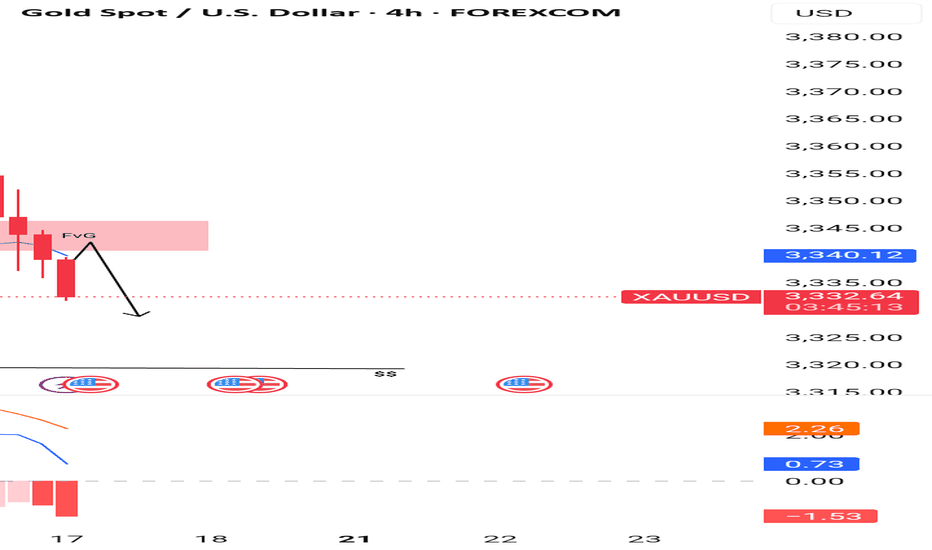

Gold Just Flipped Is the Drop Coming?🚨 Gold Market Update – Are You Ready? 🚨

Yesterday, the gold market swept the liquidity from the previous days taking out stop orders and clearing out weak positions. After the sweep, price closed lower, showing clear signs of weakness. 📉

But that’s not all...

In the process, it also broke through a key bullish Fair Value Gap (FVG) an area where buyers had previously shown strength. That FVG is now inverted, meaning it could act as a strong resistance level going forward.

With this shift in structure, there's a real possibility that gold could drop further, potentially hunting the liquidity resting near previous lows. The market might be gearing up for a deeper move.

🔥 So the question is:

Are YOU ready for the next leg down?

📌 As always Do Your Own Research (DYOR)

This is not financial advice just reading the tape.

Goldbears

GOLD is About to COLLAPSE from a Fake Pump!📊 GOLD SMC Analysis (XAU/USD 4H)

Gold just tapped into a major Fair Value Gap + Premium OB Zone, aligning with the 79% retracement level. Market structure shows exhaustion, and a perfect short setup is forming.

🔍 Smart Money Narrative:

Strong prior bearish move = institutional sell-off ✅

Clean retrace into FVG (Fair Value Gap) and OB (Order Block) = sell zone 💯

Price tapped into 3,351 – 3,364 range (marked red)

That level aligns with the 79% Fib + channel resistance 🚨

The confluence = Smart Money liquidity grab ➡️ expect dump

📍 Key Confluences:

✅ FVG: clear imbalance filled (great trap zone)

✅ Order Block: bearish origin of last impulse

✅ 79% Fib Level: classic retracement kill zone

✅ Bearish Trendline + Channel Top: dynamic resistance

✅ 3:1+ RRR short idea in play

📉 Trade Plan (Sell Setup):

Entry Zone: 3,351 – 3,364

Stop Loss: 3,442 (above swing high)

Take Profit:

TP1: 3,280 (61.8% level)

TP2: 3,120.76 (full move, 0% Fib)

RRR: 1:3 to 1:4 🤑🔥

🧠 Institutional Logic:

Retail is chasing breakout highs 😬

Smart Money is selling into OB + FVG → trap those late longs

Next? Smash weak lows and rebalance price with a deep pullback

💬 “Gold’s headed for a cliff dive?” Drop a 💰 or ‘XAU’ if you’re riding this wave down!

Gold’s Showdown: Bulls vs. Bears at the Make or Break Level🚀 Gold on the Edge: Breakout or Fakeout?

Alright, gather around, folks. Gold’s approaching that ⚔️ Make or Break Level, and this is where things get spicy. It’s like watching two fighters square up—you know something big is about to happen.

💡 Why This Level Matters

We’re at the spot where bulls and bears are throwing shade and maybe a few punches. This level isn’t just another line on the chart; it’s the VIP zone where momentum either takes off or taps out.

Right now, we’re leaning bullish—especially if Gold punches through and holds above this zone. We’re looking for a breakout that could take us toward 3,380, maybe even 3,420 if the party keeps going.

But… if the bears win this round and push back, we’re eyeing 3,288 as a second chance for buyers. Think of it as a rebound opportunity—if Gold stabilizes there, it could still be game on for the bulls.

📝 Our Playbook:

Breakout confirmed? Ride the momentum.

Fakeout rejection? Watch for buys at 3,288—a possible second chance for the bulls.

Stay sharp and react—no hero moves. We’re letting the price action decide.

Your thoughts? Bullish or bearish on Gold at this level? 🐂🐻

Gold is again with bears. VWAP setup & Silver remains 30.10

My apologies if I am short one-day & long the next.

About 48 hours ago I wrote that I thought Gold would likely get a bump-up & then sell off to the 14-18 November Lows, seen in this chart below 4HR.

The main chart above shows Gold's weakness in a VWAP setup, where price, MA and the average VWAP move below VWAP (purple line).

There was also a bullish head n shoulders pattern in the Asia session today early, very low timeframes, which nobody wanted a bar of.

So lets quickly talk Silver, it sells off about 15 hours ago from a TOP2 and sells off very aggressively, but price normally turns around at the bottom and moves back up the charts.

But in XAGUSD the above has not happened. It's been sitting at the bottom around 30.09 and hourly candles show this occurring. Nobody is buying Silver down there. Silver is awaiting its big-brother to come down the corridor.

So what happens next? I think Gold sells off back down to levels near Silver and a move back to the 14-18 November lows.

Yesterday I traded gold from around 2635 up to 2650 I think it was. So it moved up nice in the Asia session. Then price stalled for 4 or 5 hours. There should've been my cue that something was not right in the long entry for gold, then reading into economic data I thought was okay was my next mistake.

I look for the bigger moves in trading which is much harder, some will put out an alert for a few pips here and there and still claim a win when their Stop was taken-out, they are stats-driven of course for their telegram channel 4! Cheers