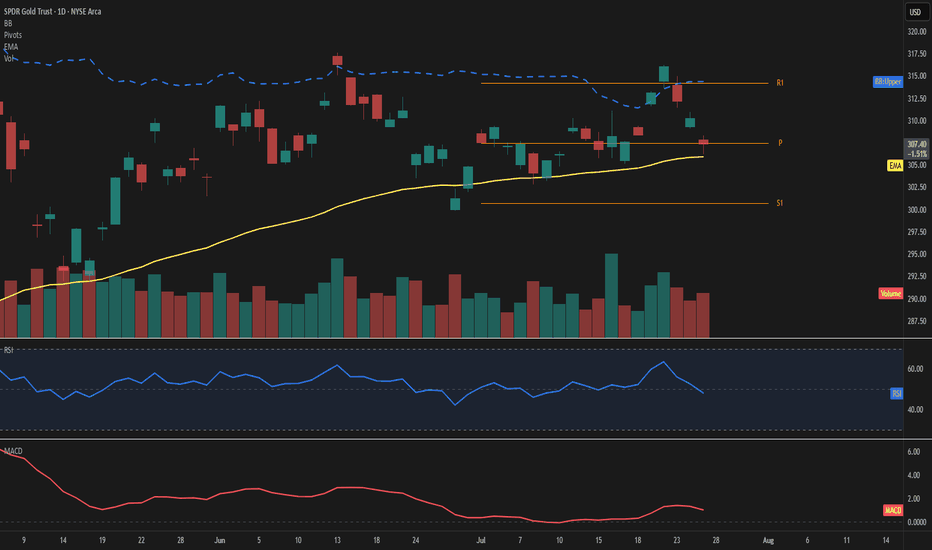

GLD – Price consolidates at highsPrice is hovering just above the 50-day EMA at 307, showing signs of short-term hesitation near the Fibonacci pivot. The upper Bollinger Band sits at 314, leaving moderate room for expansion if momentum picks up.

The RSI reads 48, reflecting a balanced setup without clear directional bias. MACD remains slightly positive, suggesting a still-constructive but soft momentum.

Key levels to watch include the pivot at 307 and the support at 301. On the upside, the 314 area aligns with both R1 and the upper band, acting as the next challenge.

Volume is up sharply (+22%) despite a mild -0.9% price pullback, indicating possible accumulation beneath the surface.

As long as price holds above the 50-day EMA, the structure remains intact.

A move away from the pivot zone will likely define the next directional wave.

GLD

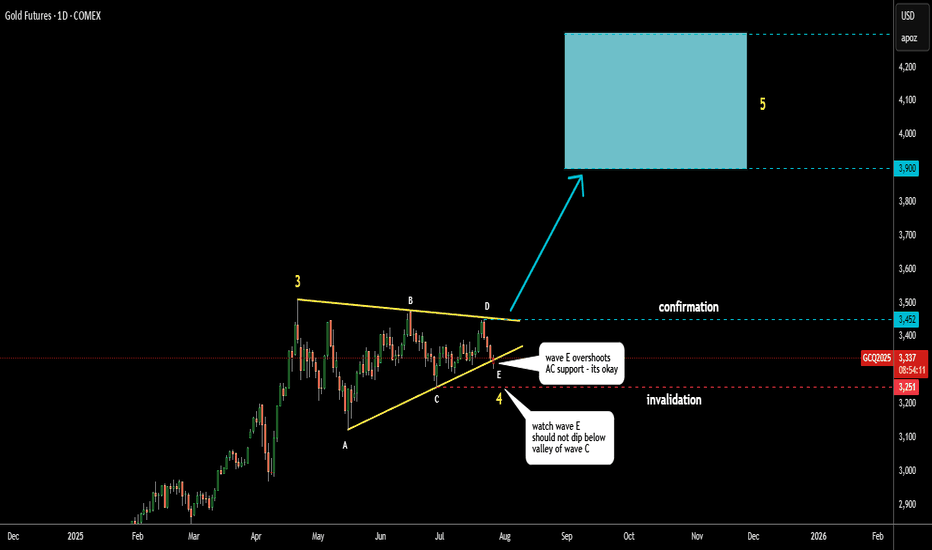

Gold Update 28 JULY 2025: On The EdgeGold is accurately following the path shown in my earlier post.

Wave D respects the triangle rules, staying below the top of wave B.

Wave E appears nearly complete, even piercing the A–C support line.

This is acceptable as long as wave E stays above the wave C low at $3,251.

Keep a close eye on this invalidation point.

The target range remains unchanged: $3,900–$4,300.

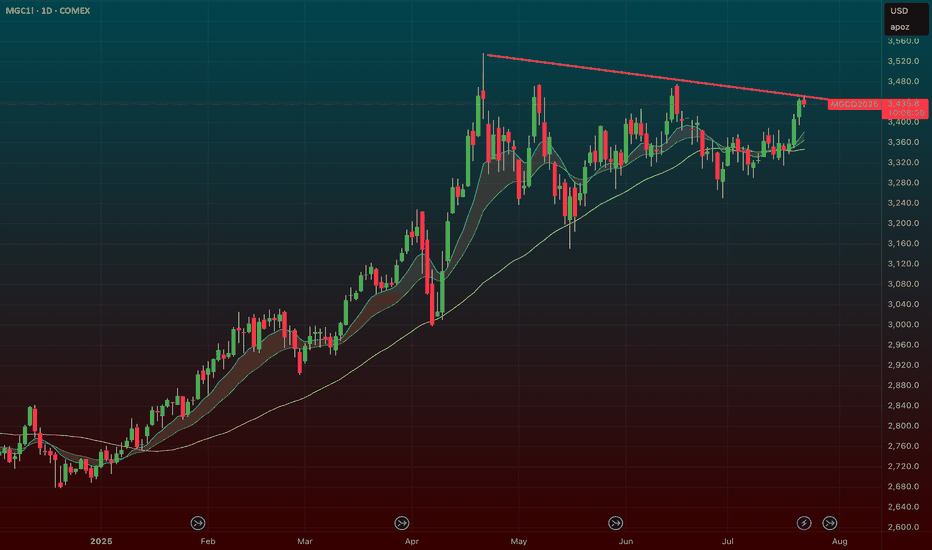

$GLD / $GC – Gold Poised for Breakout as Hard Assets FlexAMEX:GLD / SET:GC – Gold Poised for Breakout as Hard Assets Flex

Gold is setting up for a major breakout, and the broader market is finally catching on to the hard asset trade. Whether it’s inflation ticking up or the never-ending government deficit spending, the market is starting to signal something big.

🔹 Macro Tailwinds:

Inflation pressures + record deficit = a perfect storm for gold.

The dollar is under pressure — metals ( AMEX:GLD , AMEX:SLV , SET:GC ) are responding.

This theme isn’t going away anytime soon.

🔹 Technical Setup:

AMEX:GLD and SET:GC (Gold Futures) are coiled tightly just under breakout levels.

Volume is steady, and momentum is building under the surface.

A move through current resistance could send this entire trade into overdrive.

🔹 My Positioning:

1️⃣ Options: Long AMEX:GLD calls with 1-month expiration — slow mover, but clean structure.

2️⃣ Futures: Trading SET:GC contracts on the breakout side.

3️⃣ Silver Exposure: Still holding partials in AMEX:SLV — it’s following gold’s lead but with more juice.

Why I’m Focused Here:

This is not a one-day theme — hard assets are becoming a rotation trade.

If this confirms, we could see multi-week upside in precious metals.

It’s rare to get clean technicals that align this well with macro.

$USOIL: Will we see breakout or breakdown from this wedge? I have been watching the Commodity markets recently keenly to get direction or for market indications. AMEX:GLD , Copper and TVC:USOIL are the big 3 which determines the direction of commodity markets and hence the inflation. Inflation dictates direction of TVC:US10Y , TVC:DXY and hence the Equity markets. So, what are commodity markets telling us? With AMEX:GLD and OANDA:XCUUSD at ATH what does this mean for TVC:USOIL : TVC:USOIL Is in a bearish pattern and no sign of concrete bullish reversal on the commodity. Recently it has shown some signs of strength but still below its 0.5 Fib retracement level which is at 68 and we have time and again said that 0.318 Fib level at 80 $ might prove to be an upper resistance which will be difficult to breakout.

In the recent months whenever TVC:USOIL tries to break out of the 60 RSI sellers came back and pushed the prices down. Currently with RSI at 50 we might have some room for upside. Oil bulls can have a 20% upside in the RSI taking it to 60 which has historically proved to be a resistance. And a 20% upside in price is also possible with price hitting our 0.318 resistance level of 80%. Above that there is limited upside for $USOIL. The downward slopping wedge shown below indicates a breakout might be imminent which might take TVC:USOIL to 80 $ which is our highest target in this range bound market.

In contrast the bull run in other important commodities like AMEX:GLD and COPPER might have some legs as they are showing strength by breaking above the previous ATH. It is always a good idea to buy strength and ATH.

Verdict: TVC:USOIL remains range bound with 55 $ on lower bound and 80 on the upper bound. Commodity bulls can look at AMEX:GLD and OANDA:XCUUSD for better returns.

$DXY: New lows begets new lows. $USM2: Why is it increasing? Here we are again with one more TVC:DXY chart analysis. I think the US Dollar does not fail to surprise us week after week. Making new lows every week is giving a boost to the Equity markets. The SP:SPX and NASDAQ:QQQ are at ATH. In my articles on April 18 and June 16

Perfect trade setup: AMEX:GLD to 325; DXY to 95 for AMEX:GLD by RabishankarBiswal

TVC:DXY weakness and EM markets: NSE:NIFTY more upside? for NSE:NIFTY by RabishankarBiswal — TradingView

We have time and again said that in the near term TVC:DXY chart looks weak and could touch 95 by end of July. I think it might be achieved earlier. We have looked at the consequences of 95 handle on TVC:DXY on various asset classes like AMEX:GLD , NSE:NIFTY and EMs. These asset classes are reaching ATH every single week. But we have seldom investigated the reason behind the weakness in $DXY. Looking through my macro charts I found an amazing chart which might explain most of this weakness.

The ECONOMICS:USM2 is almost at 22 T $ surpassing its previous high on March 2022. M2 is basically the total amount of money in circulation in the economy on top of the nominal M1. Higher M2 indicates higher amount of liquidity which is then channelized into riskier assets like CRYPTOCAP:BTC , AMEX:GLD , SP:SPX , NASDAQ:QQQ and EMS like $NIFTY. And with such high ECONOMICS:USM2 in circulation, it is very clear why TVC:DXY is making new lows each week. This can also explain why US Fed is hesitant to reduce rates. With M2 so high US Fed should not hurry.

Verdict: TVC:DXY to 95 by 31 July, Cycle low of 90 by year end. ECONOMICS:USM2 keeps increasing. US Fed stays put.

Gold Update: Possible Triangular Consolidation Before New RallyIt looks like corrective wave 4 is in the making within a large Triangle

3 waves A, B and C already emerged in 3-waves structure

which confirms triangle

Wave D should stay under the top of wave B

Wave E could either touch or break down the support line

It should keep above the valley of wave C

Target area changed higher as this consolidation tends to narrowing within a

contracting triangle.

Lowest target now $3,900

Optimistic target is at $4,300

Breakdown below $3,123 would invalidate the pattern

GOLD GOES 'PREPARING FOR SCORCHING-HOT JULY'. UPSHOT OF 1H 2025Gold market shines bright in first half of 2025, with nearly 25 percent year-to-date gain, which becomes one of the best start of the year in history ever following 1H 2016 (became a launching pad for Gold to more than Triple in price over next decade) and 1H 1973 (where Gold bugs sharply skyrocketed to infinity and beyond, printed more than 10x over next decade).

The gold spot market in July 2025 is shaped by both fundamental and technical factors supporting a cautiously bullish outlook.

Fundamental perspectives

Were you ready or not, Gold prices have surged significantly in 2025, driven by persistent global uncertainties including geopolitical conflicts (e.g., Middle East tensions), trade disputes, and inflation concerns.

Central banks, notably the Federal Reserve, are expected to cut interest rates later in 2025, reducing the opportunity cost of holding gold, a non-yielding asset. This monetary easing alongside continued inflation worries and safe-haven demand underpins strong gold fundamentals.

Major financial institutions like J.P. Morgan and UBS forecast gold prices averaging around $3,500–$3,675 per ounce in late 2025, with potential to reach $4,000/oz by mid-2026.

Central bank gold purchases and diversification away from US dollar assets also support demand.

Technical perspectives

Technically, gold has experienced volatile but mostly sideways trading in a roughly $300 range around $3,200–$3,500 since mid-2025, reflecting consolidation after a strong rally earlier in the year.

Key support lies near $3,000 and $3,200 levels (125-Day, or 6-Month SMA), with resistance around $3,500 to $3,800. Indicators such as moving averages and RSI suggest an upward trend with possible short-term corrections.

A breakout above $3,500 could trigger further gains toward $3,800, while a drop below $3,200 may lead to testing $3,000 support.

Overall, July is expected to see continued range-bound trading amid new external uncertainties, with bullish momentum intact.

In summary, gold’s fundamentals remain robust due to macroeconomic and geopolitical drivers, while technicals point to consolidation with potential for renewed upward moves in the July 2025 spot market.

--

Best #GODL wishes,

@PandorraResearch Team 😎

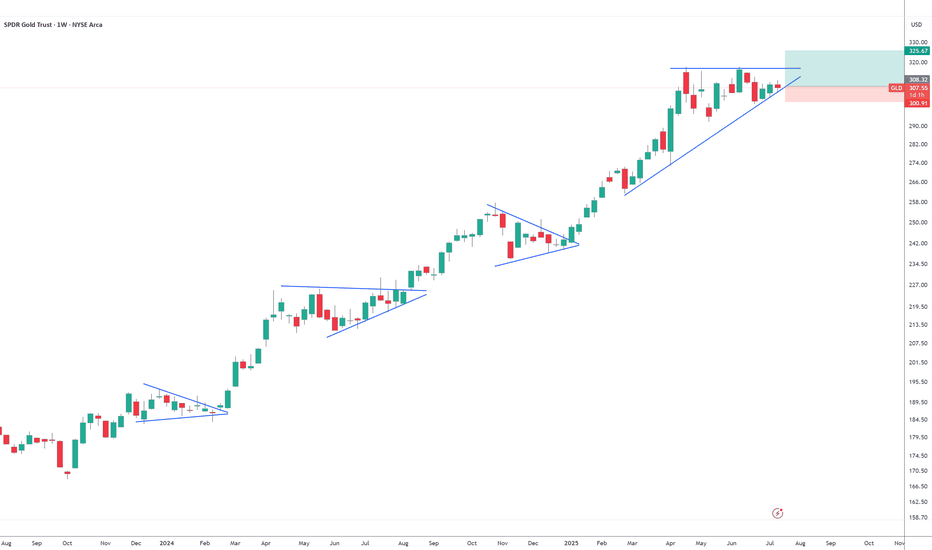

GLD Weekly Trade Setup — June 16, 2025🪙 GLD Weekly Trade Setup — June 16, 2025

🎯 Instrument: GLD (SPDR Gold Shares)

📉 Strategy: Short Bias via Puts

📅 Entry Timing: Market Open

📈 Confidence Level: 65%

🧠 Technical & Sentiment Snapshot

Current Price: $311.78

5-Min Chart: Below EMAs (10/50/200); RSI ≈ 34 → short-term oversold

Daily Chart: Above 10EMA ($309.94), RSI ≈ 56 → neutral-to-bullish

Bollinger Bands: Near lower band on M5 → volatility likely

Support/Resistance:

• Support: $311.68 / $307.28

• Resistance: $312.20 / $313.00

🗞️ Market Sentiment Overview

VIX: Elevated at 20.82 → high risk premium environment

Options Flow: Heavily put-weighted near $305–$310 strikes

Max Pain: $285 → bearish options bias into expiration

News: Geopolitical tensions increase flight-to-safety temporarily, but fading momentum fuels retrace setups

🔽 Recommended Trade: GLD PUT

Parameter Value

🎯 Strike $307.00

💵 Entry Price $0.84

🎯 Profit Target $1.25–$1.70

🛑 Stop Loss $0.50

📅 Expiry June 20, 2025

📏 Size 1 contract

⚖️ Confidence 65%

🧷 Trade Plan

📥 Entry: At market open

📈 PT Zone: $1.25 to $1.70 premium, based on drop to $306–307

🛑 Stop: If premium drops to $0.50 OR GLD breaks above $313

💰 Risk Mgmt: Keep exposure <2% of total account equity

⚠️ Key Considerations

Upside Risk: Sudden bullish shift or risk-off headlines can drive reversal

Time Decay: Premium erosion risk is higher if GLD consolidates

Volatility Drag: VIX dropping could suppress put premiums quickly

🧾 TRADE_DETAILS (JSON)

json

Copy

Edit

{

"instrument": "GLD",

"direction": "put",

"strike": 307.0,

"expiry": "2025-06-20",

"confidence": 0.65,

"profit_target": 1.25,

"stop_loss": 0.50,

"size": 1,

"entry_price": 0.84,

"entry_timing": "open",

"signal_publish_time": "2025-06-16 16:15:17 UTC-04:00"

}

💡 If GLD struggles to reclaim $312.20 at the open, the put setup becomes attractive. Breakout above $313? Exit quickly.

GOLD poised for breakout GLD & /gcAfter going on a huge run to 317 we have spent a significant time now basing out and consolidating we’ve come down into that 300 range and tested and built up quite a bit of support

With the Iranian intentions we could kickstart the next move in gold 317 is the breakout. I am looking to play this breakout on an intra day pull back with some calls one month out for a swing Trey looking at the 320 or 325 strike price

Silver & Gold Surge: SLV Inflows & GLD TargetsThe precious metals market is currently experiencing a significant surge, with both silver and gold capturing the attention of investors worldwide. This rally is underpinned by a confluence of factors, ranging from robust investment inflows into exchange-traded funds (ETFs) to evolving macroeconomic landscapes and persistent geopolitical uncertainties. The iShares Silver Trust (SLV) ETF has witnessed an unprecedented influx of capital, signaling a strong bullish sentiment for the white metal, while gold, represented by the GLD, is poised for a potential rebound, with analysts eyeing key price levels. Understanding the intricate dynamics driving these movements is crucial for anyone looking to navigate the contemporary financial markets.

SLV ETF Inflows Surge: Silver's Accelerated Rally

The iShares Silver Trust (SLV), the world's largest silver-backed exchange-traded fund, has recently recorded its most substantial inflows in years, marking a pivotal moment for the silver market. Last week alone, the SLV ETF saw weekly inflows surge by $451 million, a dramatic increase from previous weeks, pushing its year-to-date inflows to over $458 million and its total assets under management to more than $17 billion. This remarkable accumulation of capital into SLV signifies a profound shift in investor sentiment, reflecting a strong conviction that silver prices are set for continued appreciation. When investors pour money into an ETF like SLV, it directly translates into the fund acquiring more physical silver, thereby tightening supply and exerting upward pressure on prices. This massive inflow is not merely speculative; it indicates a broad-based belief among both institutional and retail investors in silver's potential.

Several key factors are fueling this accelerated rally in silver prices. One significant driver is the record-breaking surge in gold prices. Historically, silver has often been referred to as "poor man's gold" due to its similar safe-haven properties but lower price point. When gold experiences a substantial rally, silver often follows suit, as investors look for a more affordable alternative within the precious metals complex. Gold's recent ascent to nearly $3,500 per ounce has undoubtedly created a halo effect for silver, drawing in capital from those seeking exposure to precious metals without the higher entry cost of gold.

Another compelling reason for silver's outperformance is its perceived undervaluation relative to gold. The gold/silver ratio, which measures how many ounces of silver are needed to buy one ounce of gold, had peaked at around 106 when gold was surging. However, this ratio has since dropped significantly to around 92, indicating that silver has begun to catch up, suggesting it was previously undervalued. This rebalancing of the ratio has encouraged investors to shift their focus towards silver, anticipating further narrowing of the gap.

Beyond its role as a monetary metal and safe haven, industrial demand plays a uniquely critical role in silver's price dynamics, distinguishing it from gold. Silver is an indispensable component in numerous high-tech and green energy applications due to its exceptional electrical conductivity, thermal properties, and reflectivity. The renewable energy sector, particularly photovoltaic (PV) solar panels, consumes substantial amounts of silver, with each panel containing approximately 20 grams of the metal. The global push towards decarbonization and the increasing adoption of solar energy are creating an insatiable demand for silver. Additionally, its use in electric vehicles (EVs), electronics manufacturing, 5G technology, and medical devices further bolsters its industrial consumption. Reports indicate that global silver demand reached 1.2 billion ounces in 2024, driven by these industrial applications, with a significant supply deficit projected to continue. This robust and growing industrial demand provides a strong fundamental floor for silver prices, making it less susceptible to purely speculative swings.

Geopolitical tensions and economic uncertainties also contribute to silver's appeal as a safe-haven asset. In times of global instability, investors tend to flock to tangible assets like precious metals to preserve wealth. While gold typically garners more attention in such scenarios, silver also benefits from this flight to safety. The ongoing geopolitical developments and concerns about inflation continue to reinforce the attractiveness of both gold and silver as hedges against economic volatility and currency depreciation.

From a technical analysis perspective, silver's rally appears robust. The iShares Silver Trust (SLV) has broken above significant resistance levels, such as $31.75, which had previously acted as a ceiling. The ETF is trading well above its 50-day and 100-day Exponential Moving Averages (EMA), indicating a strong bullish trend. While the Relative Strength Index (RSI) has moved closer to overbought levels, the overall trend remains bullish, and the MACD indicator continues to signal upward momentum. Analysts suggest that if these technical indicators hold, silver could target the $40 mark in the near future. The breadth of participation from both institutional and retail investors, coupled with increasing trading volumes, suggests that this rally has stronger foundations than typical short-term spikes.

Furthermore, expectations of potential interest rate cuts by the US Federal Reserve are also providing tailwinds for precious metals. Lower interest rates reduce the opportunity cost of holding non-yielding assets like silver and gold, making them more attractive to investors. The anticipation of such policy shifts often prompts investors to front-run these decisions, leading to increased demand for precious metals.

GLD ETF Weekly Forecast: Gold's Rebound Potential

While silver commands attention with its recent surge, gold, represented by the GLD remains the cornerstone of the precious metals market. Gold recently hit record highs, touching nearly $3,500 per ounce, before experiencing a slight retreat due to profit-taking and some strengthening of the US Dollar. However, analysts are now forecasting a potential rebound, with a target of $3430 on the cards for the current week, indicating that the bullish sentiment for gold remains largely intact.

GLD is influenced by a diverse array of factors, making its price movements complex yet predictable to those who understand its drivers. One of the primary factors is gold's status as a safe-haven asset. During periods of economic uncertainty, political instability, or market volatility, investors traditionally turn to gold to preserve capital. Recent geopolitical tensions, such as the ongoing conflict in Eastern Europe, have consistently driven inflows into gold, as it acts as a hedge against global crises.

The strength or weakness of the US Dollar plays a crucial role in gold's price. Gold is primarily priced in US Dollars, meaning that a weaker dollar makes gold comparatively cheaper for buyers holding other currencies, thereby increasing demand and pushing prices up. Conversely, a stronger dollar can make gold more expensive, potentially dampening demand. While there has been some recent dollar strength, the overall sentiment regarding the dollar's long-term trajectory and its inverse relationship with gold remains a key determinant.

Interest rates and monetary policy, particularly from the US Federal Reserve, significantly impact gold prices. As a non-yielding asset, gold becomes less attractive when interest rates are high, as investors can earn better returns from interest-bearing assets. Conversely, lower interest rates reduce the opportunity cost of holding gold, making it more appealing. The anticipation of future rate cuts by central banks often provides a strong impetus for gold rallies.

Inflation and deflationary pressures also influence gold's appeal. Gold is widely regarded as a hedge against inflation. When the purchasing power of fiat currencies erodes due to rising inflation, investors often turn to gold to protect their wealth. Conversely, in deflationary environments, gold's appeal as a store of value can also increase. Recent inflation data, such as the Consumer Price Index (CPI) and Producer Price Index (PPI), are closely watched for their potential impact on gold's trajectory.

Central bank reserves and their purchasing trends are another significant, albeit often overlooked, factor. Central banks globally hold gold as a reserve asset to diversify their portfolios and safeguard against financial turmoil. Increased gold purchases by central banks signal a broader institutional confidence in gold and can significantly impact its demand and price.

Supply and demand dynamics in the physical gold market, including mining production, recycling, and demand from jewelry and industrial sectors, also play a role. While new supply from mining is relatively small compared to the total existing stock, changes in production levels can still influence prices. Investment demand through ETFs and other financial products further contributes to the overall demand picture.

From a technical standpoint, gold's recent retreat from its $3,500 peak has led to some profit-taking. However, key support levels are being tested, and analysts are looking for a rebound. The immediate resistance levels are around $3340-$3345, with a more significant hurdle at $3400. A decisive break above these levels, particularly $3400, could pave the way for a retest of the $3430 mark and potentially higher, towards $3500 and even $3600. The current bias for gold remains bullish, with buying opportunities identified at key pivot levels. The market is closely watching economic reports, such as the upcoming CPI data, as well as geopolitical developments, which could act as catalysts for gold's next major move.

The Interplay Between Gold and Silver

The intertwined fortunes of gold and silver are a recurring theme in the precious metals market. While both are considered safe-haven assets, their individual characteristics lead to nuanced differences in their price drivers. Gold is predominantly viewed as a monetary asset and a store of value, making it highly sensitive to macroeconomic indicators, interest rates, and geopolitical stability. Silver, while sharing these attributes, also benefits significantly from its extensive industrial applications. This dual nature often makes silver more volatile than gold, as it reacts to both investment demand and industrial cycles.

The recent outperformance of silver, as evidenced by the massive SLV ETF inflows, suggests a market correction where silver is catching up to gold's earlier gains. The narrowing gold-silver ratio indicates that investors believe silver was undervalued and is now reasserting its true worth. This dynamic creates a powerful feedback loop: as gold rallies, it draws attention to the precious metals sector, prompting investors to look for relative value, which often leads them to silver. As silver then accelerates, it further validates the strength of the broader precious metals market.

The current environment, characterized by persistent inflation concerns, ongoing geopolitical tensions, and the global push towards green energy technologies, provides a fertile ground for both gold and silver. Gold offers a traditional hedge against uncertainty, while silver provides exposure to both safe-haven demand and the booming industrial sector. The significant institutional inflows into SLV underscore a growing recognition of silver's unique position at the intersection of finance and industry.

In conclusion, the precious metals market is currently in a robust uptrend, driven by a powerful combination of investment demand, safe-haven appeal, and fundamental industrial growth. The unprecedented inflows into the SLV ETF signal a strong bullish outlook for silver, fueled by its undervaluation relative to gold and its critical role in emerging green technologies. Concurrently, gold, despite recent fluctuations, maintains a strong bullish bias, with analysts forecasting a rebound to key price levels, supported by its enduring safe-haven status and macroeconomic tailwinds. For investors, understanding these intertwined dynamics and monitoring key economic and geopolitical developments will be paramount in capitalizing on the ongoing rally in both gold and silver. The message is clear: the precious metals are shining bright, and their current momentum suggests further upside potential.

$USOIL & $XLE: Sustainable bull run or short-term bounce?Recently the commodities and the commodity stocks are having a bull run. Oil being one of the largest categories within the Bloomberg Commodity Index Futures is late to the party after the AMEX:GLD rally. In my recent posts I made the case that the TVC:USOIL will remain range bound, and we will see 55 $ in $USOIL. But since then, TVC:USOIL has gone through a small rally with price currently @ 65 $ which has taken it closer to the 0.5 Fib retracement level. AMEX:XLE , which represents the S&P500 energy sector stocks, is also attempting to post a rally.

In the short-term markets have diverged from our last predictions. Let’s be honest in the short term such rallies might be accompanied by short covering and the weakness in TVC:DXY is also helping the Energy rally. But now the question comes where do we go from here?

TVC:USOIL and AMEX:XLE can have a bull rally due to short covering and momentum pushing it across the 0.5 Fib level. If TVC:USOIL breaks above 0.5 then the next stop 0.618 will take us 80 $ indicating a 25% upside form here. And a similar upside in the AMEX:XLE will take us 131 $, which is also 25% up from its current value and the upper range of the upward slopping channel indicative from the chart.

Verdict: Short term probable bounce in TVC:USOIL and $XLE. Long term bearish on TVC:USOIL with target 55 - 60 $.

GLD Swing Setup – Long Call Into Gold’s Weekly Strength🪙 GLD Swing Setup – Long Call Into Gold’s Weekly Strength

📆 Date: June 6, 2025

📈 Outlook: Moderately Bullish (14-day swing)

📊 Strategy: Long call aiming for continuation above key resistance

🔍 Model Consensus

Model Bias Strike Entry Target(s) Stop Confidence

Grok Mod. Bullish 311C 3.90 5.07 1.95 70%

Claude Mod. Bullish 312C 3.40 5.10 / 6.80 2.04 70%

Llama Mod. Bullish 320C 1.19 1.75 / 2.38 0.60 75%

Gemini Mod. Bullish 320C 1.20 1.75 / 2.35 0.60 75%

DeepSeek Mod. Bearish 308P 3.60 1.80 (fade) 5.40 60%

✅ Majority Bias: Bullish

💡 Preferred Strike: $320 Call (3:1 model preference)

📈 Chart Levels:

Support: $301.50 – $303.00

Resistance: $310.25 – $311.67 → breakout zone

Max Pain: $308 (gravitational pull zone short-term)

⚙️ Technical Summary

Daily/Weekly Charts: Price above mid BB, above EMAs, MACD trending positive

RSI: Neutral-to-bullish (daily ~56, weekly ~66)

VIX: Low = stable sentiment & slower decay

News: Bullish gold flow / macro sentiment steady

OI Skew: Heavy 297–299 puts, but aggressive calls up to $320 → breakout pressure

✅ Trade Setup

Metric Value

Instrument GLD

Direction CALL (Long)

Strike $320

Expiry 2025-06-18

Entry Price $1.19 (ask)

Profit Targets $1.75 / $2.35

Stop-Loss $0.60 (50% risk)

Position Size 1 contract

Confidence 75%

Entry Timing Market Open

📈 Trade Management Plan

🎯 Targets

Scale out 50% at $1.75

Final exit at $2.35

🛑 Stop Triggers

Break below $307.50 support

Premium drops to $0.60

📆 Hold Time

Max 10 trading days

Exit early if price stagnates near $308

⚠️ Key Risks

Triple-top near $310.25 could stall breakout

Low VIX reduces premiums faster in chop

Gold news or dollar spikes can flip the narrative fast

Max Pain at $308 could cap rallies short-term

GLD Swing Trade Setup – 6/18 $320 Call for 5–10 Day Breakout Mov🟡 GLD Swing Trade Setup – 6/18 $320 Call for 5–10 Day Breakout Move

📅 Trade Date: June 4, 2025 | 📈 Timeframe: 5–10 Day Swing

🎯 Playing a bullish continuation with defined risk & strong confidence

🧠 Multi-Model Consensus

Model Bias Strategy Strike Entry PT SL Confidence

Composite Mod. Bullish Long Call 320 1.68 2.52 0.84 75%

🔎 Technical & Sentiment Overview

Weekly Chart: Price > EMAs, clean bullish MACD crossover

15-min Chart: Consolidating near $311–$313 support, breakout forming

Sentiment: Bullish news tailwinds (gold demand, USD weakening)

Max Pain: $308 = short-term pullback risk

Implied Volatility: Stable with limited crush risk

Options Flow: Moderate OI build in $313–$325 calls, upward bias

🎯 Trade Setup – Long GLD Call

Instrument: GLD

Direction: CALL (LONG)

Strike: $320.00

Expiry: 2025-06-18

Entry Price: $1.68

Profit Target: $2.52 (50% gain)

Stop Loss: $0.84 (50% loss)

Size: 1 contract

Entry Timing: Market open

Confidence: 75%

⚠️ Risk Management & Considerations

🛑 SL Discipline: Exit if premium drops to $0.84

🕒 Time Stop: Exit within 7–10 days if trade stagnates

🔁 News Risk: Watch for economic releases and dollar strength reversals

⚖️ Support Check: Must hold $310.50 zone on M15 chart

✅ Trade Thesis Summary

With GLD holding bullish structure on higher timeframes, models show strong agreement on upside continuation. We're targeting the $320 breakout with a controlled-risk weekly option.

Gold Update: 2 optionsIndeed, the top metal surged well beyond $3,000, as I mentioned in my earlier post (see related post for details).

The price reached a new all-time high of $3,510 before pulling back, as expected.

So far, the retracement has been rejected at the trendline support around $3,123 (futures).

From here, there are two possible scenarios:

1) Blue Labels

The price may have already completed wave 4. If so, we could now see a large wave 5 move to the upside.

This wave could reach the blue target box, which represents 61.8% to 100% of the distance from wave 1 to wave 3, added to the bottom of wave 4.

This target zone lies between $3,700 and $4,100.

Keep in mind that gold is a commodity, and commodities often have extended fifth waves — so the higher end of the blue box is still possible.

2) White Labels

Typically, fourth waves retrace down to the valleys of previous lower-degree fourth waves.

In this case, the market could form another leg down to complete a larger, more complex correction, potentially hitting $2,975 before wave 5 begins.

If that happens, the target for wave 5 may be lower, but with a possible extended fifth wave, it could still reach the blue box area.

$QQQ Over $523.5 for a retest of Highs. Lower High Setup?As you can see on the notes in the chart, several 5 counts lead to sell offs in the last Quarter. Will this trend continue or will we run it to a 9 Count again? 3 Days left. Watch these levels as I have a possible selloff to May open Price. This would effectively follow my 10D chart forecast of new lows in the next 30-40 trading days, if not 20 for significant damage either way. I will continue to update as we go.

Gold. Long-term Elliott Wave Structure.I'm showing this beautiful weekly chart since 1971 when president Richard Nixon ended the international convertibility of the US dollar to gold. The path followed by gold since that time, is a text-book Elliott wave structure where long term wave 3 has ended. Wave 4 resides at 900 dollars per ounce.

Gold Eiffel Tower The GOLD GTFO is still in play.

What saved Gold was the stopping for the market crash when Trumnpchenko manipulated the markets. Had the crash continued Gold would have crashed with it. As it is the last safe haven for money to pile into and people just give up and sell everything in sight.

If you were an early buyer of gold and sold above $3,000 then you have a nice 50% gain.

Take your money and RUN! All the way to the bank! Don't be a dick for a tick. If you are then you will ride it all the way back down.

When will it top no one can know. But what pros do is take their money and RUN! So be a pro! ;)

Click like follow subscribe!

$GLD Market Update – Bearish Engulfing Follow-Up

Yesterday, AMEX:GLD closed with a Bearish Engulfing pattern. However, rather than offering a sell-on-strength opportunity, it opened sharply lower today—a move generally favorable for risk assets.

🔍 Key Technical Levels:

First Horizontal Support: ~$294.40 (Stop)

Additional Support Zones:

🔹 $278.32

🔹 $272.58 (Stop)

Ultimate Support: ~$261.24 (Stop)

This level is unlikely to be tested unless we see a sharp reversal in macro trends like inflation, global trade dynamics, and productivity.

$GLD short term top in $260-148 target on the downsideAMEX:GLD looks a bit extended here. I could see the possibility of GLD falling back to the $260 support at a minimum and maximum all the way down to $148

The $209 support would be the 50% retracement of the recent run. I like that as a level for a bounce.

Let's see where we end up.

Gold chart showing interesting dataInteresting chart on GOLD futures.

Always wise to WAIT until end of day/week.

Daily Chart

Heavy selling has not meant much BUT the movement today is....... different.

Weekly Chart

RSI is not bad but it is weaker than Oct 24.

$ Flow is down a significant amount compared to last top.

GOLD v DXY in breakout move --- HVF hunt volatility funnelAlways good to measure against the DXY not just the USD value

Not perfect of course as it is mainly the Euro and Yen but still insightful.

Been watching the relationship for a while

currently breaking out to the upside

HVF theory means this should be a violent expansion

Target 1 coming up.