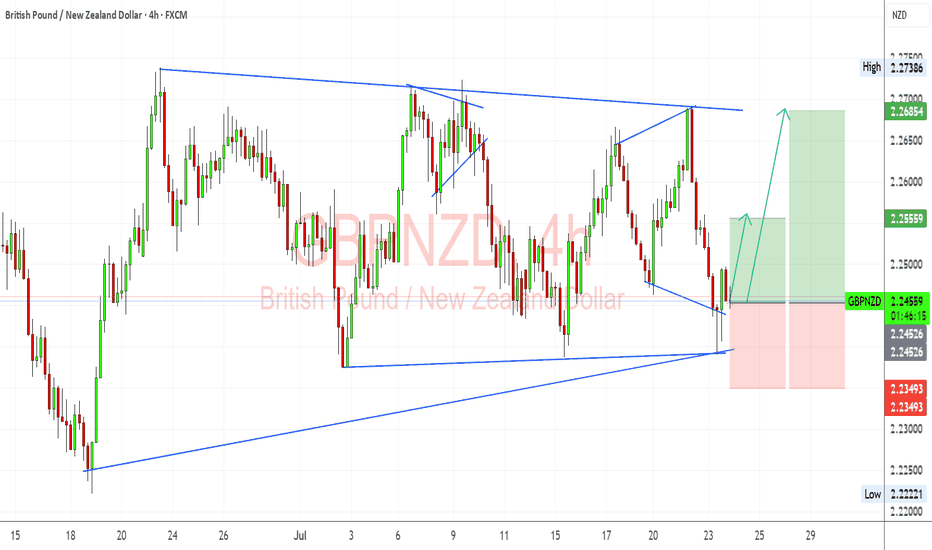

GBPNZD Analysis — 4H Chart ReviewI’m watching GBPNZD for a potential bullish continuation after a successful retest of the long-term ascending trendline. Price rejected near the lower boundary of the symmetrical triangle and showed bullish momentum right off that support. My structure suggests potential upside targets at 2.25559 (minor resistance) and 2.26854 (upper triangle boundary/major resistance zone).

🔍 Fundamental Context:

🇬🇧 GBP Fundamentals:

UK CPI came in softer than expected, and BoE rate cuts are slowly being priced in for late 2025.

However, BoE still sounds relatively hawkish compared to RBNZ due to inflation persistence in services.

Strong UK wage growth and sticky inflation give GBP some near-term yield support.

🇳🇿 NZD Fundamentals:

RBNZ remains on hold, but dovish tilt noted in recent communications.

NZD under pressure from falling dairy prices and weak global growth sentiment (especially China).

Risk-off flows and Fed hawkishness keep NZD vulnerable as a high-beta currency.

⚠️ Risks to the Setup:

A surprise hawkish turn from RBNZ or better-than-expected NZ data could boost NZD.

Renewed UK political instability or weak retail sales data may pressure GBP.

Broader market risk sentiment — NZD may strengthen if risk-on returns and US yields drop.

🗓️ Key News/Events to Monitor:

UK Retail Sales (July 25)

RBNZ Governor Orr Speech (if scheduled)

US PCE (for global risk impact)

Chinese macro data (indirect NZD driver)

🔁 Leader/Lagger Perspective:

GBPNZD often leads EURNZD during GBP-specific catalysts (BoE speeches, UK CPI).

It lags NZDUSD and NZDCAD when risk sentiment or commodity cycles dominate.

📌 Summary: Bias and Watchpoints

I'm bullish on GBPNZD in the short term, especially after a strong trendline retest and recovery off the 2.2450 zone. Fundamentals support GBP resilience over NZD due to relatively hawkish BoE stance and weaker New Zealand data. The main risk to this setup would be a dovish BoE surprise or strong NZ commodity-led rebound. I'll be watching UK Retail Sales and general risk sentiment closely. This pair can act as a leader during UK-specific news but becomes a lagger when risk flows dominate broader NZD direction.

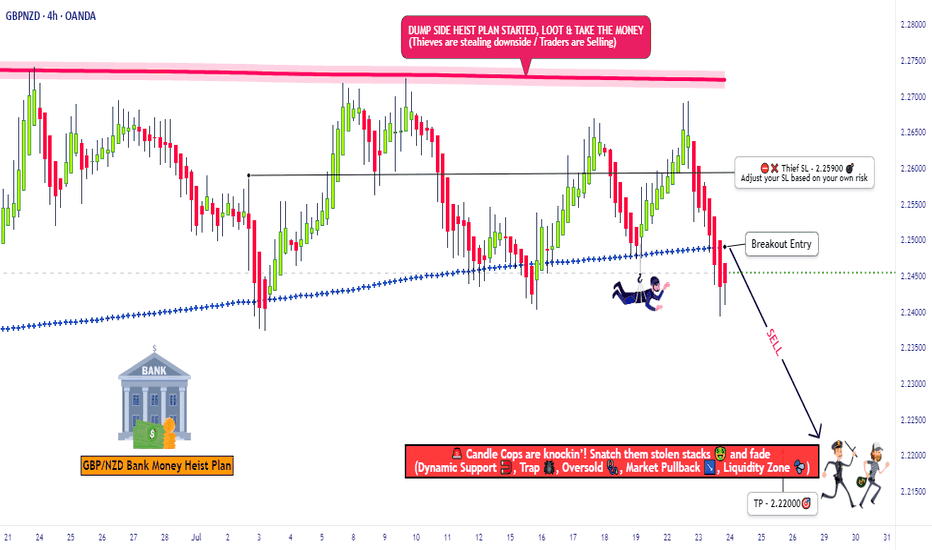

Gbpnzdshort

"GBP/NZD: Bearish Storm Brewing – Get Ready!🚨 GBP/NZD HEIST ALERT: "Pound vs Kiwi" Bearish Trap Setup! 🚨 (Scalping/Day Trade)

🌟 Attention, Market Robbers & Profit Pirates! 🌟

🔥 Thief Trading Strategy Activated – Time to short the GBP/NZD like a pro! This pair is setting up for a bearish heist, and we’re locking in entries before the drop. High-risk, high-reward? You bet.

🎯 TRADE PLAN (Bearish Ambush)

Entry Zone (Short) 📉:

Optimal: Sell limit orders on retests (15m/30m timeframe).

Thief’s Trick: Layer entries (DCA-style) near recent highs for max efficiency.

"Enter like a sniper, escape like a ghost." 👻

Stop Loss 🛑:

4H Swing High/Wick (Near 2.25900) – Adjust based on your risk & lot size.

"A smart thief always has an exit route." 🏃💨

Target 🎯: 2.22000 (or escape early if the trap snaps shut!)

💣 WHY THIS HEIST? (Bearish Triggers)

Technical Setup: Oversold bounce? Nah. Consolidation → Reversal trap.

Fundamentals: Weak GBP sentiment? Strong NZD data? Check the news!

Market Psychology: Bulls are getting trapped at resistance—time to fade them.

⚠️ THIEF’S WARNING

News = Volatility Bomb 💣 – Avoid new trades during high-impact events.

Trailing SLs = Your Best Friend – Lock profits & dodge reversals.

💎 BOOST THIS IDEA & JOIN THE HEIST!

🔥 Hit 👍 LIKE, 🚀 BOOST, and FOLLOW for more lucrative robberies!

💸 "Steal the market’s money—before it steals yours." 🏴☠️

🔔 Stay tuned—next heist coming soon! 🔔

gbpnzd buy signal. Don't forget about stop-loss.

Write in the comments all your questions and instruments analysis of which you want to see.

Friends, push the like button, write a comment, and share with your mates - that would be the best THANK YOU.

P.S. I personally will open entry if the price will show it according to my strategy.

Always make your analysis before a trade

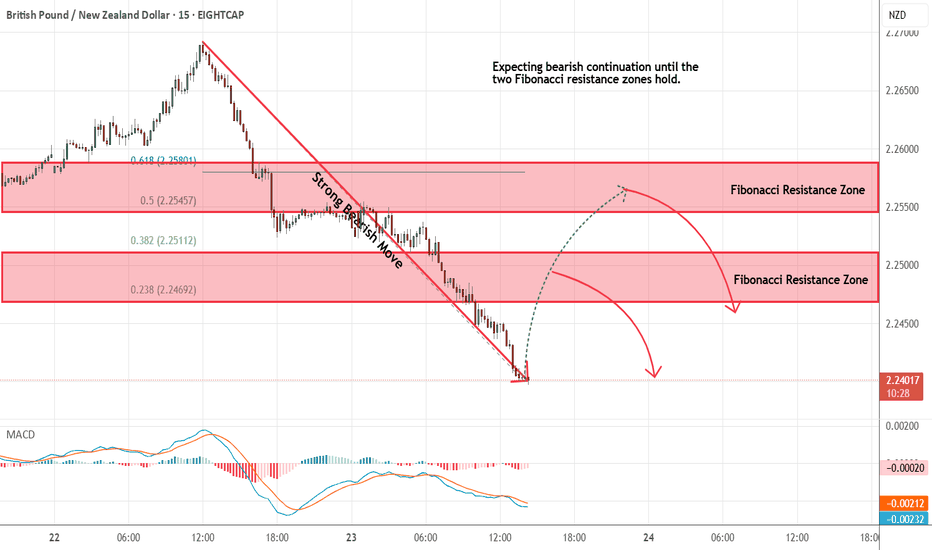

GBPNZD - Looking To Sell Pullbacks In The Short TermM15 - Strong bearish move.

No opposite signs.

Expecting bearish continuation until the two Fibonacci resistance zones hold.

If you enjoy this idea, don’t forget to LIKE 👍, FOLLOW ✅, SHARE 🙌, and COMMENT ✍! Drop your thoughts and charts below to keep the discussion going. Your support helps keep this content free and reach more people! 🚀

-----------------------------------------------------------------------------------------------------

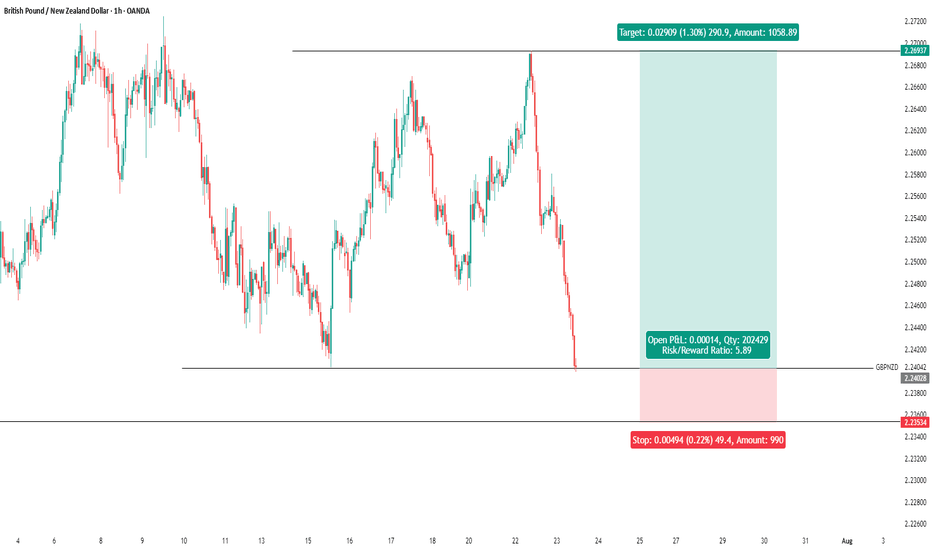

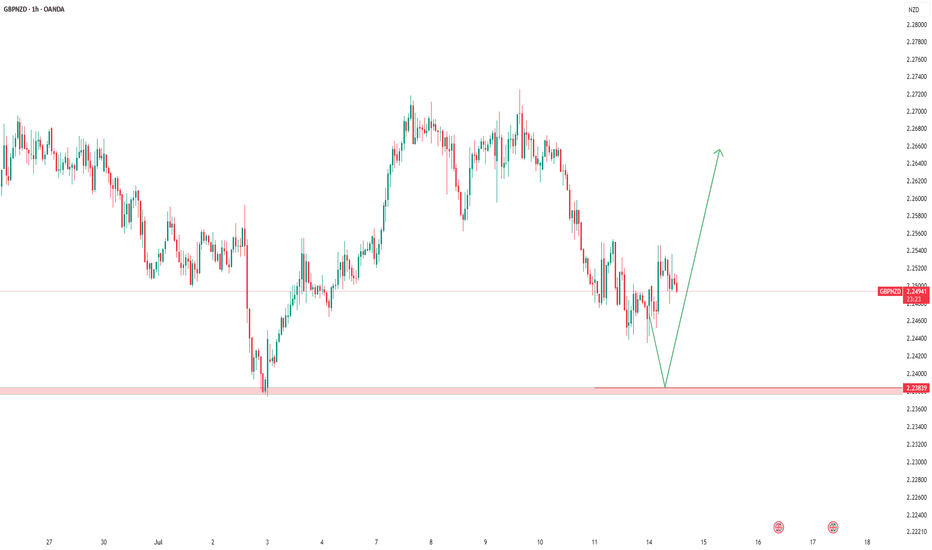

GBPNZD – Waiting for Price to Reach the ZoneWe’re currently waiting for price to reach our key level.

Once it does, and we see a valid buy signal, we’ll enter a long position.

🔄 All scenarios remain active.

Those who follow my analyses regularly already know the flow —

so no need to repeat the full breakdown.

As always, we don’t predict – we react to price.

We’re not here to guess what the market will do,

we’re here to manage our risk and trade what we see.

GBPAUD waiting for conditions to break out of the wide rangeGBPAUD found some buying momentum at the 2.085 support in today's trading session. In the long term, the pair's trading range is wide, extending from 2.102 to 2.067. A breakout of this range will form a new trend.

A BUY trading signal is confirmed when the pair breaks the resistance at 2.10200.

A SELL signal is confirmed when the pair breaks the support at 2.085.

📈 Key Levels

Support: 2.085 - 2.067

Resistance: 2.102 - 2.138

GBPNZD - Looking To Sell Pullbacks In The Short TermH1 - Strong bearish move.

No opposite signs.

Currently it looks like a pullback is happening.

Expecting bearish continuation until the two Fibonacci resistance zones hold.

If you enjoy this idea, don’t forget to LIKE 👍, FOLLOW ✅, SHARE 🙌, and COMMENT ✍! Drop your thoughts and charts below to keep the discussion going. Your support helps keep this content free and reach more people! 🚀

--------------------------------------------------------------------------------------------------------------------

gbpnzd buy signal. Don't forget about stop-loss.

Write in the comments all your questions and instruments analysis of which you want to see.

Friends, push the like button, write a comment, and share with your mates - that would be the best THANK YOU.

P.S. I personally will open entry if the price will show it according to my strategy.

Always make your analysis before a trade

gbpnzd buy signal. Don't forget about stop-loss.

Write in the comments all your questions and instruments analysis of which you want to see.

Friends, push the like button, write a comment, and share with your mates - that would be the best THANK YOU.

P.S. I personally will open entry if the price will show it according to my strategy.

Always make your analysis before a trade

gbpnzd buy signal. Don't forget about stop-loss.

Write in the comments all your questions and instruments analysis of which you want to see.

Friends, push the like button, write a comment, and share with your mates - that would be the best THANK YOU.

P.S. I personally will open entry if the price will show it according to my strategy.

Always make your analysis before a trade

GBP/NZD Giving Amazing Bearish P.A , Be Ready For Extra 250 PipsHere is my opinion on GBP/NZD , this pair is very bearish and now we have a very good breakout for second support and we have a very good closure below it so i see that we have a good chance to sell it when the price go back to retest the broken support if we have a good touch and bearish price action , we can targeting 200 pips .

gbpnzd buy signal. Don't forget about stop-loss.

Write in the comments all your questions and instruments analysis of which you want to see.

Friends, push the like button, write a comment, and share with your mates - that would be the best THANK YOU.

P.S. I personally will open entry if the price will show it according to my strategy.

Always make your analysis before a trade

GBP/NZD - Triangle Breakout (05.06.2025)The GBP/NZD Pair on the M30 timeframe presents a Potential Selling Opportunity due to a recent Formation of a Triangle Breakout Pattern. This suggests a shift in momentum towards the downside in the coming hours.

Possible Short Trade:

Entry: Consider Entering A Short Position around Trendline Of The Pattern.

Target Levels:

1st Support – 2.2345

2nd Support – 2.2285

🎁 Please hit the like button and

🎁 Leave a comment to support for My Post !

Your likes and comments are incredibly motivating and will encourage me to share more analysis with you.

Best Regards, KABHI_TA_TRADING

Thank you.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

gbpnzd buy signal. Don't forget about stop-loss.

Write in the comments all your questions and instruments analysis of which you want to see.

Friends, push the like button, write a comment, and share with your mates - that would be the best THANK YOU.

P.S. I personally will open entry if the price will show it according to my strategy.

Always make your analysis before a trade

GBPNZD – Bearish Rejection + Fundamental DivergenceGBPNZD is facing strong resistance at 2.2757, where price is showing signs of a double top / lower high formation. This zone aligns with prior rejection highs and is reinforced by bearish price action. Momentum is fading, and sellers are beginning to step in.

A break below 2.2500 confirms downside pressure, targeting:

2.2178 – Structural support

2.2002 – Demand area

2.1810 – Swing base

2.1677 – Final bearish extension zone

Fundamental Overview:

🔻 GBP Headwinds:

UK CPI came in hot recently, but forward guidance shows the Bank of England may not hike further.

Growth concerns and mixed economic signals keep GBP vulnerable, especially with weak retail data and subdued consumer confidence.

Political uncertainty and trade tensions with the EU are also weighing on sentiment.

🟢 NZD Tailwinds:

The RBNZ remains relatively hawkish, with inflation still above target and robust employment holding up.

Strong dairy prices and resilient trade balance support the NZ economy.

Risk appetite has been favorable for commodity-linked currencies like NZD.

Summary:

Bias: Bearish below 2.2757

Trigger: Break & close below 2.2500

Targets: 2.2178 → 2.2002 → 2.1810

Invalidation: Break above 2.2800

Fundamental divergence supports downside: GBP faces policy uncertainty and growth risks, while NZD holds firm on RBNZ stance and stable macro backdrop.

GBPNZD Potential Bearish Reversal After Trendline Break

Market Structure: Price recently formed a lower high and broke below an ascending trendline, signaling potential bearish momentum.

Key Resistance Levels:

2.29400 – Major structure zone, likely to act as resistance.

2.32995 – Invalidation Level – if price breaks and holds above this level, the bearish bias is no longer valid.

Trade Idea:

Watching for a pullback toward 2.29400 followed by bearish confirmation to short the pair.

Targeting downside movement toward the 2.18000–2.16000 area.

Bias: Bearish

Confirmation Needed: Rejection at resistance and bearish candlestick pattern.

---

Disclaimer: This analysis is for educational purposes only and does not constitute financial advice. Always do your own research before making any trading decisions.

GBPNZD Targets 2.18 – Watch for Breakdown from Rising ChannelGBPNZD is showing signs of topping after testing key resistance near the 2.25 zone. A rising channel has broken to the downside, followed by a bearish consolidation structure on the daily timeframe. With the BoE divided on rate cuts and the RBNZ likely holding firm amid sticky inflation, the macro landscape favors a bearish correction. Technical targets align with prior swing zones at 2.2000, 2.1840, and 2.1540.

🔍 Technical Analysis

Chart Structure:

Multiple rising wedge and channel breakdowns

Recent failed attempt to retake 2.2510 (50% fib level)

Bearish flag forming beneath broken structure

Key Resistance:

2.2510–2.2570 zone capped price multiple times

Downside Targets:

2.2000 → Previous structure + fib confluence

2.1840–2.1810 → Key support zone (Feb–March lows)

2.1540 → Major trendline/test level and historical support

📉 Bias: Bearish

📐 Trigger: Breakdown below minor support (~2.2450) confirms continuation

🌍 Fundamental Context

🇬🇧 British Pound (GBP):

BoE split on rate cuts: Some members (Taylor) pushing for action, others cautious due to sticky inflation

UK Q1 GDP beat (+0.6%), but manufacturing data weak and inflation expectations rising

Overall: GBP momentum slowing amid policy indecision and trade risks

🇳🇿 New Zealand Dollar (NZD):

RBNZ holding firm: Inflation still above target; central bank cautious

NZD stronger on risk-on mood and China stabilization

Potential upside if AUD/NZD weakens further (cross correlation)

🎯 Trade Setup

Sell Bias below 2.2450–2.2480 zone

Target 1: 2.2000 – structural support

Target 2: 2.1840 – key March low

Target 3: 2.1540 – deeper swing support

Stop Zone: Above 2.2570 – invalidates the bearish flag thesis

This trade offers a strong R:R profile if the pair breaks and sustains below 2.2450.

✅ What to Wait For Before Shorting

A strong bearish daily candle closing below 2.2450 with momentum.

OR a clean rejection wick from 2.25 with follow-through selling.

Volume increase or rejection at resistance would add conviction.

🧭 Conclusion

GBPNZD is setting up for a deeper correction after a failed bullish continuation and clean technical rejection near the 2.25 area. With macro support fading for GBP and NZD sentiment firming slightly, sellers may take control into June. A daily close below 2.2450 confirms bearish intent, with multiple downside levels open for targeting.

eurnzd buy signal. Don't forget about stop-loss.

Write in the comments all your questions and instruments analysis of which you want to see.

Friends, push the like button, write a comment, and share with your mates - that would be the best THANK YOU.

P.S. I personally will open entry if the price will show it according to my strategy.

Always make your analysis before a trade

gbpnzd buy signal. Don't forget about stop-loss.

Write in the comments all your questions and instruments analysis of which you want to see.

Friends, push the like button, write a comment, and share with your mates - that would be the best THANK YOU.

P.S. I personally will open entry if the price will show it according to my strategy.

Always make your analysis before a trade

gbpnzd buy signal. Don't forget about stop-loss.

Write in the comments all your questions and instruments analysis of which you want to see.

Friends, push the like button, write a comment, and share with your mates - that would be the best THANK YOU.

P.S. I personally will open entry if the price will show it according to my strategy.

Always make your analysis before a trade