GBPUSD NEW UPDATESHello, Its been a long time since no post new ideas here!

Here is my longterm/swing trades on FX:GBPUSD , I recommend on longs only at below entry.

This idea base only on my own. This is also daily, it might take or not.

But the idea here is long at this zone, see the chart for your view.

This is not a financial advice, my idea on pound is continue to rise or clear the above previous high 1.34 zone or more highs.

This is your longterm/swing trades.

Trade wisely, I will update once the price breaks the first $$$ target zone.

Do your charts and compare it.

Follow for more.

Gbpusdlong

Just broke through a high liquidity zone!!It just broke through a high liquidity zone!!

The marked line is the arrival point.

We still have plenty of profit-making possibilities left, so be patient.

Wait for a good pullback with the corresponding manipulation to find a good re-entry!!

If the market goes without us, it's better to take a loss where we don't know what we're doing.

Note: (A fairly crowded zone is always a liquidity zone.)

Keep it simple!

If you liked it, don't forget to follow me!

GBPUSD is in the Selling DirectionHello Traders

In This Chart GBPUSD HOURLY Forex Forecast By FOREX PLANET

today GBPUSD analysis 👆

🟢This Chart includes_ (GBPUSD market update)

🟢What is The Next Opportunity on GBPUSD Market

🟢how to Enter to the Valid Entry With Assurance Profit

This CHART is For Trader's that Want to Improve Their Technical Analysis Skills and Their Trading By Understanding How To Analyze The Market Using Multiple Timeframes and Understanding The Bigger Picture on the Charts

GBPUSD:This is a bullish situationThe GBP/USD is still fluctuating repeatedly at present. Taking various factors into account, there is a great deal of market noise in the current currency market, and many currency pairs are in a sideways trend.

The British pound has been fluctuating sideways for several weeks, and the market is digesting the previous significant upward rally. The 1.30 level on the upside serves as a resistance level, while the 1.29 level on the downside acts as a support level. The so-called "golden cross" has recently occurred, so this is a bullish market.

Trading strategy:

buy@1.2910

TP:1.2970-1.2990

Get daily trading signals that ensure continuous profits! With an astonishing 90% accuracy rate, I'm the record - holder of an 800% monthly return. Click the link below the article to obtain accurate signals now!

GBPUSD Be bullishWhen the GBPUSD pair executes a definitive breach of the 1.30000 resistance ceiling — a level of both psychological and technical significance — it is poised to precipitate a substantial influx of bullish sentiment. This event not only satisfies key technical prerequisites for an upward price trajectory but also catalyzes a profound shift in market sentiment.

Consequentially, diverse market participants, ranging from institutional hedge funds to high - volume forex dealers and astute retail investors, will be drawn to the market, precipitating a marked upswing in trading volumes. The resultant robust buying momentum is forecast to drive the formation of a pronounced uptrend, propelling the pair to appreciably higher price levels.

From a forward - looking perspective, resistance levels at 1.31400 and 1.32100 are likely demarcated by prior price action, Fibonacci retracement ratios, or psychologically significant thresholds. As the pair gravitates towards these levels, short - term traders who previously established short positions at higher price points will likely execute mass short - covering, inundating the market with selling pressure.

Simultaneously, long - term bulls seeking to realize profits will contribute to the selling pressure, further exacerbating the downward - leaning market dynamics. These converging forces may well impede the pair’s upward progression and potentially instigate a short - term price correction.

Should the GBPUSD pair fail to surmount the 1.30000 resistance hurdle and commence a retracement, the 1.28800 level — identified as a zone of prior price congestion or corroborated by key technical indicators — is anticipated to attract value - seeking buyers. The influx of buying interest at this level may effectively arrest the downward momentum.

Deeper into the price spectrum, the 1.27000 level, which aligns with major moving averages or critical trendlines, functions as a pivotal line of defense. Given its status as a widely recognized strong support zone, a substantial influx of buying pressure is likely to materialize as the price approaches this level, thereby forestalling a more significant price decline and fostering market stability.

💎💎💎 GBPUSD 💎💎💎

🎁 Buy@1.28800 - 1.29000

🎁 TP 1.30000 - 1.31400

The market has been extremely volatile lately. If you can't figure out the market's direction, you'll only be a cash dispenser for others. If you also want to succeed,Follow the link below to get my daily strategy updates

GBP/USD Longs from 1.28900 back up to 1.30000I’m looking for long opportunities around the 5-hour demand zone, aiming to take price back up to the 6-hour supply zone, where I will then look for potential sell setups.

Since price is currently positioned between these key levels, I will wait to see where it starts to slow down and how it reacts. Ideally, I want to see accumulation in the demand zone and distribution in the supply zone before making any decisions. However, overall, my bias for GU remains bullish, especially as the U.S. dollar continues to weaken.

Confluences for GU Buys:

- A clear 5-hour demand zone presents a potential buying opportunity.

- Liquidity remains to the upside, which price may target before a reversal.

- DXY has shifted bearish, indicating a potential bullish move for GBP/USD.

- Price has been consistently bullish on the higher timeframe over the past few weeks.

Note: If price breaks below the nearby demand zone, I will expect a temporary bearish trend to form.

GBPUSD:The strategy for next week remains bullishOn Friday, the GBP/USD traded and stopped at 1.2943, hovering near the upper end of the recent trading range. The currency pair has regained the ground above the 50-day Exponential Moving Average (EMA) at 1.2933, and currently, this level serves as an intraday support level, while the 200-day EMA at 1.2896 continues to underpin the broader momentum. The price movement is approaching the resistance zone of 1.2973 to 1.3008, which has restricted multiple rebound attempts this month. Breaking through this level may reach 1.3014. On the downside, the pivot point at 1.2937 and 1.2903 remain key levels worthy of attention. The short-term structure is constructive, but the bulls need a clear breakout to confirm the continuation of the trend beyond the resistance of the downward trend line.

Trading strategy:

buy@1.2910

TP:1.2970-1.2990

Get daily trading signals that ensure continuous profits! With an astonishing 90% accuracy rate, I'm the record - holder of an 800% monthly return. Click the link below the article to obtain accurate signals now!

GBPUSD longAll timeframes are extremely bullish with each timeframe having its own individual target.

3 month timeframe has a target of 1.39

1 month timeframe has a target of 1.3450

Weekly timeframe has a target of 1.3135

Daily timeframe has a target of 1.3020

My main focus is on the daily target as of now.

Price took a lot of orders at the 1.2600 psychological level and there was a lot of bullish orders.

Price broke and retested the 1.2880 liquidity region and the next target was 1.3020, however, that target was never hit.

All price is currently doing is collecting orders in order to reach that target

Yesterday and today during the Asian session, we see that price took orders at 1.2880, indicating that price is headed to 1.3020 target.

I expect numerous buy setups to form before we reach the 1.3020 target. I will update them as they form.

GBP/USD: Struggles at Resistance, Risks of Weak Oscillation PersDuring the European session on Tuesday, GBP/USD held steady above 1.29000. However, the technical outlook maintained a bearish bias. The US dollar strengthened due to upbeat data, suppressing the rebound of the British pound. The exchange rate faced resistance at key resistance levels when attempting to rise.

If it fails to break through these resistance levels, in the short term, it may continue the weak, oscillatory downward trend, and the downside risks still remain. The market lacks strong momentum, and overall, it stays in a weak, oscillatory pattern.

GBPUSD

sell@1.29600-1.29900

tp:1.28800

I will share trading signals every day. All the signals have been accurate for a whole month in a row. If you also need them, please click on the link below the article to obtain them.

EURUSD and GBPUSD Analysis todayHello traders, this is a complete multiple timeframe analysis of this pair. We see could find significant trading opportunities as per analysis upon price action confirmation we may take this trade. Smash the like button if you find value in this analysis and drop a comment if you have any questions or let me know which pair to cover in my next analysis.

GBP/USD: Weekly Analysis and Key LevelsThis week, the GBP/USD exchange rate has experienced notable fluctuations. As of March 22nd, the pair stood at 1.29114, down 0.00540 (0.42%) from the previous day. The intraday high reached 1.2971, while the low touched 1.2887. On Thursday (March 20th), the Bank of England announced its interest rate decision, keeping the benchmark rate unchanged at 4.5% with an 8-1 vote. Following the announcement, GBP/USD faced brief downward pressure as the central bank did not signal potential rate cuts. However, the pair later regained some ground due to a weakening US dollar index.

Closely monitor the breakout of key levels. The area above 1.3010 is a significant resistance level. If the exchange rate can decisively break through and stabilize above this level, consider going long on dips in the short term, targeting 1.3050 or higher. Below, the 1.2860 level is a crucial support zone. If the exchange rate breaks below this level and sustains the move, consider cutting losses or going short on rallies, as further downside potential may open up. Until the exchange rate clearly breaks through or falls below these key levels, it is advisable to remain on the sidelines and wait for clear trend signals to emerge.

I will share trading signals every day. All the signals have been accurate for a whole month in a row. If you also need them, please click on the link below the article to obtain them.

CAD JPY BUY Trade Setup 2 hour timeframe On the 2 hour timeframe CAD JPY has broken a key structure level forming a Higher high and higher low uptrend pattern, we need to wait for a retest of the higher low level for the completion of a Bullish Break and Retest pattern, also this level align with the Fib Retracement zone 0.618-0.50

Entry will be based off candlestick confirmation on the retest level.

Patience Patience ⏰👌🏻

GBP/USD Bullish Channel – Buy Opportunity! Overview:

The British Pound (GBP) against the US Dollar (USD) is currently trading within an ascending channel on the 4-hour timeframe. The price is approaching a key buy zone at the lower trendline, presenting a potential long opportunity if bullish momentum continues.

Key Market Structure Analysis:

🔹 Uptrend in Progress: GBP/USD has been forming higher highs and higher lows inside a well-defined rising channel.

🔹 Support Zone: A potential buy entry is around 1.2925, aligning with the lower boundary of the channel.

🔹 Target Projection: If the price bounces from support, the next key resistance target is 1.3085.

Potential Trade Setup:

✅ Bullish Scenario:

A retest and bounce from 1.2925 could trigger a buy setup.

Upside target:

🎯 1.3085 – Key resistance level within the channel.

⚠️ Bearish Scenario (Invalidation):

A break below 1.2925 could invalidate the bullish setup and signal a deeper retracement.

Below the channel support, price might target the 1.2600 region as the next demand zone.

Final Thoughts:

GBP/USD remains in a strong uptrend, with the lower channel support acting as a key decision point. If bulls defend this level, we could see further upside momentum. However, a breakdown of the structure could shift the sentiment.

Will GBP/USD continue its bullish momentum? Share your thoughts below!

GBP/USD: ID50 Setup Bullish Trade Opportunity1. **ID50 Setup Formation:**

- The market appears to have formed a **peak formation low**, followed by a reversal into an upward trend.

- The price retraced to the **50 EMA (blue line)**, which aligns with the **ID50 trade entry zone** in BTMM.

- A bounce off this moving average suggests **bullish continuation**.

2. **Market Structure & Momentum:**

- Higher highs and higher lows are evident, confirming an uptrend.

- The **red EMA (13 EMA)** remains above the **50 EMA**, reinforcing the bullish sentiment.

- Price recently tested the **50 EMA support**, indicating a potential **buying opportunity**.

3. **Key Levels to Watch:**

- The nearest **resistance zone** is around **1.29700**, which might serve as the next target.

- Support is currently around **1.29000**, aligning with the 50 EMA.

**Conclusion:**

If the price maintains support above the 50 EMA, the **bullish ID50 setup** suggests a continuation of the uptrend. A break above recent highs could lead to further gains. However, traders should watch for potential **stop hunts** before a strong move occurs.

GBP/USD Intraday Market Analysis: Potential Upside ReversalThe GBP/USD 15-minute chart suggests a possible bullish reversal following a period of consolidation near the 200-period moving average. Price action formed multiple rejection wicks at a key support level, indicating buying interest. A bullish engulfing candle has emerged, confirming a potential shift in momentum.

The risk-to-reward setup highlights a long position, with stop-loss protection just below the recent lows and a target towards previous liquidity zones. The stochastic-based momentum indicator shows a crossover in oversold territory, further supporting potential upside movement.

If price sustains above the 200 EMA and breaks through immediate resistance, further bullish continuation is likely. However, failure to hold above the entry level could invalidate the setup, leading to further downside pressure.

GBP/USD Market Analysis: Potential Short Setup at ResistanceThe GBP/USD pair is trading near the **1.3000** psychological level, showing signs of consolidation after a strong bullish move. The chart suggests a potential reversal as price approaches a key resistance zone, with an apparent liquidity grab at the recent high.

The highlighted area around **1.2946 - 1.2921** represents a significant **H4 demand zone**, where price could retrace before continuing its next move. A break below this zone would indicate a deeper correction, with potential downside targets towards **1.2870** (OA level).

**Key Considerations:**

- A sustained break above **1.3000** could invalidate the bearish setup, leading to further upside momentum.

- A rejection at this level, combined with bearish price action, could confirm a short opportunity with a target towards the demand zone and lower support areas.

**Conclusion:** Traders should monitor price action around the resistance level and confirmation of a bearish reversal before committing to short positions. If bullish momentum persists, a breakout could open the door for further gains.

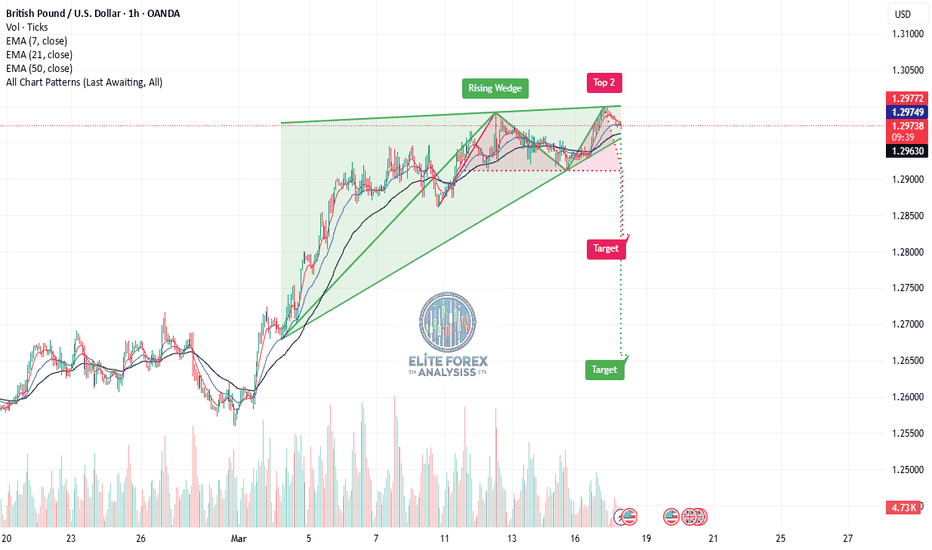

GBP/USD Chart Analysis: (1H Timeframe)**Chart Analysis: GBP/USD (1H Timeframe)**

**1. Chart Pattern - Rising Wedge 📉**

- The price has formed a **rising wedge**, a bearish reversal pattern.

- A rising wedge occurs when price makes higher highs and higher lows but within a narrowing range, suggesting weakening bullish momentum.

- The price has now broken out of the wedge, signaling a potential downward move.

**2. Key Levels & Targets 🎯**

- **Current Price:** Around **1.29720**

- **EMA Levels:**

- **7 EMA:** 1.29767 (Short-term trend indicator)

- **21 EMA:** 1.29748

- **50 EMA:** 1.29629 (More reliable trend indicator)

- **Bearish Breakdown Targets:**

- **First Target (Red Label):** Around **1.2800**, aligning with previous support levels.

- **Final Target (Green Label):** Around **1.2650**, suggesting a larger move downward if selling pressure continues.

**3. Confirmation of Downtrend? 🔻**

- The breakdown below the rising wedge suggests a potential **downtrend continuation**.

- The **break below 1.2900** would likely confirm a stronger bearish move.

- Volume is increasing on the move down, indicating strong selling interest.

*Possible Trade Setups 📊**

1. **Bearish Scenario:**

- A short position can be considered if price continues breaking below key EMAs and previous support.

- **Entry:** Below 1.2960

- **Stop Loss:** Above 1.3000

- **Take Profit:** 1.2800 (first target) or 1.2650 (final target).

2. **Bullish Reversal Possibility:**

- If price **reclaims the wedge** and breaks above 1.3000, it could invalidate the bearish pattern.

**Conclusion:**

- The **rising wedge breakdown** suggests bearish momentum.

- A move below **1.2900** would confirm further downside.

- **Watch for volume confirmation** before entering a trade.