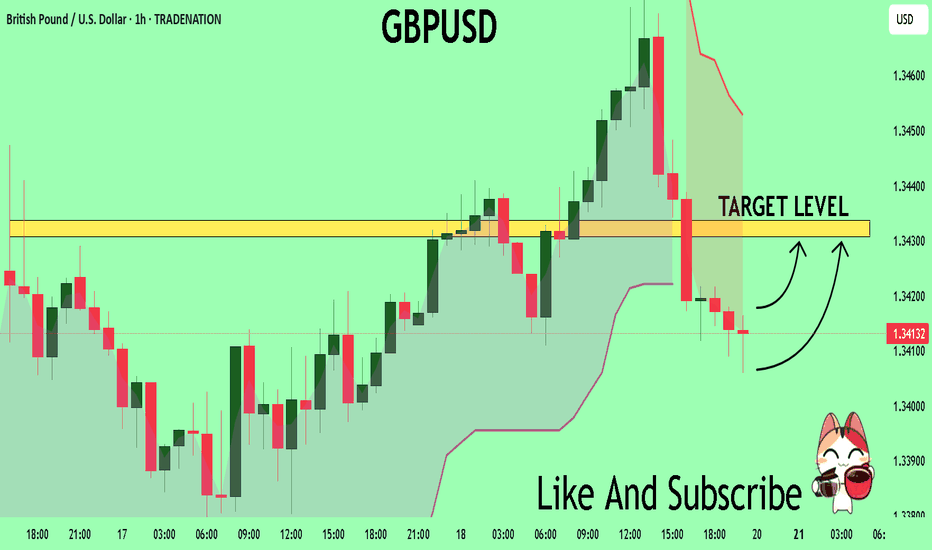

GBPUSD Expected Growth! BUY!

My dear followers,

I analysed this chart on GBPUSD and concluded the following:

The market is trading on 1.3413 pivot level.

Bias - Bullish

Technical Indicators: Both Super Trend & Pivot HL indicate a highly probable Bullish continuation.

Target - 1.3430

About Used Indicators:

A super-trend indicator is plotted on either above or below the closing price to signal a buy or sell. The indicator changes color, based on whether or not you should be buying. If the super-trend indicator moves below the closing price, the indicator turns green, and it signals an entry point or points to buy.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

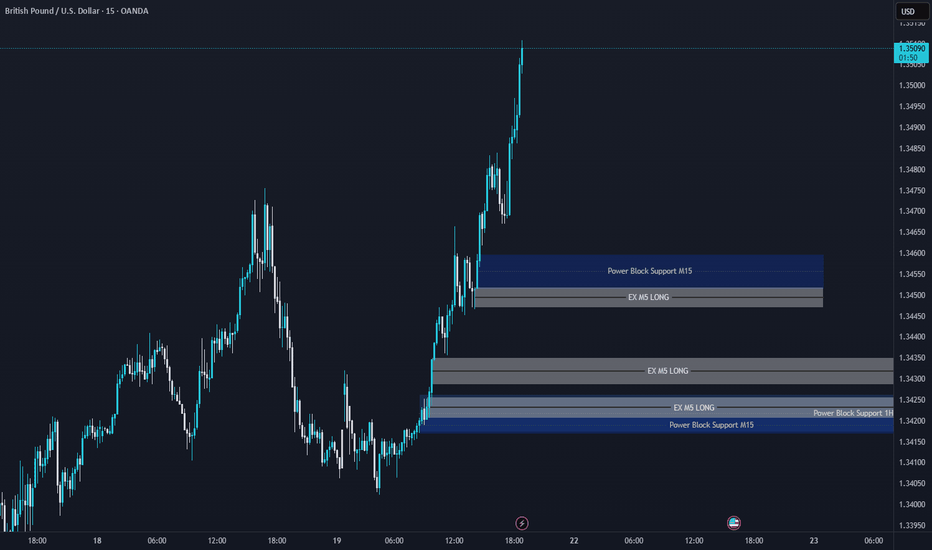

GBPUSD

GBPUSD Support & Resistance Levels🚀 Here are some key zones I've identified on the 15m timeframe.

These zones are based on real-time data analysis performed by a custom software I personally developed.

The tool is designed to scan the market continuously and highlight potential areas of interest based on price action behavior and volume dynamics.

Your feedback is welcome!

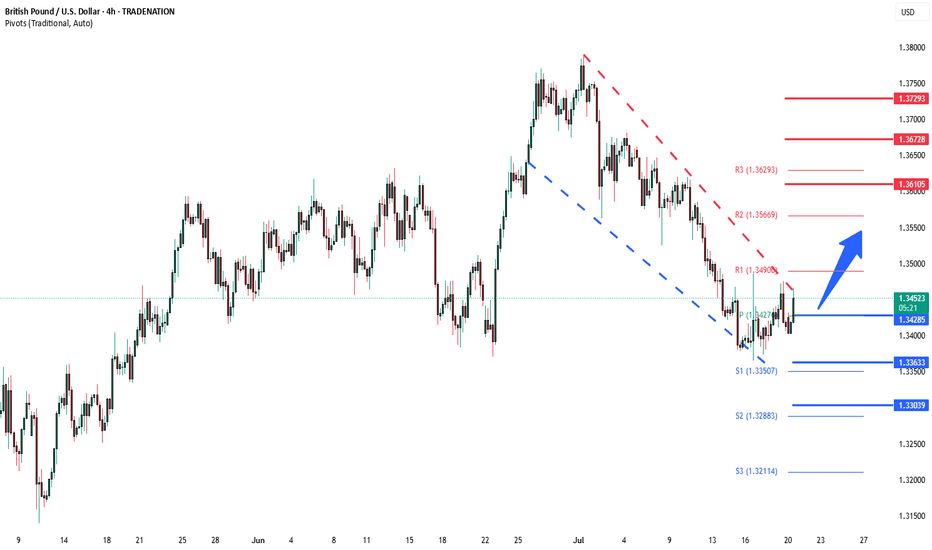

GBPUSD Week 30 Swing Zone/LevelsPEPPERSTONE:GBPUSD is expected to trend upward from the 1.34032 level towards the resistance zone. Whether it breaks through or reverses downward will ultimately depend on market players.

This projection is based on a forward-looking metric analysis, which explains why the zones are not derived from historical price action on the left side of the chart, as is common in traditional technical analysis. However, the daily candles from previous weeks still contribute meaningfully to this outlook.

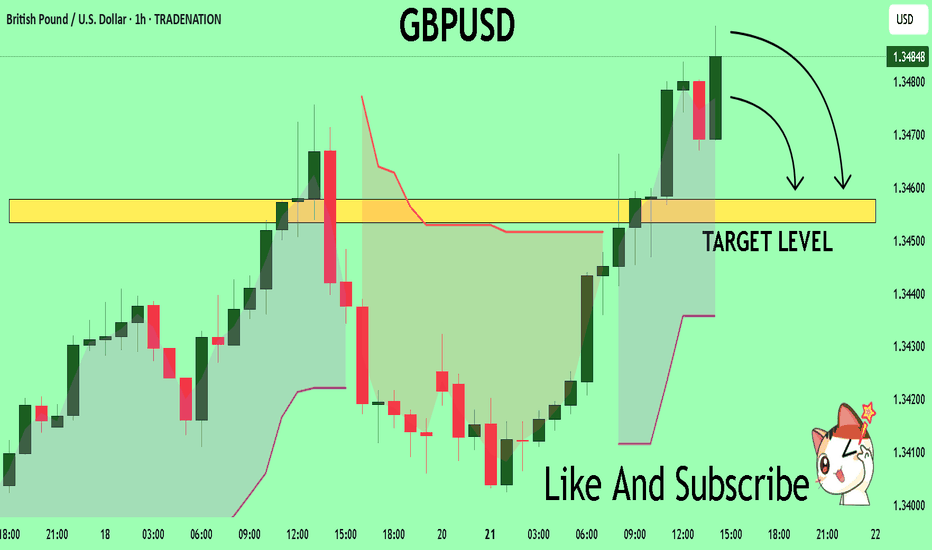

GBPUSD Under Pressure! SELL!

My dear subscribers,

GBPUSD looks like it will make a good move, and here are the details:

The market is trading on 1.3483 pivot level.

Bias - Bearish

Technical Indicators: Both Super Trend & Pivot HL indicate a highly probable Bearish continuation.

Target - 1.3457

About Used Indicators:

The average true range (ATR) plays an important role in 'Supertrend' as the indicator uses ATR to calculate its value. The ATR indicator signals the degree of price volatility.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

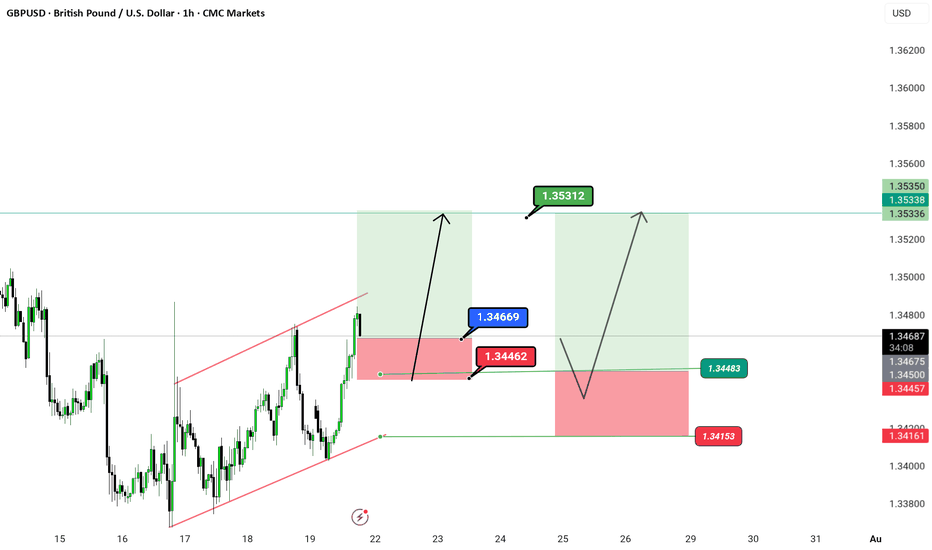

GBP/USD – Breakout bullish bias O_o🎉 GBP/USD – Breakout Party Above the Channel! 🎉

Pound-Dollar just said “bye-bye” to the red channel and is getting ready to dance its way up 💃💵

We have a clean breakout with two possible flight paths 🚀:

📍 Entry Zone: Around 1.34669

🎯 Targets:

1️⃣ 1.35312

2️⃣ 1.35350 (Double top zone – watch this closely 👀)

🛑 Stop Loss: 1.34462

❗ Invalidation below: 1.34153

📐 Structure: Parallel channel breakout 💥

📆 Timeframe: 1H

📌 Chart by: @greenfire_forex

🧠

---

#GBPUSD #ForexTrading #BreakoutSetup

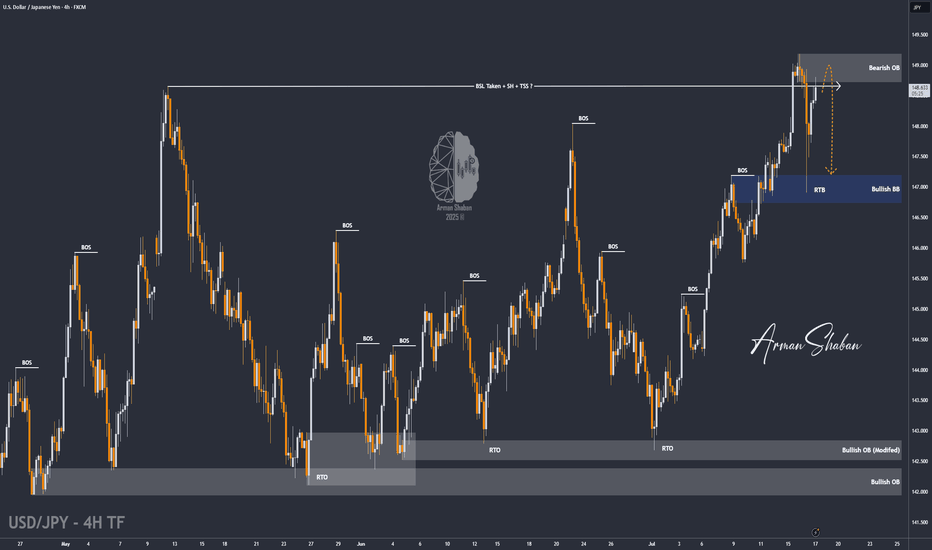

USD/JPY : Get Ready for another Fall ! (READ THE CAPTION)By analyzing the USDJPY chart on the 4-hour timeframe, we can see that after our last daily timeframe analysis, the price started its rally from the 144 zone and, as expected, hit all three targets at 145.5, 147.35, and 148.65, delivering over 500 pips in returns — even reaching as high as 149.2! Once the price broke above 148.65 and swept the liquidity above this level, it faced selling pressure and dropped to 146.9. Currently trading around 148.65, if USDJPY manages to hold below the supply zone between 148.65 and 149.2, we can expect further downside movement. This analysis will be updated with your support!

THE DAILY ANALYSIS :

Please support me with your likes and comments to motivate me to share more analysis with you and share your opinion about the possible trend of this chart with me !

Best Regards , Arman Shaban

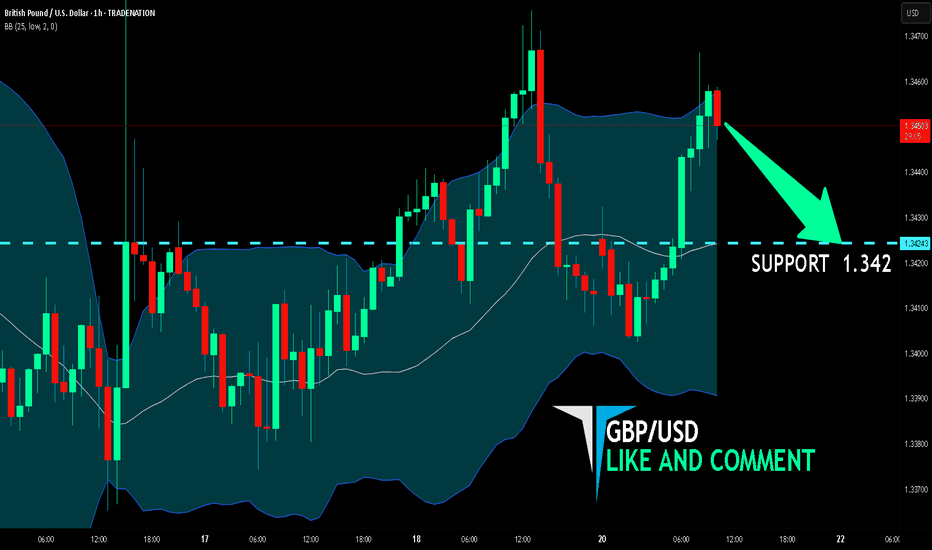

GBP/USD BEARISH BIAS RIGHT NOW| SHORT

Hello, Friends!

We are targeting the 1.342 level area with our short trade on GBP/USD which is based on the fact that the pair is overbought on the BB band scale and is also approaching a resistance line above thus going us a good entry option.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

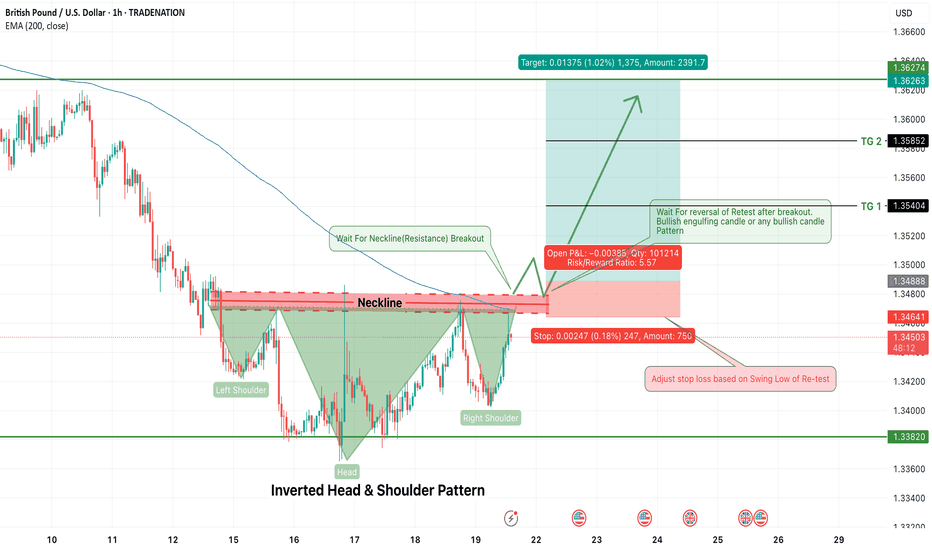

GBPUSD Long Opportunity – Inverted Head & Shoulders PatternGBPUSD is currently forming a classic Inverted Head & Shoulders pattern on the 1-hour timeframe — a powerful trend reversal signal that typically marks the shift from bearish to bullish momentum. The structure is clear, with a defined left shoulder, head, and right shoulder, and price now approaching the neckline resistance around 1.3488–1.3495.

Traders should now shift focus to two key confirmation events:

A neckline breakout

A successful retest of the neckline with a bullish reversal candle (e.g., bullish engulfing)

🔍 Trade Plan (Long Setup)

Entry: After 1H candle closes above neckline (~1.3490), wait for a retest of the breakout

Enter long on bullish confirmation candle during the retest

Stop Loss: Below the swing low of the retest (around 1.3440–1.3450)

Risk/Reward Ratio: ~5.5:1

🎯 Target Zones:

TG1: 1.3540 (Minor Resistance)

TG2: 1.3585 (Next structure zone)

Final Target: 1.3627+ (Full measured move from pattern)

📌 Confirmation Tips:

Look for bullish candlestick confirmation on neckline retest (bullish engulfing, hammer, or strong rejection wick)

Avoid entering inside the pattern – confirmation is key to reduce false breakouts

⚠️ Note to Traders:

This setup aligns with a possible shift in sentiment for GBPUSD. The pattern is developing against the larger downtrend, so discipline and stop-loss protection are crucial. A successful breakout and retest would suggest a potential short-term bullish reversal with clean upside targets.

🧠 Stay patient. Let the breakout confirm. Execute with structure.

=================================================================

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

=================================================================

Market Analysis: GBP/USD Dips FurtherMarket Analysis: GBP/USD Dips Further

GBP/USD started a downside correction from the 1.3620 zone.

Important Takeaways for GBP/USD Analysis Today

- The British Pound started a fresh decline and settled below the 1.3500 zone.

- There is a connecting bullish trend line forming with support at 1.3415 on the hourly chart of GBP/USD at FXOpen.

GBP/USD Technical Analysis

On the hourly chart of GBP/USD at FXOpen, the pair struggled above the 1.3600 zone. The British Pound started a fresh decline below the 1.3550 pivot level against the US Dollar, as discussed in the previous analysis.

The pair dipped below the 1.3500 and 1.3450 levels. A low was formed at 1.3364 and the pair is now consolidating losses. On the upside, it is facing resistance near the 1.3475 level. The next key resistance is near 1.3490 and the 50% Fib retracement level of the downward move from the 1.3619 swing high to the 1.3364 low.

An upside break above the 1.3490 zone could send the pair toward 1.3520 and the 61.8% Fib retracement level.

More gains might open the doors for a test of 1.3620. If there is another decline, the pair could find support near the 1.3415 level and a connecting bullish trend line. The first major support sits near the 1.3365 zone.

The next major support is 1.3350. If there is a break below 1.3350, the pair could extend the decline. The next key support is near the 1.3320 level. Any more losses might call for a test of 1.3250.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

GBPUSD deeper correction supported at 1.3430The GBPUSD remains in a bullish trend, with recent price action showing signs of a corrective pullback within the broader uptrend.

Support Zone: 1.3430 – a key level from previous consolidation. Price is currently testing or approaching this level.

A bullish rebound from 1.3430 would confirm ongoing upside momentum, with potential targets at:

1.3600 – initial resistance

1.3670 – psychological and structural level

1.3730 – extended resistance on the longer-term chart

Bearish Scenario:

A confirmed break and daily close below 1.3430 would weaken the bullish outlook and suggest deeper downside risk toward:

1.3370 – minor support

1.3300 – stronger support and potential demand zone

Outlook:

Bullish bias remains intact while the FTSE holds above 1.3430. A sustained break below this level could shift momentum to the downside in the short term.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

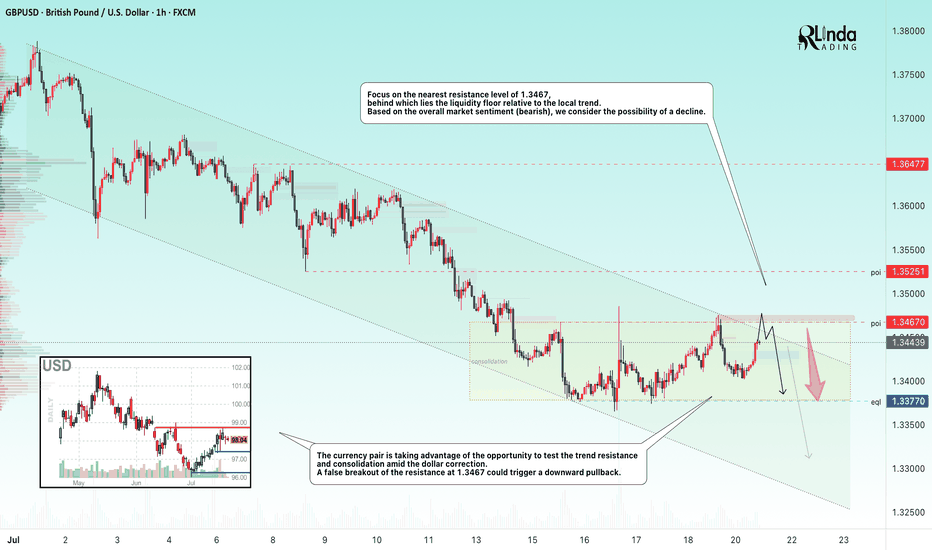

GBPUSD → Hunting for liquidity before the fallFX:GBPUSD is forming a countertrend correction towards the liquidity zone amid a correction in the dollar. Are there any chances for a trend break?

The currency pair is taking advantage of the opportunity to test the trend resistance and consolidation amid the dollar correction. Focus on the nearest resistance level of 1.3467, behind which lies a pool of liquidity relative to the local trend.

Based on the overall market sentiment (bearish), a breakout of the 1.3467 resistance could trigger a downward pullback.

Resistance levels: 1.3467

Support levels: 1.3370

If, during the retest of the specified liquidity zone, the market is unable to continue its upward movement and the price returns below the level, we will have a chance to catch a decline within the current trend.

Best regards, R. Linda!

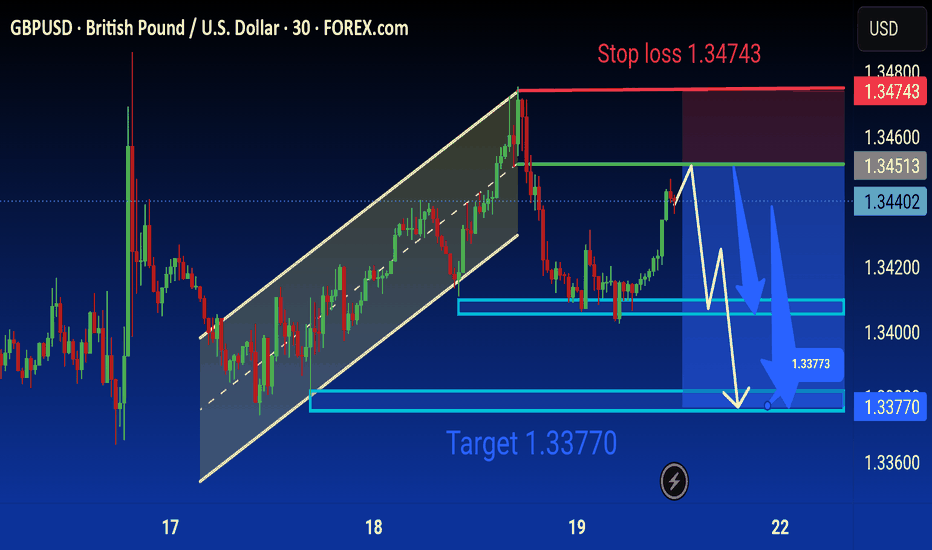

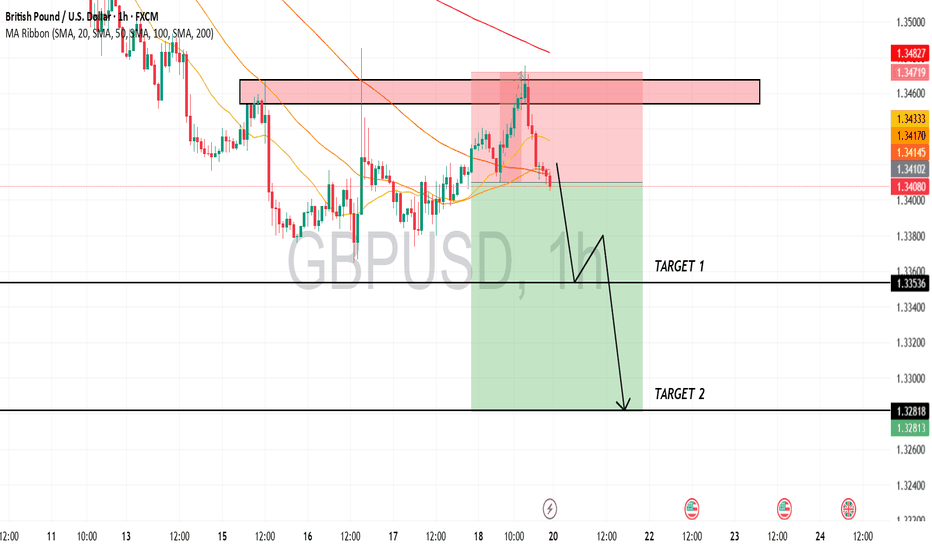

Gbpusd Analysis is Ready Move will be down technical analysis of the GBP/USD (British Pound/US Dollar) currency pair on the 30-minute timeframe using FOREX.com data. Here's a detailed breakdown of the analysis:

---

Chart Summary:

Current Price:

Sell: 1.34401

Buy: 1.34406

Timeframe: 30 minutes (M30)

Platform: TradingView with FOREX.com data

Technical Elements:

1. Ascending Channel (Yellow Parallel Lines):

Price was previously moving in an upward trend within this ascending channel.

The breakout to the downside indicates a potential trend reversal or correction.

2. Bearish Scenario (Blue Arrows):

The chart suggests a short (sell) setup.

Price is expected to face resistance around the 1.34513–1.34600 zone (marked by the green line).

A projected downward move is illustrated with blue arrows, targeting 1.33770.

3. Stop Loss:

Positioned at 1.34743 (highlighted in red), above the recent highs — managing risk for the sell position.

4. Support Zones (Blue Boxes):

First support area near 1.34000

Second, stronger support and main target at 1.33770

5. Target Label:

“Target 1.33770” is clearly marked in blue, showing the final expected move of the sell trade.

6. Forecast Path (White Lines):

Indicates potential short-term bullish pullback before continuing the bearish trend.

---

Trade Idea:

Sell GBP/USD near current resistance

Stop Loss: 1.34743

Take Profit (Target): 1.33770

Bias: Bearish short-term, following the channel breakout

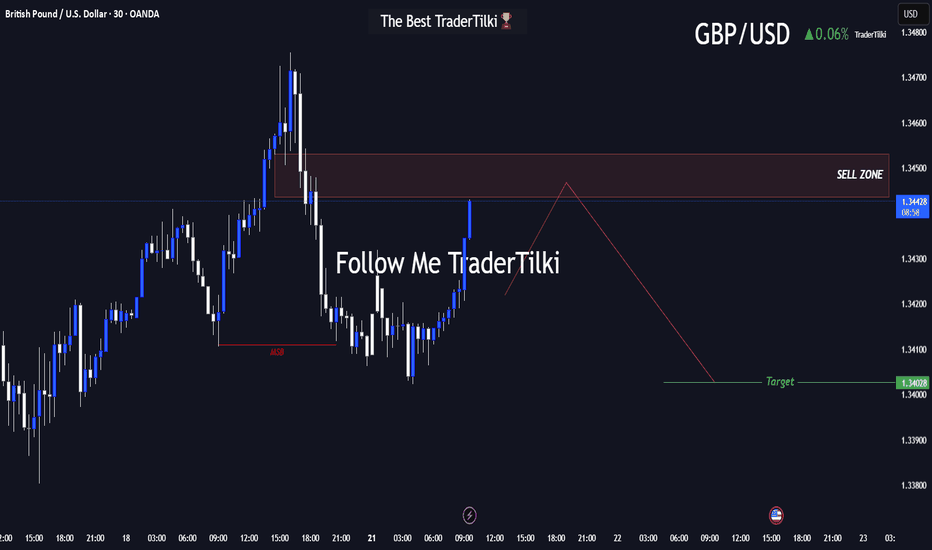

Major Levels Ahead: GBPUSD Trade Setup UnveiledHey friends, I’ve prepared a fresh GBPUSD analysis for you!

📍 Target level: 1.34028

🔻 SELL zone: Between 1.34532 and 1.34437

I expect the trade to reach its target during the London or New York session.

Every like and show of support fuels my motivation to share more analysis—thank you all for being part of this journey!

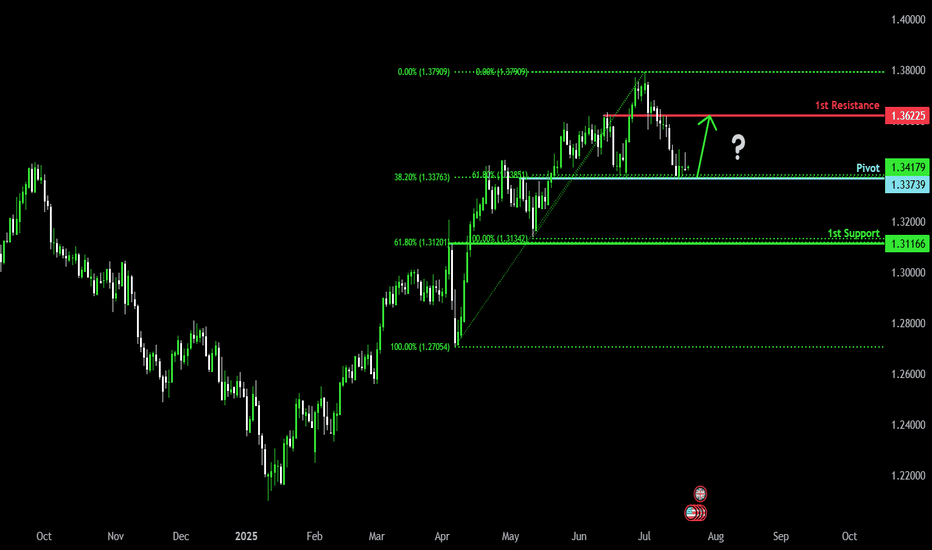

Bullish bounce?The Cable (GBP/USD) is falling towards the pivot and could bounce to the 1st resistance which is a pullback support.

Pivot: 1.3373

1st Support: 1.3116

1st Resistance: 1.3622

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

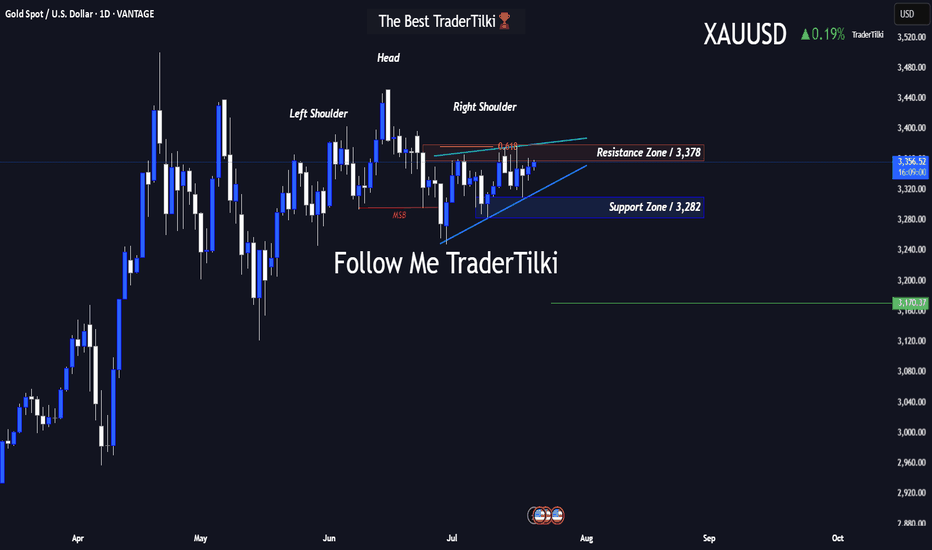

GOLD-XAUUSD vs. The FED: Technicals or Fundamentals?Good Morning Traders,

Let’s break down what gold is showing us on the 1-day chart:

- **Resistance:** 3,378

- **Support:** 3,282

- There’s a noticeable **head and shoulders pattern** on the chart. Under normal conditions, gold’s target sits at **3,170**.

Gold is highly sensitive to fundamental factors. Sudden war news or events like last week’s rumors about Trump firing the Fed Chair can trigger serious volatility.

That’s why I always combine **technical and fundamental analysis** in my approach.

For gold to reach the 3,170 target, the **3,282 support level must first be broken**. Since that hasn't happened yet, we can't confirm a bearish move—fundamentals play a key role here.

Keep in mind: this is a **swing trade** setup based on a 1-day chart. Reaching the target could take time.

I want to sincerely thank everyone who’s been supporting my analyses with likes—your support is

my biggest source of motivation when it comes to sharing content.

Much love and respect to you all.💛

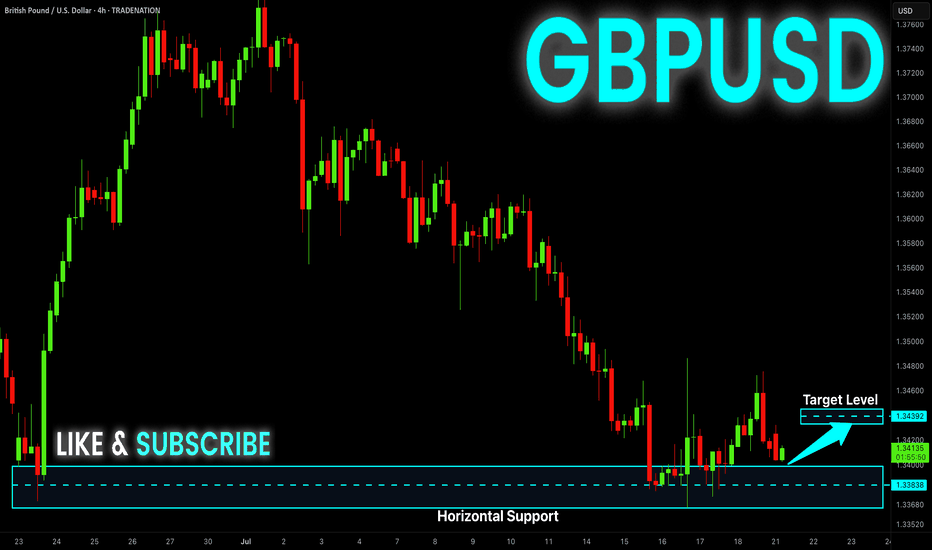

GBP-USD Local Long! Buy!

Hello,Traders!

GBP-USD is about to retest

The horizontal support

Level below at 1.3383

And as this is a strong

Support level we will be

Expecting a local bullish

Rebound and a move up

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

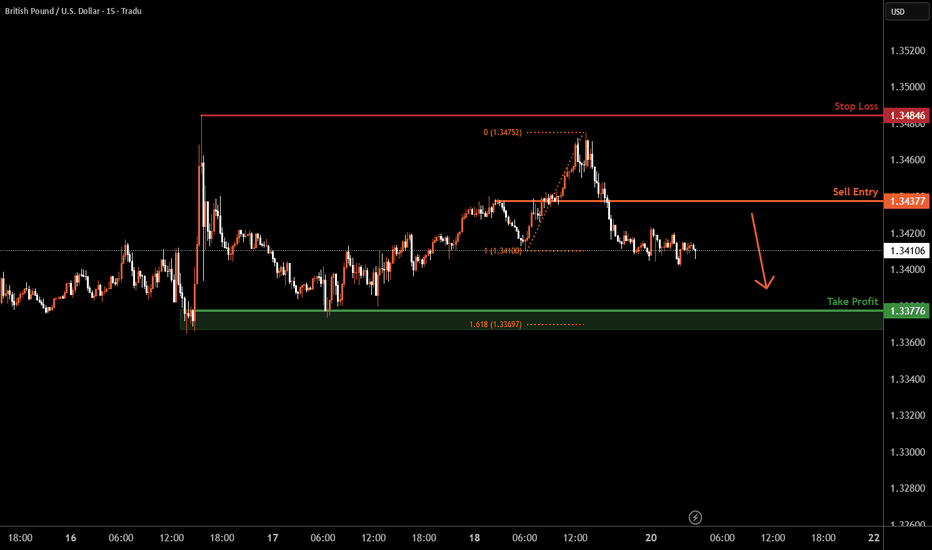

GBPUSD M15 I Bearish Reversal Based on the M15 chart, the price could rise toward our sell entry level at 1.3437, a pullback resistance.

Our take profit is set at 1.3377, an overlap support that aligns closely with the 161.8% Fib extension

The stop loss is set at 1.3484, a swing high resistance.

High Risk Investment Warning

Trading Forex/CFDs on margin carries a high level of risk and may not be suitable for all investors. Leverage can work against you.

Stratos Markets Limited (tradu.com ):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 66% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Europe Ltd (tradu.com ):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 66% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Global LLC (tradu.com ):

Losses can exceed deposits.

Please be advised that the information presented on TradingView is provided to Tradu (‘Company’, ‘we’) by a third-party provider (‘TFA Global Pte Ltd’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by TFA Global Pte Ltd.

The speaker(s) is neither an employee, agent nor representative of Tradu and is therefore acting independently. The opinions given are their own, constitute general market commentary, and do not constitute the opinion or advice of Tradu or any form of personal or investment advice. Tradu neither endorses nor guarantees offerings of third-party speakers, nor is Tradu responsible for the content, veracity or opinions of third-party speakers, presenters or participants.

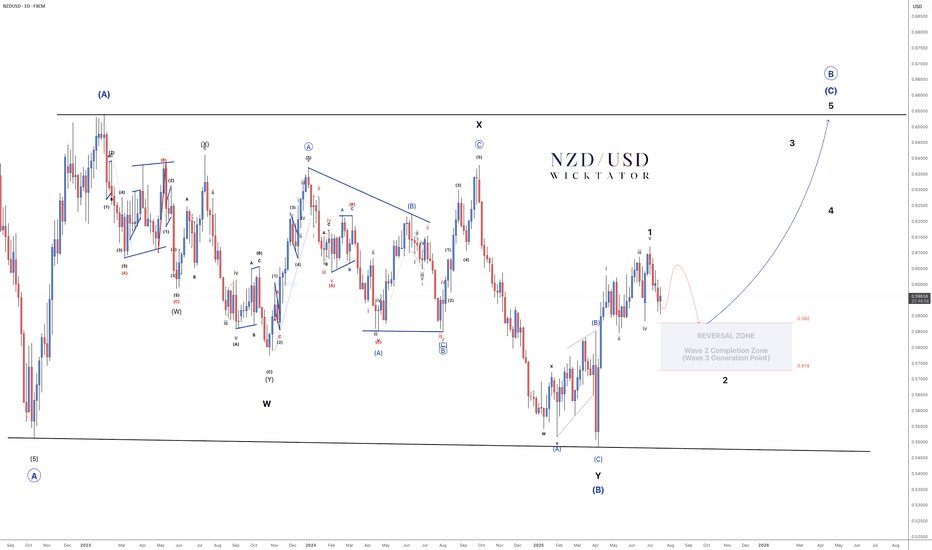

NZDUSD - Elliott Wave: High-Probability Reversal Zone Ahead!NZDUSD – Elliott Wave Roadmap

3Day Chart

Every move has been unfolding with precision — true to Elliott Wave Theory.

We're in the final leg of a massive A-B-C correction:

- Wave A and the complex Wave B (WXY) are complete.

- Wave C is now in play, targeting the highs of Wave A.

We’ve just seen a clean 5-wave advance (wave 1 leading diagonal).

Now expecting a classic ABC correction for wave 2, into our reversal zone (38.2–61.8% Fib).

🔍 Once price enters this zone, we’ll drop to lower timeframes and:

- Look for bullish confirmations (BOS, trendline break)

- Set entries with stops below corrective lows

- Targets: 0.63 (500 pips) and 0.65 (700 pips)

📌 Why is the buy zone so big?

It’s a higher timeframe zone. Once price enters, we zoom into lower timeframes for precise entries. The zone simply tells us when to focus, not where to blindly buy.

This is the Wave 3 generation point — and that’s where the real move begins.

Plan your trade. Watch for the setup. Execute with confidence.

Goodluck and as always, Trade Safe!

NZDUSD 12H Chart - Looking for this ABC correction for wave 2

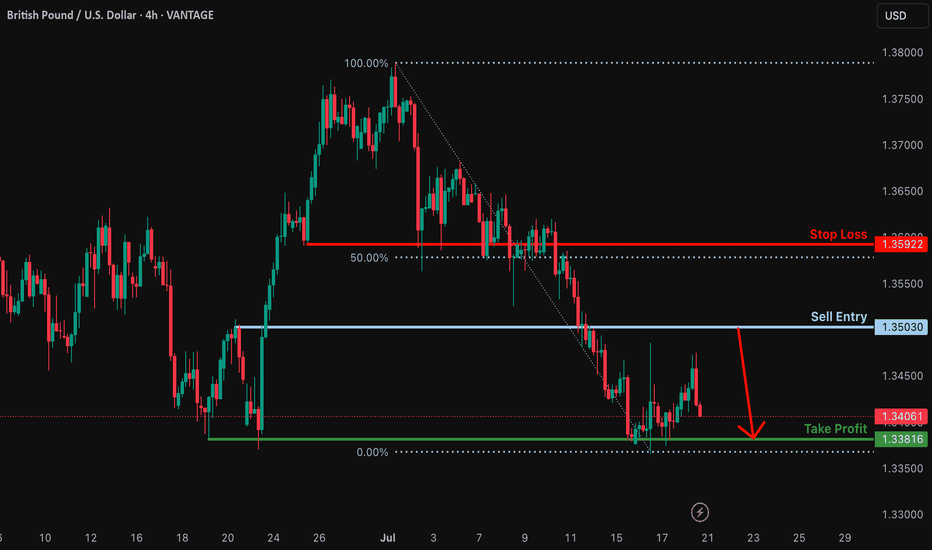

Bearish reversal off pullback resistance?GBP/USD is rising towards the resistance which is a pullback resistance and could drop from this level to our take profit.

Entry: 1.3603

Why we like it:

There is a pullback resistance level.

Stop loss: 1.3592

Why we like it:

There is a pullback resistance that is slightly above the 50% Fibonacci retracement.

Take profit: 1.3361

Why we like it:

There is a pullback support.

Enjoying your TradingView experience? Review us!

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.

GBPUSD is in the Selling DirectionHello Traders

In This Chart GBPUSD HOURLY Forex Forecast By FOREX PLANET

today GBPUSD analysis 👆

🟢This Chart includes_ (GBPUSD market update)

🟢What is The Next Opportunity on GBPUSD Market

🟢how to Enter to the Valid Entry With Assurance Profit

This CHART is For Trader's that Want to Improve Their Technical Analysis Skills and Their Trading By Understanding How To Analyze The Market Using Multiple Timeframes and Understanding The Bigger Picture on the Charts

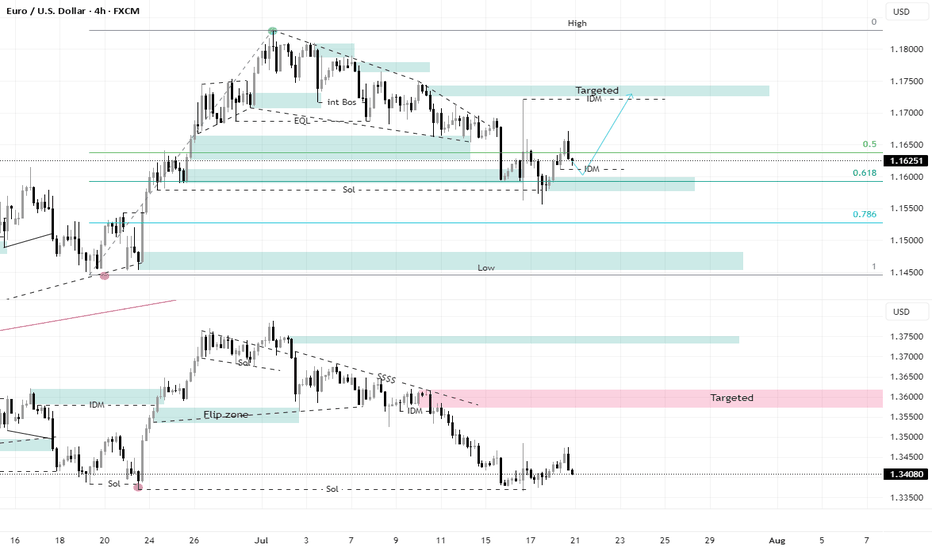

DXY was looking for More Liquidity to sweepIt appears that the DXY was searching for more liquidity before continuing its decline. There are good buying areas for the EURUSD, as the liquidity swept to the bottom, and the immediate rebound indicates the strength of this area and can be considered a buying zone.

This area coincides with the 61 Fibonacci support line, confirming the possibility of an upside move.

The GBPUSD was targeting the bottom to trigger a liquidity sweep on the weekly timeframe. This is also an SMT signal, but it is somewhat weak, but it confirms the complete vision of the analysis.

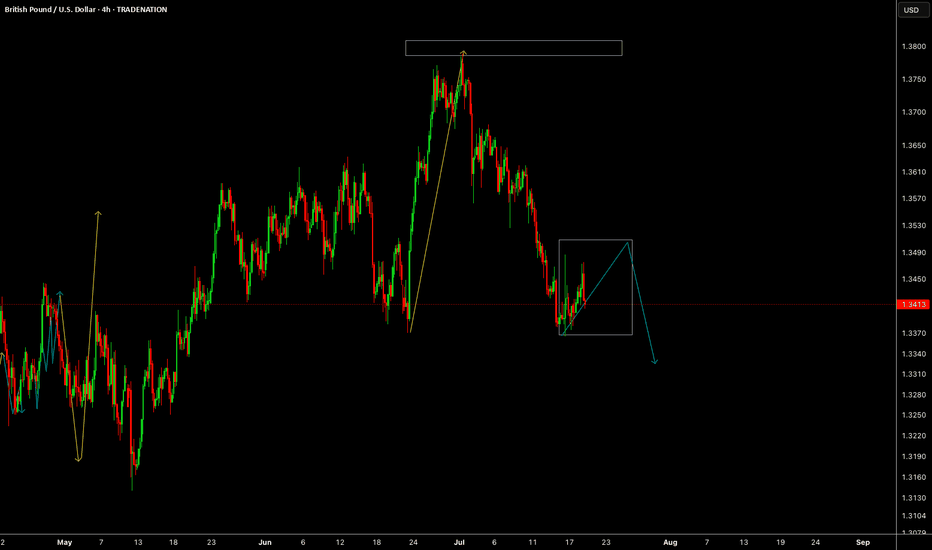

GBPUSD July Playbook: Bearish Setup at Channel High GBPUSD just printed a CC SELL signal right at the top of its rising channel — setting the stage for a potential July pullback.

📌 Breakdown using Vinnie’s Trading Cheat Code System:

✅ RSI Overbought zone triggered

✅ CC Sell + Confirm Sell combo at channel resistance (~1.38)

✅ Price stretched far above the mean with no higher timeframe support nearby

✅ MACD histogram rolling over — momentum shift in play

🎯 Targets:

1.3500 (channel median / recent base)

1.3280 (deeper support / previous Confirm Buy area)

This looks like a textbook trap-the-buyers setup. Patience on the entry — I’ll be stalking rallies to sell into.

🧠 Tools Used:

Vinnie’s Confirm Alerts

CC Trend Indicator

RSI OB/OS Scanner

MACD HPS Screener

Following this closely — could be one of the cleanest short opportunities of the month.