The Greatest Opportunity of Your Life : Answering QuestionsThis video is an answer to Luck264's question about potential price rotation.

I go into much more details because I want to highlight the need to keep price action in perspective related to overall (broader) and more immediate (shorter-term) trends.

Additionally, I try to highlight what I've been trying to tell all of you over the past 3+ years...

The next 3-%+ years are the GREATEST OPPORTUNITY OF YOUR LIFE.

You can't even imagine the potential for gains unless I try to draw it out for you. So, here you go.

This video highlights why price is the ultimate indicator and why my research/data is superior to many other types of analysis.

My data is factual, process-based, and results in A or B outcomes.

I don't mess around with too many indicators because I find them confusing at times.

Price tells me everything I need to know - learn what I do to improve your trading.

Hope you enjoy this video.

Get Some.

#trading #research #investing #tradingalgos #tradingsignals #cycles #fibonacci #elliotwave #modelingsystems #stocks #bitcoin #btcusd #cryptos #spy #gold #nq #investing #trading #spytrading #spymarket #tradingmarket #stockmarket #silver

GOLD-SILVER

SPY/QQQ Plan Your Trade For 3-28-25 EOD Review : Brutal SellingI sure hope all of you were able to profit from this big selling trend today.

And I also hope you didn't get trapped in the potential for a base/bottom rally off the recent lows.

This move downward reminds me of the 2022-2023 downward trending pattern when the Fed was raising rates.

What Trump is doing with tariffs is very similar. It is slowing the economy in a way that will not break it - but it will result in slower, more costly, economic function.

Watch this video and I sure hope all of you have great (profitable) stories to share with me today.

I know I do. And, I'm positioned for the weekend. Ready to profit no matter what the markets do.

Get some.

#trading #research #investing #tradingalgos #tradingsignals #cycles #fibonacci #elliotwave #modelingsystems #stocks #bitcoin #btcusd #cryptos #spy #gold #nq #investing #trading #spytrading #spymarket #tradingmarket #stockmarket #silver

SPY/QQQ Plan Your Trade For 3-28-25 : Carryover in Counter TrendToday's pattern suggests the SPY/QQQ will attempt to move downward in early trading. The SPY may possibly target the 564-565 level before finding support. The QQQ may possibly attempt to target the 475-476 level before finding support.

Overall, the downward trend is still dominant.

I believe the SPY/QQQ may find some support before the end of trading today and attempt to BOUNCE (squeeze) into the close of trading.

Gold and Silver are RIPPING higher. Here we go.

Remember, I've been telling you of the opportunities in Gold/Silver and other market for more than 5+ months (actually more than 3+ years). This is the BIG MOVE starting - the BIG PARABOLIC price rally.

BTCUSD has rolled downward off the FWB:88K level - just like I predicted. Now we start the move down to the $78k level, then break downward into the $58-62k level looking for support.

Love hearing all of your success stories/comments.

GET SOME.

Happy Friday.

#trading #research #investing #tradingalgos #tradingsignals #cycles #fibonacci #elliotwave #modelingsystems #stocks #bitcoin #btcusd #cryptos #spy #gold #nq #investing #trading #spytrading #spymarket #tradingmarket #stockmarket #silver

SPY’s Epic Crash: Bearish Flag Unleashed!Buckle up, trading fam, because the SPDR S&P 500 ETF Trust (SPY) just pulled a move so wild, it’s giving Keeping Up with the Kardashians a run for its money. We’re talking a bearish flag breakdown on the 4-hour chart that’s got more twists than a Game of Thrones finale, more drama than a Bachelor rose ceremony, and more profit potential than a Shark Tank pitch gone viral. If you’re ready to laugh, learn, and maybe make some cash, then grab your popcorn—this 2,500-word rollercoaster is about to take you on a ride you won’t forget! 🎢

Act 1: SPY’s Golden Era—Living Its Best Barbie Life

Let’s set the scene: it’s late October 2024, and SPY is strutting its stuff like it’s Margot Robbie in Barbie. The price climbs from $570 to a dazzling $607.98 by mid-January 2025—a 6.5% glow-up that’s got traders swooning harder than Ken at a Dreamhouse party. SPY’s basically saying, “I’m not just an ETF—I’m iconic,” as it basks in the glow of a bull market hotter than a Love Island villa.

But here’s the tea: even the shiniest stars can fall. By mid-January, the Stochastic Oscillator at the bottom of the chart is flashing “overbought” signals louder than a Real Housewives reunion meltdown. It’s the first sign of trouble—like when you realize the DJ at the club just played “Sweet Caroline” for the third time, and the vibe’s about to go south. SPY’s living large, but the party’s about to get crashed, Jersey Shore style.

Act 2: The Flagpole Plunge—SPY Sinks Faster Than the Titanic

Cue the dramatic music, because mid-January 2025 is when SPY decides to pull a full-on Titanic. The price plummets from $607.98 to $566.77 in a matter of days—a $41.21 drop, or 6.8%, that’s got traders screaming “I’m not okay!” louder than a Euphoria episode. This sharp decline is the flagpole of our bearish flag pattern, and it’s a doozy. SPY’s sinking faster than Jack and Rose’s ship, and the bulls are left clinging to the wreckage like there’s no room on the door. 🚢

The Stochastic Oscillator dives into oversold territory (below 20), confirming the bearish momentum is stronger than the Hulk after a double espresso. It’s a bloodbath on Wall Street, and SPY’s the main character in this tragic plot twist. But just when you think the drama’s over, SPY decides to play coy—like a Bachelor contestant who says “I’m not here for the right reasons” but sticks around for the drama anyway. Enter the consolidation phase, aka the “flag” part of the bearish flag pattern. Let’s break it down, shall we?

Act 3: The Flag—SPY’s Tease Game Is Stronger Than a Love Island Bombshell

From late January to mid-February 2025, SPY enters a consolidation phase that’s more tantalizing than a Love Island bombshell walking into the villa. The price bounces between $566.77 and $577.74, forming a sneaky little upward-sloping channel. It’s like SPY’s playing hard to get, teasing traders with a “Will I rally? Will I crash?” vibe that’s got everyone on edge. The Stochastic Oscillator hovers below 50, like a villa couple who’s “just talking” but definitely not coupled up yet.

This consolidation is the “flag” in the bearish flag pattern, and it’s a classic setup. Think of it as SPY taking a quick breather after its big fall, sipping a cocktail by the pool before diving back into the drama. Bearish flags are continuation patterns, meaning the price is likely to keep falling after this little flirt-fest. It’s like when you’re watching The Masked Singer—you know the reveal’s coming, but the suspense is what keeps you glued to the screen. And trust me, you won’t want to miss the next act.

Act 4: The Breakout—SPY Says “I’m Out!” Like a RuPaul’s Drag Race Exit

Mid-February 2025 arrives, and SPY decides it’s done with the games. The price breaks below the lower trendline of the flag at $566.77, and it’s like watching a RuPaul’s Drag Race queen sashay away after a lip-sync battle: dramatic, fierce, and leaving the bulls in the dust. The breakout confirms the bearish flag pattern, and the bears are strutting their stuff like they just won the crown. 👑

The price doesn’t just dip—it plunges to $546.33 by late March 2025, a further drop of $20.44 (or 3.6%) from the breakout point. The Stochastic Oscillator dives back into oversold territory, confirming the bearish momentum is back with a vengeance. SPY’s basically telling the bulls, “You better work—because I’m not!” as it leaves them gagging on the runway.

Let’s talk about the measured move—the price target for this bearish flag. We take the length of the flagpole ($41.21) and project it downward from the breakout point ($566.77). That gives us a target of $525.56. SPY doesn’t quite hit that mark—it bottoms out at $546.33—but it gets close enough to make traders sweat harder than a Chopped contestant with 30 seconds left on the clock. It’s a solid performance, even if it didn’t stick the landing perfectly.

Pop Culture Parallels: SPY’s Bearish Flag Is a Reality TV Showdown

Let’s take a step back and look at this chart through a pop culture lens, because SPY’s bearish flag is basically a reality TV showdown. The initial uptrend from October to January is the honeymoon phase—think The Bachelor contestants on their first group date, all smiles and champagne. 🥂

The flagpole drop in mid-January is the drama bomb, like when a contestant gets caught kissing someone else in the hot tub. The consolidation phase is the confessional montage, where everyone’s talking smack and plotting their next move. And the breakout? That’s the rose ceremony—SPY’s handing out its final rose to the bears, and the bulls are sent packing with nothing but a suitcase and some tears.

Trading Tips: How to Slay This Bearish Flag Like a Drag Race Superstar

Now that we’ve had our fun, let’s get down to business. How can you trade this bearish flag like a Drag Race superstar? Here’s the tea, served piping hot:

1. Short the Breakout (Sashay, Don’t Shantay)

When SPY broke below the flag at $566.77, that was your cue to short the stock faster than you can say “Sashay away!” A short position here could’ve netted you a $20.44 gain per share as the price dropped to $546.33—enough to buy yourself a new wig for the next challenge.

2. Set a Stop-Loss (Don’t Get Read for Filth)

To avoid getting read for filth by a fake-out, set a stop-loss above the flag’s upper trendline at $577.74. That way, if the breakout flops harder than a Drag Race comedy challenge, you’re safe.

3. Target the Measured Move (Go for the Crown)

The measured move target of $525.56 was the goal, but SPY stopped at $546.33. That’s still a win—like making it to the top 4 but not snatching the crown. If you’d shorted at the breakout, you’d be serving looks and profits.

4. Watch for a Bounce (Don’t Sleep on the Comeback)

As of late March 2025, SPY’s at $546.33, and the Stochastic is oversold. This could mean a short-term bounce is coming, like a Drag Race queen returning for an All-Stars season. Keep an eye on resistance at $566.77 and $577.74—if SPY breaks above those, the bears might be in for a shady twist.

The Bigger Picture: Is SPY’s Downtrend the New Black?

Let’s zoom out for a hot second. Before this bearish flag, SPY was in a strong uptrend for months, living its best life like a Vogue cover star. This pattern marks a potential trend reversal, like when skinny jeans went out of style and baggy pants became the new black. If the downtrend continues, the next support level could be around $540—or even lower if things get really messy.

But here’s the million-dollar question: is this the start of a bigger bear market, or just a temporary dip? It’s like trying to predict the winner of Survivor—nobody knows, but everyone’s got a theory. The Stochastic being oversold suggests a bounce might be near, but the overall trend is still bearish. So, keep your wits about you, because this market’s shadier than a Real Housewives dinner party.

Why This Chart Is More Addictive Than a Love Is Blind Binge

If you’re still here, you’re officially obsessed—and I don’t blame you! This SPY chart is more addictive than a Love Is Blind binge because it’s got all the elements of a great reality show: drama, suspense, and a cast of characters (the bulls and bears) who can’t stop fighting. The bearish flag is the villain we love to hate, and the price action is the love triangle we can’t stop watching.

Plus, trading is a lot like reality TV. You’ve got your highs (the uptrend), your lows (the flagpole drop), and those messy in-between moments (the consolidation). But when the breakout happens, it’s like the finale episode where someone finally gets engaged—or in this case, the bears get their moment in the spotlight. 💍

Final Thoughts: Don’t Miss the Next Episode of SPY’s Reality Show

SPY’s bearish flag breakdown is a masterclass in technical analysis, wrapped in a package of drama and sass that’d make even the most stoic trader crack a smile. Whether you’re a Wall Street pro or a newbie just here for the tea, this chart has something for everyone.

So, what’s next for SPY? Will it hit that $525.56 target, or will the bulls stage a comeback like a Love Is Blind couple at the altar? Only time will tell, but one thing’s for sure: you won’t want to miss the next episode of this reality show. Keep your eyes on the chart, your finger on the trigger, and your sense of humor intact—because in the world of trading, you’ve got to laugh to keep from crying. 😜

Join the Trading Villa!

If you loved this recap of SPY’s bearish flag drama, don’t ghost me like a Love Island ex! Drop a comment with your thoughts—are you shorting SPY, or are you waiting for a bounce? And if you want more trading tea, puns, and reality TV references, hit that follow button faster than you can say “I’m here to make friends.” Let’s spill the tea and make some money together! 🍵

SPY/QQQ Plan Your Trade For 3-27-25 : Breakaway PatternToday's Breakaway pattern suggests the markets will continue to melt downward (possibly attempting to fill the Gap from March 24).

I strongly believe the SPY/QQQ are completing the "rolling top" pattern I suggested would happen near or after the March 21-24 TOP pattern my deeper cycle research suggested was likely.

At this point, things are just starting to line up for a broader market decline while the current EPP pattern plays out as a Breakdown of the EPP Flagging formation (moving into consolidation).

Gold and Silver are RIPPING higher. Yes, I do expect a little bit of volatility near these recent highs. But, I also expect metals to continue to rally higher from these levels over the next 10-15+ days. Watch the video.

Bitcoin is stalling/topping - just as I suggested it would months ago.

Now we see how the market move into this new trending phase and how far this current trend will drive price trends. I believe the SPY/QQQ/Bitcoin will all continue to move downward while Gold/Silver move (RIP) higher on this breakaway move.

This is a PERFECT trader's market.

Get some.

#trading #research #investing #tradingalgos #tradingsignals #cycles #fibonacci #elliotwave #modelingsystems #stocks #bitcoin #btcusd #cryptos #spy #gold #nq #investing #trading #spytrading #spymarket #tradingmarket #stockmarket #silver

GOLD H1 Market Update: Bear Trap / liquidity sweep BUY DIPS📊 Technical Outlook update

🔸Bullish OUTLOOK

🔸3050 USD Resistance Heavy

🔸3000/3040 Trading Range

🔸2990 potential Bear Trap

🔸Price Target BULLS: 3100 USD - 3150 USD

🔸Recommended Strategy: BUY DIPS 2990

📊 Gold Market Summary – This Week

💰Gold Price Surge: Gold prices soared above $3,000, prompting Bank of America to raise its price target.

💸Profit-Taking Pressure: After the surge, mild profit-taking caused a slight price correction.

🛡️Safe-Haven Demand: Gold continues to show strength, supported by safe-haven flows amid economic uncertainty.

📅 Economic Data Impact: U.S. economic data (e.g., 0.9% rise in durable goods orders) is influencing gold prices, pushing them to session highs.

🔄Consolidation with Bullish Outlook: Gold is consolidating but remains bullish due to favorable U.S. dollar performance and Federal Reserve policies.

🌍Geopolitical Tensions: Ongoing Russia-Ukraine conflict and U.S.-Russia tensions continue to support gold’s status as a safe-haven asset.

💎 Summary:

Gold remains resilient with strong demand, positive economic indicators, and geopolitical tensions supporting its value, despite minor price corrections.

SPY/QQQ Plan Your Trade for 3-26-25 : Flat-Down PatternToday's Flat-Down pattern for the SPY/QQQ suggests the markets will consolidate in a sideways channel, generally drifting downward.

As I've been warning all of you for the past month+, the market will likely roll over into a topping formation over the next few days, then start an aggressive downward trend targeting $525-535 on the SPY.

Today's video covers some details related to my expectations and how traders can prepare for the bigger moves I see pending.

Gold and Silver are poised for a potentially BIG BREAKOUT move to the upside. And I still believe Gold/Silver are going to rally another 15-20% within the next 30-45 days.

Bitcoin should follow the SPY/QQQ into a "rollover top" type of pattern then shift into a downward price trend over the next few days.

Everything is following my predictions/expectations almost perfectly.

Now, we try to profit from some of these big moves.

Go get some.

#trading #research #investing #tradingalgos #tradingsignals #cycles #fibonacci #elliotwave #modelingsystems #stocks #bitcoin #btcusd #cryptos #spy #gold #nq #investing #trading #spytrading #spymarket #tradingmarket #stockmarket #silver

SPY/QQQ Plan Your Trade For 3-25-25 : Top PatternToday's Top Pattern suggests the SPY/QQQ will find resistance slightly above yesterday's closing price level and attempt to roll over into a bearish price trend.

Watch today's video to see which levels I believe will be the top for the SPY & QQQ.

I do expect metals to rally over the next 3+ weeks and I'm watching for this morning's bounce to carry onward and upward.

Bitcoin should be rolling downward off that FWB:88K top level I predicted months ago.

We are moving into a topping phase - so get ready for the markets to attempt to ROLL DOWNWARD over the next 5+ trading days into a deeper low price level.

Get some.

#trading #research #investing #tradingalgos #tradingsignals #cycles #fibonacci #elliotwave #modelingsystems #stocks #bitcoin #btcusd #cryptos #spy #gold #nq #investing #trading #spytrading #spymarket #tradingmarket #stockmarket #silver

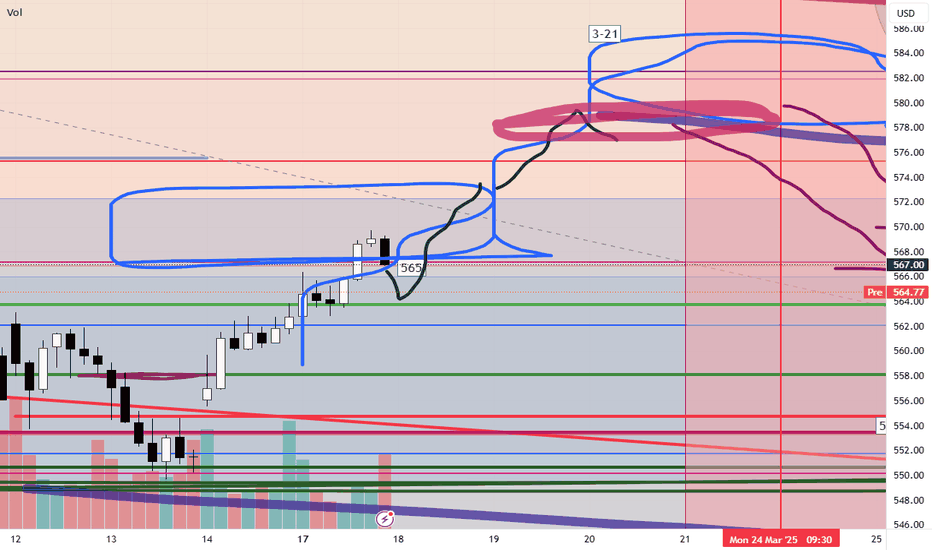

SPY/QQQ Plan Your Trade for 3-24-25 : Bozu Trending PatternToday's Bozu Trending pattern suggests a very aggressive price move is likely. I believe this move will be to the upside after my weekend research suggested we are moving into a "blow-off" topping pattern that will act as a Bull Trap.

Overall, I belive the SPY/QQQ have about 2-3 days up upward price trending early this week, then the markets will suddenly roll into a topping pattern and start to aggressively move downward.

The next base/bottom of the continued downward price trend sets up in early/mid April. The March 21-24 base/bottom is likely the minor base/bottom we have seen over the past 3-5+ days.

I believe the breakdown in the SPY/QQQ late this week and into next week will result in a new lower low - causing the Consolidation phase of this downturn to extend down to the 520-525 level on the SPY.

Bitcoin is very close to my $88,000 upper target level (only about $250 off that level). Get ready, BTCUSD should make an aggressive move downward after stalling near the FWB:88K level peak.

Gold and Silver are moving into a trending mode. I believe both Gold and Silver will rally this week and into the next few weeks as we expand into the Expansion phase.

Buckle up. If my research is correct, we are going to see a BIG ROLLOVER this week.

Get some.

#trading #research #investing #tradingalgos #tradingsignals #cycles #fibonacci #elliotwave #modelingsystems #stocks #bitcoin #btcusd #cryptos #spy #gold #nq #investing #trading #spytrading #spymarket #tradingmarket #stockmarket #silver

Trading Is Not Gambling: Become A Better Trader Part III'm so thankful the admins at Tradingview selected my first Trading Is Not Gambling video for their Editor's Pick section. What an honor.

I put together this video to try to teach all the new followers how to use analysis to try to plan trade actions and to attempt to minimize risks.

Within this video, I try to teach you to explore the best opportunities based on strong research/analysis skills and to learn to wait for the best opportunities for profits.

Trading is very similar to hunting or trying to hit a baseball... you have to WAIT for the best opportunity, then make a decision on how to execute for the best results.

Trust me, if trading was easy, everyone would be making millions and no one would be trying to find the best trade solutions.

In my opinion, the best solution is to learn the skills to try to develop the best consistent outcomes. And that is what I'm trying to teach you in this video.

I look forward to your comments and suggestions.

Get some.

#trading #research #investing #tradingalgos #tradingsignals #cycles #fibonacci #elliotwave #modelingsystems #stocks #bitcoin #btcusd #cryptos #spy #gold #nq #investing #trading #spytrading #spymarket #tradingmarket #stockmarket #silver

SPY/QQQ Plan Your Trade for 3-21-25 : BreakAway PatternToday's Breakaway pattern may show up in the form of an Island Top or break-away to the upside if my analysis is correct.

I see the markets stalling over the past few days, potentially setting up a "last breakaway" type of pattern today.

I've highlighted how these "last" patterns work where price sets up a peak or trough (in this case a peak) as a last/exhaustion move and how this move can sometimes be very aggressive.

I urge traders to stay cautious today as we are moving into a MAJOR REVERSAL weekend.

I believe the markets will suddenly change direction next week (early) and will move back into downward trending by March 25-26.

Gold and Silver may rally today if the markets move into that Exhaustion Peak pattern. Keep an eye out for Gold/Silver/Bitcoin to potentially rally today and into early next week.

Overall, traders should stay very cautious as we move into next week's peak/top/rollover.

Don't get too aggressive trying to prepare for the rollover or any potential upside move over the next 3-5+ days.

Let the markets show us what and when we need to be aggressive.

Get Some.

#trading #research #investing #tradingalgos #tradingsignals #cycles #fibonacci #elliotwave #modelingsystems #stocks #bitcoin #btcusd #cryptos #spy #gold #nq #investing #trading #spytrading #spymarket #tradingmarket #stockmarket #silver

SPY/QQQ Plan Your Trade For 3-20-25 : Flat-Down PatternToday's SPY Cycle pattern suggests the SPY/QQQ will stay somewhat muted in trading range today.

I still believe the SPY/QQQ are in a moderate melt-up type of trend - attempting to reach a peak near the end of this week or early next week (see the patterns for March 24, 25, 26).

Even though I believe we are struggling to try to move higher, I do believe any failure of the SPY to move above the 0.382 Fibonacci retracement level would be a technical failure related to the breadth of this pullback.

Thus, I believe the markets have at least one more attempt to try to move higher over the next 5+ days before topping and rolling over into a broader downtrend.

Gold and Silver moved solidly lower this morning - almost like a Panic type of selling. I believe this is related to the Flat-Down pattern and I believe Gold/Silver will recover fairly quickly. I do believe this is a huge opportunity for Gold/Silver over the next 30+ days. I believe Gold will attempt to move above $3500-3600 before the end of April.

BTCUSD rolled higher yesterday by more than $4000 - just like I predicted.

Incredible.

And, that is another reason why I believe the SPY/QQQ have more room to the upside than we are seeing right now.

Remember this is a trader's market.

Get some.

#trading #research #investing #tradingalgos #tradingsignals #cycles #fibonacci #elliotwave #modelingsystems #stocks #bitcoin #btcusd #cryptos #spy #gold #nq #investing #trading #spytrading #spymarket #tradingmarket #stockmarket #silver

Trading Is Not Gambling : Become A Better Trade Part IOver the last few weeks/months, I've tried to help hundreds of traders learn the difference between trading and gambling.

Trading is where you take measured (risk-restricted) attempts to profit from market moves.

Gambling is where you let your emotions and GREED overtake your risk management decisions - going to BIG WINS on every trade.

I think of gambling in the stock market as a person who continually looks for the big 50% to 150%++ gains on options every day. Someone who will pass up the 20%, 30%, and 40% profits and "let it ride to HERO or ZERO" on most trades.

That's not trading. That's flat-out GAMBLING.

I'm going to start a new series of training videos to try to help you understand how trading operates and how you need to learn to protect capital while taking strategic opportunities for profits and growth.

This is not going to be some dumbed-down example of how to trade. I'm going to try to explain the DOs and DO N'Ts of trading vs. gambling.

If you want to be a gambler - then get used to being broke most of the time.

I'll work on this video's subsequent parts later today and this week.

I hope this helps. At least it is a starting point for what I want to teach all of you.

Get some.

#trading #research #investing #tradingalgos #tradingsignals #cycles #fibonacci #elliotwave #modelingsystems #stocks #bitcoin #btcusd #cryptos #spy #gold #nq #investing #trading #spytrading #spymarket #tradingmarket #stockmarket #silver

SPY/QQQ Plan Your Trade For 3-19-25 : Top PatternToday's Top pattern suggests the SPY/QQQ will attempt to rally up to resistance, then form a peak/top in price, and then roll over a bit.

After yesterday's fairly consolidated price range, I believe the SPY/QQQ may rally through most of the day and move into the topping pattern near the end of today's trading day.

Overall, I believe the markets are still rolling into the Excess Phase Peak consolidation phase and that means traders need to prepare for extreme price volatility.

What is interesting is how BTCUSD is trying to rally a bit, but not finding upward momentum.

As I stated in today's video, I believe a fairly big move upward, possibly $3000 or more, in BTCUSD could happen between now and the end of this week.

This would be a perfect upward price advance into resistance that could correlate with a move h higher in the SPY/QQQ - targeting the upper level of the Consolidation Phase.

Gold and Silver have reached a "pause" level. I believe Gold and Silver will only pause for 48 to 96 hours before attempting to break higher. So, metals will still attempt to break higher into late March 2025.

Get some.

#trading #research #investing #tradingalgos #tradingsignals #cycles #fibonacci #elliotwave #modelingsystems #stocks #bitcoin #btcusd #cryptos #spy #gold #nq #investing #trading #spytrading #spymarket #tradingmarket #stockmarket #silver

SPY/QQQ Plan Your Trade For 3-18-25 : Gap Reversal Counter-TrendFirst off, thank you for all the great comments and feedback. I really love hearing from TradingView subscribers and how my research is helping everyone find success.

Just recently, I received some DMs from viewers saying my research has been "dead on" - which is great.

One thing is for sure, the big move in Gold/Silver is just getting started.

Today's SPY Cycle Pattern is a Gap-Reversal in a Counter Trend mode. The long-term & short-term bias is currently BEARISH - so I believe the GAP Reversal will be to the upside.

Meaning, I suggest we start the day with a mild lower GAP - followed by a moderate price reversal in early trading, leading to a continued melt-up type of trend for the SPY/QQQ

Gold and Silver are likely to attempt to melt a bit higher into the TOP pattern for today. I believe this is just a temporary resistance level for metals.

Bitcoin is struggling to find upward momentum - but I believe BTCUSD still has a $3k-$5k rally left to reach the current Consolidation highs. We'll see if it breaks higher over the next 3-5 days before rolling over into a new downtrend.

Again, I really appreciate all of my followers and viewers. I want all of you to learn to see, read, and understand price action more clearly than ever before.

That's why I don't use any technical indicators on my chart. I want you to understand PRICE is the ultimate indicator.

Get some..

#trading #research #investing #tradingalgos #tradingsignals #cycles #fibonacci #elliotwave #modelingsystems #stocks #bitcoin #btcusd #cryptos #spy #gold #nq #investing #trading #spytrading #spymarket #tradingmarket #stockmarket #silver

SPY/QQQ Plan Your Trade Video for 3-17: GAP PotentialAs we start moving into the Excess Phase Peak pattern consolidation phase, I believe the SPY/QQQ will attempt a moderate rally for about 3-5+ days, then roll into a deep selling mode after March 21-24.

I don't believe we have reached a bottom - yet.

I do see a lot of people talking about "the bottom is in" and I urge all of you to THINK.

What do you believe will be the basis of US and GLOBAL economic growth starting RIGHT NOW?

Can you name one thing that will be the driver of economic expansion and activity?

I can't either.

Thus, I suggest traders prepare for more sideways consolidation range trading over the next 60+ days as hedge assets and currencies attempt to balance risks.

BTCUSD, Gold, Silver should all be fairly quiet this week. I'm not expecting any huge price moves this week.

I expect the SPY/QQQ & BTCUSD to move a bit higher while Gold and Silver melt upward a bit further.

Then, after March 21, I expect bigger volatility and a broad rotation in the SPY/QQQ/Bitcoin where Gold/Silver will start a bigger move higher.

Get some.

#trading #research #investing #tradingalgos #tradingsignals #cycles #fibonacci #elliotwave #modelingsystems #stocks #bitcoin #btcusd #cryptos #spy #gold #nq #investing #trading #spytrading #spymarket #tradingmarket #stockmarket #silver

GOLD H1 Update: Bullish Outlook BUY DIPS by ProjectSyndicate🏆 Gold Market Highlights (March 2025)

📊 Technical Outlook

🔸Bullish OUTLOOK

🔸Broke out and set new ATH

🔸Strong UPTREND: Sequence of Higher Lows

🔸Recommend to BUY DIPS 2925/2950 USD

🔸Price Target BULLS: 3050 USD - 3100 USD

📈 Historic Milestone Achieved

🏅 Gold Futures Surpass $3,000

🔥 Gold prices hit an all-time high, closing above $3,000 ATH

🚀 Major breakout in the precious metals market!

📊 Analyst Perspectives

🔮 Continued Bullish Sentiment

📉 Both Wall Street & Main Street expect further gains beyond $3,000.

💡 Analysts see upside momentum continuing in the coming weeks.

🌍 Market Dynamics

⚡ Factors Driving the Rally

🌎 Global trade tensions & geopolitical risks pushing investors toward gold.

📌 Safe-haven demand surging amid uncertainty.

⏳ Historical Context

📜 Comparisons to the 1980 Bull Run

🔄 Parallels drawn between the current rally and the historic 1980 surge.

❓ Can gold repeat history and extend its gains even further?

🏦 Global Demand Trends

🇨🇳 China’s Record Gold ETF Inflows

📈 Massive inflows into gold ETFs in China, signaling strong demand.

💰 Jewelry demand expected to stabilize as the economy recovers.

🏦 Investor Behavior

🎯 Increased Attention Amid Uncertainty

🏛️ Investors shifting focus to gold as a hedge against economic instability.

💎 Gold’s safe-haven status reaffirmed, attracting more institutional buyers.

📢 Final Takeaway:

🔹 Gold is shining brighter than ever! 🌟

🔹 Expect volatility, but long-term outlook remains bullish. 💹

🔹 Keep an eye on key resistance & support levels. 🔍

SPY/QQQ Plan Your Trade For 3-14-25: Temp BottomToday's Cycle Pattern is a Temporary Bottom pattern. I suspect the markets may attempt to move a bit lower in early trading before attempting to find a new base/support level.

Yesterday's low may prove to be very important depending on what the markets do today. Initially, I thought yesterday's low was the Temporary Bottom pattern (one day early). But, I do believe the markets will continue to be volatile in early trading today and may move downward to retest lows before trying to move higher - setting up the Temporary Bottom pattern.

Gold and Silver will likely continue to melt upward unless there is some big news that disrupts the US Dollar's downward slide. I see Gold trying to rally above $3200 very quickly over the next 15+ days.

Bitcoin is still consolidating and is currently in a short upward price phase (much like the SPY/QQQ). In fact, the SPY/QQQ and Bitcoin are all in an EPP consolidation phase.

So, that means even though we may see a volatile type of price move over the next 15-30+ days, price is ultimately trapped in a consolidated price range and will/should attempt to break downward into the Ultimate Low.

Therefore, if we get a moderate pullback/rally phase over the next 5+ trading days, be aware that the rally upward will end near March 21-24 and turn downward very sharply before the end of March (based on my research).

You have lots of opportunity if this base sets up for a moderate rally in the SPY/QQQ, but play it cautiously as I don't believe we'll see new ATHs anytime soon.

Get some.

#trading #research #investing #tradingalgos #tradingsignals #cycles #fibonacci #elliotwave #modelingsystems #stocks #bitcoin #btcusd #cryptos #spy #gold #nq #investing #trading #spytrading #spymarket #tradingmarket #stockmarket #silver

Blood Moon Bottom? Lunar Study on Bitcoin Price Action.In my years as a commodity trader, it crossed my desk multiple times the incredible frequency in which full moons aligned with significant price action sessions amongst precious metals; almost with a degree of precision that is hard to believed if measured too closely.

Tonight there will be the first Blood Moon since 2022, which stood out to me on the session that gold set new all time highs and silver showed signs of incredible strength and momentum.

I was curious of the rarity of Blood Moons, and upon learning the date of the last occurrence, something stood out to me. I knew it was right around the time that the FTX disaster found a bottom, and a new bull market kicked off in equities on the back of AI exuberance.

Then I looked a little closer. They were not just close in proximity, but the last Blood Moon occurred nearly at literal Bitcoin bottoms in the wake of the FTX disaster .

Whoa. Okay, certainly there are coincidences out there, and I've seen technical analysis referred to as "astrology for men" enough times to exercise a little restraint on this topic, but I found it fascinating.

Will this Blood Moon mark a local low before resumption of bullish momentum? Will equities have marked a bottom too?

RSI around both events reached very similar levels too.

For those that want to investigate further, check out the 2014 Blood Moons on top of a Bitcoin chart.

SPY/QQQ Plan Your Trade EOD Update for 3-13-25What a crazy day. The markets certainly decided to burn the longs almost all day.

I got a few messages from traders who continued trying to pick bottoms in this downtrend. FYI, that can be very dangerous.

If you are a short-term trader and are trying to pick a base/bottom all day today - you have to have a limit in terms of how much you are willing to risk within a single day.

I've seen dozens of traders blow up their accounts in a big, trending market.

Please learn from your actions. Develop a STOP POINT related to your trading decisions.

There is no reason to continue to try to execute "bounce" trades when the markets are trending as strongly as they are today.

This video should help you understand what I see as the potential over the next 5+ days.

We are still trying to hold above critical support near the 50% retracement level on the SPY.

Everything depends on what happens in DC and how the markets perceive risks.

Gold/Silver rallied very strong today. This is FEAR related to risks.

If the US government enters a shutdown, Gold and Silver could skyrocket much higher.

Get some.

#trading #research #investing #tradingalgos #tradingsignals #cycles #fibonacci #elliotwave #modelingsystems #stocks #bitcoin #btcusd #cryptos #spy #gold #nq #investing #trading #spytrading #spymarket #tradingmarket #stockmarket #silver

SPY/QQQ Plan Your Trade Update For 3-13-25 - Fear Settling InWith the US government only about 39 hours away from a complete SHUT DOWN, I want to warn everyone that metals are doing exactly what they are supposed to do - hedge risks. While the SPY/QQQ are continuing to melt downard.

I created this video to show you the Fibonacci Trigger levels on the 60 min SPY chart, which I believe are very important. Pause the video when I show you the proprietary Fibonacci price modeling system and pay attention to the fact that any upward price trend must rally above 563.85 in order to qualify as a new Bullish price trend.

That means we need to see a very solid price reversal from recent lows or an intermediate pullback (to the upside) which will set a new lower Bullish Fibonacci trigger level.

Overall, the SPY/QQQ are in a MELT DOWN mode and I expect this to last into early next week unless the US government reaches some agreement to extend funding.

This is not the time to try to load up on Longs/Calls.

The US and global markets are very likely to MELT DOWNWARD over the next 2 to 5+ days if the US government does SHUT DOWN.

FYI.

Gold and Silver may EXPLODE HIGHER.

Get some.

#trading #research #investing #tradingalgos #tradingsignals #cycles #fibonacci #elliotwave #modelingsystems #stocks #bitcoin #btcusd #cryptos #spy #gold #nq #investing #trading #spytrading #spymarket #tradingmarket #stockmarket #silver

SPY/QQQ Plan Your Trade For 3-13-25: Carryover PatternToday's pattern suggests the markets may attempt to continue to find support and move into a sideways pullback (upward) price channel.

I believe the markets have reached an exhaustion point that will move the SPY/QQQ slightly upward over the next 5 to 10+ days - reaching a peak near the 3-21 to 3-24 Bottoming pattern.

This bottoming pattern near March 21-24 suggests the markets will move aggressively downward near that time to identify deeper support.

I believe metals will continue to move higher as risks and fear drive assets into safe havens.

Bitcoin should continue to slide a bit higher while moving through the consolidation phase.

Watch today's video to learn more about what I do and how I help traders find the best opportunities.

Get some.

#trading #research #investing #tradingalgos #tradingsignals #cycles #fibonacci #elliotwave #modelingsystems #stocks #bitcoin #btcusd #cryptos #spy #gold #nq #investing #trading #spytrading #spymarket #tradingmarket #stockmarket #silver

SPY/QQQ Plan Your Trade for 3-12-25 : Rally111 PatternToday's Rally pattern in Carryover mode may prompt a powerful base/bottom move in the SPY/QQQ.

In today's video, I explain in great detail how I read these charts and why the Excess Phase Peak (EPP) patterns are so important.

We are moving into the Consolidation Phase of the EPP patterns for the SPY/QQQ.

We are already into the Consolidation Phase of an EPP pattern for Bitcoin

Gold and Silver are a bit mixed. Yet Silver has already broken above the upper EPP Peak, rallying into a new EPP Peak level. Meanwhile, Gold is still struggling to find momentum for a bullish breakout.

While I don't believe the US markets are poised for a big downward price move, today's video shows you what may be likely 4 to 12+ months into the future.

So, pay attention to today's video. It clearly illustrates how to use the EPP patterns with Fibonacci and shows you what I believe could happen over the next 6 to 12+ months.

If the SPY/I continues to try to rally higher today, it will be interesting. This means we have potentially found our consolidation base and are now moving into a very volatile sideways consolidation phase.

Get some.

#trading #research #investing #tradingalgos #tradingsignals #cycles #fibonacci #elliotwave #modelingsystems #stocks #bitcoin #btcusd #cryptos #spy #gold #nq #investing #trading #spytrading #spymarket #tradingmarket #stockmarket #silver