Will Live Cattle Ever Fill the GapFriday’s Slaughter is estimated at 125,000. 4,000 more than last week, and 4,000 more than the same week last year.

Friday’s Cutout Values

Choice: 267.89, Down .18 from the previous day.

Select: 241.85, Down .73 from the previous day.

Choice/Select Spread: 26.04

5 Area Average Cattle Price

Live Steer:144.37

Live Heifer: 141.69

Dressed Steer: 232.30

Dressed Heifer: 232.23

Live Cattle

Commitments of Traders Update: Friday’s Commitments of Traders report showed Managed Money were net sellers of 9,968 futures/options, through July 5th. The Bulk of this was new short positions, 7,162. This shrinks their net long position to 14,297.

Technicals: For the week ending July 8th, August live cattle were down .65. The market continues to chop around in the middle of the range over the last two months. Recently, major moving averages have been a roadblock for the Bull camp. Today, those come in at 135.425 (200 day moving average) and 135.95 (100 day moving average). We remain stubbornly optimistic that we can work back out above these levels and potentially make another run at filling the April 25th gap.

Resistance: 135.40-136.05***, 137.95-138.75***, 140.275**

Pivot: 134.40

Support: 132.45-132.775***, 129.975-130.725****

Futures trading involves substantial risk of loss and may not be suitable for all investors. Trading advice is based on information taken from trade and statistical services and other sources Blue Line Futures, LLC believes are reliable. We do not guarantee that such information is accurate or complete and it should not be relied upon as such. Trading advice reflects our good faith judgment at a specific time and is subject to change without notice. There is no guarantee that the advice we give will result in profitable trades. All trading decisions will be made by the account holder. Past performance is not necessarily indicative of future results.

GF1!

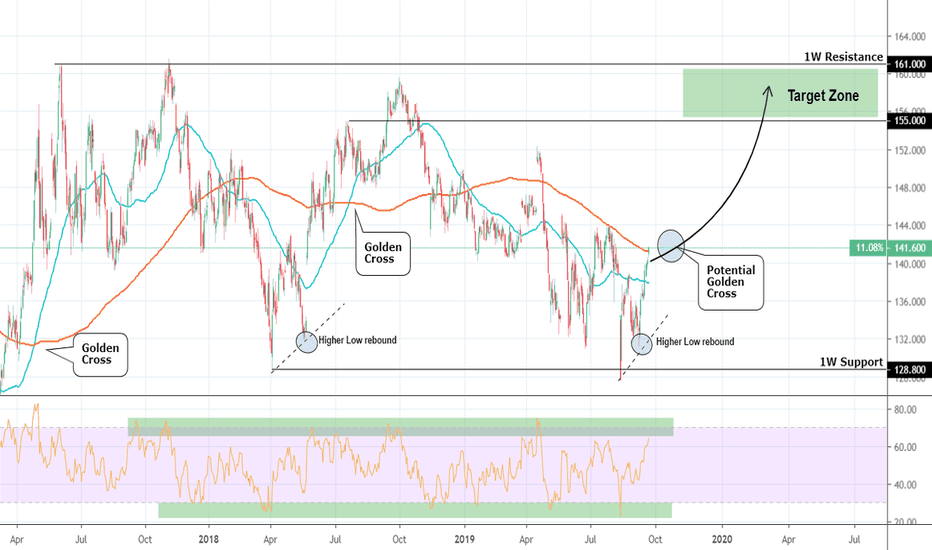

Feeder Cattle: Strong Buy Signal on potential Golden Cross.Feeder Cattle is coming off a strong Higher Low rebound early this month with 1D already on strong bullish technical action (RSI = 60.454, MACD = 0.850, Highs/Lows = 3.0514). Since this bullish sequence started on a strong August rebound on the 128.800 1W Support, it is more likely to see an extension towards the 161.000 1W Resistance.

A potential 1D Golden Cross formation in October should come as validation of this just as it has done twice already since 2017. We are long on GF with 155.000 - 161.000 as our Target Zone.

** If you like our free content follow our profile (www.tradingview.com) to get more daily ideas. **

Comments and likes are greatly appreciated.

Feeder Cattle: Long term Buy opportunity.GF is trading on a 1W Ascending Triangle that is near the 139.225 Support and Higher Low zone (RSI = 46.649, MACD = -0.700, Highs/Lows = 0.0000). This creates ideal conditions for a long term buy towards 159.500.

** If you like our free content follow our profile (www.tradingview.com) to get more daily ideas. **

Comments and likes are greatly appreciated.

Long term setup within the 1W Channel Up.Feeder Cattle (GF1!) is trading within a long term 1W Channel Up (RSI = 63.368, B/BP = 10.8420) on a very stable pace setup (MACD = 2.490, Highs/Lows = 3.4700) that allows us for a better pattern recognition. If those recurrences are valid, the GF should seek a Higher Low near 155.000 before making a Higher High near 164.000 (target).

1D Channel Down. Short.Feeder Cattle is trading within a Channel Down on 1D (MACD = -0.360, Highs/Lows = -0.0614, B/BP = -1.7440). The neutral RSI = 45.095 suggests that it is coming off a recent Lower High, which as seen on the chart was at 151.500. We have opened short and our TP is 146.900 and 144.975 in extension (we will update if needed to pursuit the extension).