“GER30 Bull Vault Heist: The Ultimate Loot Plan”💎“The Bull Vault Job: GER30 Heist Blueprint”💎

🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Welcome fellow Chart Raiders & Market Hackers 🧠💰—your next mission is here.

We’re pulling off a precision breakout plan on GER30 / DE30 "Germany30" — a market vault bursting with bullish loot. This isn’t just trading... this is Thief Trading Style™ — where smart analysis meets slick execution. 👨💻💎📊

💼 The Heist Plan:

📈 Entry: Market shows a wide open vault. Ideal long setups near the last swing low (15–30m for sniper entries). Don’t chase—wait for the retrace.

🛑 Stop Loss: Guard your getaway! Use recent swing lows on 4H (e.g. 24170). Customize based on your risk profile & lot sizes.

🎯 Target: Aim for 24720 or EXIT before the cops (a.k.a. reversal zones) show up. Always secure your gains.

📌 Scalpers’ Signal: Stay LONG-only. Follow swing traders if low on ammo (capital). Use trailing SLs like tripwires to protect your profits.

📊 Market Heat Check: The DE30 is radiating bullish pressure 💥—fueled by fundamentals, macro trends, COT positions, sentiment indicators, and intermarket clues. We read between the lines. You just follow the blueprint. 🧠

🚨 Pro Tips:

Avoid entering trades during high-impact news.

Manage risk like a vault door—solid, tested, and ready.

💖 Smash that Boost Button 💖 if you believe in the Art of Legal Market Extraction™ — it supports the plan, strengthens the crew, and keeps this hustle alive!

🎭 More blueprints & breakdowns coming soon. Stay locked in...

Until the next market hit, trade sharp, trade smart. 🐱👤📈💰

Germanstocks

DE40 / GER40 "Germany40" Index Market Bullish Heist Plan🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑 💰💸✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the DE40 / GER40 "Germany40" Index Market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is to escape near the high-risk Red Zone Level. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 🏆💸"Take profit and treat yourself, traders. You deserve it!💪🏆🎉

Entry 📈 : "The vault is wide open! Swipe the Bullish loot at any price - the heist is on!

however I advise to Place buy limit orders within a 15 or 30 minute timeframe most recent or swing, low or high level. I Highly recommended you to put alert in your chart.

Stop Loss 🛑:

📍 Thief SL placed at the recent/swing low level Using the 4H timeframe (22250.0) Day/Swing trade basis.

📍 SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

🏴☠️Target 🎯: 24700.0 (or) Escape Before the Target.

🧲Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

💰💵💸DE40 / GER40 "Germany40" Index Market Heist (Swing Trade Plan) is currently experiencing a neutral trend there is high chance for bullishness,., driven by several key factors. .☝☝☝

📰🗞️Get & Read the Fundamental, Macro economics, COT Report, Geopolitical and News Analysis, Sentimental Outlook, Intermarket Analysis, Index-Specific Analysis, Positioning and future trend targets with Overall Score..... go ahead to check👉👉👉🔗🔗🌎🌏🗺

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

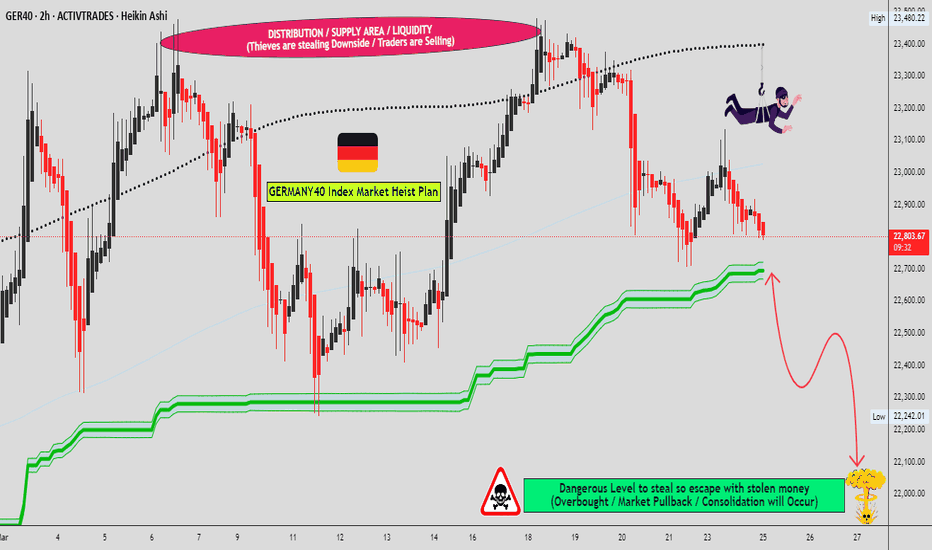

"GERMANY 40" Index CFD Market Heist Plan (Day / Swing Trade)🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑💰✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the GER40 "GERMANY 40" Index CFD Market. Please adhere to the strategy I've outlined in the chart, which emphasizes short entry. Our aim is the high-risk Green Zone. Risky level, oversold market, consolidation, trend reversal, trap at the level where traders and bullish robbers are stronger. 🏆💸Book Profits Be wealthy and safe trade.💪🏆🎉

Entry 📈 : "The heist is on! Wait for the breakout (22650) then make your move - Bearish profits await!"

however I advise placing Sell Stop Orders below the breakout MA or Place Sell limit orders within a 15 or 30 minute timeframe. Entry from the most recent or closest low or high level should be in retest. I Highly recommended you to put alert in your chart.

Stop Loss 🛑: Thief SL placed at 23000 (swing / Day Trade Basis) Using the 2H period, the recent / swing high or low level.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯: 22000 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Short side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

GER40 "GERMANY 40" Index CFD Market Heist Plan (Scalping / Day Trade) is currently experiencing a bearishness,., driven by several key factors.

📰🗞️Get & Read the Fundamental, Macro, COT Report, Geopolitical and News Analysis, Sentimental Outlook, Intermarket Analysis, Index-Specific Analysis, Positioning and future trend targets.. go ahead to check 👉👉👉

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

📌Please note that this is a general analysis and not personalized investment advice. It's essential to consider your own risk tolerance and market analysis before making any investment decisions.

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

A high probability short setup on GER40! Hello traders,

GER40 is flashing a prime shorting opportunity! On the higher timeframe, the index has formed a double top, a classic reversal pattern. The setup has been confirmed with a decisive neckline break, signaling strong bearish momentum.

I'm watching for a slight pullback to the neckline, where I'll be looking to enter short positions. My initial target is 21,637, with an extended move down to 21,112 if sellers maintain control.

Stay tuned for updates, and if you find this analysis valuable, give it a boost! Let’s catch this move together. 🚀🔥

DAX Stock Index PlungesDAX Stock Index Plunges

As we noted six days ago, European stock markets were showing optimism amid expectations that the armed conflict in Ukraine—now approaching its third year—would be resolved. During this period, the DAX 40 (Germany 40 mini on FXOpen) gained approximately 1.6%, setting a historic record.

However, sentiment appears to be shifting in the opposite direction. According to the Germany 40 mini chart on FXOpen, the German stock index DAX 40 experienced a sharp decline yesterday, losing around 2%. This drop is partly driven by Trump's latest tariff statements. According to Trading Economics:

→ The US President is considering imposing new 25% tariffs on automobile, semiconductor, and pharmaceutical imports, with an official announcement expected in early April.

→ Market sentiment deteriorated after ECB Executive Board member Isabel Schnabel tempered expectations of a more expansionary monetary policy.

Technical Analysis of the DAX 40 (Germany 40 mini on FXOpen)

Since the start of 2025, the index has been following an upward trend (illustrated by the blue channel), which remains intact. However, yesterday’s aggressive drop pushed the price into the lower half of the channel, indicating increased bearish activity. If negative sentiment persists, the price could decline further—potentially testing the lower boundary of the channel.

The 22,200 level appears to be a significant support zone, as bulls demonstrated strength here less than 10 days ago (as indicated by the blue arrows):

→ The price formed a long lower wick when testing the psychological 22k mark.

→ It then surged into the upper half of the channel with a strong bullish candle.

Conversely, the 22,730 level has flipped from support to resistance (marked by orange arrows), signalling the presence of bearish pressure.

Trade on TradingView with FXOpen. Consider opening an account and access over 700 markets with tight spreads from 0.0 pips and low commissions from $1.50 per lot.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Strategies for Trading German Stocks with a Focus on 1&1 AGCurrent market conditions favour this stock, but only if it falls to the monthly demand level of around 11 euros per share. As digital communication expands, companies like 1&1 AG are positioned to thrive amidst rising competition and innovation.

Expecting the price of 1&1 AG stock to drop to the strong monthly imblanace at 11 euros per share.

DWS Group (DWS): Potential Trend Continuation from SupportAnalyzing the DWS Group chart on the German stock exchange XETR, our previous assumption was that the top would be found between €40.52 and €42.62. The actual top was at €44.88, which aligns well with our prediction. After this peak, the stock experienced a significant 16% sell-off over three days.

Currently, the stock is trading between the 50% and 61.8% Fibonacci retracement levels, which is a plausible and acceptable range for Wave ((iv)). Additionally, the High-Volume Node Point-of-Control from the entire chart since the IPO serves as a crucial support level. This level should act as the lowest point, as falling below it would enter the Wave ((i)) territory, which we aim to avoid. From an Elliott Wave perspective, we might see an upward trend for the DWS Group. Despite being a volatile stock that has mostly moved sideways since its IPO in 2018, it has been forming higher highs and higher lows since the post-COVID-19 low. This suggests a potential continuation of the trend, making it an interesting stock for potential entries.

Given the current situation, the stock appears to be in a sideways range rather than being overbought, providing potential entry opportunities up to the €32 level. This could be an attractive entry point for investors looking to capitalize on the continuation of the trend.

VOLKWAGEN moving up towards $126 in new impulse up.The stock displayed an impulsive rise between Oct-Dec 2023 and a subsequent correction of the same through the months of dec-jan.

The correction was almost an 61.8% retracement of the impulse and the price shot up quite strongly as soon as the corrective wave was over.

Now the stock is already in wave 3 structure and with sub-divisions or without them $126 is the projected target zone for the stock.

GERMANY 30 MovePair : DE30EUR - Germany 30

Description :

Bearish Channel in Short Time Frame and Long Time Frame as an Corrective Pattern , In LTF its Rejecting from the Lower Trend Line and in STF it has Breakout the Upper Trend Line. Break of Structure and Divergence

Entry Precautions :

Wait until it Complete its Retest or Rejects from Previous Support

Adidas: How fast are you? 👟Lately, Adidas has made fine progress in the scope of wave 2 in turquoise, moving toward the magenta zone between 157.06€ and 141.72€. Soon, the share should reach this price range and complete the current movement, before turning upwards to develop wave 3 in turquoise above the resistance at 187.78€. However, there is a 32% chance that Adidas could act faster, skipping the magenta zone and climbing above this mark earlier already.

Mercedes-Benz Group: Parking 🚘Mercedes is about to park wave (2) in magenta in our green target zone between €67.31 and €77.90. Once this top is placed, the share should continue the overarching downward trend, dropping below the support at €60.72 and (after a short countermovement) further southwards. There is a 30% chance, though, that Mercedes could leave the green zone on the northern side and thus climb above the resistance at €77.90. In that case, we would expect the share to develop a higher top first before heading downwards. Wave alt.B in green would then expand into the magenta-colored zone between €84.44 and €89.37.

Quick analysis on 2HRADear German traders, on 2HRA you can see on the chart thet the price just canceled what seemed to be a breakout of the channel the price is consolidating at, before you buy it you must wait for the price to break the resistance level with a higher volume than the highest one we have currently

Puma: Nearing the Finish Line 🏁Puma is nearing the finish line, marked by the final low of wave II in gray. To reach it, the share should still advance a bit deeper into the turquoise zone between 54.32€ and 44.25€. Once the low is established, Puma should take off and start a fresh upwards trend, heading for the resistance at 70.88€, which should be conquered in due time. However, there is a 25% chance that the share could cancel the ascent, complete wave alt.B in magenta instead and dive below the support at 41.32€. In that case, we would expect Puma to develop wave alt.II in gray below this mark first before turning upwards.

DAX is a great buy with potential as high as 16280The long term pattern on DAX is a Bullish Megaphone.

Since February though it has been trading inside a Rectangle pattern, offering buy low / sell high opportunities.

Rectangle trade is a buy with Target 1 = 15700.

Megaphone trade is a buy over Resistance A with Target 2 = 16280.

Mercedes-Benz Group: In the Parking Lot 🚗 🚗 🚗Mercedes-Benz has found a parking spot in the big green parking lot between €67.31 and €77.90 and is about to finish wave in green. Though, as the course has just turned slightly downwards, the current movement could also already be complete. As soon as this high is finalized, the share should pay its parking ticket, leave the parking lot and drive southwards, crossing the support at €62.41 and subsequently heading for the next one at €50.19 as well.

BMW Long Resault: 13.5% Profit✅According to the pullback, the resistance is broken and the pullback confirmation can be entered into a buy position with the target of the specified high level.

Stay with me to get more analysis after following me by sharing with friends and leaving a comment.

According to my risk and capital management system, the risk of each trade is one percent per position.

What do you think about this analysis and other analyses?

What symbol would you like me to analyze for you?

BMW, longAccording to the pullback, the resistance is broken and the pullback confirmation can be entered into a buy position with the target of the specified high level.

Stay with me to get more analysis after following me by sharing with friends and leaving a comment.

According to my risk and capital management system, the risk of each trade is one percent per position.

What do you think about this analysis and other analyses?

What symbol would you like me to analyze for you?

German DAX index: Pausing for a breatherThe German Dax index rose 25% from its lows in early October, delivering nine weeks of gains and outperforming US stock indices. The bullish price action has been rather sharp for a market that had a 27% decline from its top in the first nine months of the year.

In November 2022, the Dax saw overbought RSI for the first time in over a year and the index also managed to surpass quite easily its 50-day and 200-day moving averages, as well as a significant 50% Fibonacci threshold of 2022's low to high.

As prices now meet fierce resistance in surpassing the 61.8% Fibonacci level around 14,560 points, a pullback is possible in the following weeks.

The first area of support is located at the psychological level of 14,000. This level might serve as a solid test for validating the 50% Fibonacci level breakout occurred in November.

If the Dax fails to remain above 14,000, bears may gain impetus and push the price down below 13,500 (38.2% Fibonacci and 200-day moving average).

Currently, the strong 61.8% Fibonacci level resistance dominates the upside. If prices broke over this level, the June high of 14,700 would be the next resistance. However, with two important central banks meeting in less than two weeks (Fed on the 14 and ECB on the 15), the upside room for bulls may be limited here.