Gbpusdanalysis

GBPUSD is in the Selling DirectionHello Traders

In This Chart GBPUSD HOURLY Forex Forecast By FOREX PLANET

today GBPUSD analysis 👆

🟢This Chart includes_ (GBPUSD market update)

🟢What is The Next Opportunity on GBPUSD Market

🟢how to Enter to the Valid Entry With Assurance Profit

This CHART is For Trader's that Want to Improve Their Technical Analysis Skills and Their Trading By Understanding How To Analyze The Market Using Multiple Timeframes and Understanding The Bigger Picture on the Charts

GbpUsd is approaching a strong sell zoneExactly one week ago, I pointed out that while TRADENATION:GBPUSD strength persists, the pair is approaching a significant sell zone , starting at the psychological level of 1.30.

This level was touched recently, and the pair is currently fluctuating within this range now.

My view remains the same: GBP/USD is likely to experience a drop in the near future, and I’m now looking for potential entries for a swing trade.

As mentioned before, 1.30 is a key psychological level, with the technical resistance just above it at 1.3050. Additionally, GBP/USD is known for its volatility, and this resistance zone extends slightly above 1.31.

In conclusion, traders should consider selling rallies, with a target around 1.27, aiming for at least a 1:2 risk-to-reward ratio when setting their stop loss.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analyses and educational articles.

GBP/USD Market Outlook & Analysis (Bullish)**GBP/USD Market Outlook & Analysis**

**📊 Price Action & Key Levels**

- **GBP/USD trades around 1.29300** in a narrow range, struggling for momentum.

- Last week’s **high of 1.29900** remains a key resistance level.

- **Key Support Levels:**

- **1.29000 (Psychological level)** → A breakdown may trigger more downside.

- **1.2850 (Next key support)** → Watch for buying interest.

- **Key Resistance Levels:**

- **1.2990 (Last week's peak)** → A breakout could open doors for **1.3050+.**

**🌍 Fundamental Drivers**

- **USD Weakness:**

- Fears that **Trump’s tariffs could slow the US economy** weigh on the dollar.

- Weak US inflation and a **cooling labor market** increase **rate cut expectations** for 2024.

- University of Michigan’s **Consumer Sentiment Index fell** to a 2.5-year low, fueling bearish sentiment.

- **GBP Struggles Despite BoE Expectations:**

- **UK GDP contracted by 0.1% in January**, capping the pound’s upside.

- However, **expectations that the BoE will cut rates more slowly than the Fed** provide support for GBP/USD.

**📅 Key Events to Watch**

- **Monday:** US **Retail Sales & Empire State Manufacturing Index**.

- **Wednesday:** **FOMC meeting** → Market expects no rate change but will closely watch guidance.

- **Thursday:** **BoE meeting** → If policymakers signal slower rate cuts, GBP could strengthen.

**📈 Trading Strategy & Takeaways**

- **Bullish bias above 1.29300** if the dollar remains under pressure.

- **Break above 1.29400** could see GBP/USD testing **1.3050** in the short term.

- **If 1.29000 breaks,** watch for a potential dip toward **1.28500** before buyers step in.

- **Major volatility expected midweek** with FOMC & BoE—trade cautiously!

📢 **Final Word:** GBP/USD remains in a tug-of-war between a weak USD and soft UK data. Stay patient and wait for confirmation before making moves! 💹🔥 #Forex #GBPUSD

GBP/USD - 4H Chart Analysis & Trade Setup

Market Overview:

GBP/USD has been in an uptrend, forming a rising channel structure.

The price is now testing a resistance zone, potentially indicating a reversal.

Technical Analysis:

Trend: Bullish (but approaching key resistance)

Resistance Level: 1.29720 - 1.30000 (Highlighted Zone)

Support Level: 1.24906 (Potential target)

Stop Loss: 1.30970 (Above resistance)

Pattern: Rising Channel Breakout Setup

Trade Idea (Short Setup):

🔴 Sell Entry: Near 1.29720 (Resistance rejection confirmation)

✅ Target: 1.24906 (Major support zone)

⛔ Stop Loss: 1.30970 (Above resistance to avoid fakeouts)

Conclusion:

GBP/USD is testing key resistance and may face bearish rejection.

A break below the channel confirms bearish momentum towards 1.24906.

Traders may consider short positions with a defined risk-reward setup.

📉 Bearish bias unless price breaks above resistance.

GBPUSD Trading Strategy for Next WeekIf no major unexpected situations occur, the GBP/USD is most likely to embark on a downward journey. Dominated by bears, it will gradually decline in a volatile manner, testing the key support level below.

GBPUSD Trading Strategy for Next Week:

GBPUSDsell@1.2930-1.2980

tp:1.2900-1.2850

sl:1.3000

I firmly believe that realized profits and a high win rate are the best measures of trading proficiency.

Every day, I share highly accurate trading signals. These signals include precise entry points, stop-loss levels for risk control, and profit targets derived from in-depth analysis.

Follow me to unlock substantial returns in the financial markets.

Click on my profile to access trading guides on market trends, trading strategies, and risk management.

GBP/USD Bullish Breakout AnalysisThe GBP/USD currency pair has successfully broken above a key bullish trendline, signaling potential further upside momentum. This breakout suggests that buyers are gaining control, and the pair could continue its upward movement toward the next resistance levels.

Current Market Structure & Key Levels:

Breakout Confirmation: The pair has breached the bullish trendline resistance, indicating renewed bullish strength.

Immediate Resistance: The price is currently facing a strong resistance level at 1.28120. This level is critical as it could act as a temporary hurdle before further upside movement.

Break & Continuation: If GBP/USD successfully breaks and holds above 1.28120, we can expect bullish continuation toward the next upside targets at 1.28700 and 1.29650.

Support Levels: In case of a retracement, the pair might find support at the previously broken trendline, which could now act as a demand zone.

Technical Outlook:

Momentum Shift: The breakout of the trendline suggests a shift in momentum favoring buyers.

Volume Confirmation: If the breakout is accompanied by increasing trading volume, it will further strengthen the bullish bias.

Fundamental Factors: Any economic data releases related to GBP or USD, as well as central bank decisions, could influence price action and confirm or invalidate the breakout.

Trading Plan:

A confirmed break and retest of 1.28120 could provide a good buying opportunity with upside targets of 1.28700 and 1.29650.

A failure to break this resistance may result in a temporary pullback before another attempt at a breakout.

Traders should monitor price action, volume, and potential news catalysts to validate the breakout for further bullish continuation.

GBP/USD "The Cable" Forex Market Bullish Heist Plan🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑💰🐱👤🐱🏍

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the GBP/USD "The Cable" Forex market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is the high-risk Red Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 🏆💸Book Profits Be wealthy and safe trade.💪🏆🎉

Entry 📈 : "The vault is wide open! Swipe the Bullish loot at any price - the heist is on!

however I advise placing Buy limit orders within a 15 or 30 minute timeframe. Entry from the most recent or closest low or high level should be in retest.

Stop Loss 🛑: Thief SL placed at (1.25500) swing Trade Basis Using the 6H period, the recent / swing low level.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯: 1.29300 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

📰🗞️Fundamental, Macro, COT Report, Quantitative Analysis, Intermarket Analysis, Sentimental Outlook:

GBP/USD "The Cable" Forex Market market is currently experiencing a bullish trend,., driven by several key factors.

🔰Fundamental Analysis

1. Economic Indicators: The UK's GDP growth rate, inflation rate, interest rate, and employment figures are strong, supporting a bullish outlook.

2. Central Bank Policies: The Bank of England's decision to keep interest rates low has weakened the pound, but the Federal Reserve's hawkish stance has strengthened the dollar.

3. Fiscal Policies: The UK government's spending and taxation policies have been neutral, while the US government's policies have been supportive of economic growth.

🔰Macroeconomic Factors

1. Trade Balance: The UK's trade balance has improved, supporting a bullish outlook.

2. Political Stability: The UK's political stability has improved, while the US's political stability has been neutral.

3. Global Economic Trends: Global economic trends have been supportive of a bullish outlook.

🔰Global Market Analysis

1. Commodity Prices: Commodity prices have been neutral, with oil prices steady and gold prices slightly higher.

2. Currency Correlations: The GBP/USD pair has a strong positive correlation with the EUR/USD pair.

3. Global Economic Trends: Global economic trends have been supportive of a bullish outlook.

🔰COT Data

1. Commitment of Traders Report: The report shows that commercial traders are net long, while non-commercial traders are net short.

2. Open Interest: Open interest has increased, indicating a potential trend reversal.

3. Commercial Positions: Commercial traders' positions indicate a bullish outlook.

🔰Intermarket Analysis

1. Correlations with Other Markets: The GBP/USD pair has a strong positive correlation with the EUR/USD pair and a negative correlation with the USD/JPY pair.

2. Divergences: There are no significant divergences between the GBP/USD pair and other markets.

🔰Quantitative Analysis

1. Technical Indicators: Technical indicators, such as moving averages and RSI, indicate a bullish outlook.

2. Statistical Models: Statistical models, such as regression analysis, indicate a bullish outlook.

🔰Market Sentiment Analysis

1. Trader Sentiment: Trader sentiment is bullish, with a majority of traders expecting the pair to rise.

2. Sentiment Indicators: Sentiment indicators, such as sentiment indexes and put-call ratios, indicate a bullish outlook.

🔰Positioning

1. Long/Short Positions: Long positions are increasing, while short positions are decreasing.

2. Positioning Data: Positioning data indicates a bullish outlook.

🔰Next Trend Move

1. Bullish/Bearish Outlook: The outlook is bullish, with a potential target of 1.3000.

2. Trend Analysis: Trend analysis indicates a potential trend reversal.

🔰Overall Summary Outlook

1. Bullish Outlook: The overall outlook is bullish, with a potential target of 1.3000.

2. Volatility Expected: Volatility is expected to remain high in the short term.

📌Keep in mind that these factors can change rapidly, and it's essential to stay up-to-date with market developments and adjust your analysis accordingly.

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

GBP/USD 30-Minute Bearish Trade Setup & Analysis200 EMA (Blue) at 1.29285 – Represents long-term trend support/resistance.

30 EMA (Red) at 1.29329 – Represents short-term trend direction.

Trade Setup:

Entry: The trade seems to enter near the 30 EMA after price rejects a resistance zone (highlighted in purple).

Stop Loss: Placed above the resistance zone at around 1.29564 - 1.29568.

Take Profit Levels:

TP1: ~1.29250

TP2: ~1.28996

TP3: Final target at ~1.28827

Market Analysis:

The price has rejected the 30 EMA, signaling potential bearish movement.

The downtrend projection suggests a possible break below 1.29250, aiming for the lower support levels.

The risk-to-reward ratio appears favorable, with a tight stop loss and multiple profit-taking points.

Possible Scenarios:

Bearish Case (High Probability): If price stays below the 30 EMA, it may continue down towards the target points.

Bullish Case (Low Probability): If price breaks above the resistance zone, it could invalidate the short setup, triggering the stop loss.

Would you like a deeper analysis or confirmation with another indicator?

#GBPUSD 4HGBPUSD (4H Timeframe) Analysis

Market Structure:

The price is currently trading near a key resistance area, where previous selling pressure has been observed. This level has historically acted as a barrier, rejecting upward movements and leading to price declines.

Forecast:

A sell opportunity is anticipated from the resistance area if the price shows signs of rejection, such as bearish candlestick patterns or a decrease in buying momentum.

Key Levels to Watch:

- Entry Zone: Consider entering a sell position if the price fails to break above the resistance and confirms rejection.

- Risk Management:

- Stop Loss: Placed above the resistance area or recent swing high to manage risk.

- Take Profit: Target nearby support levels for potential downside movement.

Market Sentiment:

The resistance area is a critical zone to monitor for potential price reversal. Confirmation through bearish signals is recommended before executing a trade.

Market Analysis: GBP/USD RalliesMarket Analysis: GBP/USD Rallies

GBP/USD is showing bullish signs above the 1.2870 zone.

Important Takeaways for GBP/USD Analysis Today

- The British Pound is gaining pace above the 1.2870 zone against the US Dollar.

- There is a connecting bullish trend line forming with support at 1.2925 on the hourly chart of GBP/USD at FXOpen.

GBP/USD Technical Analysis

On the hourly chart of GBP/USD at FXOpen, the remained in a positive zone above the 1.2560 level. The British Pound formed a base and started a fresh increase against the US Dollar, as mentioned in the previous analysis.

The pair gained pace for a move above the 1.2715 and 1.2760 resistance levels. The pair even settled above the 1.2900 level and the 50-hour simple moving average.

On the upside, the GBP/USD chart indicates that the pair is facing resistance near 1.2965. The next major resistance is near the 1.2980 level. If the RSI moves above 60 and the pair climbs above 1.2980, there could be another rally. In the stated case, the pair could rise toward the 1.3050 level or even 1.3120.

On the downside, there is a major support forming near 1.2925. There is also a connecting bullish trend line forming with support at 1.2925. If there is a downside break below the 1.2925 support, the pair could accelerate lower.

The next major support is near the 1.2870 zone or the 23.6% Fib retracement level of the upward move from the 1.2559 swing low to the 1.2966 high, below which the pair could test 1.2800.

Any more losses could lead the pair toward the 1.2760 support. It is close to the 50% Fib retracement level of the upward move from the 1.2559 swing low to the 1.2966 high.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

GBP/USD Strength Persists, but Watch for Reversal at 1.30Similar to EUR/USD, GBP/USD experienced a strong rally starting in March, breaking above the key resistance level in the 1.2775 zone.

Over the past three days, the pair has consolidated well above the broken resistance level, suggesting that another upward spike is likely.

However, the 1.30 level is both a significant technical and psychological barrier. If the price reaches this zone, a correction could follow.

In conclusion, I’m closely watching the pair, and if we see a spike toward 1.30, I will look for selling opportunities.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analyses and educational articles.

GBPUSD Analysis todayHello traders, this is a complete multiple timeframe analysis of this pair. We see could find significant trading opportunities as per analysis upon price action confirmation we may take this trade. Smash the like button if you find value in this analysis and drop a comment if you have any questions or let me know which pair to cover in my next analysis.

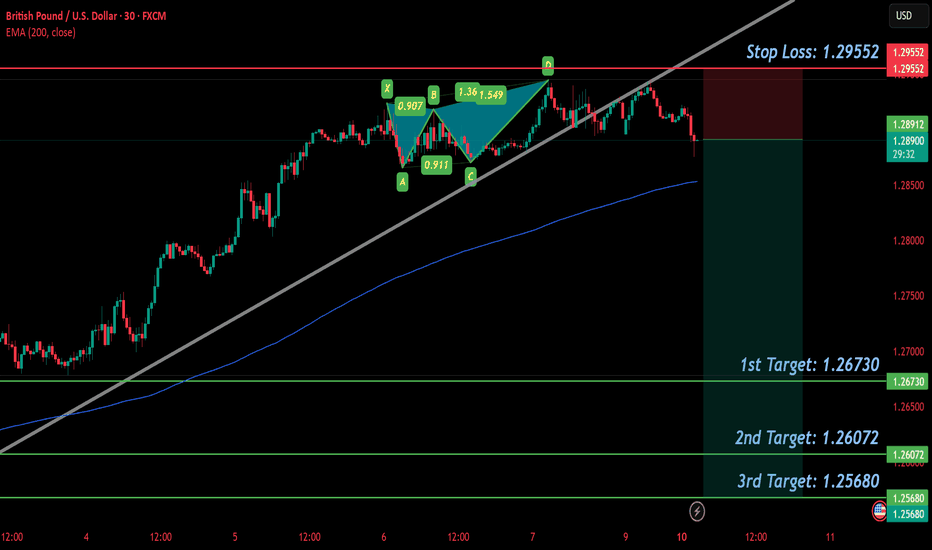

GBP/USD SELL IDEA (R:R=5)Selling GBP/USD now. I placed a sell earlier at 1.29276 after seeing a wonderful BUTTERFLY form on the 30 min chart. Already starting to form lower highs and lower lows on smaller timeframes.

Stop Loss is: 1.29552

(Due to SL hunting)

Please move SL to break even when trade is 100+ pips in profit.

1st Target: 1.26730

2nd Target: 1.26072

3rd Target: 1.25680

Happy Trading! :)

GBPUSD Weekly FOREX Forecast: March 10 - 14th In this video, we will analyze EURUSD and EUR Futures. We'll determine the bias for the upcoming week, and look for the best potential setups.

The GBP has been a bit stronger than its counterparts, and has shown bullish intent in recent days. Friday's candle was very strong, and price is likely to see higher prices over the next week.

A correction to Friday's candle is likely, followed by longer term bullishness.

Enjoy!

May profits be upon you.

Leave any questions or comments in the comment section.

I appreciate any feedback from my viewers!

Like and/or subscribe if you want more accurate analysis.

Thank you so much!

Disclaimer:

I do not provide personal investment advice and I am not a qualified licensed investment advisor.

All information found here, including any ideas, opinions, views, predictions, forecasts, commentaries, suggestions, expressed or implied herein, are for informational, entertainment or educational purposes only and should not be construed as personal investment advice. While the information provided is believed to be accurate, it may include errors or inaccuracies.

I will not and cannot be held liable for any actions you take as a result of anything you read here.

Conduct your own due diligence, or consult a licensed financial advisor or broker before making any and all investment decisions. Any investments, trades, speculations, or decisions made on the basis of any information found on this channel, expressed or implied herein, are committed at your own risk, financial or otherwise.

GBPUSD Bearish ContinuationGBPUSD price seems to exhibit signs of overall Bearish momentum as the price action may form a credible Lower High with multiple confluences through key Fibonacci and Resistance levels which presents us with a potential short opportunity.

Trade Plan :

Entry @ 1.2580

Stop Loss @ 1.2830

TP 0.9 - 1 @ 1.23550 - 1.2330

DeGRAM | GBPUSD will correct before continuing to growGBPUSD is in an ascending channel between the trend lines.

The price is moving from the lower boundary of the channel, but has already reached the 62% retracement level.

Indicators point to an overbought chart.

We expect a local correction before the growth continues.

-------------------

Share your opinion in the comments and support the idea with a like. Thanks for your support!

GBPUSD is in the Selling DirectionHello Traders

In This Chart GBPUSD HOURLY Forex Forecast By FOREX PLANET

today GBPUSD analysis 👆

🟢This Chart includes_ (GBPUSD market update)

🟢What is The Next Opportunity on GBPUSD Market

🟢how to Enter to the Valid Entry With Assurance Profit

This CHART is For Trader's that Want to Improve Their Technical Analysis Skills and Their Trading By Understanding How To Analyze The Market Using Multiple Timeframes and Understanding The Bigger Picture on the Charts