GLD

COPX - bully bounce timeCOPX took another hit today and lost +4% which is a little surprising considering Max Pain this Friday is $37... maximum-pain.com

Expecting a turn soon. Probably starting next week after some more pain and fear...

Indicators appear to be looking for a turn on the daily, and Volume is drying up on this leg down.

Potential selling climax on July 19th.

Bollinger' Band width can go lower but not much IMO before a turn.

New high isn't likely given the drop out of the longer term regression channel.

Tradable bounce - lasting ~30 days...maybe less on deck for COPX.

Maybe another 3% to 4% down. Falling knifes and all... buy the fear.

Bounce Target = $40.xx See Chart

Not financial advice.

Wheaton Precious Metals' Q2 Revenues Reached New Record-HighWheaton's attributable gold equivalent production climbed to 194,140 toz and the sales amounted to 176,700 toz.

Revenues grew to new record-high at $330.4 million.

Two new acquisitions were completed in Q2.

The dividend was raised for the fourth quarter in a row; the dividend yield equals 1.35% now.

STRIKEPOINT GOLD INC. Swing Trade PositionSUMMARY

Technical Analysis: I am long the stock because I see price action has completed a corrective ABC pattern on the daily Chart. From here price action could develop a bullish counter trend.

Fundamentals: The company has commenced drilling at their High-grade Willoughby property. The Company is cashed up and IF! they hit bigly then share price pushes higher.

I do not share in your gains nor in your losses. Do your own due diligence. Trade safe, be well.

Visit their webpage and look through their corporate presentation - www.strikepointgold.com

Trade Idea: GLD March 18th 140/September 17th 165 LCD*... long call diagonal.

Comments: Here, I'm preliminarily pricing out a bullish assumption GLD setup, buying the back month 90 delta and selling the front month at-the-money call. I'd prefer to deploy this at that obvious support level at 160, which has resulted in some buying interest previously. If that occurs, I'd have to tweak the strikes slightly, selling an at-the-money 160, for example, and then buying whatever the 90 delta strike in the back month.

The Metrics:

Buying Power Effect: 22.79 ($2279)

Max Profit: The Width of the Diagonal Spread (25.00) Minus the Debit Paid (22.79) = 2.21 ($221)

ROC %-Age as a Function of Buying Power Effect: 2.21/22.79 = 9.7%

Break Even: The Long Call Strike (140) + the Debit Paid (22.79) = 162.79 versus a spot price of 164.64

Trade Management:

Take profit on the setup's approach of max (which would be 25.00).

Otherwise, roll out the short call to a strike at or above your break even of 164.64 to reduce setup cost basis.

Variations:

Preliminarily, I'm pricing out the setup with a fairly long-dated back month. To get in with less buying power effect, look to buy a shorter duration back month 90 delta, with the trade-off being that you'll have less time to reduce cost basis via the short call in the event that gold prices keep on going down. To look for more profit potential, sell a less monied call (e.g., the 30 delta) to give the trade more room to the upside.

GOLD - Seasonality bullish in august and septemberHappy Sunday traders!

Trading strategy using seasonality, app.seasonax.com Seasonality for Gold is bullish in august and september for the past 25 years.

I am long GLD Sept $175 call options at 1.99, down ight now to 1.55. The Sept Put/call open interest ratio is .72.

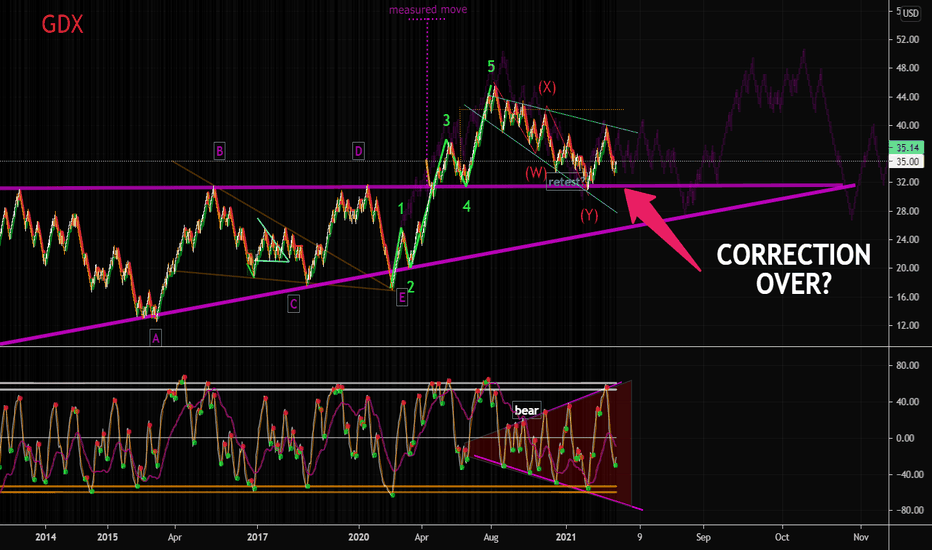

GDX HAS COILED ENERGYThe metals have been stuck in a range for quite a while. Gold Miners ETF (GDX) appears to have made 5 waves up since the crash in 2020 and formed an ongoing complex correction. What do you think? Has GDX bottomed? Take note of the lower stoch/rsi wavetrend indicator and the broadening nature that has occurred since this correction. This looks like a hidden bearish pattern that will eventually break. When it breaks, GDX is likely to move up incredibly strong. Perhaps one more push lower? I don't know... But I'll be ready if it drops again.

For me, I have some medium-longer term targets over 55-60.

Gold COT - Growing signs of bullishnessCommitment of Traders (COT) shows growing signs of commercial being less short than the last 3 months which marks a possible bullish sentiment potentially coming into this market.

Discussion

There are three core issues when looking at gold, in my opinion:

1) Basel III, has implications for trading paper gold - the majority of traded gold to date and its effects are not well understood;

2) Mark-to-market of commodities against the US dollar including gold;

3) Input costs of mining new gold (Oil) noting that a majority of the gold traded is simply 'paper' gold or derivatives - even by gold miners themselves.

Notice that I have not made any commentary on inflation or deflation. There is no evidence from the perspective of the US market that either will be significant in the near to medium term, irrespective what the media and others promote.

Suggestion

Keep an eye of this, along with gold miners and ETFs.

Gold Back to All Time Highs1. Gold price is entering a narrow wedge with an 11 month resistance and a 2 year support. This support has repeatedly been tested over the last 2 years, and is more powerful than the medium term resistance level.

2. Price is currently at the top of the wedge. A break of resistance sets up a run to all time highs, with pull backs around 1915.00 and 1965.00. I expect price to move higher swiftly after a break of 1820.00.

$BABA $NOW $CVNA $GLD I OptionsSwing WatchlistBABA 1D I Testing the $205 area for the third time, could be seeing a triple bottom before the breakout from this falling wedge.

NOW 1D I We could be seeing a possible inverse H&S, Watching above the $567 level for continuation and possible retest of $600 before its ER.

GLD 1D I After breaking out from a bull flag back, we are seeing GLD retrace back and possibly making a double bottom near $165.

CVNA 1D I Showed strength last week and it is testing ATH levels. Watching a break above $325 with volume to see it continue run up into earnings.

Gold BreakoutLike the seasons, the markets appears to be attempting a shift. I made a recent post about long term treasury yields flipping bullish this month so far and now Gold appears to be doing the exact same thing as it has seen a beautiful breakout of a descending broadening wedge.

This is one of the more bullish patterns that exists, which means if this monthly candle shown on the chart confirms, big things could be in store for the precious metal.

Keep a close eye on this and the stock market as a whole as the year goes on. If big money starts aggressively piling their cash into hedges such as gold and bonds, that could mean bad things for many of the overvalued stocks out there.

This would especially mean bearish things for speculative tech stocks and cryptocurrencies.