GBPJPY: Entering the most optimal medium-term Sell Zone.The GBPJPY pair is bullish on its 1D technical outlook (RSI = 59.237, MACD = 0.300, ADX = 16.909) as it is expanding the bullish wave of the 6 month Channel Down. The two prior peaked on the 0.786 and 0.9 Fibonacci retracement level respectively. This bullish wave has already reached the 0.786 Fib, so it has entered the most optimal Sell Zone for the medium term. Even if it peaks on the 0.9 Fib, a -5.90% bearish wave (similar with the 3 prior) would test 183.500.

See how our prior idea has worked out:

## If you like our free content follow our profile to get more daily ideas. ##

## Comments and likes are greatly appreciated. ##

Gbpjpytrading

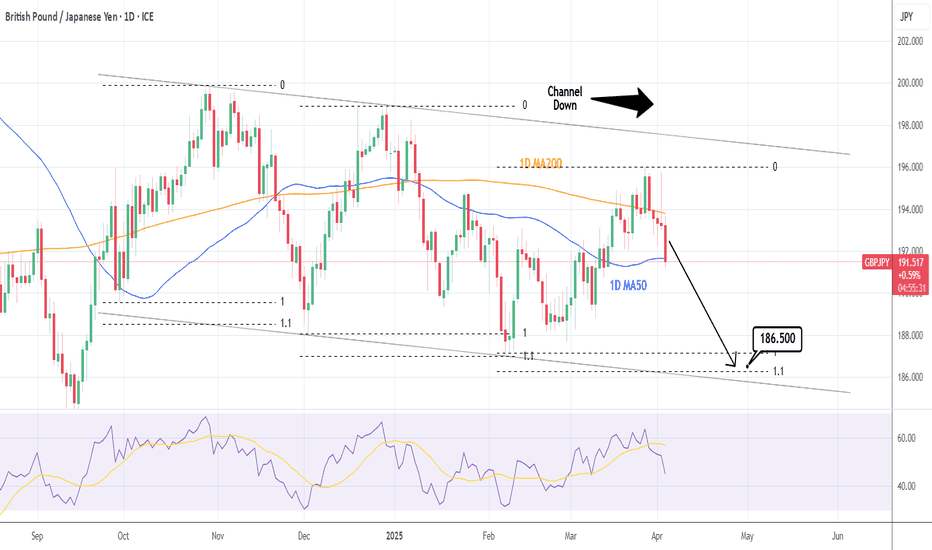

GBPJPY: Channel Down started its new bearish wave.GBJPY is neutral on its 1D technical outlook (RSI = 45.648, MACD = 0.440, ADX = 26.099) as the price is testing the 1D MA50 again, being already on a 4 red day streak. The recent March 28th high almost touched the top of the 6 month Channel Down, so it can be technically considered a LH. Since the 1D RSI already crossed under its MA, we have a validated sell signal. Both prior bearish waves reached the 1.1 Fibonacci extension. Aim just over it (TP = 186.500).

## If you like our free content follow our profile to get more daily ideas. ##

## Comments and likes are greatly appreciated. ##

GBPJPY: Channel Down on its new bullish wave.GBPJPY is bearish on its 1D technical outlook (RSI = 41.292, MACD = -0.960, ADX = 36.514) as since the February 13th LH and rejection near the 1D MA50, it was been on its new bearish wave. The 1D RSI doesn't give a buy signal until it hits its S1 Zone, so we remain bearish on this pair with a typical TP = 185.500, unless the RSI hits S1 first, in which case you'll be encouraged to take profit earlier.

## If you like our free content follow our profile to get more daily ideas. ##

## Comments and likes are greatly appreciated. ##

GBPJPY: Imminent bullish breakout. Long term target 208.000GBPJPY is neutral on its 1D technical outlook (RSI = 49.276, MACD = -0.320, ADX = 25.216) as it is consolidating around its 1D MA50. The Channel Up since the August 5th 2024 Low as well as its RSI structure, draws comparisons with the 2023 Channel Up, which after one last pullback, it rebounded to the 2.0 Fibonacci extension and beyond. We're turning bullish (TP = 208.000).

## If you like our free content follow our profile to get more daily ideas. ##

## Comments and likes are greatly appreciated. ##

GBPJPY: Channel Up rally has started.The GBPJPY pair is neutral on its 1D technical outlook (RSI = 49.167, MACD = -0.620, ADX = 31.719) as so far it remains under both the 1D MA50 and 1D MA200, which are very close to each other. Basically today we are having a clean technical rejection on those two. In spite of this, the prevailing pattern is a Channel Up and we have already started the 3rd bullish wave. The two prior started after a 1D RSI Bullish Cross and the shortest one has been +7.34%. We are aiming for this extension (TP = 201.900).

## If you like our free content follow our profile to get more daily ideas. ##

## Comments and likes are greatly appreciated. ##

GBPJPY: Medium term correction.GBPJPY is bullish on its 1D technical outlook (RSI = 59.018, MACD = 1.270, ADX = 45.334) but on a decreasing rate as the aggressive rise has taken a pause and the price, despite inside a Channel Up since August, has turned sideways since October 4th on the 4H MA50. We expect the bearish wave of the Channel Up to start any day now. Even though the previous targeted the 0.618 Fib, we will aim for the 0.5 this time (TP = 190.000) as the decline may start a little higher than the current price. Keep in mind that the best trigger to sell will be a 1D MACD Bearish Cross.

## If you like our free content follow our profile to get more daily ideas. ##

## Comments and likes are greatly appreciated. ##

GBPJPY: Bull Flag to start a great rally.GBPJPY is neutral on its 1D technical outlook (RSI = 54.480, MACD = 0.880, ADX = 34.811) as it's been basically consolidating since last Friday with the price ranging around the 1D MA50 and 1D MA200. This consolidation is being done while the 1D RSI shows a Bullish Divergence in a Channel Up. Last time this happened was in March 2023, a Bullish Flag that pushed the price later aggressively to the top of the 2 year Channel Up. We turn heavily bullish on GBPJPY (TP = 220.000).

See how our prior idea has worked out:

## If you like our free content follow our profile to get more daily ideas. ##

## Comments and likes are greatly appreciated. ##

GBPJPY possible week ahead trajectory GBPJPY has strong drop past week with JPY news has broken out of the structure. The price is currently below the weekly support level as with the formation of a weekly pin bar, there still bearing momentum. We may see further downside with GBPJPY, may drop to weekly support and could continue to bounce back to 194.25 level with strong momentum.

GBPJPY: Inverse Head and Shoulders calls the bottom.GBPJPY got oversold on its 1D technical outlook (RSI = 28.124, MACD = -0.770, ADX = 29.222) as it was rejected today on the 1D MA50. On Sep 16th it touched the bottom of the long term Channel Up and rebounded, while the 1D RSI has been on a bullish divergence. We expect this bottom to be in the form of an Inverse Head and Shoulders. We are aiming for the 1D MA200 and the 0.5 Fibonacci level (TP = 150.500).

See how our prior idea has worked out:

## If you like our free content follow our profile to get more daily ideas. ##

## Comments and likes are greatly appreciated. ##

GBPJPY and GBPUSD Top-down analysis Hello traders, this is a complete multiple timeframe analysis of this pair. We see could find significant trading opportunities as per analysis upon price action confirmation we may take this trade. Smash the like button if you find value in this analysis and drop a comment if you have any questions or let me know which pair to cover in my next analysis.

GBPJPY: Bullish continuation. 1D MA50 in full support.GBPJPY is almost overbought on its 1D technical outlook (RSI = 69.343, MACD = 1.720, ADX = 59.150) and is extending the bullish wave inside the 16 month Channel Up. The overbought technicals shouldn't be a factor for a bearish reversal as long as the 1D MA50 continues to support. We are confident with buying, aiming at the top of the Channel Up (TP = 208.000).

## If you like our free content follow our profile to get more daily ideas. ##

## Comments and likes are greatly appreciated. ##

GBPJPY: Head and Shoulders formed. Sell signal.GBPJPY is neutral on its 1D technical outlook (RSI = 50.345, MACD = 0.240, ADX = 29.640) as the recent bullish run came to an end on the HH trendline. For now the 1D MA50 held but the peak pattern formed is a Head and Shoulders. The 1D MACD is on a Bearish Cross, so the short signal is complete. Our target is the S1 level, potentially a contact with the 1D MA200 (TP = 185.500).

See how our prior idea has worked out:

## If you like our free content follow our profile to get more daily ideas. ##

## Comments and likes are greatly appreciated. ##

GBPJPY Top-down analysis Hello traders, this is a complete multiple timeframe analysis of this pair. We see could find significant trading opportunities as per analysis upon price action confirmation we may take this trade. Smash the like button if you find value in this analysis and drop a comment if you have any questions or let me know which pair to cover in my next analysis.

GBPJPY Top-down analysis Hello traders, this is a complete multiple timeframe analysis of this pair. We see could find significant trading opportunities as per analysis upon price action confirmation we may take this trade. Smash the like button if you find value in this analysis and drop a comment if you have any questions or let me know which pair to cover in my next analysis.

GBPJPY: Systemic Top being formed. Sell.GBPJPY is on a bullish 1D technical outlook (RSI = 65.529, MACD = 1.210, ADX = 62.251), which is a natural consequence of the strong 3 week rally since the January 2nd bottom. However this rally appears to have come to an end as not only has the price hit and got rejected twice on the R1 level (188.660) but the 1D RSI has also reach the top of its six month Channel Down and is reversing.

The price action's HH trendline is a little higher, so we can allow some space for a final blow off top before a selloff. The Sine Waves so a clear and very consistent Peak-Bottom pattern and right now the price is exactly on the Peak. Consequently, we consider the current price level as a low risk sell opportunity. We are targeting the 1D MA200 (TP = 182.350).

See how our prior idea has worked out:

## If you like our free content follow our profile to get more daily ideas. ##

## Comments and likes are greatly appreciated. ##

GBPJPY Top-down analysis Hello traders, this is a complete multiple timeframe analysis of this pair. We see could find significant trading opportunities as per analysis upon price action confirmation we may take this trade. Smash the like button if you find value in this analysis and drop a comment if you have any questions or let me know which pair to cover in my next analysis.

GBPJPY Top-down analysis Hello traders, this is a complete multiple timeframe analysis of this pair. We see could find significant trading opportunities as per analysis upon price action confirmation we may take this trade. Smash the like button if you find value in this analysis and drop a comment if you have any questions or let me know which pair to cover in my next analysis.

GBPJPY: Strong 1D MA200 buy opportunity.GBPJPY remains bearish on the 1D timeframe (RSI = 34.266, MACD = -0.180, ADX = 42.349) despite today's rebound following yesterday's bottom near the S1 level. The key here is that this bottom was made very close to the 1D MA200, which hasn't been crossed since April 6th. The 1D RSI almost got oversold for a moment (near 30.000) yesterday, so all indicators point towards a rebound. We are bullish, targeting 188.00. If we get a 1D candle closing over the R1 level (188.660), we will rebuy and aim foe the HH trendline (TP = 190.000).

See how our prior idea has worked:

## If you like our free content follow our profile to get more daily ideas. ##

## Comments and likes are greatly appreciated. ##

GBPJPY Top-down analysis Hello traders, this is a complete multiple timeframe analysis of this pair. We see could find significant trading opportunities as per analysis upon price action confirmation we may take this trade. Smash the like button if you find value in this analysis and drop a comment if you have any questions or let me know which pair to cover in my next analysis

GBPJPY: Hit a 2 year Resistance. Hard fall possible.GBPJPY hit today the top (HH line) of the Megaphone pattern that started on the May 24th 2021 High. Tha last time it did (April 18th 2022), the price got rejected back to the 0.618 Fibonacci level and the 1W MA50. Right now the 1W MA50 is already near the 0.618 Fibonacci and is headed towards the 0.5. With the 1W technicals vastly overbought (RSI = 75.716, MACD = 4.620, ADX = 61.529), we expect a hard landing for the pair and open a long term sell targeting the 0.5 Fibonacci (TP = 170.000), where not only we project contact with the 1W MA50 but is also where the HL of the Rising Wedge is.

## If you like our free content follow our profile to get more daily ideas. ##

## Comments and likes are greatly appreciated. ##

GBPJPY Scalping and breakout opportunitiesGBPJPY is neutral between the Falling Resistance and a 1 year Rising Support Zone.

This creates an opportunity to scalp inside a Triangle pattern.

Besides that, buy above the Falling Resistance and target 166.000 (Resistance A + 0.618 Fibonacci) and sell under the Rising Support Zone and target 155.550 (Support A).

Follow us, like the idea and leave a comment below!!