GBPUSD-MORE-SELL

GBP/USD Technical & Sentiment Analysis - Short-Term OutlookGBP/USD Technical Analysis with Sentiment Data:

Current Price and Support Levels: As of the latest close, GBP/USD is trading at 1.23791. It's important to consider that the current price is in close proximity to significant support levels at 1.23784, 1.23141, and 1.22637. These levels have historically acted as robust areas of price support, potentially attracting buying interest.

Major Resistance Levels: On the other hand, the current price is also approaching major resistance levels within the range of 1.23895 to 1.23897 and 1.24213. These are substantial price zones where traders may contemplate taking profits or initiating short positions if GBP/USD reaches these levels.

Short-Term Outlook: Given the technical analysis, my inclination towards a short position with the target of revisiting the 3rd support level at 1.22637 as a pullback appears technically sound. Should the price fail to breach the immediate resistance levels and begins to retreat, it could discover support around the levels which I've identified.

Sentiment Analysis: It's noteworthy that, based on sentiment data (Myfxbook), 76% of traders are currently in short positions, representing 11,193.20 lots, while 24% are in long positions, accounting for 3,505.61 lots. This indicates a bearish sentiment in the market, with a significantly higher number of traders shorting GBP/USD compared to those taking long positions. Specifically, 35,217 traders are short, while 11,825 are long, which further emphasizes the bearish sentiment.

Additional Considerations:

Market Sentiment: With the majority of traders holding short positions, it aligns with my short-term outlook. However, we have to keep a close eye on market sentiment as it can change rapidly.

Longer-Term Perspective: Maintain a broader perspective even though my primary focus is on the short-term. GBP/USD can be influenced by extended economic trends and political events, so staying well-informed about these influences is imperative.

Routine Monitoring: Continuously monitor price action, market sentiment, and adjust strategy in response to evolving market conditions.

Remember, trading in the forex market carries inherent risks, and it's vital to maintain a well-defined trading strategy and risk management plan. Seek guidance from a financial advisor or conduct further research before executing any trading decisions. VANTAGE:GBPUSD $XM:GBPUSD #GBPUSD #EAForexGlobal

GBPUSD Bullish on Hot UK InflationGBPUSD

You can find me on tradingview.com

Strategy Bullish

The British pound held firm around $1.28, staying close to its peak of $1.2848 recorded in June 16th, as hotter-than-expected inflation numbers raised anticipation among investors that the Bank of England would respond to the persistent inflationary pressures by implementing further interest rate hikes. In May, the headline inflation rate remained unchanged at 8.7%, slightly above the projected 8.4% and surpassing the policymakers' target of 2%. Additionally, the core inflation rate accelerated to 7.1%, reaching its highest level since March 1992. The Bank of England will likely deliver a 13th consecutive interest rate hike on Thursday, bringing borrowing costs to fresh 15-year highs. Markets now price another 150 basis points of hiking for a peak at 6%.

GBPUSD broke resistance zone 1.2464and closed above 1.2697

GBPUSD made since March14th2023 2consequent HH AND HL. The next HL must close above 1.2382

otherwise the market structrue will not be valid anymore and the danger of bearish structure will be created.

If the bullish market structure continues then 2 bullish scenarios are potentially possibel(See green arrows

Trendomat and Buy Sell pressure are green what indicates continuation of the bullish trend

$1.29 in the Hands of UK Inflation and Powell

With the Bank of England set to deliver its June interest rate decision on Thursday, today’s inflation numbers will materially influence the Bank’s outlook on inflation, the UK economy, and monetary policy.

To date, inflation has remained sticky. With a more resilient-than-expected UK economy, the markets expect a hawkish 25 basis-point interest rate hike. An annual inflation rate below 8% could support a BoE pause after the summer.

Economists forecast the UK annual inflation rate to soften from 8.7% to 8.4% in May. Investors will need to look beyond the headline figure, with food price inflation and core inflation needing consideration.

However, wage growth remains a bugbear that would also need to slow to give the doves more voice.

With inflation in the spotlight, investors should track Bank of England commentary for clues on monetary policy and the economic outlook. However, no Monetary Policy Committee members on the calendar to speak, leaving chatter with the media to move the dial.

Looking at the EMAs and the 4-hourly chart, the EMAs sent bullish signals. The GBP/USD sat above the 50-day EMA, currently at $1.26889. The 50-day EMA pulled further away from the 200-day EMA, with the 100-day EMA widening from the 200-day EMA, delivering bullish signals.

A hold above the S1 ($1.2716) and the 50-day EMA ($1.26899) would support a breakout from R1 ($1.2810) to target R2 ($1.2855). However, a fall through S1 ($1.21716) and the 50-day EMA ($1.20097) which is on the same time the Monthly average price would bring S2 ($1.19885) into view. A fall through the 50-day EMA would send a bearish signal.

Resistance & Support Levels

R1 – $

1.2810

S1 – $

1.21716

R2 – $

1.2855

S2 – $

1.19885

R3 – $

1.2948

S3 – $

1.16547

A breakout from the Tuesday high of $1.28067 would signal an extended breakout session. However, the Pound would need the UK inflation numbers and Fed Chair Powell to support a bullish session.

In the event of an extended rally, the GBP/USD would likely test the Second Major Resistance Level (R2) at $1.2855 and resistance at $1.29. The Third Major Resistance Level sits at $1.2948.

Failure to move through the pivot would leave the First Major Support Level (S1) at $1.2716 in play. However, barring a UK inflation-fueled sell-off, the GBP/USD should avoid sub-$1.2650. The Second Major Support Level (S2) at $1.2668 should limit the downside. The Third Major Support Level (S3) sits at $1.2575.

GBPUSD 4H (pivot price 1.31000)GBPUSD

stabilizing above 1.31000 will support rising to touch 1.31444 then 1.31683 then 1.31988

stabilizing under 1.31000 will support falling to touch 1.2996 then 1.2949

pivot price: 1.31000

Resistance prices: 1.31444 & 1.31683 & 1.32248

Support prices: 1.2996 & 1.2949& 1.2885

timeframe: 4H

👉 GBPUSD Uplink formedGBPUSD Uplink formed

The main goal is to buy from the support level for the next week

❤️ If you find this helpful and want more FREE predictions on TradingView

. . . . . Please show your support

. . . . . . . . Click the 👍 LIKE button

. . . . . . . . . . . Leave your feedback below in the comments!

❤️ I use all my transactions in real trading in my account, my account has already reached Profitability:

1549.04%🙏!❤️

It's your turn!

Be sure to leave a comment and let us know how you see this opportunity and prediction.

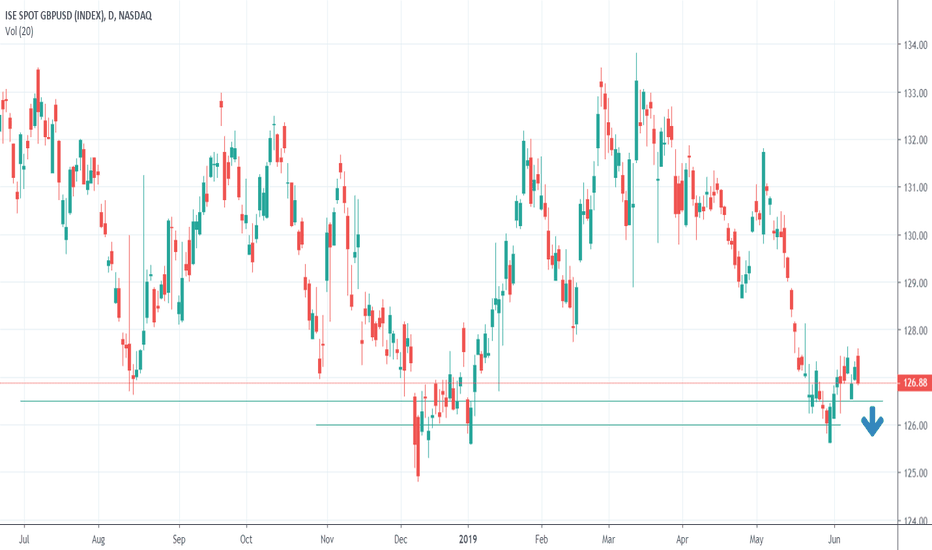

GBPUSD Selling with a level breach GBPUSD Selling with a level breach

❤️ If you find this helpful and want more FREE forecasts in TradingView

. . . . . Please show your support back,

. . . . . . . . Hit the 👍 LIKE button,

. . . . . . . . . . . Drop some feedback below in the comment!

❤️ Your Support is very much 🙏 appreciated!❤️

💎 Want us to help you become a better Forex trader?

Now, It's your turn!

Be sure to leave a comment let us know how do you see this opportunity and forecast.

GBPUSD Fundamental Analysis – September 19th 2019Here are the key factors to keep in mind today for British Pound trades:

UK Retail Sales: UK Retail Sales for August are predicted to decrease by 0.3% monthly and to increase by 2.3% annualized. Forex traders can compare this to UK Retail Sales for July which increased by 0.2% monthly and by 2.9% annualized. UK Retail Sales Including Auto and Fuel for August are predicted flat at 0.0% monthly and to increase by 2.8% annualized. Forex traders can compare this to UK Retail Sales Including Auto and Fuel for July which increased by 0.2% monthly and by 3.3% annualized.

Bank of England Interest Rate Decision, Asset Purchase Target and Corporate Bond Target: The Bank of England is predicted to keep interest rates at 0.75%, the Asset Purchase Target £435B and the Corporate Bond Target at £10B. Forex traders can compare this to the previous Bank of England meeting where the UK central bank decided to keep interest rates at 0.75%, the Asset Purchase Target £435B and the Corporate Bond Target at £10B.

Here are the key factors to keep in mind today for US Dollar trades:

US Initial Jobless Claims and Continuing Claims: US Initial Jobless Claims for the week of September 14th are predicted at 214K and US Continuing Claims for the week of September 7th are predicted at 1,672K. Forex traders can compare this to US Initial Jobless Claims for the week of September 7th which were reported at 204K and to US Continuing Claims for the week of August 31st which were reported at 1,670K.

US Philadelphia Fed Business Outlook: The Philadelphia Fed Business Outlook for September is predicted at 10.5. Forex traders can compare this to the Philadelphia Fed Business Outlook for August which was reported at 16.8.

US Current Account Balance: The US Current Account Balance for the second-quarter is predicted at -$127.4B. Forex traders can compare this to the US Current Account Balance for the first-quarter which was reported at -$130.4B.

US Existing Home Sales: US Existing Home Sales for August are predicted to decrease by 0.7% monthly to 5.38M. Forex traders can compare this to US Existing Home Sales for July which increased by 2.5% monthly to 5.42M.

US Leading Index: The US Leading Index for August are predicted to decrease by 0.1% monthly. Forex traders can compare this to the US Leading Index for July which increased by 0.5% monthly.

Should price action for the GBPUSD remain inside the or breakdown below the 1.2440 to 1.2525 zone the following trade set-up is recommended:

Timeframe: D1

Recommendation: Short Position

Entry Level: Short Position @ 1.2470

Take Profit Zone: 1.2210 – 1.2310

Stop Loss Level: 1.2555

Should price action for the GBPUSD breakout above 1.2525 the following trade set-up is recommended:

Timeframe: D1

Recommendation: Long Position

Entry Level: Long Position @ 1.2575

Take Profit Zone: 1.2705 – 1.2780

Stop Loss Level: 1.2525

GBPUSD symmetrical triangle Trade. "In the name of Allah, the Most Gracious, the Most Merciful".

GBPUSD symmetrical triangle Trade.

Note: This is only for Educational Purpose this is not Investment advice.

Please support the setup with your likes, comments and by following on Trading View.

Thanks

Adil Khan.

Analysis of GBPUSD 13.06.2019 by PaxForexAnalysis of GBPUSD 13.06.2019 by PaxForex

The price is below the moving average of 20 MA and MA 200, indicating the downward trend.

MACD is below the zero level.

The oscillator Force Index is below the zero levels.

If the level of support is broken, you shall follow the recommendations below:

• Timeframe: H4

• Recommendation: Short Position

• Entry Level: Short Position 1.2650

• Take Profit Level: 1.2600 (50 pips)

If the price rebound from the support level, you shall follow the recommendations below:

• Timeframe: H4

• Recommendation: Long Position

• Entry Level: Long Position 1.2700

• Take Profit Level: 1.2730 (30 pips)