Goldenratio

FDX watch $244.36: SemiMajor Covid fib giving furious resistanceFDX dumped upon last earnings but has been trying to recover.

Currently struggling against a semi-major covid fib at $244.26

It seems likely it will reject to green support zone $231 -233

======================================================

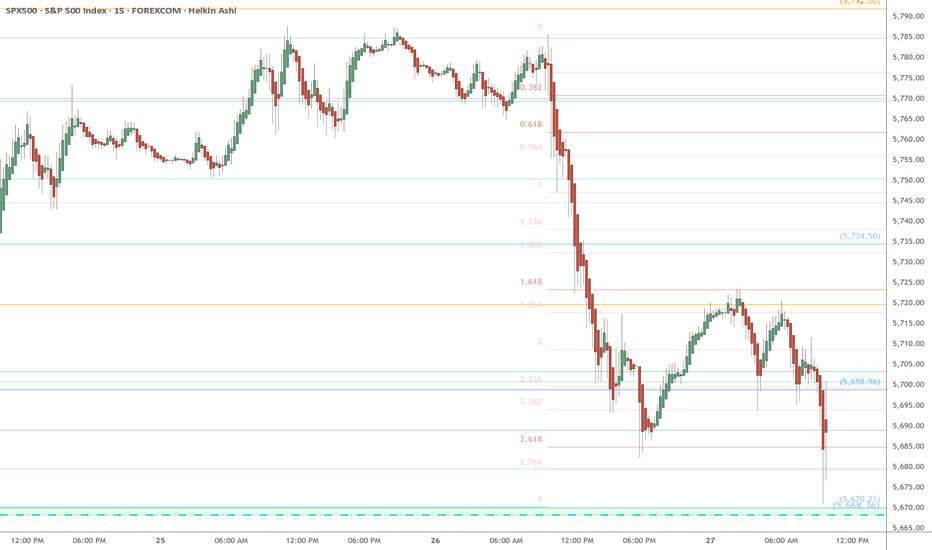

BTC eyes on 82k: Pit Stop en-route to 75k? or bounce into 85k? BTC at a significant fib cluster going into Sunday evening.

Bulls must hold 82k til Monday US open for a hopeful bounce.

Bears will try to snap it and cascade down towards 80k then 75k.

========================================================

.

RBRK watch $76.xx: Golden Genesis + Local 4.236 may give a DIPRBRK got a nice strong boost from the last earnings report.

Now at a tight confluence of Golden Genesis plus local 4.236

Look for a dip to buy or a Break-n-Retest of $76.30-76.41 range.

=======================================================

.

XYZ eyes on $59.xx: Double Golden Fibs that bulls need to HoldXYZ got a nice bounce with the market but is pulling back.

Now at a key support zone of two Golden Fibs (Genesis+Covid)

$58.95 - 59.25 is the exact zone of interest that muss must hold.

========================================================

.

CART heads up at $49.79: Golden Genesis sister of our bouncerCART has been accelerating its uptrend.

Now approaching a Golden Genesis fib.

Its Golden sister below was our bouncer.

It is PROBABLE that we get a dip here.

It is PLAUSIBLE to form a significant top.

It is POSSIBLE to Break-n-Retest and go.

====================================

.

PLTR eyes on $84.69 (again): Golden Genesis fib and a MUST HOLDHere we are again at a Golden Genesis fib, strongest of all fibs.

"Golden" as in an exponent/multiple of .618, the Golden Ratio.

"Genesis'" as in the primary wave of this asset's growth pattern.

A retest was expected but bulls needed it to happen much sooner.

The high altitude drop has pierced the fib instead of a clean bounce.

Bulls need to "orbit" this fib and then attempt to slingshot Northward.

=============================================================================

Previous post calling the last pullback:

============================================================================

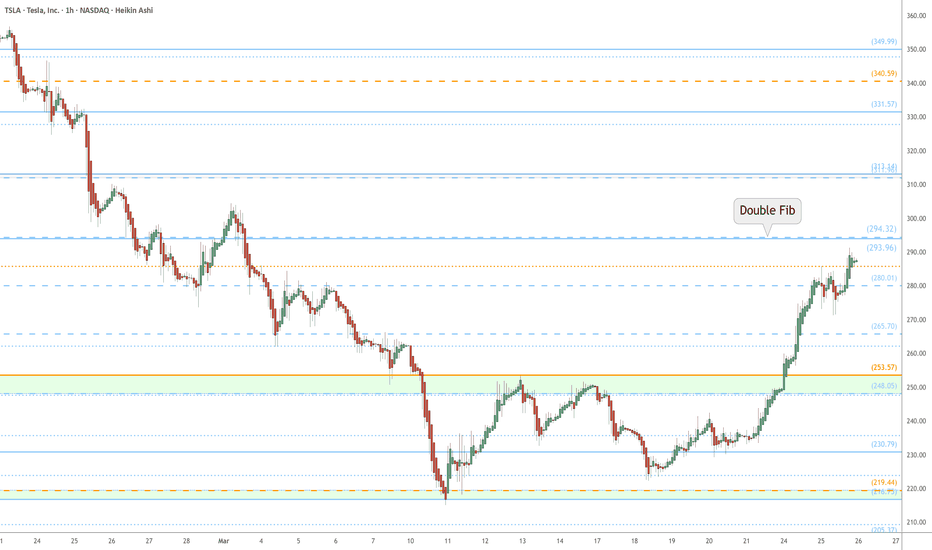

TSLA watch $294: Double Fib hurdle to bounce from Golden GenesisTSLA finally got past our Golden Genesis fib at $253.

Strong bounce cut through several Covid fibs (dashed).

Watch tight confluence of Covid+Genesis around at $294.

$ 293.96 - 294.32 is the exact zone of concern for bulls.

==================================================

.

EBAY watch $66.xx: Golden Genesis + Covid fibs for supportEBAY in a wild oscillation after last earnings report.

Currently orbiting/stabilizing around a Dual fib zone.

Look for a clean bounce ("Ping") off this zone for longs.

$ 65.91 - 66.16 is the exact zone of interest.

Top of zone is a Golden Genesis, ideal bounce.

===============================================

.

CEG eyes on $224: Golden Genesis that could mark bottom CEG is trying to recover along with the nuclear sector in general.

Currently orbiting a well established Golden Genesis fib at $224.06

Look for a clean bounce off this fib to continue the recovery climb.

==========================================================

.

NVDA watch $123: Golden Covid + Golden local fibs key resistanceNVDA launched from our Golden Genesis zone at $113.

Now testing major resistance with Golden Covid at $122.

Looking for dips to buy or Break-n-Retest to confirm bottom.

Previous Analysis:

============================================================

.

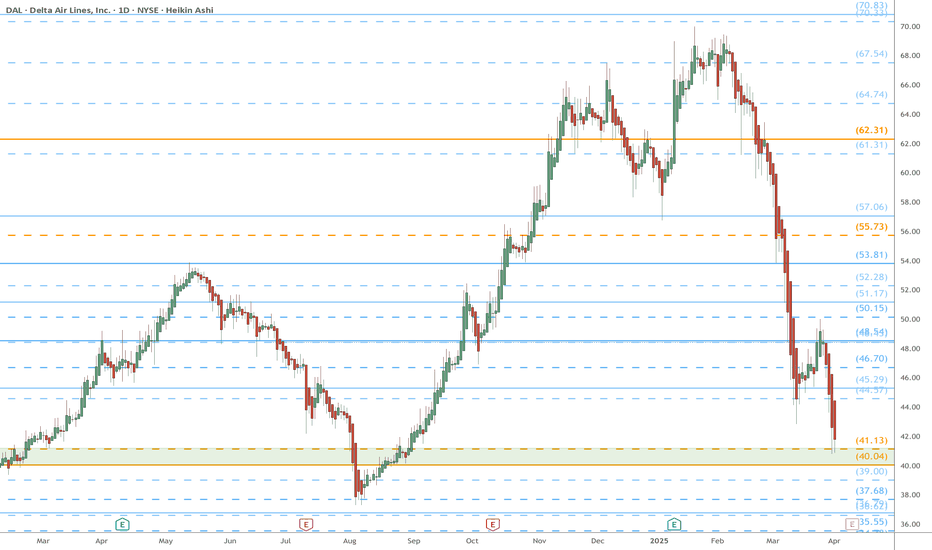

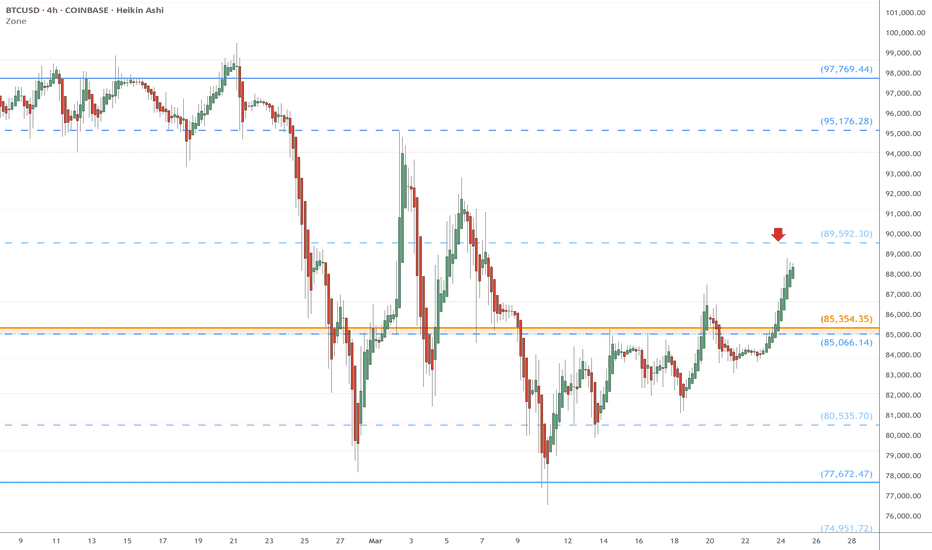

BTC heads up at 89.6k: minor Covid fib that might end our bounceBTC broke above our Golden Genesis fib at 85.3k.

Now pushing towards a minor Covid fib at 89.6k.

This fib may end bounce and retest the 85k zone.

==================

Previous Plots below

==================

85k zone to break;

105k top Call:

73k previous top:

ADBE watch $388: Earnings Dump hit major support zone for a buy?ADBE earnings disappointed, dropping price to a major support zone.

$ 387.21 - 387.97 is the exact zone of interest that bulls need to hold.

Ideally this is a bottom at which to consolidate and then move North.

============================================================

.

NRG eyes on $93.xx: Double Fib could End Bounce or mark Bottom NRG about to test a tight confluence of Genesis + Covid fibs.

$ 93.37 - 93.45 is the zone that could be a serious hurdle to cross.

Break-n-Retest could mark a bottom but unlikely on first attempt.

==========================================================

.

NFLX eyes on $860-ish: Major Fib Cluster and Key Support to holdNFLX dropping rapidly along with the market wide pullback.

It has just hit a major fib cluster at the $859.07-865.73 zone.

If this zone fails then look lower at the $811.19-814.75 zone.

Previous Analysis that gave several entries:

========================================================

.