GBPUSD(20250402)Today's AnalysisToday's buying and selling boundaries:

1.2913

Support and resistance levels

1.2973

1.2951

1.2936

1.2889

1.2875

1.2852

Trading strategy:

If the price breaks through 1.2936, consider buying, the first target price is 1.2951

If the price breaks through 1.2913, consider selling, the first target price is 1.2889

Gbpusdsignal

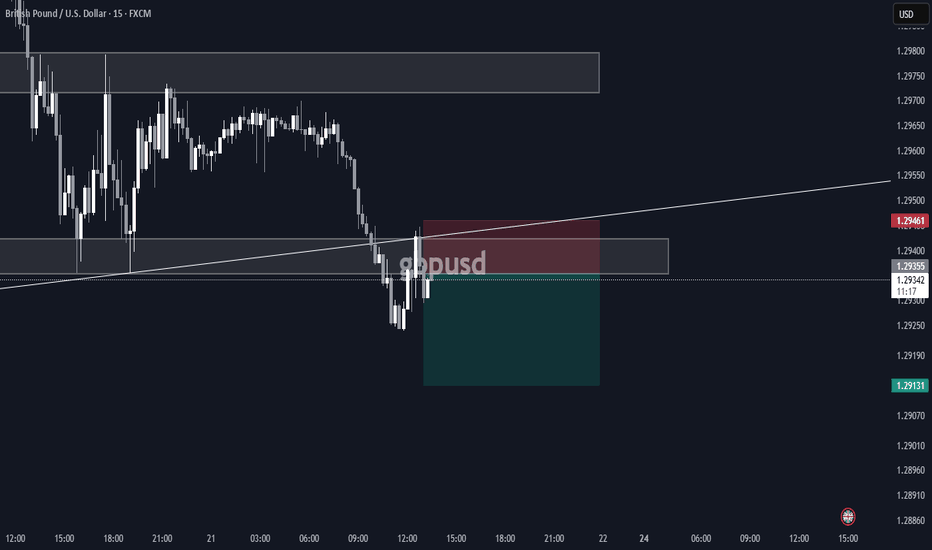

GBP/USD 1-Hour Chart Analysis: Bearish Setup with Key ResistanceGBP/USD 1-Hour Chart Analysis: Bearish Setup with Key Levels

Key Technical Indicators:

Current Price: $1.29427

30 EMA (Red Line): $1.29453 (Short-term trend)

200 EMA (Blue Line): $1.29351 (Long-term trend)

Key Resistance Zone: $1.29663 - $1.29851 (shaded purple)

Support & Target Levels:

TP 1: $1.29358

TP 2: $1.29153

TP 3: $1.28895

Final Target: $1.28662

Analysis:

Trend:

The price is struggling around the 30 EMA and 200 EMA, showing indecision.

The shaded resistance zone ($1.29663 - $1.29851) is a key area where sellers may take control.

Trade Setup:

Entry: Expected near $1.29663 (potential rejection from resistance).

Stop Loss: Above $1.29851 (to minimize risk if price breaks higher).

Take Profit Targets: Multiple levels, with the final target at $1.28662.

Bearish Confirmation:

If price gets rejected at resistance, a downside move toward support levels is likely.

A break below 1.29358 could accelerate selling pressure.

Conclusion:

The chart suggests a potential bearish trade setup, with resistance acting as a key rejection point.

Watch for confirmation signals at the resistance zone before entering a short trade.

A break above $1.29851 would invalidate the bearish outlook.

GBPUSD:This is a bullish situationThe GBP/USD is still fluctuating repeatedly at present. Taking various factors into account, there is a great deal of market noise in the current currency market, and many currency pairs are in a sideways trend.

The British pound has been fluctuating sideways for several weeks, and the market is digesting the previous significant upward rally. The 1.30 level on the upside serves as a resistance level, while the 1.29 level on the downside acts as a support level. The so-called "golden cross" has recently occurred, so this is a bullish market.

Trading strategy:

buy@1.2910

TP:1.2970-1.2990

Get daily trading signals that ensure continuous profits! With an astonishing 90% accuracy rate, I'm the record - holder of an 800% monthly return. Click the link below the article to obtain accurate signals now!

GBPUSD:The strategy for next week remains bullishOn Friday, the GBP/USD traded and stopped at 1.2943, hovering near the upper end of the recent trading range. The currency pair has regained the ground above the 50-day Exponential Moving Average (EMA) at 1.2933, and currently, this level serves as an intraday support level, while the 200-day EMA at 1.2896 continues to underpin the broader momentum. The price movement is approaching the resistance zone of 1.2973 to 1.3008, which has restricted multiple rebound attempts this month. Breaking through this level may reach 1.3014. On the downside, the pivot point at 1.2937 and 1.2903 remain key levels worthy of attention. The short-term structure is constructive, but the bulls need a clear breakout to confirm the continuation of the trend beyond the resistance of the downward trend line.

Trading strategy:

buy@1.2910

TP:1.2970-1.2990

Get daily trading signals that ensure continuous profits! With an astonishing 90% accuracy rate, I'm the record - holder of an 800% monthly return. Click the link below the article to obtain accurate signals now!

GBPUSD(20250328)Today's AnalysisToday's buy and sell boundaries: 1.2936

Support and resistance levels:

1.3057

1.3012

1.2983

1.2890

1.2861

1.2816

Trading strategy:

If the price breaks through 1.2983, consider buying, the first target price is 1.3012

If the price breaks through 1.2936, consider selling, the first target price is 1.2890

GBPUSD 4H SHORTAt the moment, GBPUSDT the asset is being marked down. There was a price reaction to the POI range from which a reaction was received instantly. I missed this moment due to personal matters, although there was a reminder. I understand that the risk of not opening, or the receipt of new variables from the market, can break the trend, but I will try to open a short from the designated mark 1.29686$

Targets

$1.28609

$1.28030

$1.27534

$1.26722

Risk for stop order -1%

GBPUSD in Correction Phase – Potential for a Short OpportunityGBPUSD ( FX:GBPUSD ) is approaching the Support zone($1.286-$1.278) , Support lines and Important Support line .

Regarding Elliott Wave theory , GBPUSD appears to have completed the microwave 5 of the main wave 3 with the help of the Ending Diagonal Pattern and is currently completing the main wave 4 . The main wave 4 is likely to have a Double Three Correction(WXY) .

I expect GBPUSD to decline at least to the Support zone($1.286-$1.278) and Support lines .

Note: If GBPUSD goes above $1.30 we should expect more pumping. The worst Stop Loss(SL) for a SHORT position could be $1.30.

Note: If GBPUSD falls below $1.2760, we should expect more dumping.

Please respect each other's ideas and express them politely if you agree or disagree.

British Pound/U.S. Dollar Analyze (GBPUSD), 4-hour time frame.

Be sure to follow the updated ideas.

Do not forget to put a Stop loss for your positions (For every position you want to open).

Please follow your strategy and updates; this is just my Idea, and I will gladly see your ideas in this post.

Please do not forget the ✅' like '✅ button 🙏😊 & Share it with your friends; thanks, and Trade safe.

GBPUSD(20250327)Today's AnalysisToday's buying and selling boundaries:

1.2897

Support and resistance levels:

1.2974

1.2945

1.2927

1.2868

1.2849

1.2821

Trading strategy:

If the price breaks through 1.2897, consider buying, the first target price is 1.2927

If the price breaks through 1.2868, consider selling, the first target price is 1.2849

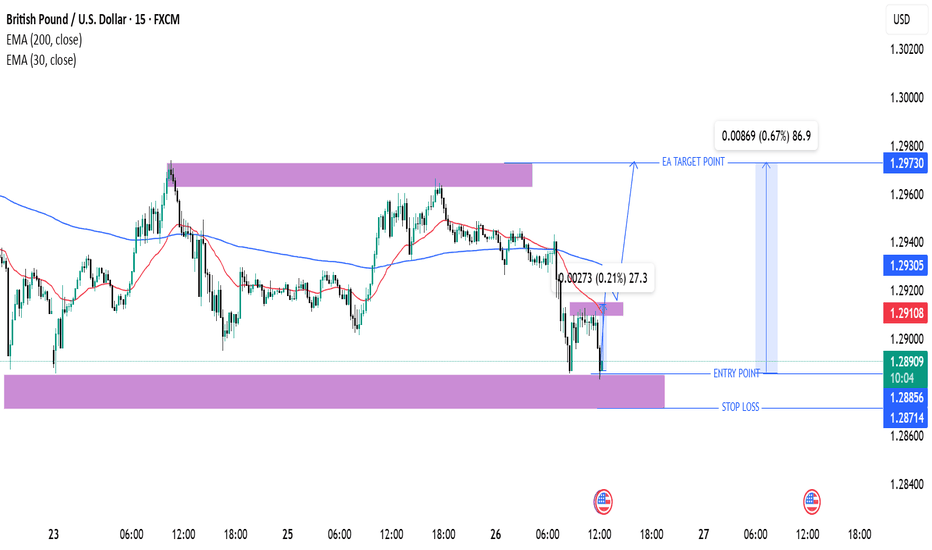

GBP/USD Trade Analysis: Bullish Reversal from Support ZoneExponential Moving Averages (EMAs):

200 EMA (Blue) at 1.29309: Represents the long-term trend.

30 EMA (Red) at 1.29122: Represents the short-term trend.

Price is currently below both EMAs, suggesting a bearish trend.

Support and Resistance Zones:

Resistance Zone (Purple at the top): Price previously reacted strongly at this level.

Support Zone (Purple at the bottom): A potential demand area where price is currently bouncing.

Trade Setup:

Entry Point: Near 1.28875 (highlighted on the chart).

Stop Loss: Set around 1.28714-1.28856, below the support zone.

Target Point: 1.29730, above the resistance and near the 200 EMA.

Risk-to-Reward Ratio: The setup aims for a higher reward than risk.

Trade Idea:

Bullish Reversal Trade: The price is reacting at a support zone, and the target aligns with a previous resistance level.

A confirmation (strong bullish candle or break of 30 EMA) could indicate a move toward 1.29730.

EMA Crossover Watch: If the 30 EMA crosses above the 200 EMA, it may confirm a stronger uptrend.

Potential Risks:

If price breaks below 1.28714, the bullish idea is invalid.

Resistance at 1.29309 (200 EMA) could slow the move upward.

GBP/USD: Struggles at Resistance, Risks of Weak Oscillation PersDuring the European session on Tuesday, GBP/USD held steady above 1.29000. However, the technical outlook maintained a bearish bias. The US dollar strengthened due to upbeat data, suppressing the rebound of the British pound. The exchange rate faced resistance at key resistance levels when attempting to rise.

If it fails to break through these resistance levels, in the short term, it may continue the weak, oscillatory downward trend, and the downside risks still remain. The market lacks strong momentum, and overall, it stays in a weak, oscillatory pattern.

GBPUSD

sell@1.29600-1.29900

tp:1.28800

I will share trading signals every day. All the signals have been accurate for a whole month in a row. If you also need them, please click on the link below the article to obtain them.

GBPUSD(20250326)Today's AnalysisToday's buying and selling boundaries:

1.2937

Support and resistance levels:

1.3001

1.2977

1.2962

1.2912

1.2897

1.2873

Trading strategy:

If the price breaks through 1.2962, consider buying, the first target price is 1.2977

If the price breaks through 1.2937, consider selling, the first target price is 1.2912

GBPUSD(20250325)Today's AnalysisToday's buying and selling boundaries:

1.2929

Support and resistance levels:

1.3007

1.2978

1.2959

1.2899

1.2880

1.2850

Trading strategy:

If the price breaks through 1.2929, consider buying, the first target price is 1.2978

If the price breaks through 1.2899, consider selling, the first target price is 1.2880

EURUSD and GBPUSD Analysis todayHello traders, this is a complete multiple timeframe analysis of this pair. We see could find significant trading opportunities as per analysis upon price action confirmation we may take this trade. Smash the like button if you find value in this analysis and drop a comment if you have any questions or let me know which pair to cover in my next analysis.

GBPUSD(20250320)Today's AnalysisToday's buying and selling boundaries: 1.2989

Support and resistance levels:

1.3045

1.3024

1.3010

1.2967

1.2954

1.2933

Trading strategy:

If the price breaks through 1.3010, consider buying, the first target price is 1.3024

If the price breaks through 1.2989, consider selling, the first target price is 1.2967

GbpUsd is approaching a strong sell zoneExactly one week ago, I pointed out that while TRADENATION:GBPUSD strength persists, the pair is approaching a significant sell zone , starting at the psychological level of 1.30.

This level was touched recently, and the pair is currently fluctuating within this range now.

My view remains the same: GBP/USD is likely to experience a drop in the near future, and I’m now looking for potential entries for a swing trade.

As mentioned before, 1.30 is a key psychological level, with the technical resistance just above it at 1.3050. Additionally, GBP/USD is known for its volatility, and this resistance zone extends slightly above 1.31.

In conclusion, traders should consider selling rallies, with a target around 1.27, aiming for at least a 1:2 risk-to-reward ratio when setting their stop loss.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analyses and educational articles.