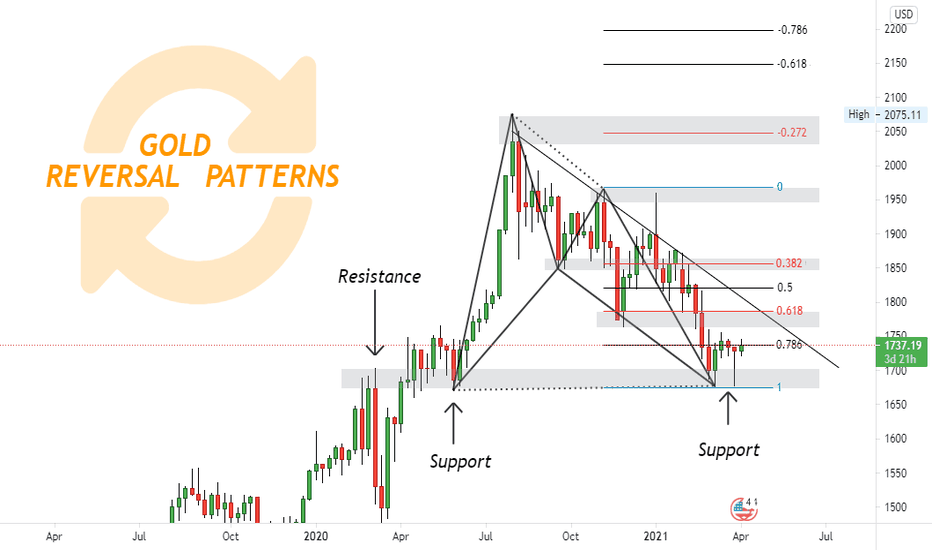

GOLD// Possible BottomLooking at gold from the WEEKLY, we can see price holding strong support on the area price had to break to create new ATHs. Fast forward, we can see price forming a Harmonic pattern, and quite a few areas of price rejection and some signs that this bottom might be in.

Firstly, there is a big M pattern and more recently and extended M has been formed. Usually extended M's retest the broken support and have a retracement of 50%. This 50% area would be around my 0.618 level. I speculate that price will retest this area; we would also likely be testing the recent downtrend line.

Secondly, going long from a recent ATH once we can validate support is a strategy I've been using and have been >70% successful when implemented from a Crypto standpoint. Obviously Gold isnt crypto and has exposure to more volume and also manipulation. However, seeing the recent price action, I'd say right now is worth a shot going long seeing that we are so close to support with the Dollar seemingly about to sink to hell.

Adding to this, commodities have been on a rise and analysts are pushing the possibility of a 'Super Cycle'. With the dollar diminishing, stimmys giving out and fear of inflation, investors are likely to look for their 'Golden Hedge'.

Let me hear your thoughts.