THE KOG REPORT - NFPTHE KOG REPORT – NFP

This is our view for NFP, please do your own research and analysis to make an informed decision on the markets. It is not recommended you try to trade the event if you have less than 6 months trading experience and have a trusted risk strategy in place. The markets are extremely volatile, and these events can cause aggressive swings in price.

Following on from the FOMC KOG Report which worked quite well, we’ll stick with the same chart and for today suggest caution. It’s the first day of the month and the last day of the weekly candle. The close here for gold is important and will give us further clues to the next few months.

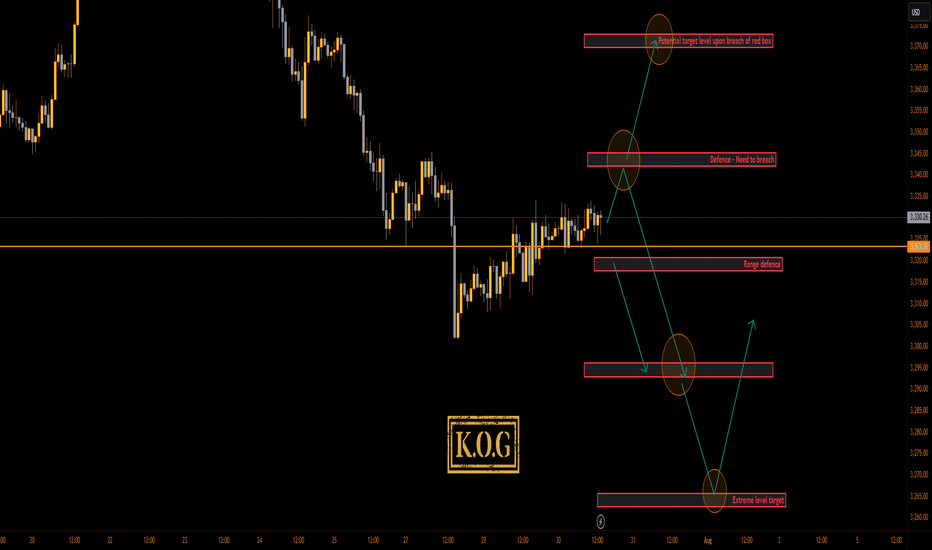

We’ve shared the red boxes and the red box targets are below. There is a key level above 3306-10 which will need to be breached to correct the move back up to the 3330-34 region for the weekly close. However, we now have an undercut low which is potential if there is more aggressive downside to come and that level is sitting around the 3240-50 region which for us may represent an opportunity for a swing low. We’re a bit low and stretched here to short and as we’ve already hit our target for the day so we’ll wait for the extreme levels and if hit and our indicators line up, we may take some scalps. Otherwise, as usual on these events, the ideal trade will come next week.

RED BOXES:

Break above 3290 for 3295, 3306, 3310 and 3320 in extension of the move

Break below 3275 for 3267, 3260, 3255 and 3250 in extension of the move

Please do support us by hitting the like button, leaving a comment, and giving us a follow. We’ve been doing this for a long time now providing traders with in-depth free analysis on Gold, so your likes and comments are very much appreciated.

As always, trade safe.

KOG

Goldindicators

THE KOG REPORT - FOMCTHE KOG REPORT – FOMC

This is our view for FOMC, please do your own research and analysis to make an informed decision on the markets. It is not recommended you try to trade the event if you have less than 6 months trading experience and have a trusted risk strategy in place. The markets are extremely volatile, and these events can cause aggressive swings in price.

It’s been an aggressive month on the markets especially this week which has been testing for traders due to the extended movement on gold. We’ve managed to stay ahead of the game and although we missed the move downside, we’ve capture scalps up and down trading it on an intra-day basis rather than a swing.

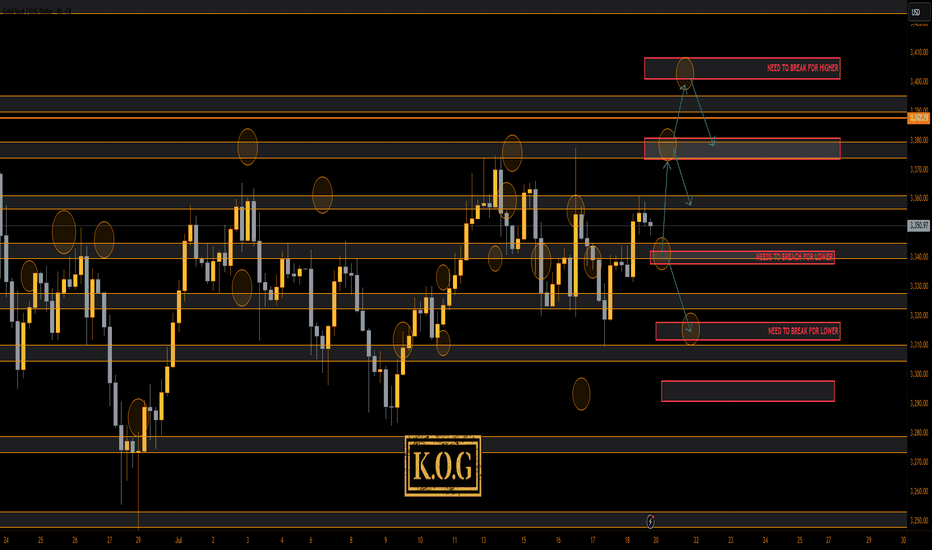

Looking at the 4H chart, we can see we have support forming at the 3310 level which is the key level for this week and will need to be broken to go lower. If we can flip the 3334 resistance, price should attempt higher into the 3355-60 region which is where we may settle in preparation for NFP. on Friday This is the level that needs to be watched for the daily close, as a close above will confirm the structure and pattern test which can form a reversal if not breached.

Now, here is the flip! We’re still sitting below the daily red box but we know this break does give a retracement and with sentiment long, it may not be a complete retracement again. Here 3345-50 is the red box to watch and as above, if not breached, we may see a rejection here which will confirm no reversal for higher and, potentially a further decline into the 3270-5 regions for the end of the month and quarter.

Pivot – 3323-6

RED BOX TARGETS:

Break above 3335 for 3338, 3340, 3345, 3347 and 3357 in extension of the move

Break below 3320 for 3310, 3306, 3302, 3297 and 3393 in extension of the move

Please do support us by hitting the like button, leaving a comment, and giving us a follow. We’ve been doing this for a long time now providing traders with in-depth free analysis on Gold, so your likes and comments are very much appreciated.

As always, trade safe.

KOG

THE KOG REPORT THE KOG REPORT:

In last week’s KOG Report we said we would be looking for a price to attempt the higher level red box sitting around the 3370-75 region and if not breached, we felt an opportunity to short would be available from that region. We said if that failed and the move commenced, we would be looking at a complete correction of the move back down into the 3330-35 region, where we would then monitor price again in anticipation of a long from there or the extension level of 3310 which was also a red box short target (move complete). As you can see from the above, not only did we get that higher red box, we rejected, completed the move downside and then our traders managed to get that long trade all the way back up into the Excalibur target, red box targets and the hotspots shared in Camelot.

A decent week again, not only on Gold but also the numerous other pairs we trade, share targets on and analyse.

So, what can we expect in the week ahead?

For this week we can expect more ranging price action, but due to the previous range from last week being so tight, it looks like we’ll see a breakout coming in the latter part of the week unless there is news to bring us unexpected volume.

We have the key level below 3335-40 support and above that resistance and a red box sitting at 3375-80. This is the region that needs to watched for the break, and if broken we should hit the range high again at 3400-10. However, if rejected, we could again see this dip to attack that lower order region 3310-6 before attempting to recover.

Last week we wanted to see that curveball and although we did see some aggressive price action, I think we will see something extreme for this week. It’s that lower level 3310-6 that is a key region for bulls, if broken we can see a complete flush in gold taking us down into the 3250’s before we start the summer run. That for us would be the ideal scenario going into the month end, but, we’ll play it how we see and as usual, we go level to level and update any changes as we go along.

KOG’s Bias for the week:

Bullish above 3340 with targets above 3355, 3361, 3368, 3372 and above that 3385

Bearish below 3340 with targets below 3335, 3330, 3322, 3316, 3310 and below that 3304

RED BOX TARGETS:

Break above 3350 for 3355, 3361, 3367, 3375 and 3390 in extension of the move

Break below 3340 for 3335, 3330, 3320, 3310 and 3306 in extension of the move

Please do support us by hitting the like button, leaving a comment, and giving us a follow. We’ve been doing this for a long time now providing traders with in-depth free analysis on Gold, so your likes and comments are very much appreciated.

As always, trade safe.

KOG

THE KOG REPORT THE KOG REPORT:

In last week’s KOG Report we said we would be looking for the price to spike down into potentially the extension level 3310 and then give us the tap and bounce we wanted to be able to capture the long trade in to the 3345-50 region initially. It was those higher resistance levels that we said we would stick with and the bias was bearish below. This move resulted in a decent long trade upside into the region we wanted, and then the decline we witnessed mid-week completing all of our bearish target levels which were shared with everyone.

On top of that, we got the bounce we wanted for the long trade but only back up into the 3335 level which was an Excalibur active target. The rest, we just sat and watched on Friday as unless we were already in the move, the only thing we could have done is get in with the volume, which isn’t a great idea with the limited pull backs.

All in all, a great week in Camelot not only on Gold, but also the other pairs we trade with the DAX swing trade being a point to point swing move executed with precision by the team.

So, what can we expect in the week ahead?

We’ll keep it simple again this week but will say this, there seems we may see a curveball on the way this week. With tariff news over the weekend we may see price open across the markets with gaps, one thing we will say is if you see these gaps, don’t gap chase until you see a clean reversal!

We have the higher level here of 3375-85 resistance and lower support here 3350-45. If support holds on open we may see that push upside into the red box which is the one that needs to be monitored. Failure to breach can result in a correction all the way back down into the 3335 level initially. Again, this lower support level is the key level for this week and needs to be monitored for a breach which should then result in a completed correction of the move.

Our volume indicators are suggesting a higher high can take place here and if we do get a clean reversal we should see this pull back deeply. As usual we will follow the strategy that has been taught and let Excalibur guide the way.

KOG’s bias for the week:

Bullish above 3350 with targets above 3360, 3373, 3375 and 3383 for now

Bearish below 3350 with targets below 3340, 3335, 3329, 3320 and 3310 for now

RED BOX TARGETS:

Break above 3365 for 3372, 3375, 3382, 3390 and 3406 in extension of the move

Break below 3350 for 3340, 3335, 3329, 3322 and 3310 in extension of the move

It’s a HUGE RANGE this week so play caution, wait for the right set ups, don’t treat it like it’s your every day market condition. News from Tuesday so expect Monday to be choppy!

Please do support us by hitting the like button, leaving a comment, and giving us a follow. We’ve been doing this for a long time now providing traders with in-depth free analysis on Gold, so your likes and comments are very much appreciated.

As always, trade safe.

KOG

THE KOG REPORTTHE KOG REPORT:

In last week’s KOG Report we said we would be looking for price to attempt that higher level and potentially break for higher pricing. If it didn’t the path showed the level for an opportunity to short which fell just short but worked well into the level we initially wanted.

We then published the red box targets and the bias through the week which held, and we managed to complete all bearish targets by Friday.

Was it easy? No! Did we expect that flush? No! We simply got to a stage on Friday where we could only watch or get in with the volume, so we stood back and just watched.

So, what can we expect in the week ahead?

Simple one this week. We can see potential for lower, however, we’re too low to attempt shorting this, especially with the key level 3250-55 just below and major support. For that reason, we published the red boxes to help you all, look for the break either side! Ideally, we want to support on the low from the open and then continue with the move upside into the 3280-85 level initially, which should flip us on the support at 3270-75. We could range there as there is no news tomorrow but a gradual incline is what we’re looking for.

Support 3250-55 needs to break for lower, while resistance 3306-10 is the level that needs to break to go higher. That’s our potential range for now.

KOG’s bias for the week:

Bullish above 3250 with targets above 3278, 3285, 3297 and above that 3306

Bearish below 3250 with targets below 3240, 3232, 3220 and below that 3212

RED BOX TARGETS:

Break above 3275 for 3279, 3285, 3289 and 3306 in extension of the move

Break below 3260 for 3255, 3251, 3240 and 3235 in extension of the move

Please do support us by hitting the like button, leaving a comment, and giving us a follow. We’ve been doing this for a long time now providing traders with in-depth free analysis on Gold, so your likes and comments are very much appreciated.

As always, trade safe.

KOG

THE KOG REPORT - FOMCTHE KOG REPORT – FOMC

This is our view for FOMC, please do your own research and analysis to make an informed decision on the markets. It is not recommended you try to trade the event if you have less than 6 months trading experience and have a trusted risk strategy in place. The markets are extremely volatile, and these events can cause aggressive swings in price.

A you can see traders the pre-event price action started yesterday with the hourly now playing between the MA’s and waiting for FOMC for a potential breakout. As usual, we have highlighted the key levels and added the red boxes for all of you to help navigate the movement should this not be priced in.

Also remember, there is a press conference after the release, this is usually the time the market will react to anything Powell says about future plans for the economy.

Now, looking at the 4H, we have support at the 3370-65 level and below that 3355. If these are attacked and give a RIP, opportunity for the long trade may be available into the 3395 red box which price will need to break to go higher. If we can break above this red box, we can then look to attempt higher price with the levels 3430, 3445 and above that 3455-60 on the horizon. It’s that red box sitting higher up around the 3470-75 region which needs to be watched if we do get up there as an opportunity to attempt the reverse trade may present itself from there depending on the volume.

So in summary, we have 3 key levels in play, ideally a move upside and rejection from the 3400-6 level giving a further dip would suit buyers to get better pricing.

KOG’s RED BOX TARGETS:

BREAK ABOVE 3395 for 3404, 3406, 3410, 3420, 3430, 3435 and 3459 in extension of the move

BREAK BELOW 3380 FOR 3375, 3364, 3351, 3342, 3333 AND 3327 IN EXTENSION OF THE MOVE

LEARN AND GENERATE YOUR OWN SIGNALS. You don't need any of us to guide you.

Please do support us by hitting the like button, leaving a comment, and giving us a follow. We’ve been doing this for a long time now providing traders with in-depth free analysis on Gold, so your likes and comments are very much appreciated.

As always, trade safe.

KOG

THE KOG REPORTTHE KOG REPORT

In last week’s KOG Report we said we would want the lower level red box to be tested and rejected in order to give us the move upside into that 3330-35 region where we wanted to monitor the price for the short. We managed to get a pin point move, however, we had to exit the short trades early due to the support level holding us up. We then continued to follow Excalibur and the red box indi’s which were suggesting higher pricing and by the end of the week we had completed all our bullish above target levels, plus Excalibur trade targets and LiTE again performed at 100% accuracy.

A phenomenal week in Camelot, not only on Gold but the numerous other pairs we trade, analysis and post on.

So, what can we expect from the week ahead?

For this week we can expect some gaps on open which is going to make it difficult due to skewed data. We will however stick with the red box levels and the tools we have to make a plan for the two scenarios we may see potential of.

Scenario one:

Price opens and gaps upside, we’ll be looking for the levels of 3455-60 for a potential reaction in price, if achieved, an opportunity may be available to short there back down into the 3450, 3443 and 3435 levels.

Scenario two:

If we do open and gap downside, we’ll look for the levels of 3430-23 to hold us up, and if achieved, an opportunity to long there back up into the 3450-5 level and in extension of the move 3465 may be available.

It’s a difficult one again as no one knows how the market is going to open and what is going to happen. So we’ll update traders as much as we can during the day and the week with KOG’s bias of the day and red box target levels

KOG’s bias of the week:

Bearish below 3465 with targets below 3425, 3420, 3410 and 3406

Bullish on break of 3465 with targets above 3477, 3485, 3492, 3495 and 3503

Red Boxes:

Break above 3435 for 3443, 3448, 3465 and 3476 in extension of the move

Break below 3420 for 3410, 3406, 3397, 3385 and 3380 in extension of the move

Many of our followers and traders have seen the power of the red boxes, Imagine this on your own TV screen, 4H for swing trading, 1H for day trading and 15min for scalping. Any pair on any chart 23hrs a day. Add to that the Knights indicator giving you swing points, key levels and retracement levels and our custom volume indicator telling you when to long, when to short and when to stand back from your trades.

LEARN AND GENERATE YOUR OWN SIGNALS. You don't need any of us to guide you.

Please do support us by hitting the like button, leaving a comment, and giving us a follow. We’ve been doing this for a long time now providing traders with in-depth free analysis on Gold, so your likes and comments are very much appreciated.

As always, trade safe.

KOG

THE KOG REPORT THE KOG REPORT:

In last weeks KOG Report we said we would wait for the market to open and look for a reaction on the Red box and based on that reaction we would decide where we wanted to go and how to trade it! We immediately opened with a bounce which gave us the opportunity to then get on with the move upside as you can see in last weeks chart completing the move we wanted and the red box targets apart from 3406 (we got as far as 3404). We then identified the red box region we were expecting another RIP from and to the point we got the move down to complete the short. Please look at the chart, you will see how we picked the top, the bottom, and then the range trades within the circled levels with point to point, level to level trades all the way through the week.

A fantastic week in Camelot on not only Gold but all the other pairs we trade.

So, what can we expect in the week ahead?

Looking at the economic calendar there isn’t much going on in the early part of the week so there is potential here for the move to terminate just below before giving a bounce upside into the levels of 3330-35 which is the level to watch for the break this week. A rejection at that level can cause further declines taking us into the 3350 level and possibly 3230-25 before we form a swing low.

There is a flip here as stated above, and that is that 3330-35 region, if we break above there then bulls have that opportunity to drive this upside to clear the NFP move and take us back to target the 3400 level. It all depends on the reactions we get at the levels so we’ll start the week with the plan of action, and of course, in these markets we’ll adapt If we have to.

KOG’s bias of the week:

Bearish below 3336 with targets below 3306, 3299, 3297, 3285 and 3275

Bullish on break of 3336 with targets above 3345, 3350, 3355, 3367 and 3376

Red boxes:

Break above 3310 for 3320, 3332, if held above 3335, 3347 and 3362 in extension of the move

Break below 3306 for 3299, 3295, 3285, 3280 and 3264 in extension of the move

Many of our followers and traders have seen the power of the red boxes, Imagine this on your own TV screen, 4H for swing trading, 1H for day trading and 15min for scalping. Any pair on any chart 23hrs a day. Add to that the Knights indicator giving you swing points, key levels and retracement levels and our custom volume indicator telling you when to long, when to short and when to stand back from your trades.

LEARN AND GENERATE YOUR OWN SIGNALS. You don't need any of us to guide you.

Please do support us by hitting the like button, leaving a comment, and giving us a follow. We’ve been doing this for a long time now providing traders with in-depth free analysis on Gold, so your likes and comments are very much appreciated.

As always, trade safe.

KOG

THE KOG REPORT THE KOG REPORT

In last week’s KOG Report we said we would be looking for price to attempt the high, fail and make the move downside. This worked well in the early part of the week giving traders a fantastic capture for the short trade into the red box target levels which were all complete. During the week we update trades with the plan to long, and although there was a break from the red box, our lower red box bounced price giving the long trade completing the move.

It was only towards the end of the week where we started ranging that we only managed to capture short scalps on the upside move before the suggesting we call it a day, thankfully before the small decline from the level.

So, what can we expect in the week ahead?

We have a key level here of 3310-6 which has been a previous pivot in this range and is holding price down at the moment. This now make a crucial support region forming at the 3280-5 level with extension of the move into 3275. If this level holds and the red box reacts, we can see price push up from here and attempt to target the 3400 level again, which is towards the top of the range.

It’s this lower red box that needs to be watched for the break, as a break here will target the 3250-55 region initially and then go for the potential swing low around the 3210-2- region which in this scenario maybe the ideal long trade.

As always, we’ll update traders through the week with our analysis and red box target levels but for now, let’s see if we gap on open. Please remember, the market gaps with intention, the intention is usually to get traders in chasing the gap as soon as they see immediate exhaustion, this hardly ever works on gold and BTC especially. We’ve back tested the stretch, so please play caution on chasing gaps.

More choppy and ranging price action expected!

KOG’s bias of the week:

Bullish above 3285 with targets above 3306, 3310, 3321 and 3335

Bearish below 3285 with targets below 3267, 3255 and 3240

RED BOXES:

Break above 3290 for 3297, 3306, 3310, 3320 and 3330 in extension of the move

Break below 3280 for 3277, 3270, 3267 and 3255 in extension of the move

Many of our followers and traders have seen the power of the red boxes, Imagine this on your own TV screen, 4H for swing trading, 1H for day trading and 15min for scalping. Any pair on any chart 23hrs a day. Add to that the Knights indicator giving you swing points, key levels and retracement levels and our custom volume indicator telling you when to long, when to short and when to stand back from your trades.

LEARN AND GENERATE YOUR OWN SIGNALS. You don't need any of us to guide you.

KEY LEVEL 3237!

Please do support us by hitting the like button, leaving a comment, and giving us a follow. We’ve been doing this for a long time now providing traders with in-depth free analysis on Gold, so your likes and comments are very much appreciated.

As always, trade safe.

KOG

THE KOG REPORT Bank Holiday tomorrow so we'll keep it simple and update the KOG Report on Tuesday ready for the week ahead. Please have a look at the last few KOG Reports to see how it went, wasn't a bad week at all.

This week, immediate red boxes are on the chart, there is a red box active above and the indicator is suggesting a potential retracement on the move. So we'll look for price to attempt the high, if failed we can expect the move downside into the order region where we may settle.

RED BOXES:

Break above 3365 for 3370, 3376, 3381, 3390 and 3403 in extension of the move

Break below 3350 for 3343, 3335, 3330, 3323 and 3310 in extension of the move

Please do support us by hitting the like button, leaving a comment, and giving us a follow. We’ve been doing this for a long time now providing traders with in-depth free analysis on Gold, so your likes and comments are very much appreciated.

As always, trade safe.

KOG

THE KOG REPORTTHE KOG REPORT:

In last week’s KOG Report we said we would be looking for the price to attempt the higher resistance level shown on the chart which was slightly higher than the red box. We wanted this level to reject price and give us the move down into the level which was shown on the chart. As you can see this move worked from the open, respecting the red box active level instead and completing all the bias level bearish targets in one swoop after the break.

We then updated the KOG Report with the move we wanted in order to then long into immediate resistance to again test the short trade, which again worked while we suggested traders look for the lower red box levels to attempt the long trades.

There was slight stretch again downside, but those red boxes played their part giving us the move on confirmation for the longs towards the end of the week, ending the week on a high.

It was a difficult week to trade with aggressive movement across the markets, however, the levels are reacting well and although there is a stretch on price, we’re getting the movement we want.

So, what can we expect in the week ahead?

We have key level now on the daily also aligning with the EMA50 at 3162 on the daily chart, while that 4H shows us a possible reversal on the flip. For this reason we have given the immediate red box levels of 3225-30 resistance and 3190-85 support. We have also plotted the potential range of play for the early part of the week, where we feel price may stabilise until a further move.

We’re looking for two possible moves here, one in order to continue to short and then look for the longer trade lower down, or, a break of the red box and bias level into higher resistance upon which we’ll trade level to level and then look higher for a potential short again. The bias level for this week has a huge extension of the move so it will be tradeable both directions. We have applied filters to the algo which is under test so we’ll also want to see if that works in our favour.

So, for now, support below can give us the move into the 3225-30 region which is the level to watch for the break, if rejected there may be an opportunity to short but that short must break below the 3185 level to continue and complete the move downside into the 3150-55 and below that 3130 levels. That’s where we feel the opportunity to long for the swing may come from but please remember, it’s changed structure until we break and hold above the 3265 level. That will be this week’s key level.

KOG’s bias of the week:

Bearish below 3235 with targets below 3196, 3185, 3177, 3165 and 3155

Bullish on break of 3230 with targets above 3242, 3250, 3255 and 3262

RED BOXES:

Break above 3210 for 3118, 3220, 3225, 3230, 3235 and 3247 in extension of the move

Break below 3195 for 3187, 3179, 3165, 3155, 3150 and 3137 in extension of the move

Please do support us by hitting the like button, leaving a comment, and giving us a follow. We’ve been doing this for a long time now providing traders with in-depth free analysis on Gold, so your likes and comments are very much appreciated.

As always, trade safe.

KOG

Best GOLD XAUUSD Psychological Levels Indicator on TradingView

There is one free technical indicator that will show you every significant psychological level on Gold XAUUSD chart.

It is available on TradingView and it is very easy to set.

Discover the best psychological support and resistance indicator for Gold trading , its settings and useful tips.

First, let's discuss the significance of psychological levels in GOLD XAUUSD analysis and trading.

The classic way of the search of significant supports and resistance is based on the analysis of a historic price action.

However, while Gold constantly sets new historic highs such a method does not work, because there are no historic resistances to rely on.

In such a situation, the only reliable strategy to find potentially strong resistances is to analyze psychological levels.

Psychological levels are the round numbers based price levels. Because of the common human psychological biases, these levels attract the interest of the market participants and the prices tend to react to them.

A great example of a psychological level in Gold trading is 3000 level.

It served as a resistance first and after a breakout turned into an important support.

And I found a free technical indicator that plots all the significant psychological levels efficiently.

One more thing to note is that I strictly recommend searching for psychological levels on a daily time frame, because it provides the most relevant perspective.

To use this indicator, search "round" in indicators wind ow.

It is called "Round numbers above and below".

Click on that and it will start working immediately.

You can see that the indicator plotted 3 significant psychological resistances above current prices and 3 supports below on Gold chat.

In the settings of the indicator, you can change the number of levels to identify and change the style of the horizontal lines.

Examine the reaction of the price to psychological supports that the indicator shows. These levels may remain significant in futures and applied for pullback/breakout trading.

With a crazy bullish rally that we contemplate on Gold this year, psychological levels will be the most reliable technical analysis tools for the identification of future bearish reversals and corrections.

This free technical indicator on TradingView will help you in search of the strongest ones.

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

THE KOG REPORTTHE KOG REPORT:

Last week’s KOG Report didn’t really go the way we wanted! We got the move we wanted initially into the low, then the long upside, but the levels we wanted to short from again were smashed through. We managed to navigate and adapt to the move and after changing the plan on the FOMC KOG Report we ended again with an extremely decent week on Gold.

As we’ve always said, when markets don’t go our way, don’t hold on to hope. If you're in the wrong way, accept your wrong and change your bias, this will not only save your account but together with the right risk management, you’ll be able to come out of the market in positive for the week.

So, what can we expect from the week ahead?

We have some news over the weekend that can open us up with gaps, otherwise Monday should be a ranging day and we’ll see some action Tuesday onwards. For this week we’ve added the red boxes for everyone, the indicator is working like a dream and allowing our traders to scalp, swing trade and day trade across the 15min/1h/4h timeframes. So please take note of them!

The problem we have this week is the structure entails two possible moves by the way they’ve set this up. For that reason, we’ll look at the key levels on the red boxes for the break and close together with KOG’s red box targets and bias of the week, before we commit to the market other than scalping.

We have the key level below 3306-10 support which if held again can push upside this time in attempt to break through the 3330 level and target the 3350-55 and above that 3365 region before a RIP. 3360 is the level to watch, if broken above and supported, we can start again with longs into that 3400+ region, but only on confirmation.

The ideal scenario here for us is a break of this symmetrical pattern in one direction, then applying our trading strategy to it which will confirm the move, we can only do this once it’s broken and then update you with the plan.

For now, we’ll play the red boxes and of course wait for our trusted algo Excalibur to guide us. As always, we will update the wider community as we go through the week.

KOG’s bias of the week:

Bullish above 3310 with targets above 3335, 3345, 3350, 3350, 3362 and 3370

Bearish below 3310 with targets below 3306, 3301, 3297, 3285 and 3274

RED BOXES (TAKE NOTE)

Break above 3335 for 3342, 3350, 3354, 3365, 3370. 3373 and 3385 in extension of the move

Break below 3320 for 3310, 3306, 3298, 3293, 3285 and 3279 in extension of the move

Please do support us by hitting the like button, leaving a comment, and giving us a follow. We’ve been doing this for a long time now providing traders with in-depth free analysis on Gold, so your likes and comments are very much appreciated.

As always, trade safe.

KOG

THE KOG REPORT - FOMCTHE KOG REPORT – FOMC

This is our view for FOMC, please do your own research and analysis to make an informed decision on the markets. It is not recommended you try to trade the event if you have less than 6 months trading experience and have a trusted risk strategy in place. The markets are extremely volatile, and these events can cause aggressive swings in price.

Our NFP KOG Report worked pretty well apart from it being a Friday and us closing out positions for the weekend only for the move to complete on Monday. For this FOMC we’ll share the levels and potential reaction points on the red boxes as well as the red box target levels. Due to the range, it’s best to wait for the break and also for them to move the price to where they want, then hunt the trade once price has settled.

We have the immediate support level below 3360-55 which if held can push this upside to break the recent high and that 3480-90 level again. Break of that level we have red box region 3330-20 which is where we could get a RIP but that will give us the flip with potential for the order region 3350-55 to turn into resistance unless broken. For that reason, a down move for now could only give scalps for decent captures on tap and bounces.

3320 is the line in the sand, if broken below we’ll get the long from the 3290-95 region which will come next week.

Note, these days it’s only Trump that manages to move the markets aggressively, so this FOMC is most likely already priced in. Not worth attempting the immediate levels so we’ll rather wait for the extreme levels.

RED BOXES INDI LEVELS:

Break above 3395 for 3406, 3410, 3420, 3430 and 3435 in extension of the move

Break below 3375 for 3370, 3366, 3356, 3351 and 3345 in extension of the move

Please do support us by hitting the like button, leaving a comment, and giving us a follow. We’ve been doing this for a long time now providing traders with in-depth free analysis on Gold, so your likes and comments are very much appreciated.

As always, trade safe.

KOG

THE KOG REPORT - NFPTHE KOG REPORT – NFP

This is our view for NFP, please do your own research and analysis to make an informed decision on the markets. It is not recommended you try to trade the event if you have less than 6 months trading experience and have a trusted risk strategy in place. The markets are extremely volatile, and these events can cause aggressive swings in price.

We’ve done well this week on gold, capturing the high into the low and then taking the long late session which has nearly completed our higher target for a decent week on this precious metal. As we’ve said, best practice is to let this play out, let them take it to where they want, once it settles, then look for the trade.

We have support now at the 320-35 level which is a key level that will need to break in order to reverse and go lower. This level also lines up with our Excalibur levels and red boxes so we can say it’s pretty strong. Above, we have the 3270-75 region which is the previous order level, our volume indicator is suggesting a pull back, so rejection there can take us back into support to settle for the NFP release. It’s this level, if held which can push this upside and our thoughts are at the moment, are they going to take this back into the previous range and hold it there into the close.

So as long as 3240 holds us, we’re likely to see higher pricing for now, 3310-20 is the key level above which needs to break to then give us the flip and potential for a new all time high.

For now, let’s sit back and see what happens.

RED BOXES:

Break above 3262 for 3265, 3270, 3275 and 3288 in extension of the move

Break below 3252 for 3240, 3236, 3230 and 3220 in extension of the move

Please do support us by hitting the like button, leaving a comment, and giving us a follow. We’ve been doing this for a long time now providing traders with in-depth free analysis on Gold, so your likes and comments are very much appreciated.

As always, trade safe.

KOG

THE KOG REPORT THE KOG REPORT:

In last week’s KOG Report we said we would be looking for the price to continue upside into the region given which gave us a fantastic capture for the start of the week. We then had to adapt as the bias level and targets on the red box indi changed suggesting more upside. We continued to complete all our bias above targets as well as Excalibur and LiTE giving us 100% again for the week!

It wasn’t easy as it sounds, it took a lot of work and constant monitoring but the pip capture on gold was out of this world and well worth it!

So, what can we expect from the week ahead?

For this week we seem to be creating a DB on the 4hr chart which entails caution. We have resistance just above at the 3330-35 with extension 3240-45 region which if attacked and rejected in the early session could give the potential short trade into the support level 3295-8 which is the key level that needs to break for us to go lower.

There is a lot of liquidity above, especially those who like us shorted and held trades from the 3450 levels so the bias this week changes to the 3350-55 level, break above and we will confirm the move higher, otherwise, our thoughts are a test is likely on the high but we would like to get that long from lower to again create a new ATH.

Let’s see how we open, these markets need to be adapted to every day so making long terms plans as intra-day traders isn’t on our agenda at the moment. The market is giving short term, so why not take advantage of the conditions while they last.

Potential for gaps on open so please be careful, we’re on red boxes and extreme levels only.

RED BOXES INDI LEVELS:

Break above 3320 for 3327, 3330, 3335, 3345, 3347 and above that 3362 in extension of the move

Break below 3310, for 3306, 3297, 3295, 3280, 3266 and 3255 in extension of the move

Even the scalping levels are HUGE!

Please do support us by hitting the like button, leaving a comment, and giving us a follow. We’ve been doing this for a long time now providing traders with in-depth free analysis on Gold, so your likes and comments are very much appreciated.

As always, trade safe.

KOG

Gold (XAUUSD) 15-Min Buy Setup: Bullish Breakout with High Risk-Instrument: XAUUSD (Gold vs. US Dollar)

Timeframe: 15 minutes

Indicators:

EMA 200 (Blue): 3,170.78 (long-term trend indicator)

EMA 30 (Red): 3,231.53 (short-term trend indicator)

---

Key Levels:

Entry Point: 3,226.55 (highlighted with a blue arrow and line)

Stop Loss: 3,213.38 (purple zone bottom)

Target (Take Profit): 3,272.25

---

Trade Setup:

Type: Long (Buy) Position

Risk-to-Reward Ratio:

Risk: ~13.17 points (from 3,226.55 to 3,213.38)

Reward: ~45.7 points (from 3,226.55 to 3,272.25)

R/R Ratio: Approximately 3.5:1, which is favorable

---

Market Context:

Price is curren

THE KOG REPORT THE KOG REPORT:

In last week’s KOG Report we said we would anticipate a potential curveball and that being that price may just support on the open at the immediate support level and give the move upside into the 3010 and above that 3020 region which was achieved. We then updated traders with the FOMC report suggesting a further move upside into the 3050-55 region which is where we suggested the potential short will come from.

After the push up into the level and then some accumulation, Friday gave us the volume we needed to break away from the range and complete the move downside to end the week.

Again, nearly all of our bias level targets were completed, the bias level worked well, Excalibur performed well and the red box indi’s worked a dream, even in the choppy market conditions.

So, what can we expect in the week ahead?

We have an issue with gold at the moment, although it’s broken the immediate range, it’s still above 3000 with a larger range low around the 2990 and below that 2970-75 region. That potential swing point below is an area of interest for us this week and leading up towards the end of the month. For that reason, if we can support at the first red box below, and continue the move that started on Friday up into those 3025, 3030 and above that 3035-7 price points we’ll want to monitor this careful for a reversal to form. If we can get it, an opportunity to add or take the short may be available to traders, this time in attempt to break below the 3000 level into those lower support level mentioned and shown on the chart, which also correspond with the red boxes. As many of you have seen over the last year or so, we’ve been sharing these indicator boxes on the 4H for the wider community for free, as they are extremely powerful in identifying turning points and entry and exit points for traders. So let’s keep an eye on them this week for the break and closes, RIP’s and rejections.

We’re mostly looking for this one move to complete, however, there has to be a flip! This week, the flip is breaking above that 3035-37 level which will also be this week’s bias level. If we do breach, we’ll be looking at this to then continue higher, breaking 3050 and then resuming the move into the active Excalibur targets above which ideally, we don't want to see happen yet!

So, we know we want higher, what we do want though is better entry levels for the longs, until then, if we can capture these short trades we’ll of course gratefully take them.

KOG’s bias for the week:

Bearish below 3040 with targets below 3010, 3006, 2997, 2985 and below that 2978

Bullish on break of 3040 with targets above 3050, 3055, 3063 and above that 3067

RED BOXES:

Break above 3037 for 3040, 3047, 3050, 3055, 3063 and 3066 in extension of the move

Break below 3010 for 3006, 3000, 2997, 2990 and 2985 in extension of the move

This should give you an idea of your levels, please use them!

Please do support us by hitting the like button, leaving a comment, and giving us a follow. We’ve been doing this for a long time now providing traders with in-depth free analysis on Gold, so your likes and comments are very much appreciated.

As always, trade safe.

KOG

THE KOG REPORT - FOMCTHE KOG REPORT – FOMC

This is our view for FOMC, please do your own research and analysis to make an informed decision on the markets. It is not recommended you try to trade the event if you have less than 6 months trading experience and have a trusted risk strategy in place. The markets are extremely volatile, and these events can cause aggressive swings in price.

While gold is relatively new to this range we have to entail some caution if we’re even going to consider trading this FOMC. Markets are a little fragile, we’re at ATH’s and the moves are extremely aggressive. So, we’ll highlight the red box levels and the potential move we’ll be looking for, sticking to the extreme and key levels, ignoring the intermediate levels.

Looking at the chart we have a support region below 3010-15 which if spiked into and held can push this back up this time to break above 3030 and attempt to attack that 3050 region. That in our opinion would be the first point to start looking for price to exhaust, but it will only give us the flip so longer scalps are likely to be all we’ll get.

If we break above the 3055 region we’re likely to go higher giving us a red box resistance level of 3065-75. It’s this level we would ideally like to target from a lot lower down if we can get that entry. For that reason, we have given the level below on the break of 3010 sitting around 2990-80, we’ll have to wait and see, but if we can get down there a nice swing could present itself.

RED BOX INDICATOR:

Break above 3030 for 3050, 3055, 3063 and 3070 in extension of the move

Break below 3020 for 3912, 3006, 2996 and 2990 in extension of the move

Please do support us by hitting the like button, leaving a comment, and giving us a follow. We’ve been doing this for a long time now providing traders with in-depth free analysis on Gold, so your likes and comments are very much appreciated.

As always, trade safe.

KOG

THE KOG REPORT THE KOG REPORT:

In last week’s KOG Report we said it would be a difficult one to decipher so we suggested traders wait for the break, trade into the levels given and then look for the RIPs. This worked particularly well for us giving us the move into the lower level as analysed on the break, using the red boxes for direction and then giving us the tap and bounce that we wanted to take the long trades back up into the new all time highs we witnessed towards the end of the week.

We managed to compete all of our bias level targets, getting a pin-point move from KOG’s bias and on top of that completing Excalibur targets and the red box targets. Not a bad week at all on Gold.

So, what can we expect in the week ahead?

For this week we’ll be looking for a retracement on the move, however, we are not discounting a curveball move from immediate support to clear liquidity from above. We have the resistance level above 2990 and lower support 2980 which could be the play for the opening. If we break above 2995, we’ll be looking for price to attempt that 3010 and above that 3020 region before attempting to short it again.

On the flip, if we do reject that higher level and can break below 2980, we’ll stick with the plan from last week where we’re looking to continue the retracement back down first into the 2965 level and below that 2950-55. If you look on the chart, we have highlighted a lower level which is sitting around 2935-20, an aggressive move downside can take us there on the manipulation move, so please trade with caution this week and keep an eye on the levels.

KOG’s bias for the week:

Bearish below 2995 with targets below 2970, 2965, 2955 and below that 2950

Bullish on break of 2995 with targets above 3003, 3006, 3010, 3016 and above that 3020

RED BOXES:

Break above 2995 for 2997, 3003, 3009, 3016 and 3021 in extension of the move

Break below 2980 for 2975, 2971, 2965, 2959, 2955 and 2945 in extension of the move

Short and simple this week, let’s see how the week plays out and remember, your risk model is there to protect you, use it, keep your losers small and your winners big!

Please do support us by hitting the like button, leaving a comment, and giving us a follow. We’ve been doing this for a long time now providing traders with in-depth free analysis on Gold, so your likes and comments are very much appreciated.

As always, trade safe.

KOG

THE KOG REPORT THE KOG REPORT:

In last week’s KOG Report we said we would wait for the 2847-50 level to confirm support, and if it did the opportunity to long the market following KOG’s bias level targets would be available to traders. This worked well during the early part of the week as we managed to complete all targets by Tuesday! Once price confirmed encroaching the resistance we decided not to attempt the swing short, instead, trade the choppy range on the indicators which also worked well for traders.

Pre-NFP we released the KOG Report giving the idea to watch the support level 2910, if given the opportunity to long could be available into the higher levels on the boxes. Although we got the pinpoint long, the move did not complete after a 200pip+ capture, not a bad week at all, not only on Gold but all the other pairs we trade and analyse in Camelot hitting a phenomenal 32 Take profit levels.

Well done again to the community.

So, what can we expect in the week ahead?

It’s a difficult one to decipher this week with the previous weeks range holding into the close on Friday. We have support below at the 2895 with extension into 2885 and resistance at 2930-35 with extension into the 2945 region. We also have the range high and low which you can see on the chart with a slight incline! For that reason, we would suggest best practice for market open is to wait, wait for price to break out of the range with the key levels here being 2920 which needs to break upside to start the move into the 2935 level and above that 2950-55 which is where we may get that potential swing short opportunity from. Please note, here we need to see a daily close above the 2935 region to continue the move upside, ideally, we want to see tap and bounces from these higher levels.

On the flip, if we see resistance at that 2920 level and get a close below our red box support level 2907-10, we can consider the level to level short trades downside targeting the 2885 and potentially below that 2970-75 for now.

As above we'll keep it simple for now, we can’t magic up an idea and hope for the best, when price accumulates like this, we have a fair idea of what it can do, but we need that set up to pull the trigger. Until that comes we can we'll just simply play the range.

You can see from past KOG Reports how extremely powerful the red boxes we share for free are, they almost play price to perfection. So, lets stick with them and let Excalibur lead the way for this week.

KOG’s Bias for the week:

Bullish above 2898 with targets above 2920, 2934 and above that 2945

Bearish on break of 2898 with targets below 2895, 2880, 2874 and below that 2868

RED BOXES:

Break above 2916 for 2920, 2925, 2929, 2933 and 2941 in extension of the move

Break below 2900 for 2885, 2876, 2870 and 2868 in extension of the move

Please do support us by hitting the like button, leaving a comment, and giving us a follow. We’ve been doing this for a long time now providing traders with in-depth free analysis on Gold, so your likes and comments are very much appreciated.

As always, trade safe.

KOG

THE KOG REPORT - NFPTHE KOG REPORT – NFP

This is our view for NFP, please do your own research and analysis to make an informed decision on the markets. It is not recommended you try to trade the event if you have less than 6 months trading experience and have a trusted risk strategy in place. The markets are extremely volatile, and these events can cause aggressive swings in price.

Firstly, we would suggest traders stay away from this NFP altogether, the markets are very delicate and moving to extreme levels not only on Gold but most forex pairs. For that reason we’ll keep it simple and look at the key levels together with the structure formed.

We have the higher resistance level here which is the previous order region 2930-35 which looks to be a potential region price may want to attack if they want to continue this move upside, above that is the extension of the move around 2945-55. Price needs to stay below this level, If we can reject and not break above these levels, an opportunity to see the market correct may be available back down in attempt to break 2900 level.

On the flip, if they push price downside, we’ll wait, the range needs to be broken, price should want to retest the flip and then continue the move, that’s when we can start using the red boxes to target those lower levels and potentially look for the swing low from the circled hotspot.

As above, keep it simple, the trade comes after the event and most accounts are blown during these events due to traders using large lots on small accounts attempting to capture the volume driven candles. Unless you’re already in and protected, the swing in the opposite direction can cause huge problems to less experienced traders.

RED BOXES:

Break above 2930 for 2934, 2940, 2944 and 2955 in extension of the move

Break below 2910 for 2903, 2895, 2890 and 2879 in extension of the move

Please do support us by hitting the like button, leaving a comment, and giving us a follow. We’ve been doing this for a long time now providing traders with in-depth free analysis on Gold, so your likes and comments are very much appreciated.

As always, trade safe.

KOG

THE KOG REPORT THE KOG REPORT:

In last week’s KOG Report we said we would be looking for price to tap into the lower red box region, give the long trade up into the red box resistance which was active and then give us the opportunity to short the market sticking to our bias and our bias target levels. Although we missed the precise entry by 30pips from the highs, we managed to get in and complete not only the bias target levels, KOG’s bias of the day target levels, Excalibur target algo levels and LiTE EA targets hitting 100% on those for the week.

A fantastic week on markets on just on Gold but on the other pairs we trade and analyse as well. Well done to our traders and team.

So, what can we expect in the week ahead?

After the move we witnessed last week we would expect there to be some retracement on the horizon, however, it all depends on this lower level of 2850-47 holding price up in the early sessions. If we do see a clean set up here an opportunity to take that potential long into the level above 2865-70 should be available. It these level above that are concerning, they need to break above for us to confirm this as a short term low, however, unless broken 2875-80 and above that 2895-2900 should be decent target levels for the longs and also pivotal points to watch for reversal to continue the move downside.

On the flip, we do have a level below sitting at 2805-10, which is also a bearish below level. If we continue this move downside from the opening, we’ll look to continue with the move downside on the daily red boxes and then look for an opportunity to take a swing long from lower down.

Key levels this week:

Resistance – 2890 / 2904

Support – 2850 / 2830 / 2810

Potential range – 2810 – 2880

KOG’s bias for the week:

Bullish above 2847 with targets above 2865, 2871, 2876, 2880 and above that 2904

Bearish below 2847 with targets below 2840, 2835, 2830 and below that 2810

RED BOXES:

Break above 2860 for 2865, 2872, 2874, 2885 and 2900 in extension of the move

Break below 2847 for 2840, 2836, 2831, 2823 and 2810 in extension of the move

Please do support us by hitting the like button, leaving a comment, and giving us a follow. We’ve been doing this for a long time now providing traders with in-depth free analysis on Gold, so your likes and comments are very much appreciated.

As always, trade safe.

KOG