"Planning the Perfect DE40 Robbery? Here’s the Setup!"💥🔥Thief Trading Style: The Ultimate Market Heist Plan for DE40/Germany40🔥💥

"Steal the Trend, Escape the Trap, and Vanish with Profits!"

🌍🌟**Hola, Hallo, Marhaba, Bonjour, Ola, and Hey Traders!**🌟

Welcome to the Thief Trading Vault – where we don’t just trade, we plan market heists with precision and escape like professionals!

To all my fellow Profit Pirates, Smart Robbers, and Money Hunters – this one's for you. 🤑💸💼

🔐💹DE40/Germany40 Master Robbery Plan – Swing Trade Setup

Strategy Type: Swing & Scalp Friendly

Market Direction: Neutral ➜ Bullish Bias

Approach: DCA + Tactical Entry Zones + News-Conscious Trading

📍ENTRY (The Vault Is Open!)

Break in like a pro! We are eyeing a long entry setup.

Wait for price to dip near key pullback zones (within recent 15m or 30m swing highs/lows). Use buy limit orders to scale in.

🛠 Thieves love layering: DCA style entry strategy ensures lower average cost.

💡“Swipe smart, enter silently.”

📍STOP LOSS (Secure Your Exit!)

Our risk control is set at recent 4H swing low – around 23950.00.

However, your SL can vary based on risk profile, lot size, and number of entries.

Protect the stash! 💼🔒

📍TARGET (Getaway Point!)

🎯 Target: 24570.00 or exit early if resistance becomes tight.

We’re approaching a “Red Zone” – a high-risk area loaded with fake-outs, bear traps, and profit-takers.

🔁Scalpers' Goldmine Tips

Only scalp LONG SIDE ONLY.

Big accounts? Jump in anytime.

Small accounts? Tag along with swing setups.

Always use a trailing SL to secure gains and avoid traps.

🧠Technical + Fundamental Blend

This setup isn’t just chart-based.

We analyze:

🔍 Fundamentals & Macro Trends

🧾 COT Reports & Sentiment

🌐 Geopolitical Events

📊 Intermarket & Index-Specific Data

🧭 Trader Positioning & Future Price Bias

📎 Full outlook & premium research available – Klickk the Lnk🔗🧠

📢IMPORTANT REMINDERS:

⚠️ Major news releases = High risk.

Avoid fresh entries during those hours.

Use trailing SLs to lock profits during volatile sessions.

🚀Support The Thieves – Hit Boost!

Smash that 💥Boost Button💥 if this plan helped you plan your next profit heist.

More boosts = More strategies unlocked.

Join our elite robbers’ squad and conquer the market daily with the Thief Trading Style! 🏆💰❤️

📌DISCLAIMER:

This is a general swing trade strategy and not financial advice.

Always evaluate your own risk level and market understanding before entering trades.

Markets shift fast – adapt, stay sharp, and never trade blindly. 🎯

📅 Stay tuned – more robbery plans, more precision trades, and more fun ahead!

Follow & Boost if you want in on the next mission!

🕶️🐱👤 See you at the getaway spot!

Germanindex

“GER30 Bull Vault Heist: The Ultimate Loot Plan”💎“The Bull Vault Job: GER30 Heist Blueprint”💎

🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Welcome fellow Chart Raiders & Market Hackers 🧠💰—your next mission is here.

We’re pulling off a precision breakout plan on GER30 / DE30 "Germany30" — a market vault bursting with bullish loot. This isn’t just trading... this is Thief Trading Style™ — where smart analysis meets slick execution. 👨💻💎📊

💼 The Heist Plan:

📈 Entry: Market shows a wide open vault. Ideal long setups near the last swing low (15–30m for sniper entries). Don’t chase—wait for the retrace.

🛑 Stop Loss: Guard your getaway! Use recent swing lows on 4H (e.g. 24170). Customize based on your risk profile & lot sizes.

🎯 Target: Aim for 24720 or EXIT before the cops (a.k.a. reversal zones) show up. Always secure your gains.

📌 Scalpers’ Signal: Stay LONG-only. Follow swing traders if low on ammo (capital). Use trailing SLs like tripwires to protect your profits.

📊 Market Heat Check: The DE30 is radiating bullish pressure 💥—fueled by fundamentals, macro trends, COT positions, sentiment indicators, and intermarket clues. We read between the lines. You just follow the blueprint. 🧠

🚨 Pro Tips:

Avoid entering trades during high-impact news.

Manage risk like a vault door—solid, tested, and ready.

💖 Smash that Boost Button 💖 if you believe in the Art of Legal Market Extraction™ — it supports the plan, strengthens the crew, and keeps this hustle alive!

🎭 More blueprints & breakdowns coming soon. Stay locked in...

Until the next market hit, trade sharp, trade smart. 🐱👤📈💰

DE40 H4 Analysis 23 Jul to 27 Jul - Bullish FlagDE40 Showing a bullish Flag 23,735 - 23,800. If it breaks this zone, Most probably can fly upto 24,466 and higher. Take your risk under control and wait for market to break support or resistance on smaller time frame. Best of luck everyone and happy trading.🤗

GER40 Trading Plan: Ride the Wave or Get Trapped?🚨 DE40 Heist Alert: The Bullish Breakout Robbery Plan (Swing & Scalp Strategy) 🚨

🌟 Hi! Hola! Ola! Bonjour! Hallo! Marhaba! 🌟

Attention Money Makers & Market Robbers! 🤑💰💸

Based on the 🔥Thief Trading Style🔥, here’s our master plan to loot the DE40 / GER40 "Germany40" Index. Follow the strategy on the chart—focusing on LONG entries—and escape near the high-risk Red Zone. This area is overbought, consolidating, and a potential reversal trap where bears lurk. 🏆 Take profits fast—you’ve earned it! 💪

🎯 Heist Entries:

📈 Entry 1: "The Breakout Heist!" – Wait for Resistance (24200) to break, then strike! Bullish profits await.

📈 Entry 2: "Big Players’ Pullback!" – Jump in at 23300+ for a safer steal.

🔔 Pro Tip: Set a chart alert to catch the breakout instantly!

🛑 Stop Loss Rules:

*"Yo, listen! 🗣️ If you’re entering with a buy-stop, DON’T set your SL until AFTER the breakout. Place it at the nearest swing low (4H timeframe) or wherever your risk allows—but remember, rebels risk more! 🔥"*

🏴☠️ Target: 24,800

🧲 Scalpers: Only play LONG! Use trailing SL to lock in profits. Big wallets? Go all in. Small stacks? Join the swing heist!

📊 Market Pulse:

The DE40 is neutral but primed for bullish momentum. Watch:

Fundamentals (COT, Macro, Geopolitics)

Sentiment & Intermarket Trends

Positioning & Future Targets

📌 Check our bioo linkks for deep analysis! 🔗🌍

⚠️ Trading Alert:

News = Volatility! Protect your loot:

Avoid new trades during major news

Use trailing stops to secure profits

💥 Boost This Heist!

Hit 👍 & 🔄 to strengthen our robbery crew! Let’s dominate the market daily with the Thief Trading Style. 🚀💵

Stay tuned—another heist drops soon! 🎯🐱👤

DE40 / GER40 "Germany40" Index Market Bullish Heist Plan🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑 💰💸✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the DE40 / GER40 "Germany40" Index Market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is to escape near the high-risk Red Zone Level. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 🏆💸"Take profit and treat yourself, traders. You deserve it!💪🏆🎉

Entry 📈 : "The vault is wide open! Swipe the Bullish loot at any price - the heist is on!

however I advise to Place buy limit orders within a 15 or 30 minute timeframe most recent or swing, low or high level. I Highly recommended you to put alert in your chart.

Stop Loss 🛑:

📍 Thief SL placed at the recent/swing low level Using the 4H timeframe (22250.0) Day/Swing trade basis.

📍 SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

🏴☠️Target 🎯: 24700.0 (or) Escape Before the Target.

🧲Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

💰💵💸DE40 / GER40 "Germany40" Index Market Heist (Swing Trade Plan) is currently experiencing a neutral trend there is high chance for bullishness,., driven by several key factors. .☝☝☝

📰🗞️Get & Read the Fundamental, Macro economics, COT Report, Geopolitical and News Analysis, Sentimental Outlook, Intermarket Analysis, Index-Specific Analysis, Positioning and future trend targets with Overall Score..... go ahead to check👉👉👉🔗🔗🌎🌏🗺

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

DAX at a Crossroads: Will Resistance Trigger a Pullback?The German 40 (DAX) has been on a strong bullish run, now trading into a key resistance zone near previous range highs. This area is likely packed with liquidity (buy stops), making it a potential turning point. Given the overextended price action and current fundamentals, a retracement is likely as profit-taking and stop orders trigger. While sentiment has been bullish, caution is warranted at these levels. I am expecting a pullback before any further upside. Not financial advice.

"GERMANY30" Index CFD Market Heist Plan (Scalping/Day Trade)🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑💰✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the "GERMANY30" Index CFD Market. Please adhere to the strategy I've outlined in the chart, which emphasizes short entry. Our aim is the high-risk Green Zone ATR. Risky level, oversold market, consolidation, trend reversal, trap at the level where traders and bullish robbers are stronger. 🏆💸Book Profits Be wealthy and safe trade.💪🏆🎉

Entry 📈 : "The vault is wide open! Swipe the Bearish loot at any price - the heist is on!

however I advise to Place sell limit orders within a 15 or 30 minute timeframe most nearest or swing, low or high level.

Stop Loss 🛑: (22500) Thief SL placed at the nearest / swing high level Using the 4H timeframe scalping / day trade basis.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯: 21400 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Short side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

"GERMANY30" Index CFD Market Heist Plan (Scalping/Day Trade) is currently experiencing a bearishness,., driven by several key factors.

📰🗞️Get & Read the Fundamental, Macro Economics, COT Report, Geopolitical and News Analysis, Sentimental Outlook, Intermarket Analysis, Index-Specific Analysis, Positioning and future trend targets... go ahead to check 👉👉👉🔗

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

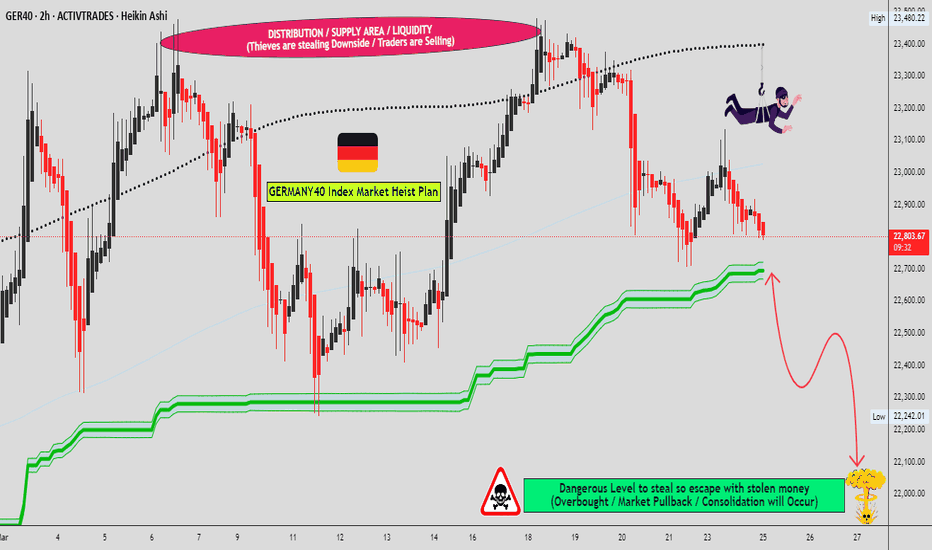

"GERMANY 40" Index CFD Market Heist Plan (Day / Swing Trade)🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑💰✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the GER40 "GERMANY 40" Index CFD Market. Please adhere to the strategy I've outlined in the chart, which emphasizes short entry. Our aim is the high-risk Green Zone. Risky level, oversold market, consolidation, trend reversal, trap at the level where traders and bullish robbers are stronger. 🏆💸Book Profits Be wealthy and safe trade.💪🏆🎉

Entry 📈 : "The heist is on! Wait for the breakout (22650) then make your move - Bearish profits await!"

however I advise placing Sell Stop Orders below the breakout MA or Place Sell limit orders within a 15 or 30 minute timeframe. Entry from the most recent or closest low or high level should be in retest. I Highly recommended you to put alert in your chart.

Stop Loss 🛑: Thief SL placed at 23000 (swing / Day Trade Basis) Using the 2H period, the recent / swing high or low level.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯: 22000 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Short side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

GER40 "GERMANY 40" Index CFD Market Heist Plan (Scalping / Day Trade) is currently experiencing a bearishness,., driven by several key factors.

📰🗞️Get & Read the Fundamental, Macro, COT Report, Geopolitical and News Analysis, Sentimental Outlook, Intermarket Analysis, Index-Specific Analysis, Positioning and future trend targets.. go ahead to check 👉👉👉

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

📌Please note that this is a general analysis and not personalized investment advice. It's essential to consider your own risk tolerance and market analysis before making any investment decisions.

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

"GERMANY40" GER40/DAX Indices Market Heist Plan🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑💰🐱👤🐱🏍

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the "GERMANY40" GER40/DAX Indices market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry and short entry. 🏆💸Book Profits, Be wealthy and safe trade.💪🏆🎉

Entry 📈 :

"The loot's within reach! Wait for the breakout, then grab your share - whether you're a Bullish thief or a Bearish bandit!"

Buy entry above 23000

Sell Entry below 22100

However, I recommended to place buy stop for bullish side and sell stop for bearish side.

📌I strongly advise you to set an alert on your chart so you can see when the breakout entry occurs.

Stop Loss 🛑:

-Thief SL placed at 22600 for Bullish Trade

-Thief SL placed at 22600 for Bearish Trade

Using the 30min period, the recent / swing low or high level.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯:

-Bullish Robbers TP 24100 (or) Escape Before the Target

-Bearish Robbers TP 21200 (or) Escape Before the Target

📰🗞️Fundamental, Macro Economics, COT data, Sentimental Outlook:

"GERMANY40" GER40/DAX Indices market is currently experiencing a Neutral trend (there is a higher chance for Bearishness)., driven by several key factors.

🔰Fundamental Analysis

The GER40 index has experienced a moderate decline of 2.5% in February, with the index currently standing at 22,500 points.

Company earnings have been mixed, with some companies exceeding expectations while others have disappointed.

The dividend yield for the GER40 is around 2.5%, which is relatively attractive compared to other major European indices.

🔰Macro Economics

The European Central Bank (ECB) has maintained its hawkish stance, keeping interest rates at 4.25% to combat inflation.

Germany's GDP growth rate is expected to slow down to 1.5% in 2025, due to the ongoing economic uncertainty.

Global trade tensions, particularly between the US and China, continue to impact the German market.

🔰Global Market Analysis

The GER40 is experiencing a bearish trend, with a 0.5% decline in the last 24 hours.

The index is currently trading at 22,500, with a high of 22,600 and a low of 22,400.

🔰COT Data

Speculators (Non-Commercials): 45,011 long positions and 30,015 short positions.

Hedgers (Commercials): 25,019 long positions and 40,011 short positions.

Asset Managers: 30,015 long positions and 20,019 short positions.

🔰Market Sentiment Analysis

The overall sentiment for the GER40 is bearish, with a mix of negative and neutral predictions.

55% of client accounts are short on this market, indicating a bearish sentiment.

🔰Positioning Analysis

The long/short ratio for the GER40 is currently unknown.

The open interest for the GER40 is approximately €10 billion.

🔰Quantitative Analysis

The GER40 has a relatively high volatility, with an average true range (ATR) of 150 points.

The index is currently trading below its 50-day moving average, indicating a bearish trend.

🔰Intermarket Analysis

The GER40 is highly correlated with the Euro Stoxx 50 index, with a correlation coefficient of 0.85.

The index is also highly correlated with the DAX index, with a correlation coefficient of 0.90.

🔰News and Events Analysis

The GER40 has been impacted by the ongoing economic uncertainty in Europe.

The index has also been affected by the decline in German industrial production.

🔰Next Trend Move

Bearish Prediction: Some analysts predict a potential bearish move, targeting 22,000 and 21,800, due to the ongoing economic uncertainty and decline in German industrial production.

Bullish Prediction: Others predict a potential bullish move, targeting 23,000 and 23,200, due to the attractive valuations and potential economic recovery.

🔰Overall Summary Outlook

The overall outlook for the GER40 is bearish, with a mix of negative and neutral predictions.

The market is expected to experience a moderate decline, with some analysts predicting a potential bearish move targeting 22,000 and 21,800.

🔰Real-Time Market Feed

As of the current time, the GER40 is trading at 22,500, with a 0.5% decline in the last 24 hours.

🔰Future Prediction

Short-Term: Bearish: 22,200-22,000, Bullish: 22,800-23,000

Medium-Term: Bearish: 21,800-21,600, Bullish: 23,200-23,400

Long-Term: Bearish: 21,400-21,200, Bullish: 24,000-24,200

📌Keep in mind that these factors can change rapidly, and it's essential to stay up-to-date with market developments and adjust your analysis accordingly.

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

GER40/DAX "Germany40" CFD Index Market Heist Plan🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

⚔Dear Money Makers & Thieves, 🤑 💰✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the GER40/DAX "Germany40" CFD Index Market. Please adhere to the strategy I've outlined in the chart, which emphasizes short entry. Our aim is the high-risk Green Zone. Risky level, oversold market, consolidation, trend reversal, trap at the level where traders and bullish thieves are getting stronger. 🏆💸Book Profits Be wealthy and safe trade.💪🏆🎉

Entry 📈 : "The vault is wide open! Swipe the Bearish loot at any price - the heist is on! profits await!" however I advise placing Sell limit orders within a 15 or 30 minute timeframe. Entry from the most recent or swing low or high level should be in retest.

Stop Loss 🛑: Thief SL placed at (23000) swing Trade Basis Using the 2H period, the recent / swing high or low level.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

🏴☠️Target 🎯: 21400 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Short side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

GER40/DAX "Germany40" CFD Index Market is currently experiencing a Neutral trend to Bearish., driven by several key factors.

📰🗞️Read the Fundamental, Macro Economics, COT Report, Seasonal Factors, Intermarket Analysis, Sentimental Outlook, Future trend predict.

Before start the heist plan read it.👉👉👉

📌Keep in mind that these factors can change rapidly, and it's essential to stay up-to-date with market developments and adjust your analysis accordingly.

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

DAX pullback US Automobile tariffs “in the neighbourhood of 25%”Yesterday, Wednesday 19th Feb, Germany’s DAX equity index experienced the biggest decline of the major European indices, with automakers like Volkswagen (-2.78%) and BMW (-2.28%) underperforming.

Key Trading Level is at 21923

Support: 21770 followed by 21350 and 21060

Resistance: 22850 followed by 23000 and 23300

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

GER40 "Germany 40" Indices Market Bearish Heist Plan🌟Hi! Hola! Ola! Bonjour! Hallo!🌟

Dear Money Makers & Robbers, 🤑 💰🐱👤

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the GER40 "Germany 40" Indices Market. Please adhere to the strategy I've outlined in the chart, which emphasizes short entry. Our aim is the high-risk Green Zone. Risky level, oversold market, consolidation, trend reversal, trap at the level where traders and bullish robbers are stronger. 🏆💸Be wealthy and safe trade.💪🏆🎉

Entry 📈 :

"The heist is on! Wait for the breakout (21250.00) then make your move - Bearish profits await!"

however I advise placing Sell limit orders within a 15 or 30 minute timeframe. Entry from the most recent or closest high or low level should be in retest.

Stop Loss 🛑:

Thief SL placed at 21500.00 (swing Trade) Using the 2H period, the recent / nearest low or high level.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯:

First Target 20800.00 (or) Escape Before the Target

Final Target 20300.00 (or) Escape Before the Target

Scalpers, take note 👀 : only scalp on the Short side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

📰🗞️Fundamental, Macro, COT, Sentimental Outlook:

GER40 "Germany 40" Indices Market is currently experiencing a Neutral (there is a high chance for Bearish trend)., driven by several key factors.

🟠Fundamental Analysis

1. Earnings Growth: The Germany 40 index has experienced a decline in earnings growth, with a 5-year average earnings growth rate of 5%.

2. Dividend Yield: The dividend yield of the Germany 40 index is currently 2.5%, which is relatively low compared to historical standards.

3. Valuation: The price-to-earnings (P/E) ratio of the Germany 40 index is currently 15.6, which is slightly above its historical average.

⚪Macro Analysis

1. GDP Growth: The German economy has experienced a slowdown in GDP growth, with a 2022 growth rate of 1.4%.

2. Inflation: The inflation rate in Germany has remained relatively low, with a 2022 inflation rate of 1.4%.

3. Interest Rates: The European Central Bank (ECB) has maintained a dovish stance, keeping interest rates low to support economic growth.

🟢COT Analysis

1. Non-Commercial Traders: Non-commercial traders, such as hedge funds and institutional investors, have increased their short positions in the Germany 40 index, with a net short exposure of 10,000 contracts.

2. Commercial Traders: Commercial traders, such as banks and brokerages, have decreased their long positions in the Germany 40 index, with a net long exposure of 5,000 contracts.

⚫Sentiment Analysis

1. Retail Trader Sentiment: Retail traders have a bearish sentiment towards the Germany 40 index, with 55% being bearish.

2. Institutional Investor Sentiment: Institutional investors have decreased their bullish sentiment towards the Germany 40 index, with 50% being bullish.

3. Hedge Fund Sentiment: Hedge funds have increased their bearish sentiment towards the Germany 40 index, with 60% being bearish.

🟤Positioning Analysis

1. Long Positions: Long positions in the Germany 40 index have decreased, with a net long exposure of 50,000 contracts.

2. Short Positions: Short positions in the Germany 40 index have increased, with a net short exposure of 10,000 contracts.

3. Open Interest: Open interest in the Germany 40 index has decreased, with a current open interest of 500,000 contracts.

🟣Based on this analysis, the Germany 40 index is expected to trend bearish in the short term, with a 60% chance of a downtrend and a 30% chance of an uptrend. However, please note that market predictions can be unpredictable and influenced by various factors.

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

📌Please note that this is a general analysis and not personalized investment advice. It's essential to consider your own risk tolerance and market analysis before making any investment decisions.

📌Keep in mind that these factors can change rapidly, and it's essential to stay up-to-date with market developments and adjust your analysis accordingly.

💖Supporting our robbery plan will enable us to effortlessly make and steal money 💰💵 Tell your friends, Colleagues and family to follow, like, and share. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

DE40 "German DAX 40" Indices Market Bullish Heist Plan🌟Hi! Hola! Ola! Bonjour! Hallo!🌟

Dear Money Makers & Robbers, 🤑 💰

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the DE40 "Germany 40" Indices market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is the high-risk Red Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. Be wealthy and safe trade.💪🏆🎉

Entry 📈 : You can enter a Bull trade at any point,

however I advise placing Buy limit orders within a 15 or 30 minute timeframe. Entry from the most recent or closest low or high level should be in retest.

Stop Loss 🛑: Using the 4h period, the recent / nearest low or high level.

Goal 🎯: 20,800 (or) escape Before the Target.

Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

Warning⚠️ : Our heist strategy is incompatible with Fundamental Analysis news 📰 🗞️. We'll wreck our plan by smashing the Stop Loss 🚫🚏. Avoid entering the market right after the news release.

Fundamental Outlook 📰🗞️

The DE40 (German DAX 40) index is expected to move in a bullish trend. Here's a breakdown of the analysis:

Reasons for Bullish Trend:

Strong Economic Growth: Germany's economy is expected to continue growing, driven by strong consumer spending and investment.

Low Unemployment: Unemployment rates in Germany are at historic lows, which is expected to support consumer spending and economic growth.

Positive Earnings: Many German companies are expected to report positive earnings, which could boost investor sentiment and drive the index higher.

Monetary Policy: The European Central Bank (ECB) is expected to maintain its accommodative monetary policy, which could support the economy and drive the index higher.

Fundamental Analysis:

GDP Growth Rate: 1.5% - 2.0% expected for Q4

Inflation Rate: 1.2% - 1.5% expected for January

Unemployment Rate: 3.2% - 3.5% expected for January

Earnings Growth: 5% - 7% expected for Q4

Please note that this is a general analysis and not personalized investment advice. It's essential to consider your own risk tolerance and market analysis before making any investment decisions.

Take advantage of the target and get away 🎯 Swing Traders Please reserve the half amount of money and watch for the next dynamic level or order block breakout. Once it is resolved, we can go on to the next new target in our heist plan.

Keep in mind that these factors can change rapidly, and it's essential to stay up-to-date with market developments and adjust your analysis accordingly.

💖Supporting our robbery plan will enable us to effortlessly make and steal money 💰💵 Tell your friends, Colleagues and family to follow, like, and share. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🫂

GER 40 Trade LogGER40 Short Position (Discretionary)

Rationale :

- Overextension: The GER40 index appears significantly overextended without substantial fundamental support.

- Rising German Bond Yields: An increase in German government bond yields suggests a shift towards higher borrowing costs, potentially impacting equity valuations.

- MACD Divergence: A notable divergence between the MACD indicator and price action indicates a weakening bullish momentum, often preceding a trend reversal.

- CVD Divergence: Divergence in the Cumulative Volume Delta points to a disparity between buying and selling pressures, signaling a potential downturn.

Trade Details :

- Position: Short GER40 via market order

- Risk Management:

- Risk per Trade: 1% of trading capital

- Risk-Reward Ratio (RRR): 1:2

Note: This trade is discretionary and anticipates a sharp correction at market open. Despite the lack of a formal signal, the confluence of technical indicators and macroeconomic factors supports this decision.

GER40 "GERMANY40 Index" Money Heist Plan on Bullish SideHallo! My Dear Robbers / Money Makers & Losers, 🤑 💰

This is our master plan to Heist GER40 "GERMANY40 Index" based on Thief Trading style Technical Analysis.. kindly please follow the plan I have mentioned in the chart focus on Long entry. Our target is Red Zone that is High risk Dangerous level, market is overbought / Consolidation / Trend Reversal / Trap at the level Bearish Robbers / Traders gain the strength. Be safe and be careful and Be rich.

Attention for Scalpers : If you've got a lot of money you can get out right away otherwise you can join with a swing trade robbers and continue the heist plan, Use Trailing SL to protect our money 💰.

Note: If you've got a lot of money you can get out right away otherwise you can join with a swing trade robbers and continue the heist plan, Use Trailing SL to protect our money.

Entry : Can be taken Anywhere, What I suggest you to Place Buy Limit Orders in 15mins Timeframe Recent / Nearest Swing Low

Stop Loss 🛑 : Recent Swing Low using 1H timeframe

Warning : Fundamental Analysis news 📰 🗞️ comes against our robbery plan. our plan will be ruined smash the Stop Loss. Don't Enter the market at the news update.

Loot and escape on the target 🎯 Swing Traders Plz Book the partial sum of money and wait for next breakout of dynamic level / Order block, Once it is cleared we can continue our heist plan to next new target.

Support our Robbery plan we can easily make money & take money 💰💵 Follow, Like & Share with your friends and Lovers. Make our Robbery Team Very Strong Join Ur hands with US. Loot Everything in this market everyday make money easily with Thief Trading Style.

Stay tuned with me and see you again with another Heist Plan..... 🫂

German index, what to expect next? In my previous analysis, I projected a reversal in GER40, expecting a corrective move toward the daily Fair Value Gap (DFVG) in the 18,000-18,200 range. Over the past week, the price has nearly reached this target. Looking ahead, I see two potential scenarios:

1. **Further Decline:** The price may continue to move lower, targeting the 1-hour FVG, which is also visible on the 4-hour, daily, and weekly timeframes.

2. **Rebalance and Retest:** A minor drop to the Previous Day's Low (PDL) could lead to a rebound, with a likely rebalancing toward the premium levels early next week (Monday-Thursday). This would include a retest of the Buy-to-Sell (BTS) zone and potentially the 4-hour bearish Order Block (OB), followed by more aggressive selling down to the 18,000-18,200 range.

Once this zone is reached, I'll be monitoring for a potential bounce, which I will detail in my next update.

DAX(GER30), nuke is coming?I explained the fundamental part in my EURUSD post. Check it out here:

Now, let's talk about the technical part:

At the London opening, we saw significant manipulation downward with a liquidity sweep from the previous day's low (PDL) and other swings. Now, I would love to see an aggressive movement upwards toward the all-time high (ATH), where I'll be looking for a short setup. However, if the price closes on the 1-4h time frame with a big fat candle, I won't touch the GER40 (DAX) for a while because there won't be any targets ("sky is the limit") to get liquidity from.

There's one possible scenario: a move into premium after the first market structure (MS) shift today, followed by a second shift (break of structure, BoS). Bearish order flow will be confirmed, with the final target being the 4h fair value gap (FVG).

What's unraveling the economic powerhouse of Europe?Once a stalwart of European stability, Germany's economic engine is facing unprecedented challenges. This deep dive explores the intricate factors driving its recession and the far-reaching implications for the continent.

Geopolitical tensions and supply chain disruptions have wreaked havoc on Germany's economy. The ongoing conflict in Ukraine, coupled with the lingering effects of the COVID-19 pandemic, has disrupted energy supplies, increased production costs, and hindered global trade.

Rising interest rates and weak global demand have further exacerbated the downturn. The European Central Bank's aggressive monetary tightening to combat inflation has made borrowing more expensive for businesses and consumers, dampening investment and spending. Meanwhile, a global economic slowdown, driven by factors such as rising interest rates, geopolitical tensions, and inflation, has reduced demand for German exports, a crucial driver of its economy.

The consequences for Germany and Europe are profound, with potential for increased unemployment, slower growth, and political instability. As Germany is one of Europe's largest economies, its downturn has a ripple effect on other countries in the region. The recession could lead to job losses, as businesses cut costs to weather the storm, exacerbating social tensions and increasing the burden on government welfare systems. Slower growth in Germany will contribute to slower growth in the Eurozone as a whole, limiting the ECB's ability to raise interest rates further and potentially hindering its efforts to combat inflation. Economic downturns can often lead to political instability, as governments face increased pressure to implement policies that alleviate economic hardship. This could lead to political gridlock or even changes in government.

Can Germany weather this storm? Join us as we delve into the complexities of this economic enigma and explore potential paths forward.

GERMANY 30/40 de40 Bullish Side Money Heist planMy Dear Robbers / Traders,

This is our master plan to Heist GERMANY 30/40 Market based on Thief Trading style Technical Analysis.. kindly please follow the plan I have mentioned in the chart focus on Long entry. Our target is Red Zone that is High risk Dangerous level, market is overbought / Consolidation / Trend Reversal at the level Bearish Robbers / Traders gain the strength. Be safe and be careful and Be rich.

Note: If you've got a lot of money you can get out right away otherwise you can join with a swing trade robbers and continue the heist plan, Use Trailing SL to protect our money.

Stop Loss : Recent Swing Low using 4h timeframe

Warning : Fundamental Analysis comes against our robbery plan. our plan will be ruined smash the Stop Loss. Don't Enter the market at the news update.

Loot and escape on the target 🎯 Swing Traders Plz Book the partial sum of money and wait for next breakout of dynamic level / Order block, Once it is cleared we can continue our heist plan to next new target.

support our robbery plan we can easily make money & take money 💰💵 Join your hands with US. Loot Everything in this market everyday make money easily with Thief Trading Style.

GERMANY 30 / 40 Bullish Money Heist Plan Trade setupMy Dear Robbers / Traders,

This is our master plan to Heist DE30/GERMANY 30/40 Market based on Thief Trading style Technical Analysis.. kindly please follow the plan I have mentioned in the chart focus on Long entry. Our target is Red Zone that is High risk Dangerous level market is overbought / Consolidation / Trend Reversal at the level Bearish Robbers / Traders gain the strength. Be safe and be careful and Be rich.

Note: If you've got a lot of money you can get out right away otherwise you can join with a swing trade robbers and continue the heist plan,

Stop Loss: Recent Swing Low using 4h timeframe

Loot and escape on the target 🎯 Swing Traders Plz Book the partial sum of money and wait for next breakout of dynamic level / Order block, Once it is cleared we can continue our heist plan to next new target.

support our robbery plan we can easily make money & take money 💰💵 Join your hands with US. Loot Everything in this market everyday

GERMANY 30/40 DE30/40 Robbery Plan To make and take moneyMy Dear Robbers / Traders,

This is our master plan to Heist GERMANY 30/40 Bank based on Thief Trading style Technical Analysis.. kindly please follow the plan I have mentioned in the chart. Our target is Red Zone that is High risk Dangerous level Police Force is waiting for our arrival, Market is overbought / Consolidation / Trend Reversal at the level Bearish Robbers / Traders gain the strength. Be safe and be careful and Be rich.

Note: If you've got a lot of money you can get out right away otherwise you can join with a swing trade robbers and continue the heist plan,

Loot and escape on the target 🎯 Swing Traders Plz Book the partial sum of money Use Trailing Stop To Protect Looted Money and wait for next breakout of dynamic level / Order Block, Once it is cleared we can continue our heist plan to next new target it will update after the Breakouts.

support our robbery plan we can easily make money & take money 💰💵 Join your hands with US. Loot Everything in this market everyday.