DAX testing supportCould the DAX bounce back here after starting the day lower?

At the time of writing, the German benchmark index was testing key short-term support between 23,928 to 24,041. This area was previously resistance while the 21-day exponential average also comes into play here.

if we see a bounce here then a new all-time high could be on the cards. Else, a potential break down could target the old support and resistance range around 23,500.

By Fawad Razaqzada, market analyst with FOREX.com

Germany40

Rob the DAX! GER40 Bullish Mission Begins Now!🏴☠️GER40 Bullish Vault Heist! Target: 25400 🎯💼

🚨Mission Briefing: Robbery in Progress - DE40 / Germany40 Index Heist!

🎯 Plan: Bullish

🗂️ Asset: DE40 / GER40 “Germany40” Index

📦 Strategy: Thief’s signature Layered Limit Orders 🧱 (Multi-entry precision loading)

🔑 Entry Point:

"The vault is open 24/7! Thief goes in anytime 🔓💰"

Place multiple buy limit orders at recent swings / lows on the 15m-30m chart.

📲 Tip: Set alerts at breakout zones. Be early. Be greedy.

🚨 Stop Loss:

🎯 SL at 23,300 🔐 – beneath 4H structure (swing low wick-based).

Adjust SL based on lot size and number of active entries.

🏆 Escape Point (Target):

💼 25,400 = Target stash 💰

🔥 Use Trailing SL and ride the wave – exit before the trap if market hesitates!

📈 Scalpers / Swingers Alert:

💎 Only Long-side loot allowed!

💸 Small capital? Join the swing team 🚀

💰 Big capital? Front-run the breakout!

🎯 Trailing SL = Smart thieves protect profits.

🧠 Why Bullish?

The index is warming up after consolidation. Neutral bias flipping bullish 🔄 due to:

📰 Weakening macro shock absorbers

💣 Risk appetite reviving

💡 Institutional positioning + COT shift

🔄 USD reaction + EU equity flow

💼 Check all macro + intermarket juice for full confidence 📊🔗

⚠️ Risk Management Tips for Robbers:

🕰 Avoid news hour trades

🔄 Use Trailing SL always

📉 Don't chase… let the market come to you

👀 Eyes on economic calendar and VIX movement

❤️ Support the Robbery Crew!

💥 Hit that BOOST button if you love making money the Thief Way 🏴☠️

🎯 Help us grow the robbery empire & take over the charts 📈💰

🧨 Another Heist Plan coming soon! Stay sneaky, stay funded 🤑🐱👤💼

#ThiefTrader #GER40Plan #IndexHeist #LayeredLoot #MarketRobbery #FTSEStyleRobbery

GER40 in Motion: This Setup Speaks Volumes 🌅 Good morning, my friends,

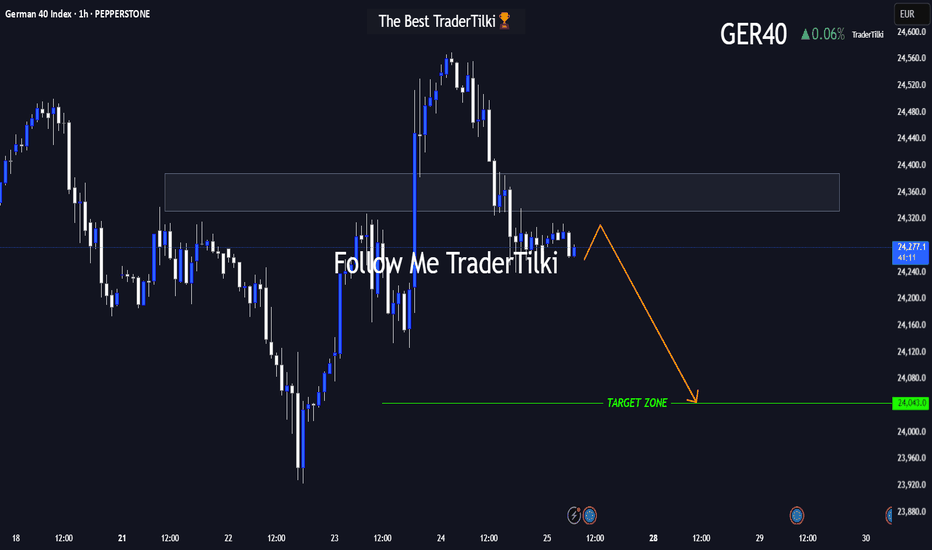

I’ve put together a fresh GER40 analysis just for you. Even if the 1-hour timeframe shows some upward momentum, I fully expect the price to reach my target level of **24,050**.

I'm holding firm until that level is hit.

Every single like from you is a massive source of motivation for me to keep sharing analysis. Huge thanks to everyone supporting with a tap!

The DAX Index Is Losing Its Bullish MomentumThe DAX Index Is Losing Its Bullish Momentum

At the end of May, we noted that the German stock index DAX 40 was exhibiting significantly stronger performance compared to other global equity indices. However, we also highlighted the 24,100 level as a strong resistance zone.

Two months have passed, and the chart now suggests that bearish signals are intensifying.

From a technical analysis perspective, the DAX 40 formed an ascending channel in July (outlined in blue). However, each time the bulls attempted to push the price above the 24,460 level (which corresponds to the May high), they encountered resistance.

It is worth noting the nature of the bearish reversals (indicated by arrows) – the price declined sharply, often without intermediate recoveries, signalling strong selling pressure. It is likely that major market participants used the proximity to the all-time high to reduce their long positions.

From a fundamental standpoint, several factors are weighing on the DAX 40:

→ Ongoing uncertainty surrounding the US–EU trade agreement, which has yet to be finalised (with the deadline approaching next week);

→ Corporate news, including disappointing earnings reports from Puma, Volkswagen, and several other German companies.

Given the above, it is reasonable to assume that bearish activity could result in an attempt to break below the lower boundary of the ascending blue channel.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Before GER40 Roars, It WhispersHey guys👋

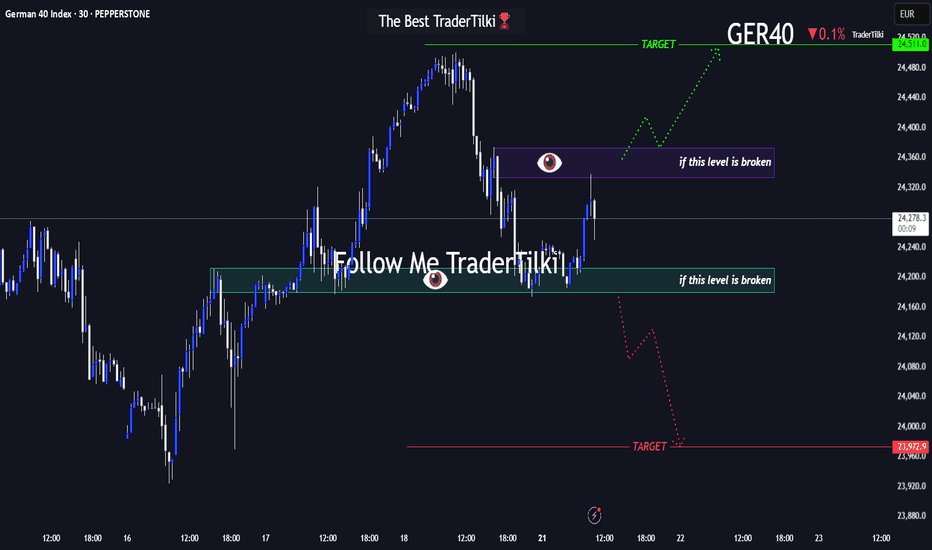

Here’s the latest GER40 analysis I’ve prepared for you:

🔻 If the **24,179** support level breaks, the next target is **23,972**.

🔺 If the **24,373** resistance level breaks, the next target is **24,511**.

🎯 I’ve shared two key levels with you — please monitor them carefully.

Every like from you gives me a big boost of motivation 🙏

Thanks to everyone who supports my work — truly appreciate it 💙

US30 (Dow Jones) Is On My Radar — The Moment’s Getting Close!Hey Guys,

I've marked my sell zone on the Dow Jones (US30) chart.

Once price reaches my entry range, I’ll be jumping into this high-probability trade setup.

🚪 Entry Levels: 44,551 – 44,632 – 44,677

🛑 Stop Loss: 44,725

🎯 Targets:

• TP1: 44,468

• TP2: 44,359

• TP3: 44,126

📐 Risk-to-Reward Ratio: Approximately 2.41 from the 44,551 entry

Your likes and support are what keep me motivated to share these analyses consistently.

Huge thanks to everyone who shows love and appreciation! 🙏

DAX Stock Index Declines Amid Trump Tariff ThreatDAX Stock Index Declines Amid Trump Tariff Threat

The German stock index DAX 40 (Germany 40 mini at FXOpen) is showing bearish momentum at the start of the week. This may be driven by a combination of factors, the most significant of which is the threat of tariffs on Europe from the United States.

According to Reuters, US President Donald Trump has announced a 30% tariff on most goods from the EU, set to come into effect next month. However, the decision is not yet final. Analysts caution against premature panic, suggesting that negotiations could still result in a trade agreement — nonetheless, the chart reflects a sense of unease among investors.

Technical Analysis of the DAX 40 Chart

The price surge in July above the previous all-time high near the 24,500 level appears to be a false bullish breakout — a sign of market weakness.

Buyers may hope that the market will find support at the former resistance line (marked in red), drawn through the local highs of June.

However, if news surrounding the US–EU negotiations turns negative, the DAX 40 index could fall towards the 23,650–23,750 support area, which is reinforced by the lower boundary of the medium-term ascending channel.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

“GER30 Bull Vault Heist: The Ultimate Loot Plan”💎“The Bull Vault Job: GER30 Heist Blueprint”💎

🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Welcome fellow Chart Raiders & Market Hackers 🧠💰—your next mission is here.

We’re pulling off a precision breakout plan on GER30 / DE30 "Germany30" — a market vault bursting with bullish loot. This isn’t just trading... this is Thief Trading Style™ — where smart analysis meets slick execution. 👨💻💎📊

💼 The Heist Plan:

📈 Entry: Market shows a wide open vault. Ideal long setups near the last swing low (15–30m for sniper entries). Don’t chase—wait for the retrace.

🛑 Stop Loss: Guard your getaway! Use recent swing lows on 4H (e.g. 24170). Customize based on your risk profile & lot sizes.

🎯 Target: Aim for 24720 or EXIT before the cops (a.k.a. reversal zones) show up. Always secure your gains.

📌 Scalpers’ Signal: Stay LONG-only. Follow swing traders if low on ammo (capital). Use trailing SLs like tripwires to protect your profits.

📊 Market Heat Check: The DE30 is radiating bullish pressure 💥—fueled by fundamentals, macro trends, COT positions, sentiment indicators, and intermarket clues. We read between the lines. You just follow the blueprint. 🧠

🚨 Pro Tips:

Avoid entering trades during high-impact news.

Manage risk like a vault door—solid, tested, and ready.

💖 Smash that Boost Button 💖 if you believe in the Art of Legal Market Extraction™ — it supports the plan, strengthens the crew, and keeps this hustle alive!

🎭 More blueprints & breakdowns coming soon. Stay locked in...

Until the next market hit, trade sharp, trade smart. 🐱👤📈💰

DAX flirts with ATHs againAfter breaking out of the triangle formation a couple of days ago, the DAX is now flirting with the previous record hit in early June at 24490. With Trump's tariffs uncertainty at the forefront again, there is a possibility we could potentially see a double top or a false break reversal formation here, so do watch out for that. However, we will continue to focus on the long side until we see an actual, confirmed, reversal. With that in mind, dip-buying remains the preferred trading strategy.

Key support levels to watch:

24,278, marking yesterday's high

24,176, broken resistance from last week

23,927, the base of this week's breakout

The technical picture would turn bearish in the event we go back below the support trend of the triangle pattern.

In terms of upside targets,

24,750, marking the 127.2% Fib extension of the big drop from March

24,890, marking the 127.2% Fib extension of the most recent drop from June high

25,000, the next big psychological level

By Fawad Razaqzada, market analyst with FOREX.com

Is the Trend Intact? Key Signal Emerging on GER40 4H ChartHey Guys,

We could see a pullback on the GER40 index from the 24,060 level. If that happens, the 23,824 – 23,675 zone could present a potential buying opportunity. The primary trend still points upward, and bullish momentum remains intact.

Also worth noting—the rise in volume is quite striking, which supports my target level of 24,500.

I meticulously prepare these analyses for you, and I sincerely appreciate your support through likes. Every like from you is my biggest motivation to continue sharing my analyses.

I’m truly grateful for each of you—love to all my followers💙💙💙

Quick take on DAXTariffs, no tariffs, tariffs, no tariffs... Let's look at the technical picture...

XETR:DAX

MARKETSCOM:GERMANY40

Let us know what you think in the comments below.

Thank you.

77.3% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Past performance is not necessarily indicative of future results. The value of investments may fall as well as rise and the investor may not get back the amount initially invested. This content is not intended for nor applicable to residents of the UK. Cryptocurrency CFDs and spread bets are restricted in the UK for all retail clients.

“GER40 Heist in Progress – Bearish Blueprint Deployed!”🦹♂️💼 “Operation: Black Forest Heist” – DAX Day/Swing Trade Plan 💼🦹♀️

📍Thief Trading Style | CFD Tactical Chart Blueprint | GER40 Recon Mission

🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Movers, Risk Raiders & Precision Planners 🧠💸,

Suit up for a clean-cut operation on the Germany 40 (GER40) Index! 🎯

With our sharp-edged Thief Trading blueprint 🔪, we’re scanning for a potential bearish trap—market’s heating up with oversold setups and momentum cracks near key resistance. Watch for the green MA zone—we suspect it's where bullish imposters hide. 🕵️♂️📉

🔓 Entry Plan

“The vault’s cracking... get ready!”

Wait for price to breach the ATR Line (23000.0). Once the level is crossed cleanly, it’s go-time:

🧨 Use Sell Stop orders just under the breakout

🎣 Or hunt pullback setups on 15m/30m charts with Sell Limit entries at resistance

🔐 Stop-Loss Strategy

Keep it tight. Protect your loot.

🚧 Place SL around swing high/low on the 4H chart (e.g. 23400.0)

⚖️ Adapt SL based on lot size, risk appetite, and number of entries

🎯 Target Zone

Mission Objective: 22600.0

Or exit earlier if the security alarm (price action shift) starts ringing. Don't get greedy—get out smart. 💼🚪💨

📉 Market Outlook:

Current trend: Neutral but suspiciously wobbly – early signs of bearish dominance. 🐻

This trade aligns with multiple signals:

📊 Technical: Consolidation near highs

💼 Fundamental: Macro & news risks

🧠 Sentiment: Crowd leaning long = opportunity for reversal

📰 Caution Note – News Events = Laser Tripwires

Stay sharp during releases!

Avoid new setups when big headlines drop

Use trailing stops to secure gains on running trades

Position smart, manage tighter, act quicker 🕶️

💥 Smash that Boost Button if this plan sharpens your edge or adds value to your mission! 💥

Together, we move like shadows and strike like lightning—Thief Traders never miss a clean setup.⚔️🕵️♀️

Stay tuned for the next raid… the market’s full of opportunities waiting to be unlocked. 🗝️🚀

#004 DAX GERMANY 40: LONG Opportunity

GERMANY 40 – Possible Daily Reversal Starting: LONG on Strategic Support

Hello, I am Trader Andrea Russo, Founder of the SwipeUP Élite FX Method, and today I want to point out this investment on Germany 40 (DAX), in a long configuration from the 23,345 area.

🔍 Technical Context

In recent days, the DAX has undergone a strong correction that has brought the price from 24,800 to test the lows in the 23,200 area. This area corresponds to a long-term daily support level, already used in the past for institutional accumulations.

The price generated a strong bearish spike right at the opening of the cash session, but without closing below the previous lows. This behavior is often indicative of a pre-reversal bearish manipulation.

Confirming this scenario, a double bottom pattern has formed with positive divergence on the 8H and daily cyclical oscillators. In addition, volumes are growing right on the support: a typical signal of an invisible accumulation phase by institutional operators.

✅ Trade Strengths

Daily static support confirmed at 23,200–23,300, already defended several times in the past.

Manipulative spike evident in the first hour of cash opening, followed by rejection of the lows.

Bullish divergence on the cyclical indicators (WT_CROSS) in H8.

Favorable risk/reward ratio (~3.6:1), with well-defined technical stop loss.

Volatility under control: the VIX is stable and the US session opened without a selloff.

Neutral/positive macro environment: weak euro, expectations of monetary easing, low pressure on bonds.

Derivatives sentiment favorable: open interest rising in the 23,300–23,400 area on DAX futures.

🎯 Operating Levels

ENTRY: 23,345

STOP LOSS: 23,170

TAKE PROFIT: 24,007

📌 This positioning allows you to operate with limited risk and a realistic objective, perfectly compatible with standard technical movements on the German index in 2–3 days.

⏱️ Expected Timings

First directional candle expected within 8–16 hours (1–2 H8 candles).

Estimated duration of the trade: between 48 and 72 hours to reach the target.

🧠 Operating Conclusion

The long investment on DAX from 23,345 represents one of the clearest technical configurations seen in the last week on European indices.

The simultaneous presence of cyclical signals, manipulation, structure and static support offers a high probability of success.

The final target at 24,007 is technically and statistically achievable with rigorous management.

💬 Leave a like if you want to receive the 8H analysis update and comment your vision on Germany 40.

🔔 Follow the profile to not miss the next multi-asset updates!

GER40 Trading Plan: Ride the Wave or Get Trapped?🚨 DE40 Heist Alert: The Bullish Breakout Robbery Plan (Swing & Scalp Strategy) 🚨

🌟 Hi! Hola! Ola! Bonjour! Hallo! Marhaba! 🌟

Attention Money Makers & Market Robbers! 🤑💰💸

Based on the 🔥Thief Trading Style🔥, here’s our master plan to loot the DE40 / GER40 "Germany40" Index. Follow the strategy on the chart—focusing on LONG entries—and escape near the high-risk Red Zone. This area is overbought, consolidating, and a potential reversal trap where bears lurk. 🏆 Take profits fast—you’ve earned it! 💪

🎯 Heist Entries:

📈 Entry 1: "The Breakout Heist!" – Wait for Resistance (24200) to break, then strike! Bullish profits await.

📈 Entry 2: "Big Players’ Pullback!" – Jump in at 23300+ for a safer steal.

🔔 Pro Tip: Set a chart alert to catch the breakout instantly!

🛑 Stop Loss Rules:

*"Yo, listen! 🗣️ If you’re entering with a buy-stop, DON’T set your SL until AFTER the breakout. Place it at the nearest swing low (4H timeframe) or wherever your risk allows—but remember, rebels risk more! 🔥"*

🏴☠️ Target: 24,800

🧲 Scalpers: Only play LONG! Use trailing SL to lock in profits. Big wallets? Go all in. Small stacks? Join the swing heist!

📊 Market Pulse:

The DE40 is neutral but primed for bullish momentum. Watch:

Fundamentals (COT, Macro, Geopolitics)

Sentiment & Intermarket Trends

Positioning & Future Targets

📌 Check our bioo linkks for deep analysis! 🔗🌍

⚠️ Trading Alert:

News = Volatility! Protect your loot:

Avoid new trades during major news

Use trailing stops to secure profits

💥 Boost This Heist!

Hit 👍 & 🔄 to strengthen our robbery crew! Let’s dominate the market daily with the Thief Trading Style. 🚀💵

Stay tuned—another heist drops soon! 🎯🐱👤

DAX Stock Index Rises Over 20% Year-to-DateDAX Stock Index Rises Over 20% Year-to-Date

The German DAX 40 index (Germany 40 mini on FXOpen) is showing significantly stronger performance than other major global stock indices as of the end of May. For comparison, since the beginning of 2025:

→ The tech-heavy Nasdaq 100 has remained largely flat;

→ The S&P 500 is down by 1%;

→ Japan’s Nikkei 225 has fallen by approximately 4.5%.

Why Is Germany’s Stock Index Climbing?

The rally may be driven by a combination of factors, including:

→ An ambitious fiscal stimulus programme launched by the German government, featuring substantial public investment in defence and infrastructure development.

→ A dovish monetary policy stance from the European Central Bank (ECB) amid slowing inflation. Expectations of further interest rate cuts in 2025 have made equities more attractive than bonds, drawing capital into the stock market.

Technical Analysis of the DAX 40 Chart

These fundamental drivers have supported the formation of an upward trend channel (marked in blue), with the median line acting as a key area of support.

The DAX stock index experienced a sharp drop on Friday (highlighted by the arrow) after the US President unexpectedly announced 50% tariffs on EU imports, citing slow progress in trade negotiations. By Sunday, however, Trump postponed the tariffs until 9 June following a “constructive conversation” with European Commission President Ursula von der Leyen.

Since then, the price has:

→ Rebounded from the lower boundary of the channel, which is reinforced by support at the 23,350.0 level;

→ Approached the 24,100 level — a strong resistance zone this month.

Given the uncertainty sparked by Trump’s impulsive policy shifts, investors may be shifting capital from US to European markets, further supporting the DAX 40’s position as a leader among global stock indices.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

DAX enters major resistance zone after 3-day rallyThe DAX has enjoyed a very good recovery from its lows made earlier this month, outperforming many global indices. However, even the flying German index could be due a pullback now that it has reached a major resistance area.

As per the chart, the area between 21970 to 22240 marks a major zone. This area was previously a key support zone which gave way during the height of the tariffs uncertainty, paving the way for a sharp drop.

Now, with Trump changing his tone, we have seen European markets regain much of those losses. But the potential for the trade war to drag on is there, which is why we can't rule out the possibility of a fresh drop from around this area.

If the market does turn lower, then some of the key support levels to watch are drawn on the chart, with the first area for the bulls to defend coming in at around 21,500/50 (shaded in light blue).

By Fawad Razaqzada, market analyst with FOREX.com

DAX hits fresh record on stimulus plansThe German DAX index has just hit a fresh all-time high.

The latest gains come as a global bond sell-off extended its run, driven by Germany’s ambitious spending plans, which are poised to reshape the eurozone’s economic outlook and has already had a sizeable impact on regional stocks. Today, the focus was also on the rate decision from the European Central Bank. The ECB cut rates by 25bps as expected and President Lagarde said the next rate decision in April is defendant on data.

The market's attention shifts to US labour market data as we head to the business end of the week.

From a technical view point, the strong rally means dip-buyers continue to remain in control of price action. For that reason, there is no point in trying to pick the top. Concentrate on support levels until we see a clear reversal pattern.

Short-term support now comes in around 23,311, marking the high from Monday, followed by 23,229, marking the high from Wednesday. Below these levels, 22,937 is the next key support to watch for a potential bounce, before the trend line comes into focus a bit lower down.

By Fawad Razaqzada, market analyst with FOREX.com

DAX Stock Index PlungesDAX Stock Index Plunges

As we noted six days ago, European stock markets were showing optimism amid expectations that the armed conflict in Ukraine—now approaching its third year—would be resolved. During this period, the DAX 40 (Germany 40 mini on FXOpen) gained approximately 1.6%, setting a historic record.

However, sentiment appears to be shifting in the opposite direction. According to the Germany 40 mini chart on FXOpen, the German stock index DAX 40 experienced a sharp decline yesterday, losing around 2%. This drop is partly driven by Trump's latest tariff statements. According to Trading Economics:

→ The US President is considering imposing new 25% tariffs on automobile, semiconductor, and pharmaceutical imports, with an official announcement expected in early April.

→ Market sentiment deteriorated after ECB Executive Board member Isabel Schnabel tempered expectations of a more expansionary monetary policy.

Technical Analysis of the DAX 40 (Germany 40 mini on FXOpen)

Since the start of 2025, the index has been following an upward trend (illustrated by the blue channel), which remains intact. However, yesterday’s aggressive drop pushed the price into the lower half of the channel, indicating increased bearish activity. If negative sentiment persists, the price could decline further—potentially testing the lower boundary of the channel.

The 22,200 level appears to be a significant support zone, as bulls demonstrated strength here less than 10 days ago (as indicated by the blue arrows):

→ The price formed a long lower wick when testing the psychological 22k mark.

→ It then surged into the upper half of the channel with a strong bullish candle.

Conversely, the 22,730 level has flipped from support to resistance (marked by orange arrows), signalling the presence of bearish pressure.

Trade on TradingView with FXOpen. Consider opening an account and access over 700 markets with tight spreads from 0.0 pips and low commissions from $1.50 per lot.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

DAX 40 Remains in Strong Overbought ZoneThe German index has recorded eight consecutive sessions of gains, appreciating more than 5% in the short term. The price level of 21,400 points now stands as the all-time high barrier for the current long-term bullish trend.

Strong Trend:

The bullish momentum that emerged after the significant drop in August 2024 has been key to the continuation of the long-term uptrend. However, the accelerated pace of buying in the short term could lead to bearish corrections in the coming sessions.

RSI:

The RSI indicator shows an impressively bullish slope, currently displaying readings of 83 —well above the overbought level of 70. The current event in the DAX price indicates that recent movements have created an imbalance in bullish and bearish forces, which could trigger early bearish corrections as the price continues to advance.

Key Levels:

21,400 points: Positioned as the new resistance zone at the latest all-time high. Consistent buying pressure is necessary to maintain the bullish bias currently observed in the index.

20,300 points: The nearest support level on the chart and a potential area for bearish corrections in the short term. If the price drops below this level, sustained bearish pressure on the DAX could return.

By Julian Pineda, CFA - Market Analyst

Germany’s DAX 40 Stock Index Hits Record HighGermany’s DAX 40 Stock Index Hits Record High

The country’s Finance Minister, Jörg Kukies, stated in an interview with CNBC that it is crucial for Germany to enter a period of economic growth, adding that structural deficiencies need to be addressed.

“We have just received another downward revision of growth forecasts from the IMF,” he said at the World Economic Forum in Davos. The International Monetary Fund (IMF) now projects Germany’s GDP growth at 0.3% in 2025 and 1.1% in 2026, according to the January update of its World Economic Outlook. This marks a sharp decline from the October forecast of 0.8% growth in 2025.

Germany’s annual gross domestic product contracted in both 2023 and 2024. Quarterly GDP figures were also modest, although the economy has so far avoided a technical recession.

Kukies also remarked that domestic German companies are “under stress” but continue to perform “very well” on the global market, seemingly referencing the rise of the DAX 40 stock index (Germany 40 mini on FXOpen). Indeed, yesterday the index surpassed the 21,300-point level for the first time in history.

Technical analysis of the DAX 40 stock index chart (Germany 40 mini on FXOpen) indicates that the price is forming two ascending channels. While rising within the steeper purple channel, the price has exceeded the upper boundary of the blue channel.

However, given that the price has not yet reached the upper boundary of the purple channel (as indicated by the arrow), it is reasonable to suggest that bullish momentum may be waning. If so, a possible scenario could involve a correction with a bearish breakout of the lower purple line, leading the price back into the blue channel. It is also possible that there will be one more attempt to set a new record, accompanied by the formation of bearish divergence on the RSI indicator.

Trade on TradingView with FXOpen. Consider opening an account and access over 700 markets with tight spreads from 0.0 pips and low commissions from $1.50 per lot.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.