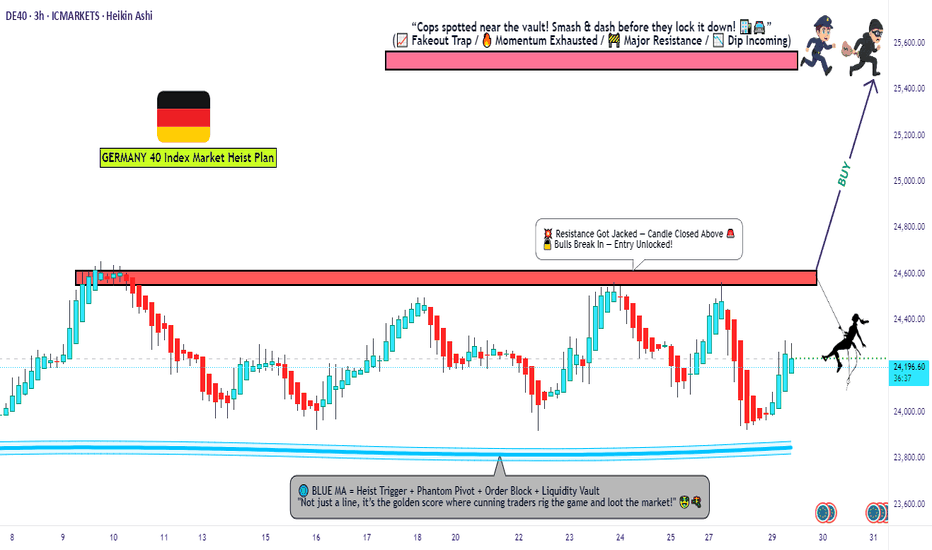

DE40 Breakout Robbery – Bullish Setup Revealed!💣 DE40 / GER40 INDEX BREAKOUT RAID 🚨

🌟 Hi! Hola! Ola! Bonjour! Hallo! Marhaba! 🌟

Dear Market Robbers, Money Makers, and Chart Bandits 🕶️💰💣,

We’re rollin' out our latest Thief Trader Heist Plan based on laser-sharp technical + fundamental recon 🧠💼 on the Germany DE40 / GER40 Index. It’s time to gear up and break the resistance vault 🏦💥

🎯 THE MASTER HEIST SETUP: LONG ONLY 🎯

📈 Entry Setup:

"The heist is on! Wait for breakout & retest near 24600 🔓.

Once confirmed, GO BULLISH and snatch that market loot!"

✅ Use Buy Stop above resistance

✅ (OR) Buy Limit from pullback zones using 15m–30m swing lows/highs

🎯 DCA / Layered limit entries for optimal robbery!

🔔 Set Alerts: Don't sleep on this! Mark your alarms to catch the breakout.

🛑 STOP LOSS: PLAY IT SMART, NOT EMOTIONAL

🗣️ "Don’t drop your SL before the breakout—wait for the confirmation candle. Place it smart based on your entry lot size & risk."

📍Thief SL Plan: Below the recent 4H wick swing low – around 21700

🔒 Protect the loot once you're in the trade!

🏁 TARGET: TIME TO ESCAPE THE SCENE

🎯 Primary Profit Vault: 25500

🛫 Escape earlier if signs of resistance emerge. A clean get-away is the goal!

🔪 SCALPERS MODE: ONLY LONG SIDE

💰 Got the funds? Feel free to enter early.

💼 Otherwise, team up with swing traders. Use Trailing SL to guard your treasure.

🔎 FUNDAMENTALS BACKING THIS HEIST

📊 GER40 shows bullish momentum backed by:

Global macro optimism

Strong Eurozone data

Risk-on flows into European indices

Technical chart breakout formations

📰 Get full market breakdowns (COT, Macro, Intermarket, Sentiment, etc.) – Check your trusted sources and confirm your targets.

🚨 TRADING ALERT: STAY ALERT DURING NEWS

⚠️ Big news = high volatility! Follow the robbery code:

Avoid new trades during major news drops

Trail SLs on running positions

Stay glued to live updates!

❤️ SUPPORT THE THIEF CREW

If this plan helped you, hit that BOOST 🚀

Let’s keep raiding the charts, stacking profits like pros 🏆

Join the Thief Crew, where we rob the market... not dreams.

🎭 Until the next plan… stay sneaky, stay profitable. 🐱👤💸💥

Germany30

Rob the DAX! GER40 Bullish Mission Begins Now!🏴☠️GER40 Bullish Vault Heist! Target: 25400 🎯💼

🚨Mission Briefing: Robbery in Progress - DE40 / Germany40 Index Heist!

🎯 Plan: Bullish

🗂️ Asset: DE40 / GER40 “Germany40” Index

📦 Strategy: Thief’s signature Layered Limit Orders 🧱 (Multi-entry precision loading)

🔑 Entry Point:

"The vault is open 24/7! Thief goes in anytime 🔓💰"

Place multiple buy limit orders at recent swings / lows on the 15m-30m chart.

📲 Tip: Set alerts at breakout zones. Be early. Be greedy.

🚨 Stop Loss:

🎯 SL at 23,300 🔐 – beneath 4H structure (swing low wick-based).

Adjust SL based on lot size and number of active entries.

🏆 Escape Point (Target):

💼 25,400 = Target stash 💰

🔥 Use Trailing SL and ride the wave – exit before the trap if market hesitates!

📈 Scalpers / Swingers Alert:

💎 Only Long-side loot allowed!

💸 Small capital? Join the swing team 🚀

💰 Big capital? Front-run the breakout!

🎯 Trailing SL = Smart thieves protect profits.

🧠 Why Bullish?

The index is warming up after consolidation. Neutral bias flipping bullish 🔄 due to:

📰 Weakening macro shock absorbers

💣 Risk appetite reviving

💡 Institutional positioning + COT shift

🔄 USD reaction + EU equity flow

💼 Check all macro + intermarket juice for full confidence 📊🔗

⚠️ Risk Management Tips for Robbers:

🕰 Avoid news hour trades

🔄 Use Trailing SL always

📉 Don't chase… let the market come to you

👀 Eyes on economic calendar and VIX movement

❤️ Support the Robbery Crew!

💥 Hit that BOOST button if you love making money the Thief Way 🏴☠️

🎯 Help us grow the robbery empire & take over the charts 📈💰

🧨 Another Heist Plan coming soon! Stay sneaky, stay funded 🤑🐱👤💼

#ThiefTrader #GER40Plan #IndexHeist #LayeredLoot #MarketRobbery #FTSEStyleRobbery

GER/DAX - TIME FOR RECOVERTeam, this morning, the DAX target hit our target 1, we took some profit, we set a stop loss at BE, and it got stopped out

Time for us to re-enter the DAX again at 23880-23855

STOP loss 23780

Once the price move at 23950 - bring STOP LOSS TO BE

Target 1 at 23985-24015

Target 2 at 24065-24096

lets go

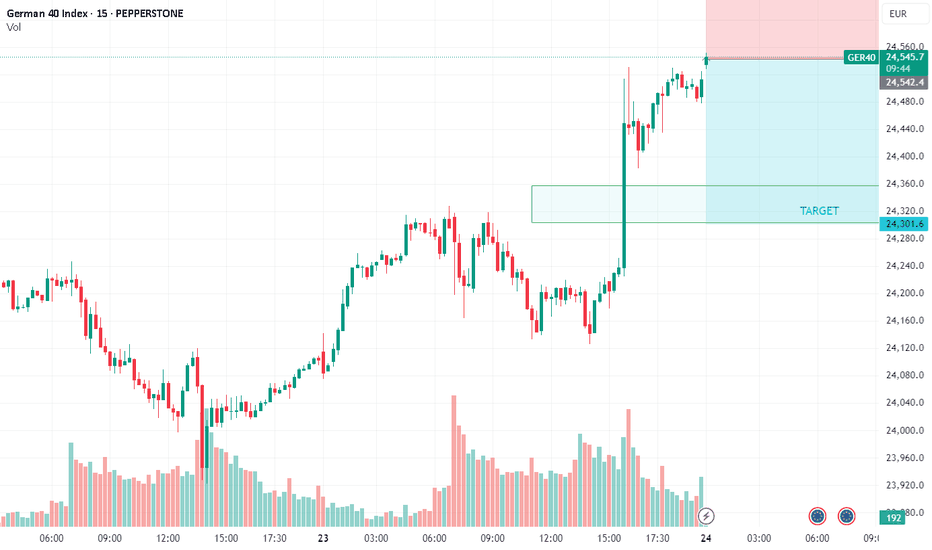

DAX / GER - ANOTHER ROUND OF ENTRY LONGTeam, we have successfully short DAX.GER earlier today with more than 300 points. both target hit

However the market has exceeding the dropping. We decide to go LONG

at the price range 23964-23945

With STOP LOSS at 23865-82

Once the trade hit above 21030-45 - BRING STOP LOSS TO BE

Target 1 at 21080-24115 = please take 50-70% volume target

30% Target remaining at 24165-24196

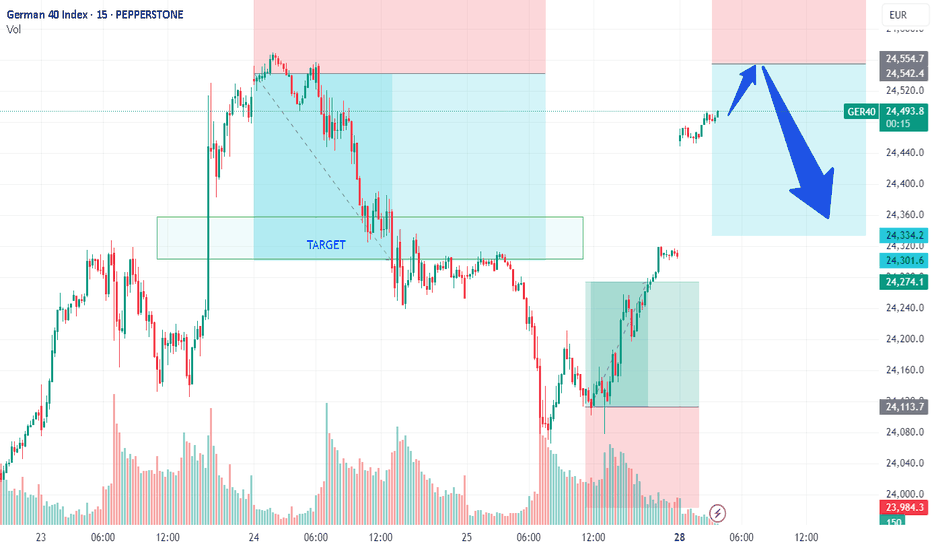

DAX/GER - PREPARE TO SHORT on DAX market opening Team,

We all know that the European Union and the United States agreed on Sunday to a broad trade deal that sets a 15 per cent tariff on most E.U. goods, including cars and pharmaceuticals.

The 27-nation bloc also agreed to increase its investment in the United States by more than $600 billion above current levels.

If the DEAL does not go through, it would be nasty to the market—especially to the Europeans, who are likely to get hurt by the export cost to the United States, especially the Car. The EUROPEAN is currently facing many challenges from Chinese car manufacturing.

We have been trading very well with the DAX in the past. We expect that when the market opens, we should short-range at 24530-60 - GET READY.

Stop loss at 24620-50

Please NOTE: once the price pulls back toward 24475-50, bring our STOP LOSS TO BE (Break even)

Our 1st target at 24425-24400

2nd Target at 24350-24300

Last Friday, in OUR LIVE TRADING, we mentioned that LONG DAX at 24100

DAX/GER30 - TIME TO SHORT AT CURRENT PRICETeam, great win for the US30 on trade surplus 26 billion last month

expect to have great trade surplus over 300 billion

the Japanese went crazy 3.5% due to tariff drop from 25% down to 15%

The whole market has been pumping

We find an opportunity to SHORT THE DAX/GER 30 at the current level 24543-24556

STOP LOSS AT 24650

WITH TARGET at 24360-24320

PLEASE NOTE: once the price drop below 24500, bring stop loss to BE to protect your trade.

STICK TO THE PLAN.

"Planning the Perfect DE40 Robbery? Here’s the Setup!"💥🔥Thief Trading Style: The Ultimate Market Heist Plan for DE40/Germany40🔥💥

"Steal the Trend, Escape the Trap, and Vanish with Profits!"

🌍🌟**Hola, Hallo, Marhaba, Bonjour, Ola, and Hey Traders!**🌟

Welcome to the Thief Trading Vault – where we don’t just trade, we plan market heists with precision and escape like professionals!

To all my fellow Profit Pirates, Smart Robbers, and Money Hunters – this one's for you. 🤑💸💼

🔐💹DE40/Germany40 Master Robbery Plan – Swing Trade Setup

Strategy Type: Swing & Scalp Friendly

Market Direction: Neutral ➜ Bullish Bias

Approach: DCA + Tactical Entry Zones + News-Conscious Trading

📍ENTRY (The Vault Is Open!)

Break in like a pro! We are eyeing a long entry setup.

Wait for price to dip near key pullback zones (within recent 15m or 30m swing highs/lows). Use buy limit orders to scale in.

🛠 Thieves love layering: DCA style entry strategy ensures lower average cost.

💡“Swipe smart, enter silently.”

📍STOP LOSS (Secure Your Exit!)

Our risk control is set at recent 4H swing low – around 23950.00.

However, your SL can vary based on risk profile, lot size, and number of entries.

Protect the stash! 💼🔒

📍TARGET (Getaway Point!)

🎯 Target: 24570.00 or exit early if resistance becomes tight.

We’re approaching a “Red Zone” – a high-risk area loaded with fake-outs, bear traps, and profit-takers.

🔁Scalpers' Goldmine Tips

Only scalp LONG SIDE ONLY.

Big accounts? Jump in anytime.

Small accounts? Tag along with swing setups.

Always use a trailing SL to secure gains and avoid traps.

🧠Technical + Fundamental Blend

This setup isn’t just chart-based.

We analyze:

🔍 Fundamentals & Macro Trends

🧾 COT Reports & Sentiment

🌐 Geopolitical Events

📊 Intermarket & Index-Specific Data

🧭 Trader Positioning & Future Price Bias

📎 Full outlook & premium research available – Klickk the Lnk🔗🧠

📢IMPORTANT REMINDERS:

⚠️ Major news releases = High risk.

Avoid fresh entries during those hours.

Use trailing SLs to lock profits during volatile sessions.

🚀Support The Thieves – Hit Boost!

Smash that 💥Boost Button💥 if this plan helped you plan your next profit heist.

More boosts = More strategies unlocked.

Join our elite robbers’ squad and conquer the market daily with the Thief Trading Style! 🏆💰❤️

📌DISCLAIMER:

This is a general swing trade strategy and not financial advice.

Always evaluate your own risk level and market understanding before entering trades.

Markets shift fast – adapt, stay sharp, and never trade blindly. 🎯

📅 Stay tuned – more robbery plans, more precision trades, and more fun ahead!

Follow & Boost if you want in on the next mission!

🕶️🐱👤 See you at the getaway spot!

“GER30 Bull Vault Heist: The Ultimate Loot Plan”💎“The Bull Vault Job: GER30 Heist Blueprint”💎

🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Welcome fellow Chart Raiders & Market Hackers 🧠💰—your next mission is here.

We’re pulling off a precision breakout plan on GER30 / DE30 "Germany30" — a market vault bursting with bullish loot. This isn’t just trading... this is Thief Trading Style™ — where smart analysis meets slick execution. 👨💻💎📊

💼 The Heist Plan:

📈 Entry: Market shows a wide open vault. Ideal long setups near the last swing low (15–30m for sniper entries). Don’t chase—wait for the retrace.

🛑 Stop Loss: Guard your getaway! Use recent swing lows on 4H (e.g. 24170). Customize based on your risk profile & lot sizes.

🎯 Target: Aim for 24720 or EXIT before the cops (a.k.a. reversal zones) show up. Always secure your gains.

📌 Scalpers’ Signal: Stay LONG-only. Follow swing traders if low on ammo (capital). Use trailing SLs like tripwires to protect your profits.

📊 Market Heat Check: The DE30 is radiating bullish pressure 💥—fueled by fundamentals, macro trends, COT positions, sentiment indicators, and intermarket clues. We read between the lines. You just follow the blueprint. 🧠

🚨 Pro Tips:

Avoid entering trades during high-impact news.

Manage risk like a vault door—solid, tested, and ready.

💖 Smash that Boost Button 💖 if you believe in the Art of Legal Market Extraction™ — it supports the plan, strengthens the crew, and keeps this hustle alive!

🎭 More blueprints & breakdowns coming soon. Stay locked in...

Until the next market hit, trade sharp, trade smart. 🐱👤📈💰

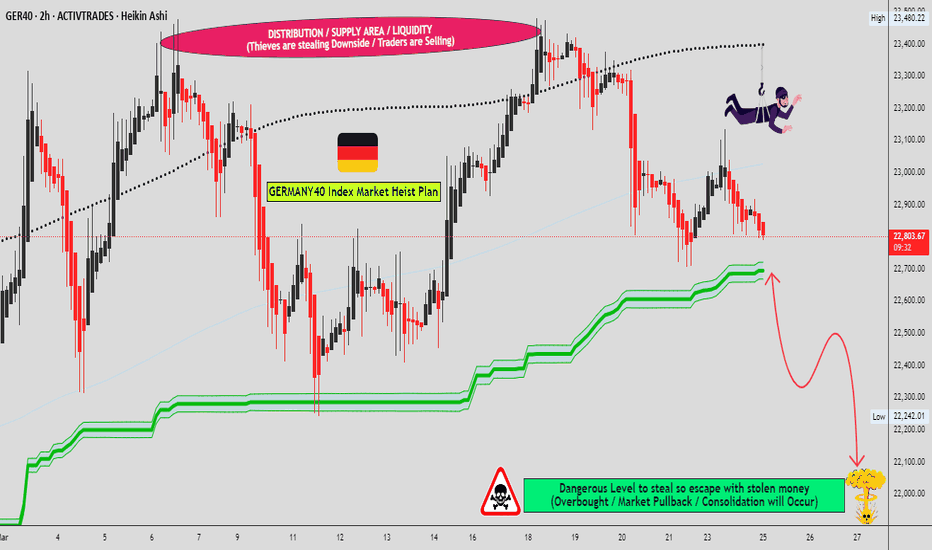

“GER40 Heist in Progress – Bearish Blueprint Deployed!”🦹♂️💼 “Operation: Black Forest Heist” – DAX Day/Swing Trade Plan 💼🦹♀️

📍Thief Trading Style | CFD Tactical Chart Blueprint | GER40 Recon Mission

🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Movers, Risk Raiders & Precision Planners 🧠💸,

Suit up for a clean-cut operation on the Germany 40 (GER40) Index! 🎯

With our sharp-edged Thief Trading blueprint 🔪, we’re scanning for a potential bearish trap—market’s heating up with oversold setups and momentum cracks near key resistance. Watch for the green MA zone—we suspect it's where bullish imposters hide. 🕵️♂️📉

🔓 Entry Plan

“The vault’s cracking... get ready!”

Wait for price to breach the ATR Line (23000.0). Once the level is crossed cleanly, it’s go-time:

🧨 Use Sell Stop orders just under the breakout

🎣 Or hunt pullback setups on 15m/30m charts with Sell Limit entries at resistance

🔐 Stop-Loss Strategy

Keep it tight. Protect your loot.

🚧 Place SL around swing high/low on the 4H chart (e.g. 23400.0)

⚖️ Adapt SL based on lot size, risk appetite, and number of entries

🎯 Target Zone

Mission Objective: 22600.0

Or exit earlier if the security alarm (price action shift) starts ringing. Don't get greedy—get out smart. 💼🚪💨

📉 Market Outlook:

Current trend: Neutral but suspiciously wobbly – early signs of bearish dominance. 🐻

This trade aligns with multiple signals:

📊 Technical: Consolidation near highs

💼 Fundamental: Macro & news risks

🧠 Sentiment: Crowd leaning long = opportunity for reversal

📰 Caution Note – News Events = Laser Tripwires

Stay sharp during releases!

Avoid new setups when big headlines drop

Use trailing stops to secure gains on running trades

Position smart, manage tighter, act quicker 🕶️

💥 Smash that Boost Button if this plan sharpens your edge or adds value to your mission! 💥

Together, we move like shadows and strike like lightning—Thief Traders never miss a clean setup.⚔️🕵️♀️

Stay tuned for the next raid… the market’s full of opportunities waiting to be unlocked. 🗝️🚀

DAX | Bearish Below 23810–23690, Targeting 23395 and 23160DAX | Technical Analysis

The price has stabilized below the pivot zone (23810 – 23690), confirming the continuation of bearish momentum.

📉 As long as the price remains below 23810 and 23690, the downtrend is expected to persist, with a potential move toward 23395. A confirmed break below this level could extend the decline toward 23160.

Pivot Zone: 23810 – 23690

Resistance Levels: 24085, 24300

Support Levels: 23395, 23160

Trend Outlook: Bearish Momentum

GER40 Trading Plan: Ride the Wave or Get Trapped?🚨 DE40 Heist Alert: The Bullish Breakout Robbery Plan (Swing & Scalp Strategy) 🚨

🌟 Hi! Hola! Ola! Bonjour! Hallo! Marhaba! 🌟

Attention Money Makers & Market Robbers! 🤑💰💸

Based on the 🔥Thief Trading Style🔥, here’s our master plan to loot the DE40 / GER40 "Germany40" Index. Follow the strategy on the chart—focusing on LONG entries—and escape near the high-risk Red Zone. This area is overbought, consolidating, and a potential reversal trap where bears lurk. 🏆 Take profits fast—you’ve earned it! 💪

🎯 Heist Entries:

📈 Entry 1: "The Breakout Heist!" – Wait for Resistance (24200) to break, then strike! Bullish profits await.

📈 Entry 2: "Big Players’ Pullback!" – Jump in at 23300+ for a safer steal.

🔔 Pro Tip: Set a chart alert to catch the breakout instantly!

🛑 Stop Loss Rules:

*"Yo, listen! 🗣️ If you’re entering with a buy-stop, DON’T set your SL until AFTER the breakout. Place it at the nearest swing low (4H timeframe) or wherever your risk allows—but remember, rebels risk more! 🔥"*

🏴☠️ Target: 24,800

🧲 Scalpers: Only play LONG! Use trailing SL to lock in profits. Big wallets? Go all in. Small stacks? Join the swing heist!

📊 Market Pulse:

The DE40 is neutral but primed for bullish momentum. Watch:

Fundamentals (COT, Macro, Geopolitics)

Sentiment & Intermarket Trends

Positioning & Future Targets

📌 Check our bioo linkks for deep analysis! 🔗🌍

⚠️ Trading Alert:

News = Volatility! Protect your loot:

Avoid new trades during major news

Use trailing stops to secure profits

💥 Boost This Heist!

Hit 👍 & 🔄 to strengthen our robbery crew! Let’s dominate the market daily with the Thief Trading Style. 🚀💵

Stay tuned—another heist drops soon! 🎯🐱👤

DAX/GER - TIME TO KILLHi everyone, I have been very patience on DAX

last week, we kill them nicely

and now we are waiting for them to hit our short zone and kill more

when you look at the chart, ensure to add extra short at those price ranges.

There will be two target

70-110 points - take 50% profit and bring stop loss to BE

Aim for second target between 120-230 points

Today we did LIVE trading on NAS and very profitable. In fact everyday we kill the market well.

Hope everyone making millions

DE40 / GER40 "Germany40" Index Market Bullish Heist Plan🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑 💰💸✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the DE40 / GER40 "Germany40" Index Market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is to escape near the high-risk Red Zone Level. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 🏆💸"Take profit and treat yourself, traders. You deserve it!💪🏆🎉

Entry 📈 : "The vault is wide open! Swipe the Bullish loot at any price - the heist is on!

however I advise to Place buy limit orders within a 15 or 30 minute timeframe most recent or swing, low or high level. I Highly recommended you to put alert in your chart.

Stop Loss 🛑:

📍 Thief SL placed at the recent/swing low level Using the 4H timeframe (22250.0) Day/Swing trade basis.

📍 SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

🏴☠️Target 🎯: 24700.0 (or) Escape Before the Target.

🧲Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

💰💵💸DE40 / GER40 "Germany40" Index Market Heist (Swing Trade Plan) is currently experiencing a neutral trend there is high chance for bullishness,., driven by several key factors. .☝☝☝

📰🗞️Get & Read the Fundamental, Macro economics, COT Report, Geopolitical and News Analysis, Sentimental Outlook, Intermarket Analysis, Index-Specific Analysis, Positioning and future trend targets with Overall Score..... go ahead to check👉👉👉🔗🔗🌎🌏🗺

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

DAX/GER - setting up a perfect SHORTTeam, please carefully review the chart.

We have a soft short position at this market price of 24037-24056

However, I would love to ADD extra volume at 23135-23155

Our first target at 23950-23925

NOTE: once it reaches the target - take 30-50% volume partial and bring stop loss to BE

Our second target is 23865-23825

Please follow the instructions carefully.

DAX at a Crossroads: Will Resistance Trigger a Pullback?The German 40 (DAX) has been on a strong bullish run, now trading into a key resistance zone near previous range highs. This area is likely packed with liquidity (buy stops), making it a potential turning point. Given the overextended price action and current fundamentals, a retracement is likely as profit-taking and stop orders trigger. While sentiment has been bullish, caution is warranted at these levels. I am expecting a pullback before any further upside. Not financial advice.

"GERMANY30" Index CFD Market Heist Plan (Scalping/Day Trade)🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑💰✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the "GERMANY30" Index CFD Market. Please adhere to the strategy I've outlined in the chart, which emphasizes short entry. Our aim is the high-risk Green Zone ATR. Risky level, oversold market, consolidation, trend reversal, trap at the level where traders and bullish robbers are stronger. 🏆💸Book Profits Be wealthy and safe trade.💪🏆🎉

Entry 📈 : "The vault is wide open! Swipe the Bearish loot at any price - the heist is on!

however I advise to Place sell limit orders within a 15 or 30 minute timeframe most nearest or swing, low or high level.

Stop Loss 🛑: (22500) Thief SL placed at the nearest / swing high level Using the 4H timeframe scalping / day trade basis.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯: 21400 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Short side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

"GERMANY30" Index CFD Market Heist Plan (Scalping/Day Trade) is currently experiencing a bearishness,., driven by several key factors.

📰🗞️Get & Read the Fundamental, Macro Economics, COT Report, Geopolitical and News Analysis, Sentimental Outlook, Intermarket Analysis, Index-Specific Analysis, Positioning and future trend targets... go ahead to check 👉👉👉🔗

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

"GERMANY 40" Index CFD Market Heist Plan (Day / Swing Trade)🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑💰✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the GER40 "GERMANY 40" Index CFD Market. Please adhere to the strategy I've outlined in the chart, which emphasizes short entry. Our aim is the high-risk Green Zone. Risky level, oversold market, consolidation, trend reversal, trap at the level where traders and bullish robbers are stronger. 🏆💸Book Profits Be wealthy and safe trade.💪🏆🎉

Entry 📈 : "The heist is on! Wait for the breakout (22650) then make your move - Bearish profits await!"

however I advise placing Sell Stop Orders below the breakout MA or Place Sell limit orders within a 15 or 30 minute timeframe. Entry from the most recent or closest low or high level should be in retest. I Highly recommended you to put alert in your chart.

Stop Loss 🛑: Thief SL placed at 23000 (swing / Day Trade Basis) Using the 2H period, the recent / swing high or low level.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯: 22000 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Short side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

GER40 "GERMANY 40" Index CFD Market Heist Plan (Scalping / Day Trade) is currently experiencing a bearishness,., driven by several key factors.

📰🗞️Get & Read the Fundamental, Macro, COT Report, Geopolitical and News Analysis, Sentimental Outlook, Intermarket Analysis, Index-Specific Analysis, Positioning and future trend targets.. go ahead to check 👉👉👉

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

📌Please note that this is a general analysis and not personalized investment advice. It's essential to consider your own risk tolerance and market analysis before making any investment decisions.

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

#dax Forex Signal German index #dax says I am rising in the medium term in technical indicators. 30% increase is normal. It is necessary to take a position for a decrease when the blue line at the top, which is our technical resistance, turns.

If you want to be in action at the right place and at the right time, you can follow me.

I can draw it for you. Please write me privately.

NOTE: IT DOES NOT CONTAIN INVESTMENT ADVICE. EVERYONE IS FREE TO BUY AND SELL THE SHARES THEY WANT FROM THEIR PERSONAL ACCOUNT WITH THEIR OWN FREE WILL. NO ONE CAN GUIDE ANYONE OR PROVIDE SHARES THAT WILL PROVIDE 100% GUARANTEED PROFIT.

I can draw it for you. Please write me privately.

GER40/DAX "Germany40" CFD Index Market Heist Plan🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

⚔Dear Money Makers & Thieves, 🤑 💰✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the GER40/DAX "Germany40" CFD Index Market. Please adhere to the strategy I've outlined in the chart, which emphasizes short entry. Our aim is the high-risk Green Zone. Risky level, oversold market, consolidation, trend reversal, trap at the level where traders and bullish thieves are getting stronger. 🏆💸Book Profits Be wealthy and safe trade.💪🏆🎉

Entry 📈 : "The vault is wide open! Swipe the Bearish loot at any price - the heist is on! profits await!" however I advise placing Sell limit orders within a 15 or 30 minute timeframe. Entry from the most recent or swing low or high level should be in retest.

Stop Loss 🛑: Thief SL placed at (23000) swing Trade Basis Using the 2H period, the recent / swing high or low level.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

🏴☠️Target 🎯: 21400 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Short side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

GER40/DAX "Germany40" CFD Index Market is currently experiencing a Neutral trend to Bearish., driven by several key factors.

📰🗞️Read the Fundamental, Macro Economics, COT Report, Seasonal Factors, Intermarket Analysis, Sentimental Outlook, Future trend predict.

Before start the heist plan read it.👉👉👉

📌Keep in mind that these factors can change rapidly, and it's essential to stay up-to-date with market developments and adjust your analysis accordingly.

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩