Gbpnzdstrategy

GBP/NZD: The Great Liquidity Grab? (Long Trade Plan)"🏦💰 GBP/NZD BANK VAULT RAID: Bullish Heist in Progress! (Long Setup) 💰🏦

🚨 Overbought Trap? Or Trend Continuation? Here’s How to Loot Pips Safely! 🚨

🦸♂️ GREETINGS, MARKET MARAUDERS!

To all the Profit Pirates & Risk-Takers! 🌍💸

Using our 🔥Thief Trading Tactics🔥 (a ruthless combo of price action + liquidity grabs + macro triggers), we’re executing a bullish heist on GBP/NZD ("Sterling vs Kiwi")—this is not advice, just a strategic raid blueprint for those who trade like outlaws.

📈 THE HEIST PLAN (LONG ENTRY FOCUS)

🎯 Profit Zone: 2.28700 (or escape earlier if momentum stalls)

💥 High-Stakes Play: Overbought but squeezing higher—trap for bears.

🕵️♂️ Trap Spot: Where sellers get liquidated.

🔑 ENTRY RULES:

"The Vault’s Open!" – Swipe bullish loot on pullbacks (15-30min TF).

Buy Limit Orders near swing lows for better risk/reward.

Aggressive? Enter at market—but tighter stops.

📌 SET ALERTS! Don’t miss the breakout retest.

🛑 STOP LOSS (Escape Route):

Thief SL at recent swing low (2H timeframe).

⚠️ Warning: "Ignore this SL? Enjoy donating to the market."

🎯 TARGETS:

Main Take-Profit: 2.28700 (or trail partials).

Scalpers: Ride long waves only. Trailing SL = VIP exit pass.

📡 FUNDAMENTAL BACKUP (Why This Heist Works)

Before raiding, check:

✅ COT Data (Are funds long GBP/short NZD?)

✅ Rate Spreads (GBP vs NZD yield shifts)

✅ Commodity Correlations (Dairy prices? Risk mood?)

✅ Sentiment Extreme (Retail over-shorting?)

🚨 NEWS RISK ALERT

Avoid new trades during RBNZ/BOE speeches (unless you like volatility casinos).

Trailing stops = your bulletproof vest.

💣 BOOST THIS HEIST!

👍 Smash Like to fuel our next raid!

🔁 Share to recruit more trading bandits!

🤑 See you at the target, rebels!

⚖️ DISCLAIMER: Hypothetical scenario. Trade at your own risk.

#Forex #GBPNZD #TradingView #LiquidityGrab #TrendContinuation #ThiefTrading

💬 COMMENT: "Long already—or waiting for a deeper pullback?" 👇🔥

GBP/NZD Vault Breach?! Ready for a Clean Bullish Heist?🔓💷 GBP/NZD — The Sterling Vault Heist Plan 🐱💻💰💹

🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

To all the Money Makers, Market Magicians, and Chart Whisperers — it's time for another precision strike in the forex jungle! 🤑📊⚔️

🚨 Operation: GBP/NZD – Sterling vs Kiwi Bank Play 🚨

We're eyeing a bullish breakout based on solid thief-style technicals and stealthy fundamentals. The play: Long entry with high conviction — the vault is cracked open, now it's about how smooth the job gets executed! 🏦💸

🎯 Setup Breakdown:

🎯Entry Zone:

The loot is there for the taking! Ideal entries near recent 15min or 30min lows/swing points — look for a pullback entry to join the bullish breakout crew.

🟢 The market shows strength, momentum, and intention.

🛑Stop Loss (Thief Shield):

Placed tactically near the 2H swing low (around 2.23800).

⚖️ Adjust based on your lot sizing, trade volume, and risk appetite — the escape route is always planned.

💰Target Area (The Vault Door):

📌 Eyeing 2.28500 as the final vault exit — but feel free to grab your profits early if the heat rises. 🔥

Smart robbers know when to vanish.

🧠 Scalper's Note:

Ride only on the bullish side.

💼 Got big pockets? Enter now.

💡 Running light? Wait for the retest and team up with swing players for the score.

Use Trailing SL to guard your gold — protect what you steal!

📚 Market Intel:

This bullishness is no accident — backed by:

📰 Macros | 💹 COT Data | 📊 Sentiment | 🔎 Intermarket Analysis

The vault doesn’t open every day — this move is calculated.

⚠️Heads Up:

News volatility can trigger alarms 🚨

❌ Avoid fresh entries during major releases

✅ Use trailing SLs to manage live positions

Stay sharp. React fast. Think like a thief. 🧠

💥 If you vibe with the Thief Trading Style, smash that ❤️Boost Button❤️ and support the squad!

We move smart, strike clean, and profit consistently. This is Forex Heisting, redefined.

Stay tuned — the next master plan is loading... 🧨🔐💷📈

GBP/NZD "Sterling vs Kiwi" Forex Bank Money Heist (Bullish)🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑 💰💸✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the GBP/NZD "Sterling vs Kiwi" Forex Bank Heist. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is to escape near the high-risk ATR Line Zone. It's a Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 🏆💸"Take profit and treat yourself, traders. You deserve it!💪🏆🎉

Entry 📈 : "The heist is on! Wait for the Crossing previous high (2.25500) then make your move - Bullish profits await!"

however I advise to Place Buy stop orders above the Moving average (or) Place buy limit orders within a 15 or 30 minute timeframe most recent or swing, low or high level for Pullback entries.

📌I strongly advise you to set an "alert (Alarm)" on your chart so you can see when the breakout entry occurs.

Stop Loss 🛑: "🔊 Yo, listen up! 🗣️ If you're lookin' to get in on a buy stop order, don't even think about settin' that stop loss till after the breakout 🚀. You feel me? Now, if you're smart, you'll place that stop loss where I told you to 📍, but if you're a rebel, you can put it wherever you like 🤪 - just don't say I didn't warn you ⚠️. You're playin' with fire 🔥, and it's your risk, not mine 👊."

📍 Thief SL placed at the nearest/swing low level Using the 1H timeframe (2.24000) Day trade basis.

📍 SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

🏴☠️Target 🎯: 2.28500

🧲Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

💰💵💸GBP/NZD "Sterling vs Kiwi" Forex Bank Money Heist is currently experiencing a bullishness,., driven by several key factors. .☝☝☝

📰🗞️Get & Read the Fundamental, Macro Economics, COT Report, Quantitative Analysis, Sentimental Outlook, Intermarket Analysis, Future trend targets with overall score... go ahead to check 👉👉👉🔗🔗🔗

⚠️Trading Alert : News Releases and Position Management 📰🗞️🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

GBP/NZD "Pound vs Kiwi" Forex Bank Heist Plan (Scalping/Day)🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑💰✈️

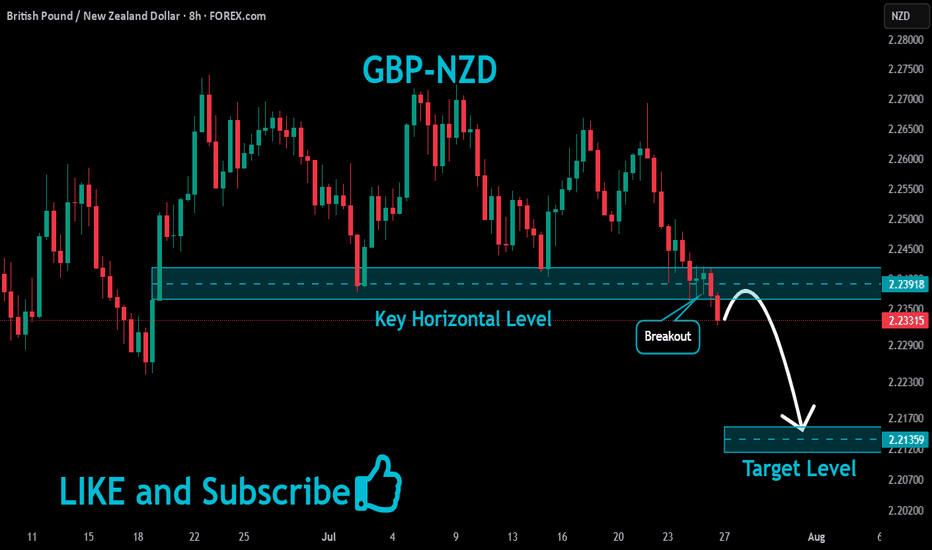

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the GBP/NZD "Pound vs Kiwi" Forex Market. Please adhere to the strategy I've outlined in the chart, which emphasizes short entry. Our aim is the high-risk Pink MA Zone. Risky level, oversold market, consolidation, trend reversal, trap at the level where traders and bullish robbers are stronger. 🏆💸"Take profit and treat yourself, traders. You deserve it!💪🏆🎉

Entry 📈 : "The heist is on! Wait for the breakout then make your move at (2.23500) - Bearish profits await!"

however I advise to Place sell stop orders below the Breakout level (or) after the breakout of Support level Place sell limit orders within a 15 or 30 minute timeframe most NEAREST (or) SWING low or high level for Pullback entries.

📌I strongly advise you to set an "alert (Alarm)" on your chart so you can see when the breakout entry occurs.

Stop Loss 🛑: "🔊 Yo, listen up! 🗣️ If you're lookin' to get in on a sell stop order, don't even think about settin' that stop loss till after the breakout 🚀. You feel me? Now, if you're smart, you'll place that stop loss where I told you to 📍, but if you're a rebel, you can put it wherever you like 🤪 - just don't say I didn't warn you ⚠️. You're playin' with fire 🔥, and it's your risk, not mine 👊."

📌Thief SL placed at the nearest/swing High or Low level Using the 4H timeframe (2.26000) Day/Scalping trade basis.

📌SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯: 2.20800

💰💵💴💸GBP/NZD "Pound vs Kiwi" Forex Market Heist Plan (Day / Scalping Trade) is currently experiencing a Bearish trend.., driven by several key factors.👇👇👇

📰🗞️Get & Read the Fundamental, Macro, COT Report, Quantitative Analysis, Sentimental Outlook, Intermarket Analysis, Future trend targets... go ahead to check 👉👉👉🔗🔗

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

GBP/NZD Sterling vs Kiwi Forex Bank Heist Plan (Swing/Day Trade)🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑💰💸✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the GBP/NZD "Sterling vs Kiwi" Forex Bank. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is the high-risk Red Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 🏆💸"Take profit and treat yourself, traders. You deserve it!💪🏆🎉

Entry 📈 : "The heist is on! Wait for the MA breakout (2.28000) then make your move - Bullish profits await!"

however I advise to Place Buy stop orders above the Resistance level (or) Place buy limit orders within a 15 or 30 minute timeframe most recent or swing, low or high level.

📌I strongly advise you to set an "alert (Alarm)" on your chart so you can see when the breakout entry occurs.

Stop Loss 🛑:

Thief SL placed at the recent/swing low level Using the 4H timeframe (2.25300) Day / swing trade basis.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

🏴☠️Target 🎯: 2.31500 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

GBP/NZD "Sterling vs Kiwi" Forex Bank Heist Plan (Day/Scalping Trade) is currently experiencing a bullishness,., driven by several key factors.

📰🗞️Get & Read the Fundamental, Macro, COT Report, Quantitative Analysis, Sentimental Outlook, Intermarket Analysis, Future trend targets.... go ahead to check 👉👉👉🔗

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

GBP/NZD "Sterling vs Kiwi" Forex Market Heist Plan on Bearish🌟Hi! Hola! Ola! Bonjour! Hallo!🌟

Dear Money Makers & Robbers, 🤑 💰

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the GBP/NZD "Sterling vs Kiwi" Forex market. Please adhere to the strategy I've outlined in the chart, which emphasizes short entry. Our aim is the high-risk Green Zone. Risky level, oversold market, consolidation, trend reversal, trap at the level where traders and bullish robbers are stronger. 👀 Be wealthy and safe trade.💪🏆🎉

Entry 📉 : Traders & Thieves with New Entry a Bear trade can be initiated on the MA level breakout of 2.15654.

however I advise placing sell limit orders within a 15 or 30 minute timeframe. Entry from the most recent or closest high level should be in retest.

Stop Loss 🛑: Using the 4h period, the recent / nearest high level.

Goal 🎯: 2.11200 (OR) Before escape in the bank

Scalpers, take note : only scalp on the Short side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

Fundamental Outlook 📰🗞️

The GBP/NZD (British Pound vs New Zealand Dollar) market is expected to move in a bearish direction, driven by several key factors.

BEARISH FACTORS:

UK Economic Uncertainty: The ongoing UK economic uncertainty, including the Brexit negotiations and the COVID-19 pandemic, is expected to weaken the British Pound.

New Zealand Economy: The New Zealand economy is expected to grow at a faster pace than the UK economy, with a forecast of 2.5% GDP growth for the next quarter, which could strengthen the New Zealand Dollar.

Monetary Policy: The Reserve Bank of New Zealand is expected to keep interest rates low, but the Bank of England is expected to cut interest rates, which could weaken the British Pound.

Commodity Prices: The price of commodities such as dairy products and meat is expected to increase, which could strengthen the New Zealand Dollar.

UPCOMING FUNDAMENTAL ANALYSIS:

UK GDP Growth: The upcoming UK GDP growth report is expected to show a slowdown in economic growth, which could weaken the British Pound.

New Zealand GDP Growth: The upcoming New Zealand GDP growth report is expected to show a strong economic growth, which could strengthen the New Zealand Dollar.

UK Inflation Rate: The upcoming UK inflation rate report is expected to show a low inflation rate, which could weaken the British Pound.

New Zealand Inflation Rate: The upcoming New Zealand inflation rate report is expected to show a higher inflation rate, which could strengthen the New Zealand Dollar.

MARKET SENTIMENT:

Bearish Sentiment: 60%

Bullish Sentiment: 30%

Neutral Sentiment: 10%

Trading Alert⚠️ : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

Please note that this is a general analysis and not personalized investment advice. It's essential to consider your own risk tolerance and market analysis before making any investment decisions.

Keep in mind that these factors can change rapidly, and it's essential to stay up-to-date with market developments and adjust your analysis accordingly.

💖Supporting our robbery plan will enable us to effortlessly make and steal money 💰💵 Tell your friends, Colleagues and family to follow, like, and share. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🫂

#GBPNZD 4HGBPNZD (British Pound / New Zealand Dollar)

Timeframe: 4-Hour (4H)

Pattern: Expanding Pattern

An expanding pattern, also known as a broadening formation, has been identified on the 4-hour chart of the GBPNZD pair. This formation signals increasing volatility and market indecision, often leading to a strong breakout in either direction after completion.

In this case, the pattern appears to be forming higher highs and lower lows, indicating widening price movements.

Forecast: Buy

The current analysis suggests a potential buying opportunity within the pattern. The pair may continue moving upwards from the lower bound of the pattern, likely targeting the upper resistance area formed by the expanding structure.

Technical Outlook:

Support Zone: The lower boundary of the expanding formation, acting as a dynamic support.

Resistance Zone: The upper boundary of the pattern, serving as dynamic resistance.

*Key Levels to Watch: The breakout or bounce near these key zones.

A break above the upper boundary would confirm a bullish continuation, with momentum favoring more upside potential.

Make sure to watch for confirmation signals like volume increase or momentum indicators to validate the entry.

GBPNZD Technical Analysis anda Trade Idea The GBPNZD has experienced a strong rally on the back of RBNZ data release being fairly dovish today. This has resulted in NZD to weaken somewhat offering a potential buy opportunity. This rally has overextended and I'm looking for an entry point on a pullback down into the 61.8% Fibonacci retracement level. In the video we talk about the trend market structure, price action and I attempt to simplify some ideas to help people who are new to trading understand how the markets work. This analysis is for educational purposes only and not to be construed as financial advice.

7 Dimension Analysis For GBPNZD Yearly: The market is entrenched in a multi-year downtrend. Despite yearly structure breakouts, rejections from the CIP level have been consistent, indicating strong resistance. The failure to breach upper yearly resistance suggests substantial selling pressure. A post-breakout bearish buildup implies a high likelihood of further downside in the coming years.

Monthly: A shift from a bullish to a bearish character is evident. Strong resistance rejections, particularly marked by a classic doji in August 2023 within a blue-box-highlighted area, indicate significant downward potential. The momentum flow in August 2023 adds conviction to the bearish scenario.

Weekly: While the weekly chart shows some sideways movement, the current positioning lacks clarity. Further examination is required for a comprehensive view of the market dynamics.

😇7 Dimension Analysis

Time Frame: Daily

Swing Structure: Bearish

Structure Behavior: Choch 50%

Swing Move: Impulsive

Inducement: Done; high is confirmed

Pull Back: 1

Internal Structure: Bearish

Ext OB: Unmitigated

Resistance: Found at the FVG area, with demand formed and three proper IFC rejections.

Time Frame Confluence: Daily

Pattern

Chart Patterns: A rounding triple top within a green rectangle indicates a bearish breakout, signaling the end of the corrective move.

Candle Patterns: Inside, with a Harami on Friday close.

Volume

Fixed range volume indicates a strong seller presence.

Significant bearish volume is observed at the green rectangle.

During the cycle, only one bearish candle had a significant impact on price.

Momentum RSI

Zone: Sideways

Range shift: Not clear but oscillating between sideways to bearish.

Divergence: A hidden bullish divergence suggests the potential for short-term bullish momentum.

Overbought sold rejections count: 1, with a bullish divergence.

Volatility Bollinger Bands

The middle band is below, indicating a bearish trend.

Expansion suggests a short-term sideways zone.

Just finished a walking on the band.

Strength According to ROC

Values: -0.37 GBP vs. 3.5 NZD, indicating NZD's strength.

Sentiment

High selling sentiment according to all the studies.

✔️Entry Time Frame: H1

✅Entry TF Structure: Bearish

☑️Current Move: Impulsive is starting.

✔Support Resistance Base: Extreme supply area.

☑️Candles Behavior: Rally-based drop, Momentum.

☑️Trend Line Marked: Waiting for breakout.

💡Decision: Ready for sell

🚀Entry: 2.046

✋Stop Loss: 2.0602

🎯Take Profit: 1.9750

2nd If Internal Structure change also Exit 3rd trendline breakout, Fomo

😊Risk to Reward Ratio: 1:5

🕛Expected Duration: 15 days

SUMMARY:

The analysis reveals a strongly bearish sentiment in the market. The yearly and monthly perspectives provide a broader context, while the daily analysis points to an imminent impulsive move. The entry strategy aligns with the overall bearish outlook, with a clear risk-to-reward ratio and an expected duration of 15 days.

GBPNZD, ripe to short to the next significant levelThe GBPNZD was rejected by the upper trendline of the ascending channel on 21st August, 2023.

made a pull back to the 2.13930 support. Price is currently being resisted by the EMA-50 on the 4HR time frame. A break below the EMA-50 could push the price down to ultimately re-test the EMA-200 support at 2.10941.

On the other hand, the fibo retracement could pull price above to 2.14605 resistance entry where the price can have a significant short.

GBPNZD-4HR INCOMING STRONG SELL Hey Everyone, We had a long bullish impulse on FX:GBPNZD , price broke out and sellers now have control. Looking at 4HR market structure, price is looking to drop significantly to fill up the gap that price have left behind.

Let's not miss out on a great opportunity, thank you for your support :)

I see buys on GbpnzdWe had price break a major level making a new high. With the new high made this is called our indication. Which means that with the right momentum we can expect price to come back to that high after a correction. Due to price being on a uptrend which means no lows have been broken we can anticipate that price is bullish.

GBPNZD POTENTIAL LONG FORMATION IN PROGRESS (BULLISH CHANNEL)When we look at the pair there are more bullish signs and bearish signs hence we are only looking for buying opportunities.

We have listed the reasons for our bullish basis below:

1: Higher times frames show a strong bullish trend.

2: Lower bullish channel test and potential bounce.

3: Up-trendline test and bounce.

4: Pair us making new highs which signal a bullish trend.

Nothing in the markets is ever perfect and this includes pattern formations. It's not every often we see textbook-style patterns. As long as risk is managed, if we happen to get stopped, we move to the next trading setup.

GBPNZD SELLHello trader last analysis for the Day so let’s Set Our Eyes on GBPNZD We are Currently taking A sell based on we are Currently on a Support and Resistance Level price failed to break our Resistance zone and also we end up having A trend line breakout and a Successfully retest back to trend, so to keep everything as Educationally as possible When trading technically we understand that use of S&R support and Resistance failed to break Our R zone We expect price to fall back to our support. We Sell immediately the market open, remember proper risk management. Drop your comments on What you think about this trade thank you.

The pound rebounded as scheduled, can the bulls recover?On Wednesday (March 15), GBP/USD continued to fall by 0.85% to close at USD1.2056.The UBS incident has caused the market to worry about the state of the European banking system, because the impact of the collapse of Silicon Valley Bank, which is a major customer of technology companies in the United States, is accelerating.Credit Suisse's share price plunged by more than 30% at one point, after its largest investor said it could not provide the bank with more financial assistance.The stock's plunge led to a decline in the broader European banking stock index, triggering demand for safe-haven dollars and forcing investors to avoid high-risk currencies such as the British pound.However, the market believes that the eurozone market may be hit first, while the British market is slightly protected, so at this stage, the performance of the pound is slightly stronger than that of the euro.Subsequently, British Chancellor of the Exchequer Hunt announced a fiscal plan. Fiscal measures for this year and next two years will cost 94 billion pounds, demonstrating the British government's determination to boost economic growth and avoid recession.This has helped limit the decline of the pound to a certain extent.

On the trend of GBP/USD, it was mentioned in the article yesterday that if the 1.201 position can be supported, it is possible to carry out a short-cycle restorative rebound on this basis.It is currently trading near the level of 1.211.From this point of view, there is still strong support near the 1.201 level below, but the current trend is still volatile and the trend is not clear.The overall volatility range is still limited to between 1.1930-1.22.

In order to facilitate everyone to continue to follow up on my analysis and sharing, you can like and follow me; in addition, I will share the daily real-time strategy in the channel. If you can't follow up in real time, you may make operational errors.You can use the following methods to enter my channel for free to follow the latest news and follow up on market trends in real time.

GBP/USD:The pound was blocked, and the bears reacted strongly?The latest data from the United Kingdom show that the number of people employed in the British labor market has increased by 65,000, higher than the expected 52,000, and the unemployment rate remains at 3.7%.But the pace of wage growth has slowed, which is good news for the Bank of England.Because the central bank is seeking to control inflation, this is another factor to be considered at next week's interest rate meeting.On a global scale, the market turmoil after the collapse of Silicon Valley Bank has led to huge changes in the market's pricing of the central bank's interest rate outlook in the past few trading days.According to CME's Fedwatch tool, there is now a 25% chance that the Fed will keep interest rates unchanged at its next meeting.Even the market has begun to digest the expectation that the Fed will turn to interest rate cuts at the end of the year.Under this situation, the pressure on the Bank of England to raise interest rates may be eased, which will be of great help to resolve the British government's debt.In terms of interest spreads, the British pound will not be pulled too wide by other currencies.As a result, the pound may be able to gain some support from it.

Due to the rebound of the British pound for four consecutive trading days, it has left the original downward trend channel. However, over time, the market fear caused by the US banking crisis has gradually eased. Today, the dollar index stopped falling and rebounded sharply, suppressing the rise of the British pound and driving the British pound to begin to adjust the market. At present, the British pound has the intention of returning to the downward trend channel.However, if the 1.201 position can be supported, it is possible to carry out a short-term restorative rebound on this basis.

In order to facilitate everyone to continue to follow up on my analysis and sharing, you can like and follow me.