Gold - losing it's shineLook for a retest of last week's break of trend, around 1850 or so for a short. DXY will keep rallying for years in my opinion, but yeah there will be breathers and gold will catch a bid for a few days/weeks.

To me Gold is ready for a lot more downside especially with so many bulls still in this market. Someone will probably let me know about physical gold or silver and how the demand is through the roof - yeah, you're getting that info from Gold Dealers. Um, ok? Anyway, I don't care.

The chart is bearish.

GLD

GOLD - GC 2 HourA correction in the DX will provide Flow Info for Gold

should the Peak Inflation narrative capture the mindshare

short term.

Gold is on a knife's edge.

Boom boom directly ahead.

1780 to 1690 remains the lower range, with 1828 the

short term pivot, with 1888 the Key level for a retest of

the higher end of the short-term range.

_________________________________________________

The COT has remained aligned against the Specs for some

time, it has been largely ignored by most NextGen Goldbugs

who are malinforned and susceptible to the decade long traps

sprung by the usual suspects.

How many fines has JOM paid for rigging the COT over the

past two decades?

Too many.... A DX turn will excite the Bugs.

"it's time to Buy" .... yeah, naw, another chase trap is all it will

amount to within the Buy Zone.

Change of trend will be the new narrative - wash, rinse and repeat

for the Yellow Dawg.

Gold has Zero real utility for the coming years...

Against the Monetary Base Gold has been Left for Dead, the ST Louis

Fed maintains the Data.

____________________________________________________

Expect actions shortly, with increased VX.

DX DXY USD - Dollar 2 HourAfter reaching parity with the Swiss Franc Facta, the DXY peaked ST over 1.05.

Our TOSS level was 104.55, it has been met Short Term on a Throw Over.

It's nowhere near done moving higher, but for now, will range to digest a large

move into the Safety Trade

It did peak while sentiment was reaching extremes unseen. Again we do not

expect Extreme Fear readings to give up much more than a persistent Fear

Reading.

Only Direct Subsidies to Consumers and FMonetary/Fiscal Pivots will resolve the

embedded Senticators.

____________________________________________________________________

My long-standing FX Accident Thesis is well underway and will continue into

October of 2023.

A new Low at the close of the session sends the DX lower, a potential distribution

is setting up nicely Shorter Term.

We'll need to see if this ends up with a larger distribution. It well may be turning

slightly on this pattern.

Observing the reaction on Gold will be telling, it did hit my PO @ 1798.90 dipping

in ever so slightly. Gold is reaching a DOM demand level.

The COT remains in a SELL for Large Participants.

Is a surprise in store, there appears to be one waiting in the shadows.

The Gold Odyssey - deep retraceGold has been in a four week retracement, with the greatest momentum this past week, pushing down to near 1800.

The weekly and daily technicals suggest more downside to 1765, where the next support lies. Watch these levels for a possible consolidation / bounce.

Clearly, this retracement is deeper than expected, and would require a quick rebound to resume the long term pattern.

XAUUSD GOLD Supply And Demand AnalysisSee Picture Short for analysis..

Thoughts? I love gold for buying so this woud be a small risk.

The Gold Odyssey - retrace & relaunchQuick note that previous projections to 2100 still maintained and appear to be on track, despite a recent retracement in Gold, partially due to the sudden rise of the USD.

Although Gold prices fell below the daily 55EMA, today (5th May) saw a gap up in Asian hours after opening. There is a strong follow through (Gap and Run) and IF it closes at this level, then technically, Gold is likely to be back on the uptrend again.

Watch as the MACD is turning upwards to crossover. May is an important month to break out of consolidation.

Gold - What to expect from the FOMCIn our latest post on gold, we noted that the bearish trend lacked momentum, which would result in a sideways moving price action. We said that gold profit-taking would ensue to cover traders' losses elsewhere. We expect this trend to continue in the short term. We will pay close attention to the FED on Wednesday as it is expected to hike interest rates by 50 basis points. In our opinion, this will put further pressure on the U.S. economy, which will see more selling pressure. That is particularly bearish for gold in the short term. Therefore, we voice caution throughout this week as we expect gold to manifest high volatility. Indeed, we think there are high odds for gold to see a short-lived flush that will take it towards 1800 USD. Although in the medium and long term, we remain bullish.

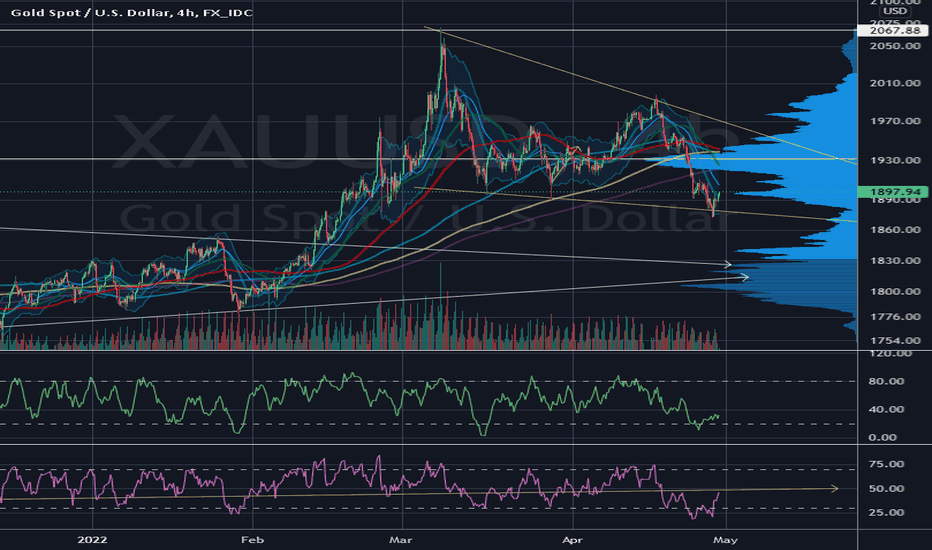

Illustration 1.01

The picture above illustrates XAUUSD on the daily time frame and volume below it.

Technical analysis - daily time frame

RSI, MACD, and Stochastic are bearish; DM+ and DM- suggest that same condition. Meanwhile, volume is declining, which suggests fewer people are willing to sell at the current price level. We expect volume to drop even more if the price continues lower. Overall, the daily time frame continues to be bearish. However, we think lower prices from the current level are attractive for accumulating more gold.

Technical analysis - weekly time frame

RSI is bearish. MACD is also bearish; however, it still hovers in the bullish area. Stochastic is bearish. DM+ and DM- are bullish, although if a bearish crossover occurs, it will cause us to change our medium-term to bearish. Overall, the weekly time frame is bearish.

Please feel free to express your ideas and thoughts in the comment section.

DISCLAIMER: This analysis is not intended to encourage any buying or selling of any particular securities. Furthermore, it should not serve as a basis for taking any trade action by an individual investor. Therefore, your own due diligence is highly advised before entering a trade.

Long GLD With rising inflation and politicals risk all around the world, Gold continues to perform as a safe haven for assets. From the TA perspective, Gold has formed a double bottom and it is breaking out late march level ($1957ish). It is aiming for a 0.61 Fib level around $2000, possibly all-time high,

Gold Trading RangeGold may have found a floor today as both MFI and RSI indicators have bounce out oversold territory. Looking at the 4H chart, the MFI and RSI indicators have been a consistent indicator this year of telling when gold bottoms.

I have started entering into gold again but I will be trading with caution as the range is small and I am looking to liquidate my positions once we reach around 1950 range. There is a wedge pattern forming and it could be bullish but it will need momentum and volume to break out past 1950.

Forewarn, Dollar is still going strong and bonds are starting to look attractive so gold may continue to get pummeled. Gold and silver will need the dollar to come down for the two metals to start rising again.

GDX In the last week, GDX erased the bullishness of the preceding month with one fell swoop of an Bearish Engulfing kind (weekly chart).

So expecting continued bearish candles would be expected as it follows through.

The daily chart supports that view so far, and it just broke down of the 55EMA, after a gap down. The good thing is that it did not really gap and run... at least not yet.

Technicals are overall bearish, at least for a bit. Expecting bounces off 36, maybe even 35.

GOLD- Barrick GOLD just printed a GOLDEN CROSSA golden cross is the opposite of a death cross which is a bullish sign. The 50 dma is crossing UP through the 200dma. It's getting close short term overbought, any pullbacks are adding opportunities. GOLD the metal is not going up solely because of Ukraine but is likely adding a short term premium on it and would expect a pullback on any resolution, though I don't see this ending, or ending well...... We can only pray someone near Putin takes him out for the sake of humanity and ends this unprovoked genocide. I am beyond disturbed by what's transpiring and this is already out of hand. This can turn into WW3 easily and soon, sadly I fear. I digress, GOLD the metal will have many pullbacks on it's way to $3,000, $5,000 and $10,000. That's how bad things will get. There will be a dollar crisis, a Great Depression 2 and maybe ww3 in my lifetime. Money will be the least of our problems. I suggest to keep on hand some silver and physical gold for use as money in the future. Gold miners are a highly leveraged way to play the gold run which will last for years or longer. Barrick in my opinion is the best well run gold and copper miner which pays a nice dividend. Stay away from Bitcoin and other shitcoins, they are all a SCAM!! GL Hoping for the best. I stand with Ukraine!!!!! F Putin!!!!

Gold - XAUUSD is about to push above 2 000 USDTechnical and fundamental factors continue to push gold higher. At the moment, it trades around 1 995 USD/oz., just slightly below 2 000 USD price tag. We maintain a bullish stance on gold and we expect it to break above 2 000 USD and continue higher. Our medium-term price target of 2100 USD stays in place. Our long-term price target of 2300 USD also remains active.

Technical analysis - daily time frame

RSI, MACD, and Stochastic are all bullish. DM+ and DM- show bullish conditions in the market with ADX rising. Overall, the daily time frame is very bullish for gold.

Technical analysis - weekly time frame

RSI, MACD, and Stochastic are all bullish. The same applies to DM+ and DM-. Meanwhile, ADX shows that the bullish trend of a higher degree continues to strengthen. Overall, the weekly time frame is very bullish for XAUUSD.

Please feel free to express your ideas and thoughts in the comment section.

DISCLAIMER: This analysis is not intended to encourage any buying or selling of any particular securities. Furthermore, it should not serve as a basis for taking any trade action by an individual investor. Therefore, your own due diligence is highly advised before entering a trade.

Silver in the Channel Published an earlier version of this idea with more poorly drawn corridors, but it seems for the most part to be validated for the time being. I expect silver to challenge recent highs and potentially cool back down toward mid 20s once that happens (before moving up further). However it is entirely possible that once silver reaches these targets that it simply continues to tear through them - it depends on other factors, but regardless, I am LONG.

I think metals, and silver especially, will be rising moving forward both in the short, medium, and long term. Inflation is only beginning, monetary conditions are changing worldwide and the financial system is on the brink of a paradigm shift. Out with "old" thinking and in with even older thinking!

Post Script: I'm a noob here, so apologies for any miss-steps.

GLD head and shouldery looking, short term target ~170volume declining on back half of the formation. neckline break could spell trouble (call it 175-177 zone), would imply downside to 168 or so, a little below the 200 day. short term formation so might be short lived.

longer term, I still ee a beautiful cup-n-handle here, which i think stays in tact. if this pattern does validate, it seems the bottom end there would be nice to step in for exposure to the 10 year cup-n-handle pattern.

The Gold Odyssey continues as old is still GoldOn 20 Feb 2022, Gold was reviewed as " The Gold Odyssey continues... an old but Gold story "

It was almost two months ago that was described the handle (of the giant sized Cup & Handle) would be completed this year. Since then, we had a preview with Gold spiking to 2078, only to pull back hard. This shook weak hands badly, having retraced to hard over a week. As I told my circle about gold last week, many asked if Gold is actually not going down. And yesterday's long upper tailed doji might have misled more to think so too.

We need to see the big picture for this.

The weekly chart is suggesting that this week is critical to see a bullish run start. This just so happens to be in the 4 April and 16 April window marked out since February.

Furthermore, the daily technicals look about ripe to launch off a bull run, and it should be above 1980 by the end of the week for a clear bullish break out.

Having done that, 2100 would be the target by mid-2022.

PS. I do not like the reasons for this bull run as, in alignment to the markets declining, something is about to happen that we do not see yet... not in the papers at least.

Stay safe...