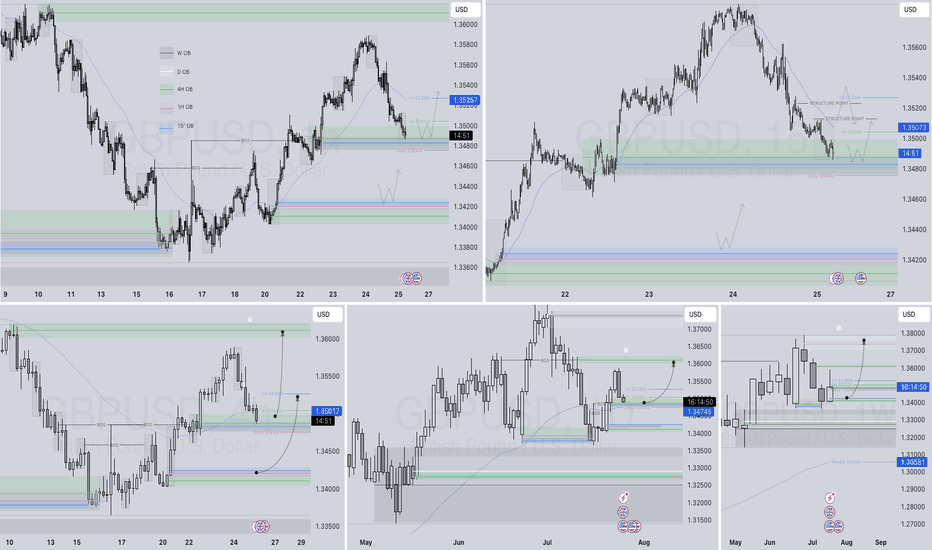

GBPUSD Q3 | D25 | W30 | Y25 FUN COUPON FRIDAYGBPUSD Q3 | D25 | W30 | Y25

Daily Forecast🔍📅

Here’s a short diagnosis of the current chart setup 🧠📈

Higher time frame order blocks have been identified — these are our patient points of interest 🎯🧭.

It’s crucial to wait for a confirmed break of structure 🧱✅ before forming a directional bias.

This keeps us disciplined and aligned with what price action is truly telling us.

📈 Risk Management Protocols

🔑 Core principles:

Max 1% risk per trade

Only execute at pre-identified levels

Use alerts, not emotion

Stick to your RR plan — minimum 1:2

🧠 You’re not paid for how many trades you take, you’re paid for how well you manage risk.

🧠 Weekly FRGNT Insight

"Trade what the market gives, not what your ego wants."

Stay mechanical. Stay focused. Let the probabilities work.

FRGNT

FX:GBPUSD

Gbpusdlongsetup

GBPUSD Q3 | D23 | W30 | Y25📊GBPUSD Q3 | D23 | W30 | Y25

Daily Forecast🔍📅

Here’s a short diagnosis of the current chart setup 🧠📈

Higher time frame order blocks have been identified — these are our patient points of interest 🎯🧭.

It’s crucial to wait for a confirmed break of structure 🧱✅ before forming a directional bias.

This keeps us disciplined and aligned with what price action is truly telling us.

📈 Risk Management Protocols

🔑 Core principles:

Max 1% risk per trade

Only execute at pre-identified levels

Use alerts, not emotion

Stick to your RR plan — minimum 1:2

🧠 You’re not paid for how many trades you take, you’re paid for how well you manage risk.

🧠 Weekly FRGNT Insight

"Trade what the market gives, not what your ego wants."

Stay mechanical. Stay focused. Let the probabilities work.

FRGNT

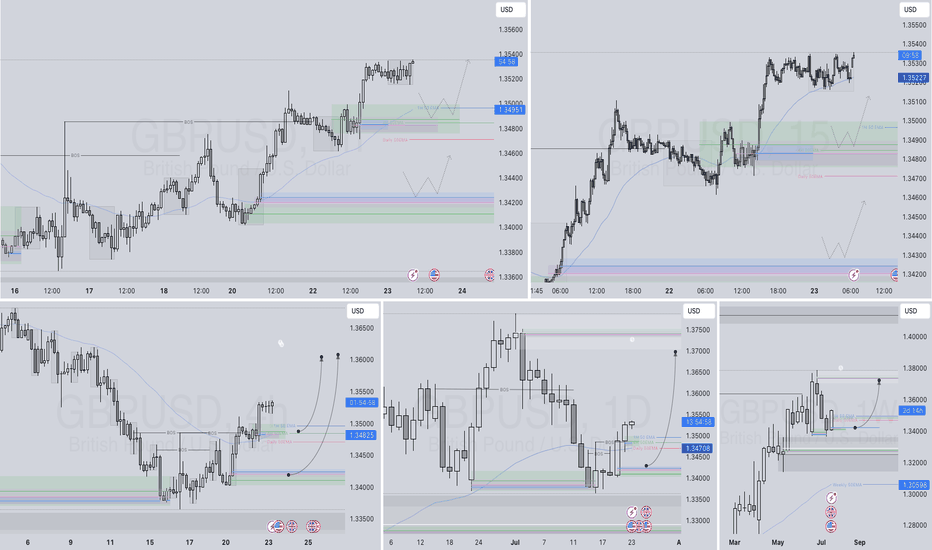

GBPUSD LONG FORECAST Q3 D16 W29 Y25GBPUSD LONG FORECAST Q3 D16 W29 Y25

Welcome back to the watchlist GBPUSD ! Let's go long ! Alignment across all time frames.

Professional Risk Managers👋

Welcome back to another FRGNT chart update📈

Diving into some Forex setups using predominantly higher time frame order blocks alongside confirmation breaks of structure.

Let’s see what price action is telling us today!

💡Here are some trade confluences📝

✅Daily order block

✅1H Order block

✅Intraday breaks of structure

✅4H Order block

📈 Risk Management Principles

🔑 Core Execution Rules

Max 1% risk per trade

Set alerts — let price come to your levels

Minimum 1:2 RR

Focus on process, not outcomes

🧠 Remember, the strategy works — you just need to let it play out.

🧠 FRGNT Insight of the Day

"The market rewards structure and patience — not emotion or urgency."

Execute like a robot. Manage risk like a pro. Let the chart do the talking.

🏁 Final Words from FRGNT

📌 GBPUSD is offering textbook alignment — structure, order flow, and confirmation all check out.

Let’s approach the trade with clarity, conviction, and risk-managed execution.

🔑 Remember, to participate in trading comes always with a degree of risk, therefore as professional risk managers it remains vital that we stick to our risk management plan as well as our trading strategies.

📈The rest, we leave to the balance of probabilities.

💡Fail to plan. Plan to fail.

🏆It has always been that simple.

❤️Good luck with your trading journey, I shall see you at the very top.

🎯Trade consistent, FRGNT X

GBPUSD LONG FORECAST Q3 D15 W29 Y25GBPUSD LONG FORECAST Q3 D15 W29 Y25

Welcome back to the watchlist GBPUSD ! Let's go long ! Alignment across all time frames.

Professional Risk Managers👋

Welcome back to another FRGNT chart update📈

Diving into some Forex setups using predominantly higher time frame order blocks alongside confirmation breaks of structure.

Let’s see what price action is telling us today!

💡Here are some trade confluences📝

✅Daily order block

✅1H Order block

✅Intraday breaks of structure

✅4H Order block

📈 Risk Management Principles

🔑 Core Execution Rules

Max 1% risk per trade

Set alerts — let price come to your levels

Minimum 1:2 RR

Focus on process, not outcomes

🧠 Remember, the strategy works — you just need to let it play out.

🧠 FRGNT Insight of the Day

"The market rewards structure and patience — not emotion or urgency."

Execute like a robot. Manage risk like a pro. Let the chart do the talking.

🏁 Final Words from FRGNT

📌 GBPUSD is offering textbook alignment — structure, order flow, and confirmation all check out.

Let’s approach the trade with clarity, conviction, and risk-managed execution.

🔑 Remember, to participate in trading comes always with a degree of risk, therefore as professional risk managers it remains vital that we stick to our risk management plan as well as our trading strategies.

📈The rest, we leave to the balance of probabilities.

💡Fail to plan. Plan to fail.

🏆It has always been that simple.

❤️Good luck with your trading journey, I shall see you at the very top.

🎯Trade consistent, FRGNT X

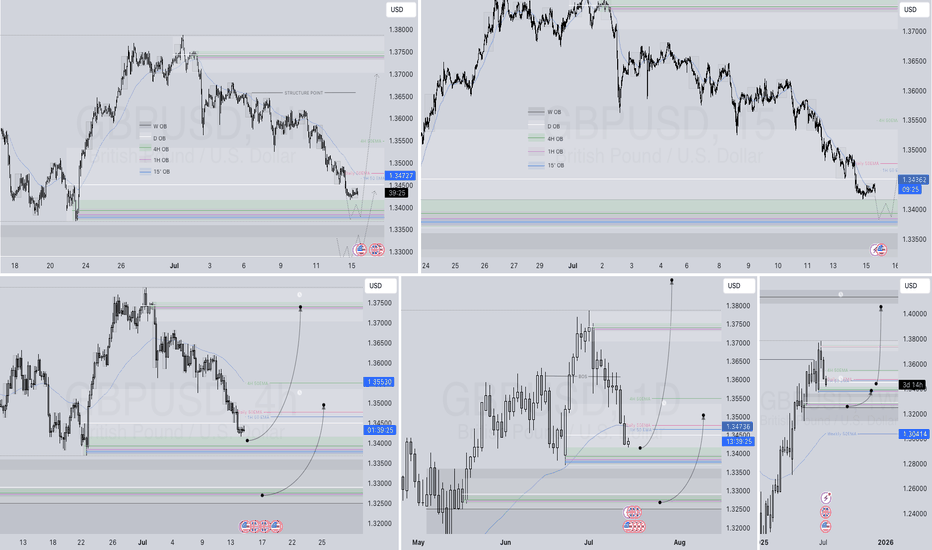

GBPUSD📌 GBPUSD – Scenario-Based Plan

The first level I’ve marked is a short-term zone.

If we get a strong buy signal there with good R/R, I’ll enter and trail aggressively.

The second level is a stronger demand zone and a better area for potential long setups.

❗️Remember: These are just scenarios — not predictions.

We stay ready for whatever the market delivers.

#GBPUSD: Bulls are in control, DXY Dropping Sharply!Hello Team,

We have identified a promising opportunity with a favourable price movement. The Pound Sterling to US Dollar (GBPUSD) pair has exhibited strong bullish volume, indicating potential further appreciation.

The current geopolitical tensions, particularly the involvement of the United States in the Iran-Israel conflict, are expected to negatively impact the US Dollar. This decline could potentially lead to an appreciation of the GBPUSD pair and other USD-denominated currencies.

It is advisable to closely monitor the price behaviour of the GBPUSD pair and consider potential investment opportunities based on its current trend.

Best regards,

Team Setupsfx

GBPUSD | 2 Long Scenarios | The Empire will strike backGeneral

GBPUSD fell through the first big support zone (Zone 2) unless a reclaim i am not gonna look for longs currently. Personally waiting for price falling deeper into Zone 1. Marked 2 Scenarios that i would want to see to develop.

Be aware that i usually use LTF (such as the 1 hour chart to plan my entries). Meaning the SLs and RR are not completly correct as shown.

1. Long (Green arrow)

Price moves below Zone 1. Reclaim. Enter on reclaim.

Target: Slightly below Zone 3

Stop- Loss: Depending on the LTF entry i wouldnt want to see it going below Zone 1 again

Time duration: Days, weeks, months, years... ;)

2. Long (Orange arrow)

Price pushes into Zone 1, reacts supportive and then generates a Swing. Enter on breaking of the generated swing.

Target: Slightly below Zone 3

Stop- Loss: A bit below of top of the Zone 1

Time duration: Days, weeks, months, years... ;)

Good luck

Disclaimer:

- This information does not constitute as financial advice and is only for educational purposes. I am not your financial advisor.

- You trade entirely at your own risk

- Make your own research

- Finance and trading is evil, capitalism is bad, duh ;)

GBPUSD: Will DXY Bounce Back? |GBPUSD Swing Sell|The GBPUSD pair is currently rallying towards a potential selling zone, where sellers could push the price down. However, the main concern is the current state of the DXY, which clearly indicates another sell-off and could lead to another lower low. Please remember to use risk management while trading forex pairs.

There are three take-profit targets that can be set according to your trading plan. This analysis doesn’t guarantee that the price will move as described.

Good luck and trade safely!

Thank you for your unwavering support! 😊

If you’d like to contribute, here are a few ways you can help us:

- Like our ideas

- Comment on our ideas

- Share our ideas

Team Setupsfx_

❤️🚀

#GBPUSD: Risk Entry Vs Safe Entry, Which One Would You Chose? The GBPUSD currency pair presents two promising opportunities for entry, potentially generating gains exceeding 500 pips. However, entering these markets carries a substantial risk of stop-loss hunting during the commencement of the week. Conversely, adopting a safe entry strategy offers a favourable chance for a bullish position.

We encourage you to share your thoughts and feedback on our ideas. ❤️🚀

Team Setupsfx_

GBPUSD Analysis🔁 GBPUSD update!

As our followers know,

we previously took a great profit from this level (see pinned idea below).💸

Now, that level is broken and we are patiently waiting for a pullback to enter a short trade.🔻

***If the price breaks above, we may switch to a buy setup — let’s wait for a clear signal!🕵️

For detailed entry points, trade management, and high-probability setups, follow the channel:

ForexCSP

GBP/USD Buy from 2hr demand zone?This week, my analysis for GU focuses on a potential buy opportunity from the 2H demand zone. Although this zone is still quite a distance from current price action, I’m patiently waiting to see which side of liquidity gets taken first — that will help highlight a more immediate area of interest.

Given the recent bearish movement, I’m anticipating a possible break of structure to the downside, targeting the underlying Asia lows. This move could create a new supply zone, which may present a more valid setup in the short term.

However, if price maintains its current trajectory, I’m also eyeing the 13H supply zone, which would offer a strong POI for future sell opportunities after a bullish correction.

Confluences for GU Buys:

- Price is approaching a 2H demand zone.

- Market has been bearish, suggesting a correction may be due.

- DXY analysis aligns with a potential GU recovery.

- Liquidity buildup points toward a possible retracement to the 13H supply zone.

P.S. If the week starts with a bullish move, that could offer a better setup for shorts later on as price approaches the higher supply zone. Stay alert and flexible with your setups — wishing everyone a strong and disciplined trading week!

GBP/USD "The Cable" Forex Bank Heist Plan (Swing / Day Trade)🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑 💰💸✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the GBP/USD "The Cable" Forex Market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is the high-risk Red Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 🏆💸"Take profit and treat yourself, traders. You deserve it!💪🏆🎉

Entry 📈 : "The heist is on! Wait for the MA breakout (1.30500) then make your move - Bullish profits await!"

however I advise to Place Buy stop orders above the Moving average (or) Place buy limit orders within a 15 or 30 minute timeframe most recent or swing, low or high level.

📌I strongly advise you to set an "alert (Alarm)" on your chart so you can see when the breakout entry occurs.

Stop Loss 🛑: "🔊 Yo, listen up! 🗣️ If you're lookin' to get in on a buy stop order, don't even think about settin' that stop loss till after the breakout 🚀. You feel me? Now, if you're smart, you'll place that stop loss where I told you to 📍, but if you're a rebel, you can put it wherever you like 🤪 - just don't say I didn't warn you ⚠️. You're playin' with fire 🔥, and it's your risk, not mine 👊."

📍 Thief SL placed at the recent/swing low level Using the 4H timeframe (1.27000) Swing/Day trade basis.

📍 SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

🏴☠️Target 🎯: 1.35000 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

💰💵💸GBP/USD "The Cable" Forex Market Heist Plan (Swing/Day) is currently experiencing a bullishness,., driven by several key factors. 👇👇👇

📰🗞️Get & Read the Fundamental, Macro, COT Report, Quantitative Analysis, Sentimental Outlook, Intermarket Analysis, Future trend targets... go ahead to check 👉👉👉🔗🔗

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

GBP/USD Long up towards a short 1.28400 up to 1.30000GBP/USD (GU) Analysis – This Week

This week, GBP/USD presents multiple opportunities depending on how price reacts at key levels. Recently, price has been moving bearish due to the impact of Trump’s tariffs, but this doesn’t change the fact that the overall market structure remains bullish, with strong upside momentum over the past few weeks.

If price breaks this major structural level, we could see bearish pressure dominate in the coming weeks. However, this could also be a deep retracement before another bullish continuation.

Right now, I’m watching a clean 4-hour demand zone positioned below liquidity. If price moves lower first, I’ll also be keeping an eye on the 3-hour supply zone as a potential area for shorts.

Confluences for GU Buys:

- GU has been bullish over the past few weeks despite recent short-term bearishness.

- The U.S. dollar has dropped significantly, which is generally bullish for GBP/USD.

- There is liquidity resting above, along with imbalances that need to be filled.

- A clean 4-hour demand zone sits below liquidity, with an additional 5-hour demand zone further below.

Note: If price reacts to the current demand zone and moves higher, I will wait for a deeper supply zone, such as the one marked in Scenario D at 1.30800. However, I’ll remain patient and watch where price starts to slow down, accumulate, or distribute before making a decision.

GBPUSD LONGOn the Daily Timeframe, price moved out from an Area of interest and and might be seeking the next area of value due to the lower timeframe of Price Action forming.

4H/1H - Price is trading around the base of an ascending channel which might be signifying a possible change of lower timeframe trend. If the base hold then I'll be waiting for a M15 Flag which I will taking a RE or RRE on it.

GBPUSD Rally: Will It Retrace? Key Liquidity Zones & Trada Idea.📈 The GBP/USD has seen a significant rally recently, with previous highs on the weekly and daily higher timeframes acting as potential upside targets. But the big question is: how far could the pair retrace? 🤔 On the daily timeframe, we can clearly see a bullish imbalance that might serve as an internal range liquidity target for a pullback. This aligns with the market's natural behavior of seeking liquidity and rebalancing inefficiencies. 🔄

In this video, we dive into the trend 📊, market structure 🧩, and price action 🎯, discussing key factors like the imbalance and liquidity dynamics to keep in mind. Plus, we share a trade idea based on a specific set of rules on the 15-minute timeframe ⏱️.

⚠️ Not financial advice – this is for educational purposes only! 🚨

GBPUSD: hovers around 1.2600GBP/USD holds ground around 1.2600 in the European session on Thursday. The pair is helped by a modest US Dollar downtick but broad risk-off mood due to renewed tariff threats from US President Donald Trump could limit the risk sensitive Pound Sterling.

GBP/USD Technical Overview

The Relative Strength Index (RSI) indicator on the 4-hour chart declines toward 50, reflecting a loss of bullish momentum. On the downside, 1.2530 (Fibonacci 61.8% retracement level of the latest downtrend) aligns as first resistance before 1.2500 (round level, static level) and 1.2470 (100-period Simple Moving Average).

Looking north, first resistance could be spotted at 1.2650 (Fibonacci 78.6% retracement) before 1.2700-1.2710 (round level, static level).

GBP.USD Longs from 1.25600 back upI expect GBP/USD to continue its bullish momentum and push higher. Following the previous break of structure, I am looking for price to mitigate the 2-hour demand zone to maintain this upward trend. If price does not react from this level, I have also identified a 3-hour demand zone as a secondary point of interest.

If price reacts bullishly from either of these zones, my next selling opportunity will be at the refined 1-hour supply zone around 1.26600. Once price reaches this level, I will look for signs of distribution to confirm a potential short setup.

Confluences for GU Buys:

- For price to continue higher, it must mitigate a strong demand zone to gain momentum.

- Liquidity remains above, providing a natural target for price.

- The higher time frame trend is still bullish.

- Clean 2-hour, 3-hour, and 11-hour demand zones are in close proximity.

- DXY has been bearish, which aligns with this bullish GU outlook.

P.S. If price drops instead, I have an extreme discounted zone marked at the 11-hour demand zone at the bottom as a potential long entry.

GBPUSD Scenario 1.1.2025This market is very difficult to predict at the moment, the point is that we have very close resistance around the price level 1.2520, if we hold this level, we can consider the previous low as an sfp from which the price can start to rise, or if we do not hold this level, we will fall below it and the market will try to hold the second sfp or send the price even lower.

GBPUSD BUY | Idea Trading AnalysisGBPUSD is moving on support zone

The chart is above the support level, which has already become a reversal point twice.

We expect a decline in the channel after testing the current level which suggests that the price will continue to rise

Hello Traders, here is the full analysis.

Price reversal going up, levels for BUY. Great BUY opportunity GBPUSD. ! GOOD LUCK!

I still did my best and this is the most likely count for me at the moment.

-------------------

Traders, if you liked this idea or if you have your own opinion about it, write in the comments. I will be glad 🤝