GOLD Analysis: Will buyers push toward 3,230?OANDA:XAUUSD continues to trade within a clearly defined ascending channel, with price action consistently respecting both upper and lower boundaries. The recent price action suggests buyers are currently in control, indicating the potential for continued upside.

Given the strength of the current bullish momentum, there is a strong likelihood that price may break above the key resistance zone. If that happens, it could come back to retest the level as support before continuing higher. A successful retest would reinforce the bullish structure and open the door for a potential move toward the 3,230 target, which aligns with the channel’s upper boundary.

However, if price fails to break above the resistance zone, it could signal weakening bullish momentum and open the door for a deeper pullback toward the lower boundary of the ascending channel.

Always confirm your setups and manage your risk accordingly.

Best of luck!

Goldforecast

XAUUSD Entry on break of structure ?Hello traders, this is a complete multiple timeframe analysis of this pair. We see could find significant trading opportunities as per analysis upon price action confirmation we may take this trade. Smash the like button if you find value in this analysis and drop a comment if you have any questions or let me know which pair to cover in my next analysis.

Gold Price Surpasses $3,200 for the First Time in HistoryGold Price Surpasses $3,200 for the First Time in History

According to the XAU/USD chart today, the price of an ounce of gold is fluctuating above the $3,200 level on global exchanges — a level never reached before.

Since the beginning of 2025, gold has gained approximately 22%.

Why Is Gold Rising Today?

Today’s bullish momentum in the gold market is driven by two key factors.

First, inflation data. Figures released yesterday for the CPI (Consumer Price Index) revealed a slowdown in inflation in the United States. This suggests a greater likelihood of monetary policy easing by the Federal Reserve. According to Reuters, gold prices now reflect expectations of three interest rate cuts by the end of 2025 — and lower rates typically support a stronger XAU/USD.

Second, fears of a global recession. Although US President Donald Trump has introduced a 90-day delay on the implementation of international trade tariffs, this does not apply to China, where tariffs have been increased to a striking 145%. Traders fear that Beijing could retaliate by raising tariffs on US goods beyond the current 84%.

Technical Analysis of XAU/USD

At present, the gold market is showing strong upward momentum, which began in early March (as illustrated by the blue trend channel). Key points include:

→ A breakout above the upper boundary of the channel;

→ The RSI indicator suggests a potential bearish divergence forming.

This points to the possibility of a short-term pullback into the blue channel, which would be a natural correction — especially considering the rapid $200 surge from $3,000 to $3,200 over just two days. However, given the current news backdrop, it seems unlikely that the bulls will relinquish control anytime soon.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

XAUUSD Analysis todayHello traders, this is a complete multiple timeframe analysis of this pair. We see could find significant trading opportunities as per analysis upon price action confirmation we may take this trade. Smash the like button if you find value in this analysis and drop a comment if you have any questions or let me know which pair to cover in my next analysis.

XAUUSD Analysis todayHello traders, this is a complete multiple timeframe analysis of this pair. We see could find significant trading opportunities as per analysis upon price action confirmation we may take this trade. Smash the like button if you find value in this analysis and drop a comment if you have any questions or let me know which pair to cover in my next analysis.

Market Analysis: Gold Crashes As Trade War EscalatesMarket Analysis: Gold Crashes As Trade War Escalates

Gold price started a fresh decline below $3,050.

Important Takeaways for Gold Price Analysis Today

- Gold price climbed higher toward the $3,150 zone before there was a sharp decline against the US Dollar.

- A key bearish trend line is forming with resistance near $3,068 on the hourly chart of gold at FXOpen.

Gold Price Technical Analysis

On the hourly chart of Gold at FXOpen, the price climbed above the $3,050 resistance. The price even spiked above $3,150 before the bears appeared.

A high was formed near $3,167 before there was a fresh decline. There was a move below the $3,100 support level. The bears even pushed the price below the $3,000 support and the 50-hour simple moving average.

It tested the $2,970 zone. A low is formed near $2,970 and the price is now showing bearish signs. There was a minor recovery wave above the 23.6% Fib retracement level of the downward move from the $3,167 swing high to the $2,970 low.

However, the bears are active below $3,050. Immediate resistance is near $3,040. The next major resistance is near the $3,068 zone and a key bearish trend line. It is close to the 50% Fib retracement level of the downward move from the $3,167 swing high to the $2,970 low.

The main resistance could be $3,135, above which the price could test the $3,165 resistance. The next major resistance is $3,200.

An upside break above the $3,200 resistance could send Gold price toward $3,250. Any more gains may perhaps set the pace for an increase toward the $3,320 level. Initial support on the downside is near the $3,000 level.

The first major support is near the $2,970 level. If there is a downside break below the $2,970 support, the price might decline further. In the stated case, the price might drop toward the $2,950 support.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

XAUUSD Analysis todayHello traders, this is a complete multiple timeframe analysis of this pair. We see could find significant trading opportunities as per analysis upon price action confirmation we may take this trade. Smash the like button if you find value in this analysis and drop a comment if you have any questions or let me know which pair to cover in my next analysis.

GOLD Technical Analysis - Correction Incoming?OANDA:XAUUSD is trading within a well-defined ascending channel, with price action now testing the upper boundary. This level could act as dynamic resistance, and a rejection here could trigger a corrective move toward the 3,035 support zone.

If buyers defend this support, the bullish structure remains intact, with a potential move back toward higher levels. However, if price breaks below this zone, a deeper pullback toward the lower boundary of the channel could come into play.

Monitoring candlestick patterns and volume at this critical zone is essential for identifying buying opportunities. Proper risk management is advised, always confirm your setups and trade with solid risk management.

If you have any thoughts on this setup or additional insights, drop them in the comments!

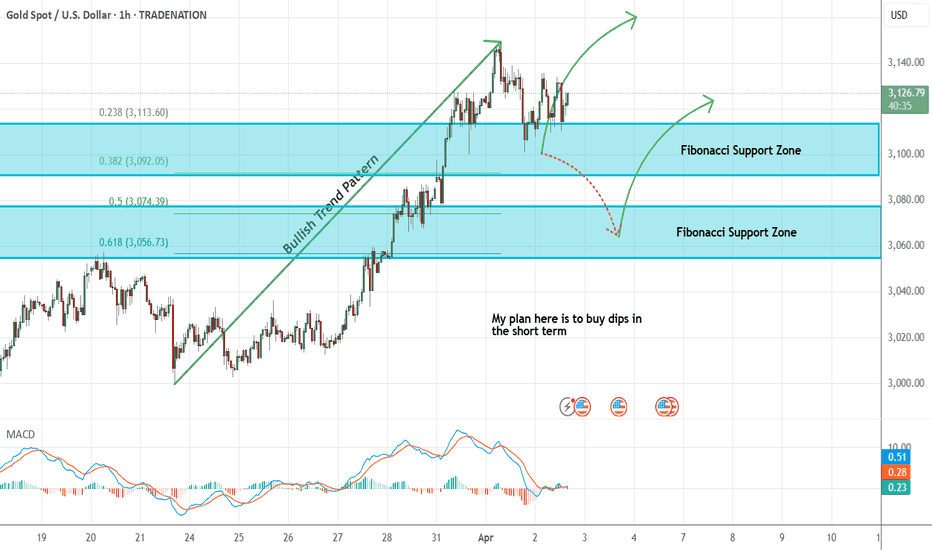

Gold - Looking To Buy Dips In The Short TermH1 - Bullish trend pattern in the form of higher highs, higher lows structure

Strong bullish momentum

Expecting retraces and further continuation higher until the two Fibonacci support zones hold.

If you enjoy this idea, don’t forget to LIKE 👍, FOLLOW ✅, SHARE 🙌, and COMMENT ✍! Drop your thoughts and charts below to keep the discussion going. Your support helps keep this content free and reach more people! 🚀

--------------------------------------------------------------------------------------------------------------------

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

XAUUSD Analysis todayHello traders, this is a complete multiple timeframe analysis of this pair. We see could find significant trading opportunities as per analysis upon price action confirmation we may take this trade. Smash the like button if you find value in this analysis and drop a comment if you have any questions or let me know which pair to cover in my next analysis.

Gold Prices Hover Near Record Highs Ahead of Trump’s TariffGold Prices Hover Near Record Highs Ahead of Trump’s Tariff Announcement

As shown on the XAU/USD chart today, gold prices are fluctuating near their all-time high, set when the price of an ounce surpassed $3,140 for the first time in history.

Gold has risen by approximately 19% in the first three months of 2025.

Why Is Gold Rising?

On 2 April, traders' sentiment is driving gold prices higher in anticipation of US President Trump’s tariff announcements, expected later this evening.

This event enhances gold’s appeal as a safe-haven asset, as concerns grow that Trump’s aggressive trade policies could slow global economic growth and fuel inflation.

Additionally, media reports highlight strong demand for gold from central banks, while exchange-traded funds linked to the precious metal are seeing capital inflows from investors concerned about geopolitical uncertainty.

Technical Analysis of XAU/USD

Gold price movements have formed two ascending channels in 2025: a broader blue channel and a steeper purple channel.

Notably, gold is currently trading near the midpoints of both channels, indicating that supply and demand may have reached equilibrium after buyers broke through resistance around $3,088 (marked by an arrow).

It is likely that XAU/USD will exhibit low volatility until news about Trump’s tariffs emerges. This could trigger sharp price movements, with a potential test of the purple channel’s boundaries in the near future.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

GOLD is in buy zone!XAUUSD has just drop to daily support with strong price action formation on the lower timeframe with an inverted head & shoulder showing possible bounce off the daily support level. As long term trend is up, we may see a sudden bounce to neck line where daily resistance is.

A possible buy trade is high probability.

XAUUSD Analysis todayHello traders, this is a complete multiple timeframe analysis of this pair. We see could find significant trading opportunities as per analysis upon price action confirmation we may take this trade. Smash the like button if you find value in this analysis and drop a comment if you have any questions or let me know which pair to cover in my next analysis.

XAUUSD Analysis todayHello traders, this is a complete multiple timeframe analysis of this pair. We see could find significant trading opportunities as per analysis upon price action confirmation we may take this trade. Smash the like button if you find value in this analysis and drop a comment if you have any questions or let me know which pair to cover in my next analysis.

Gold (XAU/USD) Technical Analysis – Next Week Big Move?The daily chart of Gold Spot (XAU/USD) presents a well-structured triangle pattern breakout, a strong uptrend, and a critical resistance zone near all-time highs (ATH). The price action suggests that gold is in a bullish phase but approaching a key decision point where it could either break higher or face a temporary pullback.

This analysis provides a detailed breakdown of the pattern, key levels, potential scenarios, and trading strategies for the coming week.

1. Technical Chart Breakdown

A. Triangle Pattern Breakout (Bullish Continuation)

The chart shows a symmetrical triangle formation, which typically signals a consolidation phase before a major price movement.

After a period of accumulation within the triangle, gold broke out upwards, confirming a bullish continuation pattern.

This breakout was supported by strong volume and buying pressure, reinforcing the trend strength.

B. Trendline & Support Levels (Key Areas for Buyers)

A rising trendline has been acting as dynamic support, confirming that the market remains in a bullish structure.

Major Support Levels:

$3,000 – A psychological support level that may act as a bounce zone in case of rejection at resistance.

$2,885 – A well-defined horizontal support level, previously tested multiple times.

If the price falls below $2,885, it could signal a trend reversal or a deeper correction.

2. Key Price Levels & Market Sentiment

A. Resistance & Target Levels (Where Sellers Might Step In)

Primary Resistance Zone: $3,137 - $3,150

This level represents a combination of all-time high (ATH), historical resistance, and a key breakout target.

If the price breaks and holds above this zone, it could trigger further upside towards $3,200 - $3,250.

However, if sellers dominate at this level, a pullback or correction could occur.

B. Stop-Loss & Risk Management Considerations

Traders should be cautious around the resistance zone and place stop-loss levels strategically to manage risk.

Stop-Loss Suggestions:

For Long Trades: Below $3,000 (to protect against fake breakouts).

For Short Trades: Above $3,150 (if price rejects resistance and starts a reversal).

3. Trading Strategy for Next Week

Scenario 1: Bullish Breakout & Continuation

If gold breaks and sustains above $3,137, it will confirm a bullish continuation.

Entry Strategy: Look for a retest of the breakout level ($3,100 - $3,137) before entering long positions.

Profit Targets:

First Target: $3,200

Second Target: $3,250+

Stop-Loss: Below $3,000, to protect against sudden reversals.

Scenario 2: Rejection at Resistance & Pullback

If gold fails to break $3,137 and forms a bearish rejection candle, it may indicate a short-term pullback.

Short Entry Strategy: Wait for confirmation of rejection with bearish price action signals (e.g., bearish engulfing, long upper wick).

Downside Targets:

First Target: $3,000

Second Target: $2,885 (major support)

Stop-Loss: Above $3,150, to avoid being trapped in a false breakdown.

Scenario 3: Bearish Reversal (Break Below $2,885)

If gold falls below $2,885, it could signal a potential trend reversal.

Short Trade Setup: Enter below $2,885, targeting $2,800 - $2,750 in the medium term.

Stop-Loss: Above $2,900, in case of a false breakdown.

4. Indicators & Confirmation Signals

A. Volume & Candlestick Patterns

Watch for high volume during breakouts to confirm strength.

Candlestick patterns such as bullish engulfing, hammer (for support bounces), or shooting star (for resistance rejection) can provide strong confirmation signals.

B. RSI (Relative Strength Index) & Overbought Conditions

If RSI is above 70, it could indicate that gold is overbought, increasing the likelihood of a pullback.

If RSI stays above 50 but below 70, it confirms bullish strength.

C. Moving Averages for Trend Confirmation

50-day and 200-day moving averages can act as additional support and resistance zones.

If the price is above both moving averages, it confirms the bullish trend.

5. Conclusion – What to Watch for Next Week?

✅ If price breaks and holds above $3,137 → Expect continuation towards $3,200 - $3,250.

✅ If price rejects at $3,137 → Watch for a pullback towards $3,000 or $2,885 for re-entry.

✅ If price drops below $2,885 → Expect deeper correction with a shift in trend structure.

📌 Key Takeaway: Gold remains bullish, but traders should watch the resistance level at $3,137 closely for confirmation of a breakout or a possible reversal. Risk management is crucial in case of unexpected market shifts.

Would you like me to add more insights using Fibonacci levels or historical trends? 📊🚀

XAUUSD, EURUSD and GBPUSD Analysis todayHello traders, this is a complete multiple timeframe analysis of this pair. We see could find significant trading opportunities as per analysis upon price action confirmation we may take this trade. Smash the like button if you find value in this analysis and drop a comment if you have any questions or let me know which pair to cover in my next analysis.

XAUUSD Analysis todayHello traders, this is a complete multiple timeframe analysis of this pair. We see could find significant trading opportunities as per analysis upon price action confirmation we may take this trade. Smash the like button if you find value in this analysis and drop a comment if you have any questions or let me know which pair to cover in my next analysis.

XAUUSD Analysis todayHello traders, this is a complete multiple timeframe analysis of this pair. We see could find significant trading opportunities as per analysis upon price action confirmation we may take this trade. Smash the like button if you find value in this analysis and drop a comment if you have any questions or let me know which pair to cover in my next analysis.

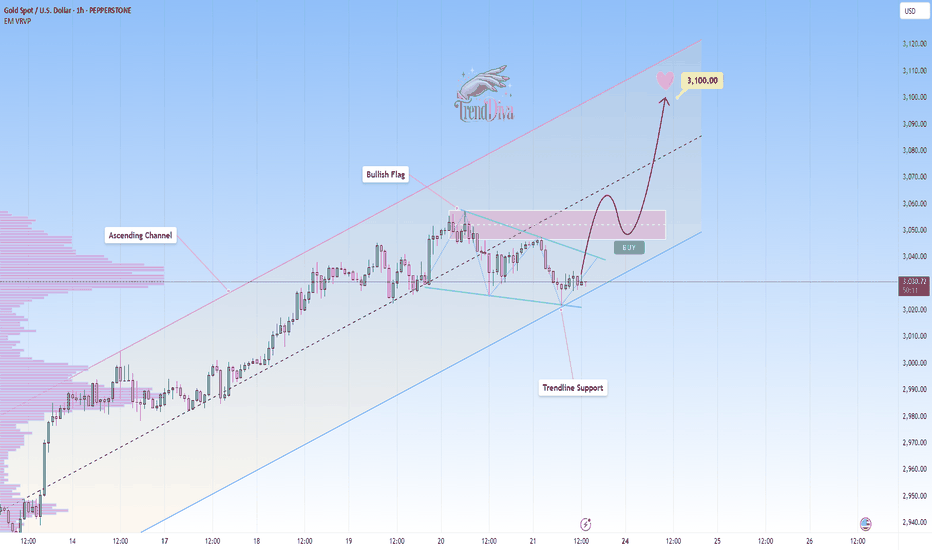

GOLD in a Bullish Flag – Breakout Incoming?OANDA:XAUUSD is undergoing a corrective move as it tests the lower boundary of the ascending channel, which serves as dynamic trendline support. The structure aligns with a bullish flag formation, indicating the potential for a continuation to the upside if buyers step in.

A successful rebound from this level could lead to a move toward the midline of the channel, with the next target at 3,100, aligning with the upper boundary of the channel. This scenario would preserve the broader bullish trend.

A confirmed breakdown below the trendline support, however, would invalidate the bullish outlook and open the door for further downside.

Monitoring candlestick patterns and volume at this critical zone is essential for identifying buying opportunities. Proper risk management is advised, always confirm your setups and trade with solid risk management.

If you have any thoughts on this setup or additional insights, drop them in the comments!

Gold - Short Term Sell Idea Update!!!Hi Traders, on March 20th I shared this idea "Gold - Expecting Retraces and Further Continuation Lower"

We expected to see retraces and further continuation lower. You can read the full post using the link above.

The bearish move delivered, as expected!!!

If you enjoy this idea, don’t forget to LIKE 👍, FOLLOW ✅, SHARE 🙌, and COMMENT ✍! Drop your thoughts and charts below to keep the discussion going. Your support helps keep this content free and reach more people! 🚀

-------------------------------------------------------------------------------------------------------------------

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

XAUUSD Analysis todayHello traders, this is a complete multiple timeframe analysis of this pair. We see could find significant trading opportunities as per analysis upon price action confirmation we may take this trade. Smash the like button if you find value in this analysis and drop a comment if you have any questions or let me know which pair to cover in my next analysis.

GOLD(XAUUSD) -Weekly Forecast,Technical Analysis & Trading Ideas💡 OANDA:XAUUSD Daily Timeframe:

As forecasted by 4CastMachine AI last week, gold started its decline when it hit the red channel line.

This decline will continue, but the support area of 2955 could trigger a rebound.

At the support area of 2955, the up trend line will also prevent further declines.

If this area is broken, the price will decline to the support area of 2789.95.

This area, which was previously a major resistance, will become a major support, creating a good buying opportunity.

So, given the long-term uptrend, we can use this area as a long-term BUY ZONE.

💡 TVC:GOLD H4 Timeframe:

The price is in a Corrective wave.

Given the break of the ascending trend line in the RSI, the corrective wave is expected to continue to a depth of 2955.

💡 H1 Timeframe:

A Head and Shoulder Reversal Pattern has formed and the neckline has also been broken. Price is touching the neckline again. It is very likely that the downward wave will start from this area.

3027.83 support is broken now. It will act as a Resistance now!

Forecast:

Correction wave toward the Sell Zone

Another Downward Impulse wave toward Lower TPs

__________________________________________________________________

❤️ If you find this helpful and want more FREE forecasts in TradingView,

. . . . . . . . Hit the 'BOOST' button 👍

. . . . . . . . . . . Drop some feedback in the comments below! (e.g., What did you find most useful? How can we improve?)

🙏 Your support is appreciated!

Now, it's your turn!

Be sure to leave a comment; let us know how you see this opportunity and forecast.

Have a successful week,

ForecastCity Support Team

XAUUSD Analysis todayHello traders, this is a complete multiple timeframe analysis of this pair. We see could find significant trading opportunities as per analysis upon price action confirmation we may take this trade. Smash the like button if you find value in this analysis and drop a comment if you have any questions or let me know which pair to cover in my next analysis.