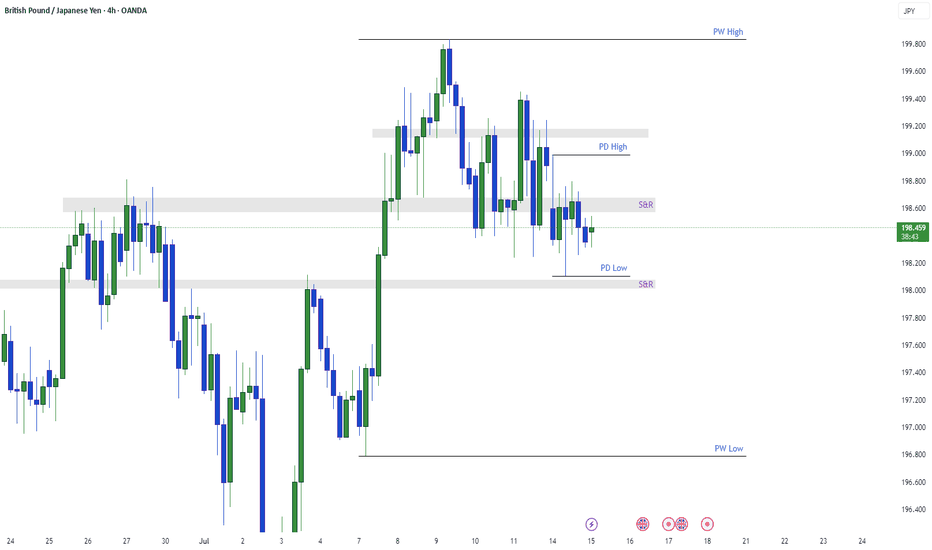

GBPJPY AccumulatingGBPJPY is building liquidity. We can see it around these zones. So trading between the zones will be wonderful. We can not say anything about the direction of GBPJPY right now because it is oscillating between the zones. The clear picture can be trade zones for scalping. No any potential move seen here.

Gbpjpyoutlook

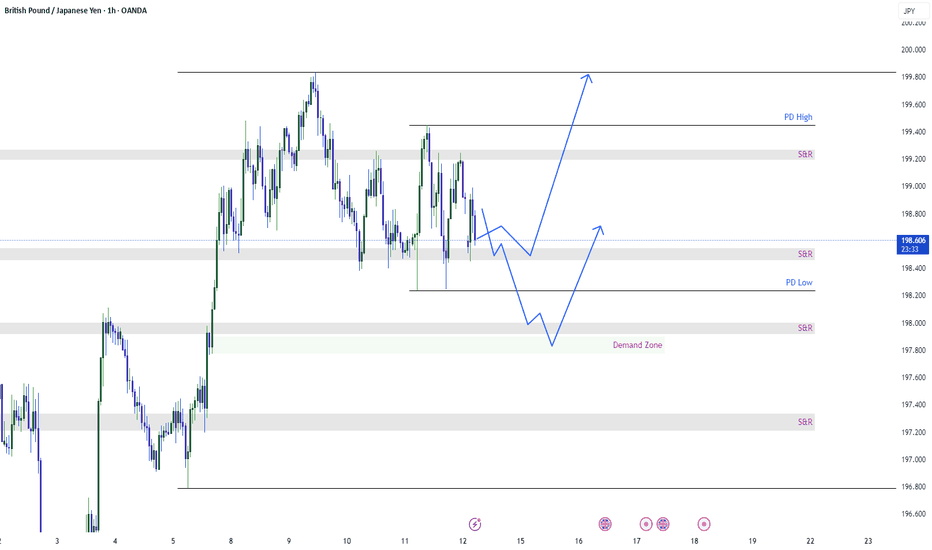

GBPJPY is still in retracementWe can see from the graph GBPJPY is oscillating between the two S&R levels. For today we expect GJ to touch the demand zone and then go higher. Therefore we can expect GBPJPY in go further down and hit the demand zone because it is still retracing. The possibilities for the GJ are shown.

GBPJPY Sweet ProfitsThe Key Levels that I shared previously for GBPJPY are drawn carefully by observing the market behavior previously. I suggest look at that key levels and plan your trades accordingly. I took the trade on the key levels I drawn. It gave me 1:2.85 . These key levels represent the behavior of the market.

GBPJPY - Expecting Bullish Continuation In The Short TermH1 - Strong bullish move.

Higher highs on the moving averages of the MACD.

No opposite signs.

Expecting further continuation higher until the two Fibonacci support zones hold.

If you enjoy this idea, don’t forget to LIKE 👍, FOLLOW ✅, SHARE 🙌, and COMMENT ✍! Drop your thoughts and charts below to keep the discussion going. Your support helps keep this content free and reach more people! 🚀

--------------------------------------------------------------------------------------------------------------------

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

GBPJPY - Looking To Sell Pullbacks In The Short TermM15 - Bearish divergence followed by the most recent uptrend line breakout.

Lower lows on the moving averages of the MACD.

No opposite signs.

Expecting pullbacks and bearish continuation until the strong resistance zone holds.

If you enjoy this idea, don’t forget to LIKE 👍, FOLLOW ✅, SHARE 🙌, and COMMENT ✍! Drop your thoughts and charts below to keep the discussion going. Your support helps keep this content free and reach more people! 🚀

--------------------------------------------------------------------------------------------------------------------

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

GBPJPY: Structure Is Still BullishAs explained in the video, my bias is still bullish. HHs and LHs are still being formed. So I am looking to buy GJ as long at 189.97 holds as support. Nice breakout and retest of the falling wedge, which has a bullish FVG and bearish breaker block confluence. I am waiting to see how London looks. Remember we have FOMC tomorrow.

GBP/JPY "The Dragon" Forex Bank Bullish Heist Plan(Scalping/Day)🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Thieves, 🤑 💰🐱👤✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the GBP/JPY "The Dragon" Forex Bank. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is the high-risk Red MA Level. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 🏆💸"Take profit and treat yourself, traders. You deserve it!💪🏆🎉

Entry 📈 : "The vault is wide open! Swipe the Bullish loot at any price - the heist is on!

however I advise to Place buy limit orders within a 15 or 30 minute timeframe most nearest or swing, low or high level.

Stop Loss 🛑:

📌Thief SL placed at the nearest/swing low or high level Using the 4H timeframe (192.000) Day/scalping trade basis.

📌SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

🏴☠️Target 🎯: 198.000 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

GBP/JPY "The Dragon" Forex Bank Heist Plan (Day / Swing Trade) is currently experiencing a bullishness,., driven by several key factors.👇

📰🗞️Get & Read the Fundamental analysis, Macro Economics, COT Report, Quantitative Analysis, Intermarket Analysis, Sentimental Outlook, Positioning and future trend target...

Before start the heist plan read it...go ahead to check 👉👉👉🔗

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

GBPJPY - MASSIVE Swing Potential Buy - Happening Now (March)This is a longer term swing idea.

Top down analysis from HTF indicates that:

- Push lower on JPYX Yen index

- Retrace higher on XXXJPY pairs

- Divergence in the Yen pairs, confirming a low

- Price Action has created a lot of liquidity on the downside, which has been taken, signifying upside.

Comment below if you have questions. Happy to help.

Peaceful Trading to you all.

GBP/JPY "The Beast" Forex Market Heist Plan🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Thieves, 🤑 💰🐱👤🐱🏍

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the ˗ˏˋ ★ ˎˊ˗GBP/JPY "The Beast" ˗ˏˋ ★ ˎˊ˗ Forex Market. Please adhere to the strategy I've outlined in the chart, which emphasizes short entry. Our aim is the high-risk Green Zone. Risky level, oversold market, consolidation, trend reversal, trap at the level where traders and bullish thieves are getting stronger. 🏆💸Book Profits Be wealthy and safe trade.💪🏆🎉

Entry 📈 : "The heist is on! Wait for the breakout (187.700) then make your move - Bearish profits await!" however I advise placing Sell limit orders within a 15 or 30 minute timeframe. Entry from the most recent or closest low or high level should be in retest.

Stop Loss 🛑: Thief SL placed at (190.500) swing Trade Basis Using the 3H period, the recent / swing high or low level.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯: 185.000 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Short side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

📰🗞️Fundamental, Macro, COT Report, Sentimental Outlook:

GBP/JPY "The Beast" Forex Market is currently experiencing a Bearish trend in short term, driven by several key factors.

˗ˏˋ ★ ˎˊ˗Fundamental Analysis˗ˏˋ ★ ˎˊ˗

Interest Rates: BoE at 4-4.5% (easing cycle), BoJ at 0.25-0.5%—yield gap narrows, mildly bearish for GBP/JPY.

Inflation: UK at 2.5-3% (cooling), Japan at 2.5% (persistent)—neutral, balances GBP vs. JPY strength.

Growth: UK GDP ~1-1.5%, Japan ~1%—both modest, neutral impact.

Trade: UK exports lag, Japan benefits from U.S. tariff shifts—bullish for JPY, bearish for GBP/JPY.

Risk Sentiment: Safe-haven JPY gains in risk-off—bearish pressure.

˗ˏˋ ★ ˎˊ˗Macroeconomic Factors˗ˏˋ ★ ˎˊ˗

U.S.: Fed at 3-3.5%, PCE 2.6%—USD softness aids GBP/JPY—bullish (Eurostat/U.S. data).

Eurozone: PMI 46.2—stagnation weakens EUR, indirectly supports GBP—bullish (Eurostat).

Global: China 4.5%, Japan 1%—slow growth, JPY safe-haven appeal—bearish (ECB forecasts).

Commodities: Oil $70.44—stable, neutral for GBP/JPY (global data).

Trump Policies: Tariffs shift trade to Japan—JPY strength, bearish for GBP/JPY.

˗ˏˋ ★ ˎˊ˗Global Market Analysis˗ˏˋ ★ ˎˊ˗

Forex Markets: GBP/USD at 1.2650, USD/JPY at 150.00—GBP resilience vs. JPY strength—mixed.

Equity Markets: FTSE 100 stable, Nikkei range-bound—neutral correlation.

Crypto/Commodities: Gold at $2,930—risk-off supports JPY—bearish.

˗ˏˋ ★ ˎˊ˗Commitments of Traders (COT) Data˗ˏˋ ★ ˎˊ˗

Speculators: Net short JPY ~140,000 contracts (down from 150,000)—fading bearishness, mildly bullish JPY.

Hedgers: Net long JPY ~90,000—exporters expect JPY strength, bearish for GBP/JPY.

Open Interest: ~280,000 contracts—steady interest, neutral.

˗ˏˋ ★ ˎˊ˗Market Sentiment Analysis˗ˏˋ ★ ˎˊ˗

Retail: 65% short GBP/JPY at 189.50 (global X posts)—contrarian upside—bullish potential.

Institutional: Cautious, favoring JPY in risk-off—bearish outlook.

Corporate: UK/Japan firms hedge at 190-192—neutral.

Social Media Trends: Bearish setups to 185.00—short-term bearish sentiment.

˗ˏˋ ★ ˎˊ˗Positioning Analysis˗ˏˋ ★ ˎˊ˗

Speculative: Longs target 192.00-194.00, shorts aim for 188.00-185.00.

Retail: Shorts at 190.00-191.00—squeeze risk if price rises.

Institutional: Leaning short GBP/JPY, eyeing JPY strength.

˗ˏˋ ★ ˎˊ˗Quantitative Analysis˗ˏˋ ★ ˎˊ˗

SMAs: 50-day ~194.00, 200-day ~193.00—price below both, bearish signal.

RSI: 45 (daily)—neutral, fading bearish momentum.

Bollinger: 188.50-190.50—price near lower band, potential bounce.

Fibonacci: 38.2% from 198.94-189.31 at 190.50—resistance above.

Volatility: 1-month IV 10%—±1.80 daily range.

˗ˏˋ ★ ˎˊ˗Intermarket Analysis˗ˏˋ ★ ˎˊ˗

GBP/USD: 1.2650—GBP holds vs. USD, bullish for GBP/JPY.

USD/JPY: 150.00—JPY weakens vs. USD, bullish for GBP/JPY.

XAU/USD: $2,930—gold rise, JPY safe-haven—bearish.

FTSE 100: Stable—neutral.

Bonds: UK 10-year 4%, Japan 0.9%—yield gap narrows, bearish.

˗ˏˋ ★ ˎˊ˗News and Events Analysis˗ˏˋ ★ ˎˊ˗

Recent: Trump tariff threats (25% Mexico/Canada, 10% China, Feb 25)—risk-off lifts JPY—bearish.

Upcoming: U.S. PCE today (Feb 28)—hot data strengthens USD, pressures GBP/JPY; soft data boosts risk-on, supports GBP—mixed impact.

Impact: Bearish bias today, PCE reaction pivotal.

˗ˏˋ ★ ˎˊ˗Next Trend Move˗ˏˋ ★ ˎˊ˗

Technical:

Support: 188.50-188.00

Resistance: 190.50-192.00

Below 188.50 targets 185.00; above 190.50 aims for 194.00.

Short-Term (1-2 Days): Dip to 188.00 if PCE lifts USD; rebound to 190.50 if risk-on prevails.

Medium-Term (1-3 Months): Range 185.00-195.00, tariff/JPY strength key.

˗ˏˋ ★ ˎˊ˗Overall Summary Outlook˗ˏˋ ★ ˎˊ˗

GBP/JPY at 189.50 faces bearish short-term pressure from JPY safe-haven demand (tariffs, risk-off) and technicals (below SMAs), despite GBP resilience vs. USD. COT shows fading JPY shorts, sentiment leans bearish, and PCE today could sway direction. A short-term dip to 188.00 is likely, with medium-term consolidation unless macro shifts favor GBP.

˗ˏˋ ★ ˎˊ˗Future Prediction˗ˏˋ ★ ˎˊ˗

Bullish: 192.00-195.00 by Q2 2025 if USD softens (DXY to 105), risk-on resumes, or BoE holds rates.

Bearish: 185.00-188.00 if JPY strengthens (USD/JPY to 145), tariffs escalate, or risk-off persists.

Prediction: Bearish short-term to 188.00 (PCE/USD strength), then cautiously bullish to 192.00 by mid-2025 (risk-on recovery).

📌Keep in mind that these factors can change rapidly, and it's essential to stay up-to-date with market developments and adjust your analysis accordingly.

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

GBP/JPY "The Guppy" Forex Market Bullish Heist Plan🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Thieves, 🤑 💰🐱👤🐱🏍

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the GBP/JPY "The Guppy" Forex market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is the high-risk Red Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 🏆💸Book Profits wealthy and safe trade.💪🏆🎉

Entry 📈 : "The heist is on! Buy above (193.000) then make your move - Bullish profits await!"

however I advise placing Place Buy limit orders within a 15 or 30 minute timeframe. Entry from the most recent or closest low or high level should be in retest.

Stop Loss 🛑:

Thief SL placed at the recent / nearest low level Using the 2H timeframe (190.000) swing trade basis.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯:

1st Target - 197.000 (or) Escape Before the Target

Final Target - 202.000 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

📰🗞️Fundamental, Macro, COT, Sentimental Outlook:

🎇GBP/JPY "The Guppy" Forex Market is currently experiencing a bullish trend,., driven by several key factors.

⭐Market Overview

Current Price: 191.300

30-Day High: 195.500

30-Day Low: 185.000

30-Day Average: 190.000

Previous Close Price: 191.000

Change: 0.300

Percent Change: 0.16%

⭐Fundamental Analysis

Economic Indicators: The UK's GDP growth rate is expected to slow down to 1.4% in 2025, while Japan's GDP growth rate is expected to remain steady at 1.2%.

Monetary Policy: The Bank of England is expected to maintain its interest rates at 0.1% in 2025, while the Bank of Japan is expected to maintain its interest rates at -0.1%.

Trade Balance: The UK's trade balance is expected to remain in deficit, while Japan's trade balance is expected to remain in surplus.

Inflation Rate: The UK's inflation rate is expected to rise to 2.5% in 2025, while Japan's inflation rate is expected to remain steady at 1.5%.

⭐Macro Economics

Global Economic Trends: The ongoing global economic recovery is expected to drive up demand for the GBP, driven by increasing investor confidence.

Inflation Rate: Global inflation is expected to rise to 3.8% in 2025, potentially increasing demand for the GBP as a hedge against inflation.

Interest Rates: Central banks are expected to maintain low interest rates in 2025, potentially increasing demand for the GBP.

Commodity Prices: Commodity prices are expected to rise by 5% in 2025, driven by increasing demand for raw materials.

⭐COT Data

Non-Commercial Traders (Institutional):

Net Long Positions: 55%

Open Interest: 100,000 contracts

Commercial Traders (Companies):

Net Short Positions: 35%

Open Interest: 50,000 contracts

Non-Reportable Traders (Small Traders):

Net Long Positions: 10%

Open Interest: 10,000 contracts

COT Ratio: 1.6 (indicating a bullish trend)

⭐Sentimental Outlook

Institutional Sentiment: 60% bullish, 40% bearish.

Retail Sentiment: 55% bullish, 45% bearish.

Market Mood: The overall market mood is bullish, with a sentiment score of +40.

⭐Technical Analysis

Trend: The GBP/JPY pair is experiencing a strong downtrend, with the market respecting the 20-period Weighted Moving Average (WMA) as dynamic resistance

Key Levels: Support Zone: 187.500 - 187.334, Resistance Zones: 188.414 & 190.021 - 190.313

Target: 189.87, with a potential further decline to 186.2

⭐Next Move Prediction

Bullish Move: Potential upside to 195.000-197.000.

Target: 197.000 (primary target), 202.000 (secondary target)

Next Swing Target: 202.000 (potential swing high)

Stop Loss: 185.000 (below the 30-day low)

Risk-Reward Ratio: 1:2 (potential profit of 5.700 vs potential loss of 2.850)

⭐Future Data Summary

1-Day: -0.03%

5-Days: 0.80%

1-Month: 0.68%

6-Months: 0.55%

Year-to-Date: -2.84%

1-Year: 1.04%

5-Years: 33.90%

⭐Overall Outlook

The overall outlook for GBP/JPY is bullish, driven by a combination of fundamental, technical, and sentimental factors. The expected increase in global economic growth, growing demand for the GBP, and bullish market sentiment are all supporting the bullish trend. However, investors should remain cautious of potential downside risks, including changes in global economic trends and unexpected regulatory developments.

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

📌Please note that this is a general analysis and not personalized investment advice. It's essential to consider your own risk tolerance and market analysis before making any investment decisions.

📌Keep in mind that these factors can change rapidly, and it's essential to stay up-to-date with market developments and adjust your analysis accordingly.

💖Supporting our robbery plan will enable us to effortlessly make and steal money 💰💵 Tell your friends, Colleagues and family to follow, like, and share. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

GBPJPY - Sell Idea Today - for NY Session NOTE: This idea is counter-trend, so lower probability

Looking to come back into fair value below.

Trading the retracement.

We're sitting at an area of interest where market is reacting from.

As long as we don't break the highs, then looking for a quick Sell for today. Not holding over the weekend.

GBPJPY: Time To Sell?I am currently selling GJ...

- M15 Bearish Breaker Block

- M30 Bearish CHoCH

- Creating LHs and LLs

- Multiple rejections at the 38.2 fib

- QP 191.25 flipped to resistance

But it is possible we may get a retracement into the premium discount fibs or a pull back to retest the M15 BB around 191.526.

1st Target 190

2nd Target 187.5

GBP/JPY "The Guppy" Forex Market Bullish Heist Plan🌟Hi! Hola! Ola! Bonjour! Hallo!🌟

Dear Money Makers & Thieves, 🤑 💰🐱👤

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the GBP/JPY "The Guppy" Forex market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is the high-risk Red Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 🏆💸Be wealthy and safe trade.💪🏆🎉

Entry 📈 : "The heist is on! Wait for the breakout (193.400) then make your move - Bullish profits await!"

however I advise placing Buy limit orders within a 15 or 30 minute timeframe. Entry from the most recent or closest low or high level should be in retest.

Stop Loss 🛑: Thief SL placed at 191.600 (swing Trade) Using the 2H period, the recent / nearest low level.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯: 199.000 (or) Escape Before the Target

Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

📰🗞️Fundamental, Macro, COT, Sentimental Outlook:

GBP/JPY "The Guppy" Forex Market market is currently experiencing a bullish trend,., driven by several key factors.

🎆 Fundamental Analysis

1. Economic Growth: The UK's economic growth is expected to slow down due to Brexit uncertainty, while Japan's economy is expected to grow at a moderate pace.

2. Inflation: The UK's inflation rate is expected to remain above the Bank of England's target, while Japan's inflation rate is expected to remain low.

3. Interest Rates: The Bank of England is expected to keep interest rates steady, while the Bank of Japan is expected to maintain its accommodative monetary policy.

🎆 Macroeconomic Analysis

1. Trade Balance: The UK's trade balance is expected to remain in deficit, while Japan's trade balance is expected to remain in surplus.

2. GDP Growth: The UK's GDP growth rate is expected to slow down to 1.2% in 2023, while Japan's GDP growth rate is expected to remain at 1.1%.

3. Fiscal Policy: The UK's fiscal policy is expected to remain expansionary, while Japan's fiscal policy is expected to remain neutral.

🎆 COT Analysis

1. Non-Commercial Traders: Net long 20,019 contracts (increase of 5,011 contracts from last week)

2. Commercial Traders: Net short 15,011 contracts (decrease of 2,011 contracts from last week)

3. Non-Reportable Positions: Net long 8,011 contracts (increase of 1,011 contracts from last week)

🎆 Sentimental Analysis

1. Trader Sentiment: 52% of traders are bullish on GBP/JPY, while 40% are bearish and 8% are neutral.

2. Investor Sentiment: The GBP/JPY sentiment index shows that 48% of investors are bullish, while 32% are bearish.

3. Hedge Fund Sentiment: Hedge funds have increased their long positions in GBP/JPY, with a net long exposure of 15%.

🎆 Institutional Trader Sentiment

1. Goldman Sachs: Net long 12,011 contracts

2. Morgan Stanley: Net long 8,011 contracts

3. JPMorgan Chase: Net long 6,011 contracts

🎆 Hedge Fund Sentiment

1. Bridgewater Associates: Net long 15,011 contracts

2. BlackRock: Net long 10,011 contracts

3. Vanguard: Net long 8,011 contracts

🎆 Retail Trader Sentiment

1. Interactive Brokers: Net long 6,011 contracts

2. TD Ameritrade: Net long 4,011 contracts

3. E*TRADE: Net long 3,011 contracts

🎆 Overall Outlook

Based on the analysis, GBP/JPY is expected to move in a bullish trend, with a 55% chance of an uptrend and a 35% chance of a downtrend. The remaining 10% chance is for a neutral trend.

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

📌Please note that this is a general analysis and not personalized investment advice. It's essential to consider your own risk tolerance and market analysis before making any investment decisions.

📌Keep in mind that these factors can change rapidly, and it's essential to stay up-to-date with market developments and adjust your analysis accordingly.

💖Supporting our robbery plan will enable us to effortlessly make and steal money 💰💵 Tell your friends, Colleagues and family to follow, like, and share. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

GBP/JPY "The Dragon" Forex Market Bullish Heist Plan🌟Hi! Hola! Ola! Bonjour! Hallo!🌟

Dear Money Makers & Robbers, 🤑 💰

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the GBP/JPY "The Dragon" Forex market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is the high-risk Red Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. Be wealthy and safe trade.💪🏆🎉

Entry 📈 : "The heist is on! Wait for the breakout, then make your move - Bullish profits await!"

however I advise placing Buy limit orders within a 15 or 30 minute timeframe. Entry from the most recent or closest low or high level should be in retest.

Stop Loss 🛑: Using the 2H period, the recent / nearest low or high level.

Goal 🎯: 199.000 (or) Escape Before the Target

Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

📰🗞️Fundamental, Macro, Sentimental Outlook:

The GBP/JPY "The Dragon" Forex market is currently experiencing a neutral trend,with a slight bias towards bullishness. driven by several key factors.

⭐Fundamental Analysis

The Bank of Japan's monetary policy and the UK's economic growth will play a crucial role in determining the pair's direction.

The UK's inflation rate and interest rate decisions will also impact the pair's movement.

⭐Macroeconomic Analysis

The global economic growth, trade policies, and geopolitical tensions will influence the pair's movement.

The US dollar's strength and the euro's weakness will also impact the GBP/JPY pair.

⭐COT Report

The latest COT report shows that speculative traders are net long on the GBP/JPY pair, indicating a bullish sentiment.

⭐Sentimental Analysis

The market sentiment is mixed, with some traders expecting a bullish movement due to the UK's economic growth, while others are bearish due to the global economic uncertainty.

⭐Institutional Trader Analysis

Institutional traders are watching the pair closely, awaiting the Bank of England's interest rate decision and the UK's economic growth data.

⭐Retail Trader Analysis

Retail traders are also cautious, with some taking long positions on the pair due to the UK's economic growth, while others are taking short positions due to the global economic uncertainty.

⭐Current Market Position

Based on the analysis, the current market position for GBP/JPY is:

Day Trade: Neutral (40% bullish, 30% bearish)

Swing Trade: Slightly bullish (55% bullish, 25% bearish)

Please note that these percentages are approximate and based on general market sentiment. They should not be taken as investment advice.

⭐Outlook

Based on the analysis, the GBP/JPY pair is expected to move into a neutral direction in the short term, However, the movement is likely to be volatile, and investors should be cautious ahead of the Bank of England's interest rate decision and the UK's economic growth data.

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

📌Please note that this is a general analysis and not personalized investment advice. It's essential to consider your own risk tolerance and market analysis before making any investment decisions.

📌Keep in mind that these factors can change rapidly, and it's essential to stay up-to-date with market developments and adjust your analysis accordingly.

💖Supporting our robbery plan will enable us to effortlessly make and steal money 💰💵 Tell your friends, Colleagues and family to follow, like, and share. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🫂

GBPJPY Still Consolidating But Slowly ClimbingGJ has been consolidating for awhile but my bias is still bullish. Waiting for price to break above and retest the H4 trend line.

Reasons For Bullish Bias:

- H1 Bullish Choch

- Still forming new HLs

- Small QP 193.75 holding as support

- Multiple rejections at the OTE fib on the H4

Major GBP news coming up in 3 hrs. If I see a trading opportunity after news I will let you know.

GBPJPY Continued To Range. What's Next?Last week we didn't get much movement from GJ. Price continued to range so my initial bias is going to be neutral starting this week. Price is currently at a QP 195 so GJ still has my attention.

Key Res around 195.98

Key Sup around 189.59

I will try to update as we get more development...

GBPJPY; Massive Head & Shoulders forming on the Weekly!A massive Head & Shoulders formation on the Weekly chart (and, obviously, on the daily), forecasting a -9% plummet in this pair upon completion . (I.e. It will have to break down, first!)

There are a host of reasons why a total break down in this pair would be fundamentally justified, as well, but to highlight a few, in lead words:

- Cheap continental (EU) capital flow has long ceased - Brexit;

- Since 1990, while ~40% of EU manufacturing profits have "trickled down" to the "average Joe"s the same wealth transfer was limited to only ~8% of the UK's population. (E.g. Germany financed virtually all of the British capital expansion in the last 30 years which Britain freely squandered away, permanently.)

- Probably the most interesting/significant factor is this:

IFF A.I. fulfills even a fraction of the "hopes" attributed to it's recent rise and practical promises (GPT-x, etc.), interestingly enough Britain is in the "sweet spot" to be the most devastated by any value added by the "A.I. revolution"! (We have conducted an extensive, multi-month research project before arriving to this conclusion. Time allowing, we will attempt to include the most practical/trading related aspects of those results here.)

- Japan continues to come out of it's 30 year slumber and there are tangible signs of continuation of this progression. Also, in the presently unfolding multi-polar "new world order" the undeniable winning block will be most likely the NAFTA + Japan "manufacturing & trading block". At present, the two fastest developing regions of the world are;

1) Texas + Northern Mexico;

2) Japan + S.E. Asia (while China's problems remain well out of reach for any solution - I.e., demographics, etc.)

We are actively looking for a Short Entry at these levels.

Here is a closeup - Daily;

GBPJPY Analysis 13Oct2023The currency pair of GBPJPY has recently touched the Fibo area of 0.236 and experienced a bullish move. Currently, there has been a BoS and the Sturcture Market is showing a strong indication of bullish continuation. If the price declines again, it will only be considered a correction from the bullish trend that has occurred. It is important to note that the price decline is within the invalid area limit. This provides further support for the bullish trend that is currently prevailing in the market.

GBPJPY Analysis 10Sep2023My view of this pair is still bullish like the last analysis that I share here. For now the price is seen sideways, in my opinion this sideways series is included in the correction wave from the existing bullish trend series. We can only wait to do a short in an area that you think is valid with the help of this analysis.

GBPJPY Analysis 31July2023GBPJPY Analysis in accordance with last week's analysis where the price of bearish reached Wave (C). I am still in the positive view of this paar bearish. with the target in the lower SND area and the invalid area as the validation limit of this analysis. If you want to do a short, wait when there is a bearish candle that is quite thick.

GBPJPY Analysislooking at the existing market structure, the market may form a-b-c correction pattern with the possibility that wave B will approach the SnD area before falling again.

if you look at the fibo retracement area, there is an SnD area that intersects with the fibo area with pretty good accuracy at notation 2.618. areas like this usually in the future will be responded positively by the price.

This analysis is valid as long as the price does not rise more than the invalid area.