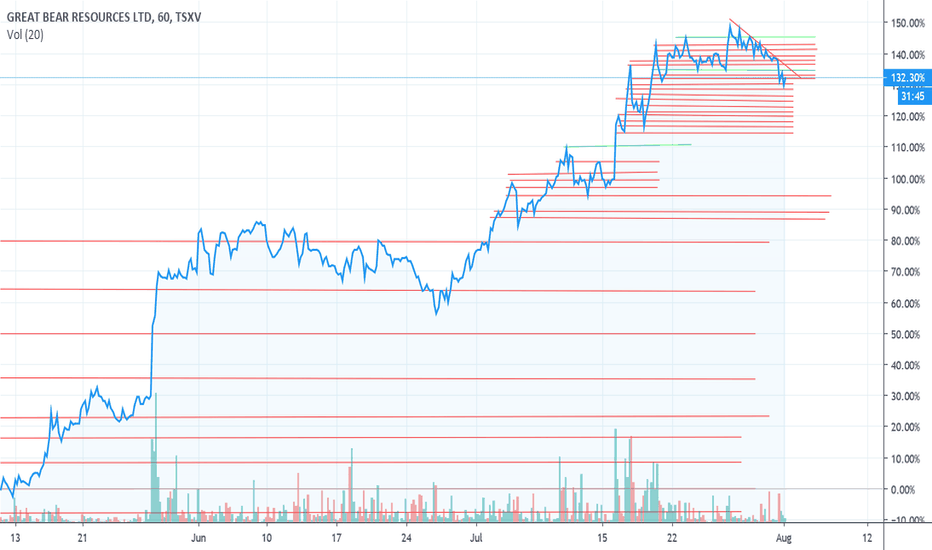

New Concept Energy ran out of concepts. GBRCracked through the floor and about to do a Wave C. Awaiting divergences for exit.

We are not in the business of getting every prediction right, no one ever does and that is not the aim of the game. The Fibonacci targets are highlighted in purple with invalidation in red. Confirmation level, where relevant, is a pink dotted, finite line. Fibonacci goals, it is prudent to suggest, are nothing more than mere fractally evident and therefore statistically likely levels that the market will go to. Having said that, the market will always do what it wants and always has a mind of its own. Therefore, none of this is financial advice, so do your own research and rely only on your own analysis. Trading is a true one man sport. Good luck out there and stay safe.

GBR

UK100 - Short Trade Idea - 7150 targetUK100, 15m Sell

Entry - 7192.8

Stop Loss - 1207.4 (14.4 pips)

Take Profit - 7152.8 (40 pips)

Descending Channel for GBR?It appears as though GBR is displaying some bearish indicators coinciding with a price decline into a descending channel.

The Williams Alligator is showing a bearish cross and the bands widening pointing to the downside showing bearish strength.

$GBR Target 14.16 for 71.84% (Higher risk)$GBR Target 14.16 for 71.84%

Or double position at 2.32

Let's try this one again... 😜 Higher risk...

—

On the far right of the chart is my Average (Grey) Current Target (Green), and Next Level to add (Red) Percentage to target is from my average.

I start every position with 1% of my account and build from there as needed and as possible.

I am not your financial advisor. Watch my setups first before you jump in… My trade set ups work very well and they are for my personal reference and if you decide to trade them you do so at your own risk. I will gladly answer questions to the best of my knowledge but ultimately the risk is on you. I will update targets as needed.

GL and happy trading.

I finally added my YouTube Training Video to my profile tagline since I’m not allowed to on here. It’s a quick 15 minute training video on how to set up your chart and how to spot opportunities. So check here first but If you have questions just message me.

$GBR Target 14.16 for 71.84% $GBR Target 14.16 for 71.84%

Or double position at 2.32

Am I the only one who see's this one?? Low(er) float.

—

On the far right of the chart is my Average (Grey) Current Target (Green), and Next Level to add (Red) Percentage to target is from my average.

I start every position with 1% of my account and build from there as needed and as possible.

I am not your financial advisor. Watch my setups first before you jump in… My trade set ups work very well and they are for my personal reference and if you decide to trade them you do so at your own risk. I will gladly answer questions to the best of my knowledge but ultimately the risk is on you. I will update targets as needed.

GL and happy trading.

GBRThis spec Oil name New Concept Energy, Inc. (NYSEAMERICAN:GBR) hit a new one-month low yesterday and started to bounce off of them. This should continue next week and we could see a very sharp recovery. GBR was a high flyer later in January. Currently is a good stock to trade, not for investment.

$GBR Target 14.74 for 67.12% $GBR Target 14.74 for 67.12%

Be careful with this one... it is for my reference and I do believe it will hit my target but I am not your financial advisor. My trade set ups work very well and they are for my personal reference and if you decide to trade them you do so at your own risk.

GL

Bear Flag & a Head and Shoulders for GBR?Since my previous post on GBR, we've clearly seen the price breakdown from what appeared like a bullish pennant or potentially a bull flag, but the bearish divergence was/is too strong...

Currently, it appears as though the price is breaking down from a bear flag with a head and shoulders pattern noticeable. I have placed a blue human head and body icon to represent the head of the H&S pattern.

It could be an ascending triangle with a fake-out to the downside occurring now, the higher low trajectory has been negated at the upward sloping support of the pattern, in the next several trading sessions it will be more apparent.

The RSI is trading in a descending triangle creating a series of lower highs.

The DMI is showing a bearish cross where I've placed the red finger point downward.

Bearish Divergence for GBR?GBR has created lower highs on the RSI since Oct 2018 but the price has continued higher until the blow-off top in late June 2020.

The RSI looks like it's trading in a Descending Channel.

The KST has seen multiple bearish crosses since Dec 2018 and continued lowers highs indicating momentum is fading.

Noticeably the price has broken flush to the downside of a bearish pennant unless it's a fake-out.

Bull Flag for GBR?In blue it appears as though GBR is trading in a bullish flag, but looking at the RSI there's a noticeable bearish divergence, meaning, the price continues to rise but the RSI is declining.

On the KST there's been a bearish cross where I have the blue finger icon pointing down.

Descending Channel for GBR?GBR has seen a parabolic 3000% gain & more since 2018, very odd considering Gold is only up approximately 70% in a similar time frame. I guess gold miners & gold don't necessarily correlate 100%.

GBR appears to be trading in a descending channel, and on the RSI there's a noticeable double top / Head & Shoulders, where I have placed the blue human icon represents the head of the H&S. The red arrow on the RSI is possibly a double top.

On a long term chart it appears as though the RSI has topped multiple times but the price has continued to rise, thus creating a bearish divergence.

Descending Triangle breakdown!Price target of 50c. Gold is in a descending triangle as well, so when that dumps don't look down!

EOM!

H&S. Short Short Short!!!!Linked to this post is a 5 day time frame which indicates a top is near with this H&S pattern.

Maybe one or two pumps left & then a deep dive down into the bre-x abyss!

Impulse wave from 1.5 usd... There is a very fast trading option at GBR. This is pulse trading. In this case, we are trading relatively short moments or breaks pulses. The exchange rate is currently in the correction phase. We are at the beginning of a triple downward wave structure. so we wait patiently for as long as the exchange rate is around the US $ 1.5 level. This is the target price for the triple downward wave structure. We expect a pulse wave from around 1.5 usd levels. With a target price of 4.28 usd environments. The basic condition for the idea is a "dirac-delta impulse structure".

Gold:Bitcoin Ratio Now Higher Than Physical Gold:Silver Ratio!You know that old crypto saying: "Litecoin is Silver to Bitcoin's Gold". Well now 'Gold is Silver to Bitcoin's Sound Money Supremacy'. Well in price ratio terms it is. I know I'm not comparing apples with apples, & for the purpose of not embarrassing Gold's post crypto performance any further, it's probably best I don't. But in terms of available supply, there are currently 777,275 metric tonnes of Silver, compared to 166,500 metric tonnes of Gold; Which gives a physical supply ratio of roughly 4.66 tonnes of Silver to each tonne of Gold. This obviously doesn't translate to the current Gold to Silver price ratio, that currently sits around today 75:1. This is why many think Silver, which has many irreducible industrial & technological applications is often sighted as a sleeping giant in terms of investment vehicles. But like gold, silver suffers heavily under the influence of secondary & futures markets, that trade paper contracts leveraged many multiples over & above the underlying physical metal good for delivery. Opting instead to settle 'delivery' in fiat currencies rather than physical metal. And herein lies the beauty of Bitcoin, with it's own baked into the protocol permissionless instant settlement & good delivery mechanism it will always be an impossible beast to bridle, as secondary & futures markets prove to be superfluous to it.

Sources:

demonocracy.info

demonocracy.info