US-China Rift: India's Golden Hour?Heightened trade tensions between the United States and China, characterized by substantial US tariffs on Chinese goods, inadvertently create a favorable environment for India. The significant difference in tariff rates—considerably lower for Indian imports than Chinese ones—positions India as an attractive alternative manufacturing base for corporations seeking to mitigate costs and geopolitical risks when supplying the US market. This tariff advantage presents a unique strategic opening for the Indian economy.

Evidence of this shift is already apparent, with major players like Apple reportedly exploring increased iPhone imports from India and even accelerating shipments ahead of tariff deadlines. This trend extends beyond Apple, as other global electronics manufacturers, including Samsung and potentially even some Chinese firms, evaluate shifting production or export routes through India. Such moves stand to significantly bolster India's "Make in India" initiative and enhance its role within global electronics value chains.

The potential influx of manufacturing activity, investment, and exports translates into substantial tailwinds for India's benchmark Nifty 50 index. Increased economic growth, higher corporate earnings for constituent companies (especially in manufacturing and logistics), greater foreign investment, and positive market sentiment are all likely outcomes. However, realizing this potential requires India to address persistent challenges related to infrastructure, policy stability, and ease of doing business, while also navigating competition from other low-tariff nations and seeking favorable terms in ongoing trade negotiations with the US.

Geopolitics

SPY Analysis & Tariff TurmoilLast Friday, the market pressure was intense, and my bullish call option, targeting $537.64 on SPY, seemed overly ambitious as tariffs and political uncertainties peaked. I stated, " AMEX:SPY Trump went all in thinking he had the cards. We were getting sent back to the McKinley era," wondering when or if Trump would fold under international pressure and market realities.

Fast-forward to Wednesday, April 8—Trump didn't just blink; he folded utterly, reversing the harsh tariff policies he initially defended aggressively. Prompted by China's aggressively dumping of U.S. Treasuries and stark recession warnings from Goldman Sachs, BlackRock, and JPMorgan, Trump pivoted significantly:

• Base tariffs: 10%

• Tariffs on China: Increased to 125%

• Tariffs on U.S. goods entering China: Increased to 84% starting April 10

While temporarily bullish, these sudden, dramatic policy swings underline ongoing instability and volatility. However, with big bank earnings on deck this Friday, short-term momentum looks positive.

Technical Levels & Trade Ideas

Hourly Chart

The hourly chart reveals a critical zone—dubbed "Liberation Day Trapped Longs"—between $544.37 (H. Vol Sell Target 1b) and $560.54 (L. Vol ST 2b). Bulls trapped here from recent highs may now look to exit on a relief rally.

• Bullish Scenario:

• Entry: SPY reclaiming and holding above $544.37.

• Target 1: $560.54 (top of trapped longs)

• Target 2: $566.54 (next resistance area)

• Stop Loss: Below recent lows near $535 to limit downside.

• Bearish Scenario (if tariffs intensify again or earnings disappoint):

• Entry: Breakdown confirmation below $535.

• Target 1: $522.20 (Weeks Low Long)

• Target 2: $510.00, potential further support

• Stop Loss: Above $544.50 to manage risk effectively.

Daily Chart Perspective

The broader daily chart shows SPY stabilizing around key lower supports after significant volatility. Recent price action suggests cautious optimism for an upward bounce, but considerable headwinds remain if tariff escalations resume.

Final Thoughts

The rapid tariff reversals and heightened volatility are unsettling. The short-term bullish move offers potential quick upside trades into earnings, but caution remains paramount. You can continue managing risks prudently and watch closely for political or economic headlines that could quickly shift market sentiment again.

Gold Rejects Channel Highs — Retracement to $3,000 Before HigherGold has printed another clean rejection at the upper boundary of a short-term ascending channel on the 6H timeframe. This latest rejection adds further validity to the structure, suggesting that we may now see a healthy technical pullback toward the equilibrium line of the channel — and potentially down to the lower support boundary near the $3,000 psychological level.

Technical Outlook:

Another rejection from channel resistance confirms structural validity.

1:4 risk-to-reward short opportunity with clear invalidation and confluence.

Targets:

– TP1: $3,005 — channel midline + psychological level

– TP2: $2,955 — previous swing high + dynamic quarterly support

$3,000 psychological levels are often retested before continuation.

Fundamentals & Geopolitical Context (as of April 1, 2025):

Gold's Macro Bull Trend Remains Intact

Despite this short-term setup, the broader macro backdrop continues to support gold:

– Central banks accumulating gold amid global de-dollarization

– Real yields remain negative across key regions

– Oil trading above $100 fuels inflationary pressure

Geopolitical Flashpoints Supporting Volatility

– Russia-Ukraine war shows no signs of easing

– Middle East tensions rising (Israel–Hezbollah conflict)

– Taiwan-U.S.-China escalation continues post-military exercises

Bitcoin Weakness = Gold Rotation Potential

– BTC struggling at $70K, showing early signs of distribution

– Miner pressure increasing ahead of halving

– Targeting possible correction to $50K = capital rotation into gold

Conclusion:

Technical rejection at resistance aligns with macro expectations of a short-term pullback.

$3,000 key psychological level likely to be retested before further upside.

Gold remains in a macro bull market; this move is likely corrective within a larger expansion leg.

Long Term Gold Bull Target $4,200:

Previous Long (Target hit and closed at $3,100):

Previous Intra Long (Target hit and closed at $3,100):

EUR/USD Daily Chart Analysis For Week of April 4, 2025Technical Analysis and Outlook:

The Euro has experienced a notable increase, surpassing resistance levels at 1.086 and 1.095 in the current trading session, thereby completing the Inner Currency Rally of 1.114. However, an intermediate price reversal has been observed, suggesting that the Eurodollar will continue to decline towards the support level at 1.090, with a potential extension down to 1.075. An upward momentum could emerge from either of these support levels.

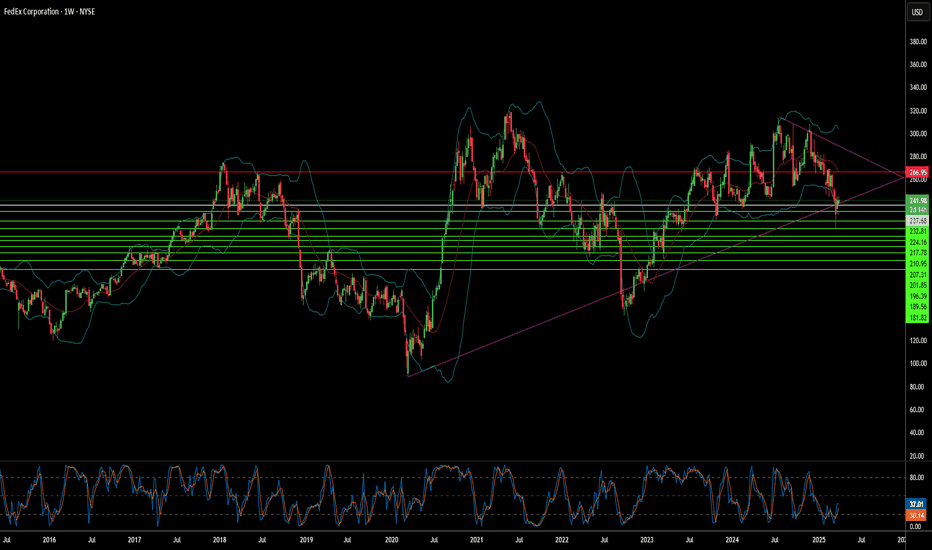

FedEx: Balancing Act or Precarious Gamble?Recent market activity highlights significant pressure on FedEx, as the logistics giant grapples with prevailing economic uncertainty. A notable drop in its stock price followed the company's decision to lower its revenue and profit outlook for fiscal year 2025. Management attributes this revision to weakening shipping demand, particularly in the crucial business-to-business sector, stemming from softness in the US industrial economy and persistent inflationary pressures. This development reflects broader economic concerns that are also impacting consumer spending and prompting caution across the corporate landscape.

In response to these domestic headwinds, FedEx has adopted a more conservative operational stance, evidenced by a reduced planned capital spending for the upcoming fiscal year. This move signals an emphasis on cost management and efficiency as the company navigates the current economic climate within its established markets. It suggests a strategic adjustment to align spending with the revised, more cautious revenue expectations.

However, this domestic caution contrasts sharply with FedEx's concurrent and ambitious expansion strategy in China. Despite geopolitical complexities, the company is making substantial investments to enlarge its footprint, building new operational centers, upgrading existing gateways, and increasing flight frequencies to enhance connectivity. This dual approach underscores the central challenge facing FedEx: balancing immediate economic pressures and operational adjustments at home while pursuing a long-term, high-stakes growth initiative in a critical international market, all within an uncertain global environment.

EUR/USD Daily Chart Analysis For Week of March 28, 2025Technical Analysis and Outlook:

The Euro has experienced a downward trend in the current trading session, surpassing the Mean Support level of 1.078, where an intermediate price reversal occurred. The analysis indicates that the Eurodollar is expected to retest the Mean Resistance level at 1.086, with a possible resistance level marked at 1.095. A downward momentum may be initiated from either the Mean Resistance of 1.086 or 1.095.

Is Gold Forming a Double Top?Gold prices surged once again toward the record high of 3,057, driven by safe-haven demand ahead of April, which brings renewed tariff threats and unfolds amid intensifying geopolitical tensions involving Russia, Ukraine, the U.S., Yemen, Israel, and Gaza.

Should gold prices retreat below this level, we may witness the formation of a potential double top pattern, with downside targets around 3,030, the 3,000 neckline, and further support levels at 2,955, 2,920, and 2,900.

On the upside, a decisive close above 3,060 could trigger another leg higher, potentially setting a new record in alignment with the 3,080 level.

From a monthly perspective, the RSI continues to flash reversal signals similar to those seen in 2024, 2020, 2011, and 2008—raising caution around gold’s elevated levels. While safe-haven demand may continue to outweigh overbought momentum, any shift toward peace could swiftly reverse gains, creating a double-edged sword scenario for the precious metal.

Written by Razan Hilal, CMT

EUR/USD Daily Chart Analysis For Week of March 21, 2025Technical Analysis and Outlook:

As indicated in the analysis conducted last week, the Euro has initiated a downward trend following a successful retest of the Mean Resistance level at 1.093. It is currently trending downward toward the Mean Support level at 1.078, potentially declining further to the Mean Support level at 1.061. Conversely, should the anticipated downward trend not materialize, the Eurodollar will retest the Mean Resistance level at 1.087, with an additional resistance level marked at 1.095.

Oil Market at Risk: Potential Breakdown Below Key SupportThe oil market is showing signs of weakness, with a technical triangle formation on the verge of breaking down. Key support at USD 66.50 per barrel is under threat, and several fundamental and macroeconomic factors suggest further downside risks.

Some Key Bearish Factors for Oil

1. Weakening Global Economy

Economic indicators across major economies are flashing warning signs. A slowdown in global growth, particularly in China and Europe, is reducing industrial demand for oil. Weaker economic activity typically translates to lower energy consumption, putting pressure on oil prices.

2. Stronger U.S. Dollar

A rising USD makes oil more expensive for buyers using other currencies, leading to lower demand. If the Federal Reserve maintains its hawkish stance on interest rates, a stronger dollar could continue weighing on oil prices.

3. Supply Overhang and Shale Resilience

Despite OPEC+ production cuts, oil supply remains ample. U.S. shale producers have kept output steady, while global inventories are rising. If supply continues to outpace demand, downward pressure on prices is likely.

4. China’s Slowing Recovery

China, the world’s largest oil importer, has struggled with weaker-than-expected economic data. Lower manufacturing activity and sluggish domestic demand are reducing the country’s need for crude oil, further dampening market sentiment.

5. Geopolitical De-escalation

A potential ceasefire in Ukraine could ease concerns over energy supply disruptions. Lower geopolitical risk would reduce the war-driven risk premium on oil, potentially triggering a price decline.

6. Growth in Alternative Energy

The increasing adoption of electric vehicles (EVs) and renewable energy is gradually reducing structural demand for crude oil. As governments push for greener energy solutions, long-term oil consumption trends may continue declining.

7. Speculative Unwinding

Traders and hedge funds could accelerate the sell-off if USD 66.50 support breaks. Technical breakdowns often lead to increased short-selling and stop-loss triggers, intensifying downward momentum.

Conclusion: More Downside Ahead?

With a weakening economy, strong dollar, and growing supply concerns, oil faces multiple headwinds. If key technical support at USD 66.50 breaks, the market could see further declines in the short term. Unless demand picks up or supply constraints emerge, the bearish trend may persist.

#OilMarket #CrudeOil #BearishOutlook #Energy

Will Oil Prices Ignite Amid a Middle East War?The global oil market is critical, with geopolitical tensions in the Middle East potentially leading to significant price fluctuations. Recent military actions by the U.S. against Yemen's Houthi group have contributed to rising oil prices, as Brent crude futures reached $71.21 per barrel and U.S. West Texas Intermediate crude futures hit $67.80 per barrel. Positive economic indicators from China, including increased retail sales, have supported oil prices despite global economic slowdown concerns.

The Middle East remains a focal point for oil price volatility due to its strategic importance in global oil supply. Iran, a major oil producer, could face disruptions if tensions escalate, potentially driving prices higher. However, global spare capacity and demand resilience might cap long-term increases. Historical events like the 2019 Saudi oil facility attacks demonstrate the market's sensitivity to regional instability, with prices spiking by $10 following the incident.

Analysts predict that if the conflict escalates to close the Strait of Hormuz, oil prices could exceed $100 per barrel. Nevertheless, historical data suggests that prices may stabilize within a few months if disruptions prove temporary. The delicate balance between supply shocks and market adjustments underscores the need to closely monitor geopolitical developments and their economic ripple effects.

As global economic uncertainties overshadow geopolitical risks, maintaining market confidence will depend on sustained positive economic data from countries like China. The potential for peace negotiations in Ukraine and changes in U.S. sanctions could also impact oil prices, making this a pivotal moment for global energy markets.

EUR/USD Daily Chart Analysis For Week of March 14, 2025Technical Analysis and Outlook:

As indicated in the analysis from the previous week, the Euro has commenced an upward trend, successfully retesting the completed Inner Currency Rally at 1.086 and advancing toward the Mean Resistance level at 1.093. Consequently, the currency is currently experiencing a retreat and is directing its focus toward the Mean Support level at 1.078, possibly declining further to the Mean Support level at 1.061. Conversely, should the anticipated downward trend fail to materialize, it is plausible that the Eurodollar will retest the Mean Resistance level at 1.093 and subsequently aim for the completed Outer Currency Rally level of 1.124, traversing Key Resistance at 1.119 along the way.

Europe’s defence awakeningThe race to bolster European defence capabilities is well underway. Since the invasion of Ukraine, European leaders have intensified calls for increased defence spending. The continent, long reliant on US security guarantees, is now facing a critical inflection point. Recent moves by the US administration to engage with Russia without consulting its European allies or Ukraine have underscored the urgent need for Europe to take charge of its own defence. This geopolitical reality has forced European leaders to acknowledge that relying on US support is no longer a guaranteed strategy, accelerating discussions on independent military capabilities and funding mechanisms.

Why is European defence spending rising?

For decades, the US has outspent Europe on defence, contributing more than two-thirds of NATO’s1 overall budget. However, NATO estimates that in 2024, 23 out of 32 members met the 2% GDP2 defence spending target, compared to just seven members in 2022 and three in 20143. More ambitious goals are being discussed. Poland is leading the way with a 4.12% of GDP2 defence budget, while discussions at NATO suggest some countries may need to increase spending to 3% or higher1.

Adding another layer of complexity is the US Department of Government Efficiency (DOGE) initiative, which is beginning to reshape US defence priorities. The shift from cost-plus to fixed-price contracts under DOGE is putting financial pressure on defence companies most exposed to the US, which may see constraints on long-term spending commitments. This could have two contrasting effects: while it may limit US capability to fund

European defence through NATO, it could also drive European nations to increase domestic procurement and reduce dependency on US defence systems.

Additionally, emerging security threats, including cyber warfare, artificial intelligence (AI)-driven military technology, and the growing presence of authoritarian regimes, have reinforced the need for increased defence investments. Europe’s reliance on outdated Cold War-era military equipment is another critical factor, pushing leaders to modernise their arsenals.

How will Europe fund its defence expansion?

Ramping up defence spending is a monumental task, especially given high sovereign debt levels across Europe. Yet, leaders are exploring creative solutions to secure the necessary funding. One approach is to reallocate existing European Union (EU) budgets, with discussions centring on repurposing unspent Cohesion Funds and Recovery and Resilience Facility (RRF) loans. However, legal restrictions within EU treaties may limit their direct application to military expenditures.

Another potential route is the issuance of European Defence Bonds, mirroring the successful NextGenerationEU pandemic recovery fund. By pooling resources at the EU level, this could offer a coordinated and cost-effective funding mechanism.

At the same time, private investment and public-private partnerships are gaining traction. Defence contractors and institutional investors are increasingly seen as strategic partners in financing large-scale projects, particularly in weapons systems, cyber defence, and artificial intelligence. Governments may leverage these collaborations to accelerate procurement and technological advancements.

Despite these options, one thing is clear—Europe must find a sustainable funding model to support its defence ambitions without derailing economic stability. Whether through EU-level financing, national budget reallocations, or private-sector involvement, securing long-term defence investment will be paramount in ensuring Europe’s security and strategic autonomy.

Impact on defence stocks: can the strong run continue?

European defence stocks have had a strong run since 2022, driven by surging order books, government contracts, and the realisation that military spending is no longer optional. Over the past year, Europe defence stocks rose 40.8%, outpacing broader European equities (+11.4%)4 . Defence stocks trade at a historical P/E5 ratio of ~14x, slightly above the long-term average, though still below peak multiples6

There are three key trends fuelling defence stock momentum:

Backlogs at record highs: European defence contractors are sitting on unprecedented order books, with consensus forecasting 2024-29 CAGRs7 of ~11% for sales and ~16% for both adjusted EBIT8 and adjusted EPS9. These growth rates compare to just 8%, 11% and 12%, respectively, for the 2019-24 period10.

Government commitments: with long-term contracts locked in and additional spending likely, demand visibility remains strong.

EU’s push for strategic autonomy: The European Commission has proposed a European Defence Industrial Strategy (EDIS), aimed at spending at least 50% of procurement budgets within the EU by 2030 and 60% by 203511.

Conclusion: a new era for European defence

The European defence sector is entering a new era of investment and strategic autonomy. With rising geopolitical risks and uncertainty over US support, European nations are taking proactive steps to build a more robust and self-sufficient military ecosystem. While funding challenges persist, the momentum behind higher budgets, technological investments, and NATO commitments makes this shift not just necessary, but inevitable.

With the EU backing structural shifts in procurement, defence stocks remain well-positioned, particularly those with exposure to land (for example, ammunition, vehicles) and air (for example, air defence, missiles, drones) domains.

1NATO = The North Atlantic Treaty Organization (an intergovernmental transnational military alliance of 32 member states).

2GDP = gross domestic product.

3NATO 2023 Vilnius Summit Declaration.

4Bloomberg, Europe defence stocks are represented by the MSCI Europe Aerospace & Defence Index and European Equities represented by MSCI Europe Index.

5P/E = price-to-earnings.

6Bloomberg as of 31 January 2025.

7CAGR = compound annual growth rate.

8EBIT = earnings before interest and taxes.

9EPS = earnings per share.

10Company data, Visible Alpha Consensus, WisdomTree as of 31 January 2025.

11European Commission: Joint communication to the European Parliament, the Council as of August 2024.

This material is prepared by WisdomTree and its affiliates and is not intended to be relied upon as a forecast, research, or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. The opinions expressed are as of the date of production and may change as subsequent conditions vary. The information and opinions contained in this material are derived from proprietary and non-proprietary sources. As such, no warranty of accuracy or reliability is given and no responsibility arising in any other way for errors and omissions (including responsibility to any person by reason of negligence) is accepted by WisdomTree, nor any affiliate, nor any of their officers, employees, or agents. Reliance upon information in this material is at the sole discretion of the reader. Past performance is not a reliable indicator of future performance.

Amid Price Uncertainty, Gold Straddle Paves the PathYellow metal prices have soared. It has been setting several new all-time highs with futures trading just shy of the USD 3,000/oz level. However, gold has struggled to breach past the crucial mark despite multiple attempts.

Some data points suggest that the rally in gold might be losing steam even though fundamental demand drivers remain intact.

A nuanced position is required at times like this. Options are tailored to help portfolio managers to position shrewdly in such dicey situations.

GEOPOLITICAL RISK IS PERSISTENTLY ELEVATED IN THE NEW WORLD ORDER

The Geopolitical Risk Index (GPR) remains above one hundred since 2022 which reflects sustained global uncertainty driven by ongoing geopolitical tensions. This trend has persisted for years, with recent tariff-related uncertainty adding fuel to this fire.

Data Source: Economic Policy Uncertainty

Gold, as a safe haven asset, benefits from these conditions. However, the recent bond selloff has driven Treasury rates higher which could potentially reduce demand for gold as it is a non-yielding asset.

CENTRAL BANKS ARE LOADING ON RISING GLOBAL TRADE UNCERTAINTIES

Central banks are resuming gold purchases, with January showing an uptick, albeit below the 2024 average. The accelerating pace could signal further momentum, particularly amid rising global trade uncertainty.

Data Source: WGC

China resumed gold buying in November 2024 following a six-month hiatus. China was one of the largest buyers in 2023 and a repeat of that in 2025 will see a sharp demand spike.

LARGE GOLD FLOWS INTO THE US

The large financial institutions which serve as counterparties in the futures market have been importing significant quantities of physical gold to the US. The recent flows have surpassed levels seen during COVID pandemic.

Physical imports have been driven by fears of a tariff on gold imports. However, the pace of imports has slowed down and is starting to plateau.

Looking back at 2020, when similar conditions arose, prices remained stagnant after the sharp rally driven by physical gold imports. The risk of a repeating pattern is even more potent given the strong resistance at the USD 3,000/oz level. A strong driver may be required to allow prices to cross this threshold.

Chart Source: WGC

Another factor contributing to the temporary physical supply shock is the refining process required before gold reaches the U.S.

The physical gold reserves held in London for Good Delivery are the 400-oz bars, which must be refined into 1-kilo bars for CME delivery. This process requires an intermediate stop in Switzerland, adding delays that exacerbate supply constraints.

However, as the additional refined metals reach the U.S. in the coming weeks, supply is expected to normalize, potentially putting downward pressure on prices.

Chart Source: WGC

Other supply stress indicators are easing. Gold leasing rates, which reflect the cost of borrowing for physical use, recently surged above 5%, with near-term borrowing costs rising sharply. Leasing rates have returned to normal, albeit slightly elevated.

TECHNICAL SIGNALS POINT TO STRONG MOMENTUM ENCOUNTERING RESISTANCE

The summary below suggests a bullish stance in gold but prices are encountering resistance. Over the past month, prices have faced strong resistance at the USD 3,000 level despite a strongly bullish sentiment.

The resistance formed after a stunning rally which pushed gold into overbought territory, a correction at this stage is expected.

Should momentum fade, gold prices may continue to consolidate between present levels and the 100-day moving average.

Gold futures prices formed a death-cross on 5th March 2025 which may fuel a near term price correction.

GOLD VOLATILITY IS NOT LOW BUT CAN RISE HIGHER IF CONDITIONS TURNS TENSE

Gold Volatility as measured by CME’s Gold CVol printed a high of 50.13 on 18th March 2020 and a low of 8.18 on 3rd May 2019.

Presently hovering at 16.35, the implied volatility in gold is not too low but below average with the potential to spike higher should geopolitical or other shocks rock the market.

Source: CME CVol

HYPOTHETICAL TRADE SETUP

Fundamentals remain intact and could intensify if tariff and/or geopolitical tensions peak. That said, the phenomenal gold rally is starting to lose shine as it encounters strong resistance with death cross forming on 5th March 2025.

Supply shocks that fueled the rally in Feb are now fading.

Equity risks are elevated with expensive S&P 500 P/E multiples. Geopolitical and trade risk remain tense. These conditions support a further bullish position in gold.

With prices expected to swing either way, portfolio managers are best positioned to have a convex position that gains from sharp moves in either direction.

To express this ambivalent view on the path ahead for gold prices, portfolio managers can utilize CME Micro Gold Options to establish a long straddle (combination of long put & long call) that gains from (a) deep pull back in prices (puts gain in value), or (b) sharp rally (calls deliver the gains), and (c) implied volatility expansion (where both puts & calls gain in value).

Conversely, this trade will incur losses if prices remain flat and if volatility shrinks.

The pay-off of the hypothetical long straddle set up using CME Micro Gold Options June 2025 contract expiring on 27th May 2025 is illustrated below.

The long call at a strike of 2,945 will cost USD 84.9 per lot and the long put at the same strike will cost USD 86.9 per lot adding up to USD 171.80 per lot in total premiums. The long straddle will generate positive returns at expiry if the underlying futures prices are (a) above the upper break even point of USD 3,116.80/oz, or (b) below the lower break even point of USD 2,732.20/oz.

Source: QuikStrike Strategy Simulator

If the underlying futures prices stay within the break-even points, this straddle is exposed to a maximum loss of USD 171.80/lot representing the total premium. Happy Investing.

MARKET DATA

CME Real-time Market Data helps identify trading set-ups and express market views better. If you have futures in your trading portfolio, you can check out on CME Group data plans available that suit your trading needs tradingview.com/cme .

DISCLAIMER

This case study is for educational purposes only and does not constitute investment recommendations or advice. Nor are they used to promote any specific products, or services.

Trading or investment ideas cited here are for illustration only, as an integral part of a case study to demonstrate the fundamental concepts in risk management or trading under the market scenarios being discussed. Please read the FULL DISCLAIMER the link to which is provided in our profile description.

EUR/USD Daily Chart Analysis For Week of March 7, 2025Technical Analysis and Outlook:

In the preliminary phase of the Inner Currency Rally, the Euro achieved a significant milestone of 1.060 during the current week's trading session. Demonstrating an unprecedented surge in "dead-cat rally" sentiment, it subsequently completed our next targeted level of Inner Currency Rally of 1.086. As a result, the market has established a Mean Support target at 1.077, which the ongoing pullback indicates may be the next point of focus. This price movement may also lead to a further decline toward an additional Mean Support level of 1.057.

Conversely, should the anticipated downward trend fail to materialize, the Eurodollar may initiate an upward trend toward the Mean Resistance level of 1.091. This movement could aim for the ultimate Outer Currency Rally level of 1.124 in the near future.

Can Brazil’s Bonds Defy Global Chaos?In an era of escalating trade tensions and economic uncertainty, Brazil’s financial markets offer a compelling enigma for the astute investor. As of March 3, 2025, with the USD/BRL exchange rate at 1 USD = 5.87 BRL, the Brazilian real has shown resilience, appreciating from 6.2 to 5.8 this year. This strength, intriguingly tied to a bond market boasting 10-year yields near 15%, prompts a deeper question: could Brazil emerge as an unexpected sanctuary amid global turmoil? This exploration unveils a landscape where high yields and domestic focus challenge conventional investment wisdom.

Brazil’s bond market operates as an idiosyncratic force with yields dwarfing those of peers like Chile (5.94%) and Mexico (9.49%). Driven by local dynamics—fiscal policy, inflation, and a central bank unbound by global rate cycles—it has seen yields ease from 16% to 14.6% year-to-date, signaling stabilization. This shift correlates with the real’s rise, suggesting a potent inverse relationship: as yields moderate, confidence grows, bolstering the currency. For the inquisitive mind, this interplay invites a reevaluation of risk and reward in a world where traditional havens falter.

Yet, the global stage adds layers of complexity. U.S.-China trade tensions, while not directly targeting Brazil, ripple through its economy—offering trade diversion benefits like increased soybean exports to China, yet threatening slowdowns that could dim growth. With China as its top trade partner and the U.S. second, Brazil straddles opportunity and vulnerability. Investors must ponder: can its bond market’s allure withstand these crosswinds, or will global forces unravel its promise? The answer lies in decoding this delicate balance, a challenge that inspires curiosity and strategic daring.

EUR/USD Daily Chart Analysis For Week of Feb 28, 2025Technical Analysis and Outlook:

In the initial rally attempt in this week's trading session, The Euro failed to reach our target of Inner Currency Rally 1.060 due to prevailing bearish sentiment. As a result, the market established a Mean Resistance target of 1.041. The current trend suggests a continuation of the downward price movement toward our designated target of Mean Support at 1.030, and there may be a retest of the Completed Outer Currency Dip at 1.020 via Key Support at 1.024. Conversely, if the anticipated downward trend does not materialize, we may witness the Eurodollar retesting the Mean Resistance level of 1.041 and subsequently target the Inner Currency Rally level of 1.060.

What Lies Beneath Chevron's Venezuelan Exit?In a striking geopolitical maneuver, the Trump administration has revoked Chevron's license to operate in Venezuela, effective March 1. This decision marks a sharp departure from the Biden-era policy, which had conditionally allowed Chevron’s operations to encourage free elections in the beleaguered nation. Beyond punishing Venezuela for unmet democratic benchmarks, the move reflects a broader U.S. strategy to bolster domestic oil production and lessen dependence on foreign energy sources. Chevron, a titan with over a century of history in Venezuela, now faces the unraveling of a vital revenue stream, prompting us to ponder the delicate dance between corporate ambition and national agendas.

The ripple effects for Venezuela are profound and perilous. Chevron accounted for nearly a quarter of the country’s oil production, and its exit is forecast to slash Venezuela’s revenue by $4 billion by 2026. This economic blow threatens to rekindle inflation and destabilize a nation already teetering on the edge of recovery, exposing the intricate ties between U.S. corporate presence and sanctioned states. For Chevron, the revocation transforms a once-lucrative asset into a geopolitical liability, thrusting the company into a high-stakes test of resilience. This clash of interests challenges us to consider the true cost of operating in the shadow of political volatility.

On the global stage, this decision reverberates through energy markets and diplomatic corridors. Oil prices have already twitched in response, hinting at tighter supplies. At the same time, the fate of other foreign firms in Venezuela hangs in the balance, shadowed by the looming threat of secondary sanctions. As the U.S. sharpens its confrontational edge, the energy landscape braces for transformation, with consequences for geopolitical alliances and energy security worldwide. Is Chevron’s departure merely a pawn in a broader strategic game, or does it herald a seismic shift in global power dynamics? The answer may redefine the boundaries of energy and influence in the years ahead.

Will Russia’s New Dawn Reshape Global Finance?As the Russo-Ukrainian War edges toward a hypothetical resolution, Russia stands poised for an economic renaissance that could redefine its place in the global arena. Retaining control over resource-laden regions like Crimea and Donbas, Russia secures access to coal, natural gas, and vital maritime routes—assets that promise a surge in national wealth. The potential lifting of U.S. sanctions further amplifies this prospect, reconnecting Russian enterprises to international markets and unleashing energy exports. Yet, this resurgence is shadowed by complexity: Russian oligarchs, architects of influence, are primed to extend their reach into these territories, striking resource deals with the U.S. at mutually beneficial rates. This presents a tantalizing yet treacherous frontier for investors—where opportunity dances with ethical and geopolitical uncertainties.

The implications ripple outward, poised to recalibrate global economic currents. Lower commodity prices could ease inflationary pressures in the West, offering relief to consumers while challenging energy titans like Saudi Arabia and Canada to adapt. Foreign investors might find allure in Russia’s undervalued assets and a strengthening ruble, but caution is paramount. The oligarchs’ deft maneuvering—exploiting political leverage to secure advantageous contracts—casts an enigmatic shadow over this revival. Their pragmatic pivot toward U.S. partnerships hints at a new economic pragmatism, yet it prompts a deeper question: Can such arrangements endure, and at what cost to global stability? The stakes are high, and the outcomes remain tantalizingly uncertain.

This unfolding scenario challenges us to ponder the broader horizon. How will investors weigh the promise of profit against the moral quandaries of engaging with a resurgent Russia? What might the global financial order become if Russia’s economic ascent gains momentum? The answers elude easy resolution, but the potential is undeniable—Russia’s trajectory could anchor or upend markets, depending on the world’s response. Herein lies the inspiration and the test: to navigate this landscape demands not just foresight, but a bold reckoning with the interplay of economics, ethics, and power.

EUR/USD Daily Chart Analysis For Week of Feb 21, 2025Technical Analysis and Outlook:

This week, the Euro reapproached our designated Mean Resistance level of 1.050 and reversed its upward momentum. This trend indicates a continuation of the downward price movement, establishing a new support level marked at 1.042. Further declines may materialize, with potential targets including Mean Support at 1.030, a weaker Key Support at 1.024, the completed Outer Currency Dip at 1.020, and the outermost target Outer Currency Dip at 1.005. Contrariwise, should the anticipated downward correction not transpire, the Eurodollar may experience an upward rally, possibly revisiting the Mean Resistance level of 1.050 and subsequently engaging with the Inner Currency Rally target of 1.060.

Can Soybeans Survive the Global Trade Chessboard?In the intricate game of international trade politics, soybeans have emerged as pivotal pieces on the global economic chessboard. The soybean industry faces a critical juncture as nations like the European Union and China implement protectionist strategies in response to US policies. This article delves into how these geopolitical moves are reshaping the future of one of America's most significant agricultural exports, challenging readers to consider the resilience and adaptability required in today's volatile trade environment.

The European Union's decision to restrict US soybean imports due to the use of banned pesticides highlights a growing trend towards sustainability and consumer health in global trade. This move impacts American farmers and invites us to ponder the broader implications of agricultural practices on international commerce. As we witness these shifts, the question arises: How can the soybean industry innovate to meet global standards while maintaining its economic stronghold?

China's strategic response, which targets influential American companies like PVH Corp., adds complexity to the global trade narrative. The placement of a major U.S. brand on China's 'unreliable entity' list highlights the power dynamics involved in international commerce. This situation prompts us to consider the interconnectedness of economies and the potential for unforeseen alliances or conflicts. What strategies can businesses implement to navigate these challenging circumstances?

Ultimately, the soybean saga is more than a tale of trade disputes; it's a call to action for innovation, sustainability, and strategic foresight in the agricultural sector. As we watch this unfold, we are inspired to question not just the survival of soybeans but the very nature of global economic relationships in an era where every move on the trade chessboard can alter the game. How will the soybean industry, and indeed, international trade, evolve in response to these challenges?

Why I Believe Brent Crude Oil is Headed to $125 by 2026www.tradingview.com 1. Supply Constraints: Geopolitics & Trade Wars

One of the biggest drivers of higher oil prices is geopolitical instability and trade policy shifts. We're already seeing major disruptions that could tighten supply further:

Middle East Tensions – The ongoing conflicts in the Red Sea, Iran, and Israel continue to create uncertainty. Attacks on shipping routes and production facilities raise the cost of transporting oil and increase the risk of supply disruptions.

Russia-Ukraine War – With Russian oil facing sanctions and restrictions, global supply chains have had to adjust, making energy markets more fragile.

OPEC+ Output Cuts – OPEC has repeatedly restricted production to keep prices elevated, and there’s no indication they’ll reverse course anytime soon.

U.S.-China Trade War & Tariffs – With Trump leading in the 2024 election polls, there’s a growing possibility that tariffs on China will return. If this happens, energy trade flows could be further disrupted, and retaliatory tariffs could add to price pressures.

Strategic Petroleum Reserve (SPR) Depletion – The U.S. used a huge portion of its SPR to lower oil prices in 2022-2023, but refilling those reserves will create additional demand, pushing prices even higher.

With these factors at play, supply is becoming more constrained, making it easier for prices to rise with even small increases in demand.

2. Demand Boom: AI, Bitcoin Mining, and Agriculture

While supply is tightening, demand for energy is skyrocketing in unexpected ways.

AI Data Centers & Industrial Demand

AI computing is extremely energy-intensive, and as companies like Microsoft, Google, and Amazon continue to expand cloud computing infrastructure, demand for electricity is surging.

Many data centers still rely on fossil fuels for backup power and cooling systems, meaning oil and gas usage will continue to increase.

Bitcoin (BTC) Mining

Bitcoin mining requires massive amounts of electricity, and as BTC prices rise, mining activity expands in energy-dependent regions.

With the 2024 BTC halving, miners will have to run at full efficiency, which translates to higher global energy consumption.

Agriculture & Food Production

The world’s growing population and extreme weather events (like El Niño) are driving higher food production needs.

Fertilizer production, transportation, and machinery all require oil, meaning agricultural commodities are directly contributing to higher energy demand.

Together, these factors suggest that demand for oil is only going to increase, making it harder for supply to keep up.

3. Oil Price vs. Stock Market: The $100 Warning Zone

Historically, when oil prices get too high, the stock market struggles. Some key examples:

2008 Recession: Oil peaked at $147 per barrel, right before the financial crisis.

2018 Market Drop: When oil hit $80+, stocks sold off sharply.

2022 Inflation Shock: Oil reached $120+, leading to Fed rate hikes and market turmoil.

Why $100+ Oil is a Warning Sign for Stocks

Higher oil prices = higher inflation. This forces central banks like the Federal Reserve to keep interest rates high, making borrowing more expensive.

Energy costs impact corporate profits. Companies across multiple sectors will see shrinking profit margins as transportation and production costs rise.

Consumer spending takes a hit. Gasoline prices cut into disposable income, which weakens overall economic growth.

If Brent crude pushes above $100, expect increased market volatility and a potential selloff in equities.

4. Brent Crude Technicals: Price Targets for 2026

Current Setup

Price Holding Key Support (~$70-$74) – Brent is respecting major trendlines, signaling strong demand in this area.

Breakout Zone Around $80-$82 – If price moves above this level, it could trigger a rally to $100+.

Fibonacci Levels Align with $125 Target:

0.618 Fib retracement at $106 → First major resistance.

0.786 Fib extension at $119 → Likely next target.

1.272 Fib extension near $125 → Final upside target for 2026.

This technical setup aligns with macro fundamentals and historical oil cycles, making a move to $125 increasingly probable.

5. Investment & Trading Strategy

Long-Term Bullish Strategy

Accumulation Zone: $70-$74 (solid support).

Upside Targets: $106, $119, $125.

Stop Loss Consideration: Below $68 (invalidates thesis).

Hedging Against Market Risk

SPX Put Options / VIX Calls – If oil rises toward $100+, consider hedging against an equity downturn.

Energy Stocks (XLE, Exxon, Chevron) – These stocks tend to outperform during oil bull markets.

Gold & Commodities – Hard assets often rally when energy prices increase.

Conclusion: The Path to $125 Brent Oil

Geopolitical instability + supply cuts = higher prices.

AI, Bitcoin, and food production = rising demand.

If oil approaches $100, watch for an equities pullback.

While no forecast is perfect, all signs point to oil prices rising into 2026. If this trend plays out, investors should be prepared for higher inflation, tighter Fed policy, and increased market volatility.

Would love to hear your thoughts—do you think oil will hit $125, or are we headed lower? 🚀📊

EUR/USD Daily Chart Analysis For Week of Feb 14, 2025Technical Analysis and Outlook:

During the trading session in the current week, the Euro reached our designated Mean resistance of 1.050 and is establishing a potential resurgence of extending upward momentum to an Inner Currency Rally of 1.060. On the other hand, if the anticipated upward resurgence does not emerge, the cryptocurrency may experience a drop toward the Mean Support of 1.039. Further engaging with the Mean Support level at 1.030 and the Key Support at 1.024, ultimately progressing toward the completed outer Currency Dip target of 1.020 and outermost Outer Currency Dip of 1.005.

Risks are Bubbling in the Nasdaq-100The Nasdaq-100 has led this cycle, driven by U.S. economic resilience and an unprecedented investment surge in artificial intelligence and cloud infrastructure.

However, risks are emerging from overvaluation, excessive AI spending that has yet to translate into revenue, and geopolitical uncertainties tied to the Trump administration.

With the Nasdaq-100 trading below its all-time high and lacking sufficient catalysts for a breakout, a near-term correction could occur if these risks materialize. Investors may consider a short position to capitalize on this potential downturn.

AI Spending and Overvaluation Risks

The "Magnificent Seven"—Apple, Microsoft, Nvidia, Amazon, Alphabet, Meta, and Tesla—have dominated market sentiment, collectively accounting for approximately 63% of the Nasdaq-100's total market cap. This highlights the rally's extreme concentration.

Much of the momentum has been driven by high expectations for rapid growth in artificial intelligence, further amplifying the market's reliance on these key players.

The broader backdrop has also been supportive: US economic growth continues to surprise to the upside, with growth expected at 2.3% for the year, while corporate earnings—even more so for tech—are likely to rise 7-14%, as per multiple analyst outlooks.

However, recent earnings reports have injected caution into AI enthusiasm. Alphabet missed revenue forecasts, sending its stock down 7.3%, while AMD dropped 6.3% after weak data-center sales. Amazon's AWS posted $28.79B in revenue, just shy of the $28.84B estimate, raising concerns over AI over-spending.

Despite this, AI capex remains aggressive. Meta reaffirmed its $60-65B 2025 capex plan, despite $17B in Metaverse losses last year. Microsoft defended its Azure and OpenAI bets, while Alphabet, despite AI competition pressures , is committing $75B to AI infrastructure in 2025.

With ambitions and excitement all around, the market’s reaction toward these companies, in light of underwhelming earnings and efficient competition from China, has not been so forgiving.

Cracks are forming, and a more cautious approach to Nasdaq-100 exposure may be warranted.

Valuations are stretched, with the index’s forward P/E ratio at 34 , up from 28 in 2023. While the AI boom, particularly in consumer adoption, took off in early 2023, the market is now pricing in near-flawless execution—yet investors have yet to fully grapple with the rising costs, intensifying competition, and looming regulatory scrutiny.

Risks remain in some of the largest Nasdaq-100 stocks, particularly Nvidia and Tesla. Nvidia’s price-to-earnings (P/E) ratio of 50.7 raises concerns about its ability to sustain past explosive growth. Similarly, Tesla, with a P/E ratio of 183.6, faces headwinds from a slowdown in the EV industry, making its valuation increasingly vulnerable.

Political and Trade Uncertainty

Donald Trump’s return to the White House has generated significant energy and excitement. However, the extremity of his policies could create new trade uncertainties, particularly for companies dependent on Chinese supply chains and international revenue.

Since his inauguration, Trump has announced a series of tariffs against major trading partners. The risk of retaliatory measures raises the possibility of a full-blown trade war. His aggressive stance on trade could introduce sudden and unpredictable market volatility.

The previous trade war saw tariffs disrupt global tech supply chains and put pressure on corporate margins. For instance, in 2018-2019 Nasdaq-100 volatility spiked and tech earnings growth slowed.

If history repeats itself, the overextended valuations of Nasdaq-100 could probably get a reality check, particularly if these firms start guiding for higher costs in upcoming earnings calls.

Technicals Point to Upcoming Resistance

The moving averages for the Nasdaq-100 reflect a bullish sentiment owing to the strong rally for the past several months.

However, the ATH level of 22,100 has proven strong resistance with prices testing this level multiple times over the past few months. A strong catalyst may be required to pass this level.

During previous corrections, price has reached between the 50-day and 100-day simple moving average (SMA).

Momentum indicators suggest that a short-term downward trend may be imminent.

Periodic movements in the index suggest a downturn is imminent and prices may reach as far as the S1 pivot point at 20,700.

Options Signal Growing Bearish Sentiment

Options positioning on E-mini Nasdaq-100 futures and Micro E-mini Nasdaq-100 futures signals a bearish sentiment. OI and volume put/call ratio for both E-mini NQ and Micro E-mini NQ are greater than 1 suggesting higher put positioning than call. There is a particualrly high concentration of puts at the March expiry.

Source: CME QuikStrike

Hypothetical Trade Setup

Given the frothing risk factors impacting the Nasdaq-100, risk of a sharp decline is high. Elevated valuations, escalating trade tensions, and slowing AI rally, all risk a correction in the index.

This decline may materialize in the next 2–3 weeks, aligning with critical macroeconomic events, including Federal Reserve announcements, inflation data releases, and upcoming corporate earnings reports.

With a correction likely, investors can express this view using a short position in Micro E-mini Nasdaq 100 (MNQ) futures expiring in March (MNQH2025). Each contract requires initial margin of USD 2,303 as of 10/Feb and provides exposure to USD 2 x Nasdaq index (~43,400).

Investors can also use the standard E-mini NQ futures to express the same bearish view with larger notional sizes.

Entry: 21,700

Target: 21,200

Stop Loss: 22,100

Profit at Target: USD 1000 ((21,700-21,200) x 2)

Loss at Stop: USD 800 ((21,700-22,100) x 2)

Reward to Risk: 1.25x

CME Group lists a raft of products covering a range of asset classes more accessible while also enabling granular hedging for portfolio managers.

Portfolio managers can learn more on how to access these micro products by visiting CME Micro Products page on CME portal to discover micro-sized contracts to gain macro exposures.

TradingView has launched The Leap trading competition starting today. New and upcoming traders can hone and refine their trading skills, test their trading strategies, and feel the thrill of futures trading with a vibrant global community through this paper trading competition sponsored by CME Group using virtual money and real time prices. Click here to learn more.

MARKET DATA

CME Real-time Market Data helps identify trading set-ups and express market views better. If you have futures in your trading portfolio, you can check out on CME Group data plans available that suit your trading needs tradingview.com/cme .

DISCLAIMER

This case study is for educational purposes only and does not constitute investment recommendations or advice. Nor are they used to promote any specific products, or services.

Trading or investment ideas cited here are for illustration only, as an integral part of a case study to demonstrate the fundamental concepts in risk management or trading under the market scenarios being discussed. Please read the FULL DISCLAIMER the link to which is provided in our profile description.