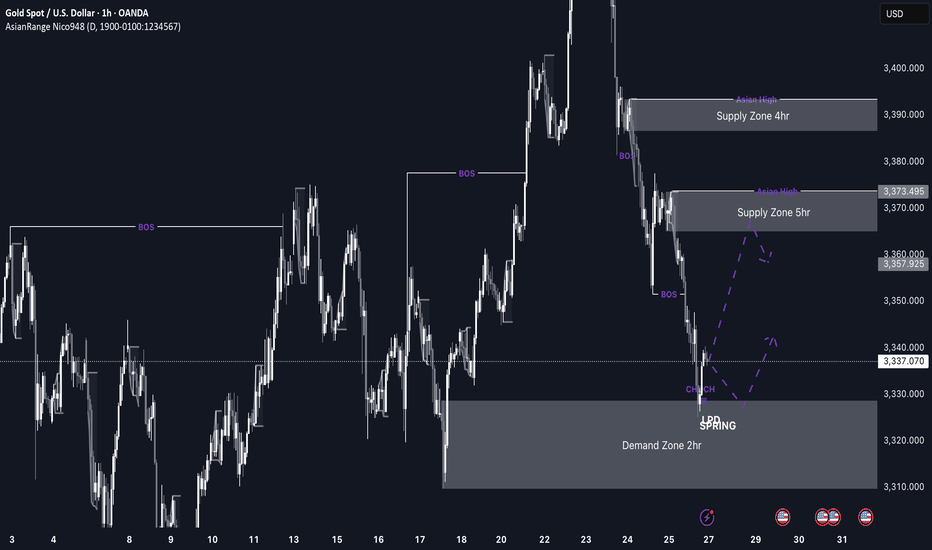

GOLD imminent possible buys up to 3,370 This week’s price action on GOLD is shaping up to be very interesting. After weeks of sustained bearish pressure, price has now entered a discounted 2hr demand zone sitting at a swing low, which makes it a high-probability area for a bullish reaction, especially as markets open.

If we do get the expected bullish reaction from this level, I’ll be watching the 3,370 region, where there’s a clean 5hr supply zone. If price reaches that level, I’ll be looking out for distribution and a potential short setup from there.

Confluences for GOLD Longs:

Price has been very bearish recently, so a retracement is expected

Currently sitting in a discounted 2hr demand zone

The overall long-term trend is still bullish

Early signs of accumulation and bullish reaction from this zone

P.S. If price fails to hold this current demand zone and breaks lower, then bearish momentum may continue. In that case, I’ll look for new long opportunities around 3,290 where a deeper demand zone exists.

Goldbuysetup

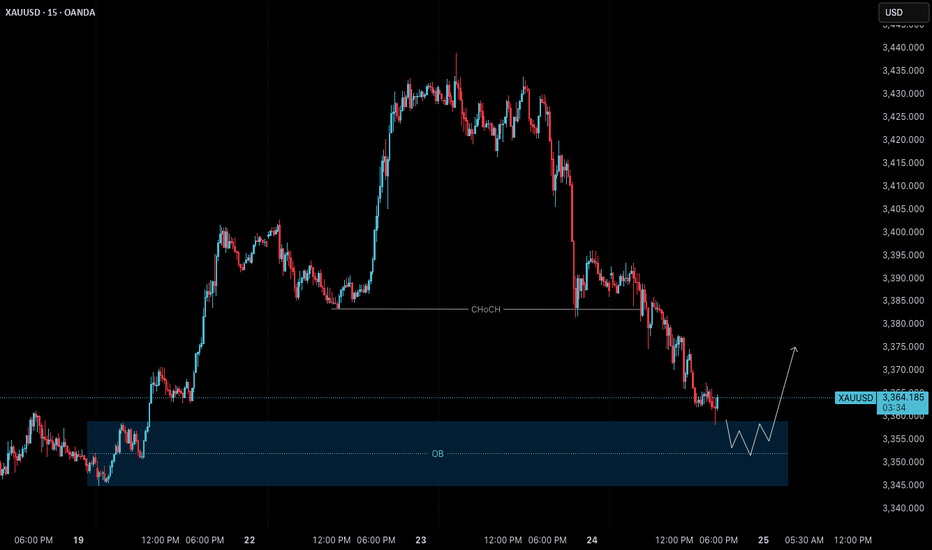

Gold – 24 July: Watching H4 OB Zone for Bullish ReversalGold – 24 July Outlook

Watching H4 OB Zone for Potential Reversal

📌 Recap of 23 July Trade:

As outlined in yesterday’s analysis, the M15 Order Block ( 3417–3412 ) held well. The market reacted precisely from this level, and our long setup successfully hit the defined 120-pip target .

However, after reaching a high near 3434 , the price failed to break above and instead rejected sharply, breaking the recent M15 higher low — a key structural sign that signals the start of a possible H4 pullback phase.

🔍 Current Market Context:

Trend Overview:

While the overall bias remains bullish, this break of M15 structure suggests short-term weakness and a corrective move in progress on the H4 chart.

Key Zone in Focus:

H4 Order Block Zone: 3359 – 3345

This is a critical zone to watch today. The market is currently trading around this area, and it could act as a potential reversal point where the uptrend resumes.

🎯 Trading Plan:

– Closely monitor the price action within the 3359–3345 zone.

– If price respects this zone and LTF (e.g., M1) shows signs of structure flip or ChoCH + BoS , it could present a fresh long setup opportunity.

– As always, only act on the trade if multiple confluences align — don’t anticipate, let the market confirm.

📈 Summary:

Bias: Watching for a bullish reversal from the 3359–3345 zone.

Setup Condition: Wait for clear LTF confirmation before entering.

Risk Management: Stick to 1:3 RR — 40 pip SL and 120 pip TP as per system.

Let the market come to your setup. Patience is your greatest edge.

📘 Shared by @ChartIsMirror

XAUUSD NEXT MOVE (READ CAPTION)Hi trader's. what do you think about gold market

current price : 3354

gold Friday breakout sell trade and gold breakout resistance 3345 and close above 3345 and gold just retest downside then he taking support and pump upside gold breakout 3365 then gold next move 3395

support zone: 3343:3330

resistance zone :3365

target 3395

stop loss: 3310

please like comment and follow thank you

Gold Falls After Rejection at 3350 – Eyes on Short-Term Pullback📊 Market Drivers:

• Gold spiked to $3,350/oz early in the day but later dropped to $3,310/oz as profit-taking kicked in and U.S. yields recovered slightly.

• Market is in a wait-and-see mode ahead of PCE inflation data on Friday, limiting upside momentum late in the session.

📉 Technical Analysis:

• Key resistance: $3,345–3,350 (daily high)

• Nearest support: $3,310 – session low; then $3,290

• EMA09: Price trading above EMA09, but below EMA21, signaling a neutral bias

• Candle/momentum: Formed shooting star reversal near $3,348 on H1 with declining volume → short-term weakness ahead

📌 Outlook:

Gold may pull back toward $3,300–3,290 short-term if USD rebounds and selling persists. But medium-term bullish bias remains if inflation data disappoints and USD continues weakening.

💡 Trade Ideas:

🔻 SELL XAU/USD at: 3,335–3,345

🎯 TP: 3,315

❌ SL: 3,352

🔺 BUY XAU/USD at: 3,295–3,305

🎯 TP: 3,315

❌ SL: 3,285

XAUUSD Reversal Zone Hit? OB + 61.8% Fib Tap In Progress!Gold (XAUUSD) | 30-Min Buy Setup – Smart Money Discount Reversal in Motion

We’ve got price doing exactly what Smart Money traders expect:

Impulse up → Pullback → Tap into OB inside discount → Launch 🚀

🔍 Breakdown:

Market Context:

Strong bullish impulse leg broke previous highs — a confirmed market structure shift

Pullback is targeting the refined Order Block + multiple fib confluences

Eyeing continuation toward 3,384.285 as main target

Key Confluences:

✅ OB Zone (purple): ~3,362.857

✅ Fib Levels:

50% = 3,364.000

61.8% = 3,359.532

70.5% = 3,356.000

79% = 3,352.000

✅ Perfect Entry Reaction: Price is starting to show a wick & stall around OB top edge (3,362)

Smart Money Entry Logic:

Price dropped from a recent high into a clean imbalance + OB area

Liquidity sweep below recent lows is setting up the reversal

Discount levels = ideal entry zone for institutional re-accumulation

Execution Plan:

Watch for M5–M15 confirmation:

Bullish engulfing or BOS inside the OB zone

Entry: Limit in OB or aggressive confirmation candle

SL: Below 3,352 (beneath 79% + OB bottom)

TP: 3,384 = last swing high

✅ RRR = 1:3+ — sniper-approved 😎

🎯 Game Plan Summary:

🔹 Entry Area 3,362.857 (OB top) → 3,356.000 (deep fib)

🔻 SL Zone Below 3,352

📈 Target 3,384.285 (premium high)

🧠 RRR Potential 1:3+ with structure & fib backing it up

💬 Pro Tip:

Let the market tap liquidity + react. No entry? No FOMO.

You don’t chase — you snipe from the OB treehouse. 🥷🎯

✅ Drop “Gold Ninja Setup” in the comments if you’re planning to catch this

📥 Save this chart — entries like this don’t show up every day

🚨 Follow @ChartNinjas88 for daily Smart Money sniper plays on XAUUSD & FX pairs

Gold Continues to Rise Amid Increased Safe-Haven Demand📊 Market Overview:

Gold prices surged on June 2, 2025, reaching multi-week highs as investors sought safe-haven assets amid escalating geopolitical tensions and trade war concerns. U.S. President Donald Trump's announcement to double tariffs on steel and aluminum imports to 50%, along with Ukraine's drone attacks on Russian facilities, prompted investors to flock to gold as a secure investment.

📉 Technical Analysis:

• Key Resistance: $3,380 – $3,405

• Nearest Support: $3,320 – $3,295

• EMA: Price is above EMA 09 → uptrend.

• Candlestick Patterns / Volume / Momentum: RSI(14) at 65 , MACD(12,26) signaling buy, indicating continued upward momentum.

📌 Outlook:

Gold may continue its short-term uptrend if it holds above the $3,320 support level. However, caution is advised due to potential technical corrections as RSI indicates overbought conditions.

💡 Suggested Trading Strategy:

SELL XAU/USD at: $3,380 – $3,385

o 🎯 TP: $3,320

o ❌ SL: $3,405

BUY XAU/USD at: $3,295 – $3,320

o 🎯 TP: $3,380

o ❌ SL: $3,270

Gold Breaks 3300 – Rally or Pullback Ahead?Gold has just broken through the critical support level at 3300 USD/oz and is currently trading around 3307. This movement aligns with previous forecasts, as gold continues to maintain a short-term bullish cycle. The next target investors are eyeing is the 3350 zone — a new resistance level that could define the upcoming trend.

📈 Technical Analysis:

• EMA 09: Candles are consistently closing above the EMA 09 line, indicating that bullish momentum remains dominant.

• Momentum remains strong, though profit-taking pressure could emerge as prices approach the 3310–3320 range.

• Short-term support: 3290 – a potential rebound area in case of a pullback.

• Major resistance ahead: 3350 – a key level that must be breached to confirm continued upside momentum.

💡 Short-Term Trade Scenarios:

🔻 SELL XAU/USD

Entry Zone: 3348 – 3350

Take Profit (TP): 3328 – 3330

Stop Loss (SL): 3360

🔺 BUY XAU/USD

Entry Zone: 3305 – 3307

Take Profit (TP): 3325 – 3327

Stop Loss (SL): 3295

Gold (XAUUSD) 15-Min Buy Setup: Bullish Breakout with High Risk-Instrument: XAUUSD (Gold vs. US Dollar)

Timeframe: 15 minutes

Indicators:

EMA 200 (Blue): 3,170.78 (long-term trend indicator)

EMA 30 (Red): 3,231.53 (short-term trend indicator)

---

Key Levels:

Entry Point: 3,226.55 (highlighted with a blue arrow and line)

Stop Loss: 3,213.38 (purple zone bottom)

Target (Take Profit): 3,272.25

---

Trade Setup:

Type: Long (Buy) Position

Risk-to-Reward Ratio:

Risk: ~13.17 points (from 3,226.55 to 3,213.38)

Reward: ~45.7 points (from 3,226.55 to 3,272.25)

R/R Ratio: Approximately 3.5:1, which is favorable

---

Market Context:

Price is curren

Gold (XAUUSD) Bullish Breakout Setup – Targeting 3,394.56 After EMA 30 (Red Line): Currently at 3,109.56

EMA 200 (Blue Line): Currently at 3,064.85

Price is above both EMAs, indicating bullish momentum in the short and long term.

📈 Trade Setup:

Entry Point: Around 3,162.15

Stop Loss Zone: Below the purple support box around 3,109–3,141 (right above the 30 EMA)

Target (Take Profit): 3,394.56 — marked as "EA TARGET POINT"

📊 Strategy Outlook:

Bullish Setup: The price recently broke out of a resistance zone (purple area) and retested it, confirming the breakout.

The risk-to-reward ratio appears favorable, as the target is significantly higher than the stop loss.

The upward price projection suggests confidence in a strong bullish continuation.

⚠️ Things to Watch:

Volume confirmation and price action near the entry level.

If price closes below the 30 EMA, it may invalidate the setup.

Always consider broader macroeconomic or fundamental factors when trading gold (e.g., USD strength, interest rates, geopolitical tension).

GOLD WEEKLY CHART MID/LONG TERM ROUTE MAP UDPATEDWeekly GOLD Analysis – Quantum Trading Mastery

Hello Everyone,

Here’s the latest update on the GOLD weekly chart we’ve been diligently tracking and trading. Below is a comprehensive breakdown of the current range and key levels we’ve identified.

Recap of Last Week’s Analysis:

Last week, our predictions aligned perfectly with market movements:

* A strong resistance level at 2790 caused a short-term reversal near 2735.

* The FVG acted as dynamic support at 2735, sustaining the bullish momentum.

* The EMA5 crossed and locked above the key level at 2735, solidifying upward movement.

* As predicted, the resistance was broken, leading to a new all-time high of 2817.

Our analysis delivered precise predictions, allowing you to trade confidently and minimize risks.

What’s Next for GOLD This Week?

Key Level: 2735

Bullish Targets:

* TP1: 2877

* TP2: 3018

* TP3: 3160

Bearish Targets:

* 2735

* 2680

* 2595

This week, we have identified two critical GOLDTURN levels at 2735 and 2595. While we anticipate GOLD reaching TP1 at 2877, there may be short-term reversals around these key levels and GOLDTURN zones.

Recommendations:

To better understand the support structure and identify optimal dip-buying opportunities, review our smaller time-frame analyses (daily, 12H, 4H, and 1H). These insights will help you navigate the market with precision, keeping long-term gaps in perspective.

We’ll continue to provide daily updates and insights to keep you informed.

Thank you for your continued support! Don’t forget to like, comment, and share this post to help others benefit as well.

The Quantum Trading Mastery

Gold (XAUUSD) Reversal Setup: Buy Opportunity from Demand Zone t# GOLD (XAUUSD)

Timeframe: 30-minute

Indicators:

EMA 30 (Red): 3,000.22

EMA 200 (Blue): 3,042.92

🔍 Price Action & Zones

Current Price: 2,982.27

Support Zone (Demand Zone): ~2,940.27 (highlighted in purple, labeled as STOP LOSS)

Resistance Zone (Supply Zone): ~3,040.17–3,042.92 (labeled as EA TARGET POINT)

📈 Trade Idea (Based on Drawing)

Strategy: Buy from demand zone, targeting supply zone

Entry: Near 2,940.27

Stop Loss: Slightly below 2,940.27

Target: ~3,040.17

Risk to Reward: ~1:2.6 (visually)

📊 EMA Dynamics

Bearish Bias in the Medium Term: Price is trading below the 200 EMA, indicating an overall bearish trend.

Short-Term Weakness: The price has also dropped below the 30 EMA, confirming bearish momentum in the short run.

🔄 Possible Scenario

Price is currently heading back down toward the demand zone, where a bounce is anticipated.

If it respects that zone, we may see a reversal toward the target zone at ~3,040.

If it breaks below 2,940, the setup would be invalidated (stop loss hit).

⚠️ Things to Watch

Rejection or support confirmation at 2,940 zone is key before entry.

Be cautious of continued bearish momentum if economic news or global risk sentiment shifts.

Look for bullish reversal patterns (e.g. hammer, bullish engulfing) at the demand zone for confirmation.

Gold (XAU/USD) Intraday Buy Setup – Demand Zone Reversal with 3.Timeframe: Appears to be intraday (possibly 5-15 minutes).

Indicators:

EMA 30 (red): Showing recent bearish momentum.

EMA 200 (blue): Positioned above, indicating a longer-term bearish trend.

Candlestick Pattern: After a steep drop, price shows signs of consolidation and potential reversal.

📌 Trade Setup (Long/Bullish Bias)

Entry Zone: Around $2,963.2

Price is expected to pull back into this purple demand zone before moving up.

Stop Loss (SL): $2,956.1

Placed below the support zone to limit downside risk.

Take Profit (TP / Target Point): $2,988.2

A previous supply zone near the EMA 30, where selling pressure could return.

📊 Risk-Reward Ratio

Risk: $2,963.2 - $2,956.1 = $7.1

Reward: $2,988.2 - $2,963.2 = $25

RRR (Reward-to-Risk Ratio): ~3.5:1

This is a solid ratio, suggesting a high-potential trade if the setup plays out.

📈 Bullish Scenario

Price pulls back into the demand zone (entry).

A bullish candlestick confirmation or wick rejection could trigger a buy.

Target is the previous structure + EMA zone.

Gold (XAU/USD) Technical Analysis: Key Resistance Test Before BrThis chart represents a Gold (XAU/USD) 30-minute timeframe analysis from TradingView. Here are the key takeaways:

Technical Indicators & Levels

Exponential Moving Averages (EMAs)

200 EMA (Blue Line): 3,110.97 – A long-term trend indicator.

30 EMA (Red Line): 3,134.65 – A short-term trend indicator.

Key Levels

Resistance Point: Around 3,136.56.

Support Zone (Stop Loss Level): 3,103.16.

Target Point: 3,167.44, indicating a potential 1.62% upside.

Potential Trade Setup

Scenario 1 (Bullish Case):

If price breaks above resistance (3,136.56) and holds, the next target is 3,167.44.

A bullish breakout could indicate further momentum.

Scenario 2 (Bearish Case):

If price fails to break resistance and drops, it could test the support zone around 3,103.16.

A break below this level might lead to further downside.

Pattern Analysis:

The chart suggests a potential retest of resistance before a breakout.

A possible accumulation phase before a strong move.

Conclusion

Bullish above 3,136.56, targeting 3,167.44.

Bearish below 3,103.16, watching for downside risk.

The 200 EMA (3,110.97) could act as dynamic support.

GOLD MONTHLY LONG TERM RANGE ROUTE MAP ANALYSISMonthly Chart Gold (9th Feb 2024)

Dear Traders,

Attached is the updated Monthly Chart Roadmap for GOLD, showcasing our meticulous analysis and 100% target accuracy since October 2023. The Golden Circle areas on the chart emphasize our precise predictions and successful target achievements over the months.

Previous Chart Highlights:

* GOLD successfully hit TP1 (2286.35) and TP2 (2603.46), with the monthly candle closing above TP2.

* EMA5 crossed and locked above the TP2 level at 2603.46, confirming strong upward momentum.

* The EMA5 detachment process was successfully completed.

* The Fair Value Gap (FVG) at 2790 provided robust support, facilitating a push toward higher levels.

What’s Next for GOLD?

This chart update includes revised entry levels, weighted target levels, and two critical GOLDTURN levels: 2742 and 2595. These levels act as strong support zones, where potential reversals may occur. If a reversal happens, prices are likely to retest any of these levels (marked in red) before bouncing back.

Pay close attention to EMA5 near the Entry Level of 2742.55. If EMA5 crosses and locks above 2742.55, it will confirm bullish momentum and make the target of TP1 (2961) achievable with ease. Although short-term bearish movements may occur, the broader picture on the monthly chart suggests a long-term bullish trend. Temporary pullbacks strengthen the trend and provide excellent dip-buying opportunities near support levels, minimizing risk.

Recommendations:

For a detailed understanding of support structures and to identify ideal buying opportunities, refer to our smaller time frame analyses, including weekly, daily, 12H, 4H, and 1H charts. These provide actionable insights while aligning with the bigger picture of long-term bullish momentum.

As always, we’re committed to keeping you informed with daily updates and insights. Don’t forget to show your support by liking, commenting, and sharing this post. Stay tuned for more updates on our Trading View channel.

Trade Safe with Confidence!

The Quantum Trading Mastery

GOLD 4H CHART ANAYLSIS / BULLISH OR BEARISH? READ CAPTION PLZ4H Gold Analysis – 7th Feb 2024

Dear Traders,

Today's market movement aligns with our strategy of buying dips. Here's a summary of key insights:

Previous Chart Review (5th Feb)

* Target 1 (2850.15) ✅ – Successfully hit

* Target 2 (2876.95) ✅ – Successfully hit

* Target 3 (2903.76) – Pending

Key Resistance Levels Activated: 2850, 2876

Goldturn Levels Hit: 2852, 2828

What is next for Gold? Bullish or Bearish?

* Price Action Expectation: Movement between Goldturn levels with EMA5 confirmation for trend direction.

* Strategy: Monitor EMA5 crosses for trade entries.

Bearish Case

* If EMA5 stays below 2850, expect a retest of Goldturn levels.

* Scenario 1: Below 2823, likely drop to 2803.

* Scenario 2: Below 2803, expect 2776.

* Scenario 3: Below 2776, target 2747 (major demand zone).

Bullish Case

* Scenario 1: Above 2852, target 2876 ✅ DONE

* Scenario 2: Above 2876, target 2903.

* Scenario 3: Above 2903, target 2925.85.

Trading Strategy

Short-Term:

Use 1H/4H timeframes for pullbacks at Goldturn levels.

Target 30-40 pips per trade for optimized risk management.

Long-Term:

Maintain a bullish bias, viewing pullbacks as buying opportunities.

Avoid chasing tops; buy dips from key levels for better trade positioning.

Trade with confidence and discipline. Stay updated with our daily insights to stay ahead.

Support us with likes, comments, boosts, and follows!

📉💰 The Quantum Trading Mastery

GOLD | XAUUSD Weekly Outlook Oct 21st: Keep BUYING!This weekly forecast is for Oct. 21 - 25th.

Gold is still bullish, and BUYS are still the best bet. The formation of a +FVG will support higher prices, and we may get that on Monday's close.

Check the comments section below for updates regarding this analysis throughout the week.

Enjoy!

May profits be upon you.

Leave any questions or comments in the comment section.

I appreciate any feedback from my viewers!

Like and/or subscribe if you want more accurate analysis.

Thank you so much!

Disclaimer:

I do not provide personal investment advice and I am not a qualified licensed investment advisor.

All information found here, including any ideas, opinions, views, predictions, forecasts, commentaries, suggestions, expressed or implied herein, are for informational, entertainment or educational purposes only and should not be construed as personal investment advice. While the information provided is believed to be accurate, it may include errors or inaccuracies.

I will not and cannot be held liable for any actions you take as a result of anything you read here.

Conduct your own due diligence, or consult a licensed financial advisor or broker before making any and all investment decisions. Any investments, trades, speculations, or decisions made on the basis of any information found on this channel, expressed or implied herein, are committed at your own risk, financial or otherwise.

GOLD Buy Off 2504 S&RLast week NFP pushed the price further down than I had expected. I had missed the initial push-up, and fortunately, I canceled my buy order and went on standby. But as with recent developments, the sell failed to go lower, even with volume, so I decided to do a second attempt at the buy, at my earlier price level.

XAUUSD PENDING PULLBACK for another rally? (buys from 22000Currently, I'm not favoring gold due to its lack of healthy price action characterized by abrupt bullish momentum without significant pullbacks. This has resulted in the creation of numerous Asian lows and imbalances below that need to be filled. Consequently, I'll wait for price to retreat and potentially reach a demand zone to sustain its strongly bullish trend.

If price consolidates and experiences a downward break, I anticipate the formation of a new supply zone, providing an opportunity to sell toward a demand zone. However, I'm keen to observe how price behaves throughout the week given gold's erratic movements.

- Gold has been moving very bullish on the lower and higher time frames.

- Lots of imbalances left below as well as multiple untaken Asia lows.

- Price took ATH's and candle stick anatomy is strongly bullish.

- Demand zones have been left around 22000 and below so potential rally from there.

P.S. With NFP scheduled for this Friday, I'm keen to observe its impact as it could significantly influence gold's direction. There's a possibility of a decline, which could fill the imbalances below and reach a demand zone, but we'll have to wait and see.

Have a great trading week guys!

Gold 100% Buy Today Gold price (XAU/USD) retreats after hitting a fresh record high earlier this Thursday and trades just above the $2,200 round-figure mark during the first half of the European session, still up for the second straight day. The prevalent risk-on environment – as depicted by a generally positive tone around the equity markets – prompts some profit-taking around the safe-haven precious metal. Apart from this, a modest uptick in the US Treasury bond yields turns out to be another factor undermining the commodity amid slightly overbought conditions on short-term charts.