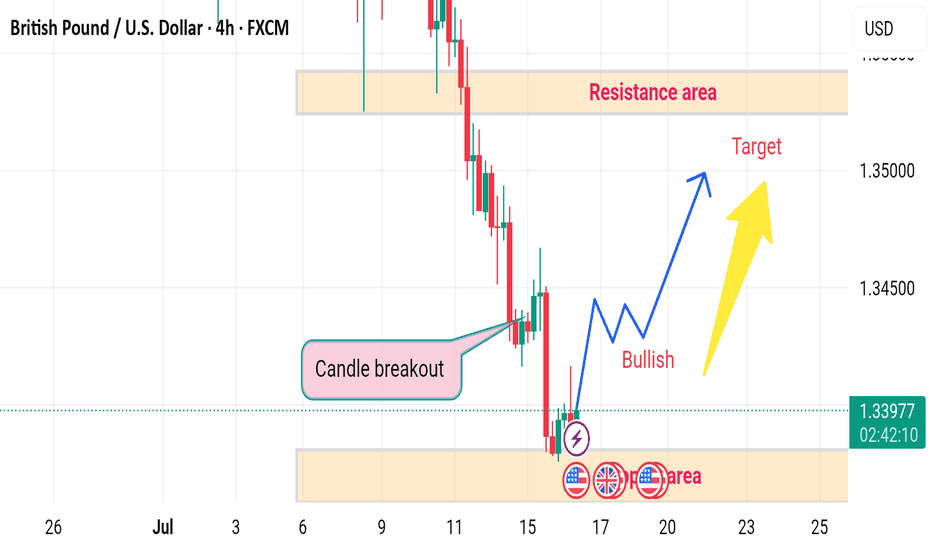

GBPUSD H4 RISESDisruption Analysis – GBP/USD (4H)

🕯️ Candle Breakout Misleading

The marked “Candle Breakout” area is followed by weak bullish momentum, but lacks strong volume confirmation or higher timeframe reversal structure.

The quick rejection after the breakout may indicate a false breakout, not a sustainable trend reversal.

⚠️ Demand Zone Weakness

The “Support Area” (demand zone) has already been tested multiple times.

Multiple touches weaken the demand zone—buyers may be exhausted, increasing the chances of a breakdown instead of a bounce.

📉 Macro Trend Still Bearish

The recent sharp downtrend shows a strong bearish structure (lower highs, lower lows).

A few bullish candles are not enough to confirm a reversal—this could just be a retracement.

💣 Upcoming Fundamental Risks

The presence of multiple economic event icons (UK & US flags) indicates high-impact news—could result in unexpected volatility or trend reversals.

Fundamental factors may disrupt the projected bullish move entirely.

🎯 Bullish Target Overoptimistic

Target near 1.35000 lies within the Resistance Area, which has previously caused sharp rejections.

Without a strong breakout above 1.3400, this target is unrealistic in current market conditions.

GBPTRY

GBP/JPY Rejection from Resistance Zone GBP/JPY Rejection from Resistance Zone 🧱📌 | Bearish Setup In Play 🔻💹

📌 Technical Analysis Overview:

The chart illustrates a clear rejection from the resistance zone around 198.460, where previous price action formed a double-top pattern (🔴 red arrow). This suggests a strong supply area with selling pressure building.

🔍 Key Observations:

📏 Trendline Break:

The upward trendline (blue) has been decisively broken.

This break signals a loss of bullish momentum.

🧱 Resistance Zone @ 198.000–198.460:

Price tested this zone multiple times but failed to break above.

Acts now as a strong resistance zone.

🟠 Support Turned Resistance:

Former support has now turned into resistance (highlighted in blue text: "SUPPOT").

📉 Bearish Projection:

The projected path indicates a possible retest of the resistance zone before a sell-off continuation.

Target area: around 194.500, marked as “TAEGET FAXS” (typo: should be “TARGET ZONE”).

🔄 Possible Scenarios:

✅ Bearish Continuation:

If price rejects again near 198.000, expect a bearish move toward 194.500.

⚠️ Invalidation:

A strong breakout above 198.460 would invalidate the bearish thesis and may resume bullish momentum.

🔚 Conclusion:

The pair is currently under pressure with a confirmed break in trend structure. As long as price remains below 198.460, the bias remains bearish with a target toward the 194.500 zone. 📉👀

GBP/USD Bearish Reversal Pattern Detected GBP/USD Bearish Reversal Pattern Detected 🔻🦈

The chart illustrates a potential bearish Gartley pattern formation near the 1.3736 resistance zone, which has historically triggered price rejections (red arrows).

🔍 Key Observations:

📌 Price action completed a bearish harmonic pattern, suggesting a reversal setup.

💡 Multiple rejections at the upper resistance zone (1.3730–1.3780) highlight strong selling pressure.

📉 Break of trendline support confirms shift in structure.

🟠 Historical support zones (orange circles) now align with the projected target level: 1.3512.

🔽 A clean breakdown below 1.3650 could accelerate bearish momentum toward the target.

🎯 Target: 1.35124

🛑 Resistance: 1.3730–1.3780

✅ Support: 1.3510–1.3550 zone

GBPUSD GBPUSD Analysis & Signal (1H Timeframe)

📅 Date: March 23, 2025

On the GBP/USD chart, the price has reached a key resistance zone around 1.29629 after an uptrend, showing signs of rejection. This resistance aligns with a descending trendline, adding to the selling pressure.

Currently, the price is heading toward the demand zone marked between 1.28613 and 1.28117, which could act as a strong support level.

Signal:

Sell:

📍Entry Point: 1.29114 (current price)

🔴Stop Loss: 1.29629 (above resistance)

🟢Take Profit 1: 1.28613

🟢Take Profit 2: 1.28117

⚠️Risk Management:

With the stop loss set above the resistance, the risk-to-reward ratio (R:R) for this trade is at least 1:2. It’s recommended to risk only 1-2% of your capital on this trade.

📝Note: Before entering the trade, wait for additional confirmations (e.g., reversal candlestick patterns or a break of the zone) and assess market conditions.

GBPUSD BUY 📊 Technical Analysis & Entry Signal 💹

🔍 The chart shows a strong uptrend where the price has broken a key resistance level and is now pulling back to retest it. As highlighted in the analysis, it's crucial to wait for a complete pullback and confirmation before entering a trade.

📈 Entry Signal:

✅ Entry: After pullback confirmation around 1.27570

🎯 Targets:

First Target: 1.27952

Second Target: 1.28269

Third Target: 1.28645

🛑 Stop Loss: 1.27414 (Risk management is essential)

📝 Important Note: Always manage your risk and avoid entering without confirmation. 📉

GBP/USD Holds Below 1.2650, Signals Potential UptrendGBP/USD maintains its position below the lower boundary of the ascending regression channel, with the Relative Strength Index (RSI) exhibiting a sideways movement above the 50 level, indicating a potential uptrend in the near future.

The level at 1.2780 (static level) is considered a temporary resistance before 1.2830 (the endpoint of the latest uptrend, highest point on December 28) and 1.2860 (midpoint of the ascending channel).

On the flip side, support levels are situated at 1.2750 (lower limit of the ascending channel), 1.2710-1.2700 (Simple Moving Average 100 periods (SMA), static level), and 1.2670 (SMA 200 periods).

The GBP/USD pair's dynamics suggest a cautious optimism, with attention focused on how the currency pair navigates the mentioned resistance and support levels. Traders will be monitoring the RSI for potential confirmation of the anticipated uptrend, while being mindful of key technical levels for potential shifts in market sentiment.

GBP/USD Rises to 1.2800 on Weakness in the US DollarGBP/USD has rebounded and climbed above the 1.2750 level after dipping to 1.2700 earlier in the day. The US Dollar struggled to find demand in the US trading session as the latest data showed a slight slowdown in the year-on-year PPI in December. GBP/USD remains above the lower limit of the ascending regression channel, with the Relative Strength Index (RSI) moving flat above 50, indicating a potential upward trend.

The level at 1.2780 (static level) is considered a temporary resistance before 1.2830 (end point of the latest upward trend, highest level on December 28) and 1.2860 (midpoint of the ascending channel).

On the flip side, support levels are at 1.2750 (lower limit of the ascending channel), 1.2710-1.2700 (Simple Moving Average 100 periods, static level), and 1.2670 (Simple Moving Average 200 periods).

Dollar Rebounds as Traders Reconsider Fed Rate Cut ExpectationsGBP/USD - The British pound weakened significantly against the greenback, dropping to 1.2625 from its previous level of 1.2735. Immediate support is anticipated at 1.2600 for the pound, followed by 1.2570 and 1.2540. Immediate resistance sits at 1.2660 (overnight high), 1.2700, and 1.2740. Expect increased volatility in Sterling within the range of 1.2600-1.2700. Trading expected within this range for the day.

"GBP/USD Forecasted to Reach 1.3500 in 2024"In a recent note, the global FX head at Goldman Sachs has indicated that GBP/USD is poised to extend its upward momentum to reach 1.3500 in the coming year. Citing correlations with stocks and alleviated concerns about global recession, GBP exhibits a "positive and reliable relationship with higher stock prices."

The recent strength of the British pound is attributed, in part, to the broad weakening of the U.S. dollar. However, since early November, the pound has also demonstrated strength based on trade-weighted fundamentals, performing exceptionally well in a moderately volatile interest rate environment and amid rising stock prices. The outlook since November has been promising, and expectations are for further gains in the upcoming year. This is why Goldman Sachs believes that the British pound has considerable room for appreciation as the market embraces the 'soft landing' perspective.

Upcoming elections are likely to encourage additional fiscal support while easing trade tensions with the EU. Both factors are expected to contribute to domestic growth, mitigating the risk of a recession and bolstering the British pound.

As we anticipate the unfolding of 2024, the projections for GBP/USD remain optimistic, driven by a combination of global economic dynamics, domestic factors, and a supportive political landscape. Investors and traders alike will be closely watching these developments as they navigate the foreign exchange market in the coming year.

"GBP/USD Forecasted to Rise to 1.3500 in 2024"In a recent update, the global FX head at Goldman Sachs has predicted that GBP/USD is poised to extend its upward momentum to reach 1.3500 next year. Citing correlations with stocks and easing concerns about global recession, Goldman Sachs notes that GBP has a "reliable positive relationship with higher stock prices."

The recent surge in the British pound is partly attributed to the broad weakness of the US dollar. Since early November, the pound has also strengthened based on trade-weighted grounds, showcasing resilience in an environment of moderate interest rate volatility and rising stock prices. Goldman Sachs anticipates more of the same in the coming year, asserting that the British pound has ample room for appreciation as the market embraces the notion of a "soft landing."

The upcoming elections are likely to both encourage additional fiscal support and alleviate some trade conflicts with the EU. Both outcomes are expected to bolster domestic growth, mitigate the risk of recession, and further support the British pound.

As we approach 2024, the forecast for GBP/USD looks optimistic, driven by a combination of global economic factors and domestic political developments. Investors will be keenly observing the unfolding dynamics in the currency markets as the British pound aims for new heights against the US dollar.

GBP/USD Resilient Above 1.2800 Amidst Dollar WeaknessGBP/USD saw a slight uptick above 1.2800 in early European trading on Thursday, supported by the prolonged weakness of the US Dollar due to bets on the Fed's dovish stance. US unemployment benefit claims data was released in a relatively quiet market. The currency pair, currently trading just above 1.2700, may find technical buyer interest if it confirms this level as support. In such a case, 1.2750 and 1.2790-1.2800 serve as potential resistance levels. Failure to hold above 1.2700 could prompt support at 1.2660 (50-period SMA), 1.2630 (100-period SMA), and 1.2600 (23.6% Fibonacci retracement). GBP/USD, influenced by broad USD selling pressure on Thursday, sought to recover losses, maintaining stability around 1.2700 as the market assessed the latest UK data on Friday.

Expectations and Analysis of GBP/USDForecasting GBP/USD, the British Pound against the US Dollar, based on performance on the daily chart below, indicates that it is still moving within an upward channel. Recent developments have been a response to signals from global central banks in their final meetings of 2023. However, the economic weakness in the UK continues to hinder a strong upward move of the British Pound against other currencies. Technically, the bullish side still needs to break through successive resistance levels at 1.2785 and 1.2850. To confirm control and ultimately advance towards the next psychological resistance level at 1.3000. On the other hand, returning to the support level at 1.2580 during the same timeframe will be crucial for the bearish side to gain control of the trend. Limited movements are expected today given the market conditions and the holiday season. Throughout this week, restricted movements are anticipated as investors are reluctant to exit the market during the holiday season, affecting liquidity.

GBP/USD Dips, Awaits UK CPI DataGBP/USD faced consecutive losses, trading around 1.2160 in Asian markets on Wednesday. Positive US economic data applied pressure. The pair retreated after reaching 1.2200, the 23.6% Fibonacci retracement level, the 50 and 100-day Simple Moving Averages (SMAs) confirming significant resistance. The 4-hour chart's Relative Strength Index (RSI) dropped to 40, indicating accumulating bearish momentum.

Immediate support lies at 1.2130 (static level). Closing below it in the 4-hour timeframe could bring further selling pressure, possibly testing temporary support at 1,2100 (static, psychological level) before targeting 1,2050, the recent downtrend's endpoint.

If GBP/USD rises above 1,2200 and confirms it as support, it could aim higher towards 1,2250 (static) and 1,2300 (38.2% Fibonacci retracement level). The pair reversed its trend after breaching 1,2200 on Monday, dropping to the 1.2150 region on Tuesday. Short-term technical outlook indicates bearish momentum and potential additional losses if the 1,2130 support fails.

US Retail Sales data for September is on the economic horizon, with a negative surprise possibly impacting the USD. However, GBP/USD might stand firm unless a significant, positive market sentiment change occurs. Stay tuned for updates on this evolving situation.

GBPTRY LongTechnical Analysis

Trend Bullish

Weekly Long

Daily Long

10H Long

4H Long

2 H Long

30min. LONG

Gold Bullish

Strategy Bullish

My Trading Conditions and my Rules(This are the Rules I follow,and they are no financial adivice for others)

Trade Consditions Higher Highs Higher Lows

Trade Rules: Taking only Buy Signals

Trade Rule 2: Only Buy Signals

Trade Rule 3: Exit only, if a Pullback my Stops hit.

Japanese Shares Rise as US Inflation Eases

The Nikkei 225 Index jumped 0.8% to above 32,200 while the broader Topix Index gained 0.3% to 2,228 on Thursday, rising from one-month lows and tracking a rally on Wall Street overnight as cooler-than-expected US inflation data raised hopes that the Federal Reserve is closer to the end of its tightening cycle. Investors also bought back technology stocks following days of consolidation, with notable gains from SoftBank Group (1.9%), Advantest (1.4%), Socionext (2.8%), Tokyo Electron (0.6%), Z Holdings (2.8%) and Renesas Electronics (2.5%). Other index heavyweights also advanced, including Sony Group (4.5%), Fast Retailing (1%), Daiichi Sankyo (4.5%), Mitsui & Co (1%) and Eisai Co (1.6%).

Australia Inflation Expectations Stable inJuly

NZX Trades Slightly Higher

New Zealand Factory Activity Shrinks to 7-Month Low

Argentina Indicators

Industrial Production 1.1 1.8 percent May/23

Industrial Production Mom 1.2 3.2 percent Apr/23

Capacity Utilization 68.9 67.3 percent Apr/23

Changes in Inventories -20633 20148 ARS Million Mar/23

Car Production 53282 54399 Units May/23

Car Registrations 38.6 33.8 Thousand May/23

Leading Economic Index -0.48 -0.28 percent May/23

Corruption Index 38 38 Points Dec/22

Corruption Rank 94 96 Dec/22

The Turkish lira extended losses to new all-time lows of 26.2 per USD, amid increasing signs of a shift to a more orthodox approach and as the central bank reportedly stopped using its reserves to support the currency. On June 22nd, the central bank of Turkey raised interest rates by 650 bps to 15%, marking a reversal from its previous ultra-loose and unorthodox monetary policy although the move fell short of meeting market expectations for a higher rate of 21%. Few days later, policymakers loosened measures designed to boost the lira, including lowering the securities maintenance ratio to 5% from 10% and the threshold for the share of lira deposits to 57% from 60%.

GBPTRY LongTechnical Analysis

Trend Bullish

Weekly Long

Daily Long

10H Long

4H Long

2 H Long

30min. LONG

Gold Bullish

Strategy Bullish

My Trading Conditions and my Rules(This are the Rules I follow,and they are no financial adivice for others)

Trade Consditions Higher Highs Higher Lows

Trade Rules: Taking only Buy Signals

Trade Rule 2: Only Buy Signals

Trade Rule 3: Exit only, if a Pullback my Stops hit.

Japanese Shares Rise as US Inflation Eases

The Nikkei 225 Index jumped 0.8% to above 32,200 while the broader Topix Index gained 0.3% to 2,228 on Thursday, rising from one-month lows and tracking a rally on Wall Street overnight as cooler-than-expected US inflation data raised hopes that the Federal Reserve is closer to the end of its tightening cycle. Investors also bought back technology stocks following days of consolidation, with notable gains from SoftBank Group (1.9%), Advantest (1.4%), Socionext (2.8%), Tokyo Electron (0.6%), Z Holdings (2.8%) and Renesas Electronics (2.5%). Other index heavyweights also advanced, including Sony Group (4.5%), Fast Retailing (1%), Daiichi Sankyo (4.5%), Mitsui & Co (1%) and Eisai Co (1.6%).

Australia Inflation Expectations Stable inJuly

NZX Trades Slightly Higher

New Zealand Factory Activity Shrinks to 7-Month Low

Argentina Indicators

Industrial Production 1.1 1.8 percent May/23

Industrial Production Mom 1.2 3.2 percent Apr/23

Capacity Utilization 68.9 67.3 percent Apr/23

Changes in Inventories -20633 20148 ARS Million Mar/23

Car Production 53282 54399 Units May/23

Car Registrations 38.6 33.8 Thousand May/23

Leading Economic Index -0.48 -0.28 percent May/23

Corruption Index 38 38 Points Dec/22

Corruption Rank 94 96 Dec/22

The Turkish lira extended losses to new all-time lows of 26.2 per USD, amid increasing signs of a shift to a more orthodox approach and as the central bank reportedly stopped using its reserves to support the currency. On June 22nd, the central bank of Turkey raised interest rates by 650 bps to 15%, marking a reversal from its previous ultra-loose and unorthodox monetary policy although the move fell short of meeting market expectations for a higher rate of 21%. Few days later, policymakers loosened measures designed to boost the lira, including lowering the securities maintenance ratio to 5% from 10% and the threshold for the share of lira deposits to 57% from 60%.

GBPTRY BULLISH Rises further after Turkish inflation dataTurkish lira fell to new marginally lower record low in early Wednesday, as Turkish June inflation data sparked fresh weakness of the currency.

Monthly inflation rose by 3.9% in June, below 4.8% consensus and annualized figure was also below expectations (38.2% in June vs 39.4% f/c), while consumer prices were slightly below previous month’s figure (June PPI 40.4% vs May 40.7%).

Inflation remains elevated, though significantly below last October’s 85.5%, the highest in over two decades.

Turkish lira fell sharply in June (down over 20% vs US dollar, the biggest monthly fall on a record), following re-election of President Erdogan and despite CBRT’s new leadership and turn towards more orthodox approach to monetary policy, as the central bank already raised interest rates after a cycle of cutting rates last year.

Trend Bullish

Pound to Lira forecast by day.

Date Weekday Min Max Rate

10/07 Monday 33.19 34.21 33.70

11/07 Tuesday 33.31 34.33 33.82

12/07 Wednesday 33.38 34.40 33.89

13/07 Thursday 33.51 34.53 34.02

14/07 Friday 33.29 34.31 33.80

17/07 Monday 33.55 34.57 34.06

18/07 Tuesday 33.51 34.53 34.02

19/07 Wednesday 33.22 34.24 33.73

20/07 Thursday 33.30 34.32 33.81

21/07 Friday 34.30 35.34 34.82

24/07 Monday 34.72 35.78 35.25

25/07 Tuesday 35.77 36.85 36.31

26/07 Wednesday 35.74 36.82 36.28

27/07 Thursday 35.59 36.67 36.13

28/07 Friday 35.50 36.58 36.04

31/07 Monday 35.54 36.62 36.08

01/08 Tuesday 35.98 37.08 36.53

02/08 Wednesday 36.08 37.18 36.63

03/08 Thursday 36.32 37.42 36.87

04/08 Friday 36.57 37.69 37.13

07/08 Monday 36.44 37.54 36.99

08/08 Tuesday 37.10 38.24 37.67

09/08 Wednesday 38.22 39.38 38.80

10/08 Thursday 39.09 40.29 39.69

GBPTRY LongStrategy Bullish

Higher Highs Higher Lows

Retracement (13%)

Price above Quartely VWAP

Price above Decade VWAP

Volatility Bullish

Maket Sentiment 92% Bullish

Yearly Trend Bullish

Quartely Trend Bullish

Monthly Bullish

Daily Bullish

4H Bullish

2H Bullish

1H Bullish

30 min. Bullish

Portfolio Strategy:

Volatility/Risk(Per Trade)

Position Sizing

Risk Management 2: Trailing Stop (Donchian/Turtle Trader)/N(Volatility(Per Day) or (Quarter)*(risk per Trade)

William Jackson, chief emerging markets economist at Capital Economics, also noted that shocks from the El Nino weather pattern could prompt inflation in central and south American regions to cool more slowly than previously expected.

"Latin American central banks are unlikely to look through food price shocks given how strong headline inflation and wage growth in the region still are. So, upside inflation surprises could postpone the upcoming monetary easing cycles, or make them more gradual."

The Mexican peso slipped 0.4% and was set to snap a four-day winning streak, after touching its highest level since early December 2015 on Wednesday.

The MSCI gauge for Latam stocks (.MILA00000PUS) gained 1.3%, led by a 1.4% advance in Brazil's Bovespa

IBOV

.

Foreigners funneled over $22 billion net into emerging market portfolios in June, the largest amount since January, according to data from the Institute of International Finance.

A Guatemalan court ordered the suspension of anti-graft presidential candidate Bernardo Arevalo's political party, threatening his place in a run-off vote and prompting U.S. warnings of a challenge to democracy.

Elsewhere, the International Monetary Fund's executive board has approved an immediate $189 million disbursement to Zambia following its first review of a $1.3 billion loan programme.

Latam FX hits 10-year high on weak dollar as US inflation slows

The index for Latin American currencies touched a 10-year high on Wednesday, led by Brazil's real, as the dollar dwindled after a U.S. inflation reading indicated just one more interest rate hike by the Federal Reserve this year.

The MSCI index for Latam currencies (.MILA00000CUS) jumped 1.6%, hitting its highest level since April 2013.

Most currencies hit multi-year highs against a weakening dollar after June U.S. consumer prices rose at their smallest annual pace in over two years.

Although talks of rate cuts have intensified in Latam of late, bets on the U.S. rate-hiking cycle coming to an end will likely lead to a favorable interest rates differential.

The Mexican peso

USDMXN

jumped 1%, breaking below the psychological barrier of 17 pesos per dollar, touching an eight year high.

Higher crude oil prices also boosted the Mexican peso and top exporter Colombia's peso

USDCOP

by 0.8%.

Copper prices hit 2-1/2-week highs, boosting currencies of main exporters. Chile's peso

USDCLP

added 0.7% and Peru's sol

USDPEN

rose 1.3%, to its highest level since November 2020. Peru's central bank is set to decide on policy rates on Thursday.

Chile's Finance Minister Mario Marcel said the government now expects gross domestic product (GDP) to grow 0.2% in 2023, revising its forecast down from a previous estimate of 0.3%.

The Brazilian real (BRBY)

USDBRL

gained 0.8%, touching a one-week high.

The rapporteur for Brazil's tax reform bill in the Senate, Eduardo Braga, on Tuesday said that he expects the proposal to be voted on in October in the House.

Data showed Brazil's services activity grew by much more than expected in May, paring some losses seen in April despite high interest rates.

"Progress on the structural reform agenda and the (Brazil) government decision to maintain the CPI target at 3% have cleared the way for rate cuts; we expect a 50bps cut on August 2," said Lawrence Brainard, chief EM economist at TS Lombard.

Meanwhile, Argentine polling firms warned of difficulties accurately predicting the upcoming presidential primaries' results due to low turnout and the emergence of surprise candidates, leaving the October election also uncertain.

The MSCI index for Latam stocks (.MILA00000PUS) jumped 2.5%, touching a one-week high, led by a 1.4% advance Brazil's Bovespa

IBOV

.

World's largest meat packer JBS SA

JBSS3

jumped 9% after proposing a New York listing.

Separately, the International Monetary Fund (IMF) approved a $3 billion, nine-month bailout programme for Pakistan.

YEN Oil AUD NZD Asian stocks fall on bad chinese data

China Industrial Output Growth Beats Estimates

The Chinese economy advanced 6.3% yoy in Q2 of 2023, faster than a 4.5% growth in Q1 but missing market estimates of 7.3%. The latest figures were distorted by a low base of comparison last year when Shanghai and other big cities were in strict lockdown. During H1, the economy grew by 5.5%. China has set a GDP growth target of around 5% for this year after the economy expanded by 3% in 2022 and missed the government's target of about 5.5%. Beijing has shown reluctance to launch greater stimulus, especially as local government debt has soared. In June alone, indicators showed a mixed picture: retail sales rose the least in 5 months, industrial output growth grew for the 14th month, and the urban jobless rate was unchanged at 5.2% but youth unemployment hit a new high of 21.3%. Data released earlier showed shipments from China fell the most in three years, as high inflation in key markets and geopolitics hit foreign demand. A Politburo meeting is expected later this month.

Asian Stocks Fall on Weak Chinese Data

Asian equity markets fell on Monday as investors reacted to key data showing China’s economy grew 6.3% in the second quarter, lower than the 7.3% expansion expected by analysts. The Shanghai Composite led the decline, losing more than 1%. The Shenzhen Component, S&P/ASX 200 and Kospi indexes also tumbled. Meanwhile, Japanese markets are closed for a holiday, while Hong Kong markets will likely be closed for the day due to a typhoon.

China Stocks Drop on Weak GDP Data

The Shanghai Composite dropped 1.1% to around 3,200 while the Shenzhen Component lost 0.8% to 10,990 on Monday, giving back gains from last week as investors reacted to key data showing China’s economy grew 6.3% in the second quarter, lower than the 7.3% expansion expected by analysts. Meanwhile, China’s industrial production and fixed asset investments increased more than anticipated, while retail sales missed forecasts. Mainland stocks gained last week amid hopes that a faltering post-pandemic recovery would prompt Beijing to offer more pro-growth policy measures. Commodity-linked and financial stocks led the decline, with notable losses from Yunnan Lincang (-3.5%), Zijin Mining (-1.5%), China Shenhua Energy (-4.5%), ICBC (-6%), Ping An Insurance (-1%) and China Merchants Bank (-1.1%).

GBPTRY breakout - the patternGBPTRY is a great trade as always, even better when traded with 0.0 pips spread and NO swap fees.

On topic - looks like an inverted head and shoulders pattern on this time frame and may rise up quite nicely today, tomorrow, toy Yoda.

Or it would fall under the descending triangle pattern and slide back to where it came from.

Let's have a look-see.

This is just a pattern analysis and not financial advice. When we give advice we usually sign a contract to protect your capital.

GBPTRY test the 0.5 FIb 🦐GBPTRY on the 4h chart after the recent impulse retraced at the 0.5 Fibonacci level.

The market starts to consolidate ove a minor support and according to Plancton's strategy if the price will break above we will set a nice long order

––––

Follow the Shrimp 🦐

Keep in mind.

• 🟣 Purple structure -> Monthly structure.

• 🔴 Red structure -> Weekly structure.

• 🔵 Blue structure -> Daily structure.

• 🟡 Yellow structure -> 4h structure.

• ⚫️ Black structure -> >4h structure.

Here is the Plancton0618 technical analysis , please comment below if you have any question.

The ENTRY in the market will be taken only if the condition of the Plancton0618 strategy will trigger.