GBPNZD Breakout from Consolidation Bullish Momentum BuildingGBPNZD has broken out of its recent consolidation pattern and is showing signs of bullish continuation. Strong GBP fundamentals combined with NZD weakness from global risk-off sentiment and tariffs support this technical move.

Technical Analysis (4H Chart)

Pattern: Breakout from a descending channel with bullish follow-through.

Current Level: 2.2418, trading above the breakout level, confirming momentum shift.

Key Support Levels:

2.2294 – recent breakout support and invalidation point for bulls.

2.2222 – secondary support if a deeper pullback occurs.

Resistance Levels:

2.2500 – near-term resistance and potential target for the breakout.

2.2690 – extended bullish target if momentum continues.

Projection: Likely to continue higher toward 2.2500, with room for 2.2690 if GBP strength persists.

Fundamental Analysis

Bias: Bullish.

Key Fundamentals:

GBP: Supported by BOE’s cautious stance on inflation and the relative resilience of the UK economy.

NZD: Pressured by global tariffs, weaker risk sentiment, and limited domestic growth catalysts.

USD Factor: Fed rate cut expectations indirectly support GBP crosses against risk currencies like NZD.

Risks:

Hawkish surprise from RBNZ could strengthen NZD.

BOE dovish signals could stall GBP upside.

Key Events:

BOE meeting and UK CPI.

RBNZ policy decision.

Risk sentiment trends globally.

Leader/Lagger Dynamics

GBP/NZD is a leader among GBP crosses, with GBP strength and NZD weakness driving momentum. It also aligns with EUR/NZD upside moves, reinforcing the bearish NZD outlook.

Summary: Bias and Watchpoints

GBP/NZD is bullish, having broken consolidation with upside targets at 2.2500 and 2.2690. The main drivers are GBP’s policy support, NZD’s risk-off weakness, and global tariff concerns. Watch for BOE and RBNZ updates as potential volatility triggers.

Gbpnzdforecast

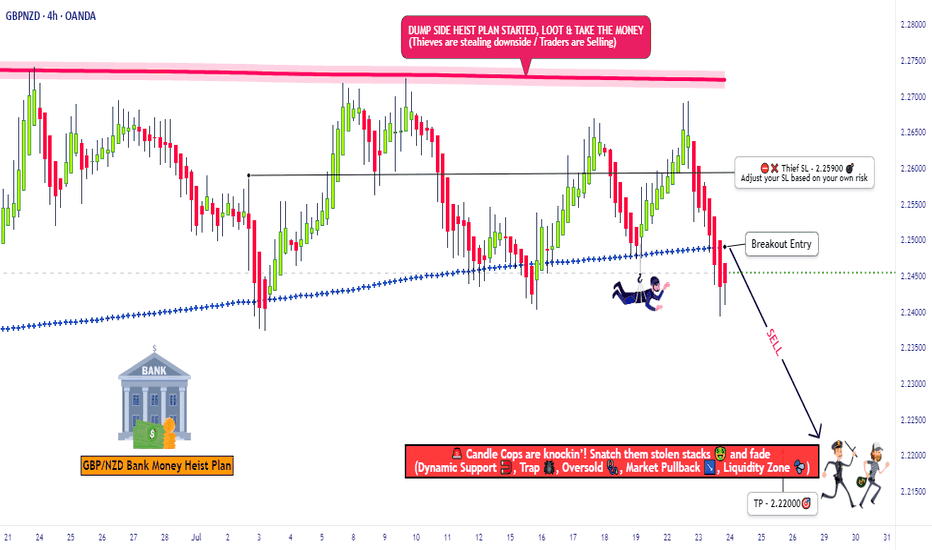

"GBP/NZD: Bearish Storm Brewing – Get Ready!🚨 GBP/NZD HEIST ALERT: "Pound vs Kiwi" Bearish Trap Setup! 🚨 (Scalping/Day Trade)

🌟 Attention, Market Robbers & Profit Pirates! 🌟

🔥 Thief Trading Strategy Activated – Time to short the GBP/NZD like a pro! This pair is setting up for a bearish heist, and we’re locking in entries before the drop. High-risk, high-reward? You bet.

🎯 TRADE PLAN (Bearish Ambush)

Entry Zone (Short) 📉:

Optimal: Sell limit orders on retests (15m/30m timeframe).

Thief’s Trick: Layer entries (DCA-style) near recent highs for max efficiency.

"Enter like a sniper, escape like a ghost." 👻

Stop Loss 🛑:

4H Swing High/Wick (Near 2.25900) – Adjust based on your risk & lot size.

"A smart thief always has an exit route." 🏃💨

Target 🎯: 2.22000 (or escape early if the trap snaps shut!)

💣 WHY THIS HEIST? (Bearish Triggers)

Technical Setup: Oversold bounce? Nah. Consolidation → Reversal trap.

Fundamentals: Weak GBP sentiment? Strong NZD data? Check the news!

Market Psychology: Bulls are getting trapped at resistance—time to fade them.

⚠️ THIEF’S WARNING

News = Volatility Bomb 💣 – Avoid new trades during high-impact events.

Trailing SLs = Your Best Friend – Lock profits & dodge reversals.

💎 BOOST THIS IDEA & JOIN THE HEIST!

🔥 Hit 👍 LIKE, 🚀 BOOST, and FOLLOW for more lucrative robberies!

💸 "Steal the market’s money—before it steals yours." 🏴☠️

🔔 Stay tuned—next heist coming soon! 🔔

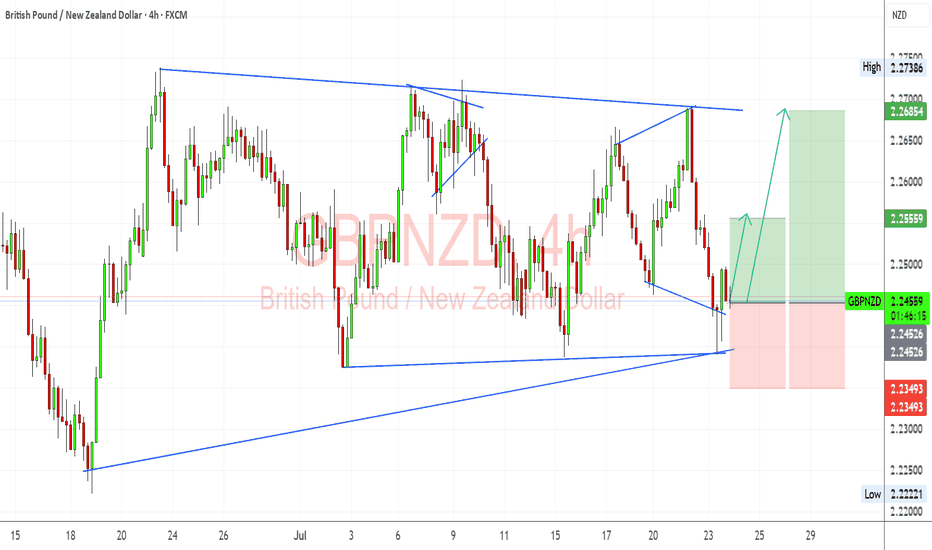

GBPNZD Analysis — 4H Chart ReviewI’m watching GBPNZD for a potential bullish continuation after a successful retest of the long-term ascending trendline. Price rejected near the lower boundary of the symmetrical triangle and showed bullish momentum right off that support. My structure suggests potential upside targets at 2.25559 (minor resistance) and 2.26854 (upper triangle boundary/major resistance zone).

🔍 Fundamental Context:

🇬🇧 GBP Fundamentals:

UK CPI came in softer than expected, and BoE rate cuts are slowly being priced in for late 2025.

However, BoE still sounds relatively hawkish compared to RBNZ due to inflation persistence in services.

Strong UK wage growth and sticky inflation give GBP some near-term yield support.

🇳🇿 NZD Fundamentals:

RBNZ remains on hold, but dovish tilt noted in recent communications.

NZD under pressure from falling dairy prices and weak global growth sentiment (especially China).

Risk-off flows and Fed hawkishness keep NZD vulnerable as a high-beta currency.

⚠️ Risks to the Setup:

A surprise hawkish turn from RBNZ or better-than-expected NZ data could boost NZD.

Renewed UK political instability or weak retail sales data may pressure GBP.

Broader market risk sentiment — NZD may strengthen if risk-on returns and US yields drop.

🗓️ Key News/Events to Monitor:

UK Retail Sales (July 25)

RBNZ Governor Orr Speech (if scheduled)

US PCE (for global risk impact)

Chinese macro data (indirect NZD driver)

🔁 Leader/Lagger Perspective:

GBPNZD often leads EURNZD during GBP-specific catalysts (BoE speeches, UK CPI).

It lags NZDUSD and NZDCAD when risk sentiment or commodity cycles dominate.

📌 Summary: Bias and Watchpoints

I'm bullish on GBPNZD in the short term, especially after a strong trendline retest and recovery off the 2.2450 zone. Fundamentals support GBP resilience over NZD due to relatively hawkish BoE stance and weaker New Zealand data. The main risk to this setup would be a dovish BoE surprise or strong NZ commodity-led rebound. I'll be watching UK Retail Sales and general risk sentiment closely. This pair can act as a leader during UK-specific news but becomes a lagger when risk flows dominate broader NZD direction.

gbpnzd buy signal. Don't forget about stop-loss.

Write in the comments all your questions and instruments analysis of which you want to see.

Friends, push the like button, write a comment, and share with your mates - that would be the best THANK YOU.

P.S. I personally will open entry if the price will show it according to my strategy.

Always make your analysis before a trade

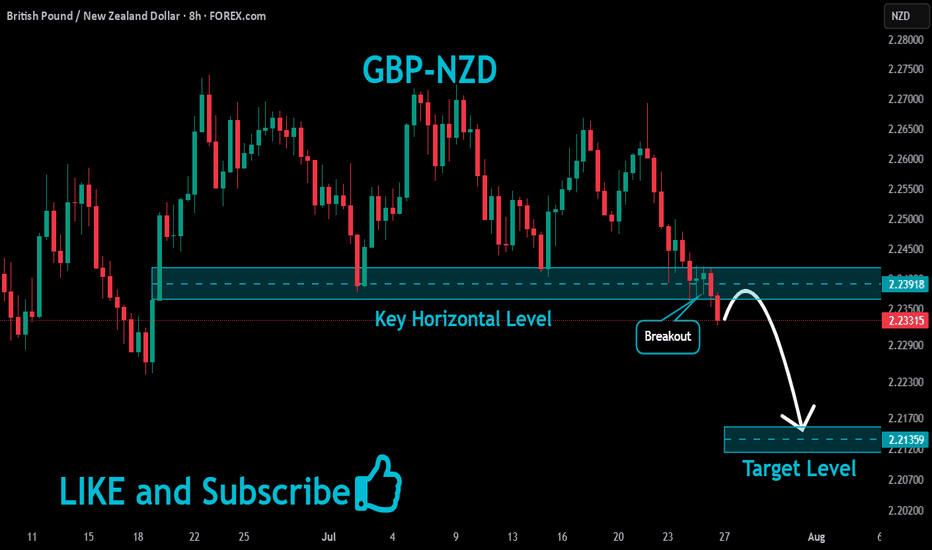

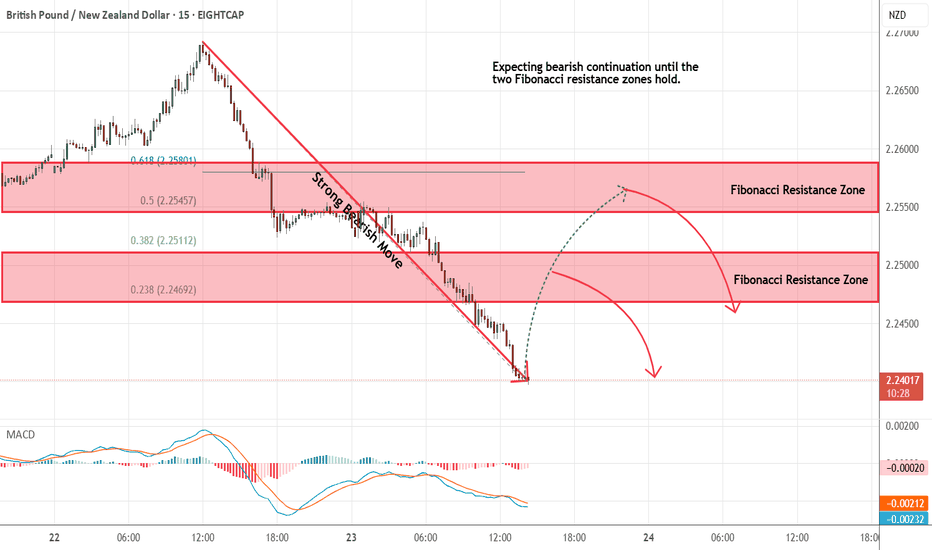

GBPNZD - Looking To Sell Pullbacks In The Short TermM15 - Strong bearish move.

No opposite signs.

Expecting bearish continuation until the two Fibonacci resistance zones hold.

If you enjoy this idea, don’t forget to LIKE 👍, FOLLOW ✅, SHARE 🙌, and COMMENT ✍! Drop your thoughts and charts below to keep the discussion going. Your support helps keep this content free and reach more people! 🚀

-----------------------------------------------------------------------------------------------------

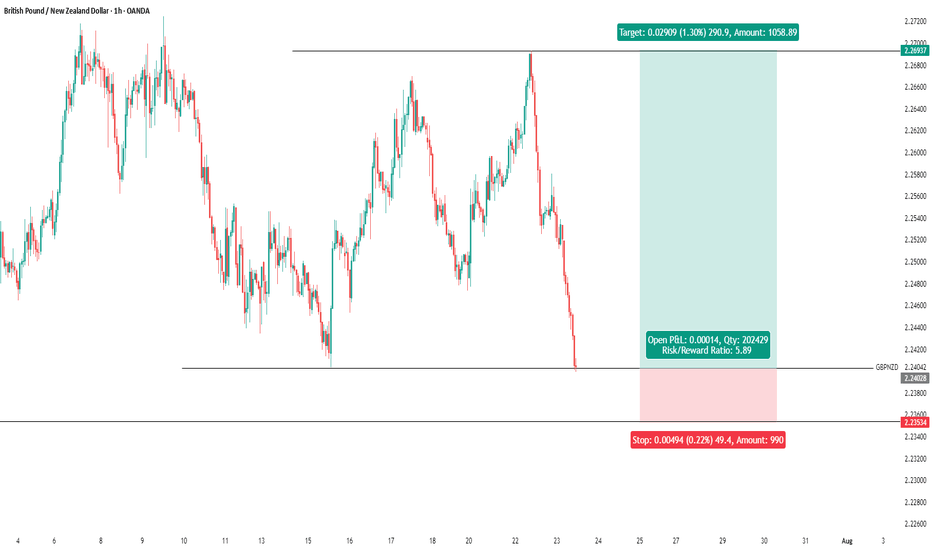

GBPNZD – Waiting for Price to Reach the ZoneWe’re currently waiting for price to reach our key level.

Once it does, and we see a valid buy signal, we’ll enter a long position.

🔄 All scenarios remain active.

Those who follow my analyses regularly already know the flow —

so no need to repeat the full breakdown.

As always, we don’t predict – we react to price.

We’re not here to guess what the market will do,

we’re here to manage our risk and trade what we see.

GBPNZD - Look for Long (SWING) 1:3GBPNZD currently shows no signs of reversal, having broken the trendline and heading toward the next supply zone on the higher timeframe. This presents a potential opportunity to go long in line with the prevailing trend, never trade against it. Let’s observe how the price action unfolds.

Disclaimer:

This is simply my personal technical analysis, and you're free to consider it as a reference or disregard it. No obligation! Emphasizing the importance of proper risk management—it can make a significant difference. Wishing you a successful and happy trading experience!

GBP/NZD Vault Breach?! Ready for a Clean Bullish Heist?🔓💷 GBP/NZD — The Sterling Vault Heist Plan 🐱💻💰💹

🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

To all the Money Makers, Market Magicians, and Chart Whisperers — it's time for another precision strike in the forex jungle! 🤑📊⚔️

🚨 Operation: GBP/NZD – Sterling vs Kiwi Bank Play 🚨

We're eyeing a bullish breakout based on solid thief-style technicals and stealthy fundamentals. The play: Long entry with high conviction — the vault is cracked open, now it's about how smooth the job gets executed! 🏦💸

🎯 Setup Breakdown:

🎯Entry Zone:

The loot is there for the taking! Ideal entries near recent 15min or 30min lows/swing points — look for a pullback entry to join the bullish breakout crew.

🟢 The market shows strength, momentum, and intention.

🛑Stop Loss (Thief Shield):

Placed tactically near the 2H swing low (around 2.23800).

⚖️ Adjust based on your lot sizing, trade volume, and risk appetite — the escape route is always planned.

💰Target Area (The Vault Door):

📌 Eyeing 2.28500 as the final vault exit — but feel free to grab your profits early if the heat rises. 🔥

Smart robbers know when to vanish.

🧠 Scalper's Note:

Ride only on the bullish side.

💼 Got big pockets? Enter now.

💡 Running light? Wait for the retest and team up with swing players for the score.

Use Trailing SL to guard your gold — protect what you steal!

📚 Market Intel:

This bullishness is no accident — backed by:

📰 Macros | 💹 COT Data | 📊 Sentiment | 🔎 Intermarket Analysis

The vault doesn’t open every day — this move is calculated.

⚠️Heads Up:

News volatility can trigger alarms 🚨

❌ Avoid fresh entries during major releases

✅ Use trailing SLs to manage live positions

Stay sharp. React fast. Think like a thief. 🧠

💥 If you vibe with the Thief Trading Style, smash that ❤️Boost Button❤️ and support the squad!

We move smart, strike clean, and profit consistently. This is Forex Heisting, redefined.

Stay tuned — the next master plan is loading... 🧨🔐💷📈

GBPNZD - Looking To Sell Pullbacks In The Short TermH1 - Strong bearish move.

No opposite signs.

Currently it looks like a pullback is happening.

Expecting bearish continuation until the two Fibonacci resistance zones hold.

If you enjoy this idea, don’t forget to LIKE 👍, FOLLOW ✅, SHARE 🙌, and COMMENT ✍! Drop your thoughts and charts below to keep the discussion going. Your support helps keep this content free and reach more people! 🚀

--------------------------------------------------------------------------------------------------------------------

gbpnzd buy signal. Don't forget about stop-loss.

Write in the comments all your questions and instruments analysis of which you want to see.

Friends, push the like button, write a comment, and share with your mates - that would be the best THANK YOU.

P.S. I personally will open entry if the price will show it according to my strategy.

Always make your analysis before a trade

gbpnzd buy signal. Don't forget about stop-loss.

Write in the comments all your questions and instruments analysis of which you want to see.

Friends, push the like button, write a comment, and share with your mates - that would be the best THANK YOU.

P.S. I personally will open entry if the price will show it according to my strategy.

Always make your analysis before a trade

#GBPNZD:+1000 PIPS Two Take Profit Swing Buy Analysis The price is currently consolidating, indicating no clear move. We’re looking for a safe entry point here. There are two potential targets for setting your take profit. We anticipate a strong price reversal on this pair and significant volume in the coming weeks.

Good luck! Show us some support by liking and commenting on the ideas.

Team Setupsfx_

gbpnzd buy signal. Don't forget about stop-loss.

Write in the comments all your questions and instruments analysis of which you want to see.

Friends, push the like button, write a comment, and share with your mates - that would be the best THANK YOU.

P.S. I personally will open entry if the price will show it according to my strategy.

Always make your analysis before a trade

gbpnzd buy signal. Don't forget about stop-loss.

Write in the comments all your questions and instruments analysis of which you want to see.

Friends, push the like button, write a comment, and share with your mates - that would be the best THANK YOU.

P.S. I personally will open entry if the price will show it according to my strategy.

Always make your analysis before a trade

GBPNZD is in Selling DirectionHello Traders

In This Chart GBPNZD 4 HOURLY Forex Forecast By FOREX PLANET

today GBPNZD analysis 👆

🟢This Chart includes GBPNZD market update)

🟢What is The Next Opportunity on GBPNZD Market

🟢how to Enter to the Valid Entry With Assurance Profit

This CHART is For Trader's that Want to Improve Their Technical Analysis Skills and Their Trading By Understanding How To Analyze The Market Using Multiple Timeframes and Understanding The Bigger Picture on the Charts

"GBP/NZD: The Perfect Long Trade (Risk-Managed Heist Plan)"🏦💰 GBP/NZD BANK HEIST: The Ultimate Sterling vs. Kiwi Money Grab! 💰🏦

🌟 Hi! Hola! Ola! Bonjour! Hallo! Marhaba! 🌟

Attention all Money Makers & Market Robbers! 🤑💸✈️

Based on the 🔥Thief Trading Style🔥 (technical + fundamental analysis), here’s our master plan to loot the GBP/NZD "Sterling vs Kiwi" Forex Bank Heist!

📜 THE HEIST BLUEPRINT:

✅ Entry Strategy (Long Only!) 📈

"The heist is ON! Wait for the breakout above the previous high (2.25500) – then strike! Bullish profits await!"

Option 1: Place Buy Stop orders above the Moving Average.

Option 2: Use Buy Limit orders near recent swing lows (15-30 min timeframe) for pullback entries.

📌 Pro Tip: Set an ALERT for the breakout entry—don’t miss the robbery window!

🛑 Stop Loss (Listen Up!)

"Yo, thieves! 🗣️ If you’re entering on a Buy Stop, DO NOT set your SL until after the breakout! 🚀 Place it where I say (or wherever you dare 😈), but remember—your risk, your rules! ⚠️🔥"

📍 Thief SL Placement: Nearest swing low (1H timeframe) – 2.23700 (adjust based on risk & lot size).

🎯 Profit Target: 2.28700 (Time to escape with the loot!)

⚡ Scalpers’ Note: Only scalp LONG! Big wallets? Go all in. Small wallets? Ride the swing. Use trailing SL to protect your stolen cash! 💰

📰 WHY THIS HEIST? (Fundamental Edge)

GBP/NZD is showing bullish momentum due to:

Macroeconomic factors

COT Report insights

Sentiment shifts & intermarket trends

🔗 Full analysis? Check our bio0 for the deep dive!

⚠️ Trading Alert: News = Danger Zone! 📰🚫

Avoid new trades during high-impact news.

Use trailing stops to lock in profits & dodge volatility traps.

💥 BOOST THE HEIST!

💖 Support the robbery crew—SMASH THAT LIKE BUTTON! 💖

🚀 More heists coming soon—stay tuned, thieves! 🏆🤝🎉

gbpnzd buy signal. Don't forget about stop-loss.

Write in the comments all your questions and instruments analysis of which you want to see.

Friends, push the like button, write a comment, and share with your mates - that would be the best THANK YOU.

P.S. I personally will open entry if the price will show it according to my strategy.

Always make your analysis before a trade

GBPNZD Pushing itself in a buy directionHello Traders

In This Chart GBPNZD 4 HOURLY Forex Forecast By FOREX PLANET

today GBPNZD analysis 👆

🟢This Chart includes GBPNZD market update)

🟢What is The Next Opportunity on EURNZD Market

🟢how to Enter to the Valid Entry With Assurance Profit

This CHART is For Trader's that Want to Improve Their Technical Analysis Skills and Their Trading By Understanding How To Analyze The Market Using Multiple Timeframes and Understanding The Bigger Picture on the Charts

GBPNZD: Price came back to strong bullish reversal point!GBPNZD reversed from a point we previously pointed out in our analysis. The price moved nicely, but it didn’t continue the bullish trend as we had initially expected. Since the price has decided to retest the bullish zone one more time, we thought it would be a great zone to swing buy GBPNZD. You can set two take-profit targets based on your own analysis and bias.

This analysis is purely for educational and secondary bias purposes only and does not guarantee that the price will move as described in the chart.

We really appreciate your unwavering support! ❤️🚀

If you’d like to lend a hand, here are a few ways you can contribute:

- Give our ideas a like

- Share your thoughts in the comments

- Spread the word about our ideas

Cheers,

Team Setupsfx_

GBPNZD: 1100+ PIPs Move, Get Ready For Price To Bounce! Hey there everyone

We’re feeling optimistic about GBPNZD and expecting a bullish move that could take it to its previous yearly high. We’ve set three take profit targets, but feel free to adjust them based on your own analysis.

Good luck and trade safely! We really appreciate your unwavering support! ❤️🚀

If you’d like to lend a hand, here are a few ways you can contribute:

- Give our ideas a like

- Share your thoughts in the comments

- Spread the word about our ideas

Cheers,

Team Setupsfx_

GBPNZD – Bearish Rejection + Fundamental DivergenceGBPNZD is facing strong resistance at 2.2757, where price is showing signs of a double top / lower high formation. This zone aligns with prior rejection highs and is reinforced by bearish price action. Momentum is fading, and sellers are beginning to step in.

A break below 2.2500 confirms downside pressure, targeting:

2.2178 – Structural support

2.2002 – Demand area

2.1810 – Swing base

2.1677 – Final bearish extension zone

Fundamental Overview:

🔻 GBP Headwinds:

UK CPI came in hot recently, but forward guidance shows the Bank of England may not hike further.

Growth concerns and mixed economic signals keep GBP vulnerable, especially with weak retail data and subdued consumer confidence.

Political uncertainty and trade tensions with the EU are also weighing on sentiment.

🟢 NZD Tailwinds:

The RBNZ remains relatively hawkish, with inflation still above target and robust employment holding up.

Strong dairy prices and resilient trade balance support the NZ economy.

Risk appetite has been favorable for commodity-linked currencies like NZD.

Summary:

Bias: Bearish below 2.2757

Trigger: Break & close below 2.2500

Targets: 2.2178 → 2.2002 → 2.1810

Invalidation: Break above 2.2800

Fundamental divergence supports downside: GBP faces policy uncertainty and growth risks, while NZD holds firm on RBNZ stance and stable macro backdrop.