GOLD NEXT WEEK #13Forecast:

Price action is consolidating. Possible complex ABC pattern in the making. If volume is strong this week, UPSIDE target's @ ~1744,1745,1748. DOWNSIDE Target's @ ~1716, ~1714 or ~1710. I'll keep you posted.

Trade safe, e well.

About Gold Next Week #

A weekly 3-10-minute forecast video on Gold's price action on a weekly basis. I'll follow up with charts throughout the week as price action develops patterns and pivot reversals points.

Topics: Market sentiment, Gold Shares / Gold EFT's, $DXY and US10/30yr bonds and yields.

System: I use a hybrid blend of Wave Principle price action, Fibonacci ratios, RSI indicator and some fundamentals.

Disclaimer: nothing talked about in this video should be regarded or seen as trade advise, a trade call, a recommendation, or a trade signal. Do your own due diligence or seek advice from a licensed professional before entering a trade.

Best Regards

OmarDjurhuus

Gc_f

GOLD NEXT WEEK #12Forecast:

If momentum is strong this week, target's ~1762 and ~1785 before correction, but if price action develops truncation @ ~1755 and reverses, target's @ ~1714 - 1709ish.

About Gold Next Week #

A weekly 3-10-minute forecast video on Gold's price action on a weekly basis. I'll follow up with charts throughout the week as price action develops patterns and pivot reversals points.

Topics: Market sentiment, Gold Shares / Gold EFT's

- $DXY and US10/30yr bonds and yields

System: I use a hybrid blend of Wave Principle price action, Fibonacci ratios, RSI indicator and some fundamentals.

Disclaimer: nothing talked about in this video should be regarded or seen as trade advise, a trade call, a recommendation, or a trade signal. Do your own due diligence or seek advice from a licensed professional before entering a trade.

Best Regards

OmarDjurhuus

GOLD NEXT WEEK #010Forecast:

A possible Bullish Ending Diagonal completion this week. Which means price action can drop a bit lower before bulls take over and push price higher. But, if bond selling continues then gold will drop also. Have that in mind. I'll update throughout the week as always. Trade safe.

About Gold Next Week #

A weekly 3-10-minute forecast video on Gold price for the coming week. I'll also follow up with charts throughout the week as price action develops patterns and pivot reversals points.

Topics: Market sentiment, Gold Shares / EFT's A-z, $DXY and US10/30Year T-note

System: I use a hybrid blend of Wave Principle price action, Fibonacci ratios, RSI indicator and some Market Data.

Disclaimer: Nothing talked about in this video should be regarded or seen as trade advise, a trade call, a recommendation, or a trade signal. Do your own due diligence or seek advice from a licensed professional before entering a trade.

Best Regards

OmarDjurhuus

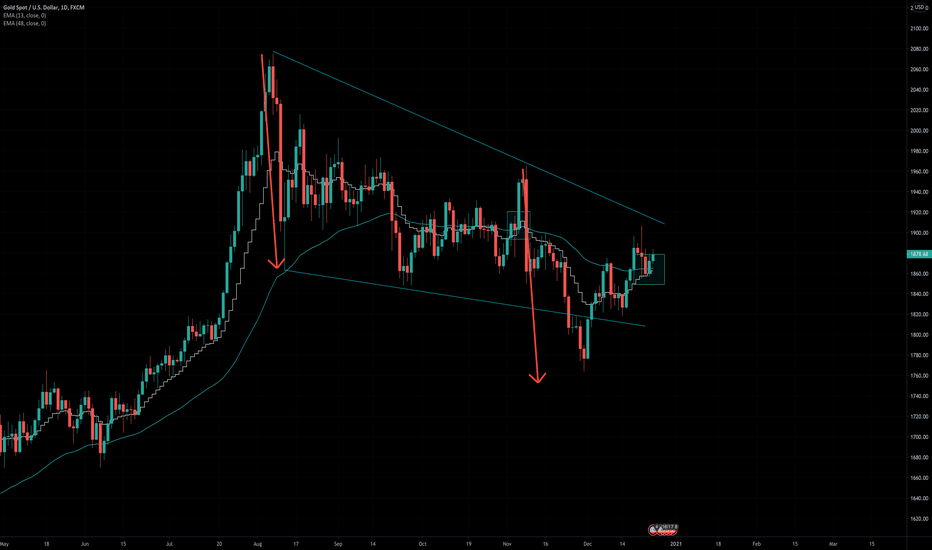

Gold getting ready to retest the All Time HighAside from a possible bull flag and the completion of 2 corrective measured moves down, the 13 EMA is about to attempt to cross over the 48 again on the daily. The first real attempt at a cross during this correction was in NOV, which popped but ultimately failed. I've found that the 1st attempt often fails and the 2nd or 3rd attempts often succeed. Good luck!

04/12/2020 Gold. Where next?We had a sell off but fail on Monday before a strong rally $70 higher. Ranging yesterday. Where are we going to today?

Today is #NFP and recently we have much of a sell on good news. Could today be that reversal day?

Based on my system, lots of support below, 1835.42-36.66 (my blue bias zone) and 1828.26-65. Bias towards the upside, targeting 1848.490, 50.43, 52.587 and 1856.28.

1864.81 is a possible upside target but should cap high of day.

If 1828.26 breaks, targets will be 1815.91 and 1812.27. 1808.07 should cap low of day.

Long FCX ( $GLD $FCX #GOLD $GC1! $GC_F $Spy $GOLD $XME)see full chart at www.tradingview.com

FCX

Entry $15

Target 1 $17

Target 2 $20

stoploss $13

Why?

Why it is a buy?

Stimulus bill #2 will eventually come out by 2021, Along with FOMC mentioning that they will allow inflation to run wild. what that means is that, the fundamental value of GOLD and other minerals will increase in price. While everyone is focus on gold, and silver, they are missing out on Copper. so I think it is defiantly an laggard and we could catch a nice buying opportunity still.

Who are they?

Freeport-McMoRan, Inc. engages in the mining of copper, gold, and molybdenum. It operates through the following segments: North America Copper Mines; South America Mining; Indonesia Mining; Molybdenum Mines; Rod and Refining; Atlantic Copper Smelting and Refining; and Corporate, Other, and Eliminations. The North America Copper Mines segment operates open-pit copper mines in Morenci, Bagdad, Safford, Sierrita and Miami in Arizona; and Chino and Tyrone in New Mexico. The South America Mining segment includes Cerro Verde in Peru and El Abra in Chile. The Indonesia Mining segment handles the operations of Grasberg minerals district that produces copper concentrate that contains significant quantities of gold and silver. The Molybdenum Mines segment includes the Henderson underground mine and Climax open-pit mine, both in Colorado. The Rod and Refining segment consists of copper conversion facilities located in North America, and includes a refinery, rod mills, and a specialty copper products facility. The Atlantic Copper Smelting and Refining segment smelts and refines copper concentrate and markets refined copper and precious metals in slimes. The Corporate, Other, and Eliminations segment consists of other mining and eliminations, oil and gas operations, and other corporate and elimination items. The company was founded by James R. Moffett on November 10, 1987 and is headquartered in Phoenix, AZ.

The Gundlach Indicator: In No Man's LandThe copper/gold ratio is traditionally viewed as a good proxy for bond yields, and that relationship has held mostly true of late. That said, we do not agree with all this exuberance over a topside "breakout". The ratio is sitting right in the middle of the recent range with heavily overbought RSI levels. Could go either way.