GBPJPY SHORT FORECAST Q2 W20 D14 Y25GBPJPY SHORT FORECAST Q2 W20 D14 Y25

Professional Risk Managers👋

Welcome back to another FRGNT chart update📈

Diving into some Forex setups using predominantly higher time frame order blocks alongside confirmation breaks of structure.

Let’s see what price action is telling us today!

💡Here are some trade confluences📝

✅Weekly order block rejection

✅Daily order block rejection

✅Intraday 15' order blocks

✅Gap fill

🔑 Remember, to participate in trading comes always with a degree of risk, therefore as professional risk managers it remains vital that we stick to our risk management plan as well as our trading strategies.

📈The rest, we leave to the balance of probabilities.

💡Fail to plan. Plan to fail.

🏆It has always been that simple.

❤️Good luck with your trading journey, I shall see you at the very top.

🎯Trade consistent, FRGNT X

Gbpjpyshort

GBPJPY SHORT FORECAST Q2 W20 D13 Y25GBPJPY SHORT FORECAST Q2 W20 D13 Y25

Professional Risk Managers👋

Welcome back to another FRGNT chart update📈

Diving into some Forex setups using predominantly higher time frame order blocks alongside confirmation breaks of structure.

Let’s see what price action is telling us today!

💡Here are some trade confluences📝

✅Weekly order block rejection

✅Daily order block rejection

✅Intraday 15' order blocks

✅Gap fill

🔑 Remember, to participate in trading comes always with a degree of risk, therefore as professional risk managers it remains vital that we stick to our risk management plan as well as our trading strategies.

📈The rest, we leave to the balance of probabilities.

💡Fail to plan. Plan to fail.

🏆It has always been that simple.

❤️Good luck with your trading journey, I shall see you at the very top.

🎯Trade consistent, FRGNT X

GBPJPY is Holding above the Support , All Eyes on BuyingHello Traders

In This Chart GBPJPY HOURLY Forex Forecast By FOREX PLANET

today GBPJPY analysis 👆

🟢This Chart includes_ (GBPJPY market update)

🟢What is The Next Opportunity on GBPJPY Market

🟢how to Enter to the Valid Entry With Assurance Profit

This CHART is For Trader's that Want to Improve Their Technical Analysis Skills and Their Trading By Understanding How To Analyze The Market Using Multiple Timeframes and Understanding The Bigger Picture on the Charts

GBPJPY is Holding above the Support , All Eyes on BuyingHello Traders

In This Chart GBPJPY HOURLY Forex Forecast By FOREX PLANET

today GBPJPY analysis 👆

🟢This Chart includes_ (GBPJPY market update)

🟢What is The Next Opportunity on GBPJPY Market

🟢how to Enter to the Valid Entry With Assurance Profit

This CHART is For Trader's that Want to Improve Their Technical Analysis Skills and Their Trading By Understanding How To Analyze The Market Using Multiple Timeframes and Understanding The Bigger Picture on the Charts

GBPJPY Bullish Breakout – Watch for Momentum Towards 194.60GBPJPY has broken out of a descending wedge and is now retesting the breakout zone near 189.50–189.80. This area aligns with previous structure support and the wedge's upper boundary. Price action indicates bullish momentum is resuming.

🔑 Key Levels:

Current Price: 189.66

Breakout Level: ~189.50

Resistance Targets:

TP1: 190.55 (recent resistance high)

TP2: 192.57

TP3: 194.61 (key supply/weekly resistance zone)

✅ Bullish Confluence:

Breakout from falling wedge pattern

Strong retest of breakout zone with consolidation

Higher low formation and bullish engulfing attempt

No major resistance until 190.50, providing clean upside

🧠 Fundamental Context:

CBI Report (UK): Sentiment and investment outlook among UK manufacturers is deteriorating, but the pound has shown resilience likely driven by broader risk-on market sentiment.

BOJ Outlook (Japan): IMF suggests BOJ is likely to delay further rate hikes due to global uncertainty from US tariffs, maintaining a dovish bias. This weakens the yen’s fundamental strength.

Market Mood: With Japan facing delayed policy tightening and UK's inflation still above target, GBPJPY favors the bullish case in the short term.

💡 Trade Idea:

Bias: Bullish above 189.30

Entry: On retest confirmation around 189.50

Target 1: 190.55

Target 2: 192.57

Target 3: 194.61

Stop Loss: Below 188.80

📌 Note: Keep an eye on US data and BOJ tone shifts. Any risk-off shift in global markets could affect yen strength unexpectedly.

GBPJPY SHORT FORECAST Q2 W19 D9 Y25GBPJPY SHORT FORECAST Q2 W19 D9 Y25

Professional Risk Managers👋

Welcome back to another FRGNT chart update📈

Diving into some Forex setups using predominantly higher time frame order blocks alongside confirmation breaks of structure.

Let’s see what price action is telling us today!

💡Here are some trade confluences📝

✅Weekly order block rejection

✅Daily order block rejection

✅Intraday 15' order blocks

✅Tokyo ranges to be filled

🔑 Remember, to participate in trading comes always with a degree of risk, therefore as professional risk managers it remains vital that we stick to our risk management plan as well as our trading strategies.

📈The rest, we leave to the balance of probabilities.

💡Fail to plan. Plan to fail.

🏆It has always been that simple.

❤️Good luck with your trading journey, I shall see you at the very top.

🎯Trade consistent, FRGNT X

GBPJPY SHORT FORECAST Q2 W19 D8 Y25GBPJPY SHORT FORECAST Q2 W19 D8 Y25

Professional Risk Managers👋

Welcome back to another FRGNT chart update📈

Diving into some Forex setups using predominantly higher time frame order blocks alongside confirmation breaks of structure.

Let’s see what price action is telling us today!

💡Here are some trade confluences📝

✅Weekly order block rejection

✅Daily order block rejection

✅Intraday 15' order blocks

✅Tokyo ranges to be filled

🔑 Remember, to participate in trading comes always with a degree of risk, therefore as professional risk managers it remains vital that we stick to our risk management plan as well as our trading strategies.

📈The rest, we leave to the balance of probabilities.

💡Fail to plan. Plan to fail.

🏆It has always been that simple.

❤️Good luck with your trading journey, I shall see you at the very top.

🎯Trade consistent, FRGNT X

USDJPY and GBPJPY Analysis todayHello traders, this is a complete multiple timeframe analysis of this pair. We see could find significant trading opportunities as per analysis upon price action confirmation we may take this trade. Smash the like button if you find value in this analysis and drop a comment if you have any questions or let me know which pair to cover in my next analysis.

GBPJPY SHORT FORECAST Q2 W19 D7 Y25GBPJPY SHORT FORECAST Q2 W19 D7 Y25

Professional Risk Managers👋

Welcome back to another FRGNT chart update📈

Diving into some Forex setups using predominantly higher time frame order blocks alongside confirmation breaks of structure.

Let’s see what price action is telling us today!

💡Here are some trade confluences📝

✅Weekly order block rejection

✅Daily order block rejection

✅Intraday 15' order blocks

✅Tokyo ranges to be filled

🔑 Remember, to participate in trading comes always with a degree of risk, therefore as professional risk managers it remains vital that we stick to our risk management plan as well as our trading strategies.

📈The rest, we leave to the balance of probabilities.

💡Fail to plan. Plan to fail.

🏆It has always been that simple.

❤️Good luck with your trading journey, I shall see you at the very top.

🎯Trade consistent, FRGNT X

Tue 6th May 2025 GBP/JPY Daily Forex Chart Sell SetupGood morning fellow traders. On my Daily Forex charts using the High Probability & Divergence trading methods from my books, I have identified a new trade setup this morning. As usual, you can read my notes on the chart for my thoughts on this setup. The trade being a GBP/JPY Sell. Enjoy the day all. Cheers. Jim

GBPJPY SHORT FORECAST Q2 W19 D5 Y25GBPJPY SHORT FORECAST Q2 W19 D5 Y25

Professional Risk Managers👋

Welcome back to another FRGNT chart update📈

Diving into some Forex setups using predominantly higher time frame order blocks alongside confirmation breaks of structure.

Let’s see what price action is telling us today!

💡Here are some trade confluences📝

✅Weekly order block rejection

✅Daily order block rejection

✅15' order block targets

✅Weekly imbalance fill targets

🔑 Remember, to participate in trading comes always with a degree of risk, therefore as professional risk managers it remains vital that we stick to our risk management plan as well as our trading strategies.

📈The rest, we leave to the balance of probabilities.

💡Fail to plan. Plan to fail.

🏆It has always been that simple.

❤️Good luck with your trading journey, I shall see you at the very top.

🎯Trade consistent, FRGNT X

GBPJPY SHORT FORECAST Q2 W18 D2 Y25GBPJPY SHORT FORECAST Q2 W18 D2 Y25

Professional Risk Managers👋

Welcome back to another FRGNT chart update📈

Diving into some Forex setups using predominantly higher time frame order blocks alongside confirmation breaks of structure.

Let’s see what price action is telling us today!

💡Here are some trade confluences📝

✅Weekly order block rejection

✅Daily order block rejection

✅15' order block targets

✅Weekly imbalance fill targets

🔑 Remember, to participate in trading comes always with a degree of risk, therefore as professional risk managers it remains vital that we stick to our risk management plan as well as our trading strategies.

📈The rest, we leave to the balance of probabilities.

💡Fail to plan. Plan to fail.

🏆It has always been that simple.

❤️Good luck with your trading journey, I shall see you at the very top.

🎯Trade consistent, FRGNT X

gbpjpy sell signalIn this analysis, it has exited an ascending channel and entered a descending channel. According to the analysis, if that support floor is crossed and a pullback to that resistance level, that is, the price is 190.829, it is suitable for selling and the stop loss is at 191.87 with a risk to reward of 1 to 5.82.

GBPJPY SHORT FORECAST Q2 W18 D28 Y25GBPJPY SHORT FORECAST Q2 W18 D28 Y25

Professional Risk Managers👋

Welcome back to another FRGNT chart update📈

Diving into some Forex setups using predominantly higher time frame order blocks alongside confirmation breaks of structure.

Let’s see what price action is telling us today!

💡Here are some trade confluences📝

✅Weekly 50 EMA

✅Daily 50 EMA

✅Intraday 15' order blocks

✅Tokyo ranges to be filled

✅Intraday 15' order block trading levels

✅

🔑 Remember, to participate in trading comes always with a degree of risk, therefore as professional risk managers it remains vital that we stick to our risk management plan as well as our trading strategies.

📈The rest, we leave to the balance of probabilities.

💡Fail to plan. Plan to fail.

🏆It has always been that simple.

❤️Good luck with your trading journey, I shall see you at the very top.

🎯Trade consistent, FRGNT X

GBP/JPY TRADE ALERT!

GBP/JPY TRADE ALERT!

Potential Trend Reversal Ahead!

Current External Trend: BULLISH

Do you agree with our Daily Time Frame Forecast?

Market has given a CIDS (Candlestick Inside Day Setup), we'll enter after retesting CIDS.

Get ready to trade!

Potential Trend Reversal Ahead!

Current External Trend: BULLISH

Do you agree with our Daily Time Frame Forecast?

Market has given a CIDS (Candlestick Inside Day Setup), we'll enter after retesting CIDS.

Get ready to trade!

GBP/JPY) Bearish analysis Read The ChaptianSMC Trading point update

GBP/JPY 2-hour chart outlines a clear bearish setup within a well-defined downtrend. Here's a breakdown of the trading idea:

---

Technical Overview:

Downtrend Channel:

The pair is respecting a downward-sloping channel, with repeated rejections at the upper boundary, confirming bearish control.

Resistance Zone (~187.8 - 188.5):

Price has reached a highlighted resistance area that aligns with previous swing highs and trendline resistance — marked with red arrows for prior rejections.

Bearish Projection:

The analysis anticipates a rejection from this resistance zone followed by a downward impulse move. A pullback is expected, but continuation toward the target support zone around 179.150 is likely.

Target Zone (~179.150):

This level lines up with previous price action and matches the measured move (blue vertical box), adding confluence.

EMA 200 (around 190.36):

Price is well below the 200 EMA, reinforcing the bearish structure and trend bias.

RSI Indicator (~52):

RSI is slightly above 50 but not bullish — this neutral reading suggests the pair has room to drop if resistance holds.

Mr SMC Trading point

---

Trading Idea Summary:

Bias: Bearish

Entry Zone: 187.8 – 188.5 (resistance)

Confirmation: Bearish candlestick pattern or rejection signal

Target: 179.150

Invalidation: Break and close above 190.365 (above EMA 200 and prior highs)

---

plase support boost 🚀 analysis follow)

GBPJPY:SIGNALHello dears

Considering the heavy decline we had, you can see that buyers entered with a strong bullish spike, which is a good sign...

Now we can buy in steps on the price pullback and move with it to the specified targets, of course with capital and risk management.

*Trade safely with us*

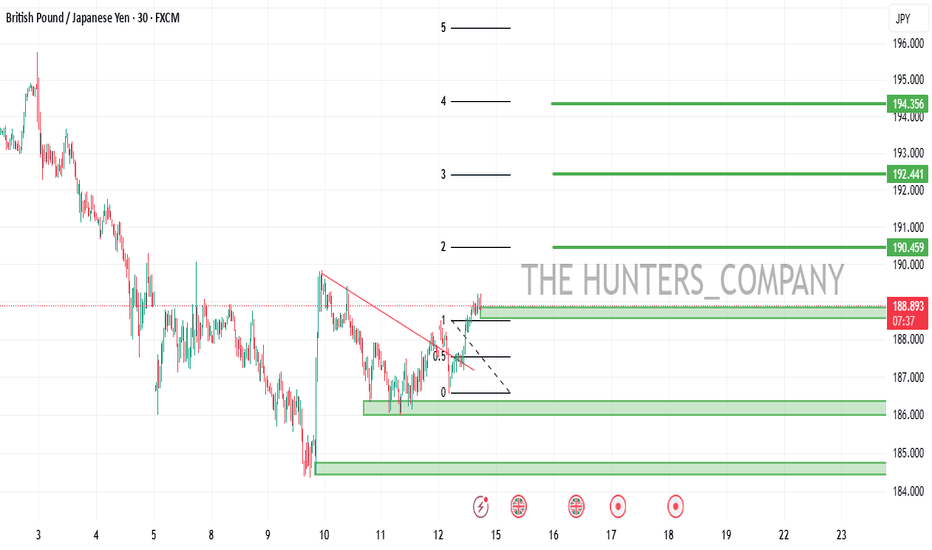

GBP/JPY Triangle Breakout (11.04.2025)The GBP/JPY Pair on the M30 timeframe presents a Potential Selling Opportunity due to a recent Formation of a Triangle Breakout Pattern. This suggests a shift in momentum towards the downside in the coming hours.

Possible Short Trade:

Entry: Consider Entering A Short Position around Trendline Of The Pattern.

Target Levels:

1st Support – 184.40

2nd Support – 182.60

🎁 Please hit the like button and

🎁 Leave a comment to support for My Post !

Your likes and comments are incredibly motivating and will encourage me to share more analysis with you.

Best Regards, KABHI_TA_TRADING

Thank you.

GBP/JPY Technical Analysis: Bearish Rejection at Key Resistance?This chart represents a GBP/JPY (British Pound / Japanese Yen) 30-minute timeframe analysis. Here are the key takeaways:

Technical Indicators & Levels

Exponential Moving Averages (EMAs)

200 EMA (Blue Line): 193.586 – A long-term trend indicator.

30 EMA (Red Line): 193.182 – A short-term trend indicator.

Key Levels

Resistance Zone (Stop Loss Level): 193.968

Support/Target Zone: 191.628

Current Price: 193.255 (as per the last recorded candle)

Trade Setup & Market Structure

Bearish Outlook (Sell Scenario)

The price is approaching a strong resistance zone (193.968), which aligns with the 200 EMA.

The price might reject this level and drop toward the target area of 191.628 (approx. 1.00% downside).

The drawn price path suggests a possible retest of resistance before a bearish move.

Bullish Reversal (Invalidation of Bearish Setup)

If the price breaks and holds above 193.968, it could invalidate the bearish setup and push higher.

A sustained move above the 200 EMA may indicate a trend shift to bullish.

Conclusion

Bearish bias as long as the price stays below 193.968.

A possible short trade opportunity if resistance holds, targeting 191.628.

Caution: If price breaks above resistance, it could lead to a bullish breakout