Wed 2nd Apr 2025 GBP/JPY Daily Forex Chart Sell SetupGood morning fellow traders. On my Daily Forex charts using the High Probability & Divergence trading methods from my books, I have identified a new trade setup this morning. As usual, you can read my notes on the chart for my thoughts on this setup. The trade being a GBP/JPY Sell. Enjoy the day all. Cheers. Jim

Gbpjpyshort

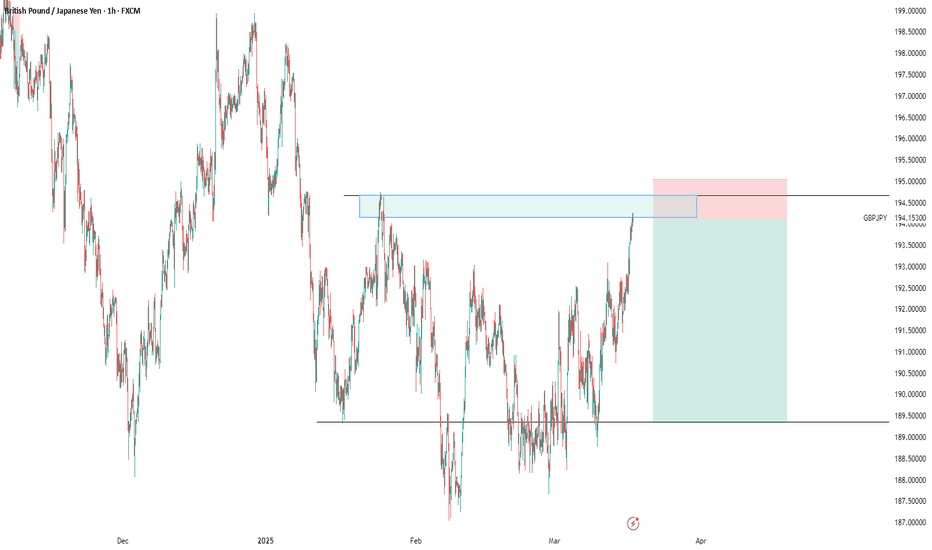

My Directional Bias on GBPJPY for the long run {29/03/2025}Educational Analysis says that GBPJPY may give countertrend opportunities from this range, according to my technical analysis.

Broker - FXCM

So, my analysis is based on a top-down approach from weekly to trend range to internal trend range.

So my analysis comprises of two structures: 1) Break of structure on weekly range and 2) External pushback to fill the remaining fair value gap

1) Break of structure on weekly range is down trend for the long run period of 10 years, may be it switch to new character or change its direction to bullish.

2) External pushback structure is the trading range where it trades on the smaller time frame,

On this structure range market on inside trading or smaller time frame is bullish towards fib of 1.618 and make turn to fill the fair value gaps of it.

Let's see what this pair brings to the table for us in the future.

Please check the comment section to see how this turned out.

DISCLAIMER:-

This is not an entry signal. THIS IS ONLY EDUCATIONAL PURPOSE ANALYSIS.

I have no concerns with your profit and loss from this analysis.

I HAVE NO CONCERNS WITH YOUR PROFIT OR LOSS,

Happy Trading, Fx Dollars.

GBPJPY - Short Term Sell Idea Update!!!Hi Traders, on March 26th I shared this idea "GBPJPY - Expecting Bearish Continuation In The Short Term"

We expected to see retraces and further continuation lower. You can read the full post using the link above.

Retrace and push lower happened until it was blocked by a bullish divergence.

If you enjoy this idea, don’t forget to LIKE 👍, FOLLOW ✅, SHARE 🙌, and COMMENT ✍! Drop your thoughts and charts below to keep the discussion going. Your support helps keep this content free and reach more people! 🚀

-------------------------------------------------------------------------------------------------------------------

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

GBPJPY - Expecting Bearish Continuation In The Short TermM15 - Double uptrend line breakout

Lower Lows

Strong bearish momentum

Potential drop after retraces if the strong resistance zone will not be broken.

If you enjoy this idea, don’t forget to LIKE 👍, FOLLOW ✅, SHARE 🙌, and COMMENT ✍! Drop your thoughts and charts below to keep the discussion going. Your support helps keep this content free and reach more people! 🚀

-------------------------------------------------------------------------------------------------------------------

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

gbpjpy sell signal. Don't forget about stop-loss.

Write in the comments all your questions and instruments analysis of which you want to see.

Friends, push the like button, write a comment, and share with your mates - that would be the best THANK YOU.

P.S. I personally will open entry if the price will show it according to my strategy.

Always make your analysis before a trade

gbpjpy sell signal. Don't forget about stop-loss.

Write in the comments all your questions and instruments analysis of which you want to see.

Friends, push the like button, write a comment, and share with your mates - that would be the best THANK YOU.

P.S. I personally will open entry if the price will show it according to my strategy.

Always make your analysis before a trade

Tue 11th Mar 2025 GBP/JPY Daily Forex Chart Sell SetupGood morning fellow traders. On my Daily Forex charts using the High Probability & Divergence trading methods from my books, I have identified a new trade setup this morning. As usual, you can read my notes on the chart for my thoughts on this setup. The trade being a GBP/JPY Sell. Enjoy the day all. Cheers. Jim

USDJPY and GBPJPY AnalysisHello traders, this is a complete multiple timeframe analysis of this pair. We see could find significant trading opportunities as per analysis upon price action confirmation we may take this trade. Smash the like button if you find value in this analysis and drop a comment if you have any questions or let me know which pair to cover in my next analysis.

gbpjpy buy signal. Don't forget about stop-loss.

Write in the comments all your questions and instruments analysis of which you want to see.

Friends, push the like button, write a comment, and share with your mates - that would be the best THANK YOU.

P.S. I personally will open entry if the price will show it according to my strategy.

Always make your analysis before a trade

GBP/JPY SELL IDEA (R:R=4.8)I just placed a sell order for GBP/JPY at 191.700. We have a wonderful X BAT that just formed on the 1 HOUR chart.

Please trade with proper risk management, since we have news announcements coming out at 8:15 AM EST today.

ADP Non-Farm Employment Change

Stop Loss: 192.368 (Daily High)

Take Profit: 188.450

Happy Trading!

GBP/JPY Sell Setup – Inverse Cup & Handle Pattern Confirmed!### **📉 GBP/JPY Sell Setup – Inverse Cup & Handle Pattern Confirmed! 🚀**

GBP/JPY is forming a **bearish inverse cup & handle pattern**, with **EMA50 confirming the downtrend**, making it a strong sell opportunity.

🔹 **Sell Entry:** **189.100**

🔹 **Stop Loss:** **189.700** (60 pips above entry)

### **📊 Take Profit Targets:**

✅ **TP1:** **188.700** (40 pips profit)

✅ **TP2:** **188.300** (80 pips profit)

✅ **TP3:** **187.900** (120 pips profit)

### **📌 Trade Management:**

✔ **Stick to SL & TP levels** to manage risk.

✔ **Secure profits** as price moves towards TP3.

✔ **Use proper position sizing** for risk management.

🔥 **Execute wisely & trade safely! 🚀📉**

GBP/JPY e Analysis & Probability Estimation March 4 2025Key Observations Across Timeframes:

1. Market Structure & Trend Analysis:

Short-term (M15, M30):

Price is consolidating near 189.200, testing the previous daily low (PDL) for liquidity.

A Break of Structure (BOS) occurred, signaling short-term bearish control.

The price is hovering at a key demand zone (PWL - 188.500/187.800).

If price breaks below 188.800, further downside is likely.

Mid-term (H1, H4):

The price rejected equilibrium (~189.800 - 190.000), showing weakness.

A Change of Character (ChOCH) to the downside suggests a bearish trend continuation.

Liquidity below PWL (187.800) could be a target before a potential bounce.

Long-term (D1):

The price is in a larger downtrend, failing to break above premium zones (~190.500 - 192.000).

Liquidity below PWL (~188.000 - 187.500) is uncollected, making it a likely target.

The next major support lies in the discount zone (~185.500 - 186.500).

2. Key Liquidity Zones & Supply/Demand Areas:

Premium Zone (~190.500 - 192.000): Major resistance; rejection happened here.

Equilibrium (~189.800 - 190.000): Price failed to hold above, signaling weakness.

Discount Zone (~187.500 - 186.500): Next strong demand area if price continues lower.

Previous Daily Low (PDL - 188.800): Price is testing this level for liquidity; a break here could lead to further downside.

Previous Weekly Low (PWL - 187.500): Untapped liquidity below, making it a strong target for price movement.

Probability-Based Scenarios:

1. Bearish Continuation to 187.800 - 186.500 (Break Below PDL & PWL)

Probability: 65%

Reasons:

Failure to hold above equilibrium (189.800).

Bearish BOS & ChOCH confirmations on H1/H4 suggest a move down.

Liquidity below 188.000 (PWL) remains uncollected.

Strong daily downtrend supports further downside.

Bearish Confirmation:

If price breaks and holds below 188.800, expect a move toward 187.500 - 186.500.

2. Bullish Reversal from Discount Zone (Bounce from 188.500 - 187.500)

Probability: 35%

Reasons:

Potential liquidity grab at PWL (188.000 - 187.500) before reversing.

Demand zone at 187.500 - 186.500 could cause a bullish reaction.

If price holds above 188.800, we may see a bounce to 189.800 - 190.000.

Bullish Confirmation:

If price fails to break below 188.500, a push back toward equilibrium (189.800) is possible.

Final Thoughts & Trade Plan:

Bearish bias (65% probability) for continuation toward 187.800 - 186.500.

Key Confirmation Levels:

Below 188.800: Bearish toward 187.500 - 186.500.

Above 189.200: Potential bullish recovery toward 189.800 - 190.000.

Trade Setup Overview:

Bias: Bearish (65% probability)

Entry Type: Breakout & Retest

📉 Sell (Short) Trade Setup:

🔴 Entry: Below 188.800 (Confirmed BOS)

🎯 Take Profit (TP) Targets:

TP1: 188.200 (PWL - Previous Weekly Low)

TP2: 187.800 (Liquidity sweep level)

TP3: 186.500 (Major discount zone)

🛑 Stop Loss (SL): 189.400 (Above minor liquidity)

📊 Risk-to-Reward (R:R):

TP1: ~1:2

TP2: ~1:3

TP3: ~1:5

🔹 Confirmation Needed:

Strong candle close below 188.800 (Break & retest scenario)

No immediate bullish rejection at 188.500

📈 Buy (Long) Trade Setup (Lower Probability - 35%)

🟢 Entry: Above 189.200 (Bullish rejection & BOS)

🎯 Take Profit (TP) Targets:

TP1: 189.800 (Equilibrium zone)

TP2: 190.500 (Supply zone)

TP3: 191.500 (Major resistance)

🛑 Stop Loss (SL): 188.700 (Below structure low)

📊 Risk-to-Reward (R:R):

TP1: ~1:2

TP2: ~1:3

TP3: ~1:5

🔹 Confirmation Needed:

Price needs to hold above 189.200 with strong bullish momentum.

No immediate rejection from equilibrium (189.800).

🛠️ Execution Tips:

🔄 Wait for a clear breakout & retest before entering.

⚖️ Adjust lot size based on risk tolerance (~1-2% per trade).

🕰️ Monitor price action on the lower timeframes (M15/M30) for entry precision.

GBP/JPY Sell Alert: Double Top Confirmation & Bearish Trend 📉 GBP/JPY Sell Trade Analysis

**Trade Setup Details:**

- **Sell Entry:** **189.500**

- **Stop Loss:** **Above 190.300**

- **Take Profit Targets:**

- **TP1:** **189.000** (+50 pips)

- **TP2:** **188.600** (+90 pips)

- **TP3:** **188.300** (final target, +120 pips)

- **Resistance Level:** **189.900**

#### **Technical Analysis Breakdown:**

1. **Double Top Pattern at 190.300:**

- This is a **bearish reversal pattern**, meaning the price tried to break above **190.300** twice but failed.

- It confirms a potential downtrend as sellers step in.

2. **EMA50 Trend Confirmation:**

- The price is moving **below EMA50**, which signals a strong **bearish trend**.

- This supports the idea that sellers are in control.

3. **Resistance Level at 189.900:**

- If price retests this level and **fails to break above**, it confirms further downside potential.

- If price **breaks above 190.300**, it invalidates the sell setup, and **risk management must be applied**.

#### ** Risk Management & Trade Execution:* *

- **Stop Loss Placement:** Above **190.300**, which is the double top resistance. If price breaks above this level, it indicates bullish momentum.

- **Risk-to-Reward Ratio (RRR):**

- TP1: **1:1** (Risk 50 pips for 50 pips gain)

- TP2: **1:1.8** (Risk 50 pips for 90 pips gain)

- TP3: **1:2.4** (Risk 50 pips for 120 pips gain)

### **Conclusion:**

This sell trade is based on a strong **bearish double top pattern** and **EMA50 trend confirmation**. The **189.900 resistance level** is key—if the price stays below it, the trade remains valid. However, if price **breaks 190.300**, it invalidates the setup, and stop-loss protection should be used.

**📊 Monitor price action, stick to your plan, and manage risk carefully!** 🚀🔥

GBPJPY trend continuation?Next week, we can expect the continuation of the trend. The technical analysis is fully explained in the chart, but what needs to be watched are the fundamental reports:

Manufacturing PMI on Monday, (impulsive move)

Tuesday nothing (correction move)

Services PMI on Wednesday, (impulsive move)

Jobless Claims on Thursday, (impulsive move)

and NFP along with Fed Chair Powell's speech on Friday. (impulsive move)

We expecting high volatility during news events. Trade what you see, not what you think.

GBPJPY jumps above 190.50The GBP/JPY pair climbs to around 190.70 during the early European trading hours on Friday. The British Pound (GBP) gains strength against the Japanese Yen (JPY) following the release of the UK's January Retail Sales data.

The Office for National Statistics reported on Friday that UK Retail Sales rose by 1.7% month-on-month in January, compared to a decline of 0.3% in December. This figure exceeded the market's expectation of a 0.3% increase. On a yearly basis, Retail Sales grew by 1.0% in January, compared to a previously revised increase of 2.8% (originally 3.6%), surpassing the forecast of 0.6%. The GBP remains strong in immediate response to the positive UK Retail Sales figures.

gbpjpy buy signal. Don't forget about stop-loss.

Write in the comments all your questions and instruments analysis of which you want to see.

Friends, push the like button, write a comment, and share with your mates - that would be the best THANK YOU.

P.S. I personally will open entry if the price will show it according to my strategy.

Always make your analysis before a trade