GBYTEUSD

Unbreakable bull trendThe BITTREX:GBYTEUSD known a violent price correction today. The target @ 34$US is still there. The bearish resistance is futile.

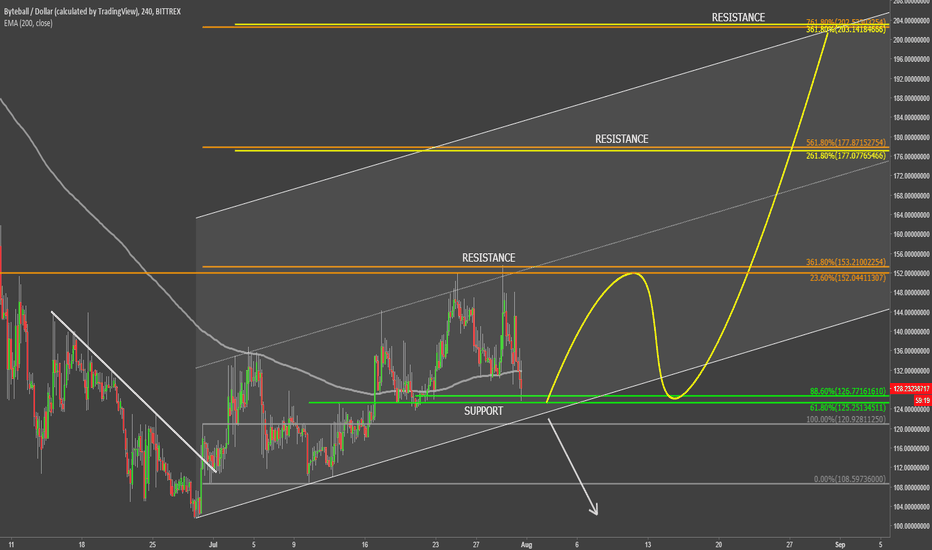

ByteBall at the Support - Uptrend Might ContinueAt the end of June Byteball has tested the low at $100, which is a strong psychological support. After bounce, price went up and broke above the downtrend trendline, corrected down, and went up again, this time breaking above the 200 Moving Average.

GBYTE/USD then bounced off strong resistance area at $150 and went down sharply. Currently it is trading at the $125 support, which could be the starting point for the uptrend continuation. It is worth mentioning that the 200 Moving Average is also acting as the support, as price still failed to break below with confidence.

If GBYTE stays above the $125 level, the uptrend is likely to continue, towards one of the Fibonacci resistance levels. First is at $177, and second is at $200 area, which is the next strong psychological resistance.

All-in-all, trend is bullish, but if the current support is broken, Byteball might once again move down towards the $100 area.

There is possibility for the beginning of uptrend in GBYTEUSD Technical analysis:

. BYTEBALL/DOLLAR is in a range bound and the beginning of uptrend is expected.

. The price is below the 21-Day WEMA which acts as a dynamic resistance.

. The RSI is at 43.

Trading suggestion:

. There is a possibility of temporary retracement to suggested support zone (114.00 to 95.00). if so, traders can set orders based on Price Action and expect to reach short-term targets.

Beginning of entry zone (114.00)

Ending of entry zone (95.00)

Entry signal:

Signal to enter the market occurs when the price comes to "Buy zone" then forms one of the reversal patterns, whether "Bullish Engulfing" , "Hammer" or "Valley" in other words,

NO entry signal when the price comes to the zone BUT after any of reversal patterns is formed in the zone.

To learn more about "Entry signal" and the special version of our "Price Action" strategy FOLLOW our lessons:

Take Profits:

TP1= @ 137

TP2= @ 157

TP3= @ 191

TP4= @ 239

TP5= @ 287

TP6= @ 360

TP7= @ 518

TP8= @ 643

TP9= @ 777

TP10= @ 895

TP11= @ 1210

TP12= Free

There is possibility for the beginning of uptrend in GBYTEUSD Technical analysis:

. BYTEBALL/DOLLAR is in a range bound and the beginning of uptrend is expected.

. The price is below the 21-Day WEMA which acts as a dynamic resistance.

. The RSI is at 43.

Trading suggestion:

. There is a possibility of temporary retracement to suggested support zone (114.00 to 95.00). if so, traders can set orders based on Price Action and expect to reach short-term targets.

Beginning of entry zone (114.00)

Ending of entry zone (95.00)

Entry signal:

Signal to enter the market occurs when the price comes to "Buy zone" then forms one of the reversal patterns, whether "Bullish Engulfing" , "Hammer" or "Valley" in other words,

NO entry signal when the price comes to the zone BUT after any of reversal patterns is formed in the zone.

To learn more about "Entry signal" and the special version of our "Price Action" strategy FOLLOW our lessons:

Take Profits:

TP1= @ 137

TP2= @ 157

TP3= @ 191

TP4= @ 239

TP5= @ 287

TP6= @ 360

TP7= @ 518

TP8= @ 643

TP9= @ 777

TP10= @ 895

TP11= @ 1210

TP12= Free

A trading opportunity to buy in Byteball is near...Technical analysis:

. BYTEBALL/DOLLAR is in a range bound and Beginning of uptrend is expected.

. The price is below the 21-Day WEMA which acts as a dynamic resistance.

. The RSI is at 36.

. While the RSI downtrend #1 is not broken, bearish wave in price would continue.

Trading suggestion:

. The price is in a range bound, but we forecast the uptrend would begin.

. There is a possibility of temporary retracement to suggested support zone (157 to 118). if so, traders can set orders based on Price Action and expect to reach short-term targets.

Beginning of entry zone (157)

Ending of entry zone (118)

Entry signal:

Signal to enter the market occurs when the price comes to "Buy zone" then forms one of the reversal patterns, whether "Bullish Engulfing" , "Hammer" or "Valley" , in other words,

NO entry signal when the price comes to the zone BUT after any of reversal patterns is formed in the zone.

To learn more about "Entry signal" and special version of our "Price Action" strategy FOLLOW our lessons:

Take Profits:

TP1= @ 191

TP2= @ 239

TP3= @ 287

TP4= @ 360

TP5= @ 518

TP6= @ 643

TP7= @ 777

TP8= @ 895

TP9= @ 955

TP10= @ 1210

TP11= Free

A trading opportunity to buy in Byteball is near...Technical analysis:

. BYTEBALL/DOLLAR is in a range bound and Beginning of uptrend is expected.

. The price is below the 21-Day WEMA which acts as a dynamic resistance.

. The RSI is at 35.

. While the RSI downtrend #1 is not broken, bearish wave in price would continue.

Trading suggestion:

. The price is in a range bound, but we forecast the uptrend would begin.

. There is a possibility of temporary retracement to suggested support zone (157 to 118). if so, traders can set orders based on Price Action and expect to reach short-term targets.

Beginning of entry zone (157)

Ending of entry zone (118)

Entry signal:

Signal to enter the market occurs when the price comes to "Buy zone" then forms one of the reversal patterns, whether "Bullish Engulfing" , "Hammer" or "Valley" , in other words,

NO entry signal when the price comes to the zone BUT after any of reversal patterns is formed in the zone.

To learn more about "Entry signal" and special version of our "Price Action" strategy FOLLOW our lessons:

Take Profits:

TP1= @ 191

TP2= @ 239

TP3= @ 287

TP4= @ 360

TP5= @ 518

TP6= @ 643

TP7= @ 777

TP8= @ 895

TP9= @ 955

TP10= @ 1210

TP11= Free

Byteball , The new Buy Zone & TPs for GBYTEUSD . Don't miss it.Technical analysis:

BYTEBALL/DOLLAR is in a down trend and Beginning of up trend is expected.

The price is below the 21-Day WEMA which acts as a dynamic resistance.

The RSI is at 30.

Trading suggestion:

*The price is in a down trend, but we forecast the uptrend would begin.

*There is possibility of temporary retracement to suggested support zone (171 to 106), if so , traders can set orders based on Price Action and expect to reach short-term targets.

Beginning of entry zone (171)

Ending of entry zone (106)

Entry signal:

Signal to enter the market occurs when the price comes to "Buy zone" then forms one of the reversal patterns, whether "Hammer" or "Trough" , in other words,

NO entry signal when the price comes to the zone BUT after any of reversal patterns is formed in the zone.

To learn more about "Entry signal" and special version of our "Price Action" strategy FOLLOW our lessons:

(We have started to prepare these lessons in TradingView. If you want us to continue, give us feedbacks!)

Take Profits:

TP1= @ 264

TP2= @ 302

TP3= @ 360

TP4= @ 518

TP5= @ 643

TP6= @ 777

TP7= @ 895

TP8= @ 955

TP9= @ 1210

TP10= Free

Byteball Road Back To $1000-Orange line is GBTE/BTC-

The Future is bright for byteball. Amazing project, if you are unfamiliar with it they use a DAG based "blockchain" you can catch up by reading the whitepaper first byteball.org or check out thier medium page for fast reads medium.com

,

Dyor.

Updates for March: medium.com

Byteball analysis I recently watched on Youtube Louis Thomas telling his viewers he is buying Byteball (see link below). His fundamental analysis has been impressive to date, and his explanation on why he liked Byteball makes sense. One key component I find interesting is its incredibly low supply of 1,000,000 coins, and a circulating supply of 645,000 coins. Of course, if the tech behind any coin is weak, then the supply doesn't matter much (I am not saying Byteball tech is weak). Furthermore, in 2017 we've seen that supply is not that important for a major rally (Ripple, Tron, and a few other coins with multi-billions in supply have proven this). Second, Byteball's performance in relation to other tokens and coins in 2017 was really unimpressive. This is perhaps the most important reason I will likely stay away, as Byteball has been available to the public long enough to have been noticed by now, or at least much more than 600 mill in market cap by the 4th quarter of 2017 (current market cap is 180 mill). Third, the crypto market in general is in a state of possible breakdown and bear market, so any altcoin will need to be scrutinized much more heavily than 2017. However, I am a chartist at the end of the day, so if the price action displays close to what I indicated in the chart, I will be interested to own some.

www.youtube.com

Byteball Rolling UpBytebal slowly but steadily rising and after each correction producing a new high. After reaching the recent high at $1188 price declined back to the 8/1 Gann Fan trendline, which was successfully rejected.

At this point, the uptrend is likely to continue and GBYTE/USD could test $1500-1600 area, where are two Fibonacci retracement levels applied to the last two corrective waves down. It should be kept in mind that the key support remains at $355 and only break and close above it could invalidate bullish outlook. At the same time, break above the upside target would confirm a further uptrend, while rejection should result in a short to medium term change in trend.