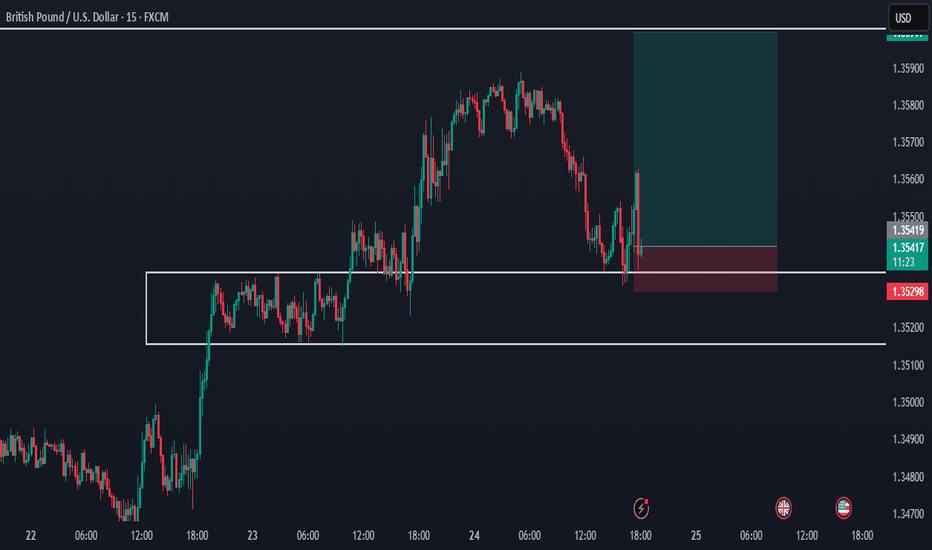

Gbplong

GBPCAD 4H long setupGBPCAD 4H Spring 💡 | Smart Money Accumulation Before Expansion

Watching a textbook Wyckoff spring unfold here on the 4H.

After a multi-day rally, price retraced, and liquidity built up just above 1.8713. What happened next?

🔻 We got a liquidity sweep, tagging below 1.8687 — then a sharp rejection wick back into the range. That’s the spring.

🧠 Why this matters:

Liquidity below the range is now likely cleared.

Smart money triggered stops and may now flip positioning.

Buyer momentum reclaiming the broken zone signals strength returning.

🎯 My Play:

Long entry after reclaim above 1.8713

Stop below 1.8687 wick low

Targeting 1.8828 > 1.8830 as TP1

Extended TP at 1.8928 — aligning with prior supply zone

⚠️ Invalidation if we lose 1.8685 with momentum and no absorption.

This is not a chase trade — it’s a calculated entry after weak hands were shaken out. Let the market prove strength, then ride the reversion.

📈 If this spring holds, I expect continuation toward prior highs.

GBPUSD GBPUSD Analysis & Signal (1H Timeframe)

📅 Date: March 23, 2025

On the GBP/USD chart, the price has reached a key resistance zone around 1.29629 after an uptrend, showing signs of rejection. This resistance aligns with a descending trendline, adding to the selling pressure.

Currently, the price is heading toward the demand zone marked between 1.28613 and 1.28117, which could act as a strong support level.

Signal:

Sell:

📍Entry Point: 1.29114 (current price)

🔴Stop Loss: 1.29629 (above resistance)

🟢Take Profit 1: 1.28613

🟢Take Profit 2: 1.28117

⚠️Risk Management:

With the stop loss set above the resistance, the risk-to-reward ratio (R:R) for this trade is at least 1:2. It’s recommended to risk only 1-2% of your capital on this trade.

📝Note: Before entering the trade, wait for additional confirmations (e.g., reversal candlestick patterns or a break of the zone) and assess market conditions.

Trade Idea: GBP/USD Long SetupPair: GBP/USD

Timeframe: 4-Hour (4H)

Trade Type: Long

Entry: 1.2900 - 1.2950

Stop Loss: 1.2850 (below previous structure low)

Technical Analysis:

GBP/USD has been trending within a well-defined ascending channel, characterized by higher highs and higher lows. The recent price action saw a pullback toward the lower boundary of this channel, around the 1.2860 region, which coincides with the 200-period Simple Moving Average (SMA) on the 4-hour chart, providing a confluence of support. A bullish candlestick pattern or a bounce from this support zone could signal a potential continuation of the uptrend toward the upper channel resistance near 1.3270.

Fundamental Analysis:

Recent economic developments support a bullish outlook for GBP/USD:

• UK Inflation Data: The UK’s Consumer Price Index (CPI) rose by 2.8% in February, down from 3% in January and below the expected 2.9%. This easing inflation may influence the Bank of England’s monetary policy decisions, potentially leading to a more accommodative stance, which can be supportive of the GBP.

• US Economic Factors: The US is set to impose new tariffs starting in April, which could impact market sentiment and influence USD strength. Additionally, upcoming US PMI data may provide further insights into economic conditions that could affect USD performance.

GBP/USD LONGHi !

Based on the current price action and I have prepared 2 trades for next week.

First is a long position from 1.287 where is VAL , price has respected this area, making it a good level for initiating a smaller long position with limited risk.

Forward I am looking at 1.3 area and looking to scaling in after confirmation above 1.302 ensures that I participate in the trend continuation without overexposing prematurely.

Step 1: Small Entry at 1.287

Entry: Long position at 1.287.

Stop Loss: Below 1.2800.

Take Profit: Partial profit near resistance at 1.3000, or hold until breakout confirmation.

Step 2: Scale In After Breakout

Entry Trigger: Wait for price action to break and hold above 1.302 (confirmed by strong candlestick close or volume spike).

Entry Price: Enter larger position at 1.302.

Stop Loss: Below recent breakout level (~1.295).

Take Profit Levels:

First Target: 1.3200.

Second Target: 1.3400.

FX:GBPUSD

GBP/USD Market Analysis: Potential Short Setup at ResistanceThe GBP/USD pair is trading near the **1.3000** psychological level, showing signs of consolidation after a strong bullish move. The chart suggests a potential reversal as price approaches a key resistance zone, with an apparent liquidity grab at the recent high.

The highlighted area around **1.2946 - 1.2921** represents a significant **H4 demand zone**, where price could retrace before continuing its next move. A break below this zone would indicate a deeper correction, with potential downside targets towards **1.2870** (OA level).

**Key Considerations:**

- A sustained break above **1.3000** could invalidate the bearish setup, leading to further upside momentum.

- A rejection at this level, combined with bearish price action, could confirm a short opportunity with a target towards the demand zone and lower support areas.

**Conclusion:** Traders should monitor price action around the resistance level and confirmation of a bearish reversal before committing to short positions. If bullish momentum persists, a breakout could open the door for further gains.

EURUSD Weekly FOREX Forecast: March 10 - 14thIn this video, we will analyze EURUSD and EUR Futures. We'll determine the bias for the upcoming week, and look for the best potential setups.

While the USD is bearish, the EUR is finding strength to the upside. This is noted in the very strong Friday candle. Meh NFP numbers, tariffs and trade wars are pulling the USD down, allowing the EUR and the other majors to move higher.

Look for a retracement to the +FVG in the beginning of the week. This could potentially set up the higher probability buy setup that potentially forms there.

Enjoy!

May profits be upon you.

Leave any questions or comments in the comment section.

I appreciate any feedback from my viewers!

Like and/or subscribe if you want more accurate analysis.

Thank you so much!

Disclaimer:

I do not provide personal investment advice and I am not a qualified licensed investment advisor.

All information found here, including any ideas, opinions, views, predictions, forecasts, commentaries, suggestions, expressed or implied herein, are for informational, entertainment or educational purposes only and should not be construed as personal investment advice. While the information provided is believed to be accurate, it may include errors or inaccuracies.

I will not and cannot be held liable for any actions you take as a result of anything you read here.

Conduct your own due diligence, or consult a licensed financial advisor or broker before making any and all investment decisions. Any investments, trades, speculations, or decisions made on the basis of any information found on this channel, expressed or implied herein, are committed at your own risk, financial or otherwise.

GBPUSD BUY 📊 Technical Analysis & Entry Signal 💹

🔍 The chart shows a strong uptrend where the price has broken a key resistance level and is now pulling back to retest it. As highlighted in the analysis, it's crucial to wait for a complete pullback and confirmation before entering a trade.

📈 Entry Signal:

✅ Entry: After pullback confirmation around 1.27570

🎯 Targets:

First Target: 1.27952

Second Target: 1.28269

Third Target: 1.28645

🛑 Stop Loss: 1.27414 (Risk management is essential)

📝 Important Note: Always manage your risk and avoid entering without confirmation. 📉

GBPUSDhello friends

Due to the severe fall that we had and cardamom breaking respectively.

Now, with another bottom failure, the price is placed in a good area, and from there, by getting confirmation, we can expect a good reaction.

This analysis is checked from a technical point of view.

Be successful and profitable.

GBPUSD A Clear Sell To Buy Set UPFirst I want to thank you all for the love you have showed. Much appreciated.

Second, I sound groggy in this video..... just exhausted but hey, I have to do this for you guys.

Anyway, this is a follow up on the last video that I did (attached here) where I mentioned that since we have already gotten a bullish break of internal structure (signaling an internal trend change) we should expect a pullback.

At the time i was recording this, price is approaching a demand zone where we should expect to see a bullish reaction to take us back to where we are looking to get involved with the sells.

If you are comfortable buying from the zone, you should (I will just wait for the reaction off that demand zone into my supply zone to sell).

Caution to the people looking to sell.

If price makes a deeper pullback, (blasting through the demand zone), cancel your sell orders and start looking for buy opportunities.

If the decisional demand zone get's blasted, let's wait for the extreme to hold.

GBPUSD - My Style!This is quite interesting for you to understand!!

Look at the green doodle, it shows where it would move

Red line shows till which time it would fall, expecting a short up move after the fall because theres a steep orderblock where people like to move things up,

The prior orange round half circle marked are 200SMA high lines.

Orange box is also where you can plan buys to wait like a shark to eat a puffer fish!!

GBPUSD Buy area at 1.23248 with strong confirmationsWait for the breakout and put the trade with proper analysis and risk mangements

GBPUSD Buy area at 1.23248 with strong confirmations

Stop Loos: 1.22963

Take Profit Level: 1.2376

Level 2nd; 1.24932

The Setup follow the 1st risk on account and use trail stop loss.

LONG GBP/GPY!Here is my current idea on GBP JPY for this week/month.

Price has already bounced off the .618 level and unless I see new market structure being formed on the MTF (4HR etc) i will continue to believe price will reach the .705 fib level.

If not I will update the chart and find a long position.

As seen from the chart, I have 3 targets in place for this bullish idea, and I will need to see a close above 194.2 to validate it.

Inflation rate news also coming on the 15th which could explain the bleeding of all GBP pairs last week and we are already near 'priced in' levels. But I will be cautious and leave an update on my thought process when it happens.

Thanks if you took the time to read and good luck.

GBPAUD to the moon?Taking a long position on GBPAUD, main reasons being:

- BoE holding interest rates for now and less rate cuts are expected next year, could drive more institutions to hold GBP and increase it's value

- AUD are trade partners with China who are experiencing significant economic instability

- COT traders are 57% long on GBP (+2.14% compared to last week)

- COT traders are 52% long on AUD, but are adding more short positions (-4.53% change in net long positions compared to last week)

- Retail traders are 93% short on GBPAUD (I find that retail is usually wrong, so this is a positive signal for GBPAUD longs in my book)

This trade is more based on Australia's weakness rather than Britain's strength. I was also thinking of shorting AUDJPY (see previous trade idea) or AUDUSD.

I couldn't get in a position that I liked on AUDJPY (yet) and I'm already in a short position on EURUSD, so I want to diversify a bit away from the US Dollar.

The reason I'm entering here is because it is filling an imbalance candle, and it's also at the 0.682 mark on the Fibonacci retracement tool.

If I get taken out I don't mind, there may be better entries on GBPAUD available if that happens, or there may be an opportunity to short AUDJPY instead, which I prefer the fundamentals of.

Don't take this as investment advice, I'm just sharing what I'm doing. Please don't follow me blindly, create your own strategy and ideas.

GBPUSD Bullish trade Idea after see some sold breakout confirmatGBPUSD bullish trade idea after seeing some sold breakout confirmations on H1.

Buy Price LEVEL: 1. 2597

SL: 1.2550

TP: 1.27141

After the FOMC meeting yesterday night, the price dropped to 1.25627 with high volume when the Fed rate of 4.50 will boost the USD.

The GBP index is bullish; just find the trade with a tight stop loss.

*Note: The market is highly volitile in December; just place a smaller number of trades.

GBP/USD - Good OpportunityHi,

This is my new analysis for GBP/USD.

Right now we are in a big reversal on 1H timeframe and at the same time we have head and shoulder pattern and both the 1H/4H EMA have crossed over. As you see in the yellow line I expect if the price break above the trendline we are going to reach 1,30.

We have opened a position at 1,27 and we are going to increase our position after breakout.

Gbpusd long Target GBP/USD churned chart paper near the 1.2600 handle, finding thin gains through the day’s market window but failing to recapture the technical level as market flows do little to bolster the Pound Sterling

GBP/USD remains hobbled on the south side of the 1.2600 handle, churning bids north of 1.2500 as the pair finds some breathing room after another leg lower from early November’s choppy plateau just below 1.3000. Cable reached a six-month low of 1.2487 late last week, clipping into a 7% decline top-to-bottom from September’s peaks at 1.3434.

Confirm signal gbpusd