Net short 15,011 contracts (decrease of 2,011 contracts from last week)

3. Non-Reportable Positions: Net long 8,011 contracts (increase of 1,011 contracts from last week)

🎆 Sentimental Analysis

1. Trader Sentiment: 52% of traders are bullish on GBP/JPY, while 40% are bearish and 8% are neutral.

2. Investor Sentiment: The GBP/JPY sentiment index shows that 48% of investors are bullish, while 32% are bearish.

3. Hedge Fund Sentiment: Hedge funds have increased their long positions in GBP/JPY, with a net long exposure of 15%.

🎆 Institutional Trader Sentiment

1. Goldman Sachs: Net long 12,011 contracts

2. Morgan Stanley: Net long 8,011 contracts

3. JPMorgan Chase: Net long 6,011 contracts

🎆 Hedge Fund Sentiment

1. Bridgewater Associates: Net long 15,011 contracts

2. BlackRock: Net long 10,011 contracts

3. Vanguard: Net long 8,011 contracts

🎆 Retail Trader Sentiment

1. Interactive Brokers: Net long 6,011 contracts

2. TD Ameritrade: Net long 4,011 contracts

3. E*TRADE: Net long 3,011 contracts

🎆 Overall Outlook

Based on the analysis, GBP/JPY is expected to move in a bullish trend, with a 55% chance of an uptrend and a 35% chance of a downtrend. The remaining 10% chance is for a neutral trend.

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

📌Please note that this is a general analysis and not personalized investment advice. It's essential to consider your own risk tolerance and market analysis before making any investment decisions.

📌Keep in mind that these factors can change rapidly, and it's essential to stay up-to-date with market developments and adjust your analysis accordingly.

💖Supporting our robbery plan will enable us to effortlessly make and steal money 💰💵 Tell your friends, Colleagues and family to follow, like, and share. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

gbpjpy buy signal. Don't forget about stop-loss.

Write in the comments all your questions and instruments analysis of which you want to see.

Friends, push the like button, write a comment, and share with your mates - that would be the best THANK YOU.

P.S. I personally will open entry if the price will show it according to my strategy.

Always make your analysis before a trade

gbpjpy buy signal. Don't forget about stop-loss.

Write in the comments all your questions and instruments analysis of which you want to see.

Friends, push the like button, write a comment, and share with your mates - that would be the best THANK YOU.

P.S. I personally will open entry if the price will show it according to my strategy.

Always make your analysis before a trade

gbpjpy buy signal. Don't forget about stop-loss.

Write in the comments all your questions and instruments analysis of which you want to see.

Friends, push the like button, write a comment, and share with your mates - that would be the best THANK YOU.

P.S. I personally will open entry if the price will show it according to my strategy.

Always make your analysis before a trade

GBPJPY Ideathis pair has formed:

1- a valid ascending trendline

2- double top

on h4 timeframe

and broke both of them with a big candle that close below the neckline and the last touch of the trendline

so we're now waiting for a retest and rejection on the neckline do we enter a short (sell) position

Follow us for more Updates and ideas

GBP/JPY "The Guppy" Forex Market Heist Plan on Bullish SideHi there! Dear Money Makers & Robbers, 🤑 💰

Based on Thief Trading style technical analysis, here is our master plan to heist the GBP/JPY "The Guppy" Forex market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is the high-risk Red Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. So Be Careful, wealthy and safe trade.

Entry 📈: Acceptable anywhere; I advise placing buy limit orders within a 15-minute Chart. The entry for the Recent/Nearest Low Point should be in pullback.

Stop Loss 🛑: Using the 2H period, the recent / nearest low level.

Goal 🎯: 198.500

Scalpers, take note: only scalp on the long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

Warning : Our heist strategy is incompatible with Fundamental Analysis news 📰 🗞️. We'll wreck our plan by smashing the Stop Loss 🚫🚏. Avoid entering the market right after the news release.

Take advantage of the target and get away 🎯 Swing Traders Please reserve the half amount of money and watch for the next dynamic level or order block breakout. Once it is resolved, we can go on to the next new target in our heist plan.

💖Supporting our robbery plan will enable us to effortlessly make and steal money 💰💵 Tell your friends, Colleagues and family to follow, like, and share. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.

I'll see you soon with another heist plan, so stay tuned 🫂

GBPJPY Top-down analysis Hello traders, this is a complete multiple timeframe analysis of this pair. We see could find significant trading opportunities as per analysis upon price action confirmation we may take this trade. Smash the like button if you find value in this analysis and drop a comment if you have any questions or let me know which pair to cover in my next analysis.

GBPJPY sell signal. Don't forget about stop-loss.

Write in the comments all your questions and instruments analysis of which you want to see.

Friends, push the like button, write a comment, and share with your mates - that would be the best THANK YOU.

P.S. I personally will open entry if the price will show it according to my strategy.

Always make your analysis before a trade

GBPJPY "The Guppy" Bank Money Heist Plan on Bullish SideHallo My Dear Robbers / Money Makers & Losers, 🤑💰

This is our master plan to Heist GBPJPY "The Guppy" Bank based on Thief Trading style Technical Analysis.. kindly please follow the plan I have mentioned in the chart focus on Short entry. Our target is Green Zone that is High risk Dangerous level, market is oversold / Consolidation / Trend Reversal / Trap at the level Bullish Robbers / Traders gain the strength. Be safe and be careful and Be rich 💰.

Note: If you've got a lot of money you can get out right away otherwise you can join with a swing trade robbers and continue the heist plan, Use Trailing SL to protect our money 💰.

Entry : Can be taken Anywhere, What I suggest you to Place Sell Limit Orders in 15mins Timeframe Recent / Nearest Swing High

Stop Loss 🛑: Recent Swing High using 2h timeframe

Warning : Fundamental Analysis news 📰 🗞️ comes against our robbery plan. our plan will be ruined smash the Stop Loss. Don't Enter the market at the news update.

Loot and escape on the target 🎯 Swing Traders Plz Book the partial sum of money and wait for next breakout of dynamic level / Order block, Once it is cleared we can continue our heist plan to next new target.

Support our Robbery plan we can easily make money & take money 💰💵 Follow, Like & Share with your friends and Lovers. Make our Robbery Team Very Strong Join Ur hands with US. Loot Everything in this market everyday make money easily with Thief Trading Style.

Stay tuned with me and see you again with another Heist Plan..... 🫂b

GBPJPY sell signal. Don't forget about stop-loss.

Write in the comments all your questions and instruments analysis of which you want to see.

Friends, push the like button, write a comment, and share with your mates - that would be the best THANK YOU.

P.S. I personally will open entry if the price will show it according to my strategy.

Always make your analysis before a trade

#GBPJPY 1DAYGBP/JPY daily chart, the overall trend appears to be an uptrend, but a potential **sell opportunity is emerging. Here's a breakdown of the situation:

1. Uptrend Formation: The pair has been trading in an upward direction, characterized by higher highs and higher lows, indicating that bullish sentiment has been dominant over the past days.

2. Potential Reversal Signals: However, certain technical indicators and price action may be hinting at a potential reversal or pullback. Signs such as overbought conditions (on RSI or stochastic), bearish candlestick patterns (like doji, shooting star), or divergence between price and momentum indicators could be signaling exhaustion in the current uptrend.

3. Key Levels: The current price is approaching key resistance levels where sellers might step in. If the price fails to break above these levels, it could result in a sell-off or a corrective phase.

4. Forecast: Given the extended nature of the uptrend and potential exhaustion, this could be a good opportunity to consider **short positions** or selling into strength. A break below recent support or a clear bearish signal would further confirm the sell scenario.

Recommendation: While the overall trend has been bullish, the upcoming days could see a correction or reversal. Watch for sell signals near resistance zones and be ready to adjust your position accordingly if the market continues to weaken.