Options Blueprint Series [Intermediate]: Gold Triangle Trap PlayGold’s Volatility Decline Meets a Classic Chart Setup

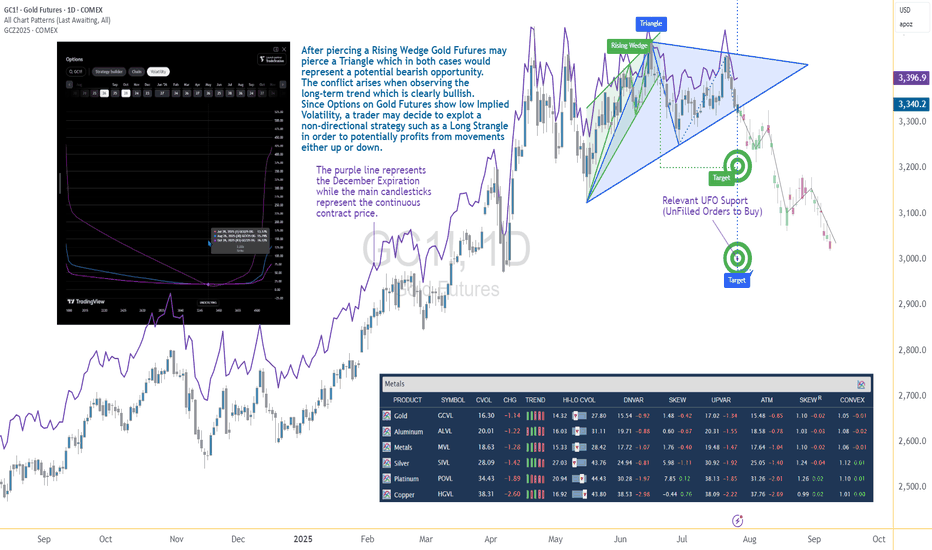

Gold Futures have been steadily declining after piercing a Rising Wedge on June 20. Now, the market structure reveals the formation of a Triangle pattern nearing its apex — a point often associated with imminent breakouts. While this setup typically signals a continuation or reversal, the direction remains uncertain, and the conflict grows when juxtaposed with the longer-term bullish trajectory Gold has displayed since 2022.

The resulting dilemma for traders is clear: follow the short-term bearish patterns, or respect the dominant uptrend? In situations like these, a non-directional approach may help tackle the uncertainty while defining the risk. This is where a Long Strangle options strategy becomes highly relevant.

Low Volatility Sets the Stage for an Options Play

According to the CME Group’s CVOL Index, Gold’s implied volatility currently trades near the bottom of its 1-year range — hovering just above 14.32, with a 12-month high around 27.80. Historically, such low readings in implied volatility are uncommon and often precede sharp price movements. For options traders, this backdrop suggests one thing: options are potentially underpriced.

Additionally, an IV analysis on the December options chain reveals even more favorable pricing conditions for longer-dated expirations. This creates a compelling opportunity to position using a strategy that benefits from volatility expansion and directional movement.

Structuring the Long Strangle on Gold Futures

A Long Strangle involves buying an Out-of-the-Money (OTM) Call and an OTM Put with the same expiration. The trader benefits if the underlying asset makes a sizable move in either direction before expiration — ideal for a breakout scenario from a compressing Triangle pattern.

In this case, the trade setup uses:

Long 3345 Put (Oct 28 expiration)

Long 3440 Call (Oct 28 expiration)

With Gold Futures (Futures December Expiration) currently trading near $3,392.5, this strangle places both legs approximately 45–50 points away from the current price. The total cost of the strangle is 173.73 points, which defines the maximum risk on the trade.

This structure allows participation in a directional move while remaining neutral on which direction that move may be.

Technical Backdrop and Support Zones

The confluence of chart patterns adds weight to this setup. The initial breakdown from the Rising Wedge in June signaled weakness, and now the Triangle’s potential imminent resolution may extend that move. However, technical traders must remain alert to a false breakdown scenario — especially in trending assets like Gold.

Buy Orders below current price levels show significant buying interest near 3,037.9 (UFO Support), suggesting that if price drops, it may find support and rebound sharply. This adds further justification for a Long Strangle — the market may fall quickly toward that zone or fail and reverse just as violently.

Gold Futures and Micro Gold Futures Contract Specs and Margin Details

Understanding the product’s specifications is crucial before engaging in any options strategy:

🔸 Gold Futures (GC)

Contract Size: 100 troy ounces

Tick Size: 0.10 = $10 per tick

Initial Margin: ~$15,000 (varies by broker and volatility)

🔸 Micro Gold Futures (MGC)

Contract Size: 10 troy ounces

Tick Size: 0.10 = $1 per tick

Initial Margin: ~$1,500

The options strategy discussed here is based on the standard Gold Futures (GC), but micro-sized versions could be explored by traders with lower capital exposure preferences.

The Trade Plan: Long Strangle on Gold Futures

Here's how the trade comes together:

Strategy: Long Strangle using Gold Futures options

Direction: Non-directional

Instruments:

Buy 3440 Call (Oct 28)

Buy 3345 Put (Oct 28)

Premium Paid: $173.73 (per full-size GC contract)

Max Risk: Limited to premium paid

Breakeven Points on Expiration:

Upper Breakeven: 3440 + 1.7373 = 3613.73

Lower Breakeven: 3345 – 1.7373 = 3171.27

Reward Potential: Unlimited above breakeven on the upside, substantial below breakeven on the downside

R/R Profile: Defined risk, asymmetric potential reward

This setup thrives on movement. Whether Gold rallies or plunges, the trader benefits if price breaks and sustains beyond breakeven levels by expiration.

Risk Management Matters More Than Ever

The strength of a Long Strangle lies in its predefined risk and unlimited reward potential, but that doesn’t mean the position is immune to pitfalls. Movement is key — and time decay (theta) begins to erode the premium paid with each passing day.

Here are a few key considerations:

Stop-loss is optional, as max loss is predefined.

Precise entry timing increases the likelihood of capturing breakout moves before theta becomes too damaging. Same for exit.

Strike selection should always balance affordability and distance to breakeven.

Avoid overexposure, especially in low volatility environments that can lull traders into overtrading due to the potentially “cheap” options.

Using strategies like this within a broader portfolio should always come with well-structured risk limits and position sizing protocols.

When charting futures, the data provided could be delayed. Traders working with the ticker symbols discussed in this idea may prefer to use CME Group real-time data plan on TradingView: www.tradingview.com - This consideration is particularly important for shorter-term traders, whereas it may be less critical for those focused on longer-term trading strategies.

General Disclaimer:

The trade ideas presented herein are solely for illustrative purposes forming a part of a case study intended to demonstrate key principles in risk management within the context of the specific market scenarios discussed. These ideas are not to be interpreted as investment recommendations or financial advice. They do not endorse or promote any specific trading strategies, financial products, or services. The information provided is based on data believed to be reliable; however, its accuracy or completeness cannot be guaranteed. Trading in financial markets involves risks, including the potential loss of principal. Each individual should conduct their own research and consult with professional financial advisors before making any investment decisions. The author or publisher of this content bears no responsibility for any actions taken based on the information provided or for any resultant financial or other losses.

Goldfutures

GOLD - GC | Weekly Recap & Plan 13.07.2025🟡 GOLD (GC) Weekly Recap & Outlook

Symbol: GC1!

Date: Week of July 8–12, 2025

Timeframes Used: 4H, Daily, Weekly, HTF structure

🔍 What Happened Last Week?

Gold saw a strong rejection from a confluence of two HTF trendlines, signaling resistance.

But that move was absorbed by:

🟦 Daily Demand (blue zone)

🔵 Daily Swing Liquidity (blue line)

This builds a bullish structure on the daily chart.

🧭 Scenarios I'm Watching

Scenario 1 — Minor Pullback:

🔹 Price may revisit the Daily Gap (pink line) and find support for continuation.

Scenario 2 — Deeper Pullback:

🟣 Price could retrace into the HTF bullish trendline (purple) before resuming upside.

🗞️ Bonus Macro Scenario: Powell Resignation?

There are growing rumors that Fed Chair Powell might resign this week.

📈 If that happens, I expect strong bullish momentum in Gold —

→ very limited retracement, and

→ potential straight breakout into new highs.

🎯 Targets for the Week:

✅ 1st Target:

W C DOL (purple line) → acts as a primary take profit area.

✅ 2nd Target (Expansion):

EQHs / DOL (extended purple levels)

Game Plan:

Watch for LTF confirmation on both retracement zones.

Maintain bullish bias unless Daily Demand fails.

If Powell resigns, be ready for breakout setups.

Gold (XAUUSD) Trade Setup – Valid Until July 10, 2025This 15-minute chart shows a clean technical breakout from a falling channel. Here's how to interpret and potentially trade this move:

🧠 Context: What Just Happened

Price was locked inside a descending channel (blue) for multiple sessions.

A breakout occurred above the channel, indicating a potential short-term bullish reversal.

The bounce aligns with recent tariff-related headlines easing off and short-covering momentum building.

I trade these support and resistance lines daily on micro gold futures.

What these lines represent:

Golden Line: Heavy Support or Resistance depending on the price direction towards the lines for major reversal or $10-$15 swings.

Silver Lines: Consolidation areas or mid way support and resistance for a scalping few touches.

Bronze dotted lines: Low volume days support and resistance for a quick $5 up or down.

Also, I can see a directional setup. Here is a hypothetical scenario that could play out:

📌 Key Zones to Watch

🔼 Resistance $3,342 Next major target / sell zone

🟧 Resistance $3,319 Current breakout level retest

⚪ Support $3,307–$3,316 Minor consolidation area

🔻 Support $3,295–$3,289 Strong demand / invalidation

🚨 Bear Pivot $3,272 Break below = bearish return

🧭 Trading Playbook

Bullish Bias (Preferred Scenario)

✅ Break and hold above $3,319 = potential move to $3,342

🎯 Target: $3,340–$3,342

🔒 SL below: $3,307

Optional re-entry on retest of $3,316 zone

Bearish Reversal (If Bulls Fail)

⚠️ If price fails $3,319 and breaks back below $3,307, sellers may reclaim control

📉 Look for short setups toward $3,295 and even $3,272

SL above: $3,319

📌 Key Tip

Watch for volume confirmation and 5m candle closes at each level. Don’t chase — let price come to your levels.

⏳ Validity

This setup remains valid through July 10, or until $3,342 target is hit or $3,272 is broken.

This is not financial advice; it's for educational purposes only.

Gold, GC!, Sideway to the Downside (Long Term)06/30/2025, 10:30 PM PT

GC! is currently at its max around 3,500.

On the Weekly MACD, the crossover between MACD lind signal line already happened. There is also a bearish divergence on weekly chart.

On the Daily chart, RSI just crosses below 50 on RSI, and MACD shows weakness on the bull (it still not in the bear's territory just yet).

Reversasl to bear side may happen if price stays below 3,200

Bullish will continues if price break out of all time high

Current range for big timeframe from 3,200 - 3,500

Plan for swing trade:

Bullish Case (short term): break trendline. If hold above 3,360, price could go up to 3,400 -> 3,450

Bearish Case (short term): If price rejects and stays below 3,360, price could go down 3,310 -> 3,280

***Disclaimer: This analysis and trade plan are for educational and informational purposes only and should not be considered as financial or investment advice.

Gold: Primarily HigherIn our primary scenario, we expect gold to set a new all-time high as part of the ongoing beige wave I. To achieve this, the price should soon generate more upward momentum during the subordinate light green wave 5 and surpass the current all-time high from April 22. Once the wave I cycle has concluded at higher levels, we anticipate the start of a new bearish phase. However, there remains a 40% chance that the precious metal has already completed the beige wave alt.I and is now entering a fresh downward cycle. Under this alternative scenario, the price would break directly below the supports at $3,123 and $2,970.

📈 Over 190 precise analyses, clear entry points, and defined Target Zones - that's what we do.

Gold Future MCXThe Gold Future Price is Stuck in A Triangle Trend Lines.

There is Good Action Seen from Both Buyers and Sellers. Lets se who wins it.

If the price breaks DOWN the Support Trend Line with Good Volume "THE PRICE CAN TRAVEL DOWN TILL 90000 Levels."

If the Price Breks UP the Resistance Trend Line with Good Volume " THE PRICE CAN TRAVEL UP TILL 95500 Levels."

NOTE: (In My View)

Price Going Down till 90000 is More Likely.....

Gold Futures (GC) – May 28, 2025

Gold is currently trading within a clean range, and I’m keeping it simple:

🔴 I will only sell in the red supply zone, but only after seeing confirmed seller reaction and order flow backing the move.

🟢 I will only buy in the green demand zone, once buyers clearly show strength and the flow supports it.

📉 My target for any trade is always the opposite zone — if I sell in the red, I’ll target the green. If I buy in the green, I’m aiming for the red.

All of this holds until aggressive order flow tells me new participants are stepping in and shifting the narrative.

No trades in the middle. Discipline and confirmation first.

#GoldFutures #GCAnalysis #SmartMoney #OrderFlow #SupplyAndDemand #FuturesTrading #PriceAction #TradingDiscipline #TechnicalAnalysis

Gold Futures: Flight of the PhoenixCOMEX:GC1!

Gold Futures Analysis:

Gold futures are currently presenting a clearer picture compared to equity index futures. Crude oil futures, on the other hand, have already priced in much of the recent tariff news, with a reversal observed from the 2025 mid-range back towards $65. Despite heightened volatility, the WTI crude oil market remains relatively balanced, with bearish sentiment materializing, if prices drop below and stay below the $65 mark.

Gold futures, however, are offering more defined risk-reward opportunities at the moment. Our analysis shows a macro bullish trend in gold, along with price discovery and market auction trends visible on lower timeframes.

On the 4-hour chart below, we observe a rising upward channel, with key levels identified and reasoning for these levels labeled on the chart.

Key Levels:

• ATH: 3201.6

• HVN (High Volume Node) for long entry: 3115

• LVN (Low Volume Node)/LIS for short entry: 3095.1

• Key LVN Support: 3003.7-3018

Scenario 1: Bearish Continuation

If Gold futures stay below the trend line that defines both our long and short trade ideas, the bearish scenario could materialize. For a short trade to be viable, we would look for a close below the LVN/LIS level (3095.1) and enter on a pullback, targeting the major LVN support zone around 3018.0.

Example trade parameters for Scenario 1:

• Entry: 3095.1

• Stop: 3125

• Target: 3018

• Risk: 29.9 points

• Reward : 77.1 points

• Risk to Reward Ratio: RRR=77.1/29.9 ≈2.58

Scenario 2: Bullish Reversal

In the event that Gold futures push back towards all-time highs due to heightened uncertainty and a flight to safety, we expect initial profit-taking by shorter timeframe traders to provide a pullback. This could present a long opportunity towards the all-time highs.

Example trade parameters for Scenario 2:

• Entry: 3115

• Stop: 3095

• Target: 3200

• Risk : 20 points

• Reward : 85 points

• Risk-to-Reward Ratio: RRR= 85/20 = 4.25

Important Notes:

• These are example trade ideas, and traders are encouraged to do their own analysis and preparation before entering any positions.

• Stop losses are not guaranteed to trigger at specified levels, and actual losses may exceed predetermined stop levels.

Behind the Curtain: Unveiling Gold’s Economic Catalysts1. Introduction

Gold Futures (GC, MGC and 1OZ), traded on the CME market, are one of the most widely used financial instruments for hedging against inflation, currency fluctuations, and macroeconomic uncertainty. As a safe-haven asset, gold reacts to a wide range of economic indicators, making it crucial for traders to understand the underlying forces driving price movements.

By leveraging machine learning, specifically a Random Forest Regressor, we analyze the top economic indicators influencing Gold Futures on daily, weekly, and monthly timeframes. This data-driven approach reveals the key catalysts shaping GC Futures and provides traders with actionable insights to refine their strategies.

2. Understanding Gold Futures Contracts

Gold Futures (GC) are among the most actively traded futures contracts, offering traders and investors exposure to gold price movements with a range of contract sizes to suit different trading strategies. CME Group provides three types of Gold Futures contracts to accommodate traders of all levels:

o Standard Gold Futures (GC):

Contract Size: Represents 100 troy ounces of gold.

Tick Size: Each tick is 0.10 per ounce, equating to $10 per tick per contract.

Purpose: Ideal for institutional traders and large-scale hedgers.

Margin: Approximately $12,500 per contract.

o Micro Gold Futures (MGC):

Contract Size: Represents 10 troy ounces of gold, 1/10th the size of the standard GC contract.

Tick Size: Each tick is $1 per contract.

Purpose: Allows smaller-scale traders to participate in gold markets with lower capital requirements.

Margin: Approximately $1,250 per contract.

o 1-Ounce Gold Futures (1OZ):

Contract Size: Represents 1 troy ounce of gold.

Tick Size: Each tick is 0.25 per ounce, equating to $0.25 per tick per contract.

Purpose: Provides precision trading for retail participants who want exposure to gold at a smaller contract size.

Margin: Approximately $125 per contract.

Keep in mind that margin requirements vary through time as market volatility changes.

3. Daily Timeframe: Key Economic Indicators

Gold Futures respond quickly to short-term economic fluctuations, and three key indicators play a crucial role in daily price movements:

o Velocity of Money (M2):

Measures how quickly money circulates within the economy.

A higher velocity suggests increased spending and inflationary pressure, often boosting gold prices.

A lower velocity indicates stagnation, which may reduce inflation concerns and weigh on gold.

o Unemployment Rate:

Reflects the strength of the labor market.

Rising unemployment increases economic uncertainty, often driving demand for gold as a safe-haven asset.

Declining unemployment can strengthen risk assets, potentially reducing gold’s appeal.

o Oil Import Price Index:

Represents the cost of imported crude oil, influencing inflation trends.

Higher oil prices contribute to inflationary pressures, supporting gold as a hedge.

Lower oil prices may ease inflation concerns, weakening gold demand.

4. Weekly Timeframe: Key Economic Indicators

While daily fluctuations impact short-term traders, weekly economic data provides a broader perspective on gold price movements. The top weekly indicators include:

o Nonfarm Payrolls (NFP):

Measures the number of new jobs added in the U.S. economy each month.

Strong NFP numbers typically strengthen the U.S. dollar and increase interest rate hike expectations, pressuring gold prices.

Weak NFP figures can drive economic uncertainty, increasing gold’s safe-haven appeal.

o Nonfarm Productivity:

Represents labor efficiency and economic output per hour worked.

Rising productivity suggests economic growth, potentially reducing demand for gold.

Falling productivity can signal economic weakness, increasing gold’s appeal.

o Personal Spending:

Tracks consumer spending habits, influencing economic activity and inflation expectations.

Higher spending can lead to inflation, often pushing gold prices higher.

Lower spending suggests economic slowing, which may either weaken or support gold depending on inflationary outlooks.

5. Monthly Timeframe: Key Economic Indicators

Long-term trends in Gold Futures are shaped by macroeconomic forces that impact investor sentiment, inflation expectations, and interest rates. The most influential monthly indicators include:

o China GDP Growth Rate:

China is one of the largest consumers of gold, both for investment and jewelry.

Strong GDP growth signals robust demand for gold, pushing prices higher.

Slower growth may weaken gold demand, applying downward pressure on prices.

o Corporate Bond Spread (BAA - 10Y):

Measures the risk premium between corporate bonds and U.S. Treasury bonds.

A widening spread signals economic uncertainty, increasing demand for gold as a safe-haven asset.

A narrowing spread suggests confidence in risk assets, potentially reducing gold’s appeal.

o 10-Year Treasury Yield:

Gold has an inverse relationship with bond yields since it does not generate interest.

Rising yields increase the opportunity cost of holding gold, often leading to price declines.

Falling yields make gold more attractive, leading to price appreciation.

6. Risk Management Strategies

Given gold’s volatility and sensitivity to macroeconomic changes, risk management is essential for trading GC Futures. Key risk strategies may include:

Monitoring Global Liquidity Conditions:

Keep an eye on M2 Money Supply and inflation trends to anticipate major shifts in gold pricing.

Interest Rate Sensitivity:

Since gold competes with yield-bearing assets, traders should closely track interest rate movements.

Higher 10-Year Treasury Yields can weaken gold’s value as a non-yielding asset.

Diversification and Hedging:

Traders can hedge gold positions using interest rate-sensitive assets such as bonds or inflation-linked securities.

Gold often performs well in times of equity market distress, making it a commonly used portfolio diversifier.

7. Conclusion

Gold Futures remain one of the most influential instruments in the global financial markets.

By leveraging machine learning insights and macroeconomic data, traders can better position themselves for profitable trading opportunities. Whether trading daily, weekly, or monthly trends, understanding these indicators allows market participants to align their strategies with broader economic conditions.

Stay tuned for the next "Behind the Curtain" installment, where we explore economic forces shaping another key futures market.

When charting futures, the data provided could be delayed. Traders working with the ticker symbols discussed in this idea may prefer to use CME Group real-time data plan on TradingView: www.tradingview.com - This consideration is particularly important for shorter-term traders, whereas it may be less critical for those focused on longer-term trading strategies.

General Disclaimer:

The trade ideas presented herein are solely for illustrative purposes forming a part of a case study intended to demonstrate key principles in risk management within the context of the specific market scenarios discussed. These ideas are not to be interpreted as investment recommendations or financial advice. They do not endorse or promote any specific trading strategies, financial products, or services. The information provided is based on data believed to be reliable; however, its accuracy or completeness cannot be guaranteed. Trading in financial markets involves risks, including the potential loss of principal. Each individual should conduct their own research and consult with professional financial advisors before making any investment decisions. The author or publisher of this content bears no responsibility for any actions taken based on the information provided or for any resultant financial or other losses.

GOLD TRADING POINT UPDATE > READ THE CHAPTIANBuddy'S dear friend 👋

SMC Trading Signals Update 🗾🗺️ Gold Traders SMC-Trading Point update you on New technical analysis setup for Gold 🪙 Gold Traders Gold 3 time frame 🖼️ looking FVG rejected point below 👇 2929+ 29209. Technical patterns). Weekly basis setup. )

Key Resistance level 2929 + 2957

Key Support level 2891 - 2848

2832

Mr SMC Trading point

Pales support boost 🚀 analysis follow)

Renewing daily new highs (ATH)...

Hello, traders.

If you "Follow", you can always get new information quickly.

Please click "Boost" as well.

Have a nice day today.

-------------------------------------

(GCL1! 1M chart)

GCL1! is renewing daily new highs (ATH).

It is not easy to analyze or trade these stocks.

Since it is supported and rising near the right Fibonacci ratio point of 1 (2828.6), there is a possibility that it will rise to the Fibonacci ratio range of 1.618 (3395.3) ~ 1.618 (3457.6).

However, since it is a state where it is not strange to fall at any time, you should think about a countermeasure for the fall when starting a transaction.

-

(1D chart)

Most chart analysts explain the current chart analysis by substituting issues other than the chart.

If you get used to this method, you may find issues other than the chart first without looking at the chart and analyze the chart while being obsessed with your subjective thoughts.

If you do that, you may analyze the chart in the wrong direction because you will interpret the chart with your subjective thoughts instead of looking at the chart as it is, so you need to be careful.

When analyzing charts, you must first look at the chart and analyze it, and then look for issues other than the chart when you have time.

-

In order to trade a stock that is renewing its ATH, you should check for support when it shows a downward trend and start.

However, since it is renewing its ATH, there is no support or resistance point to check for support.

To compensate for this, we use the 5EMA+StErr indicator and the Price Channel indicator.

Therefore, when the price falls and touches the 5EMA+StErr indicator or the Price Channel indicator, you can find the trading point depending on whether there is support.

-

(30m chart)

You can trade when it breaks out of the section made up of the Price Channel indicator or the box section made up of the HA-High and HA-Low indicators.

Of course, trading is also possible within the box section.

At this time, you should be careful that the trend can change when it passes the MS-Signal indicator.

When you touch the 5EMA+StErr indicator on the 1D chart, you can check whether there is support and trade.

-

Thank you for reading to the end.

I hope you have a successful trade.

--------------------------------------------------

Ready for CorrectionGold drops to 2830 to return to its trend line.

Give me some energy !!

✨We spend hours finding potential opportunities and writing useful ideas, we would be happy if you support us.

Best regards CobraVanguard.💚

_ _ _ _ __ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

✅Thank you, and for more ideas, hit ❤️Like❤️ and 🌟Follow🌟!

⚠️Things can change...

The markets are always changing and even with all these signals, the market changes tend to be strong and fast!!

Leap Ahead with a Bearish Divergence on Gold FuturesThe Leap Trading Competition: A Chance to Trade Gold Futures

TradingView’s "The Leap" Trading Competition is an opportunity for traders to test their futures trading skills. Participants can trade select CME Group futures contracts, including Gold Futures (GC) and Micro Gold Futures (MGC).

Register and participate here: TradingView Competition Registration .

This article presents a structured short trade setup based on a bearish divergence identified using the Commodity Channel Index (CCI) and key pivot point levels for confirmation. The trade plan focuses on waiting for price to break below the pivot point at 2866.8 before executing the trade, with clear targets and risk management.

Identifying the Trade Setup

Bearish divergence occurs when price makes higher highs while an indicator, such as CCI, makes lower highs. This signals weakening momentum and a potential reversal. The Commodity Channel Index (CCI) measures price deviations from its average and helps traders identify overbought or oversold conditions.

Pivot points are calculated from previous price action and serve as key support and resistance levels. The pivot at 2866.8 is the reference level in this setup. A breakdown below this level may suggest further downside momentum, increasing the probability of a successful short trade.

The trade plan combines CCI divergence with pivot point confirmation. While divergence signals a potential shift, entry is only considered if price trades below 2866.8. This approach reduces false signals and improves trade accuracy. The first target is set at 2823.0, aligning with an intermediate support level (S1), while the final target is near S2 at 2776.2, just above a UFO support zone.

Trade Plan and Risk Management

The short trade is triggered only if price trades below 2866.8. The stop loss is placed above the entry at a level ensuring at least a 3:1 reward-to-risk ratio.

Profit targets are structured to lock in gains progressively:

The first exit is at 2823.0, where partial profits can be taken.

The final exit is near 2776.2, positioned just above a UFO support level.

Stop placement may vary based on the trader’s preferred risk-reward ratio. Position sizing should be adjusted according to account size and market volatility.

Contract Specifications and Margin Requirements

Gold Futures (GC) details:

Full contract specs: GC Contract Specifications – CME Group

Contract size: 100 troy ounces

Tick size: 0.10 per ounce ($10 per tick)

Margin requirements depend on broker conditions and market volatility. Currently around $12,500 per contract.

Micro Gold Futures (MGC) details:

Full contract specs: MGC Contract Specifications – CME Group

Contract size: 10 troy ounces (1/10th of GC)

Tick size: 0.10 per ounce ($1 per tick)

Lower margin requirements provide access to smaller traders. Currently around $1,250 per contract.

Leverage impacts both potential gains and losses. Traders should consider market conditions and margin requirements when adjusting position sizes.

Execution and Market Conditions

Before executing the trade, price must break below 2866.8. Additional confirmation can be sought through volume trends and price action signals.

If price does not break the pivot, the short setup is invalid. If price consolidates, traders should reassess momentum before committing to the trade.

Conclusion

Bearish CCI divergence signals potential market weakness, but confirmation from the pivot breakdown is key before executing a short trade. A structured approach with well-defined targets and risk management increases the probability of success.

For traders in The Leap Trading Competition, this setup highlights the importance of discipline, confirmation, and scaling out of trades to manage risk effectively.

When charting futures, the data provided could be delayed. Traders working with the ticker symbols discussed in this idea may prefer to use CME Group real-time data plan on TradingView: www.tradingview.com - This consideration is particularly important for shorter-term traders, whereas it may be less critical for those focused on longer-term trading strategies.

General Disclaimer:

The trade ideas presented herein are solely for illustrative purposes forming a part of a case study intended to demonstrate key principles in risk management within the context of the specific market scenarios discussed. These ideas are not to be interpreted as investment recommendations or financial advice. They do not endorse or promote any specific trading strategies, financial products, or services. The information provided is based on data believed to be reliable; however, its accuracy or completeness cannot be guaranteed. Trading in financial markets involves risks, including the potential loss of principal. Each individual should conduct their own research and consult with professional financial advisors before making any investment decisions. The author or publisher of this content bears no responsibility for any actions taken based on the information provided or for any resultant financial or other losses.

THE 2ND TRADE OF THE DAY TO HIT THE STOPAs I posted on the post on NASDAQ earlier, this is our 2nd trade of the day to reach our stop and to be in loss after we made a profitable one on OIL which I will link to this post below.

You can check them and read what I explained in NASDAQ's post about how to stick to your plan and not let your emotions take over your trading.

Follow for more!

TP REACHED ON XAUUSDEarlier this morning I posted to sell on XAUUSD with a 1:2 target, and the market filled our TP with a total of 2 contracts, we added ourr 2nd one at the FVG we had and which the market filled.

I made a mistake in the previous post when I didn't pay attention the the levels since I placed the TP lvl a bit lower than 1:2, but on my broker and for the people I give trades to it went perfectly.

Follow for more!

Pre-Market Analysis for Nasdaq, Oil, and Gold Futures The Nasdaq closed higher with an upper wick on the daily chart.

As mentioned previously, this week is expected to show buying pressure at the beginning, followed by selling pressure towards the latter half. After the 240-minute chart's buy signal, the daily chart's MACD is moving closer to the Signal line, indicating buying momentum. However, achieving a complete golden cross appears challenging due to the divergence and angle. The 21,900–22,000 range is considered a short-term high zone, where the market might either sharply drop after forming an upper wick or move sideways before failing the golden cross, leading to a downward shift in the MACD and a subsequent sell-off.

Notably, Nvidia, which has been driving the current index, continues to show strength. Monitoring Nvidia's previous high as a resistance point will be crucial. While the 240-minute chart exhibits strong buying pressure, the steep angle of the recent surge suggests that managing risk and opting for selling opportunities near the highs—rather than buying on dips—would be more advantageous. Additionally, keep an eye on key economic indicators such as the ISM Services Index and JOLTS report, which are scheduled for release today.

Crude oil closed lower with an upper wick.

Given its recent rapid surge, crude oil's daily chart shows significant divergence from the 5-day moving average. It is advantageous to focus on selling at the highs in this scenario. If the price pulls back to the 240-day moving average, observing whether it finds support will be critical. This week, oil could pull back to the 3-week moving average on the weekly chart and then rebound. Therefore, caution is advised against chasing the rally, and selling near previous highs would be prudent. However, buying on dips near the 3-week moving average could present an opportunity.

On the longer-term 240-minute chart, a bearish candlestick at the high has triggered a sell signal. It would be wise to anticipate potential sharp declines and prioritize selling during rebounds. For buying opportunities, it is recommended to act cautiously and at significantly lower levels.

Gold closed lower with a lower wick.

Ahead of Friday’s non-farm payroll data, gold is likely to remain range-bound in a consolidation phase. On the weekly chart, gold faces resistance from moving averages, and this week’s key data releases may determine its trend. On the daily chart, while a buy signal was generated, gold failed to make a significant surge, leading to the MACD and Signal line moving sideways.

With market flows becoming more uncertain, a range-bound strategy is advisable. On the 240-minute chart, gold could form a triangular consolidation pattern in the short term. Until Friday, trading within a range would be the most effective approach.

The weather has turned colder with a cold wave sweeping in, and flu season is here. Please take care of your health, and I wish you successful trading today!

■Nasdaq - Range-bound Market

-Buy Levels: 21,660 / 21,565 / 21,495 / 21,450

-Sell Levels: 21,885 / 21,940 / 22,005 / 22,045 / 22,110

■Oil - Bullish Market

-Buy Levels: 72.80 / 71.90 / 71.00

-Sell Levels: 73.60 / 74.20 / 74.85

■Gold - Range-bound Market

-Buy Levels: 2,641 / 2,635 / 2,625

-Sell Levels: 2,652 / 2,658 / 2,666 / 2,672