Gbpusdsignal

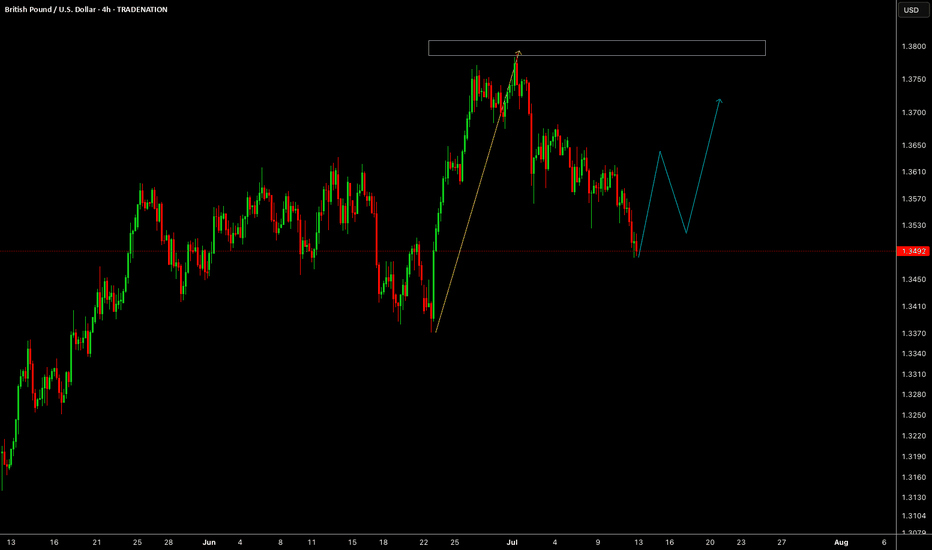

Market Trap Alert! GBP/USD Bearish Robbery Plan🔥💸 "The Cable Heist" – GBP/USD Robbery Plan Using Thief Trading Style 💸🔥

— Unfiltered Forex Forecast with Risky Intentions —

🌍 Hey Money-Makers, Market Hustlers & Chart Bandits! 🤑✈️

Hola! Bonjour! Marhaba! Hallo! Ciao! Welcome to the Forex streets where the smart rob the charts, not banks.

Ready for the GBP/USD Heist? Let’s break it down with our infamous Thief Trading Style – raw, unapologetic, and built for profits.

💼 Operation Name: “The Cable Forex Bank Robbery”

🎯 Pair: GBP/USD – aka “The Cable”

⚔️ Style: Scalp / Day Trade / Swing Heist

📊 Bias: Short (Bearish Setup)

🛠 STRATEGY SETUP: "Follow the Shadows"

🔍 Analysis Basis:

Smart-Money Traps at Key Levels

Oversold ≠ Reversal (Read between the candles)

Liquidity Hunting Zones

Retail Stop Clusters Exposed

Thief-style DCA Entries (Staggered Entry Levels)

Multi-timeframe Confirmation

COT, Sentiment & News-Driven Volatility

🎯 ENTRY ZONE:

Enter short (sell) using 15M or 30M chart.

Sell Limits near recent highs (pullback zone).

DCA (Layered Entry) recommended – Thief loves catching price slipping.

Let the liquidity work for us.

🛑 STOP LOSS (SL):

Base SL around 1.36200 on 2H Chart – above swing high.

Adjust SL per position size and total entries.

Manage risk, but remember: thieves don’t panic, they plan!

🎯 TARGET ZONE:

TP near 1.33800 or adjust using price action.

Escape before target if market mood flips – no need to be greedy.

Trail SLs if market momentum dies down.

👀 Scalpers' Special Note:

Only SHORT — don’t mess with long side unless you’re a liquidity donor.

Quick ins & outs. If you're loaded with capital, jump in big – else follow the swing team.

Use trailing SLs for safety — protect the loot.

📢 FUNDAMENTALS TO WATCH:

News Impacting GBP/USD

COT Reports

Sentiment Indicators

Macro Trends / Yield Spreads

US Dollar Strength Index (DXY)

UK Economic Reports (CPI, GDP, Rate Decisions)

⚠️ RISK MANAGEMENT TIPS:

🚨 Avoid new entries during news releases

🚨 Use trailing stops during volatility spikes

🚨 Secure running trades before major announcements

🚀 Boost the Robbery – Support the Strategy

💖 Smash that BOOST BUTTON if you're vibing with this setup. Help the Thief crew grow stronger!

Let’s keep milking the market 💸 – one “heist” at a time. Stay dangerous, stay smart.

🔓 NOTE: This isn't investment advice. Just a wild trading idea from a chart outlaw.

Always DYOR – Do Your Own Robbery (Research).

Market conditions shift fast. Stay alert, adapt, and respect your capital.

#ForexThiefStyle #CableHeist #GBPUSDShort #SmartMoneyMoves #LiquidityHunters #ChartOutlaws #TradingRebels #DayTradeLife #ScalpersParadise #ForexGang #FXHeistPlans

DeGRAM | GBPUSD forming the falling wedge📊 Technical Analysis

● Price is testing the rising-channel floor (≈1.3500) while carving a bullish falling-wedge; momentum divergence and prior green arrows hint buyers defend this rail.

● A break of 1.3590 (wedge roof / minor trendline) would confirm reversal, opening 1.3680 mid-band, with 1.3770 channel cap next. Risk is limited to a clean H4 close beneath 1.3450.

💡 Fundamental Analysis

● Softer US CPI trimmed two-year Treasury yields, eroding the dollar bid, while UK May GDP surprised to the upside and labour-market tightness keeps BoE “higher for longer” talk alive—narrowing the rate-gap that had weighed on sterling.

✨ Summary

Long 1.3500-1.3560; breakout above 1.3590 targets 1.3680 → 1.3770. Invalidate on H4 close under 1.3450.

-------------------

Share your opinion in the comments and support the idea with a like. Thanks for your support!

DeGRAM | GBPUSD will continue to correct📊 Technical Analysis

● Two false breakouts at the channel roof (1.3640 ±) underline supply; price is now carving successive lower-highs beneath the blue resistance line inside a 7-day falling channel.

● Fresh bearish rejection of 1.3605 leaves a descending triangle whose base aligns with 1.3563 support; a 30 min close below it exposes the lower rail / June pivot at 1.3525.

💡 Fundamental Analysis

● BoE Chief Economist Pill repeated that “further evidence of disinflation” is needed but rates are “sufficiently restrictive”, reviving August-cut bets, while firm US wage-inflation keeps Fed easing priced farther out—widening the short-rate gap in the dollar’s favour.

✨ Summary

Sell 1.3590-1.3610; break < 1.3563 targets 1.3525. Bear view void on an H1 close above 1.3640.

-------------------

Share your opinion in the comments and support the idea with a like. Thanks for your support!

GBPUSD📌 GBPUSD – Scenario-Based Plan

The first level I’ve marked is a short-term zone.

If we get a strong buy signal there with good R/R, I’ll enter and trail aggressively.

The second level is a stronger demand zone and a better area for potential long setups.

❗️Remember: These are just scenarios — not predictions.

We stay ready for whatever the market delivers.

GBP/USD Rebounds Inside Channel – Long Opportunity in MotionHi traders! Analyzing GBP/USD on the 30-minute timeframe, price is currently respecting a descending channel, showing signs of a bullish bounce after retesting lower support.

🔹 Entry: 1.3586

🔹 Take Profit (TP): 1.3618

🔹 Stop Loss (SL): 1.3555

Price is attempting to recover after holding at the bottom of the channel, and is now pushing toward the 20 EMA. If momentum builds, a retest of the upper trendline and the 1.3618 zone is likely. RSI is slightly recovering from neutral levels, adding confluence to this rebound setup.

This long trade offers a solid risk-to-reward ratio within a possible short-term counter-trend move. Watch closely as price approaches dynamic resistance.

⚠️ DISCLAIMER: This is not financial advice. Every trader is responsible for their own decisions and risk management.

DeGRAM | GBPUSD got out from the triangle📊 Technical Analysis

● Price pierced the blue-labelled trend-line and is threatening to exit a month-long contracting triangle; successive higher lows since 3 Jul show demand absorbing every dip.

● A confirmed H1 close above 1.3650 completes the pattern, unlocking the 1.3700-1.3720 supply zone (June range cap) with measured-move scope toward the broader channel midpoint at 1.3770.

💡 Fundamental Analysis

● Post-election political clarity and an uptick in UK 2-yr gilt yields narrow the policy-gap, while Friday’s softer US NFP trims Fed-rate expectations—both favouring sterling over the dollar.

✨ Summary

Buy 1.3620-1.3650; break >1.3650 targets 1.3700 → 1.3770. Long bias void on an H1 close below 1.3590.

-------------------

Share your opinion in the comments and support the idea with a like. Thanks for your support!

#GBPUSD: A strong bullish move incoming, comment your views The price has shown a possible price divergence, which could lead to a long-term move to 1.37. We expect the US dollar to weaken, which will likely push the price of GBPUSD to our target. Key economic data will be released later today and tomorrow, which could shape the price pattern.

Good luck and trade safely!

Team Setupsfx_

DeGRAM | GBPUSD will continue to correct📊 Technical Analysis

● Price retests the broken wedge-base & channel roof ≈ 1.370 inside a confluence resistance zone (pink). Lower-highs into this cap form a bear flag pointing toward 1.360.

● Intraday rising-wedge has already cracked; projected width and the broader descending channel intersect 1.352-1.355, reinforcing downside targets.

💡 Fundamental Analysis

● Softer UK PMI prices and pre-election caution keep BoE-cut probabilities elevated, while a stronger US JOLTS print plus hawkish FOMC minutes underpin the dollar, favouring renewed GBP/USD pressure.

✨ Summary

Fade rallies 1.368-1.372; slide below 1.360 unlocks 1.355 then 1.343. Bear thesis invalid on a 30 min close above 1.374.

-------------------

Share your opinion in the comments and support the idea with a like. Thanks for your support!

DeGRAM | GBPUSD preparing for a correction📊 Technical Analysis

● Cable is pressing the rising-channel ceiling together with the March swing-high supply at 1.378-1.380; successive long-upper-wicks plus fading 4 h RSI signal bull exhaustion at this dual resistance.

● A tiny evening-star has formed inside the pink resistance band and price is slipping back under the broken inner trend-line; first objective is the former breakout shelf / median line near 1.360, with the lower rail and April pivot at 1.343 next in view.

💡 Fundamental Analysis

● UK election blackout, soft retail-sales surprise and firmer month-end USD funding bids narrow the short-rate gap again, sapping fresh sterling demand.

✨ Summary

Short 1.374-1.380; sustain below 1.360 opens 1.343. Bear view void on a 4 h close above 1.380.

-------------------

Share your opinion in the comments and support the idea with a like. Thanks for your support!

GBPUSD's strong uptrend continuesGBPUSD is in a strong uptrend, Price has just broken the resistance zone of 1.37500.

All the bullish momentum is heading towards the resistance zone of 1.388.

If there is a close of the h4 candle below the resistance zone of 1.375, there will likely be a Pullback to 1.363 to find more buying momentum towards the target at the resistance zone of 1.388

📈 Key Levels

Support: 1.375-1.363

Resistance: 1.388

📊 Recommended Trade Setups

BUY GBPUSD 1.375-1.373 Stoploss 1.37000

BUY GBPUSD 1.363-1.361 Stoploss 1.35800

SELL GBPUSD 1.388-1.390 Stoploss 1.39300

GBPUSD: Targeting 1.4200 Swing Move Target! Swing Trading GBPUSD: We’ve identified a key reversal zone where our long-term take-profit target is set at 1.4200. This is a long-term approach, but in the short term, we could target 1.3900, which is a reasonable take-profit area. Before taking any buying entry, please do your own analysis.

Good luck and trade safely!

Like

Comment

Share

Team Setupsfx_

Exclusive: GBP/USD Swing Heist – Limited-Time Opportunity!🏴☠️ GBP/USD HEIST ALERT: Bullish Loot Grab Before the Cops Arrive! 🚨💰

🌟 Attention, Market Pirates & Profit Raiders! 🌟

"The vault is unlocked—time to swipe those pips!"

🔥 THIEF TRADING STRATEGY (Swing/Day) 🔥

Based on high-risk, high-reward technical & fundamental analysis, here’s the master plan to plunder GBP/USD ("The Cable")!

📈 ENTRY (Bullish Heist Zone)

"The vault is OPEN!" – Long at any price, but for precision:

Buy Limit orders preferred (15m-30m timeframe).

Pullback entries from recent swing lows/highs = sneakiest loot grab!

🛑 STOP LOSS (Escape Route)

Thief SL: Nearest swing low (4H chart).

Adjust based on: Risk tolerance, lot size, & number of orders.

"A good thief always has an exit plan!"

🎯 TARGETS

1.37500 (or escape early if the cops 🚓 (bearish traps) show up!).

Scalpers: Only long-side raids! Use trailing SL to lock profits.

💥 WHY THIS HEIST? (Bullish Momentum)

Technicals + Fundamentals align for a potential breakout.

Overbought? Risky? Yes—but the best loot is guarded!

📢 TRADING ALERT (News & Risk Mgmt)

Avoid new trades during high-impact news (volatility = police sirens!).

Trailing stops = Your getaway car. Protect profits!

🚀 BOOST THE HEIST!

💖 Hit "Like" & "Boost" to fuel our next raid!

💬 Comment your loot tally below!

"Stay sharp, thieves—see you at the next heist! 🤑🔥"

GBPUSD: The Big Short Opportunity?(Breakout Confirmation Needed)🚨 GBP/USD BANK HEIST ALERT: The Bearish Robbery Plan (Swing/Day Trade) 🚨

🔥 Steal Pips Like a Pro – Thief Trading Strategy Inside! 🔥

🌟 GREETINGS, MARKET PIRATES! 🌟

🤑 To all the Money Makers, Risk Takers & Midnight Breakers!

Based on our 🔥Thief Trading Style🔥 (a deadly mix of technical + fundamental + intermarket analysis), we’re plotting a massive bearish heist on GBP/USD ("The Cable").

This is not financial advice—just a strategic robbery plan for those who dare to trade smart.

📉 THE HEIST STRATEGY (SHORT ENTRY FOCUS)

🎯 Target Zone: 1.32300 (or escape earlier if the market turns)

⚡ High-Risk, High-Reward Play: Oversold market, consolidation, trend reversal setup.

💣 Trap Level: Where bullish traders get wrecked.

🔑 ENTRY RULES:

"The Heist is ON!" – Wait for breakout confirmation at 1.33800 before striking.

Sell Stop Orders below breakout MA OR Sell Limit Orders (15-30 min timeframe).

Retest Entry? Ideal if price retraces to recent low/high before dropping.

📌 ALERT SETUP: Don’t miss the breakout—set a chart alert!

🛑 STOP LOSS (Risk Management):

Thief SL at 1.34800 (Swing/Day Trade basis – 3H period).

🚨 Pro Tip: "Yo, rebels! You can place SL wherever you want… but if you ignore this level, don’t cry later. Your risk, your rules."

🎯 PROFIT TARGET:

First Take-Profit: 1.32300 (or bail earlier if momentum fades).

Scalpers: Ride the short side only. Use trailing SL to lock profits.

📰 FUNDAMENTAL BACKUP (Why This Heist Works)

Before executing, check:

✅ COT Report (Are big players dumping GBP?)

✅ Macro News (UK vs. USD economic strength)

✅ Intermarket Analysis (DXY, Bonds, Equities correlation)

✅ Sentiment & Seasonality (Is the crowd too bullish?)

⚠️ WARNING: NEWS & VOLATILITY ALERTS

Avoid new trades during high-impact news (unless you love gambling).

Use trailing stops to protect profits if the market flips.

💥 BOOST THIS HEIST! 💥

🚀 Like & Share to strengthen our Thief Trading Squad!

💸 More heists = More profits. Stay tuned for the next robbery plan!

🤑 See you on the profitable side, bandits! 🏴☠️

🔴 DISCLAIMER: This is entertainment, not financial advice. Trade at your own risk.

#Forex #GBPUSD #TradingStrategy #ThiefTrading #BankHeist #SwingTrading #DayTrading

💬 COMMENT BELOW: Are you joining the heist or waiting for a better setup? 🚨👇

GBP/USD Robbery: Can You Grab the Cash Before the Cops Arrive?🚨 GBP/USD "The Cable" forex bank Heist Alert: The Bullish Breakout Robbery Plan (Swing & Scalp Strategy) 🚨

🌟 Hi! Hola! Ola! Bonjour! Hallo! Marhaba! 🌟

Attention Money Makers & Market Robbers! 🤑💰💸

Based on the 🔥Thief Trading Style🔥, here’s our master plan to loot the GBP/USD "The Cable" forex bank. Follow the strategy on the chart—focusing on LONG entries—and escape near the high-risk Red Zone. This area is overbought, consolidating, and a potential reversal trap where bears lurk. 🏆 Take profits fast—you’ve earned it! 💪

🎯 Heist Entries:

📈 Entry 1: "The Breakout Heist!" – Wait for Resistance (1.36200) to break, then strike! Bullish profits await.

📈 Entry 2: "Big Players’ Pullback!" – Jump in at 1.34000+ buy above at any price for a safer steal.

🔔 Pro Tip: Set a chart alert to catch the breakout instantly!

🛑 Stop Loss Rules:

*"Yo, listen! 🗣️ If you’re entering with a buy-stop, DON’T set your SL until AFTER the breakout. Place it at the nearest swing low (3H timeframe) or wherever your risk allows—but remember, rebels risk more! 🔥"*

🏴☠️ Target: 1.37500

🧲 Scalpers: Only play LONG! Use trailing SL to lock in profits. Big wallets? Go all in. Small stacks? Join the swing heist!

📊 Market Pulse:

The GBP/USD "The Cable" is neutral but primed for bullish momentum. Watch:

Fundamentals (COT, Macro, Geopolitics)

Sentiment & Intermarket Trends

Positioning & Future Targets & Overall score

📌 Check our bioo linkks for deep analysis! 🔗🌍

⚠️ Trading Alert:

News = Volatility! Protect your loot:

Avoid new trades during major news

Use trailing stops to secure profits

💥 Boost This Heist!

Hit 👍 & 🔄 to strengthen our robbery crew! Let’s dominate the market daily with the Thief Trading Style. 🚀💵

Stay tuned—another heist drops soon! 🎯🐱👤

GBP/USD HEIST ALERT: Bullish Breakout or Bearish Trap?🌟 Hey! Hola! Ola! Bonjour! Hallo! Marhaba! 🌟

Calling all Market Robbers & Profit Pirates!💸💰

🔥 Thief Trading Intel: Our crew’s latest heist targets GBP/USD "The Cable"—bullish breakout incoming! Long entry only. High-risk Red Zone ahead: overbought, consolidating, and ripe for a reversal. Don’t get caught in the bear trap! 🏴☠️

"Take your loot and run, trader—you’ve earned this steal!" 💪🎯

🚪 ENTRY: The Heist Begins!

📈 "Wait for MA breakout (1.36000) then STRIKE—bullish profits await!"

Option 1: Buy Stop above Pink Resistance (breakout confirmation).

Option 2: Buy Limit at swing low/high (15-30 min TF).

📌 Pro Tip: SET AN ALERT! Don’t miss the breakout.

🛑 STOP LOSS: Escape Route

🔊 "Yo, listen up! 🗣️

Buy Stop orders? NO SL until after breakout! 🚀

Rebels: Place SL wherever—but you’ve been warned! ⚠️🔥

📍 Thief SL (Smart Crew): Recent/swing low (1.35000, 4H TF).

📍 Adjust based on your risk, lot size, and orders.

🎯 TARGET: Loot & Exit!

🎯 1.37500 (or escape early if the market turns!)

⚡ SCALPERS’ QUICK GRAB

👀 Long scalps ONLY!

Big wallets? Raid now.

Small stacks? Join swing traders.

Trailing SL = Your Money Shield! 🛡️💰

📢 WHY THIS HEIST? (GBP/USD Bullish Momentum)

"The Cable" is heating up! Key drivers:

Fundamentals (COT, Macro Data)

Sentiment & Intermarket Trends

Future Targets & Score Outlook

🔗 Full intel? Bio links below! 👉👉

⚠️ TRADING ALERT: News = Danger Zone! 📰🚨

News = Volatility Spikes! Protect your loot:

❌ Avoid new trades during news.

🔒 Trailing SL = Profit Lock.

💖 SUPPORT THE HEIST CREW!

💥 SMASH THAT BOOST BUTTON! 💥

More boosts = easier money grabs!

Stronger crew = bigger heists!

Profit daily with Thief Trading Style! 🏆🚀

Next heist coming soon—stay tuned! 🤑🐱👤🤩