FOMC Minutes in the Charts: EUR/USD & GBP/USDDuring their June meeting, minutes released on Wednesday indicated that almost all Federal Reserve officials expect further tightening in the future. Despite the majority's belief in upcoming rate hikes, policymakers chose not to increase rates due to concerns about over-tightening. They acknowledged the delayed impact of previous policies and other factors, which led them to skip the June meeting after implementing ten consecutive rate increases.

Out of the 18 participants, all but two anticipated at least one rate hike to be appropriate within this year, while twelve members expected two or more hikes.

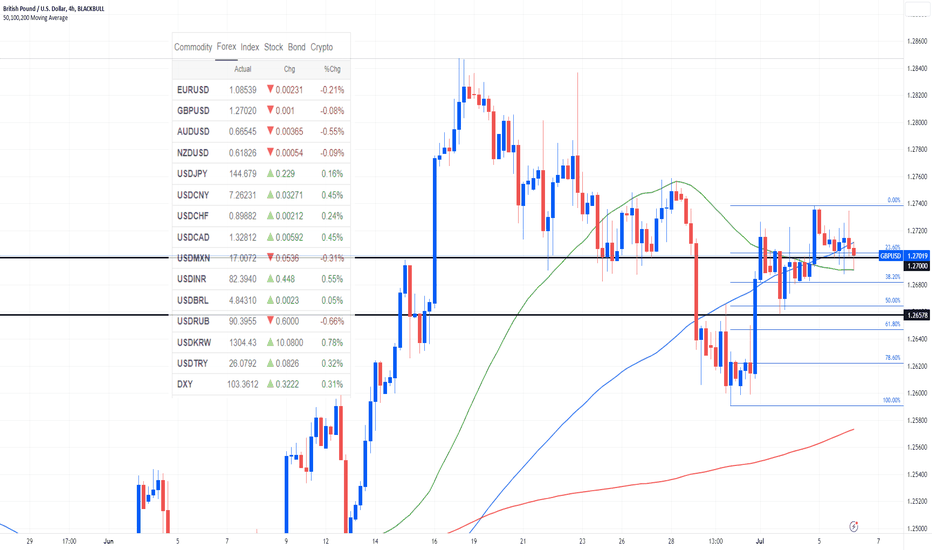

The prevailing consensus that the US central bank will raise borrowing costs by 25 basis points at the end of the July policy meeting has lent some strength to the US Dollar and exerted downward pressure on the GBP/USD and EUR/USD. The DXY (US Dollar Index) surged above 103.30, reaching its highest level of the week.

EUR/USD further declined to the 1.0850 region. The outlook for the Euro has turned negative as the EUR/USD pair dropped below the 20-day simple moving average (SMA).

If the GBP/USD pair falls below 1.2700 and confirms that level as resistance, the next potential bearish targets could be 1.2680, 1.2658, 1.2647 according to fib retracement levels and previously pivot points.

Gbpusdforecast

GBPUSD Weekly Outlook: New perspective for the week | Follow-upThis video provides a comprehensive analysis of the bullish and bearish sentiment in GBPUSD, focusing on price action-based technical analysis of support and resistance levels within the 4-hour timeframe.

In the previous week, Federal Reserve Chair Jerome Powell emphasizes the necessity for further rate hikes, and adding to the market volatility, the Bank of England surprises with a larger-than-expected rate hike, causing a stir in investor sentiment. This bullish attempt is evident on the charts around the $1.27000 zone, reflecting a momentary boost following the Bank of England's 50 basis point increases to a nearly one-year high.

Traditionally, higher interest rates lend support to currencies, but the Pound Sterling faces the risk of a potential recession in the U.K., prompting investors to seek refuge in safe-haven assets like the U.S. dollar. U.K. retail sales data, released recently, reveals a 2.1% annual decline in May, further indicating an economic slowdown.

On the U.S. economic front, Federal Reserve Chair Jerome Powell concludes his two-day testimony before Congress, reiterating the potential for at least two more interest rate hikes this year to combat rising inflation.

Looking ahead, the trajectory of the Pound Sterling will be influenced by upcoming announcements of Gross Domestic Product data from both economies this week. In light of these latest economic developments, questions arise: If the larger-than-expected rate hike from the Bank of England fails to generate positive price movement for the Pound, how will the United Kingdom navigate its persistent inflationary pressures?

This video illustrates a comprehensive analysis of the bullish and bearish sentiment in GBPUSD, focusing on a technical examination of support and resistance levels within the 4-hour timeframe. We uncover how these critical levels can unlock potential trading opportunities for the upcoming week. Notably, I highlighted a key level at the $1.27000 zone, coinciding with the ascending trendline identified in the 4H timeframe. The market's response to this zone at the beginning of the week will wield considerable influence over the direction of price action in the days to come.

Stay connected to the channel and remain engaged in the comment section to stay informed about the latest updates and developments. Thank you for watching, and I eagerly anticipate providing you with further insights into my future content.

Disclaimer:

Trading on margin in the foreign exchange market (including commodities, CFDs, stocks, etc.) carries a high level of risk and may not be suitable for all investors. The content of this speculation (including all data) is provided by me for educational and informational purposes only to assist in making independent investment decisions. All information presented here is for reference purposes only, and I do not accept any responsibility for its accuracy.

It is important that you carefully consider your investment experience, financial situation, investment objectives, and risk tolerance level, and seek advice from an independent financial advisor to assess the suitability of your situation before making any investment.

I do not guarantee the accuracy of the information provided and shall not be held liable for any loss or damage that may arise directly or indirectly from the content or the receipt of any instructions or notifications related to it.

Please note that past performance is not necessarily indicative of future results.

GBPUSD 23June2023Currently the price is forming a bearish channel, sometimes I call it compression. usually if there is price compression like this, it will look for the strongest support area before continuing the impulse wave.

if you see the red area as daily support & fibo retracement area that intersects with each other, then there is a high probability that the price will respond positively to the area before continuing its bullish trend again.

GBPUSD Forecast 18June2023if you look at the shape of the swing structure that occurs, at first glance it looks like a cup & handle pattern will occur. we only assume based on market habits, usually if a curve like this has been formed, another shape will occur.

At least we can anticipate, if you want to go long, it's better to wait until the price retraces in the H4/D1 Support area.

Looking at the position of the fibo extension, it also supports the analysis that this pair is likely to be bullish until the D1 Resistance area where the area is also the fibo extension point of 2,618.

GBPUSD Top-down analysis Hello traders, this is a complete multiple timeframe analysis of this pair. We see could find significant trading opportunities as per analysis upon price action confirmation we may take this trade. Smash the like button if you find value in this analysis and drop a comment if you have any questions or let me know which pair to cover in my next analysis.

GBPUSD 13June2023if you look at the existing curves, there is indeed a possibility for prices to continue to bullish to the SnD area, my analysis still hasn't changed. I still see this pair in a correction period. the upper limit is the invalid area, as long as the price does not rise more than the invalid area, it is better to look for opportunities to short.

#GBPUSD-700+ SELLING SETUP❤️TRADERS, we still believe GBPUSD price will come to this region before it start dropping heavily, let's not miss out on this great opportunity. Price dropped recently due to bullishness of the DXY though next week NFP is our target. Which will help a lot.

Like and Share.

Thanks all, as always ❤️

GBPUSD 8June2023for the medium term, it could be until next week, I think this pair will be bullish until the SnD area above. in my opinion the current position occurs FTR, FTR (failed to return) is a condition where prices do not respond to the SnD area. usually if this happens, there is a fairly high price jump when bullish.

GBPUSD : Current Situation & Technical , Fundamental View#GBPUSD

- Currently the MARKET SENTIMENT for GBPUSD is slightly UP SIDE. All MARKETS including STOCKS and STOCKS may be UP due to MARKET RISK ON in the past days. It affects the POUND greatly. GBPUSD may be slightly UP this week. Anyway, XXXUSD PAIRS are being BUYed slightly higher because the FED is a bit dovish.

- The price can definitely move up to the SUPPORT LEVEL below the GBPUSD. The reason for that is because there is a slightly UP BIAS in the MARKET for USD. But GBPUSD can be BUY until 1.2900 LEVEL. Before that, you can SELL at 1.2355 LEVEL. So go to GBPUSD SELL ENTRIES.

GBPUSD top-down analysis Hello traders, this is a complete multiple timeframe analysis of this pair. We see could find significant trading opportunities as per analysis upon price action confirmation we may take this trade. Smash the like button if you find value in this analysis and drop a comment if you have any questions or let me know which pair to cover in my next analysis.

GBPUSD 3June2023if you look at the current falling price, it is possible that wave b is still not complete. this swing that occurred formed an FTR (failed to return) pattern, the price failed to return to the SnD area. be careful if you want to sell, in my opinion it is better to wait for the price to rise back to the SnD area.

GPBUSD We could see more continuation to the downside(130pips)The main idea of this analysis begin with an important low that have not been liquidated yet. The monthly low of April 3, 2023 is where the price is moving to in short term. Before the price make a reversal to start moving higher this important level needs to be liquidated.

Fundamentals

Odds are highest for an agreement late tonight or tomorrow, Goldman said, enabling a House vote on Tuesday or Wednesday. The GOP warned a “lot of hangups” remain.

A soonest all this process is complete we could expect a stronger dollar. The market has been very optimistic which had make the dollar strong this past few weeks. With the dollar getting stronger this move that we are expecting is more likely to happen.

Monthly

The price is currently making higher highs. In this time frame we have bullish structure. This bullish structure goes against our bearish analysis. This doesn't means anything because we are waiting a short term move. Also, the price has more room to make a deeper correction.

Weekly

The price is currently making is correction for a possible continuation to the upside. There is more room for the continuation keep continued lower.

Daily

Price is currently in a downtrend making lower lows. The price is currently making a correction for a possible continuation to the downside. The price before making any reversal will try to get the most liquidity it can. Before any changes in trend the price will get to the level we want it.