XAUUSD Gold Trading Strategy August 11, 2025XAUUSD Gold Trading Strategy August 11, 2025:

At the beginning of the new week's trading session, the gold price fell sharply from the 340x area to the current 335x area.

Basic news: The US Dollar Index (DXY) fell to around 98 last week, unable to stay above 100. Although the 10-year Treasury yield rose to 4.285%, the Dollar remained under pressure, reflecting market concerns about political risks in the United States.

Technical analysis: After the price met the 340x resistance area, it fell sharply. Currently, the H1 frame MA lines have turned into resistance, but the H4 frame is still support. The H1 frame RSI is showing signs of increasing again and moving towards the average line; the H4 frame RSI is adjusting towards the oversold area. We will wait at the resistance areas and liquidity areas to trade.

Important price zones today: 3375 - 3380, 3350 - 3355 and 3395 - 3400.

Today's trading trend: SELL.

Recommended orders:

Plan 1: SELL XAUUSD zone 3378 - 3380

SL 3383

TP 3375 - 3365 - 3355 - 3330.

Plan 2: SELL XAUUSD zone 3395 - 3397

SL 3400

TP 3392 - 3382 - 3362 - 3330.

Plan 3: BUY XAUUSD zone 3353 - 3355

SL 3350

TP 3358 - 3368 - 3378 - 3390 (small volume).

Wish you a safe, successful and profitable new trading week.🥰🥰🥰🥰🥰

Gold-trading

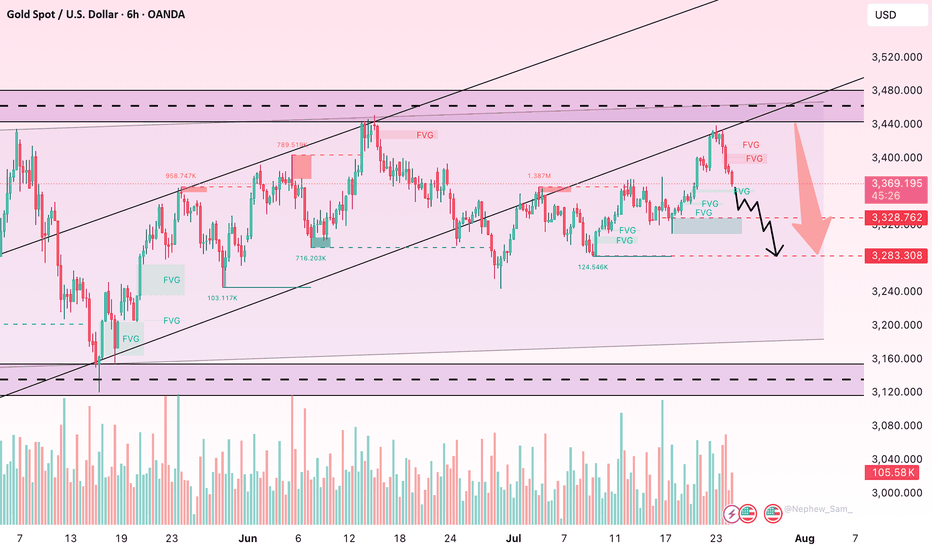

Gold’s Uptrend Faces Critical Test at Channel ResistanceThe current price action on GOLD remains confined within a well-defined ascending channel, reflecting a steady bullish structure. Recent bounces from the lower boundary have reinforced buyers’ confidence, while sellers have struggled to push the market below key support levels.

However, despite the upward structure, momentum is showing early signs of fatigue as the price approaches the channel’s upper boundary. Without a decisive breakout, the probability of a temporary pullback or consolidation phase increases substantially.

This is a sensitive zone for new entries without confirmation. A clean breakout above the channel could trigger fresh buying pressure, but a failure here may trap late buyers and lead to a sharp retracement. Patience remains essential — wait for a confirmed break or rejection before committing to a position.

Gold Retests Support – Waiting for the Next Trend ConfirmationHello everyone, looking at the 4H XAU/USD chart, it’s clear that gold is undergoing a pullback after breaking above its previous high at $3,380. Although the market has formed a higher high, we now see a Fair Value Gap (FVG) appearing, with price consolidating sideways between $3,360 and $3,380.

This reflects market indecision about the next move. Currently, gold is testing a strong support zone at $3,360 — an area with an unfilled FVG. If this support holds, gold may rebound and continue toward $3,400. Conversely, if $3,360 breaks, the next support lies at $3,312, where significant trading volume occurred previously.

Bullish Scenario

If gold holds above $3,360 and breaks above $3,380 with confirmed volume, the next target will be $3,400–$3,420, where strong resistance is located.

Bearish/Correction Scenario

If gold loses the $3,360 support, it could correct toward $3,312, or even retest the major support at $3,280. A deeper correction would present new buying opportunities at lower support zones.

With the current setup, the market is in a decision-making phase. A confirmed breakout or rejection at $3,360 will be a key factor in determining the next trend. What do you think of these scenarios? Share your view in the comments below!

XAUUSD Gold Trading Strategy August 7, 2025XAUUSD Gold Trading Strategy August 7, 2025:

Gold prices are steady as US President Donald Trump has imposed an additional 25% tariff on Indian goods due to India's continued purchases of Russian energy. This new measure raises the current 25% tariff on Indian goods to 50%.

Fundamental news: The current market pulse is still mainly revolving around the tariff story initiated by Trump, in which spot gold is trading in a fairly narrow range. Gold is still waiting for further impact from the Fed's interest rate cut process, a weaker dollar will create support for non-yielding gold.

Technical analysis: The trading range of gold prices is currently narrowing, RSI on H1 and H4 frames is approaching the overbought zone. Gold prices have recovered, but resistance zones such as 3400 - 3405 and 3420 - 3425 can be short-term profit-taking areas for investors. Liquidity zones and Fibonacci frames show that the upward force of gold prices is showing signs of slowing down.

Important price zones today: 3373 - 3378, 3400 - 3405 and 3420 - 3425.

Trading trend today: SELL.

Recommended orders:

Plan 1: SELL XAUUSD zone 3402 - 3404

SL 3407

TP 3399 - 3390 - 3380 - 3360 - OPEN.

Plan 2: SELL XAUUSD zone 3423 - 3425

SL 3428

TP 3420 - 3410 - 3390 - 3370 - OPEN.

Plan 3: BUY XAUUSD zone 3373 - 3375

SL 3370

TP 3378 - 3388 - 3400 (small volume).

Wishing you a safe, successful and profitable trading day.💗💗💗💗💗

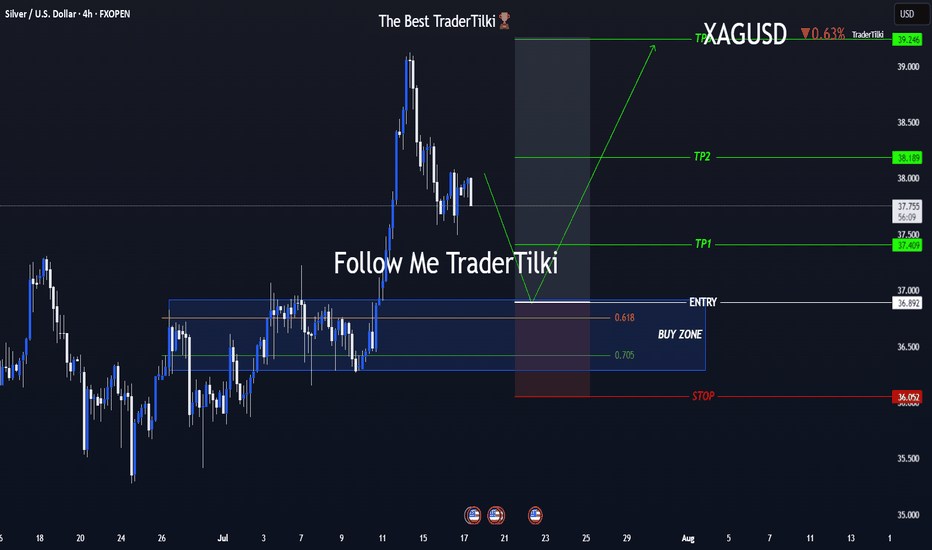

One Shot, Clear Strategy – Silver Buy Zone in SightHey everyone 👋

📌 BUY LIMIT ORDER / XAGUSD-SILVER Key Levels

🟢 Entry: 36,892

🎯 Target 1: 37,409

🎯 Target 2: 38,189

🎯 Target 3: 39,246

🔴 Stop: 36,052

📈 Risk/Reward Ratio: 2,79

I double-checked the levels and put together a clean, focused analysis just for you. Every single like seriously boosts my motivation to keep sharing 📈 Your support means the world to me! Huge thanks to everyone who likes and backs this work 💙 Our goals are crystal clear, our strategy is solid. Let’s keep moving forward with confidence and smart execution!

Gold Trading Strategy XAUUSD August 6, 2025Gold Trading Strategy XAUUSD August 6, 2025:

Spot gold edged lower in Asian trading yesterday (August 5), currently trading around $3,380/ounce. On Tuesday, the US ISM Services PMI came in at 50.1, below the forecast of 1.4 and below the previous month's reading of 0.7; the news sent gold prices soaring in the US session.

Fundamentals: Gold prices surged after weak jobs data increased the likelihood of a rate cut by the Federal Reserve. Data released last Friday showed that the number of new jobs in the US non-farm sector was much lower than expected, indicating a sharp deterioration in the labor market. The probability of the Fed cutting interest rates in September increased to 87%, up from 63% last week.

Technical analysis: Gold price is still in the uptrend channel in the H1 frame, the 3365 - 3370 area is supporting the gold price to continue following the price channel. If the gold price continues to fluctuate according to the price channel, the next prospective area could be 3400 - 3405 or even 3420 - 3425. However, the RSI and MA lines have shown signs that the buyers are weakening, so the gold price is very likely to have a strong correction from today until the end of the week.

Important price zones today: 3365 - 3370, 3400 - 3405 and 3420 - 3425.

Today's trading trend: SELL.

Recommended order:

Plan 1: SELL XAUUSD zone 3403 - 3405

SL 3408

TP 3400 - 3390 - 3380 - 3350 - OPEN.

Plan 2: SELL XAUUSD zone 3423 - 3425

SL 3428

TP 3420 - 3420 - 3400 - 3380 - OPEN.

Plan 3: BUY XAUUSD zone 3365 - 3367

SL 3362

TP 3370 - 3380 - 3390 - 3400.

Wish you a safe, successful and profitable trading day.🥰🥰🥰🥰🥰

Gold Trading Strategy XAUUSD August 6, 2025Gold Trading Strategy XAUUSD August 6, 2025:

Spot gold edged lower in Asian trading yesterday (August 5), currently trading around $3,380/ounce. On Tuesday, the US ISM Services PMI came in at 50.1, below the forecast of 1.4 and below the previous month's reading of 0.7; the news sent gold prices soaring in the US session.

Fundamentals: Gold prices surged after weak jobs data increased the likelihood of a rate cut by the Federal Reserve. Data released last Friday showed that the number of new jobs in the US non-farm sector was much lower than expected, indicating a sharp deterioration in the labor market. The probability of the Fed cutting interest rates in September increased to 87%, up from 63% last week.

Technical analysis: Gold price is still in the uptrend channel in the H1 frame, the 3365 - 3370 area is supporting the gold price to continue following the price channel. If the gold price continues to fluctuate according to the price channel, the next prospective area could be 3400 - 3405 or even 3420 - 3425. However, the RSI and MA lines have shown signs that the buyers are weakening, so the gold price is very likely to have a strong correction from today until the end of the week.

Important price zones today: 3365 - 3370, 3400 - 3405 and 3420 - 3425.

Today's trading trend: SELL.

Recommended order:

Plan 1: SELL XAUUSD zone 3403 - 3405

SL 3408

TP 3400 - 3390 - 3380 - 3350 - OPEN.

Plan 2: SELL XAUUSD zone 3423 - 3425

SL 3428

TP 3420 - 3420 - 3400 - 3380 - OPEN.

Plan 3: BUY XAUUSD zone 3365 - 3367

SL 3362

TP 3370 - 3380 - 3390 - 3400.

Wish you a safe, successful and profitable trading day.🥰🥰🥰🥰🥰

Gold Trading Strategy XAUUSD August 4, 2025Gold Trading Strategy XAUUSD August 4, 2025:

Gold prices rose more than 2% last Friday, hitting a one-week high, as weaker-than-expected US non-farm payrolls data boosted hopes for a Federal Reserve rate cut and the announcement of new tariffs fueled safe-haven demand for gold.

Fundamental news: The non-farm payrolls report showed only 73,000 jobs added in July, well below market expectations of 110,000. The unemployment rate rose to 4.2%, indicating a cooling labor market.

Technical Analysis: Gold prices are rising strongly after a strong candle in the 3285 - 3300 area as previously predicted. The bullish pattern on the H1 frame has shown that the buyers are returning very strongly. Currently, the price is showing signs of sideway at the 336x area, our strategy today will be to wait for trading at the support zones of the gold price. Important price zones today: 3315 - 3320 and 3330 - 3335.

Today's trading trend: BUY.

Recommended orders:

Plan 1: BUY XAUUSD zone 3330 - 3332

SL 3327

TP 3335 - 3345 - 3355 - 3370.

Plan 2: BUY XAUUSD zone 3318 - 3320

SL 3315

TP 3323 - 3333 - 3343 - 3363.

Plan 3: SELL XAUUSD zone 3370 - 3372

SL 3375

TP 3367 - 3357 - 3347 - 3337 (small volume).

Wishing you a safe, smooth and profitable trading week.💗💗💗💗💗

XAUUSD 4Hour TF - August 3rd,2025🟦 XAUUSD 4H Analysis Long Idea

📅 August 3rd, 2025

🔹 Top-Down Trend Bias:

• Monthly – Bullish

• Weekly – Bullish

• Daily – Bullish

• 4H – Bullish

Price has broken out of a consolidation, confirming short term bullish momentum in alignment with the higher timeframes. We’re now watching how price reacts on a potential retest of the key $3,320 structure.

🔍 Key Level: $3,320

This former resistance now acts as a critical support zone. How price reacts here will determine short-term direction.

✅ Scenario A: Bullish Continuation

Clean retest of $3,320–$3,335

1.Look for bullish confirmation: wick rejections, bullish engulfing, or lower timeframe structure shift

Target 1: $3,395

Target 2: $3,450

This setup aligns with the overall bullish bias. We have ideal R:R with a clear invalidation to exit on if $3,320 fails as support.

⚠️ Scenario B: Bearish Rejection

1.Failure to hold $3,320 = potential trap breakout

2.Look for structure below $3,320 + bearish conviction

Target: $3,225 support zone

Only valid if $3,320 flips to resistance and confirms structure shift.

🧠 Final Notes

• Let price confirm the setup

• Structure > emotion

• Both scenarios are valid, but only with confirmation

Gold price analysis July 31XAUUSD – Bearish pressure still prevails, watch for SELL in the direction of the trend

Yesterday's session witnessed a strong decline when the D1 candle closed with selling pressure up to 60 prices, forming a key candle that shapes the trend. When the market forms a main candle, the 25% and 50% candle body areas are often important price areas to continue trading in the direction of the main trend.

In the current context, the priority strategy will be to sell in the direction of the downtrend when the price rebounds to the resistance areas and there is a rejection signal.

🔹 Important resistance areas:

3301 – 3312 – 3333

🔸 Target support areas:

3285 – 3270 – 3250

🎯 Trading strategy:

Prioritize SELLing at the resistance area of 3301–3312 when there is a price reaction (rejection).

Target: 3250

BUY only considered when 3313 area is broken decisively.

Staying disciplined and sticking to the reaction price zone will be key in the context of the market moving in a clear trend.

Gold’s Next Move: Bounce or Breakdown?Gold is pulling back after breaking the 3,360 USD resistance on the 6-hour chart. Price is currently testing the nearest fair value gap (3,370–3,380), but upside momentum is stalling, partly due to unfilled supply zones above.

A retest of the lower FVG near 3,340 will be key. Holding above this level could trigger renewed buying, while a break below may invalidate the bullish structure.

Traders should closely monitor whether downside gaps continue to fill and how price behaves near support zones. Lack of strong liquidity could lead to a false breakout.

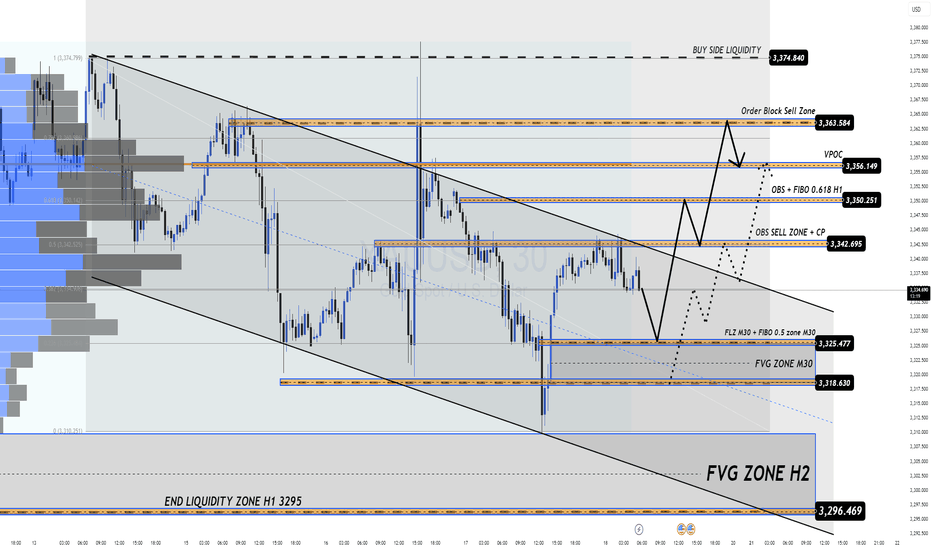

18/07 Gold Outlook Market Tensions Mount Liquidity Zones in Play Gold Outlook – Market Tensions Mount, Liquidity Zones in Play

Price action heats up as we enter the final trading day of the week. Are you ready to ride the wave or get caught in the liquidity sweep?

🔍 Market Sentiment & Global Highlights

Gold rebounded strongly after dropping on better-than-expected US data. However, several macro risks are keeping gold buyers in the game:

Buy-the-dip activity emerged amid concerns that Trump’s tariff policies may fuel inflation.

Rate cut expectations remain strong as US core inflation shows no signs of cooling.

Geopolitical risks intensified as Israel conducted fresh airstrikes on Syria.

EU threatens $84B in tariffs on US goods should trade talks break down.

💡 These tensions are giving gold strong support — especially as traders prepare for potential volatility into the weekend.

📈 Technical Overview – Liquidity Zones at Play

Yesterday's bounce from FLZ H2 (3310) — a critical demand and liquidity zone — triggered a clean reversal. Sellers took profit, volume shifted, and buyers regained control. Price has since pushed up to retest the OBS SELL ZONE + CP Pattern near the 334x area with a sharp reaction.

For today, price is likely to revisit lower liquidity pockets (M30–H2) before making the next directional move.

🔑 Key Levels to Watch

🟢 BUY ZONE: 3318 – 3316

Stop Loss: 3312

Take Profits: 3322 – 3326 – 3330 – 3335 – 3340 – 3345 – 3350 – 3360+

⚡ BUY SCALP ZONE: 3326 – 3324

Stop Loss: 3320

Take Profits: 3330 – 3335 – 3340 – 3345 – 3350 – 3360

🔴 SELL ZONE: 3363 – 3365

Stop Loss: 3370

Take Profits: 3360 – 3355 – 3350 – 3346 – 3342 – 3338 – 3335 – 3330

⚠️ Final Notes

Today’s session has no major news releases, but as it’s the end of the week, we may see liquidity grabs and unexpected volatility. Stay disciplined, stick to your plan, and always respect TP/SL.

🔔 Follow the key zones carefully – volatility loves indecision.

Smart 15-Min Entry on USDJPY – Clear Plan with 2.33 R/R📢 Hey Guys;

I've placed a buy limit order on USDJPY at a key support level.

🔵 Entry: 145.956

🔴 Stop Loss: 145.743

🟢 Targets:

• TP1: 146.069

• TP2: 146.232

• TP3: 146.468

📐 Risk/Reward Ratio: 2.33

-------

Your likes and support are what keep me motivated to share these analyses consistently.

Huge thanks to everyone who shows love and appreciation! 🙏

GOLD SELL M15Gold (XAU/USD) 15-Min Chart Analysis – July 9, 2025

The price is currently trading around the 3,295 level, after a recent Change of Character (CHoCH) and Break of Structure (BOS) indicating a shift from bullish to bearish momentum.

The market has formed a consolidation zone (highlighted in purple), suggesting a possible bearish continuation setup. Price is expected to retest the supply zone and then move lower.

Sell Setup Details:

Entry Zone: Inside the purple consolidation range (~3,295–3,297)

Stop Loss (SL): 3,305

Target (TP): 3,282

Key Support Levels:

3,292.16

3,288.16

3,282.39 (Main Target Zone)

This setup anticipates a bearish move after a rejection from the supply area, aiming for the liquidity zone near 3,282.

XAUUSD Below 3300 – Buying Opportunity or Trap? Gold Breaks Below 3300 – A Buying Opportunity or Sign of Deeper Correction?

🧭 Weekly Kickoff: Is the Sell-off Really That Dangerous?

At the start of the week, gold experienced a sharp drop to 3306 USD, breaking through the psychological 3300 support level and testing the 329x region. However, this isn't necessarily a sign of a sustainable downtrend — it's more likely a liquidity sweep before the market consolidates again for a bigger move.

🌐 Macro Updates Impacting Gold:

US inflation continues to ease, providing space for the Fed to loosen policy if needed.

FOMC minutes due soon — markets will be closely watching for clues about possible rate cuts.

Tensions in Gaza de-escalate temporarily, leading to a slight reduction in demand for safe-haven assets.

Trump's new tax bill has been passed, adding pressure to US public debt.

US–China trade war may be delayed — reducing short-term geopolitical pressure.

In summary, we are in a consolidation phase, with a high probability of a breakout in the coming days.

📉 Technical Analysis – CP Pattern in Focus

We are seeing a Continuation Pattern (CP), which generally signals that the current correction is a pause before the trend continues.

After rejecting resistance at 3336, gold fell, breaking through the 3323 support and quickly testing the 3303 zone, a key short-term support.

If gold breaks below 3293, the next target will be the 3278 USD liquidity zone, where strong buying could emerge.

📌 Key Trading Plan – 04 July

🔵 BUY ZONE

3294 – 3292

Stop Loss: 3288

Take Profit: 3298 → 3302 → 3306 → 3310 → 3315 → 3320 → 3330

🔴 SELL SCALP

3324 – 3326

Stop Loss: 3330

Take Profit: 3320 → 3316 → 3312 → 3308 → 3304 → 3300

🔴 SELL ZONE

3350 – 3352

Stop Loss: 3356

Take Profit: 3346 → 3340 → 3335 → 3330 → 3320

🧠 Market Sentiment Today

The market is currently in a consolidation phase, likely trading sideways between 3320 and 3340. A breakout seems likely once the liquidity from the US holiday subsides.

✅ Primary Bias: Look to buy dips into support zones.

⚠️ Alternative View: Only consider selling if price clearly rejects key resistance levels.

💬 What’s Your View on Gold Today?

Do you think gold will break through 3390 soon, or is there more room for a deeper correction towards 3270?

👇 Share your thoughts and analysis in the comments below!

Missiles in the Middle East, Headwinds on Nasdaq: NAS100 onHey There;

The trend line on the NAS100 has been broken to the downside. My target level after this breakout is 21,299.47. If the price moves towards this level, I think it will reach my target in line with fundamental analysis due to the broken trend line and Iran-Israel war tensions.

I meticulously prepare these analyses for you, and I sincerely appreciate your support through likes. Every like from you is my biggest motivation to continue sharing my analyses.

I’m truly grateful for each of you—love to all my followers💙💙💙

GOLD: Absolute Price Collapse Ahead! Short!

My dear friends,

Today we will analyse GOLD together☺️

The recent price action suggests a shift in mid-term momentum. A break below the current local range around 3,292.92 will confirm the new direction downwards with the target being the next key level of 3,284.27 and a reconvened placement of a stop-loss beyond the range.

❤️Sending you lots of Love and Hugs❤️

Gold Loses 3,220 – Will It Fall Further?Gold has just broken through the 3,220 support and closed the H4 candle at $3,213/ounce. The strong red candle with volume shows that the sellers are still in control. I saw the EMA34 cut down to the EMA89 early and maintained a negative slope – confirming a clear downtrend.

I am watching the 3,180 – 3,200 zone as the next target. If the price rebounds but does not surpass 3,240, I will continue to sell. The current situation is not suitable for buying against the trend, especially when the USD is still strong and the safe-haven sentiment is decreasing.

Is gold about to break $3200 support?Gold has been trending lower amid growing risk appetite with stocks surging higher.

With no big bearish catalyst in sight for stocks, the market mood is optimistic and that means the pressure on gold is growing for a drop. The big macro driver has been a thaw in US-China trade tensions. With tariff rollbacks on both sides and negotiations showing real progress, investors are getting more comfortable. What’s more, Tuesday’s softer-than-expected US inflation print added fuel to the fire — calming nerves that Trump's trade tariffs would trigger a fresh inflation wave.

So, for now, sellers are in control of defensive plays like gold and yen, while the tech sector, especially chipmakers, is the main beneficiary.

Gold could potentially break THIS key support area around $3200 after making lower highs and lower lows on the intra-day charts. While the long-term trend is still bullish, I wouldn't be surprised if the bearish momentum continued for a few more days.

The first downside target is at 3136, followed by 3073 and then - the big level - 3,000. Could we see a drop to these levels in the coming days?

By Fawad Razaqzada, market analyst with FOREX.com

Gold breaks through 3,300 – Selling pressure has not stoppedGold price plummeted from 3,325 to 3,237 USD/ounce after the US and China reached a temporary agreement to reduce taxes. The stock market is up, the USD is strong, money flows out of gold. I see selling pressure clearly dominating.

On H1, the price is still below EMA34 and EMA89, recovering weakly around 3,260. H4 confirms the downtrend that has been formed before. If it does not surpass 3,270, I am inclined to believe that gold will continue to fall to 3,200 – 3,180.

Gold Breaks Support Level – The Downtrend May Not StopAfter peaking at $3,500/ounce in April, gold is in a clear correction phase. On the H4 chart, the price has broken through both the EMA34 and EMA89, indicating that a short-term downtrend has been established. The most recent session closed at $3,223, losing nearly $130 in just a few sessions.

The sharp decline appeared after a long rally and the peak was rejected many times. The break through the EMA89 support has triggered technical selling pressure, reflecting the psychology of profit-taking after failing to surpass the old peak.