XAU/USD | Gold at a Turning Point – Breakout or Breakdown Ahead?By analyzing the gold chart on the 4-hour timeframe, we can see that after our last analysis, gold continued its correction and dropped to $3358. It’s currently trading around $3367, and for the bullish scenario to remain valid, we need to see price hold above $3358 and soon close above $3370. If this happens, another bullish move could follow.

Otherwise, if gold breaks and stabilizes below $3358, this scenario will be invalidated, and the alternative outlook suggests further downside toward $3349 and $3339. This analysis will be updated — and don’t forget to show your support, friends!

Please support me with your likes and comments to motivate me to share more analysis with you and share your opinion about the possible trend of this chart with me !

Best Regards , Arman Shaban

GBPUSD

EUR/USD | Holding Above 1.16 Could Unlock More Upside! (READ IT)By analyzing the EURUSD chart on the 4-hour timeframe, we can see that the price reacted beautifully to all the marked zones on the chart. Especially after reaching the 1.14 demand area, it experienced a strong bullish move, rallying over 200 pips to hit 1.16. Currently, EURUSD is trading around 1.16220, and if it holds above the 1.16 level, we can expect further upside. The next bullish targets are 1.16435, 1.16780, 1.17100, and 1.17500.

Please support me with your likes and comments to motivate me to share more analysis with you and share your opinion about the possible trend of this chart with me !

Best Regards , Arman Shaban

GBPUSD: Overextended move meets with supportAfter a steep and aggressive sell-off, price has tapped into a clear zone. This recent move wasn't gradual: it was impulsive and sharp, which tells us one key thing: exhaustion is likely.

The overextension into it without any meaningful pullback typically highlights imbalance, where price moves ahead of structure and becomes vulnerable to correction. But price doesn’t move in straight lines forever. Markets that fall too quickly tend to burn out just as fast. When such aggressive pushes meet with a clean, resistance like this one, they often trigger the exact opposite, a snapback correction.

I am now watching for signs of absorption and accumulation. This could play out in the form of sideways candles, wick rejections, or a sudden reversal spike. These are early signs that smart money might be stepping in.

My projected target would be toward the 1.33700 area, from the last impulsive drop. It’s a classic mean reversion setup, not just technical but psychological. Traders who chased the move late may find themselves trapped, fueling the correction as they’re forced to exit.

GBPUSD - Looking To Sell Pullbacks In The Short TermH4 - Strong bearish move.

No opposite signs.

Currently it looks like a pullback is happening.

Expecting bearish continuation until the two Fibonacci resistance zones hold.

If you enjoy this idea, don’t forget to LIKE 👍, FOLLOW ✅, SHARE 🙌, and COMMENT ✍! Drop your thoughts and charts below to keep the discussion going. Your support helps keep this content free and reach more people! 🚀

GBPUSD at make or break level ahead of a split BOEThe BOE faces a pivotal moment as it prepares to announce its latest interest rate decision.

With MPC members split between hawkish concerns about stubborn inflation and dovish worries over a weakening job market, expectations are swirling about the path forward.

Will the BOE signal a pause after this cut, or will inflation surprises force a more cautious, hawkish stance going into the end of the year?

Traders are watching for clues in the updated forecasts, as even a minor shift could spark major volatility in GBP/USD.

If the BOE sounds hawkish—maybe they raise their inflation forecasts, or the vote split shows strong resistance to further cuts, or they signal a pause in easing—then GBPUSD might have found a bottom for now.

On the flip side, if the BOE puts more emphasis on economic risks, reduces its GDP outlook, or if the vote split shows a strong push for even bigger cuts, then the pound could come under pressure.

On the charts, Cable is clinging to 1.3375, with a potential developing head and shoulders pattern threatening a deeper move lower if the neckline breaks.

Will the upcoming BOE decision be the make-or-break catalyst for the pound?

This content is not directed to residents of the EU or UK. Any opinions, news, research, analyses, prices or other information contained on this website is provided as general market commentary and does not constitute investment advice. ThinkMarkets will not accept liability for any loss or damage including, without limitation, to any loss of profit which may arise directly or indirectly from use of or reliance on such information.

GBPUSD – DAILY FORECAST Q3 | W32 | D7 | Y25📊 GBPUSD – DAILY FORECAST

Q3 | W32 | D7 | Y25

Daily Forecast 🔍📅

Here’s a short diagnosis of the current chart setup 🧠📈

Higher time frame order blocks have been identified — these are our patient points of interest 🎯🧭.

It’s crucial to wait for a confirmed break of structure 🧱✅ before forming a directional bias.

This keeps us disciplined and aligned with what price action is truly telling us.

📈 Risk Management Protocols

🔑 Core principles:

Max 1% risk per trade

Only execute at pre-identified levels

Use alerts, not emotion

Stick to your RR plan — minimum 1:2

🧠 You’re not paid for how many trades you take, you’re paid for how well you manage risk.

🧠 Weekly FRGNT Insight

"Trade what the market gives, not what your ego wants."

Stay mechanical. Stay focused. Let the probabilities work.

FX:GBPUSD

$GBPUSD at resistance?STICing it to the chat, but sometime i'd wanna take early entry. Bases on regression S&R, GBP should continue downthrnd following a previous H&S an da retest of resistance.

IF resistance break hwever, we migth see a flip, but not holding my short for the week. Fingercrossed

took early On M15 but it about time to TP.

#Tradesmartly #STIC Algo

Bearish reversal?The Cable (GBP/USD) is rising towards the pivot which acts as an overlap resistance that lines up with the 50% Fibonacci retracement and could drop to the 1st support.

Pivot: 1.3373

1st Support: 1.3267

1st Resistance: 1.3459

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

GBPUSD LONGCheck comment for the proper multi-timeframe layout due to TradingViews publishing restriction

MT5 screenshot also attached.

Still moving in line with the bullish bias I shared in Monday’s post.

Things may shift eventually, but for now — we ride it.

4H supply in control, aligned with weekly demand. 5M demand held strong.

Waited for price to return to the mapped zone, dropped to 15s for execution.

Tapped out after 3RR achieved — not more, not less.

Same system. Same pair. Different day.

GBPUSD Technical Breakdown – High-Probability Rejection Play📉 GBPUSD Technical Breakdown – High-Probability Rejection Play

🔥 Clean Structure | Strong Confluences | Smart Money Insight

This GBPUSD setup is a textbook example of price action meeting institutional behavior.

🧠 Key Observations:

• Break of Structure (BOS) identified multiple times confirming clear trend shifts.

• Price tapped into a well-defined resistance zone and showed an aggressive rejection, validating seller presence.

• Liquidity grab from the highs led to an immediate drop, marking the start of bearish momentum.

🎯 Target Zones:

• First TP: 1.33009

• Second TP: 1.32375

• Final Target: 1.31443 (aligned with major support zone and BOS retest)

🛡 Why This Setup Matters:

• Strong rejection from premium zone

• BOS confirms direction

• Volume and structure align for high RR potential

• Clean imbalance fill expectations

✅ Plan:

Sell from rejection zone with SL above the wick high. Trail stops as price approaches each target.

GBP/USD Faces Key 8-Hour Supply ZoneToday, the GBP/USD futures approached an 8-hour supply zone, presenting a potential shorting opportunity. The price action indicates the beginning of a possible downtrend within this timeframe. Additionally, the latest COT report reveals that non-commercial traders are increasing their short positions, reinforcing the bearish outlook.

It will be crucial to review the upcoming COT report over the weekend for a clearer market perspective. However, based on current signals, the market may be poised for decline. Should this 8-hour supply zone be breached or ignored, another supply area lies just above, which could serve as an alternative resistance level to monitor.

✅ Please share your thoughts about 6B1! in the comments section below and HIT LIKE if you appreciate my analysis. Don't forget to FOLLOW ME; you will help us a lot with this small contribution.

GBPUSD Ahead of BoE rate decisionThe GBPUSD remains in a bullish trend, with recent price action showing signs of a oversold really within the broader uptrend.

Support Zone: 1.3255 – a key level from previous consolidation. Price is currently testing or approaching this level.

A bullish rebound from 1.3255 would confirm ongoing upside momentum, with potential targets at:

1.3440 – initial resistance

1.3510 – psychological and structural level

1.3600 – extended resistance on the longer-term chart

Bearish Scenario:

A confirmed break and daily close below 1.3255 would weaken the bullish outlook and suggest deeper downside risk toward:

1.3210 – minor support

1.3170 – stronger support and potential demand zone

Outlook:

Bullish bias remains intact while the GBPUSD holds above 1.3255. A sustained break below this level could shift momentum to the downside in the short term.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

How could GBPUSD react to the BoE's rate decision?We are waiting for the BoE today to deliver its rate decision. Although we know the potential outcome, still, the reaction in MARKETSCOM:GBPUSD will be heavily monitored.

Let's dig in.

FX_IDC:GBPUSD

Let us know what you think in the comments below.

Thank you.

75.2% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Past performance is not necessarily indicative of future results. The value of investments may fall as well as rise and the investor may not get back the amount initially invested. This content is not intended for nor applicable to residents of the UK. Cryptocurrency CFDs and spread bets are restricted in the UK for all retail clients.

GBPUSD Approaching Key Psychological Zones!Hey friends 👋

Here’s a fresh GBPUSD analysis I’ve prepared for you. I’m planning to open a **buy** position between **1.32506 – 1.32246**, aiming for a target level of **1.33298**.

Every single like you send my way is a huge source of motivation for me to keep sharing these insights. Big thanks to everyone supporting with a like 🙏

Market Analysis: GBP/USD Rebounds CautiouslyMarket Analysis: GBP/USD Rebounds Cautiously

GBP/USD is attempting a recovery wave above the 1.3215 resistance.

Important Takeaways for GBP/USD Analysis Today

- The British Pound is attempting a fresh increase above 1.3265.

- There is a contracting triangle forming with resistance at 1.3375 on the hourly chart of GBP/USD.

GBP/USD Technical Analysis

On the hourly chart of GBP/USD, the pair declined after it failed to clear the 1.3600 resistance. As mentioned in the previous analysis, the British Pound even traded below the 1.3350 support against the US Dollar.

Finally, the pair tested the 1.3140 zone and is currently attempting a fresh increase. The bulls were able to push the pair above the 50-hour simple moving average and 1.3215. The pair even climbed above the 1.3265 level.

The bulls were able to push the pair above the 50% Fib retracement level of the downward move from the 1.3385 swing high to the 1.3141 low.

On the upside, the GBP/USD chart indicates that the pair is facing resistance near 1.3375. There is also a contracting triangle forming with resistance at 1.3375 and the 76.4% Fib retracement level of the downward move from the 1.3385 swing high to the 1.3141 low.

The next major resistance is near 1.3385. A close above the 1.3385 resistance zone could open the doors for a move toward 1.3450. Any more gains might send GBP/USD toward 1.3550.

On the downside, there is decent support forming at 1.3265. If there is a downside break below 1.3265, the pair could accelerate lower. The first major support is near the 1.3215 level. The next key support is seen near 1.3140, below which the pair could test 1.3050. Any more losses could lead the pair toward 1.3000.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

GBPUSD extends to the downside. Wait for retest to sell✏️ OANDA:GBPUSD confirms the downtrend by breaking the trendline. The downtrend is still extending to lower areas because the GBPUSD bearish wave structure is very beautiful. Some selling momentum appears around the breakout zone of 1.339, which will form a bearish structure towards the support of 1.287 in the near future. Putting faith in the trendline at the moment is reliable.

📉 Key Levels

SELL zone 1.339-1.341

SELL DCA trigger: Break and trading bellow 1.317

Target 1.287

Leave your comments on the idea. I am happy to read your views.

DeGRAM | GBPUSD rebound from the support level📊 Technical Analysis

● GBPUSD rebounded from 1.3142 support with a strong bullish impulse and is consolidating above the reclaimed demand zone near 1.3277.

● Structure shows a potential bullish reversal from the lower bound of the descending channel, aiming for resistance near 1.3400.

💡 Fundamental Analysis

● Dovish Fed repricing after weaker US job additions and soft wage growth pulled yields lower, reducing USD strength.

● BoE's 25 bps hike and upward revisions in UK inflation forecasts reinforced GBP support across rate-sensitive pairs.

✨ Summary

Long above 1.3277. Target 1.3400 → 1.3585. Setup valid while price holds above 1.3142.

-------------------

Share your opinion in the comments and support the idea with a like. Thanks for your support!

GBPUSD: Bullish (Short Term)Price formed a bullish choch and is trading above QP 1.325. Look to buy...

(H4)

🟩 Key Zone to Watch: 1.3175–1.3205

(H1)

🟩 Order Block: 1.3210–1.3225 holding as support

📉 H1 remains bearish — no BOS yet

Execution Clue for Buy Setup:

M15 or H1 bullish BOS above 1.3295–1.3300 after tapping 1.3175–1.3200

(M15)

Wait for price to reach 1.3175–1.3205

Then confirm bullish M15 BOS above 1.3225

That’s your trigger to enter on the pullback

IB pattern after correction bellow the 50EMAThis market is in uptrend

it has been in a correction phase

it reached bellow the 50EMA and near the strong

daily support zone of 1.34000

then it formed a nice IB pattern

which is triggered after the breakout and close the

HH of the MB and above the 50EMA

so I opend at the end of day a buy order at the market

at 1.34909

SL 1.33500

TP 1.37500

so the RR=1:2

GBPUSD Massive Short! SELL!

My dear friends,

My technical analysis for GBPUSD is below:

The market is trading on 1.3309 pivot level.

Bias - Bearish

Technical Indicators: Both Super Trend & Pivot HL indicate a highly probable Bearish continuation.

Target - 1.3295

Recommended Stop Loss - 1.3316

About Used Indicators:

A pivot point is a technical analysis indicator, or calculations, used to determine the overall trend of the market over different time frames.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

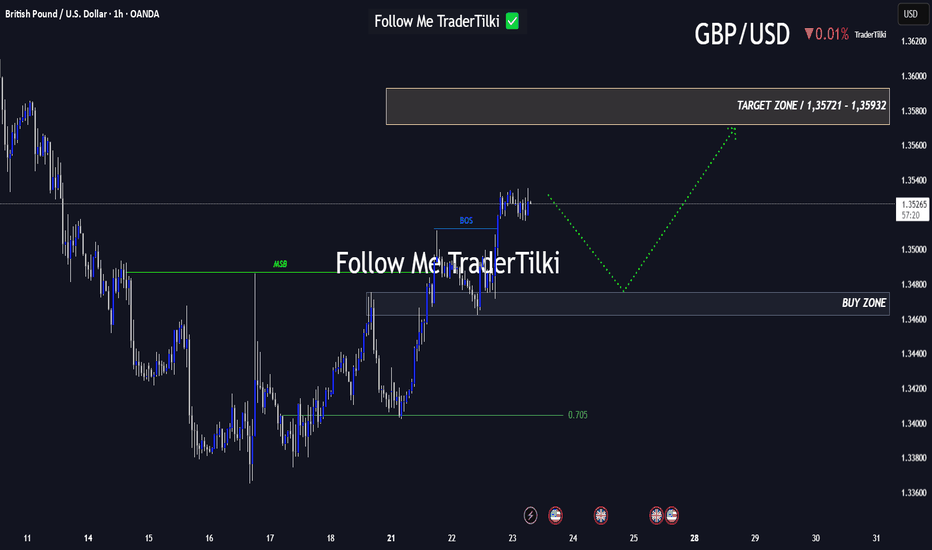

Every Like Is a Boost: This GBPUSD Analysis Is Just for You!Good morning, friends 🌞

Due to the recent shift in GBPUSD’s market structure, I plan to enter a buy position when price reaches the 1.34753 – 1.34623 range.

Target levels: 1.35721 and 1.35932 📈

Every like you send fuels my motivation to share fresh analyses. Thank you to everyone who’s supporting this journey ❤️