Bullish rise off pullback support?GER40 has reacted off the support level which is a pullback support and could potentially rise from this level to our take profit.

Entry: 22,032.93

Why we like it:

There is a pullback support.

Stop loss: 21,497.17

Why we like it:

There is a pullback support.

Take profit: 23,476.82

Why we like it:

There is a pullback resistance.

Enjoying your TradingView experience? Review us!

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.

Ger40

DAX INTRADAY important support at 21118The DAX40 continues to exhibit bullish sentiment, aligning with the prevailing short term uptrend. Recent price action suggests that the index experienced an oversold rally, which subsequently spiked above near a key resistance zone — the previous intraday consolidation level around 21,532.

This area now serves as a critical pivot point. A corrective pullback “Gap Close” to 21,532, followed by renewed buying pressure, would likely confirm a bullish reversal, with upside targets at:

22,276 – Near-term resistance

22,657 – Medium-term resistance

22,903 – Long-term resistance level

However, if price breaks and closes firmly below 21,532 on a daily basis, the bullish scenario would be invalidated. In that case, the DAX40 could extend corrective pullback toward:

21,118 – Immediate support

20,800 – Major downside target

Conclusion

The bias remains bullish above 21,532, with rallies from that level offering potential long opportunities. A daily close below 21,532, however, would shift sentiment and open the door for bearish continuation toward lower support levels.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

DAX40 INTRADAY “gap breakout” supported at 21532The DAX40 continues to exhibit bullish sentiment, aligning with the prevailing short term uptrend. Recent price action suggests that the index experienced an oversold rally, which subsequently spiked above near a key resistance zone — the previous intraday consolidation level around 21,532.

This area now serves as a critical pivot point. A corrective pullback “Gap Close” to 21,532, followed by renewed buying pressure, would likely confirm a bullish reversal, with upside targets at:

22,276 – Near-term resistance

22,657 – Medium-term resistance

22,903 – Long-term resistance level

However, if price breaks and closes firmly below 21,532 on a daily basis, the bullish scenario would be invalidated. In that case, the DAX40 could extend corrective pullback toward:

21,118 – Immediate support

20,800 – Major downside target

Conclusion

The bias remains bullish above 21,532, with rallies from that level offering potential long opportunities. A daily close below 21,532, however, would shift sentiment and open the door for bearish continuation toward lower support levels.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

Ger40 dax SeekingPips short SELL UP here hight Reward to Risk🌟Good morning ladies and gentlemen.🌟

I like the Reward to Risk profile on this setup over 7r ✅️

Although it's one of my lower win rate strategies it's a simple set and forget trade setup with the statistics to backbup my plan.

🟢SeekingPips🟢 is short with Stop Loss above the highest high this morning.

On the feed that I am using that high 21839.5

I'M LOOKING for a GAP FILL🚥

Potential bearish reversal?GER40 is rising towards the resistance level which is a pullback resistance and could drop from this level to our take profit.

Entry: 21,545.11

Why we like it:

There is a pullback resistance level.

Stop loss: 22,174.31

Why we like it:

There is a pullback resistance level that lines up with the 138.2% Fibonacci extension.

Take profit: 20,327.32

Why we like it:

There is a pullback support level.

Enjoying your TradingView experience? Review us!

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.

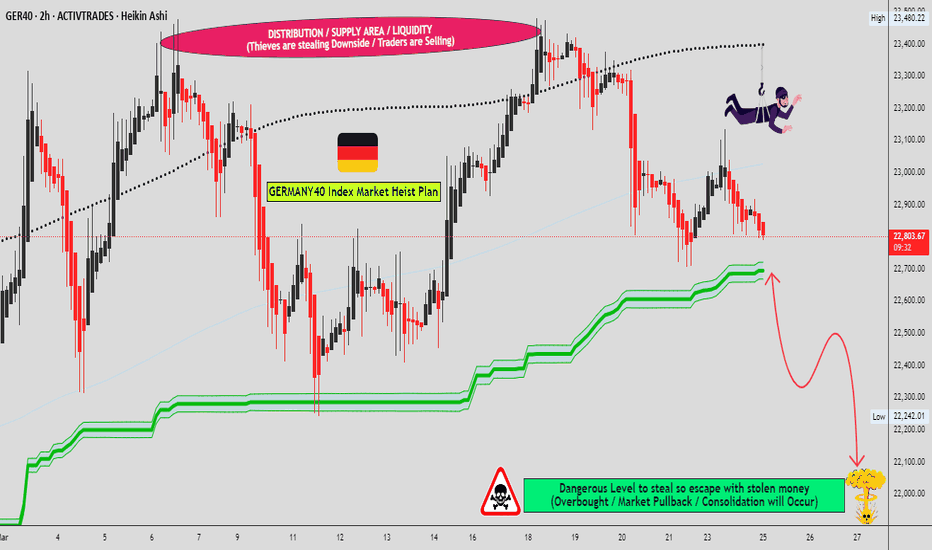

"GERMANY 40" Index CFD Market Heist Plan (Day / Swing Trade)🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑💰✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the "GERMANY 40" Index CFD Market. Please adhere to the strategy I've outlined in the chart, which emphasizes short entry. Our aim is the high-risk Green MA Zone. Risky level, oversold market, consolidation, trend reversal, trap at the level where traders and bullish robbers are stronger. 🏆💸"Take profit and treat yourself, traders. You deserve it!💪🏆🎉

Entry 📈 : "The vault is wide open! Swipe the Bearish loot at any price - the heist is on!

however I advise to Place sell limit orders within a 15 or 30 minute timeframe most nearest or swing, low or high level for Pullback Entries.

Stop Loss 🛑:

📌Thief SL placed at the nearest/swing High or Low level Using the 4H timeframe (20500) Day/Swing trade basis.

📌SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯: 18400 (or) Escape Before the Target

"GERMANY 40" Index CFD Market Heist Plan (Swing/Day Trade) is currently experiencing a Bearish trend.., driven by several key factors.👇👇👇

📰🗞️Get & Read the Fundamental, Macro, COT Report, Geopolitical and News Analysis, Sentimental Outlook, Intermarket Analysis, Index-Specific Analysis, Positioning and future trend targets... go ahead to check 👉👉👉🔗🔗

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

DAX INTRADAY decision point at 21520The DAX40 continues to exhibit bearish sentiment, aligning with the prevailing downward trend. Recent price action suggests that the index experienced an oversold rally, which was subsequently rejected near a key resistance zone — the previous intraday consolidation level around 21,520.

This area now serves as a critical pivot point. A failure to break above 21,520, followed by renewed selling pressure, would likely confirm a bearish reversal, with downside targets at:

20,333 – Near-term support

19,557 – Medium-term support

18,780 – Long-term support level

However, if price breaks and closes firmly above 21,520 on a daily basis, the bearish scenario would be invalidated. In that case, the DAX40 could extend gains toward:

21,880 – Immediate resistance

22,330 – Major upside target

Conclusion

The bias remains bearish below 21,520, with rallies into that level offering potential short opportunities. A daily close above 21,520, however, would shift sentiment and open the door for bullish continuation toward higher resistance levels.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

DAX IMPORTANT resistance retest at 21520? The DAX40 continues to exhibit bearish sentiment, aligning with the prevailing downward trend. Recent price action suggests that the index experienced an oversold rally, which was subsequently rejected near a key resistance zone — the previous intraday consolidation level around 21,520.

This area now serves as a critical pivot point. A failure to break above 21,520, followed by renewed selling pressure, would likely confirm a bearish reversal, with downside targets at:

20,333 – Near-term support

19,557 – Medium-term support

18,780 – Long-term support level

However, if price breaks and closes firmly above 21,520 on a daily basis, the bearish scenario would be invalidated. In that case, the DAX40 could extend gains toward:

21,880 – Immediate resistance

22,330 – Major upside target

Conclusion

The bias remains bearish below 21,520, with rallies into that level offering potential short opportunities. A daily close above 21,520, however, would shift sentiment and open the door for bullish continuation toward higher resistance levels.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

Bullish bounce off pullback support?GER40 has bounced off the support level which is a pullback support that lines up with the 5-% Fibonacci retracement and could rise from this level to our take profit.

Entry: 20,283,82

Why we like it:

There is a pullback support level that lines up with the 50% Fibonacci retracement.

Stop loss: 19,359.58

Why we like it:

There is a pullback support level.

Take profit: 21,468.60

Why we like it:

There is a pullback resistance level.

Enjoying your TradingView experience? Review us!

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.

DAX40 INTRADAY oversold bounce capped at 21520The DAX40 continues to exhibit bearish sentiment, aligning with the prevailing downward trend. Recent price action suggests that the index experienced an oversold rally, which was subsequently rejected near a key resistance zone — the previous intraday consolidation level around 21,520.

This area now serves as a critical pivot point. A failure to break above 21,520, followed by renewed selling pressure, would likely confirm a bearish reversal, with downside targets at:

20,333 – Near-term support

19,557 – Medium-term support

18,780 – Long-term support level

However, if price breaks and closes firmly above 21,520 on a daily basis, the bearish scenario would be invalidated. In that case, the DAX40 could extend gains toward:

21,880 – Immediate resistance

22,330 – Major upside target

Conclusion

The bias remains bearish below 21,520, with rallies into that level offering potential short opportunities. A daily close above 21,520, however, would shift sentiment and open the door for bullish continuation toward higher resistance levels.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

DAX INTRADAY oversold bounce back capped at 20820The DAX 40 Index is showing a bearish trend, with recent price action breaking below a key support level around 20820. This level acted as a consolidation zone and is now a key resistance.

An oversold bounce from current levels is possible, but if the price fails to break back above 20820, it could head lower toward the next support levels at 19550, 18780, and 17240 over time.

On the other hand, if the index breaks and closes above 20820, the bearish outlook would be invalidated, and the index could move higher to test 21100, and possibly 21870.

Conclusion

Below 20820 = bearish bias remains

Watch for a rejection at 20820 for short setups

Break and daily close above 20820 = shift to bullish outlook targeting higher levels

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

DAX Shows Upward Reaction from Key Support ZoneThe DAX is feeling the effects of a "Black Monday" scenario early on. The blue trendline that began in August was broken on Friday, and now the longer-term trend that started in October 2023 is being tested. This trendline, along with the major support zone just below it, could act as a potential turning point before a deeper selloff.

If the 18,800–18,920 zone holds, this pullback might turn into a solid buying opportunity. However, there is a clear reason behind the panic selling, and that concern still remains. If fear escalates into full-blown panic and the 18,800–18,920 support zone is broken (not just a bear trap or a temporary downward spike), the rout is likely to continue through the rest of the week.

"GERMANY30" Index CFD Market Heist Plan (Scalping/Day Trade)🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑💰✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the "GERMANY30" Index CFD Market. Please adhere to the strategy I've outlined in the chart, which emphasizes short entry. Our aim is the high-risk Green Zone ATR. Risky level, oversold market, consolidation, trend reversal, trap at the level where traders and bullish robbers are stronger. 🏆💸Book Profits Be wealthy and safe trade.💪🏆🎉

Entry 📈 : "The vault is wide open! Swipe the Bearish loot at any price - the heist is on!

however I advise to Place sell limit orders within a 15 or 30 minute timeframe most nearest or swing, low or high level.

Stop Loss 🛑: (22500) Thief SL placed at the nearest / swing high level Using the 4H timeframe scalping / day trade basis.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯: 21400 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Short side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

"GERMANY30" Index CFD Market Heist Plan (Scalping/Day Trade) is currently experiencing a bearishness,., driven by several key factors.

📰🗞️Get & Read the Fundamental, Macro Economics, COT Report, Geopolitical and News Analysis, Sentimental Outlook, Intermarket Analysis, Index-Specific Analysis, Positioning and future trend targets... go ahead to check 👉👉👉🔗

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

"GERMANY 40" Index CFD Market Heist Plan (Day / Swing Trade)🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑💰✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the GER40 "GERMANY 40" Index CFD Market. Please adhere to the strategy I've outlined in the chart, which emphasizes short entry. Our aim is the high-risk Green Zone. Risky level, oversold market, consolidation, trend reversal, trap at the level where traders and bullish robbers are stronger. 🏆💸Book Profits Be wealthy and safe trade.💪🏆🎉

Entry 📈 : "The heist is on! Wait for the breakout (22650) then make your move - Bearish profits await!"

however I advise placing Sell Stop Orders below the breakout MA or Place Sell limit orders within a 15 or 30 minute timeframe. Entry from the most recent or closest low or high level should be in retest. I Highly recommended you to put alert in your chart.

Stop Loss 🛑: Thief SL placed at 23000 (swing / Day Trade Basis) Using the 2H period, the recent / swing high or low level.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯: 22000 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Short side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

GER40 "GERMANY 40" Index CFD Market Heist Plan (Scalping / Day Trade) is currently experiencing a bearishness,., driven by several key factors.

📰🗞️Get & Read the Fundamental, Macro, COT Report, Geopolitical and News Analysis, Sentimental Outlook, Intermarket Analysis, Index-Specific Analysis, Positioning and future trend targets.. go ahead to check 👉👉👉

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

📌Please note that this is a general analysis and not personalized investment advice. It's essential to consider your own risk tolerance and market analysis before making any investment decisions.

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

DAX Ultimate buy signal on the 1D MA200 approaching.DAX is having a brutal sell-off, which wasn't technically unexpected as the index made a Higher High on March 06 at the top of its 2.5-year Channel Up. The 1D RSI is already oversold (below 30.00), which is the initial long-term buy signal. Out of the last 3 times the 1D RSI was oversold only on September 26 2023 it extended the downtrend. The other 2 times, it was an immediate buy signal.

The ultimate buy signal, if you want to wait for it, was last time (August 05 2024 Low) when the 1D MA200 (orange trend-line) broke. The minimum rally DAX had following such a bottom was +11.73%, which gives us a short-term Target of 21900 and the maximum (but still the bad case scenario of the 3 Bullish Legs) +29.48%, which gives a long-term Target of 25400.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

DAX40 INTRADAY corrective pullback capped at 22144The DAX 40 remains in a bearish trend, with recent price action suggesting an oversold bounce rather than a structural reversal.

Key Levels & Scenarios

Resistance: 22144 (previous intraday consolidation zone)

A bearish rejection from this level could resume downside momentum.

Support targets: 21544, followed by 21300 and 21000 over a longer timeframe.

Bullish Breakout Scenario:

A confirmed breakout above 22144 with a daily close above this level would invalidate the bearish outlook.

Upside targets: 22385 (next resistance), followed by 22685.

Indicators & Market Sentiment

RSI suggests the market was oversold, leading to the current bounce.

Volume analysis indicates weak bullish momentum, reinforcing the bearish bias unless 22144 is breached.

Conclusion

The prevailing bearish trend remains intact unless DAX 40 breaks and holds above 22144. Traders should watch for bearish rejection at this level for downside continuation or a daily close above 22144 for a shift to bullish momentum.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

A high probability short setup on GER40! Hello traders,

GER40 is flashing a prime shorting opportunity! On the higher timeframe, the index has formed a double top, a classic reversal pattern. The setup has been confirmed with a decisive neckline break, signaling strong bearish momentum.

I'm watching for a slight pullback to the neckline, where I'll be looking to enter short positions. My initial target is 21,637, with an extended move down to 21,112 if sellers maintain control.

Stay tuned for updates, and if you find this analysis valuable, give it a boost! Let’s catch this move together. 🚀🔥

Quarter Ends, Setup Begins: Long from DAX Support ZoneDAX returned to its major support zone around 22,000 after an extended decline through March. I’ve been triggered into a long position as we step into a fresh month and quarter. We’re sitting at strong historical demand with multiple macro events lined up this week—I’ll take what the market gives and manage it accordingly. No ego here, just flow with the setup. Let’s see where this one heads as NFP and PMI data come in.

Technicals

• Timeframe: 1H

• Entry Zone: Strong support retest at 22,000

• Setup: Long triggered on reaction from major support

• Target: Zone around 22,950

• SL: Below the support zone (~21,800)

• Fibcloud: Still trending below, watching for reclaim

• End-of-month rebalancing and Quarter close may add volatility.

Fundamentals

• DAX dropped nearly 2% on Monday, hitting its lowest levels since Feb 10, in line with global market weakness.

• US trade tariff uncertainty under Trump’s “reciprocal” rhetoric weighs on sentiment.

• Germany’s CPI eased to 2.2%, the lowest since Nov 2024, aligning with market expectations.

• Q1 performance remains strong overall, up nearly 11%, supported by Germany’s spending plan.

• Eyes on this week’s NFP and PMI data which could drive further price action.

Note: Please remember to adjust this trade idea according to your individual trading conditions, including position size, broker-specific price variations, and any relevant external factors. Every trader’s situation is unique, so it’s crucial to tailor your approach to your own risk tolerance and market environment.

DAX INTRADAY at crossroads awaits US tariffs The DAX40 continues to exhibit bullish sentiment, breaking out from a period of sideways consolidation and pushing toward previous resistance and all-time highs (ATH). The prevailing uptrend supports further upside potential, with key resistance levels in focus.

Key Support and Resistance Levels

Resistance Level 1: 23,446

Resistance Level 2: 23,815

Resistance Level 3: 24,000 - 24,420

Support Level 1: 22,575

Support Level 2: 22,204

Support Level 3: 21,814

Conclusion:

The positive reaction to fiscal spending plans and geopolitical developments reinforces the bullish sentiment for DAX40. A sustained move above the nearest resistance at 23,446 could pave the way toward higher targets, while holding above support at 22,575 is crucial to maintaining the uptrend.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

#dax Forex Signal German index #dax says I am rising in the medium term in technical indicators. 30% increase is normal. It is necessary to take a position for a decrease when the blue line at the top, which is our technical resistance, turns.

If you want to be in action at the right place and at the right time, you can follow me.

I can draw it for you. Please write me privately.

NOTE: IT DOES NOT CONTAIN INVESTMENT ADVICE. EVERYONE IS FREE TO BUY AND SELL THE SHARES THEY WANT FROM THEIR PERSONAL ACCOUNT WITH THEIR OWN FREE WILL. NO ONE CAN GUIDE ANYONE OR PROVIDE SHARES THAT WILL PROVIDE 100% GUARANTEED PROFIT.

I can draw it for you. Please write me privately.

Trade Idea: DAX 40 (15m Chart)Trade Idea: DAX 40 (15m Chart)

Price is currently retracing towards a higher timeframe Fair Value Gap (FVG) zone. This area aligns with previous supply and offers a high-probability short setup. Once price enters this FVG, watch for bearish confirmation such as a rejection candle or a shift in market structure on lower timeframes.