GNT/USD Set up Plus Cloud Resistance..GNT looking to hit new lows of a possible $0.07, two targets have been stated in the chart, now the downward trend line is approaching so we have to see how that plays out, we could see a breakout towards $0.20 Red Zone Box if we have a successful break.

GNT

#GNTBTC another local bottoming candidate ripe for a pophigher into larger zones of supply. Risk/reward pretty good still on this one as there hasn't been significant attention here yet. Bullish RSI divergence not quite as strong as seen for DCRBTC but still visible indicating there should be follow-through on a move toward the first target.

Golen setup to buySecond breaking attempt after touching lower end of support. Possibly accumulation zone and ready for some nice 2 or 3x folds (4500, 8500 possible targets)

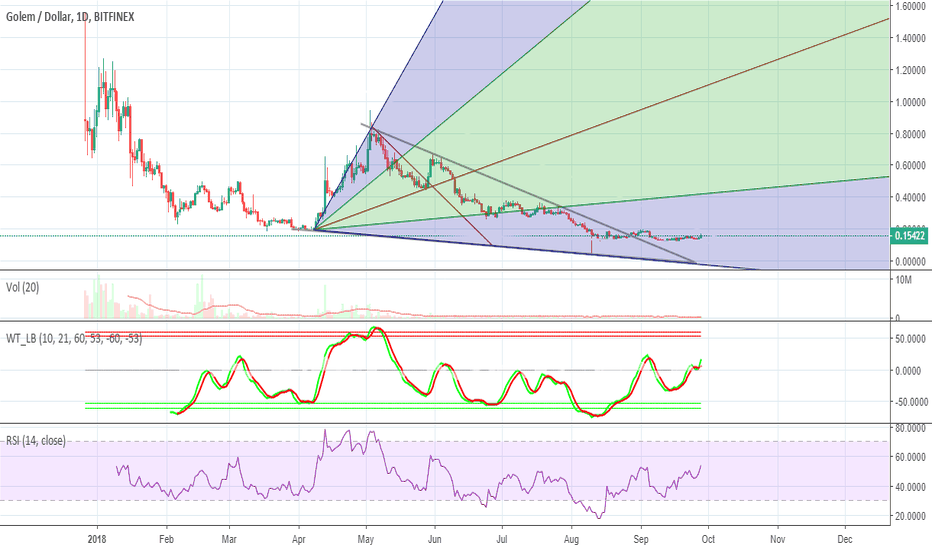

There is a possibility for the beginning of an uptrend in GNTUSDTechnical analysis:

. GOLEM/DOLLAR is in a range bound and the beginning of uptrend is expected.

. The price is below the 21-Day WEMA which acts as a dynamic resistance.

. The RSI is at 49.

Trading suggestion:

. There is a possibility of temporary retracement to suggested support zone (0.147 to 0.114). if so, traders can set orders based on Price Action and expect to reach short-term targets.

Beginning of entry zone (0.147)

Ending of entry zone (0.114)

Entry signal:

Signal to enter the market occurs when the price comes to " Buy zone " then forms one of the reversal patterns, whether " Bullish Engulfing ", " Hammer " or " Valley " in other words,

NO entry signal when the price comes to the zone BUT after any of the reversal patterns is formed in the zone.

To learn more about " Entry signal " and the special version of our " Price Action " strategy FOLLOW our lessons:

Take Profits:

TP1= @ 0.2755

TP2= @ 0.3755

TP3= @ 0.4565

TP4= @ 0.6530

TP5= @ 0.8000

TP6= @ 1.1000

TP7= Free

There is a possibility for the beginning of an uptrend in GNTUSDTechnical analysis:

. GOLEM/DOLLAR is in a range bound and the beginning of uptrend is expected.

. The price is below the 21-Day WEMA which acts as a dynamic resistance.

. The RSI is at 49.

Trading suggestion:

. There is a possibility of temporary retracement to suggested support zone (0.147 to 0.114). if so, traders can set orders based on Price Action and expect to reach short-term targets.

Beginning of entry zone (0.147)

Ending of entry zone (0.114)

Entry signal:

Signal to enter the market occurs when the price comes to " Buy zone " then forms one of the reversal patterns, whether " Bullish Engulfing ", " Hammer " or " Valley " in other words,

NO entry signal when the price comes to the zone BUT after any of the reversal patterns is formed in the zone.

To learn more about " Entry signal " and the special version of our " Price Action " strategy FOLLOW our lessons:

Take Profits:

TP1= @ 0.2755

TP2= @ 0.3755

TP3= @ 0.4565

TP4= @ 0.6530

TP5= @ 0.8000

TP6= @ 1.1000

TP7= Free

[GNT/BTC] GOLEM COULD BE A GOOD INVESTIMENT [ POT PROF 70%-400%]#GNT / BTC ( Binance, Bittrex )

Buy Range : 0.00002200-2350

Stop Loss : Not recommend

Target 1 : 0.00003882

Target 2 : 0.00005084

Target 3 : 0.00008337

DAILY CHART :

- CCI is extending positive performance

- Big volume confirm uptrend

- RSI pointing up

- MACD continue performing very good

- STOCH climbing higher

- Supported by EMA20/MA50

WEEKLY CHART :

- MACD still on negative territory but its really near to turn into positive and cross

- STOCH is on movement which is positive

- CCI still negative but in a positive way to turn into positive on 2-3 weeks

- RSI already made a higher high

CONCLUSION

GNT is showing some positive performance on the last weeks/days which could suggest bullish reversal.

Prices are really cheap and risk/reward seems safe to make an investiment and wait for profits on my different targets.

Remember make your own decisions and development

GNT Movement and wedge formed..GNT has formed a wedge and is looking to break below, RSI looks like we could be slight overbought and is attempting to pull back. A drop towards target 1 could soon be spiked back up to small red trend line then down to target 2.

GNT/BTC Breakout... MA's about to crossover...GNT looking to push out of the wedge and target 2650 Sats, MA's looking to crossover which signals towards a bullish movement and also MACD is looking bullish. After we reach the 2650 Sats possible pullback (Green Box) towards 2500 Sats.

GNT is clear on the bottomA good entry point for mid-term investors. We are at GNTBTC now at the bottom, i see here that we can go to 5k and above!gnt

GNTBuy Price: Yellow Line

TP: Green Lines

Invest Suggestion: 5-10 Percent

Profit Expectations: 5, 10 or >20 Percent

Just hold and watch. All targets will be reached within 1-3 days as my prediction. But sell after 6-7 days if any target not reached. Good Luck!

Thanks for visiting.

GNT Towards $0.11..Each replication comes with a downside movement, 20MA touched and now reversing towards the downside. (Green Box) in play and it is the last form of resistance for GNT.. $0.11 is a strong support so should hold well, but considering BTC and the $5000 prediction and with near enough all altcoins following BTC movement, we could see GNT plummet further in the future.

GNTLong once out of channel or wait for breakout below for short term sell then longer term buy to the top

GNT Ready$GNT broke out from falling wedge recently and showed a bullish sign with a divergence on daily TF. Good Luck Amigos!

GNT Sideways..GNT one of the most undervalued Cryptos on the market has been trading sideways for a while now, both grey circles are key areas that if we breach either way will dictate the price, $0.115 has held up for the last support for GNT, if broke we could see single digits for the token. I do believe this Token is a $7 coin in the future.

Golem (GNT) Likely To Reach McAfee’s Target Of $5 By Year EndGolem (GNT) is up 10% for the day while the rest of the market bleeds. Normally, this would not be a big deal but the chart above for GNT/USD on the weekly time frame shows us exactly why it is a big deal this time. RSI for GNT/USD peaked around January 2018 as shown on the chart. Since then, it has been on a steady decline trading in a falling wedge. After an extensive correction of nine months, RSI for GNT/USD has finally broken out of this falling wedge to the upside. This means that Golem (GNT) is one heartbeat away from breaking the downtrend against the US Dollar (USD) and beginning a new trend.

Earlier this year, John McAfee had predicted that Golem (GNT) would reach a price of $5 in July. That did not happen then, but we now know the reasons behind such a bold assumption. The charts look favorable for a rally to $5 by end of year but the fundamentals of Golem (GNT) have to be solid enough for that to materialize. Back then we did not know much about Golem (GNT) but now that they have a working product, it makes sense to see that interest in Golem (GNT) is on the rise.

Golem (GNT) has made a lot of progress these past nine months. The same cannot be said of most other altcoins and ICO projects because the majority of them are either scams or useless tokens with no real use cases. Golem (GNT) on the other hand had a well defined use case from the very beginning but now it has a finished product that is ready to use. Golem (GNT) is focused on three things: computing power, rendering and machine learning. Individuals can run their computers to complete these tasks in exchange for compensation in the form of Golem Network Tokens (GNT).

Read My Detailed Analysis Here: cryptodaily.co.uk

There is a possibility for the beginning of an uptrend in GNTBTCTechnical analysis:

. GOLEM/ETHEREUM is in a range bound and the beginning of uptrend is expected.

. The price is below the 21-Day WEMA which acts as a dynamic resistance.

. The RSI is at 46.

. While the RSI downtrend in the Daily chart is not broken, bearish wave in price would continue .

. The price downtrend in the daily chart are broken, so the probability of the resumption of an uptrend is increased.

Trading suggestion:

. There is a possibility of temporary retracement to suggested support zone (0.00002000 to 0.00001500). if so, traders can set orders based on Price Action and expect to reach short-term targets.

Beginning of entry zone (0.00002000)

Ending of entry zone (0.00001500)

Entry signal:

Signal to enter the market occurs when the price comes to "Buy zone" then forms one of the reversal patterns, whether "Bullish Engulfing" , "Hammer" or "Valley" in other words,

NO entry signal when the price comes to the zone BUT after any of the reversal patterns is formed in the zone.

To learn more about "Entry signal" and the special version of our "Price Action" strategy FOLLOW our lessons:

Take Profits:

TP1= @ 0.00002700

TP2= @ 0.00003250

TP3= @ 0.00003750

TP4= @ 0.00004570

TP5= @ 0.00005420

TP6= @ 0.00006260

TP7= @ 0.00007470

TP8= @ 0.00009000

TP9= @ 0.00010440

TP10= @ 0.00016800

TP11= Free

There is a possibility for the beginning of an uptrend in GNTBTCTechnical analysis:

. GOLEM/ETHEREUM is in a range bound and the beginning of uptrend is expected.

. The price is below the 21-Day WEMA which acts as a dynamic resistance.

. The RSI is at 46.

. While the RSI downtrend in the Daily chart is not broken, bearish wave in price would continue .

. The price downtrend in the daily chart are broken, so the probability of the resumption of an uptrend is increased.

Trading suggestion:

. There is a possibility of temporary retracement to suggested support zone (0.00002000 to 0.00001500). if so, traders can set orders based on Price Action and expect to reach short-term targets.

Beginning of entry zone (0.00002000)

Ending of entry zone (0.00001500)

Entry signal:

Signal to enter the market occurs when the price comes to "Buy zone" then forms one of the reversal patterns, whether "Bullish Engulfing" , "Hammer" or "Valley" in other words,

NO entry signal when the price comes to the zone BUT after any of the reversal patterns is formed in the zone.

To learn more about "Entry signal" and the special version of our "Price Action" strategy FOLLOW our lessons:

Take Profits:

TP1= @ 0.00002700

TP2= @ 0.00003250

TP3= @ 0.00003750

TP4= @ 0.00004570

TP5= @ 0.00005420

TP6= @ 0.00006260

TP7= @ 0.00007470

TP8= @ 0.00009000

TP9= @ 0.00010440

TP10= @ 0.00016800

TP11= Free

gnt in accumulating zone for long term As we see at chat Gnt reached its historycal zone for accumulation between 1700-2700 zone will be goodd zone for long term trades months before start new cycle

dialy frame stoch Rsi show bearsh signal now my test last support

if want buy stop loss closling daily under 1700 -30% from current price

second buy zone will be at the new 4h support at 2100

last buy will be at 1700-1800 zone

for me i prefer wait retrace or buy if break next resistence at 2750 when test it

targets :

4100 70% from current price

6100 154% from current price

9000 275% from current price

remember : this idea not inevestment advice

please share me your idea about gnt/Btc in comment and if u agree with it give it agree

Still in a downtrend..GNT still in a downward motion and even a break out of this trend will only give bulls slight movement.. $0.11 still very much in play, $0.13 will become a strong resistance after being broke yesterday.

$GNT, Once Again…

Daily

Looking at our trend timeframe we see price is looking for a lower low support at 1500, stochastic rsi showing momentum is in favor of bears with no signs fo reversal. Waiting for a bounce off 1500 or a daily close above 2250. Until then sitting on hands and letting price action play out.