GDX

Gold might be getting ready for another leg higherFrom my blog:

It looks we could see a correction in the US stocks too. We’ve been seeing it in other markets already. But don’t be mistaken, I think this could only be a correction within a secular bull market. I don’t want to be calling for a 2008 style crisis yet however it can always evolve into something bigger.

There is an interesting rotation happening right now though. Gold has been a mess in the past months and even years. Many were expecting it would start trending higher. I was one of them for some time but I’ve put that thesis aside until now. I’m starting to see reasons for joining the party! What if this correction in the US stocks will ignite it?

Gold, GDX & GLD: Correlated Markets Lead To BIG Profits! If you trade Gold, you must know that the GDX and the GLD are both derivative markets of Gold and are closely correlated since they both track aspects of Gold. So when either one of these move, then you must look to the other one's and see what they are doing, going to do or done already. They can give you precious clues as to what the other markets are going to do. In most cases, GDX and GLD are forward indicators of Gold itself.

Why do I point this out? Well, what you see in my charts is my analysis of these 3 markets and you can see that they are all closely mimic each other. Now, I follow the mantra of "Trade what you see. Not what you think". That means I look at each chart by itself and not dependent on what any other chart is doing or projected to do. But when I analyze Gold, I also do look to GDX and GLD as well and see if my independent analysis of those markets agree with what I see in Gold. But VERY IMPORTANT to keep in mind is that NO MARKET correlate 1:1 to any other market. What that means is that Gold can move 100 pips while GDX might only move 25 pts.

In any case, I'm showing you these trades that I took and issued out to my followers to illustrate this point. Just a tip for you the next time you decide to trade in Gold.

Want to know more? Look below to my signature box or PM me.

THE WEEK AHEAD: AA, NFLX EARNINGS; USO, GDX, XLB, EEM, IWMWith broad market volatility ramping up over the past week here (see VIX, VXN, RVX), premium sellers can afford to be picky here, since the board is alight from here to Sunday with implied volatility ranks in the 70's for ... well ... a ton of stuff.

For earnings, my eye is on AA and NFLX with nearly ideal rank/implied metrics for volatility contraction plays.

NFLX (rank 64/implied 61), a perennial earnings-related volatility contraction fave, announces earnings on Tuesday after market close. Due to its size and its having a tendency to move bigly around earnings, I would go defined: the November 16th 285/290/385/390 is paying 1.87 with a buying power effect of 3.13; a ten-wide with the same short strikes, 3.53, with a buying power effect of 6.47.

AA, announcing on Wednesday after market close: 93/52. In my mind, small enough to go full on naked: the November 16th, 71% probability of profit 31/40 short strangle is paying 1.72 with a 50% max take profit of .86; the at-the-money skinny, quasi short-straddle -- the 35/36, 3.78, with a 25% take profit of .95.

Alternatively, it's been somewhat hammered here and is within 5% of 52-week lows which may make it suitable for a bullish assumption play: the 32/39/40 Jade Lizard is paying 1.00 on the nose with no upside risk and a low side break even of 31, a 13% discount over where the underlying is currently trading.

On the non-earnings front: the top five funds in terms of implied volatility rank are USO (81/30), GDX (71/32), XLB (68/27),* EEM (66/27),** and IWM (63/26); the top five ranked by 30-day implied: EWZ (58/44), UNG (36/41),*** XOP (52/36), OIH (56/36), and GDXJ (60/34).

* -- Possible bullish assumption directional; new 52-week low.

** -- Possible bullish assumption directional candidate: new 52-week low.

*** -- Possible bearish assumption directional candidate: new 52-week high.

GDX VANECK VECTOR stands in front of a large rise...GDX VANECK VECTOR stands in front of a large rise. Your exchange rate can practically doubled. Therefore, gold miners' stocks are a good investment. The exchange rate increase can be achieved by building a triple wave structure. The first correction can start at 29 usd levels. Its size is 0.25 D1 ATR. Next, the second wave structure could be built with a target price of 35.89 usd. Then a 0.5 D1 ATR correction is expected and further rise. The third wave structure can reach 43 usd levels.

Jnug to gold Well I havnt done gold for a while now but it appears to me that a nice setup to go long is presenting itself. This ICL has been stretched but that just makes me more confident that I have a safe Jnug play here. I am not about to try to guess what kind of wave count we are in. However, If we have started our move down into the larger C wave then this move up could look like what I drew. However, It could also be the beginning of the end of the B wave which would take us higher than I drew. I will be just fine with a move back up to the 1300 range before reassessing the pattern. Jnug will do well. but I will be watching its movement along with gold to get a feel for how powerful this move will be.

Jnug chart

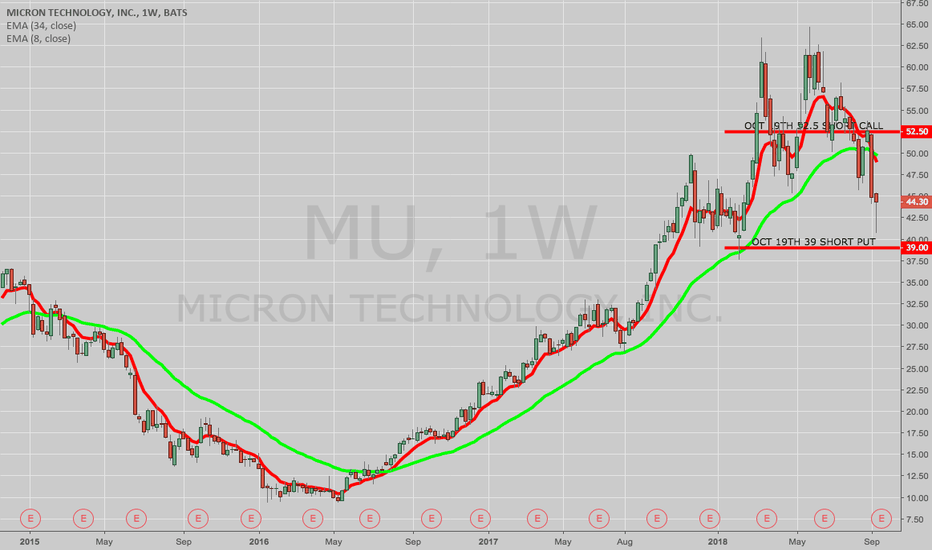

THE WEEK AHEAD: MU EARNINGS; EWZ, GDX, USOAlthough both FDX and ORCL announce earnings tomorrow (Monday) after market close, the underlying with the implied volatility metrics I generally look for in a volatility contraction play are present in MU, which announces Thursday after market close.

With a rank of 82 and a 30-day of 60%, the 70% probability of profit 39/52.5 20-delta short strangle is paying 1.66 at the mid-price. Since it's been beaten down a bit recently, I could see skewing that setup a bit to the bullish side, and or capping off call side risk via a Jade Lizard (the October 19th 39/49/50 would do the trick -- it's paying 1.13 at the mid with no upside risk above 37.87).

As far as non-earnings are concerned, implied volatility is present where it's been for a bit -- in EWZ (rank 99/implied 55) (the Brazilian exchange-traded fund), PBR (88/72) (Brazilian petro), CRON (76/124) (cannabis), GDX (66/30) (gold miners), and USO (58/27) (oil). Naturally, there's also TSLA (69/54), but with earnings in 52, you might as well wait for the full-on, earnings related volatility expansion/contraction ... .

THE WEEK AHEAD: AVGO EARNINGS; EWZ, GDX, XLooking at what's left of the trading week post-Labor Day ... .

AVGO (announcing earnings on Thursday after market close) is the only fairly liquid underlying that interests me for an earnings-related volatility contraction play (rank 57/30-day 37). The 63% probability of profit Sept 21st 200/205/235/240 iron condor pictured here is preliminarily going for 1.65 with a theta of 5.17 and a net delta of .67 with wide bid/ask showing in the off hours. Unfortunately, those 5-wides aren't available in the October monthly at the moment, so be mindful of the fact that you may experience difficulty or have to adjust on roll out if you have to since there aren't any 205's or 235's in the October yet.

EWZ is still in a state of high anxiety with a 52-week rank in the 90's and the 30-day above 40%. The 72% probability of profit October 19th 28/38 short strangle camped out around the 20 delta is still paying over a buck (1.28), which is nice in a sub-$35 underlying.

GDX (rank 44/30-day 26): Gold and silver have had the bejesus beaten out of them, so it's no surprise that the implied is relatively high here. Given the beat-down: October 19th 19 short straddle, 1.37 credit, 18.21 delta (bullish assumption). Alternatively, October 19th 19 short put (synthetic covered call), .87 credit, 59.74 delta.

Lastly: another underlying that's gotten a smack-down -- X (earnings announced 31 days ago). The October 19th 27/33 neutral assumption short strangle is paying 1.06, but I could also see going plain Jane 30-delta short put (bullish assumption) -- the October 19th 28's paying .83; going 70 delta synthetic covered call -- the October 19th 32's paying 2.94; or going skewed short straddle -- the 40 delta October 19th 32 short straddle's paying 3.67, with the strategy selected matching the strength of your assumption ... .

XAUUSD, GOLD, ABX, GDX, PAASAttempting to put more pieces of the puzzle together, considering my ideas on the miners recently published, from what I have seen over the years, B / X waves or alike (as potentially marked on the chart with a black line) usually have a subsequent opposite move in price at the end of such a wave. Therefore, the move in gold from 2016 low would have ended with a subsequent fall crashing through the lows, perfect example being the wave Jun-Sep 2012.

The fact that the price is struggling to fall lower on numerous occasions since the 2016 advance, in addition to the most recent print on the weekly having a wick and green candle, leads me to believe that at least the previous highs are able to be breached. Then, there may be a fall lower, but that is another analysis when more price info is available.

Summing up, evidence suggests that a bottom (or soon to be) of this down move is in, and now a move higher is in progress. Whether it is impulsive or not, I do not know. Therefore, this move up could possibly tie in with the simple analysis I have most recently put forward for the miners.

ABX, GDX, PAASSame as my recent ABX, GDX chart.

PAAS appears to be playing along nicely with a sideways consolidation with classic text book decreasing volume, as well as other indicators looking encouraging, so would expect another pump higher regardless of wave count (either impulsive or corrective). HOWEVER, I have also seen breakdowns from these forming triangles, which I didn't expect, so although this provides more evidence for higher price in the future, it is still hard to tell.

ABX, GDXAppears to me that for years there was a sideways consolidation, which bottomed in 2016. Then a strong move up, therefor the following questions:

1. Is this a new bull market and we have had W1 and are now (ending?) W2 at the 76 fib retrace level?

2. If not, have we had a strong upward A, now in B, yet to come strong upward C to break A highs?

3. An X wave of some sorts with lower prices to follow?

I don't know all the rules of EW in my head so happy for comments, however, if this is just an X wave, then can price really go back to less than a dollar, which might be the case if this is an X wave??

GDX POTENTIALLY TO SET BULLISH GARTLEYIn the weekly chart the movement of the GDX last month continues to decline out of the sideways channel and the triangle pattern is bearish. Although there is a rebound after touching the support at 18.55, bearish pressure is clear as long as the index value is still moving in the formed downtrend channel, or the index value is unable to move up above 22.93 as the previous swing high. A downtred push has the potential to set Bullish Gartley pattern if the GDX value touches to the next support in the 16.62 area, meaning if the pattern has been fulfilled then the last point of the pattern has the potential to be a reversal zone, a failed pattern is formed if the price turns up and exceeds 25.71.

Short $GDX transition to Long $GDX Play$GDX has been the consolidation king for quite some time. Many big players have been gambling on the options of this fella yet the GDX refused to breakdown/up from the consolidation pattern. FINALLY, this fella broke down and this is just the 1st inning of this potential short which we will enter a short after taking profits.

Gold miners are rising?...Gold miners are rising? The ETF technical image of GDX Vaneck Vector Gold Minners shows this. GDX's price began to build a rising three-wave wave structure. This equally starts as a correction of a long decreasing trend back. Low D1 ATR decreasing volatility. If the exchange rate is capable of building a full three-wave structure, it can predict a more steady trend turnaround and a longer rise.