GDXJ

Double Bottom on the Gold:SPX RatioThe Gold:SPX ratio has but in a double bottom on the monthly chart, indicating a likely short-term top in the US equities market and/or a re-test of the August 2020 highs for gold. If there is a broader market sell-off and deleveraging that brings all assets down a bit, that would be an excellent and extremely low-risk time to load up on quality gold and silver mining companies in safer jurisdictions.

STRIKEPOINT GOLD INC. Swing Trade PositionSUMMARY

Technical Analysis: I am long the stock because I see price action has completed a corrective ABC pattern on the daily Chart. From here price action could develop a bullish counter trend.

Fundamentals: The company has commenced drilling at their High-grade Willoughby property. The Company is cashed up and IF! they hit bigly then share price pushes higher.

I do not share in your gains nor in your losses. Do your own due diligence. Trade safe, be well.

Visit their webpage and look through their corporate presentation - www.strikepointgold.com

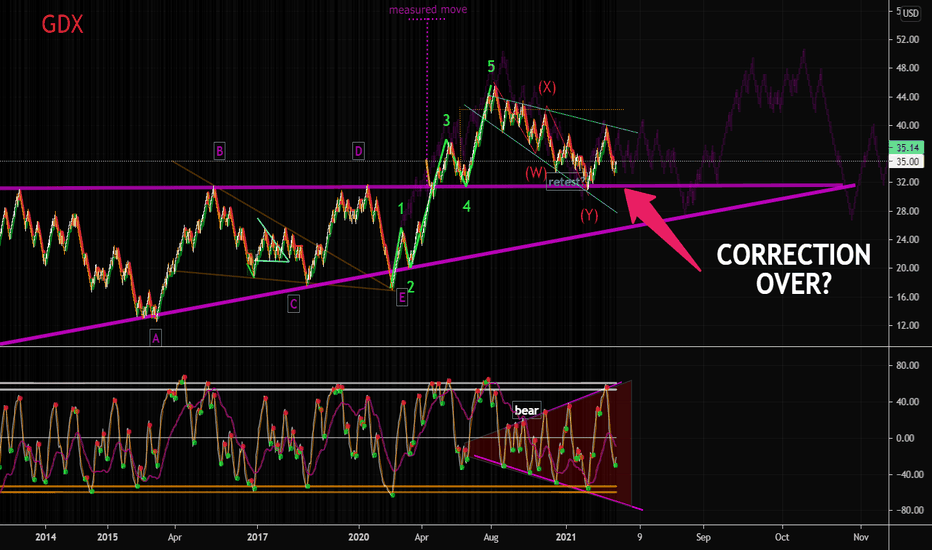

GDX HAS COILED ENERGYThe metals have been stuck in a range for quite a while. Gold Miners ETF (GDX) appears to have made 5 waves up since the crash in 2020 and formed an ongoing complex correction. What do you think? Has GDX bottomed? Take note of the lower stoch/rsi wavetrend indicator and the broadening nature that has occurred since this correction. This looks like a hidden bearish pattern that will eventually break. When it breaks, GDX is likely to move up incredibly strong. Perhaps one more push lower? I don't know... But I'll be ready if it drops again.

For me, I have some medium-longer term targets over 55-60.

Are we at a bottom for miners?Miners may finally be at or near a medium term bottom. They were up nicely today while gold was down. Also the technical are good. They are at the primary trendline, and there is a bullish RSI divergence. There is major support around 31, but not sure it will get down there.

Buying GDXJ at Support with $51 Price TargetI'm looking for this support to hold and provide GDXJ with a 15% bump back up to the $51 region.

There's a clear invalidation level just under $43 to provide a tight stop-loss and 5.6 R/R ratio.

This trade could take anywhere from 2-6 weeks to play out. Be patient and let it come to you.

The idea with this trade is simple. Buy at support and Sell at resistance.

GDXJ Arc indicates low risk entry with 250% upside The fun side of the arc in the junior miners is currently playing out. At the moment, we reside at the edge of the arc, which presents a very low risk high reward entry. Completion of the arc would indicate a gain of around 250% + overshoot, in an 18 months timeframe.

GOLD Pullback Resume Off?Gold saw a sharp sell-off last week due to comments made by Powell of interest hikes that may come sooner than expected. Since early June, gold is now down almost 8% in just this month. Nevertheless, price is holding some key technical levels. I still remain bullish on gold given the current environment of high inflation. The key levels to look out for are 1750 and 1675.

Gold Forecast – Real Or False Breakout?A few weeks ago we had a look into Gold cycles, Intermarket forecasts, and COT. At that moment gold was flagging. As you know it usually follows this pattern very well. But it doesn’t mean always. The current breakout wasn’t qualified as we didn’t have a downclose candle prior to the breakout candle.

Moreover, in 2012 we had a similar situation and it was a false breakout. So, I want to see more price action to figure out what is happening. In case, this breakout turns to be real, the market will target 2600 in 1 – 3 years. With all that in mind, let’s have a closer look into smaller time frames.

Last week the price tested the 1856 level. It was previously a strong resistance. So, no surprise price found support there. The 4h MA200 is at 1837. Technically it should be enough to build a base and start a new wave to the upside with targets 1932 and 1960. This pattern is valid till the price holds above 1800. If this level fails, the bears could take control of this market.

The Week Ahead: ARKK, ARKG, GDXJ, MJ, XBI, XLE, X, CLF, SAVE, FHere's where the premium was at as of Friday's close:

Broad Market Exchange-Traded Funds With 30-Day Implied >20%:

IWM (1/23)

Comments: I have quite a bit of IWM on here, but my order of preference is broad market, then sector, then single name, so am comfortable with adding if we get both weakness and a pop in volatility. IWM/RUT has been fairly rangebound, so it's worthwhile to pop open a chart and see where the bottom of the range is and where any puts you sell are relative to the range between 210 and 235.

Sector Exchange-Traded Funds With 30-Day Implied > 35%:

ARKK (31/45)

ARKG (18/41)

GDXJ (0/40)

MJ (7/40)

XBI (12/38)

XLE (2/36)

Comments: I've got ARKK, ARKG, and MJ July monthlies on, so I may look to add some GDXJ, even though its implied volatility is literally at the bottom of the 52-week range (which is still afflicted by the 2020 pandemic range, so implied volatility rank/percentile aren't all that helpful here), and it isn't exactly weak relative to where it's been. MJ and XBI are currently the most weak out of the group, so I'm personally leaning toward putting on some more XBI, having taken have a June trade last week.

Single Name With 30-Day >50% That Do Not Have Earnings Before Contract Expiry:

X (Steel) (9/74)

CLF (Basic Materials) (18/73)

SAVE (Airlines) (2/55)

F (Autos) (19/55)

OXY (Oil and Gas) (8/53)

SABR (Airlines; Technology) (25/51)

MRO (Oil and Gas) (0/50)

Comments: Given the slim pickings in the broad market and exchange-traded funds space, I've made a list of options highly liquid single name to potentially play while I wait for broad market or sector volatility to return. This list isn't exhaustive, and I've culled out a ton of meme names that have juicy implied volatility but are more likely to become a headache because they're (ironically) too volatile or they're in a space where they're more likely to blow up in my face (e.g., biopharma research and development, crypto).

Pictured here is an X July 16th 22 Short Put (20 delta), paying .74/contract as of Friday close, 3.48% ROC at max/27.6% annualized. As you can see, that play is somewhat close to price action of late, so I'd only put that play on if you're comfortable with potentially taking assignment at 22 and then wheeling it from there. Alternatively, opt for a setup that is consistent with any directional assumption you have as to where U.S. Steel goes from here and that takes advantage of the high implied here.

Something Big is about to happen..!Usually, Gold miners and ETFs perform better than gold itself. Whenever paper golds (Stocks and ETFs) underperform spot price it means something negative is about to happen in the stock market!

Today, most precious metal miners are negative! Take this phenomenon seriously!

Today, Gold experiencing its 9th green day in a row. Which is a very rare phenomenon! you can see only one 10 days and one 9 green days in a row since August 2018.

With the crypto dump - time to rotate into actual GOLDGold with the cup and handle breakout on the weekly chart.

This is the time on gold. If you check my account history, you can see a similar chart posted for GDXJ (the junior gold miners basket) which is breaking out as well.

Don't sleep on this.

Smart money moving back into gold with inflation tailwinds.

Gold next move This is my estimation for the following week(s), until we meet our first target around 1860-1880.

Two weeks from now is the time I consider.

Also GDXJ around 56 $ or above a little. (pending gap at that level could be filled)

Have fun meantime and don't get over excited.

www.youtube.com