Has Geopolitics Clouded Brazil's Market Horizon?The Bovespa Index, Brazil's benchmark stock market index, faces significant headwinds from an unexpected source: escalating geopolitical tensions with the United States. Recent decisions by the US administration to impose a steep 50% tariff on most Brazilian imports, citing the ongoing prosecution of former President Jair Bolsonaro, have introduced considerable uncertainty. This move, framed by the US as a response to perceived "human rights abuses" and an undermining of the rule of law in Brazil's judiciary, marks a departure from conventional trade disputes, intertwining economic policy with internal political affairs. Brazilian President Luiz Inácio Lula da Silva has firmly rejected this interference, asserting Brazil's sovereignty and its willingness to negotiate trade, but not judicial independence.

The economic repercussions of these tariffs are multifaceted. While key sectors like civil aircraft, energy, orange juice, and refined copper have secured exemptions, critical exports such as beef and coffee face the full 50% duty. Brazilian meatpackers anticipate losses exceeding $1 billion, and coffee exporters foresee significant impacts. Goldman Sachs estimates an effective tariff rate of around 30.8% on total Brazilian shipments to the US. Beyond direct trade, the dispute dampens investor confidence, particularly given the US's existing trade surplus with Brazil. The threat of Brazilian retaliation looms, potentially exacerbating economic instability and further impacting the Bovespa.

The dispute extends into the technological and high-tech realms, adding another layer of complexity. US sanctions against Brazilian Supreme Court Justice Alexandre de Moraes, who oversees Bolsonaro's trial, directly link to his judicial orders against social media companies like X and Rumble for alleged disinformation. This raises concerns about digital policy and free speech, with some analysts arguing that regulating major US tech companies constitutes a trade issue given their economic significance. Furthermore, while the aerospace industry (Embraer) received an exemption, the broader impact on high-tech sectors and intellectual property concerns, previously highlighted by the USTR regarding Brazilian patent protection, contribute to a cautious investment environment. These intertwined geopolitical, economic, and technological factors collectively contribute to a volatile outlook for the Bovespa Index.

Globaleconomy

Why Your Orange Juice Costs More?The price of orange juice is surging, impacting consumers and the broader economy. This increase stems from a complex interplay of geopolitical tensions, macroeconomic pressures, and severe environmental challenges. Understanding these multifaceted drivers reveals a volatile global commodity market. Investors and consumers must recognize the interconnected factors that now influence everyday staples, such as orange juice.

Geopolitical shifts significantly contribute to the rising prices of orange juice. The United States recently announced a 50% tariff on all Brazilian imports, effective August 1, 2025. This politically charged move targets Brazil's stance on former President Jair Bolsonaro's prosecution and its growing alignment with BRICS nations. Brazil dominates the global orange juice supply, providing over 80% of the world's trade share and 81% of U.S. orange juice imports between October 2023 and January 2024. The new tariff directly increases import costs, squeezing margins for U.S. importers and creating potential supply shortages.

Beyond tariffs, a convergence of macroeconomic forces and adverse weather conditions amplify price pressures. Higher import costs fuel inflation, potentially compelling central banks to maintain tighter monetary policies. This broader inflationary environment impacts consumer purchasing power. Simultaneously, orange production faces severe threats. Citrus greening disease has devastated groves in both Florida and Brazil. Extreme weather events, including hurricanes and droughts, further reduce global orange yields. These environmental setbacks, coupled with geopolitical tariffs, create a robust bullish outlook for orange juice futures, suggesting continued price appreciation in the near term.

Is Mexico's Peso at the Crossroads?The recent imposition of U.S. sanctions on three Mexican financial institutions - CIBanco, Intercam Banco, and Vector Casa de Bolsa - has ignited a crucial debate over the Mexican peso's stability and the intricate dynamics of U.S.-Mexico relations. Washington accuses these entities of laundering millions for drug cartels and facilitating fentanyl precursor payments, marking the first actions under new anti-fentanyl legislation. While these institutions collectively hold a relatively small portion of Mexico's total banking assets (less than 3%), the move carries significant symbolic weight and prompts a re-evaluation of the peso's outlook. The Mexican government, under President Claudia Sheinbaum, swiftly rejected the allegations, demanding concrete evidence and initiating its investigations, including the temporary regulatory intervention of CIBanco and Intercam to safeguard depositors.

Economically, the peso faces a nuanced landscape. Before the sanctions, the Mexican peso (MXN) demonstrated remarkable resilience, appreciating significantly against the dollar, bolstered by Mexico's comparatively higher interest rates and robust trade flows with the U.S. However, the recent divergence in monetary policy, with **Banxico** easing rates while the U.S. Federal Reserve maintains a hawkish stance, now presents a potential headwind for the peso. While analysts generally suggest limited systemic risk to Mexico's broader financial system from these targeted sanctions, the action introduces an element of uncertainty. It raises concerns about potential capital flight, increased compliance costs for other Mexican financial institutions, and a possible erosion of investor confidence, factors that could exert downward pressure on the peso.

Geopolitically, these sanctions underscore the escalating U.S. campaign against fentanyl trafficking, now intricately linked with broader trade and security tensions. President Donald Trump's past threats of punitive tariffs on Mexican imports - aimed at curbing drug flows - highlight the volatile nature of this bilateral relationship. The sanctions serve as a potent political message from Washington, signaling its resolve to combat the fentanyl crisis on all fronts, including financial pipelines. This diplomatic friction, coupled with the ongoing complexities of migration and security cooperation, creates a challenging backdrop for the USD/MXN exchange rate. While the U.S. and Mexico maintain a strong intergovernmental relationship, these pressures test the limits of their collaboration and could influence the peso's trajectory in the medium term.

Uncertainty: The Dollar's Unexpected Ally?The recent strengthening of the US dollar (USD) against the Israeli shekel (ILS) serves as a potent illustration of the dollar's enduring role as a safe-haven currency amid heightened geopolitical uncertainty. This trend is particularly pronounced in the context of escalating tensions involving Iran, Israel, and the United States. Investors consistently gravitate towards the perceived stability of the dollar during periods of global unrest, leading to its appreciation against more volatile and susceptible currencies, such as the shekel.

A significant driver of this dollar demand stems from the precarious security landscape in the Middle East. Reports detailing Israel's potential operation into Iran, coupled with the United States' proactive measures like authorizing voluntary departures of military dependents and preparing for a partial evacuation of its Baghdad embassy, signal Washington's anticipation of potential Iranian retaliation. Assertive declarations from Iranian officials, explicitly threatening US military bases and claiming intelligence on Israeli nuclear facilities, further amplify regional risks, compelling investors to seek the dollar's perceived safety.

Compounding this geopolitical volatility is the stalled US-Iran nuclear diplomacy. Hurdles persist not only over core issues, such as uranium enrichment and sanctions relief, but also over the basic scheduling of talks, with both sides expressing diminishing confidence in a resolution. The recent International Atomic Energy Agency (IAEA) Board of Governors meeting, where the US and European allies introduced a non-compliance resolution against Iran, adds another layer of diplomatic tension, threatening increased sanctions or nuclear expansion and reinforcing the perception of a volatile environment that inherently strengthens the dollar.

These escalating tensions have tangible economic repercussions, further fueling investor flight to safety. The immediate aftermath has seen a significant increase in oil prices due to anticipated supply disruptions and a notable depreciation of the Iranian rial against the dollar. Warnings from maritime authorities regarding increased military activity in critical waterways also reflect broad market apprehension. During such periods of instability, capital naturally flows into assets perceived as low-risk, making the US dollar, backed by the world's largest economy and its status as a global reserve currency, the primary beneficiary. This flight-to-safety dynamic during major regional conflicts involving key global players consistently bolsters the dollar's value.

US & Global Market Breakdown | Profits, Losses & Bearish TradesIn this video, I break down the current state of the US and global economy, and why I believe we’re heading into a bearish phase.

📉 Fundamentals:

I cover the key macroeconomic factors influencing the markets — including Trump’s proposed new tariffs, slowing GDP growth, and ongoing supply chain constraints. These all point toward increasing pressure on the global economy.

📊 Technical Analysis:

I go over the major indexes and highlight their recent behavior. We’ve seen reactions from resistance levels, contraction patterns forming, and a significant volume dry-up — followed by today’s spike in volume, which occurred right at resistance. These are potential signs that the market may be shifting toward a bearish trend.

That said, we could still just be witnessing a deeper pullback within a longer-term uptrend. Markets are unpredictable, and no one knows for sure — which is why it’s important to always do your due diligence.

💰 I also review the profits and losses I’ve taken on recent bullish trades, and why I’ve now positioned myself in select short opportunities based on what I’m seeing.

If I’m sharing this, it’s because I’m personally investing my capital based on my conviction — so always use your own judgment and risk management when making decisions.

If you found value in the breakdown, leave a like, comment, and subscribe for more timely updates.

EGX30 in a Higher RegionEGX30 stock is currently in a higher region than before. In the case of taking an upward trend, it is expected to breach the resistance line at 32,026.185 and then reach the resistance line at 32,055.750. And reach the third resistance line at 32,095.170 points. In case of falling, it's expected to break the 1st support line 31,976.910 points, then the 2nd support line 31,947.346, then the 3rd support line 31,907.926. It's an outstanding performance among the current situation, which is fulfilled with news like Egypt's blue-chip index EGX30 was up for a fourth consecutive session, rising 0.2% with E-Finance for Digital gaining 3.2% and Palm Hills development reaching 3.4% besides signing an agreement to develop 1.87 million SQM plot of land in Abu Dhabi. On the other side, Gulf markets declined following the latest tariff threat on European Union goods and the statement on Truth Social on Friday recommended a 50% tariff from June 1 on all EU goods sent global markets roiling.

Will Middle East Tensions Ignite a Global Oil Crisis?The global oil market faces significant turbulence amidst reports of potential Israeli military action against Iran's nuclear facilities. This looming threat has triggered a notable surge in oil prices, reflecting deep market anxieties. The primary concern stems from the potential for severe disruption to Iran's oil output, a critical component of global supply. More critically, an escalation risks Iranian retaliation, including a possible blockade of the Strait of Hormuz, a vital maritime chokepoint through which a substantial portion of the world's oil transits. Such an event would precipitate an unprecedented supply shock, echoing historical price spikes seen during past Middle Eastern crises.

Iran currently produces around 3.2 million barrels per day and holds strategic importance beyond its direct volume. Its oil exports, primarily to China, serve as an economic lifeline, making any disruption profoundly impactful. A full-scale conflict would unleash a cascade of economic consequences: extreme oil price surges would fuel global inflation, potentially pushing economies into recession. While some spare capacity exists, a prolonged disruption or a Hormuz blockade would render it insufficient. Oil-importing nations, particularly vulnerable developing economies, would face severe economic strain, while major oil exporters, including Saudi Arabia, the US, and Russia, would see substantial financial gains.

Beyond economics, a conflict would fundamentally destabilize the geopolitical landscape of the Middle East, unraveling diplomatic efforts and exacerbating regional tensions. Geostrategically, the focus would intensify on safeguarding critical maritime routes, highlighting the inherent vulnerabilities of global energy supply chains. Macroeconomically, central banks would confront the difficult task of managing inflation without stifling growth, leading to a surge in safe-haven assets. The current climate underscores the profound fragility of global energy markets, where geopolitical developments in a volatile region can have immediate and far-reaching global repercussions.

Is Sugar the New 'Dr. Copper'? What Mean for the S&P 500?Sugar isn’t just the sweet powder we add to coffee. It’s a global commodity whose price swings reveal surprising truths about the world economy. With sugar prices now hovering near the 17.5–17.7 per pound support level for the sixth time since 2022, it’s time to ask: What story are these numbers telling us?

Sugar’s History: Peaks and Valleys

Sugar has always been a fickle player in commodity markets. Its price has soared above $20 per pound due to droughts or poor harvests, only to crash when supply outstrips demand. But today’s figures are particularly troubling.

Facts:

In recent months, sugar prices have not only approached multi-year lows but remain stagnant.

Low prices signal weak demand. And where there’s no demand, there’s no production growth.

But let’s zoom out: If sugar is losing its appeal, could this be a sign of slowing economic activity? If you think this is speculative, consider real-world data.

“Dr. Copper” vs. “Dr. Sugar”

We all know copper is the economy’s barometer, correlating with industrial production, construction, and tech innovation. But why isn’t sugar part of the conversation? 🍬

Why Sugar Matters:

The Confectionery Industry: Sugar is a cornerstone of baked goods, candies, and everyday staples. A drop in consumption could reflect shrinking consumer purchasing power.

Global Ubiquity: Unlike copper, sugar is used everywhere—from developing economies to wealthy nations. Its demand mirrors economic sentiment and living standards.

The U.S. Economic Outlook: Alarming Signals

Recent U.S. economic indicators paint a grim picture:

Rising Unemployment: The U.S. unemployment rate hit 4.1% in Feb 2025 (up from 3.9% a year prior), signaling job losses in key sectors.

Slowing GDP Growth: expanded by 2.8% in 2024, little-changed from the 2.9% growth recorded in the previous year- below analysts’ expectations.

Inflation “Cooling”: While inflation dipped to 2.4% in March, falling commodity prices (like sugar) may hint at deflationary pressures.

What “Dr. Sugar” Reveals

Connecting the dots—low sugar prices, slowing production, rising unemployment, and weak GDP growth—paints a clear picture: The U.S. (and global) economy is at a crossroads.

Key Takeaways:

Falling sugar prices may signal early-stage declines in consumer demand.

Deflationary trends could threaten the S&P 500 as companies face shrinking revenues and margins.

Given current data, the risk of a recession within months remains high.

How to Use Sugar as an Economic Indicator

To track economic health:

Monitor Exchange Prices: Sudden sugar price drops may foreshadow economic slowdowns.

Compare with Other Staples: Track correlations with wheat, corn, and other food commodities to gauge consumer behavior shifts.

Watch Producers: Food industry giants often react first to demand changes. Study their earnings reports.

Conclusion: A Sweet Indicator of Bitter Times?

Sugar is more than a raw material—it’s a mirror reflecting economic sentiment. Today, with prices near historic lows and U.S. economic data flashing warning signs, we must ask: Are we ready for a potential recession?

I believe “Dr. Sugar” deserves more attention. What’s your take? Join the discussion and share your thoughts! 💬

Chips Down: What Shadows Loom Over Nvidia's Path?While Nvidia remains a dominant force in the AI revolution, its stellar trajectory faces mounting geopolitical and supply chain pressures. Recent US export restrictions targeting its advanced H20 AI chip sales to China have resulted in a significant $5.5 billion charge and curtailed access to a crucial market. This action, stemming from national security concerns within the escalating US-China tech rivalry, highlights the direct financial and strategic risks confronting the semiconductor giant.

In response to this volatile environment, Nvidia is initiating a strategic diversification of its manufacturing footprint. The company is spearheading a massive investment initiative, potentially reaching $500 billion, to build AI infrastructure and chip production capabilities within the United States. This involves critical collaborations with partners like TSMC in Arizona, Foxconn in Texas, and other key players, aiming to enhance supply chain resilience and navigate the complexities of trade tensions and potential tariffs.

Despite these proactive steps, Nvidia's core operations remain heavily dependent on Taiwan Semiconductor Manufacturing Co. (TSMC) for producing its most advanced chips, primarily in Taiwan. This concentration exposes Nvidia to significant risk, particularly given the island's geopolitical sensitivity. A potential conflict disrupting TSMC's Taiwanese fabs could trigger a catastrophic global semiconductor shortage, halting Nvidia's production and causing severe economic repercussions worldwide, estimated in the trillions of dollars. Successfully navigating these intertwined market, supply chain, and geopolitical risks is the critical challenge defining Nvidia's path forward.

Does History Repeat Itself? How Far Can the Nasdaq Fall?Let's examine the current 2025 correction on a logarithmic chart: the price movements show significant similarities to the February 2020 decline. At that time, the global crisis—then driven by COVID-19 panic—fundamentally influenced market movements, while now, trade uncertainties are generated by President Trump's aggressive tariff announcements.

The chart reveals that the Nasdaq is declining steeply, and technical levels play a decisive role: yesterday, the price bounced back from the 61.8% Fibonacci retracement level. However, it is clear that supporting technical indicators—such as the break of the RSI convergence trend on the days triggering the decline—confirm the downward movement.

In the earlier 2020 decline, massive volume accompanied the initial weeks' movements, while this year's movement is characterized by steadily increasing volume. Nevertheless, the current volume peak falls short of the peak measured in the 2020 week (4.45 million vs. 6.8 million), indicating that the trend may continue with further declines.

Overall, technical analysis—the examination of logarithmic charts, the break of the RSI trend, and volume movements—suggests that the current correction may deepen further, and the Nasdaq's target price can be estimated between 14,500 and 15,000 points.

Observing a similar scenario in history, when global events triggered high volatility, it appears that market reactions now do not differ from past patterns. If the current negative trend continues, a further deepening of the correction is plausible, as the lag in market volume (4.45M vs. 6.8M) indicates that investors have not yet been able to offset the negative sentiment prevailing in the sector.

Global Markets Crashing: What Now?⚠️ Global Markets Crashing: What Now?

Don't panic , this is a worldwide event . Even big players are affected.

The important thing is to be patient and focus on future opportunities . We're hoping for a recovery in 2025.

We're holding on! ⏳

If you're experiencing losses right now , don't get discouraged, almost everyone is in the same boat . Even the largest funds managing billions of dollars are in trouble. Trillions of dollars are being wiped out from the world economy. Every country and every stock market is crashing. If you're thinking, 'My altcoin is dropping,' just look at how much ETH has fallen (18% in just one day).

Everything across the globe is falling , so it's natural that our market and investments will also fall. Don't feel bad if you didn't sell at the top in November or December; these are learning experiences for the future. Remember to take profit in the next uptrend.

Right now, all we can do is wait and hope for global issues to be resolved. Interest rate cuts and printing more money could bring a recovery in 2025.

S tay strong and make sure to take your profits if we see a big pump towards the end of the year.

We are also holding all our assets and waiting.

Trump's Tariff Wars : What To Expect And How To Trade Them.I promised all of you I would create a Trump's Tariff Wars video and try to relate that is happening through the global economy into a rational explanation of HOW and WHY you need to be keenly away of the opportunities presented by the new Trump administration.

Like Trump or not. I don't care.

He is going to try to enact policies and efforts to move in a direction to support the US consumer, worker, business, and economy.

He made that very clear while campaigning and while running for office (again).

This video looks at the "free and fair" global tariffs imposed on US manufacturers and exports by global nations over the past 3+ decades.

For more than 30+ years, global nations have imposed extreme tariffs on US goods/exports in order to try to protect and grow their economies. The purpose of these tariffs on US good was to protect THEIR workers/population, to protect THEIR business/economy, to protect THEIR manufacturing/products.

Yes, the tariffs they imposed on US goods was directly responsible for THEIR economic growth over the past 30-50+ years and helped them build new manufacturing, distribution, consumer engagement, banking, wealth, and more.

The entire purpose of their tariffs on US goods was to create an unfair advantage for their population to BUILD, MANUFACTURE, and BUY locally made products - avoiding US products as much as possible.

As I suggested, that is why Apple, and many other US manufacturers moved to Asia and overseas. They could not compete in the US with China charging 67% tariffs on US goods. So they had to move to China to manufacture products because importing Chinese-made products into the US was cheaper than importing US-made products into China.

Get it?

The current foreign Tariffs create an incredibly unfair global marketplace/economy - and that has to STOP (or at least be re-negotiated so it is more fair for everyone).

And I believe THAT is why Trump is raising tariffs on foreign nations.

Ultimately, this will likely be resolved as I suggest in this video (unless many foreign nations continue to raise tariff levels trying to combat US tariffs).

If other foreign nation simply say, "I won't stand for this, I'm raising my tariff levels to combat the new US tariffs", then we end up where we started - a grossly unfair global marketplace.

This is the 21st century, not the 18th century.

Step up to the table and realize we are not in the 1850s or 1950s any longer.

We are in 2025. Many global economies are competing at levels nearly equal to the US economy in terms of population, GDP, manufacturing, and more.

It's time to create a FREE and FAIR global economy, not some tariff-driven false economy on the backs of the US consumers. That has to end.

Get some.

#trading #research #investing #tradingalgos #tradingsignals #cycles #fibonacci #elliotwave #modelingsystems #stocks #bitcoin #btcusd #cryptos #spy #gold #nq #investing #trading #spytrading #spymarket #tradingmarket #stockmarket #silver

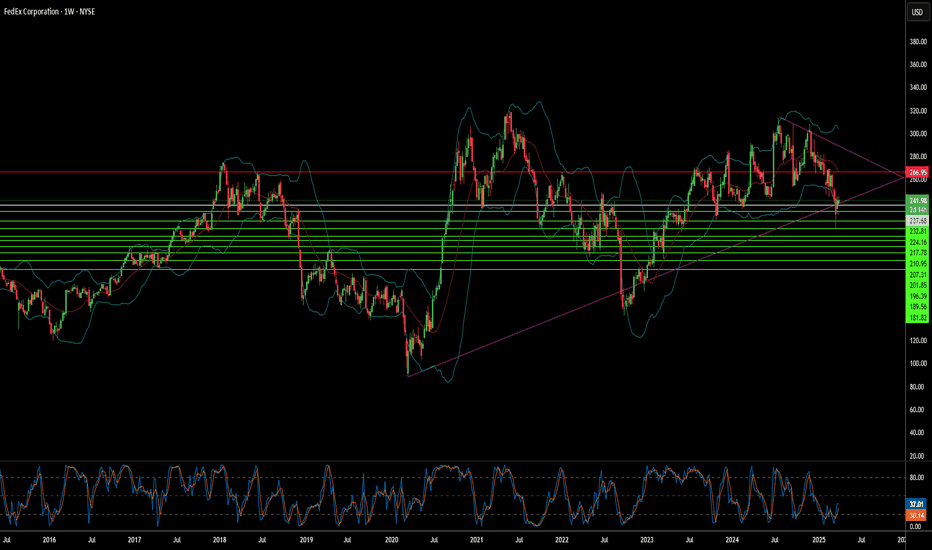

FedEx: Balancing Act or Precarious Gamble?Recent market activity highlights significant pressure on FedEx, as the logistics giant grapples with prevailing economic uncertainty. A notable drop in its stock price followed the company's decision to lower its revenue and profit outlook for fiscal year 2025. Management attributes this revision to weakening shipping demand, particularly in the crucial business-to-business sector, stemming from softness in the US industrial economy and persistent inflationary pressures. This development reflects broader economic concerns that are also impacting consumer spending and prompting caution across the corporate landscape.

In response to these domestic headwinds, FedEx has adopted a more conservative operational stance, evidenced by a reduced planned capital spending for the upcoming fiscal year. This move signals an emphasis on cost management and efficiency as the company navigates the current economic climate within its established markets. It suggests a strategic adjustment to align spending with the revised, more cautious revenue expectations.

However, this domestic caution contrasts sharply with FedEx's concurrent and ambitious expansion strategy in China. Despite geopolitical complexities, the company is making substantial investments to enlarge its footprint, building new operational centers, upgrading existing gateways, and increasing flight frequencies to enhance connectivity. This dual approach underscores the central challenge facing FedEx: balancing immediate economic pressures and operational adjustments at home while pursuing a long-term, high-stakes growth initiative in a critical international market, all within an uncertain global environment.

Will Oil Prices Ignite Amid a Middle East War?The global oil market is critical, with geopolitical tensions in the Middle East potentially leading to significant price fluctuations. Recent military actions by the U.S. against Yemen's Houthi group have contributed to rising oil prices, as Brent crude futures reached $71.21 per barrel and U.S. West Texas Intermediate crude futures hit $67.80 per barrel. Positive economic indicators from China, including increased retail sales, have supported oil prices despite global economic slowdown concerns.

The Middle East remains a focal point for oil price volatility due to its strategic importance in global oil supply. Iran, a major oil producer, could face disruptions if tensions escalate, potentially driving prices higher. However, global spare capacity and demand resilience might cap long-term increases. Historical events like the 2019 Saudi oil facility attacks demonstrate the market's sensitivity to regional instability, with prices spiking by $10 following the incident.

Analysts predict that if the conflict escalates to close the Strait of Hormuz, oil prices could exceed $100 per barrel. Nevertheless, historical data suggests that prices may stabilize within a few months if disruptions prove temporary. The delicate balance between supply shocks and market adjustments underscores the need to closely monitor geopolitical developments and their economic ripple effects.

As global economic uncertainties overshadow geopolitical risks, maintaining market confidence will depend on sustained positive economic data from countries like China. The potential for peace negotiations in Ukraine and changes in U.S. sanctions could also impact oil prices, making this a pivotal moment for global energy markets.

Will ES go more deeper ?The E-mini S&P 500 futures contract ( CME_MINI:ES1! ) exhibited a liquidation profile (Profile A), characterized by two distinct distributions. The subsequent session (Profile B) formed a balanced profile and remained entirely below the lower distribution of Profile A, indicating continued bearish sentiment.

Profile C emerged as a short-covering profile, with its upper boundary testing the high of Profile B by a minimal margin. Both Profile B and C exhibited trading activity around the lower distribution of Profile A without breaching its low. Profiles A, B, and C established a base at the C Line, identified as a longer-term support or demand zone.

Yesterday's session (Profile D) also presented a liquidation profile, briefly trading below the C Line before recovering and maintaining balance around this level. The market demonstrates reluctance for further downside, with lower prices consistently triggering short-covering rallies rather than initiating new selling. Even though Profile D traded lower, it did not exhibit significant selling conviction.

Given the prevailing geopolitical risks, including the ongoing tariff disputes and the unresolved Ukraine-Russia conflict, further liquidation during today's Regular Trading Hours (RTH) remains a possibility.

However, sustained buying interest above the balance of Profile C, driven by short covering and new long positions, would indicate a potential shift in market sentiment towards accumulation on a higher timeframe. The market's behavior during today's RTH session will be crucial in determining the next directional move.

Copper (HG): Red Metal Rally or Rusty Bet?(1/9)

Good afternoon, everyone! ☀️ Copper (HG): Red Metal Rally or Rusty Bet?

With copper at $4.88 per pound, is this industrial darling a steal or a trap? Let’s dig into the dirt! 🔍

(2/9) – PRICE PERFORMANCE 📊

• Current Price: $ 4.88 per pound as of Mar 13, 2025 💰

• Recent Move: Up slightly this week (Mar 10-13), per data 📏

• Sector Trend: Industrial metals volatile, with tariff impacts 🌟

It’s a mixed bag—let’s see what’s driving the price! ⚙️

(3/9) – MARKET POSITION 📈

• Global Demand: Key in construction, electronics, renewable energy ⏰

• Supply Dynamics: Major producers in Chile, Peru, China; tariff risks loom 🎯

• Trend: Green energy demand up, but economic slowdowns could dampen growth 🚀

Firm in its industrial roots, but facing new challenges! 🏭

(4/9) – KEY DEVELOPMENTS 🔑

• Trade War Escalation: U.S.-China tensions on Mar 13, 2025, per data, could hit supply chains 🌍

• China’s Response: Uncertain, but likely to affect prices due to its role in copper 📋

• Market Reaction: Prices volatile but up slightly, indicating cautious optimism 💡

Navigating through geopolitical storms! 🛳️

(5/9) – RISKS IN FOCUS ⚡

• Economic Slowdown: Reduced industrial activity could lower demand 🔍

• Supply Disruptions: Tariffs or geopolitical issues could disrupt supply, per data 📉

• Substitution: Other materials or technologies could reduce copper’s importance ❄️

It’s a risky ride, but potential rewards are there! 🛑

(6/9) – SWOT: STRENGTHS 💪

• Increasing Demand from Green Energy: Solar panels, wind turbines, EVs require copper 🥇

• Industrial Staple: Essential in construction and electronics, ensuring steady demand 📊

• Price History: Historically, copper has been a good long-term investment, especially during expansions 🔧

Got solid fundamentals! 🏦

(7/9) – SWOT: WEAKNESSES & OPPORTUNITIES ⚖️

• Weaknesses: Price volatility due to economic cycles and supply disruptions 📉

• Opportunities: Expansion in emerging markets, new applications in tech and infrastructure 📈

Can copper shine through the challenges? 🤔

(8/9) – 📢Copper at $4.88 per pound—your take? 🗳️

• Bullish: $5+ soon, green energy boom drives prices up 🐂

• Neutral: Steady, risks and opportunities balance out ⚖️

• Bearish: $4 looms, economic slowdown hits demand 🐻

Chime in below! 👇

(9/9) – FINAL TAKEAWAY 🎯

Copper’s $4.88 price reflects a mix of optimism and caution 📈. With green energy demand rising but economic and geopolitical risks lingering, it’s a volatile market. DCA-on-dips could be a strategy to average in over time, banking on long-term growth. Gem or bust?

Can France’s Economy Defy Gravity?The CAC 40, France’s flagship stock index, showcases the nation’s economic strength, driven by global giants like LVMH and TotalEnergies. With their vast international presence, these multinational corporations provide the index with notable resilience, allowing it to endure domestic challenges. However, this apparent stability masks a deeper, more intricate reality. Beneath the surface, the French economy grapples with significant structural issues that could undermine its long-term success, making the CAC 40’s performance both a symbol of hope and a point of vulnerability.

France confronts multiple internal pressures that threaten its economic stability. An aging population, with a median age of 40—among the highest in developed nations—shrinks the workforce, increasing the burden of healthcare and pension costs. Public debt, projected to hit 112% of GDP by 2027, restricts fiscal flexibility, while political instability, such as a recent government collapse, hampers essential reforms. Compounding these issues is the challenge of immigration. France’s immigrant population, particularly from Africa and the Middle East, faces difficulties integrating into a rigid labor market shaped by strict regulations and strong unions. This struggle limits the nation’s ability to leverage immigrant labor to offset workforce shortages while straining social unity, adding further complexity to France’s economic challenges.

Looking forward, France’s economic future hangs in the balance. The CAC 40’s resilience offers a buffer, but lasting prosperity depends on tackling these entrenched problems—demographic decline, fiscal constraints, political gridlock, and the effective integration of immigrants. To maintain its global standing, France must pursue bold reforms and innovative solutions, a daunting task requiring determination and foresight. As the nation strives to reconcile its rich traditions with the demands of a modern economy, a critical question looms: can France overcome these obstacles to secure a thriving future? The outcome will resonate well beyond its borders, offering lessons for a watching world.

Is Apple's Empire Built on Sand?Apple Inc., a tech titan valued at over $2 trillion, has built its empire on innovation and ruthless efficiency. Yet, beneath this dominance lies a startling vulnerability: an overreliance on Taiwan Semiconductor Manufacturing Company (TSMC) for its cutting-edge chips. This dependence on a single supplier in a geopolitically sensitive region exposes Apple to profound risks. While Apple’s strategy has fueled its meteoric rise, it has also concentrated its fate in one precarious basket—Taiwan. As the world watches, the question looms: what happens if that basket breaks?

Taiwan’s uncertain future under China’s shadow amplifies these risks. If China moves to annex Taiwan, TSMC’s operations could halt overnight, crippling Apple’s ability to produce its devices. Apple’s failure to diversify its supplier base left its trillion-dollar empire on a fragile foundation. Meanwhile, TSMC’s attempts to hedge by opening U.S. factories introduce new complications. If Taiwan falls, the U.S. could seize these assets, potentially handing them to competitors like Intel. This raises unsettling questions: Who truly controls the future of these factories? And what becomes of TSMC’s investments if they fuel a rival’s ascent?

Apple’s predicament is a microcosm of a global tech industry tethered to concentrated semiconductor production. Efforts to shift manufacturing to India or Vietnam pale against China’s scale, while U.S. regulatory scrutiny—like the Department of Justice’s probe into Apple’s market dominance—adds further pressure. The U.S. CHIPS Act seeks to revive domestic manufacturing, but Apple’s grip on TSMC muddies the path forward. The stakes are clear: resilience must now trump efficiency, or the entire ecosystem risks collapse.

As Apple stands at this crossroads, the question echoes: Can it forge a more adaptable future, or will its empire crumble under the weight of its design? The answer may not only redefine Apple but also reshape the global balance of tech and power. What would it mean for us all if the chips—both literal and figurative—stopped falling into place?

GLOBAL RECESSION IS COMING!The chart provided depicts the **US Dollar Index (USDOLLAR)** on a monthly timeframe, highlighting a bearish outlook. The analysis suggests a significant downturn in the value of the US dollar, which could have profound implications for the global economy. Here's a breakdown of how this scenario could lead to a global recession:

Key Observations:

1. Lower High Formation : The chart shows a lower high forming after a previous peak, signaling potential weakness in the dollar's long-term trend. This aligns with bearish market structure, indicating that sellers are gaining control.

2. Fair Value Gap (FVG) : The annotation mentions that a "Monthly FVG" has been respected. FVGs are imbalances in price action often revisited before continuing the prevailing trend. In this case, the FVG rejection reinforces the bearish continuation.

3. Projected Downtrend: The red arrow projects a steep decline in the US dollar's value, suggesting a collapse or sharp devaluation over the coming months or years.

Implications for a Global Recession:

1. Weaker Dollar and Global Trade : As the world's primary reserve currency, a collapse in the US dollar would disrupt global trade and financial systems. Countries heavily reliant on dollar-denominated trade or debt would face increased costs and financial instability.

2. Debt Crisis in Emerging Markets: Many emerging economies hold significant amounts of US dollar-denominated debt. A devalued dollar could lead to capital flight, higher borrowing costs, and defaults, triggering financial crises in these regions.

3. Commodity Price Volatility : Since commodities like oil and gold are priced in dollars, a sharp decline in its value could lead to extreme volatility in commodity markets, further destabilizing economies dependent on imports or exports of these goods.

4. Investor Panic and Market Sell-Offs : A collapsing dollar would likely trigger panic in global financial markets. Investors may flee to other safe-haven assets like gold or cryptocurrencies, leading to sharp declines in equity markets worldwide.

5. Global Economic Contraction: With trade disruptions, financial instability, and market volatility, global economic growth would slow significantly. Central banks might struggle to stabilize their economies due to reduced policy effectiveness amid currency turmoil.

Conclusion:

The chart's bearish projection for the US dollar suggests that its collapse could act as a catalyst for widespread economic instability, potentially leading to a global recession. This scenario underscores the interconnectedness of currencies, trade, and financial markets in shaping economic outcomes worldwide.

What Lies Beneath Chevron's Venezuelan Exit?In a striking geopolitical maneuver, the Trump administration has revoked Chevron's license to operate in Venezuela, effective March 1. This decision marks a sharp departure from the Biden-era policy, which had conditionally allowed Chevron’s operations to encourage free elections in the beleaguered nation. Beyond punishing Venezuela for unmet democratic benchmarks, the move reflects a broader U.S. strategy to bolster domestic oil production and lessen dependence on foreign energy sources. Chevron, a titan with over a century of history in Venezuela, now faces the unraveling of a vital revenue stream, prompting us to ponder the delicate dance between corporate ambition and national agendas.

The ripple effects for Venezuela are profound and perilous. Chevron accounted for nearly a quarter of the country’s oil production, and its exit is forecast to slash Venezuela’s revenue by $4 billion by 2026. This economic blow threatens to rekindle inflation and destabilize a nation already teetering on the edge of recovery, exposing the intricate ties between U.S. corporate presence and sanctioned states. For Chevron, the revocation transforms a once-lucrative asset into a geopolitical liability, thrusting the company into a high-stakes test of resilience. This clash of interests challenges us to consider the true cost of operating in the shadow of political volatility.

On the global stage, this decision reverberates through energy markets and diplomatic corridors. Oil prices have already twitched in response, hinting at tighter supplies. At the same time, the fate of other foreign firms in Venezuela hangs in the balance, shadowed by the looming threat of secondary sanctions. As the U.S. sharpens its confrontational edge, the energy landscape braces for transformation, with consequences for geopolitical alliances and energy security worldwide. Is Chevron’s departure merely a pawn in a broader strategic game, or does it herald a seismic shift in global power dynamics? The answer may redefine the boundaries of energy and influence in the years ahead.

$FESX1! EURO STOXX 50: 7 WEEKS OF GAINSEUREX:FESX1! EURO STOXX 50: 7 WEEKS OF GAINS

1/7

The EURO STOXX 50 is on track for its seventh consecutive weekly gain! 📈⚡️

This winning streak continues despite global trade war jitters and shifting market sentiment.

2/7

Why the optimism? 🤔

Investors appear cautiously confident about U.S. trade policy developments, with Europe seen as a more stable option amidst American economic uncertainties.

3/7

Key influences to watch:

• U.S. Jobs Data: Friday’s payroll numbers may affect overall risk sentiment.

• Trade War: Trump’s tariff talk + a one-month reprieve for Mexico & Canada = a temporary sigh of relief?

4/7

Currency factors also play a role. 💱

The Yen’s strength due to expected BoJ rate hikes could affect export-related optimism if the Euro shifts in tandem.

5/7

Commodities?

Gold remains steady near record peaks, signaling some investors are still seeking safe havens—even as equities rally.

6/7 What’s driving the EURO STOXX 50’s resilience?

1️⃣ Diversified European economy

2️⃣ Stable/dovish monetary policy

3️⃣ Shift to Europe as a “safer” bet

4️⃣ Combination of factors

Vote below! 👇✅

7/7

Market watchers see Europe’s diverse economic base 🏭🛍️ shielding stocks from U.S. volatility. Plus, the possibility of more accommodative European monetary policy adds extra support.

Can Turkey's Lira Dance with the Dollar?Turkey stands at a pivotal moment in its economic journey, navigating through the complexities of fiscal management and monetary policy to stabilize the Turkish Lira against the US Dollar. The nation has embarked on a strategic pivot towards domestic funding, significantly increasing the issuance of Turkish Government Bonds to manage soaring inflation and debt service costs. This approach, while stabilizing in relative terms, challenges Turkey to balance between stimulating growth and controlling inflation, a dance that requires both precision and foresight.

The Central Bank of Turkey's decision to cut rates amidst rising inflation paints a picture of calculated risk and strategic optimism. The bank is threading a needle between fostering economic activity and maintaining price stability by targeting a reduction in inflation over the medium term while allowing short-term increases. This policy shift, coupled with a focus on local funding, not only aims to reduce external vulnerabilities but also tests the resilience of Turkey's economy against global economic currents, including the impact of international political changes like the US election.

Globally, the economic landscape is fraught with uncertainties, and Turkey's strategy of maintaining a stable credit rating while forecasting a decrease in inflation sets an intriguing stage. The country's ability to attract investment while managing its debt profile, especially in light of global monetary policy shifts by major players like the Federal Reserve and the ECB, will be a testament to its economic stewardship. This narrative invites readers to delve deeper into how Turkey might leverage its economic policies to not only survive but thrive in a fluctuating global market.

The enigma of the USD/TRY exchange rate thus becomes a compelling study of economic strategy, where every policy decision is a move in a larger game of financial chess. Turkey's attempt to balance its books while dancing with the dollar challenges conventional economic wisdom and invites observers to ponder: Can a nation truly master its currency's fate in the global marketplace?

Is Gold the Ultimate Safe Haven in 2025?In the labyrinthine world of finance, gold has once again captured the spotlight, breaking records as speculative buying and geopolitical tensions weave a complex narrative around its valuation. The precious metal's price surge is not merely a reaction to market trends but a profound statement on the global economic landscape. Investors are increasingly viewing gold as a beacon of stability amidst an ocean of uncertainty, driven by the Middle East's ongoing unrest and the strategic maneuvers of central banks. This phenomenon challenges us to reconsider the traditional roles of investment assets in safeguarding wealth against international volatility.

The inauguration of Donald Trump as President has injected further intrigue into the gold market. His administration's initial steps, notably the delay in imposing aggressive tariffs, have led to a nuanced dance between inflation expectations and U.S. dollar strength. Analysts from major financial institutions like Goldman Sachs and Morgan Stanley are now dissecting how Trump's policies might steer inflation, influence Federal Reserve actions, and ultimately, dictate gold's trajectory. This intersection of policy and market dynamics invites investors to think critically about how political decisions can reshape economic landscapes.

China's burgeoning appetite for gold, exemplified by the frenzied trading of gold-related ETFs, underscores a broader shift towards commodities as traditional investment avenues like real estate falter. The Chinese central bank's consistent gold acquisitions reflect a strategic move towards diversifying reserves away from the U.S. dollar, particularly in light of global economic sanctions. This strategic pivot in one of the world's largest economies poses a compelling question: are we witnessing a fundamental realignment in global financial power structures, with gold at its core?

As we navigate through 2025, gold's role transcends simple investment; it becomes a narrative of economic resilience and geopolitical foresight. The interplay between inflation, monetary policy, and international relations not only affects gold's price but also challenges investors to adapt their strategies in an ever-evolving market. Can gold maintain its luster as the ultimate Safe Haven, or will new economic paradigms shift its golden allure? This enigma invites us to delve deeper into the metal's historical significance and its future in a world where certainty is a luxury few can afford.